Regulated by Malta MFSA [registration number: C/56519], Alchemy Markets is a branch of Alchemy Prime allowing EEA region users to trade 300+ assets of forex and CFDs.

Alchemy Markets was launched by “Nikil Viswanathan” and “Joe Lau.” Right now, they offer tight spreads, $0 commission, and 100% STP execution.

Alchemy Markets Broker Company Information & Regulation

Alchemy Markets Forex broker burst onto the scene in 2017. Based in Malta, Alchemy Markets quickly established itself as a force to be reckoned with in the CFD trading world.

Alchemy Markets Credentials:

- Regulated by the Malta Financial Services Authority (MFSA)

- Offers access to over 300 trading instruments across 10+ asset classes

- Boasts lightning-fast execution speeds of less than 10 milliseconds

- Implements 100% Straight Through Processing (STP) execution

The table below summarizes the company and regulation details by entity.

Parameter / Branches / Entity | Alchemy Markets Ltd (MFSA entity) | Alchemy International Ltd (FSA Seychelles entity) |

Regulation | Malta Financial Services Authority (MFSA), Licence IS/56519 | Seychelles Financial Services Authority (FSA), Securities Dealer SD136 |

Regulation Tier | EU / MiFID II regime | Offshore / non-EU regime |

Country / Jurisdiction | Malta (Portomaso Business Centre, St Julian’s; C56519) | Seychelles (CT House, Providence, Mahé; Reg. 8429852-1) |

Investor Protection Fund | Yes – Malta Investor Compensation Scheme, up to €20,000 | No statutory scheme under Seychelles FSA |

Segregated Funds | Yes (client funds held separately per MFSA rules) | Yes (broker states client funds are segregated) |

Negative Balance Protection | Yes (retail) | Yes (broker states “Balance Protection”) |

Maximum Leverage | Up to 1:30 (retail, per EU rules) | Up to 1:500 (eligible clients/products) |

Client Eligibility | EU/EEA clients; passporting evidenced on CNMV list | Non-EU clients, subject to local laws |

Summary of Specifics

Let's break down the key features that make Alchemy Markets stand out in the crowded broker marketplace:

Broker | Alchemy Markets |

Account Types | Standard, Classic, Premier, and VIP |

Regulating Authorities | MFSA Malta |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $100 |

Deposit/Withdrawal Methods | MasterCard, VISA, Skrill, Neteller, Bank Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | None |

Trading Platforms & Apps | MT4, FIX API |

Markets | Forex, Indices, Stocks, Commodities, ETFs |

Spread | From 0.2 Pips |

Commission | Varies by Market |

Orders Execution | Market, STP |

Stop Out | 50% |

Trading Features | One Click Trading, Trading Styles Allowed, No Order Distance Restriction, 1:30 Maximum Leverage, Demo Trading |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Phone, Live Chat, Email, Indoor Meeting |

Customer Support Hours | 24/5 |

Alchemy Markets Broker Account Types

Alchemy Markets offers a tiered account structure [Classic, Premier, Standard, VIP] to meet the diverse needs of their client base. Alchemy Markets Accounts Overview:

Specifics | Standard | Classic | Premier | VIP |

Platforms | MT4 | MT4 | MT4 | MT4 |

Minimum Deposit | $100 | $1000 | $5000 | $50000 |

Commission Per Lot (FX) | $0 | $0 | $0 | $0 |

Maximum Leverage | EU 1:30 International 1:500 | EU 1:30 International 1:500 | EU 1:30 International 1:500 | EU 1:30 International 1:500 |

Micro Lot Trading | Yes | Yes | Yes | Yes |

Stop Out Levels | 50% | 50% | 50% | 50% |

One Click Trading | Yes | Yes | Yes | Yes |

Trading Styles Allowed | Yes | Yes | Yes | Yes |

Additionally, Alchemy Markets offers a Demo Account, allowing traders to test strategies and familiarize themselves with the platform risk-free.

This feature is particularly valuable for newcomers to the trading world or those looking to experiment with new techniques.

Advantages and Disadvantages

Every broker has its strengths and weaknesses. Here's a balanced look of Alchemy Markets Pros and Cons:

Advantages | Disadvantages |

Regulated by MFSA | Relatively high minimum deposit for higher-tier accounts |

Competitive spreads starting from 0.2 pips | Limited cryptocurrency offerings compared to some competitors |

Fast execution speeds (< 10ms) | Only one trading account available |

Negative balance protection | Lack of social/copy trading features |

Segregated client funds | - |

How to Sign-Up and Verify an Account in Alchemy Market?

Opening a new trading account with Alpari is easy and requires minimum effort. Alchemy Market registration:

#1 Access the Official Website

Visit the Alchemy Markets website and click on "Open Account".

#2 Complete the Account Opening Form

Fill in the registration form with information including first & last name, email address, password, country of residence, and phone number.

#3 Verify Your Account

Once your application is submitted, you'll need to verify your identity:

- Upload a valid government-issued ID (passport, driver's license)

- Provide proof of residence (utility bill, bank statement, etc., not older than 3 months)

What Trading Platforms Are Available to Use in Alchemy Markets?

In our Alchemy Markets review, we found that they offertwoprimary trading platforms: MetaTrader 4 and FIX API, catering to different trader preferences and needs.

MetaTrader 4 (MT4)

- Industry-standard platform

- User-friendly interface

- Advanced charting tools

- Automated trading capabilities

- Available on desktop, web, and mobile devices

FIX API

- Direct market access

- Ultra-low latency (< 10ms execution)

- Ideal for algorithmic trading

- Customizable and scalable

- Suitable for high-frequency traders and institutions

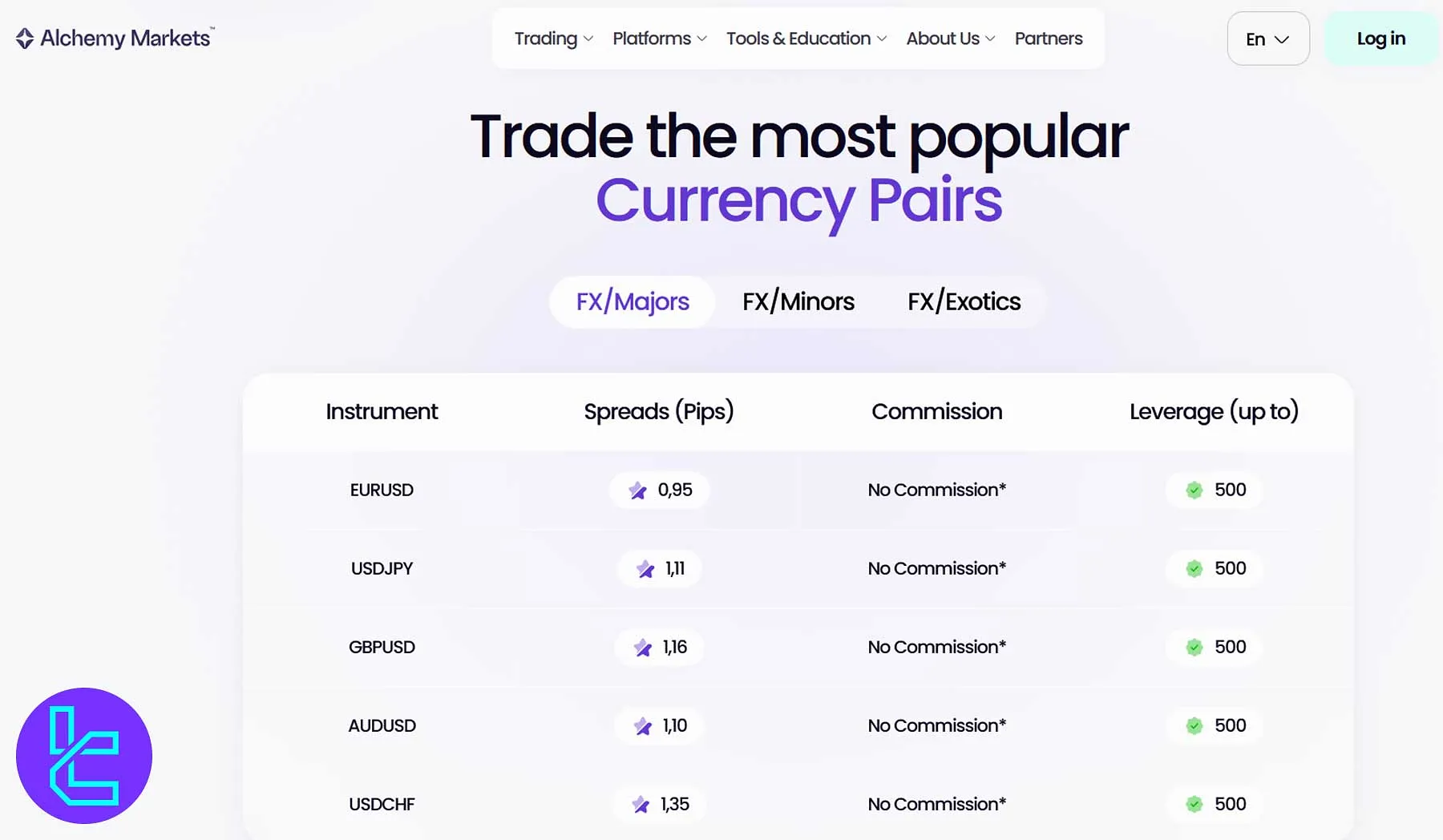

Spreads and Commissions; How Much Alchemy Markets Charge?

Alchemy Markets spreads start from 0.2 pips, but their commission is structured based on each account.

Account | Standard | Classic | Premier | VIP |

Commission on FX Per Lot | 0 | 0 | 0 | 0 |

Commission on Single Stocks | 0.40% RT | 0.35% RT | 0.30% RT | 0.25% RT |

Commission on Index CFD | 0 | 0 | 0 | 0 |

Commission on Metals | 0 | 0 | 0 | 0 |

Commission on Futures | 0.015% | 0.012% | 0.010% | 0.008% |

Alchemy Markets charges no commissions for Forex and Gold trading and offers tight spreads from 0.2 pips.

Swap Fees

Alchemy Markets applies overnight financing (swap) fees for positions held past market close. The fee (or credit) depends on the instrument, whether the position is long or short, and the prevailing interest rate differential.

Non-Trading Fees

There are no deposit fees charged by Alchemy Markets, though third-party or banking service fees may apply, including 2.9% for Skrill and Neteller transactions.

Withdrawal fees are not charged by Alchemy Markets itself, except for Skrill, Neteller, and bank wire ($35 fee).

The broker also imposes an inactivity fee on dormant accounts that have not been active for over 12 months. The fee can be up to $10 per month.

Alchemy Markets Broker Deposit & Withdrawal Methods

Alchemy Markets offers 5 methods for deposit and withdrawal to suit different preferences:

- Credit/Debit Cards (Visa, MasterCard)

- E-wallets (Skrill, Neteller)

- Bank Wire Transfer

Key Points of Payments in Alchemy Markets:

- Minimum deposit is $100

- No deposit fees charged by Alchemy Markets

- Withdrawals processed within 1-3 business days

- Some payment providers may charge their own fees

Alchemy Markets Deposit Options

Here is a summary of Alchemy Markets’ deposit options:

Option | Accepted Currencies | Fees | Processing Time |

Credit / Debit Card | USD, EUR, GBP | No Fees | Instant |

Bank Transfer | USD, EUR, GBP | No Fees | 2-3 Business Days |

Skrill | USD, EUR, GBP | 2.9% | Instant |

Neteller | USD, EUR, GBP | 2.9% | Instant |

Apple Pay / Google Pay | USD, EUR, GBP | No Fees | Instant |

Crypto-to-Fiat | Cryptos converted to USD/EUR | No Fees | Up to ~10 minutes |

Minimum deposits may depend on your country or payment provider. Always check in your account dashboard.

Alchemy Markets Withdrawal Solutions

Alchemy Markets offers corresponding withdrawal methods and timelines:

Withdrawal Solution | Processing Time | Withdrawal Fee |

Credit / Debit Card | Up to 1 Business Day | No fees |

Bank Transfer | Up to 2 Business Days | ~ 5 GBP / 5 EUR / 35 USD |

Skrill | Up to 1 Business Day | 2.9% |

Neteller | Up to 1 Business Day | 2.9% |

Apple Pay / Google Pay | Up to 1 Business Day | No fees |

Crypto-to-Fiat | Up to 1 Business Day | No fees |

Does Alchemy Markets Offer Any Investment Options?

The fact we discovered in our Alchemy Markets review is that no copy trading or social trading features are available.

The broker focuses primarily on providing a robust environment for self-directed trading across various asset classes.

Alchemy Markets Tradable Instruments & Symbols Overview

The table below summarizes the tradable instruments on Alchemy Markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Majors, Minors & Exotic Pairs | 125+ Pairs | 50–70 Pairs | Up to 1:500 |

Shares | CFDs on US, UK & EU Stocks | 800+ Stocks | 800–1200 Stocks | Up to 1:20 |

Commodities | CFDs on Metals & Energies | ~15 Instruments | 10–20 Instruments | Up to 1:100 |

Indices | Global Index CFDs (US30, DE40, UK100, etc.) | ~14 Indices | 10–20 Indices | Up to 1:100 |

Cryptocurrencies | CFDs on Bitcoin, Ethereum & Altcoins | 60+ Symbols | 40–60 Symbols | Up to 1:10 |

ETFs | CFDs on Popular ETFs (SPY, QQQ, etc.) | ~20 ETFs | 15–30 ETFs | Up to 1:20 |

Bonuses: What Promotions Are Available?

While Alchemy Markets doesn't offer trading bonuses due to regulatory constraints, they do provide an attractive affiliate program for partners.

- Competitive commission structures

- Real-time tracking and reporting

- Marketing materials and support

- Timely payouts

Awards

Alchemy Markets has achieved at least one major industry recognition: in 2025, the broker was awarded “Best Emerging Broker MEA 2025” at the UF Awards MEA, presented to Alchemy Markets in acknowledgment of its strong growth, innovative trading conditions, and regional focus in the Middle East & Africa.

This accolade underscores its rising profile among Forex and CFD brokers and affirms its investment in technology, service quality, and localized client solutions. Notable Awards & Recognitions:

- Best Emerging Broker MEA 2025 UF Awards MEA

- Recognition for localised MEA support, operational transparency and trading innovation UF Awards judging criteria 2025

- Nominated in several tech-broker categories for performance and platform quality (2024-2025)

Alchemy Markets Broker Support

Alchemy Markets prides itself on providing 24/5 [closed on weekends] comprehensive customer support.

- Live Chat: Available 24/5 for instant assistance

- Email: For detailed inquiries and documentation

- Phone Support: Direct line for urgent matters

- In-Person Meetings: Available by appointment at their Malta office

The support team is multilingual, catering to a global clientele. Response times are generally quick, with most queries addressed within 24 hours.

Pro Tip: Check out their extensive FAQ section and knowledge base before reaching out. You might find your answer there!

Restricted Countries

Alchemy Markets is a branch of Alchemy Prime, serving EEA (European Economic Area) countries. Consequently, it does not provide services to users outside the EEA region.

Beside that, Iceland is a member of EEA but Alchemy does not provide its services to Icelanders.

Alchemy Markets Broker Trust Score & Reviews

Alchemy Markets has garnered positive reviews from its user base, reflected in its impressive Alchemy Markets Trustpilot score of 4.3 out of 5 from just 7 reviews. Here's a breakdown of what traders are saying:

Positive Feedbacks:

- Fast and reliable execution

- Competitive spreads and low fees

- Responsive customer support

- User-friendly platforms

Negative Feedbacks:

- More educational resources

- Expansion of cryptocurrency offerings

- Lack of social trading features

Educational Resources

Alchemy Markets offers a range of educational resources to help traders sharpen their skills:

- Comprehensive guides on candlestick patterns

- In-depth articles on various trading strategies

- Tutorials on using technical indicators effectively

- Regular market analysis and economic calendars

- Webinars hosted by industry experts.

While their educational offering is solid, some traders feel it could be expanded further to include more advanced topics and interactive learning tools.

Alchemy Markets Comparison Table

Let's compare the pros and cons of trading with Alchermy Markets with Other Forex Brokers.

Parameters | Alchemy Markets Broker | |||

Regulation | MFSA Malta | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 0.2 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0 | From $3 | From $0 | From $0.2 to USD 3.5 |

Minimum Deposit | $100 | $200 | $100 | $10 |

Maximum Leverage | 1:500 | 1:500 | 1:500 | Unlimited |

Trading Platforms | MT4, FIX API | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Classic, Premier, and VIP | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 2,250+ | 2100+ | 200+ |

Trade Execution | Market, STP | Market | Market, Pending | Market, Instant |

TradingFinder Expert Opinion and Conclusion

Alchemy Markets enable EEA users to trade 6 markets[Forex, Indices, Stocks, Commodities, ETFs, Crypto] with 1:30 maximum leverage.

Achemy Markets broker provides institutional-grade liquidity from 20+ top-tier banks [Barclays, e.g] and non-bank providers.

On the other hand, minimum deposit is $100, which is higher than some other brokers.