ActivTrades is a London-based broker that has received more than 65 international awards and serves 100,000 users from 170 countries!

This global brokerage is regulated by the FCA (UK), one of the top financial authorities in the world.

ActivTrades Forex Broker Company Information & Regulation

ActivTrades is a well-established forex and CFD broker that has been serving traders since 2001.

With over two decades of experience in the financial markets, the company has built a strong reputation for reliability and innovation.

ActivTrades company information and regulation:

- Headquarters: London, United Kingdom

- Founded: 2001

- Regulatory bodies: FCA, SCB, CMVM, BACEN, CVM

- Client fund protection: Up to£85,000 under the Financial Services Compensation Scheme (FSCS)

- Additional insurance: Up to £1,000,000 per client

ActivTrades' multi-jurisdictional regulation ensures a high level of client protection and adherence to strict financial standards.

This regulatory oversight provides traders with peace of mind, knowing that their funds and personal information are safeguarded.

Entity Parameters/Branches | ActiveTrades United Kingdom | ActiveTrades Portugal | ActiveTrades Italy | ActiveTrades Bulgaria | ActiveTrades Brazil | ActiveTrades Mauritius | ActiveTrades Bahamas |

Regulation | FCA | CMVM | CMVM | CMVM | BACEN / CVM | FSC | SCB |

RegulationTier | 1 | 1 | 1 | 1 | 2 | 3 | 3 |

Country | UK | Portugal | Italy | Bulgaria | Brazil | Mauritius | Bahamas |

Investor Protection Fund/Compensation Scheme | FSCS | Portuguese scheme | EU scheme | EU scheme | Local scheme | Local scheme | Local scheme |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Max Leverage | 1:30 | 1:30 | 1:30 | 1:30 | Not Specified | 1:400 | 1:400 |

Client Eligibility | All countries except restricted ones (e.g. USA, Canada, Iran) | All countries except restricted ones (e.g. USA, Iran, Cuba) | All countries except restricted ones (e.g. USA, North Korea, Syria) | All countries except restricted ones (e.g. USA, Iran, Canada) | All countries except restricted ones (e.g. USA, Cuba, Iran) | All countries except restricted ones (e.g. USA, Canada, Iran) | All countries except restricted ones (e.g. USA, Canada, Iran) |

Summary of Specifications & Key Features

ActivTrades offers a comprehensive suite of trading services and features designed to cater to both novice and experienced traders.

Here's a summary of the broker's key specifications and features:

Broker | ActivTrades |

Account Types | Professional, Individual, Demo, Islamic |

Regulating Authorities | FCA, SCB, CMVM, BACEN, CVM |

Based Currencies | USD, EUR, CHF, GBP |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Withdrawal Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:400 |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, ActivTrader, TradingView |

Markets | Forex, Shares, Indices, Commodities, ETFs, Bonds, Cryptocurrency |

Spread | Floating from 0.5 pips |

Commission | Varies Based on Spread, Trade Size & Pip Value |

Orders Execution | Market Execution, Pending Order, Buy Limit, Sell Limit, Buy Stop, Sell Limit, Buy Stop Limit, Sell Stop Limit |

Trading Features | Demo Account, Islamic Account, 1:400 Maximum Leverage, EAs Allowed, Rebate |

Affiliate Program | Yes |

Bonus & Promotions | Rebate, Referral Program |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Ticket |

Customer Support Hours | 24/5 |

Restricted Countries | Afghanistan, Iran, Iraq, Japan, Portugal, Russia, Spain, USA, Yemen, North Korea, Lebanon, Syria and Many More |

ActivTrades stands out with its proprietary ActivTrader platform, which offers an intuitive interface and advanced trading tools.

The broker also provides a wide range of tradable instruments, catering to diverse trading preferences and strategies.

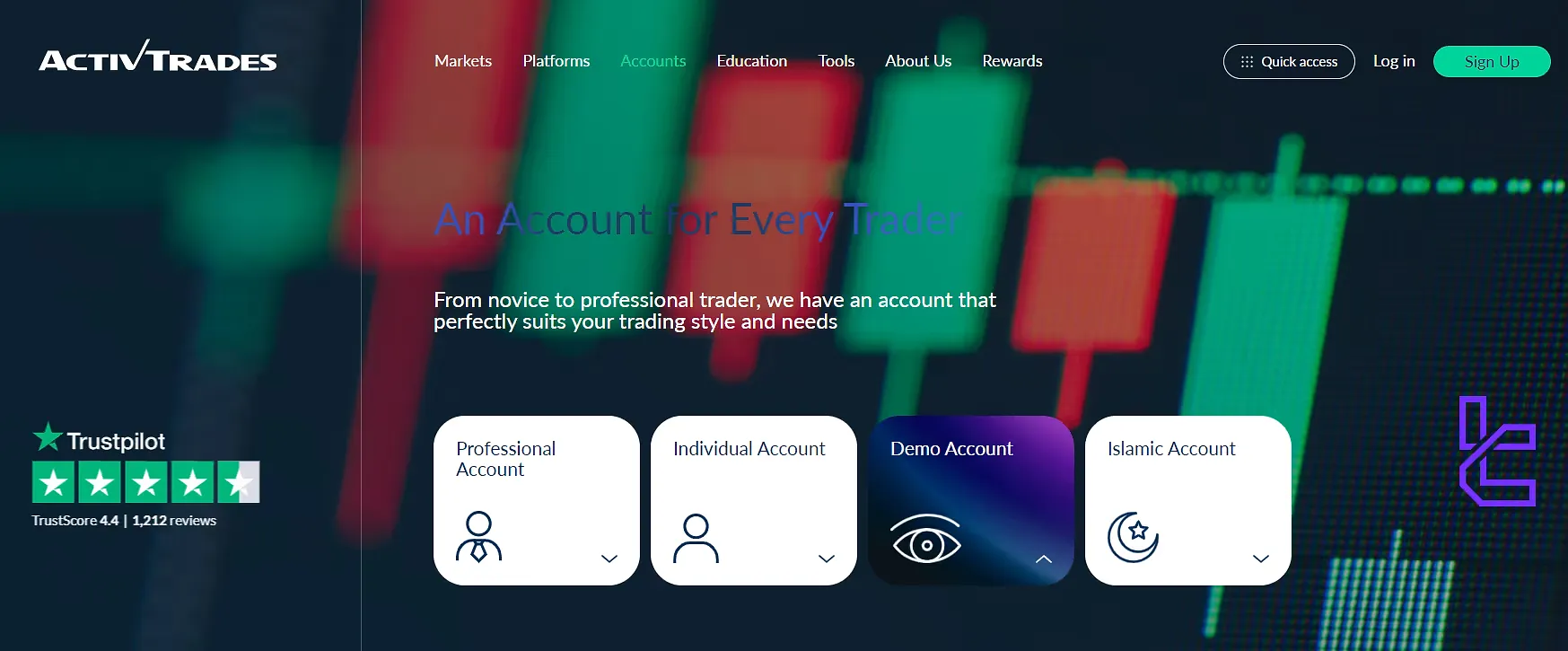

What are ActivTrades Forex Broker Account Types?

The Broker offers several 4 account types [Professional, Individual, Demo, Islamic] to suit different trading styles and experience levels; ActivTrades Broker Account Types:

Specifics | Professional | Individual | Demo | Islamic |

Base Currency | USD, EUR, CHF, GBP | USD, EUR, CHF, GBP | USD, EUR, CHF, GBP | USD, EUR, CHF, GBP |

Leverage | 1:400 | 1:30 | - | 1:400 |

Close Out | 30% | No Information Provided | No Information Provided | 30% |

Account Manager | Yes | No | No | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Insurance | Yes | Yes | Yes | Yes |

Cashback Programme | Yes | No | - | Yes |

Pesonalised Education | Yes | No | No | Yes |

Spread | From 0.5 pips | From 0.5 pips | 0 | From 0.5 pips |

The demo account is perfect for beginners who want to learn trading without risking real funds.

Pros and Cons

To provide a balanced view of this brokerage, let's examine its advantages and disadvantages. Activtrades pros and cons:

Advantages | Disadvantages |

Multi-Regulated by Top-Tier Authorities | Higher Minimum Deposit Compared to Some Competitors |

Wide Range of Tradable Instruments | Limited Promotional Offers or Bonuses |

Competitive Spreads and Fees | No US Clients Accepted |

Excellent Educational Resources | No Social Trading and Copy Trading Features |

Robust Risk Management Tools | - |

Fast Execution Speeds | - |

Negative Balance Protection | - |

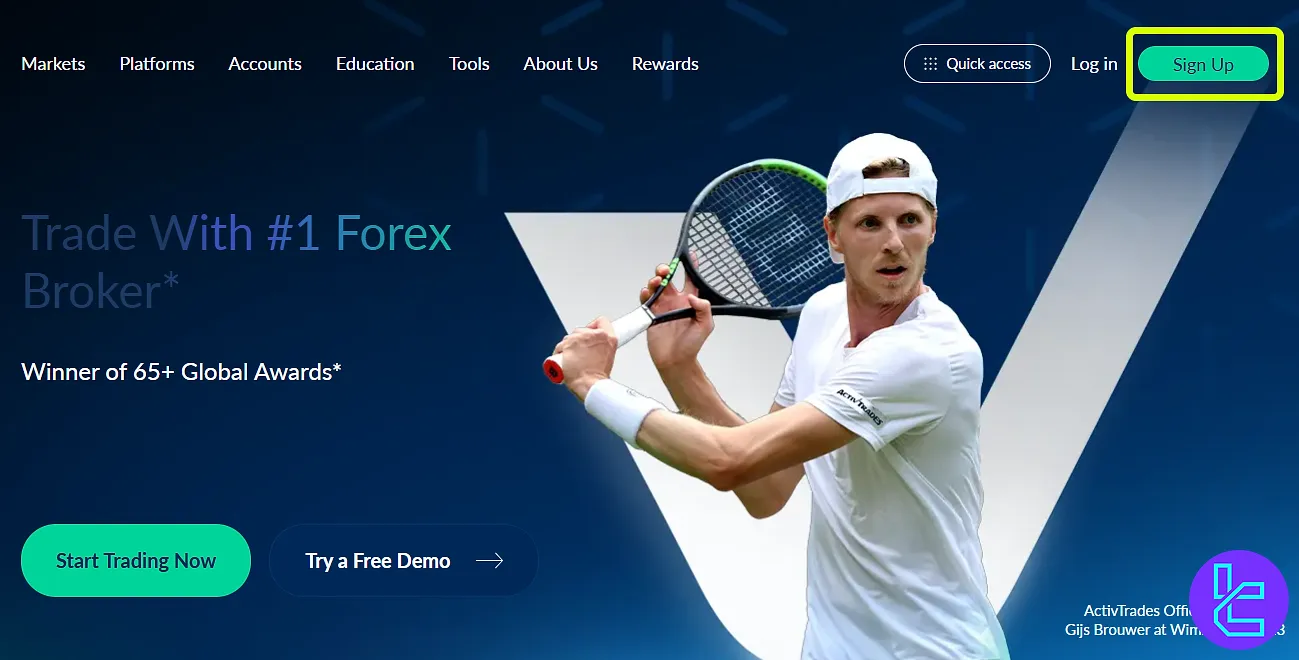

How to Register in ActivTrades?

Opening a new account with ActivTrades is easy, even for beginner traders. ActivTrades registration:

#1 Start the Sign-Up from the Official Website

Head to the official ActivTrades platform and click “Sign Up” to launch the registration flow.

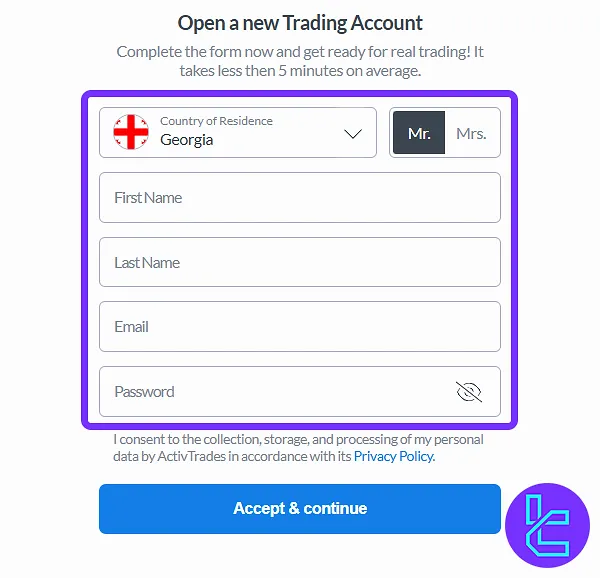

#2 Fill Out Basic and Contact Information

Provide yourfull name, email address, and mobile number, and then set a strong password. You’ll also be asked to confirm your date of birth, nationality, and residency.

#3 Enter Tax and Residential Data

Complete fields related to your tax identification number (if required), followed by your full residential address to comply with regional laws.

#4 Answer Financial Background Questions

Disclose the following information:

- Employment status

- Income bracket

- Funding source

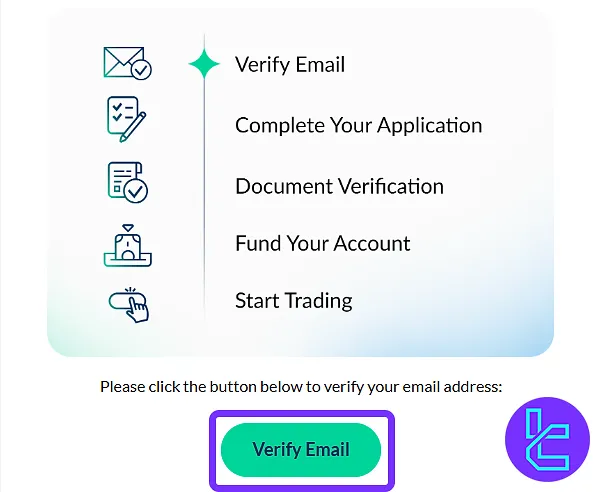

#5 Verify Your Email to Activate the Account

Open the confirmation email from ActivTrades and click “Verify Email”. Your account is now ready to proceed with full onboarding and identity verification.

ActivTrades Verification

To comply with Anti-money laundering (AML) laws, traders must verify their accounts before trading with this broker.

The required documents include a valid ID document and a utility bill.

What Are ActivTrades Trading Platforms?

ActivTrades provides a versatile platform suite tailored to the needs of both beginner and advanced traders. The available platforms include:

- ActivTrader: A proprietary web and mobile platform featuring sleek design, TradingView-powered charts, and advanced tools like Progressive Trailing Stops. It supports one-click trading, real-time news, and multi-asset watchlists, though it lacks a full-screen chart view and VPS integration;

- MetaTrader 4 (MT4): Ideal for forex traders using Expert Advisors (EAs), custom scripts, and classic indicators;

- MetaTrader 5 (MT5): A more modern multi-asset platform offering enhanced market depth and built-in strategy tester;

- TradingView: Fully integrated for advanced charting and real-time trade execution.

Charting tools include over 100 indicators, 75 drawing tools, and 16 chart styles suitable for scalpers, technical analysts, and discretionary traders alike.

ActivTrades employs a No Dealing Desk (NDD) execution model, with average order speeds of just 4 milliseconds, significantly below the industry standard.

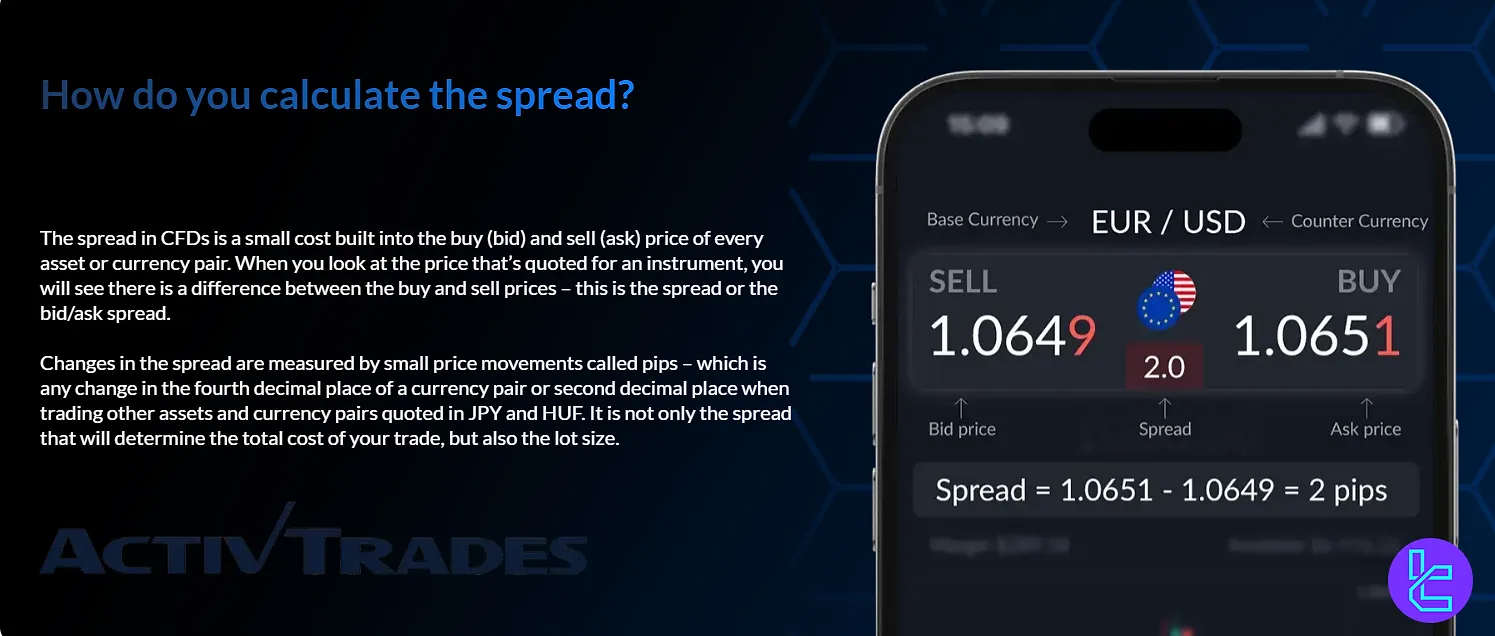

Spreads and Commissions

This Broker is known for its competitive pricing structure. In the ActivTrades review, we noticed that their spread and commissions don’t differ in account types.

It's important to note that spreads may widen during periods of high market volatility or low liquidity.

- Commission: Calculated based on Spread × Trade Size × Pip Value formula

- Spread: Starts from 0.5 pips

- CFD trading: Competitive spreads with no additional commissions

- Overnight Trade: Applies to positions held beyond the daily cut-off time

Swap Fee at ActivTrades

ActiveTrades applies swap fees on overnight positions. For short trades, swaps are credited unless the 1-month interbank rate is at or below 3%.

In that case, a charge is applied equal to the rate minus 3%. If the interbank rate turns negative, the cost is capped at a 3% markup.

Long positions incur a debit calculated as the 1-month interbank rate plus 3%.

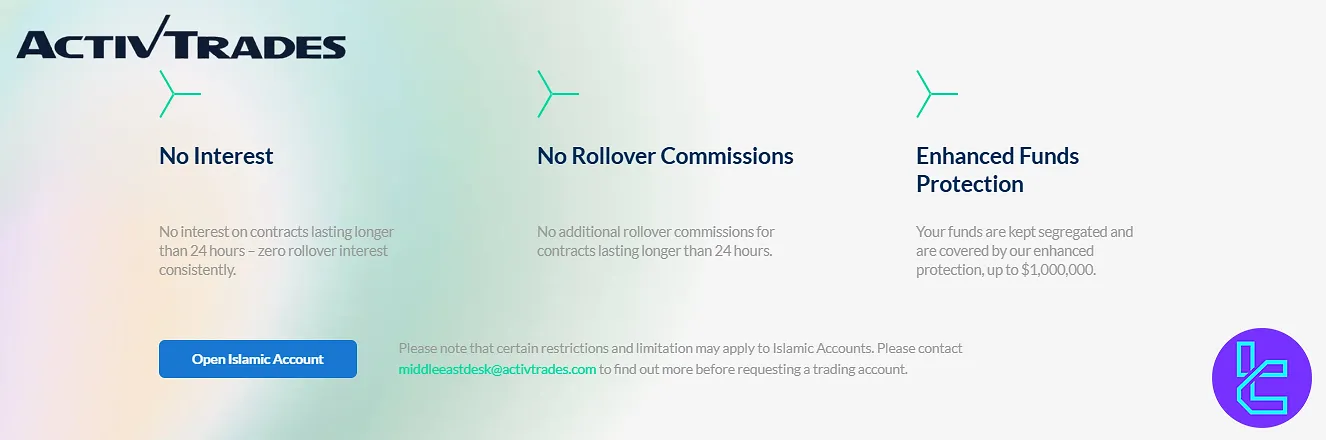

For traders who require swap-free conditions, ActiveTrades also offers Islamic accounts. These accounts comply with specific trading principles and may come with certain limitations.

Key Features:

- No interest charged on contracts held beyond 24 hours;

- No extra rollover commissions for trades lasting longer than one day;

- Segregated funds with enhanced protection of up to $1,000,000;

- Swap-free account is available for clients observing Islamic finance rules.

Non Trading Fees at ActivTrades

ActivTrades is known for maintaining relatively low overall trading costs, with most of its charges concentrated outside the trading process.

The broker does not apply any fees when opening an account or making deposits. However, non-trading costs may arise under certain circumstances.

- Inactivity: Accounts holding a balance but unused for more than 12 months are subject to a €10 monthly inactivity charge;

- Withdrawals: ActivTrades itself does not charge withdrawal fees. A 0.5% conversion fee applies when withdrawing in a different currency than the account’s base, and receiving banks may impose additional charges;

- Prepaid card: The ActivTrades prepaid card carries no service costs and includes free monthly maintenance.

What are ActivTrades Broker Deposit & Withdrawal Methods?

ActivTrades offers a wide array of local and international deposit and withdrawal options, tailored to regional user needs:

- Bank transfers (global)

- E-wallets: Skrill, Neteller, PayPal

- Crypto via BitPay (not available to UK/EU clients)

- Credit/debit cards: Visa, Mastercard

- Regional solutions: Sofort, iDeal, Trustly, Przelewy24 (Poland), Multibanco (Portugal), PIX & Boleto Bancário (Brazil)

All deposits are fee-free. Withdrawals are also free of charge except for USD wire transfers, which incur a $12.50 fee.

Payout requests submitted before 12:30 GMT are processed the same day. Bank transfers may take 1 to 3 business days, depending on the jurisdiction.

There is no enforced minimum deposit globally, except for Brazil and China, where a $500 threshold applies.

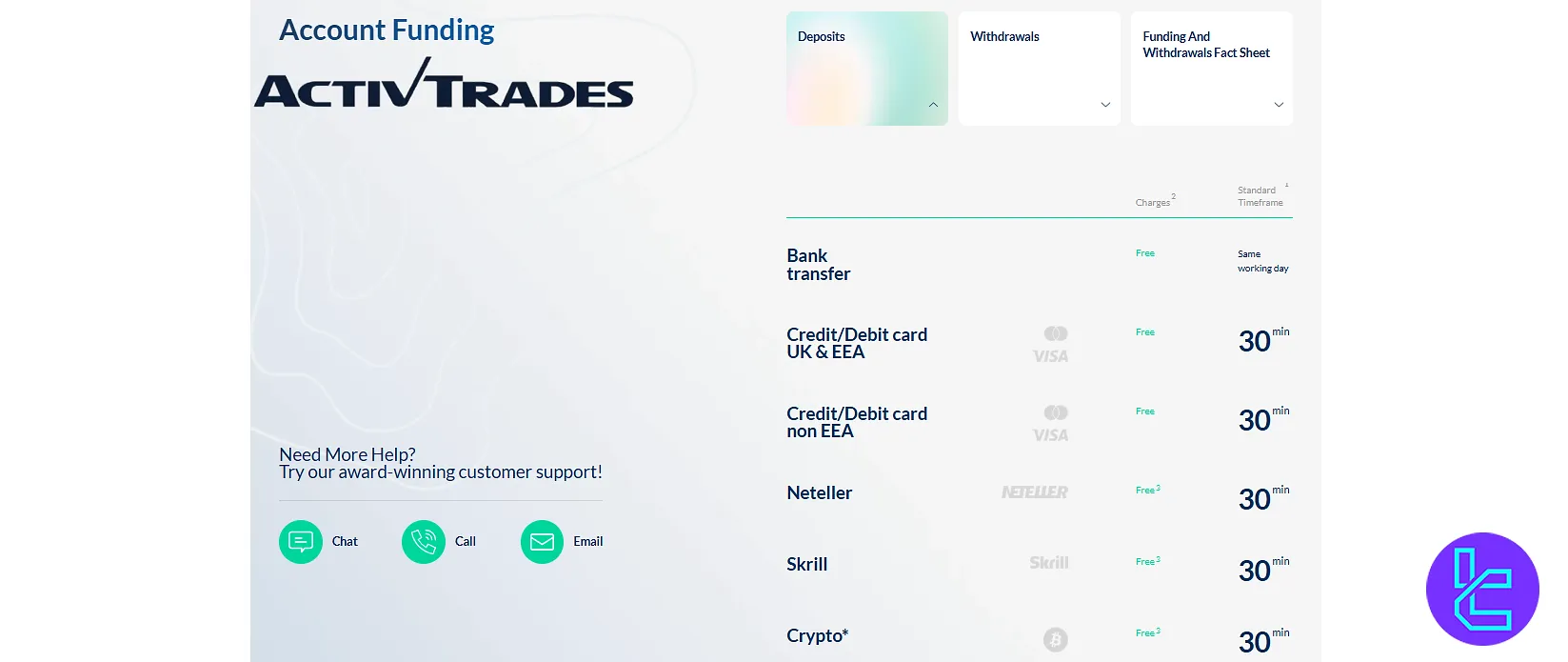

Deposit Methods at ActivTrades

ActivTrades allows funding via bank transfer, cards, e-wallets, and major cryptocurrencies. Card and wallet payments are usually near-instant, while bank transfers may take longer depending on region.

No deposit fees are charged by the broker, though a 0.5% currency-conversion applies if funding differs from the account’s base currency. In rare low-volume cases, external processing costs may also be passed on.

Further details are provided in the table below:

Deposit method | Minimum amount | Deposit fee | Funding time |

Bank Transfer | None (USD 500 in Brazil & China) | Free; possible bank charges | Same working day |

Credit/Debit Card | None | Free | ~30 minutes |

Neteller | None | Free | ~30 minutes |

Skrill | None | Free | ~30 minutes |

Crypto | None | Free | ~30 minutes |

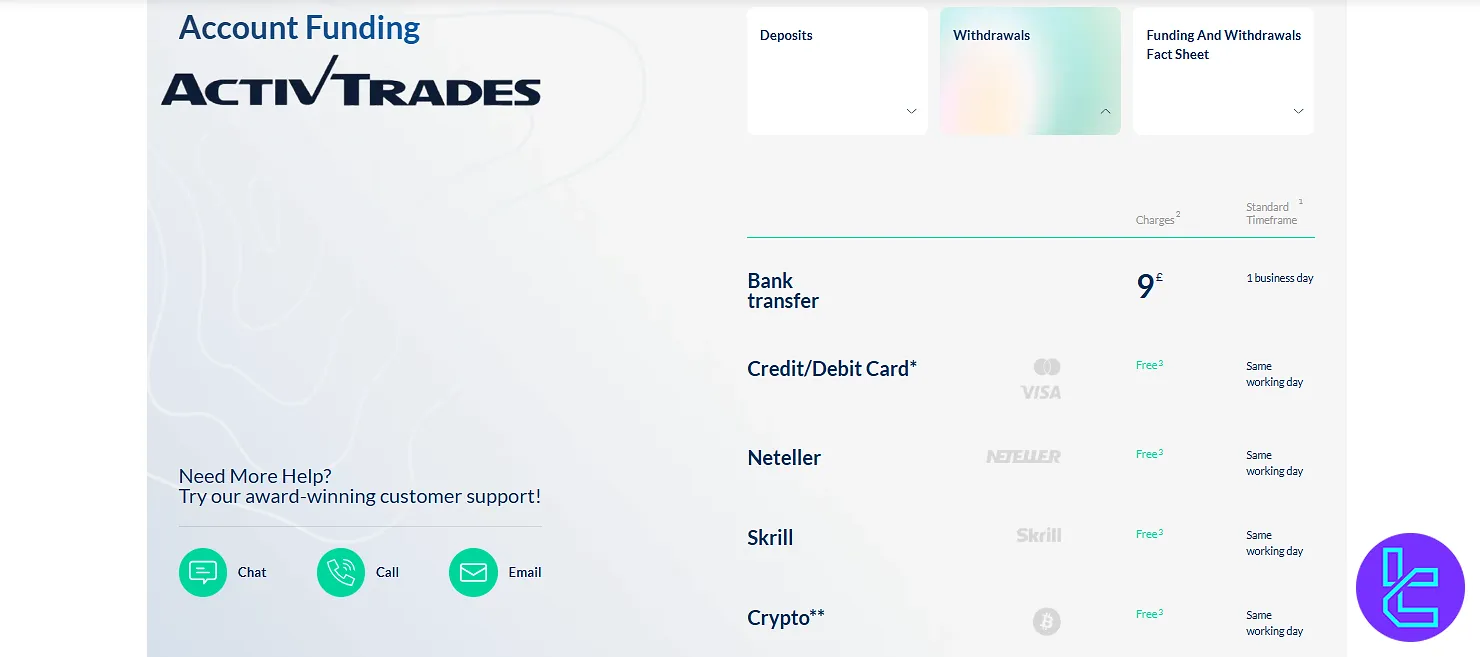

Withdrawal Methods at ActivTrades

Funds can be withdrawn through the same channels, with e-wallets and cards often processed the same day, and bank transfers subject to standard banking times.

Withdrawals are fee-free on ActivTrades’ side, except for the 0.5% conversion on currency mismatches. Intermediary banks may deduct their own charges in certain cases.

Further details are provided in the table below:

Withdrawal method | Minimum amount | Withdrawal fee | Funding time |

Bank Transfer | None (USD 500 in Brazil & China) | GBP 9 | 1 Business day |

Credit/Debit Card | None | Free; conversion fee may apply | Same working day |

Neteller | None | Free; possible external charges | Same working day |

Skrill | None | Free; possible external charges | Same working day |

Crypto | None | Free; possible network/processing costs | Same working day |

Does ActivTrades Offer Investment Options? Copy Trading + Social Trading

ActivTrades focuses primarily on self-directed trading, Thus, they do not support copy trading, signal trading, PAMM account, social trade and other investment methods.

In fact, the only way to earn indirect income from this broker is to use EAs.

What Instruments and Assets Can You Trade on ActivTrades?

ActivTrades delivers a well-rounded portfolio of over 1,000 CFD instruments across multiple asset classes:

- Forex: 50+ currency pairs including majors, minors, and exotics

- Indices: More than18 global indices like the Dow Jones, DAX40, and FTSE 100

- Commodities: Energy (oil, gas), and metals such as gold, silver, and copper

- Stocks: 600+ international equities across US, UK, and EU exchanges with zero commission and the ability to go long or short

- ET Fs: A curated selection of 20+ exchange-traded funds

- Bonds: Government debt from the US, UK, and Eurozone

- Cryptocurrencies: Not offered on FCA-regulated accounts

Trading conditions include a minimum lot size of 0.01 and leverage tiers of up to 1:30 for retail clients and up to 1:400 for professional traders.

All asset classes (except bonds) are accessible on ActivTrader, MT4, and MT5, ensuring platform flexibility and broad market exposure.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency pairs (major, minor, exotic) | 50+ | 40–60 | Up to 1:30 |

Indices | Global indices (e.g., S&P 500, DAX, FTSE 100) | 15+ | 10–20 | Up to 1:20 |

Commodities | Precious metals (gold, silver), energy (oil, natural gas), agricultural products | 10+ | 8–15 | Up to 1:20 |

Shares | CFDs on global stocks (e.g., Apple, Tesla, Alibaba) | 1,000+ | 800–1,200 | Varies by stock |

ETFs | Exchange-traded funds (e.g., SPDR S&P 500, iShares MSCI Emerging Markets) | 50+ | 40–60 | Up to 1:20 |

Bonds | Government and corporate bond CFDs | 20+ | 15–25 | Up to 1:10 |

Cryptocurrencies | Major digital currencies (e.g., Bitcoin, Ethereum, Litecoin) | 10+ | 8–15 | Up to 1:5 |

Is There Any Bonuses Offered by ActivTrades Broker?

ActivTrades maintains a conservative approach when it comes to bonuses and promotions:

- No deposit bonuses or welcome offers

- Cashback promotions for active traders

- Referral program with rewards for introducing new clients

The broker focuses on providing competitive trading conditions rather than offering flashy promotional offers.

This approach aligns with regulatory guidelines and ensures a transparent trading environment.

ActivTrades Awards

ActivTrades has received 20+ industry awards recognizing its excellence in trading conditions, platform quality and client service.

Activtrades awards and accolades highlight the broker’s competitive spreads, rapid execution and user-friendly interfaces.

Over 2024 and 2025, ActivTrades has been acknowledged globally for both its technology and customer-focused services.

Recent Awards:

- Best Broker in Germany 2024 BrokersView

- Best Forex Broker in Italy 2025 Rankia Awards

- Best in Class Ease of Use 2025 ForexBrokers.com

- Spread Betting Forex Broker 2025 FXEmpire

- TradingView Forex Broker 2025 FXEmpire

- MT4 Broker 2025 FXEmpire

ActivTrades Support

ActivTrades provides comprehensive customer support, though not on a 24/7 basis:

- Support hours: 24/5 (Sunday 22:00 GMT to Friday 22:00 GMT)

- Contact methods: Live chat, Phone support in multiple languages, Ticket

- Dedicated account managers forprofessional clients

- An extensive FAQ section and help center on the website

While not available 24/7, ActivTrades' support team is highly responsive and knowledgeable, ensuring that traders can get assistance during Forex market hours.

ActivTrades Broker Restricted Countries

ActivTrades does not accept clients from certain jurisdictions due to regulatory restrictions and sanctions:

- Afghanistan

- Belarus

- Bosnia and Herzegovina

- Brazil

- Burundi

- Canada

- Central African Republic

- Democratic Republic of the Congo

- Eritrea

- Guinea Bissau

- Guinea

- Iran

- Iraq

- Japan

- Кorea North

- Lebanon

- Libya

- Mali

- Myanmar (Burma)

- Nicaragua

- Russia

- Somalia

- South Sudan

- Spain

- Sudan

- Syria

- Tunisia

- United States of America

- Venezuela

- Yemen

- Zimbabwe

It's important to check the broker's website or contact customer support for the most up-to-date information on country restrictions, as these may change due to evolving regulatory landscapes.

Trust Scores & Reviews

ActivTrades has garnered generally positive reviews and trust scores from various sources, such as ActivTrades ForexPeaceArmy page:

- Trustpilot: 4.4/5 based on 1212 reviews

- ForexPeaceArmy: 3 out of 5 based on 151 reviews

- Reviews.io: 4.6 from 5 based on 265 reviews

Overall, ActivTrades maintains a strong reputation in the industry, backed by its long-standing presence and regulatory compliance.

Does ActivTrades Broker Offer Any Educational Resources?

ActivTrades offers a comprehensive educational program for traders of all levels:

- Webinars: Regular live sessions covering various trading topics

- Video tutorials: Step-by-step guides on platform usage and trading strategies

- E-books: In-depth resources on fundamental and technical analysis

- Trading glossary: Extensive list of trading terms and definitions

- Economic calendar: Up-to-date information on market-moving events

- Market analysis: Daily and weekly reports from expert analysts

Comparing ActivTrades with Other Forex Brokers

Traders can understand how ActivTrades compares to some of the strongest competitors in the market.

Parameters | ActivTrades Broker | |||

Regulation | FCA, SCB, CMVM, BACEN, CVM | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | ASIC, FSC, DFSA, CySEC | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.5 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | Varies Based on Spread, Trade Size & Pip Value | From $0.2 to USD 3.5 | $0 (except on Shares account) | From $0 |

Minimum Deposit | $0 | $10 | $5 | $100 |

Maximum Leverage | 1:400 | Unlimited | 1:1000 | 1:500 |

Trading Platforms | MT4, MT5, ActivTrader, TradingView | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Professional, Individual, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Micro, Standard, Ultra Low, Shares | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1000+ | 200+ | 1400+ | 2100+ |

Trade Execution | Market Execution, Pending Order, Buy Limit, Sell Limit, Buy Stop, Sell Limit, Buy Stop Limit, Sell Stop Limit | Market, Instant | Market, Instant | Market, Pending |

Trading Finder Conclusion and Final Words

ActivTrades offers forex trading in 4 trading platforms [MT4, MT5, ActivTrader, TradingView].

Minimum deposit of $0, Tight spreads [from 0.5 pips], 4 trading accounts [Professional, Individual, Demo, Islamic] and minimum order of 0.01 lots are just some of the features of ActivTrades.

On the other hand, no investment options [social trading, copy trading, PAMM account] are available at ActivTrades.