Amarkets Verification is a 3-step process that ensures security and access to all platform features..

The verification process includes confirming your email and phone number, as well as uploading identification documents. After completing the KYC process, users can begin using Amarkets' copy trading platform (commission ranges from 5% to 50%), or submit a withdrawal request with a minimum amount of just $5.

Overview of the Steps

You don't have a long way to go to verify your Amarkets broker account; Amarkets Verification steps:

- Go to My Profile;

- Verify your email and phone number;

- Submit and scan your ID documents.

Before starting this process on the Amarkets dashboard, review the table below to gather the necessary documents.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | Yes |

Residential Address Details | No |

Phone Number Verification | Yes |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | No |

Utility Bill (for POA) | No |

Bank Statement (for POA) | No |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

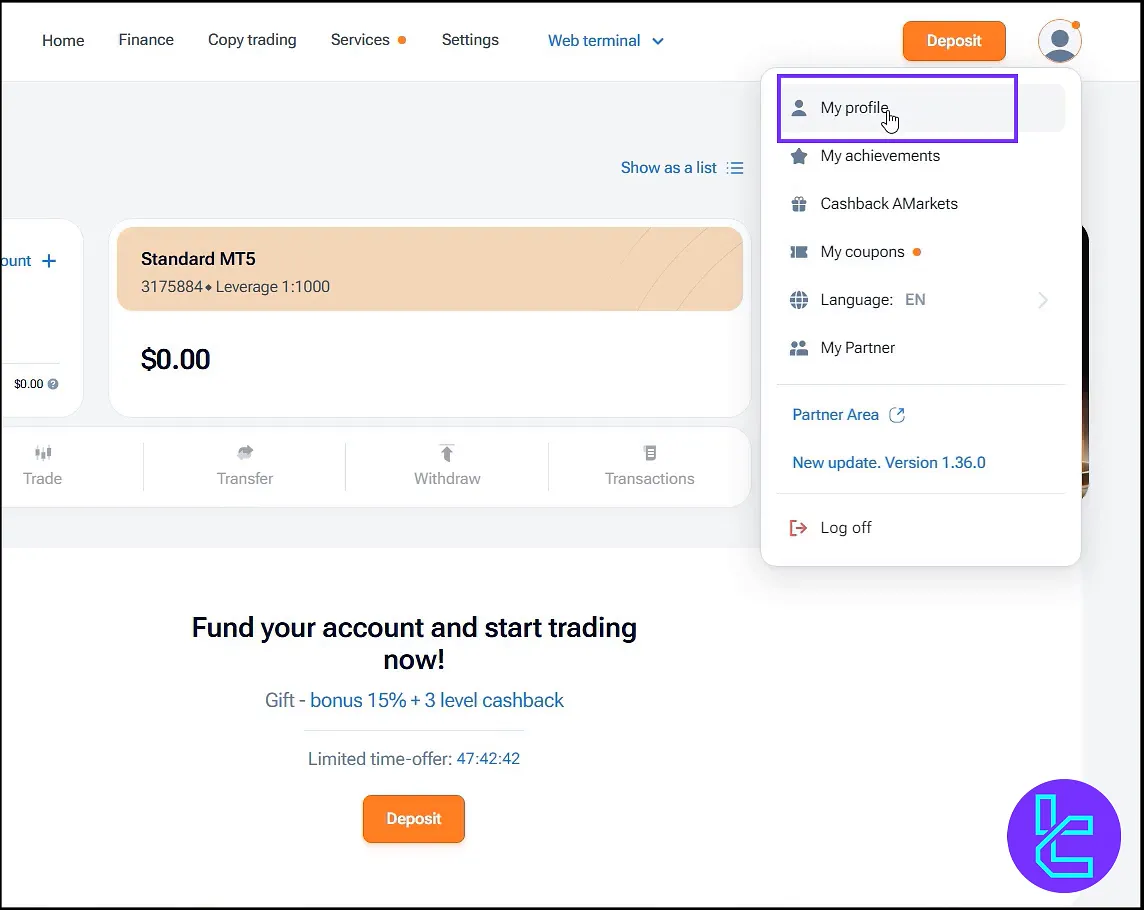

#1 Access Profile Settings

- Log in to your Amarkets account;

- Click on the avatar in the main dashboard and go to My Profile.

As you can see, the upload document section is not activated. To do so, you should verify your email and phone number.

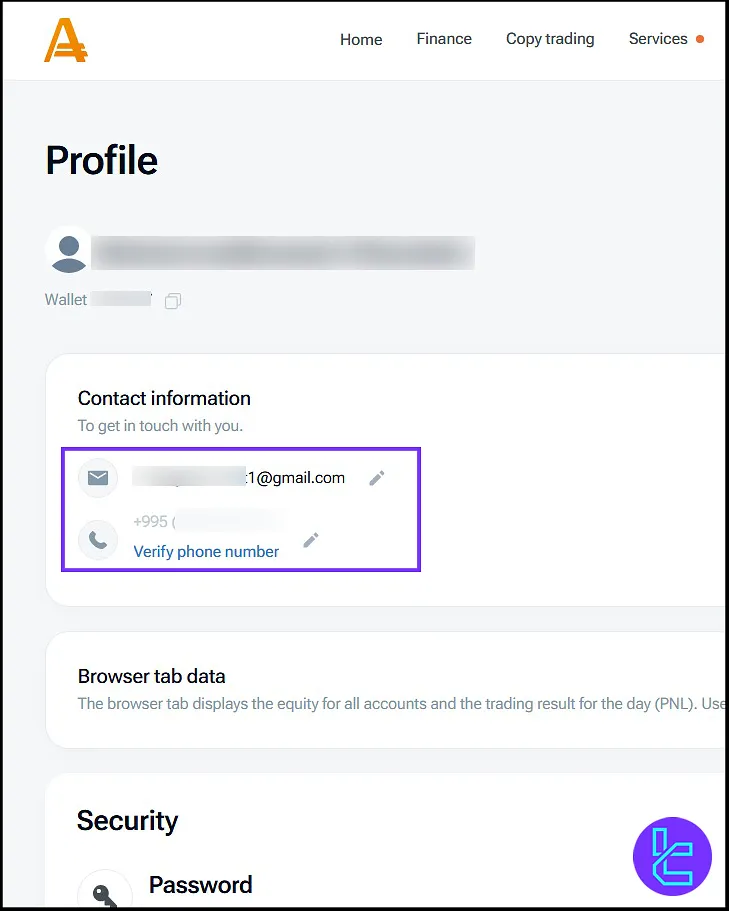

#2 Verify Email and phone number

- Enter the verification code sent to your email during registration;

- Receive a call on your registered number and input the last 4 digits to verify.

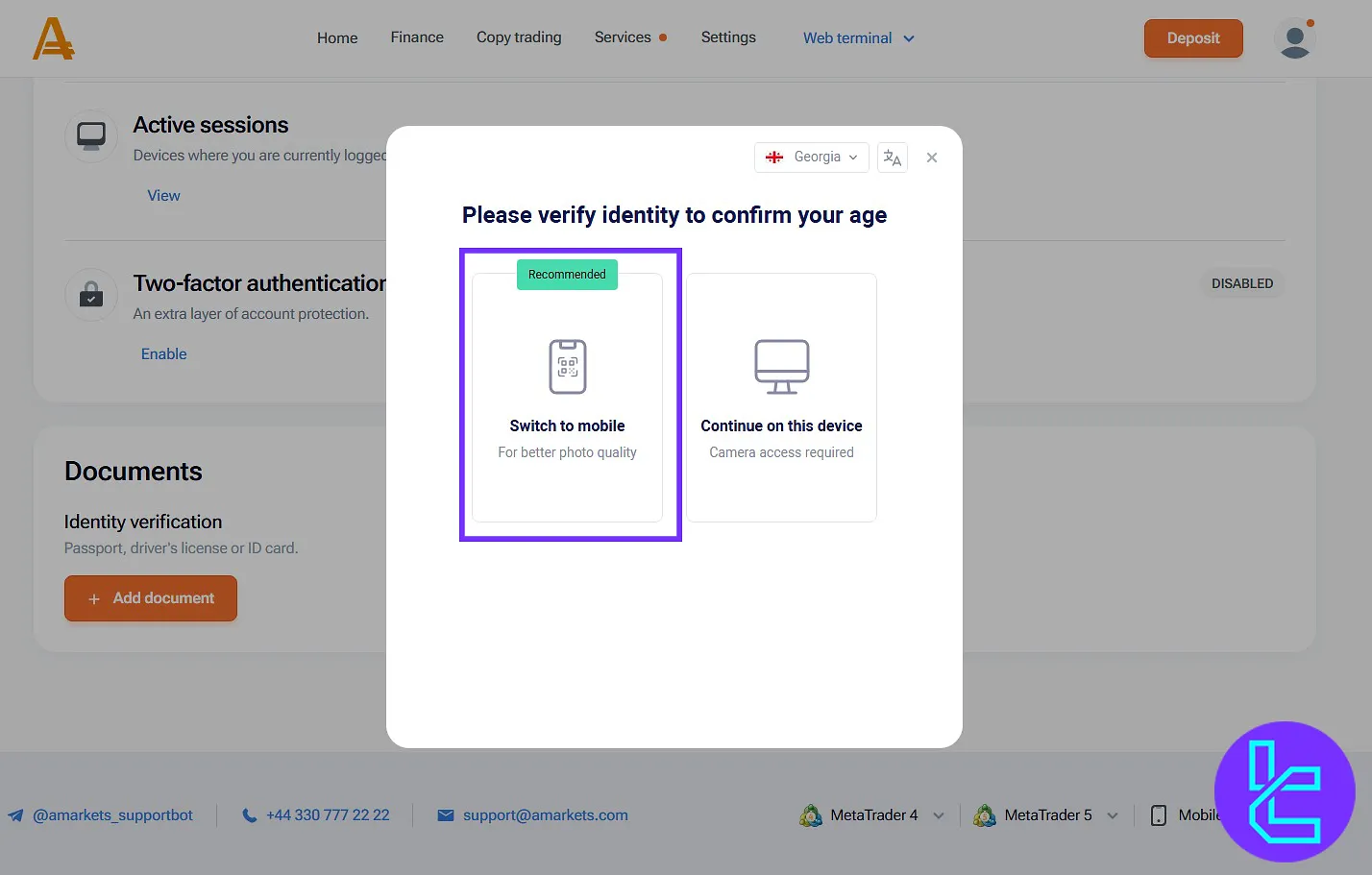

#3 Document Upload

- Once the email and phone are verified, the Add Documents option will be available; click on that;

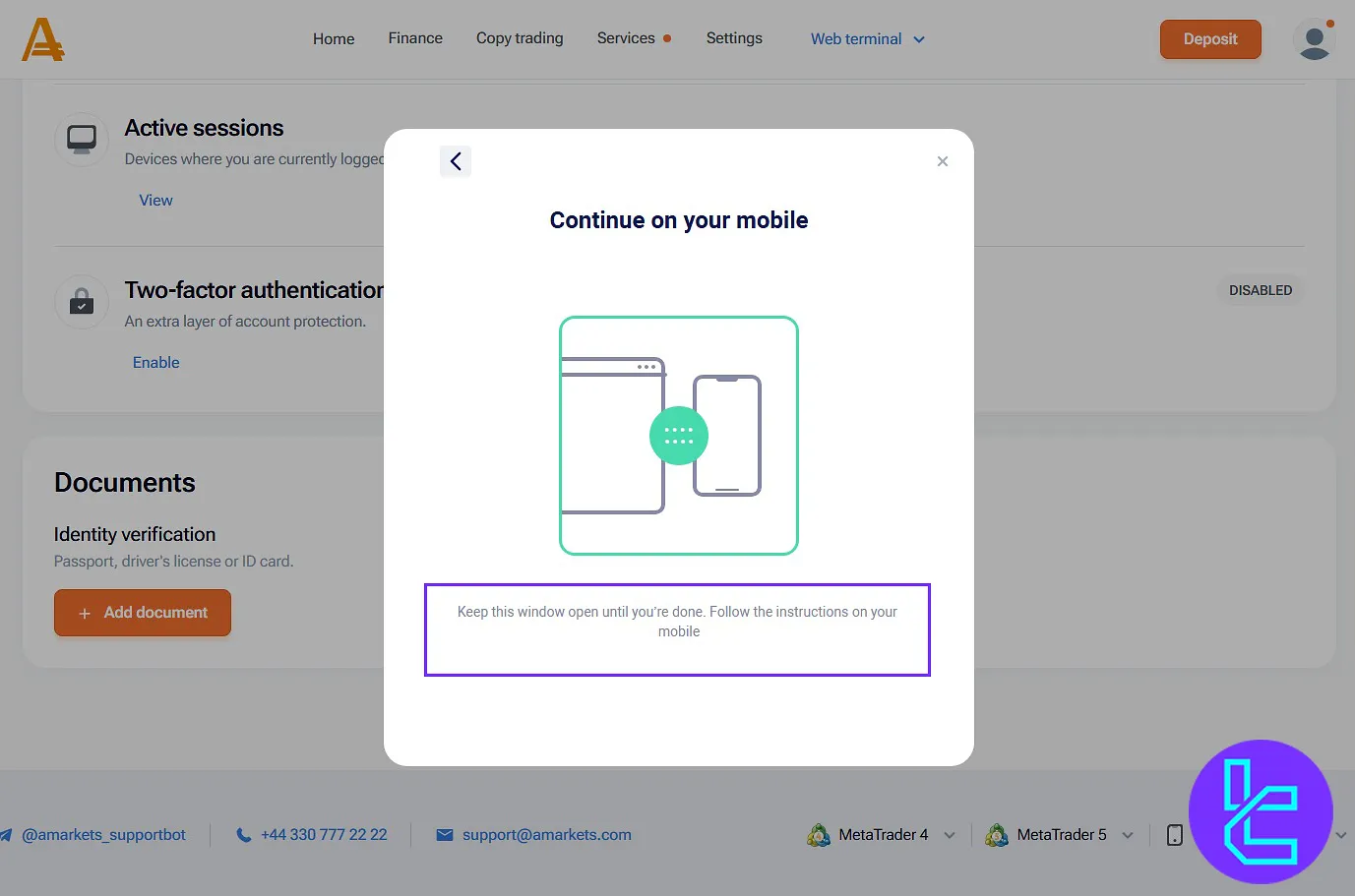

- At this stage, you can choose to continue the steps on your mobile phone or on the device you are currently using;

- Keep the windows open until your verification on the phone is complete;

- Use your mobile device to scan both sides of the document;

- Review your details like name, date of birth, and gender;

- Click Continue to finalize the verification.

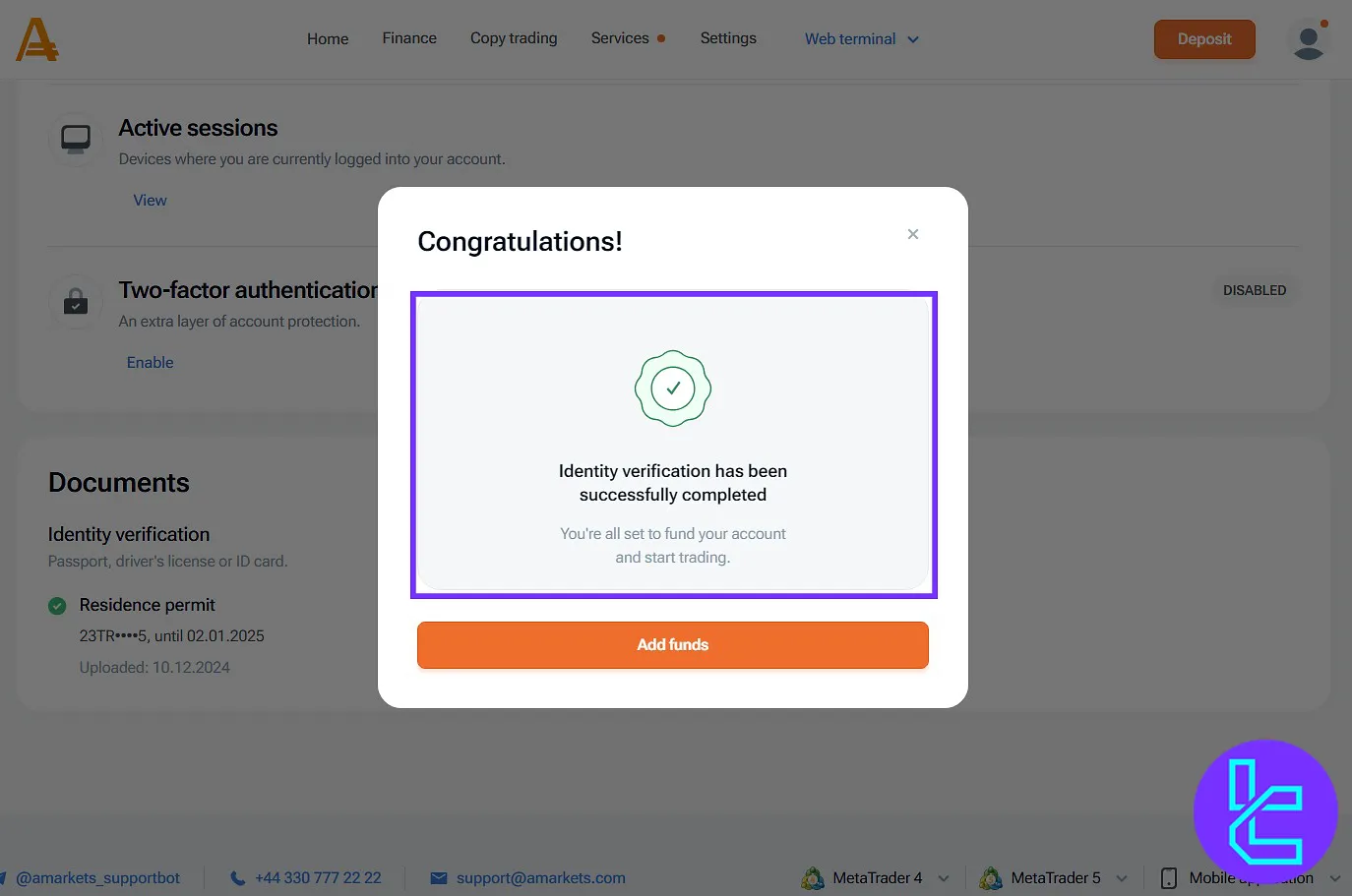

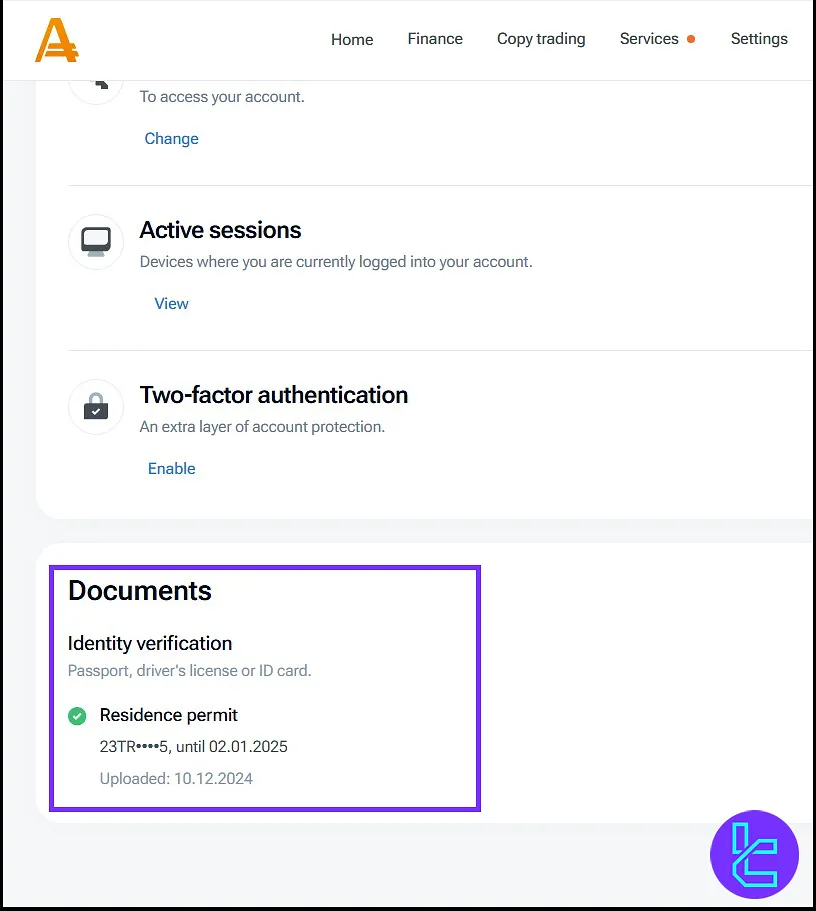

as you can see, our identity verification has been successfully completed.

You can also see the verification status from the document section.

Amarkets KYC in Comparison with Other Brokers

The table below provides a comparison of the required documents and information in the KYC procedure on Amarkets and other Forex brokers.

Verification Requirement | Amarkets Broker | |||

Full Name | No | Yes | No | No |

Country of Residence | No | No | No | Yes |

Date of Birth Entry | No | Yes | No | No |

Phone Number Entry | Yes | No | No | No |

Residential Address Details | No | Yes | No | Yes |

Phone Number Verification | Yes | Yes | No | No |

Document Issuing Country | No | Yes | No | No |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | No | Yes | No | No |

Utility Bill (for POA) | No | No | Yes | Yes |

Bank Statement (for POA) | No | No | Yes | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | Yes | No |

Financial Status Questionnaire | No | Yes | No | Yes |

Trading Knowledge Questionnaire | No | Yes | No | No |

Restricted Countries | Yes | Yes | Yes | Yes |

Conclusion and Final Words

Amarkets Verification typically takes just 5 minutes and involves entering a verification code, receiving a call, and scanning your ID.

Once verified, you're ready for the next step, which is exploring Amarkets' Deposit and Withdrawal Options. Check out our guides on the Amarkets Tutorial page for similar articles.