Alpaca Markets broker charges $0 in commissions on trades and provides zero-fee trading for users. Alpaca's API options include Trading API (for individual traders and developers) and Broker API (for developers and financial institutions).

Deposit methods include bank wire and crypto, while bank wire and crypto are available for withdrawals. Accounts with Alpaca Securities LLC are protected by SIPC insurance up to $500,000, including $250,000 in cash, with additional coverage through Lloyd’s of London.

Alpaca Markets Broker Company Information & Regulation Status

Alpaca Markets has positioned itself as a pioneer in the API-driven brokerage space. Founded in 2015, the company started as a database and machine learning venture before pivoting to a cutting-edge brokerage platform.

Alpaca operates through several regulated entities globally; Alpaca Regulations:

- Alpaca Securities LLC (US)

- Alpaca Crypto LLC (US)

- AlpacaX Securities Ltd. and AlpacaX Crypto Ltd. (Bahamas)

- Alpaca Japan Co., Ltd. (Japan)

Some facts about the broker’s regulation include:

- Alpaca Securities LLC is registered with FINRA and the SEC in the US

- Alpaca Crypto LLC is a registered Money Services Business with FinCEN

- The Bahamian entities are registered with the Securities Commission of the Bahamas

- The Japanese entity holds a securities license with the Japan Securities Dealers Association

Here are the details for Alpaca Markets’ regulation:

Entity / Parameter | Alpaca Securities LLC | Alpaca Crypto LLC | AlpacaX Crypto Ltd. | AlpacaX Securities Ltd. | AlpacaJapan Co., Ltd. |

Regulation | FINRA / SEC | FinCEN MSB | Securities Commission of the Bahamas (Digital Asset Business) | Securities Commission of the Bahamas (Securities Business) | JSDA (Registration No. 3024) |

Regulation Tier | N/A | N/A | N/A | N/A | N/A |

Country | United States | United States | Bahamas | Bahamas | Japan |

Investor Protection Fund / Compensation Scheme | Accounts with Alpaca Securities LLC benefit from SIPC protection up to $500,000 (including up to $250,000 cash) and excess insurance coverage via Lloyd’s of London | None (no SIPC/FDIC protection) | None | None | Local JSDA protections |

Segregated Funds | Yes | N/A | Yes | Yes | Yes |

Negative Balance Protection | N/A | N/A | N/A | N/A | N/A |

Maximum Leverage | N/A | N/A | N/A | N/A | N/A |

Client Eligibility | individuals and entities from most countries worldwide, except for certain restricted jurisdictions including Belarus, Russia, Ukraine conflict zones, North Korea, Iran, and more | Varies by crypto regulation | Bahamas-compliant clients | Bahamas-compliant clients | Japan-based clients |

Alpaca Markets Summary of Specifics

To give you a quick overview of what the Forex broker offers, here's a summary table of its key features:

Broker | Alpaca Markets |

Account Types | N/A |

Regulating Authorities | FINRA, SEC, FinCEN, SCB, JSDA |

Based Currencies | USD |

Minimum Deposit | N/A |

Deposit Methods | Bank Wire, Crypto |

Withdrawal Methods | Bank Wire |

Minimum Order | N/A |

Maximum Leverage | N/A |

Investment Options | N/A |

Trading Platforms & Apps | Own Platform |

Markets | Crypto, Equities, Options |

Spread | N/A |

Commission | $0 |

Orders Execution | N/A |

Margin Call/Stop Out | N/A |

Trading Features | Algorithmic Trading |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Online chat, Email |

Customer Support Hours | Online chat, (24/7) Email (Standard Working Hours) |

Alpaca Markets Use Cases

Alpaca Markets stands out as an API-based broker, diverging from the conventional account types typically offered by traditional brokers.

Instead of categorizing its services into standard account types, Alpaca focuses on various "Use Cases" designed to meet the unique needs of different trading segments; Alpaca Use Cases:

- Fintech startups

- Digital wallets

- Broker-dealers

- Hedge funds

- Proprietary trading firms

- Algorithmic traders

- Robo-advisors

- Crypto exchanges

This approach not only enhances flexibility but also allows users to create customized trading experiences that align with their objectives.

Alpaca Markets Advantages and Disadvantages

Let's break down the pros and cons of using Alpaca Markets; Alpaca Advantages and Drawbacks:

Advantages | Disadvantages |

Easy-to-use API | Higher interest costs |

Commission-free trading | Limited to US stocks, Options, and Crypto |

Free data through third-party vendors | No forex trading available |

Strong focus on algorithmic trading | - |

Alpaca Markets broker shines in its API offerings and support for algorithmic trading.

However, it may not be the best choice for traders looking for a wide range of global assets or those primarily interested in forex trading.

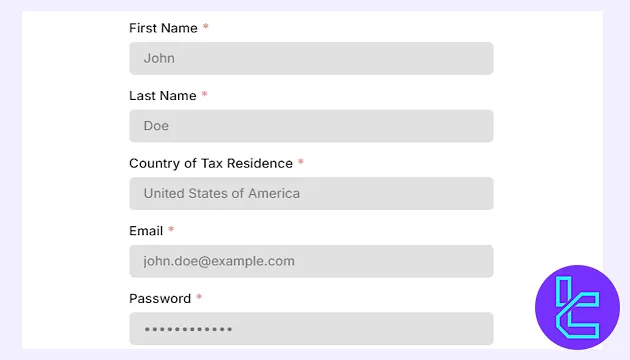

Alpaca Markets Signing Up & Verification Process

Alpaca broker provides a streamlined sign-up process, offering users 2 distinct options based on their trading needs. Alpaca Registration Options:

#1 Go to the Official Website

Begin by navigating to the Alpaca Markets homepage. Locate and click on the “Sign Up” or “Open an Account” button to launch the registration flow.

#2 Complete the Personal Information Form

Input your key details, including:

- First and Last Name

- Country of Tax Residence

- Email Address

- Password

Once completed, hit “Sign Up” to move forward.

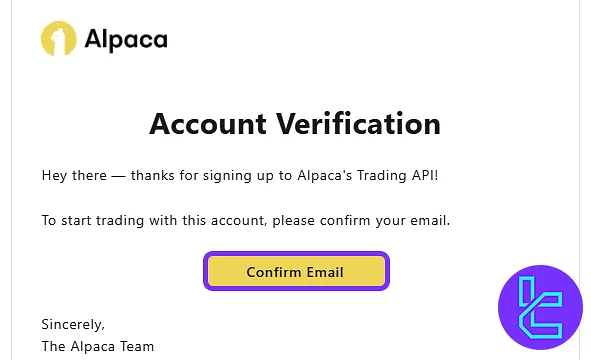

#3 Verify Your Email

Check your inbox for an email from Alpaca. Click the “Confirm Email” link to validate your address and activate your account.

#4 Complete User KYC

In this step, you must provide personal details, including name, date of birth, address, phone number, tax identification number, and upload a government-issued ID card as proof of identity.

Alpaca Broker Trading Platforms

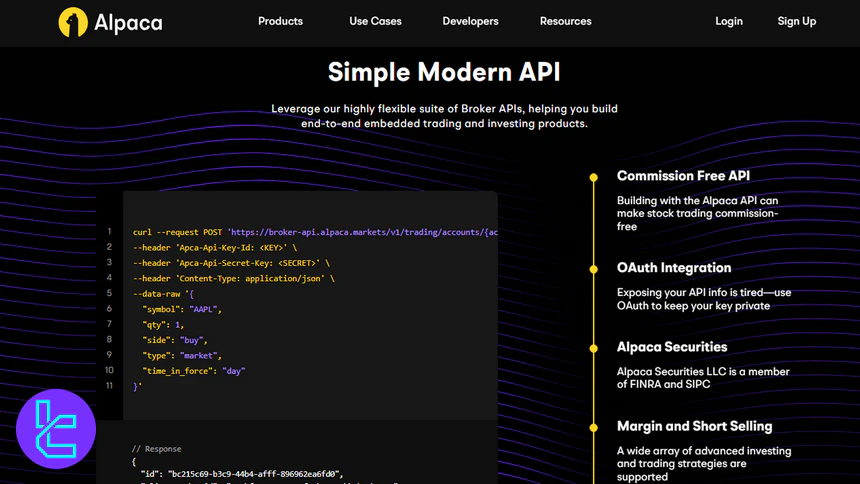

Unlike many of the best forex brokers, Alpaca Markets does not offer traditional trading platforms like MetaTrader 5 orcTrader.

Instead, Alpaca takes a modern approach by providing API-driven services tailored for developers, fintech startups, and advanced traders.

This means that instead of a conventional user interface for placing trades, users interact with Alpaca’s systems directly through their Trading API or Broker API.

This allows traders to build their own customized trading platforms, apps, or algorithms that can execute trades programmatically.

Alpaca Markets Spreads and Commissions

Alpaca typically does not charge commissions for trades. However, if your account is set up through an authorized business partner, commission-free trading may not be available.

Overall, the fees you pay depend on the specific transactions and your partnership arrangement rather than the total value of your account.

Alpaca Markets Swap Fees

Alpaca Markets does not provide information regarding swap fees, overnight financing, or rollover charges on its official website.

Therefore, it remains unclear whether any overnight or rollover costs are applied beyond standard margin interest or borrowing rates.

Alpaca Markets Non-Trading Fees

Alpaca Markets maintains a transparent fee structure with no explicit mention of inactivity charges on its official website. This means it’s unclear whether the broker applies any fees for dormant or inactive accounts.

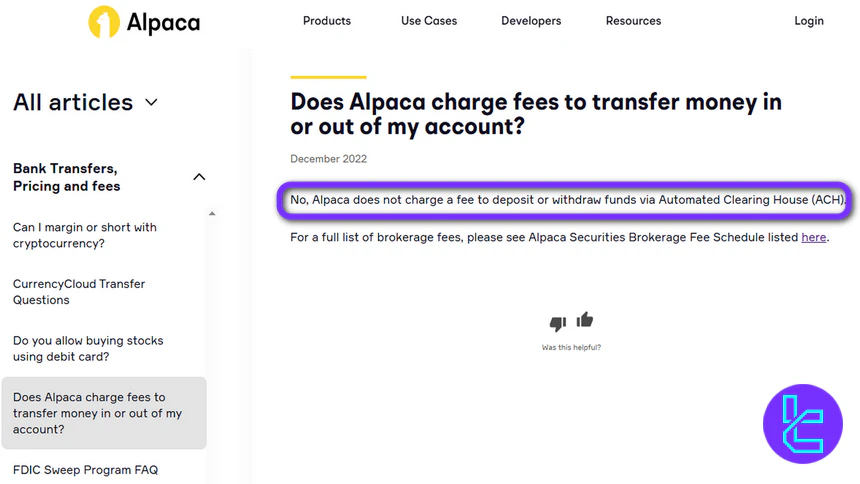

For transactions, Alpaca does not impose any deposit or withdrawal fees when using Automated Clearing House (ACH) transfers. Similarly, no additional withdrawal costs are indicated for standard account operations, making ACH the most cost-efficient funding method for clients.

Overall, based on the available information, Alpaca’s non-trading costs appear minimal, though traders should verify the latest fee schedule or contact support for confirmation regarding inactivity or other non-ACH transfer fees.

Alpaca Broker Deposit & Withdrawal Methods

Alpaca broker deposit and withdrawal have slightly different conditions compared to the typical brokers. Here are what you can find about the methods:

- Deposit/Withdrawal Options: Bank transfers;

- Currency Support: Only supports USD; no support for multiple currencies;

- Card Funding: No option for credit/debit card deposits;

- Wire Withdrawals: Available but costly;

- Cryptocurrency Transfer: Supported for deposits and withdrawals.

Alpaca Deposit

Alpaca Markets exclusively supports bank transfer-based funding for client accounts, providing several options optimized for speed, transparency, and cost-efficiency.

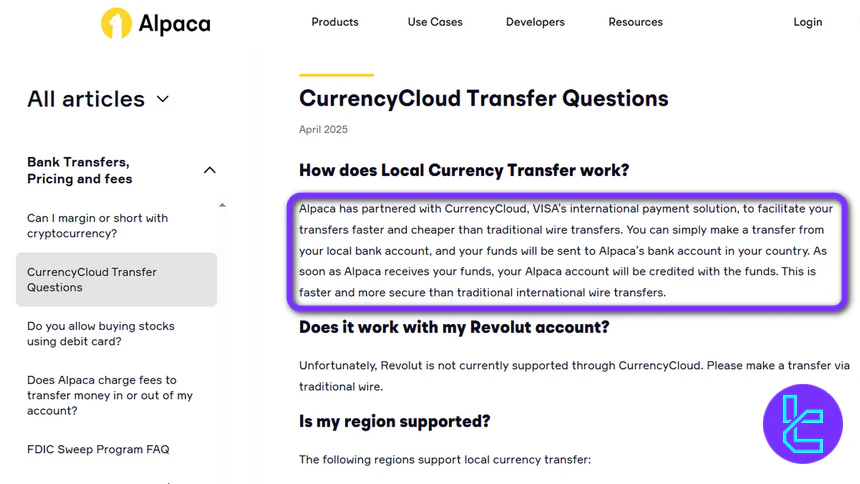

The primary method, Local Currency Transfer, is facilitated through CurrencyCloud, a global payments platform owned by VISA.

This service allows traders to deposit funds from their domestic bank accounts directly to Alpaca’s local banking partners. Transfers are processed faster than traditional international wires, with no deposit fees listed, and funds are credited once received.

For clients preferring traditional international wire transfers, deposits are processed through standard banking networks, typically taking 1–5 business days. While Alpaca does not charge a deposit fee, intermediary or bank charges may apply depending on the route.

Alpaca also offers Instant Funding via its API for USD deposits. Payments created before 8 p.m. ET on T+0 settle by 1 p.m. ET the next business day (T+1).

Transfers made after this cutoff are recognized as T+1 and settle by 1 p.m. ET on T+2. Late payments incur a daily interest penalty calculated at the federal interest rate plus 8% annually, applied until the balance is cleared.

Here are the details of Alpaca deposit methods:

Deposit Method | Supported Provider | Currency Type | Processing Time |

Bank Transfer (Local Currency Transfer) | CurrencyCloud (powered by VISA) | Local Currency (varies by country) | Typically faster than international wires |

Bank Wire (International Transfer) | Traditional Banking Network | USD | 1–5 business days |

Instant Funding (Bank Transfer) | Alpaca Instant Funding API | USD | Same day or next business day (T+1 or T+2) |

Alpaca Withdrawal

Alpaca Markets provides several options for clients to withdraw funds or transfer assets, focusing on reliability and regulatory compliance.

The primary method for cash withdrawals is bank transfers via ACH, which allows clients to move USD funds from their Alpaca account to their linked domestic bank account.

There are no fees charged by Alpaca for ACH withdrawals, although standard banking or intermediary fees may apply in some cases.

For deposited funds via ACH, withdrawals must generally be returned to the same bank account used for the deposit.

ACH withdrawals are subject to a processing hold depending on when the funds were deposited, typically around six business days for newly deposited funds.

In addition to cash withdrawals, Alpaca supports share transfers to other brokers through ACATS if the receiving broker is compatible.

Eligible clients can also withdraw cryptocurrency, with withdrawals requiring wallet whitelisting and additional security steps to ensure safe transfers.

In the table below, you can see an overview of withdrawal methods:

Withdrawal Method | Supported Provider | Currency/Asset Type | Processing Time |

ACH Bank Transfer | U.S. Bank Network | USD | 1–3 business days (after hold) |

Share Transfer (ACATS) | ACATS-Compatible Brokers | U.S. Stocks/ETFs | 3–5 business days |

Cryptocurrency Withdrawal | Supported Crypto Wallets | BTC, ETH, other eligible crypto | 1–2 business days (network dependent) |

Copy Trading & Investment Option Offerings in Alpaca

It's worth noting that copy trading is a popular feature in the broader trading landscape. Copy trading allows investors to automatically replicate the trades of experienced traders.

While Alpaca doesn't directly offer copy trading software for crypto or other markets, its API could be used to build such functionality into custom trading applications.

Alpaca Markets Tradable Markets & Symbols

Alpaca provides access to a range of markets and symbols:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Stocks | US Equities, including fractional shares | Thousands of stocks | 800–1200 | N/A |

Crypto | CFDs on cryptocurrencies | Over 20 cryptocurrencies | 20–50 | N/A |

Options | US Options trading | Thousands of options contracts | 500–1000 | N/A |

Notably, Alpaca's Local Currency Trading API allows customers to view stock prices, trades, performance, and statements in their local currency, enhancing the user experience for international traders.

Alpaca Markets Broker Bonuses and Promotions

Alpaca occasionally runs promotions to incentivize trading; A recent example is the Crypto Rewards Program:

- Duration: March 21 - May 20, 2022

- Reward: $100 worth of cryptocurrencies for every $100,000 in crypto trading volume

- No limit on how often the reward can be earned

While this promotion has ended, it demonstrates Alpaca's willingness to offer incentives to active traders. Always check Alpaca's official channels for current promotions.

Alpaca Markets Awards

Alpaca Markets has received multiple accolades highlighting its influence in the fintech and developer communities. In 2024, the platform earned the “Best API” award from Postman at their annual API Network Awards, reflecting its commitment to accessible financial services for developers worldwide.

The brokerage infrastructure provider, offering API access to stocks, ETFs, options, fixed income, and crypto, was named a 2025 Inc. Power Partner, an honor recognizing B2B companies that effectively support entrepreneurs and facilitate startup growth.

Alpaca has also been recognized at the Benzinga Global Fintech Awards. In 2023, it won Best API Solution, and in 2022, the platform was named Best Automated Trading Software, underscoring its continued leadership in API-first investment solutions for stocks and crypto.

These Alpaca awards collectively emphasize the broker’s focus on robust API services, developer support, and innovation within the global fintech landscape.

Alpaca Markets Support Team

Alpaca Markets provides a streamlined approach to customer support; Alpaca Support Channels:

- Email: support@alpaca.markets

- Online chat

It’s important to note that real-time support options are somewhat limited compared to brokers that offer phone support.

The absence of a direct phone line may be a consideration for users who prioritize immediate assistance.

Alpaca Broker List of Restricted Countries

Alpaca Trading might have geographical restrictions in place, which means its services may not be available in certain regions or countries.

This limits access to its platform for some potential clients, especially those residing in areas where Alpaca does not operate.

Traders should check the availability of Alpaca's services in their specific region before attempting to open an account to ensure they can utilize the broker’s offerings.

For the most up-to-date information on country restrictions, it's best to contact their support.

Alpaca Markets Trust Scores & Reviews

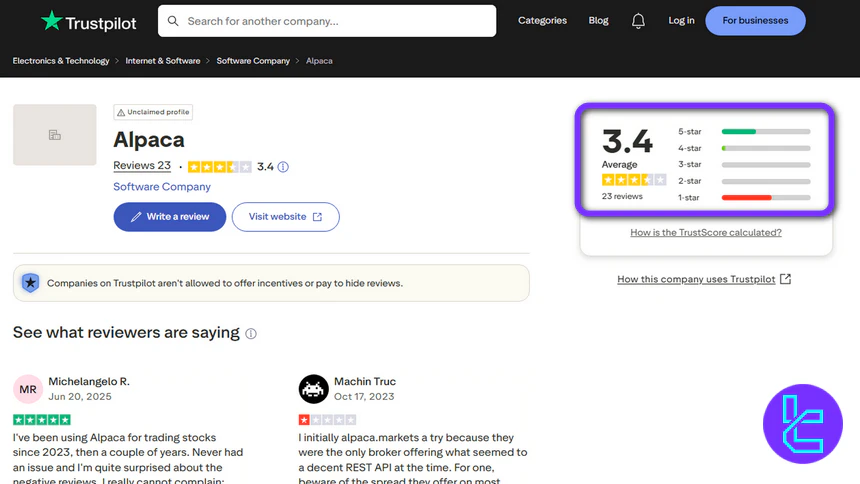

The Alpaca Markets Trustpilot profile has a score of 3.4 out of 5, based on 23 reviews as of November 2025.

This limited number of reviews raises concerns about their reliability, as such a small sample size may not accurately reflect the overall client experience.

Additionally, the authenticity of these reviews could be questioned, leading to doubts about the trustworthiness of the score.

Potential clients should approach this rating with caution and consider seeking further information from other sources to get a more comprehensive view of the broker’s performance and reputation.

Education on Alpaca Markets Broker

Alpaca Markets places a strong emphasis on user education, offering a variety of resources designed to enhance traders' knowledge and proficiency.

The broker provides access to a comprehensive learning hub that includes articles, tutorials, and guides covering a wide range of topics relevant to trading and investing; Alpaca Educational Content:

- Algorithmic trading

- Crypto basics

- App development and more

Additionally, Alpaca's educational approach includes practical examples and code recipes, allowing users to apply what they've learned in real-world scenarios.

By simplifying complex concepts, such as those related to IRA accounts and the various endpoints of the Broker API, Alpaca empowers its users to navigate the trading landscape more confidently.

Alpaca Markets in Comparison with Other Brokers

While Alpaca isn't exactly a broker, we should still compare it to other Forex brokerages to see whether using its services is beneficial or not.

Parameters | Alpaca Markets Broker | |||

Regulation | FINRA, SEC, FinCEN, SCB, JSDA | FSC | FSA, FCA, CySEC, LFSA, FSCA | FSC, CySEC |

Minimum Spread | N/A | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | Variable | From $0.0 | From $0.0 |

Minimum Deposit | N/A | $200 | $100 | $5 |

Maximum Leverage | N/A | 1:3000 | 1:1000 | 1:3000 |

Trading Platforms | Own Platform | MT4, MT5, FXTM Trader App | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | MT4, MT5, Mobile App |

Account Types | N/A | Advantage, Stocks Advantage, Advantage Plus | Classic, Raw | Standard |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 1000+ | 620+ | 550+ |

Trade Execution | N/A | Market, Instant | Market | Market |

Conclusion and final words

Alpaca is accessible for developers through its Trading API and Broker API, enabling the creation of custom trading applications.

However, Alpaca has some limitations, such as offering onlyUSD currency support and not providing currency trading.

Occasional promotions like the Crypto Rewards Program (offering $100 worth of crypto for every $100,000 in crypto trading volume) are also available.

The broker has a TrustScore of 3/5 on Trustpilot, based on 6 reviews, which may suggest limited feedback from users.