Axi offers commission-free trading services on 5 asset classes, including Forex and Cryptocurrencies. It offers affiliates up to $1,000 CPA per referred client, and a 10% commission for sub-affiliates. The broker offers various eBooks, including “Hat Trick” and “Panic Over”.

Axi (Company Information and Regulation)

Axi, operating under the trading name of Solaris EMEA Ltd, has been a well-established player in the online trading sphere since 2007. Registered in Cyprus under the number HE376148, the broker has acquired licenses from multiple top-tier regulatory bodies, including:

- Cyprus Securities and Exchange Commission (CySEC), license number 433/23;

- Australian Securities & Investments Commission (ASIC), AFSL number 318232;

- England Financial Conduct Authority (FCA), Reference Number 509746;

- Dubai Financial Services Authority (DFSA).

Essentially, Axi's regulatory status serves as a seal of approval, assuring traders that they deal with a broker prioritizing compliance and client protection.

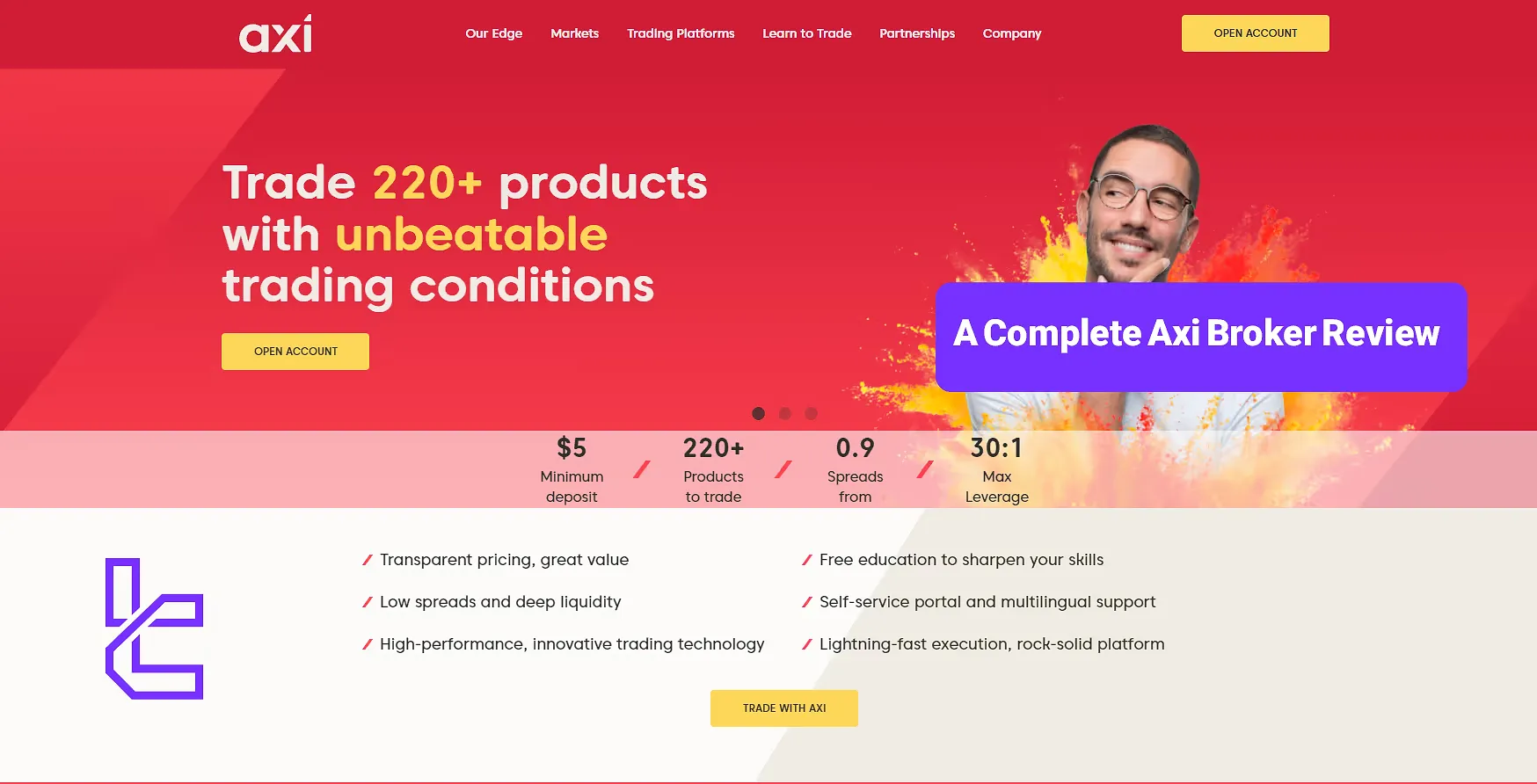

Specifics of Axi Broker

Diving deeper into the ecosystem, we find a broker that's designed its offerings to cater to a diverse range of traders. Let's break down some of the key features that make Axi stand out in the crowded broker landscape.

Broker | Axi |

Account Types | Standard, Pro |

Regulating Authorities | ASIC, FCA, DFSA, CySEC |

Based Currencies | EUR, USD, PLN |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfer, Credit/Debit Cards |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | Trading signals, Copy Trading |

Trading Platforms & Apps | MT4, Axi CopyTrade |

Markets | Forex, Indices, Shares, Commodities, Cryptocurrencies |

Spread | Variable based on the account types |

Commission | Variable based on the account types |

Orders Execution | Market, Limit, Stop-Loss, Trailing Stops, Stop |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Signals, Economic Calendar, Copy Trading |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Chat Bot, Phone, WhatsApp, Ticket |

Customer Support Hours | 24/5 |

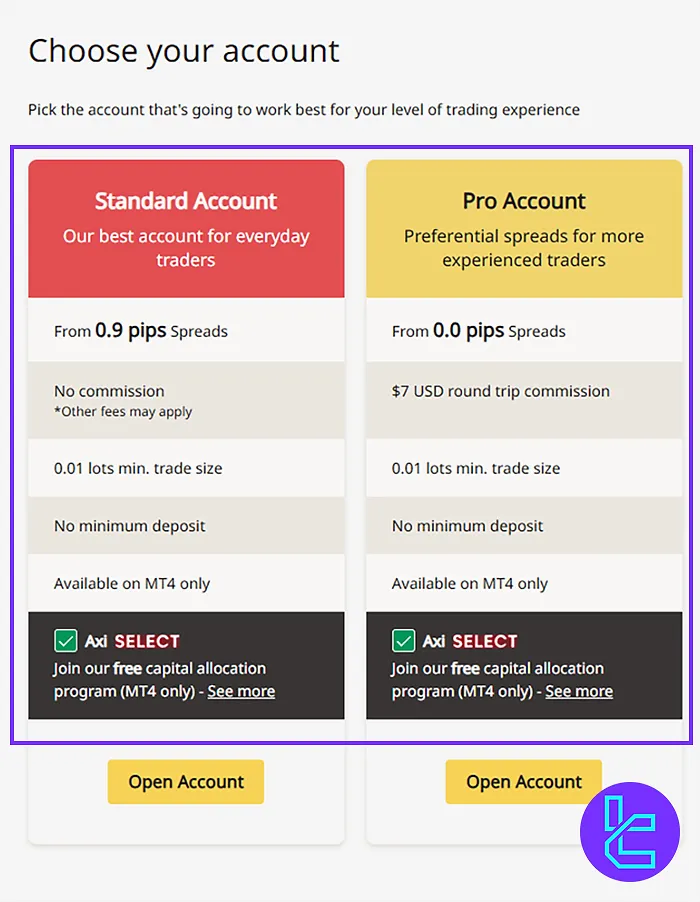

What Account Types Are Available on Axi Broker?

When it comes to account types, the broker keeps things refreshingly simple with two main options: The Pro and the Standard. Each caters to different trading styles and experience levels.

Axi provides traders with two primary account options tailored to different experience levels and trading styles:

- Standard Account: Designed for beginners and casual traders, this account features commission-free trading with slightly wider spreads. It's ideal for those seeking simplicity and zero upfront cost on trades.

- Pro Account: Built for experienced and high-volume traders, the Pro account offers ultra-tight spreads with a commission of $7 per round-turn per lot (i.e., $3.5 per side).

Both accounts require no mandatory minimum deposit, enabling users to start with any amount. However, Axi recommends a practical deposit of at least $50 to maintain effective trade management and margin coverage.

All account holders receive full access to MetaTrader 4, automated trading via Expert Advisors (EAs), and the complete range of available assets, ensuring parity in trading tools across account types.

Axi Pros & Cons

Every broker has its strengths and weaknesses, and this one is no exception. Let's take an honest look at what Axi brings to the table and where it might fall short.

Pros | Cons |

Regulated by reputable authorities | Low leverage options on retail accounts |

Competitive spreads starting from 0.0 pips | Limited payment options |

Low minimum deposit requirement | Limited trading platform offerings |

Diverse trading tools | - |

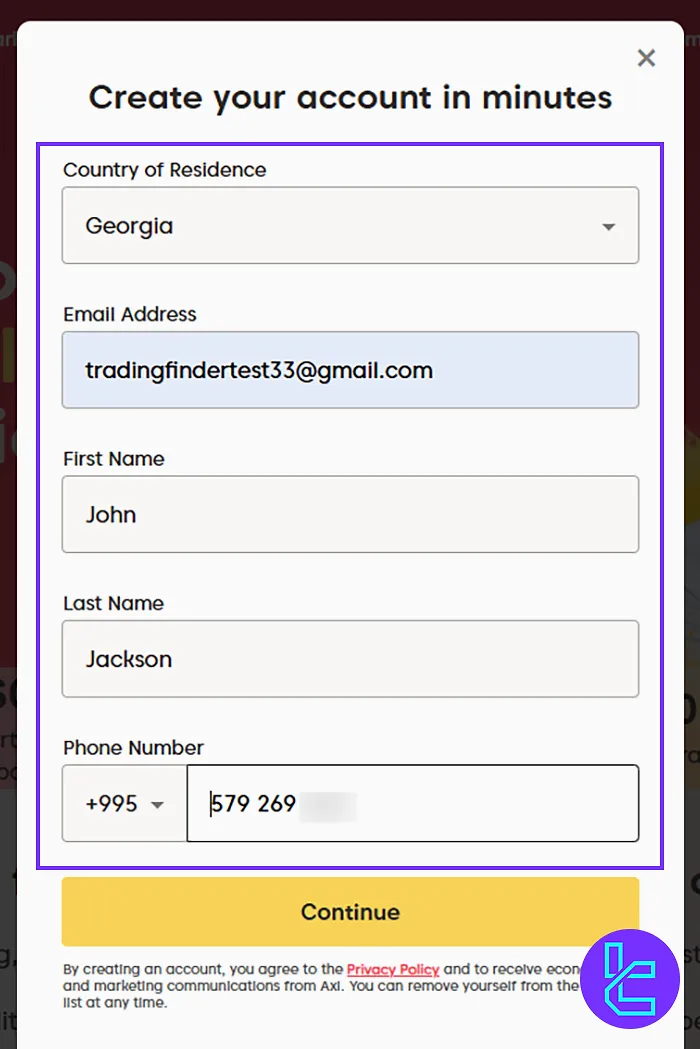

Axi Registration and Verification

Creating a new account with Axi broker is easy, even for beginner traders. Axi registration:

#1 Begin Your Application

Visit the Axi website and click on "Open Account". Enter your email, full name, mobile number, and select your country of residence.

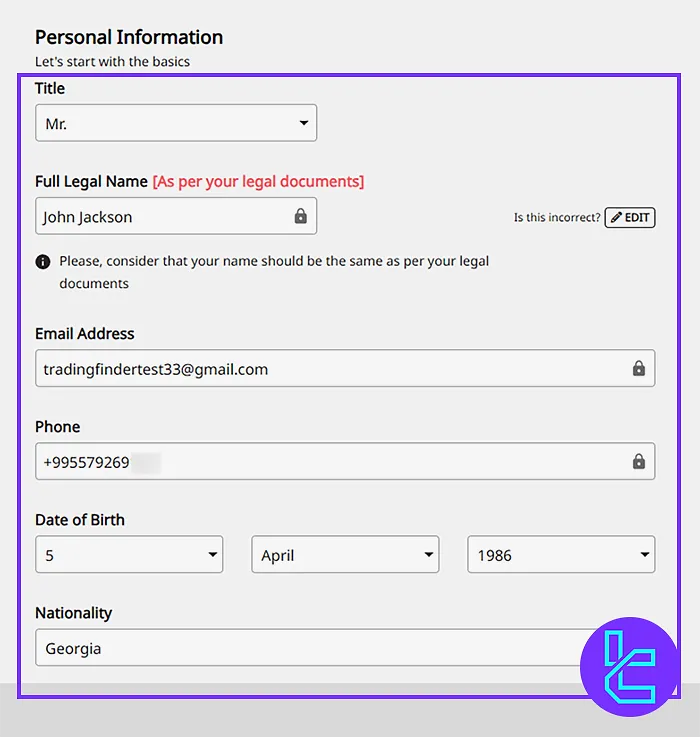

#2 Set Account Preferences

Choose your account type, trading currency, platform, and leverage, all tailored to your trading strategy.

#3 Verify Identity & Provide Financial Information

Submit your personal information, including:

- Date of birth

- Nationality

- Address

- Employment status

Disclose basic income and investment profile.

#4 Accept Terms & Register

Review and agree to the terms and conditions. Click "Submit" to complete the process and receive your login details via email.

Once registered, you must provide proof of identity and proof of address documents to complete the Axi verification process to access all Axi dashboard features.

Axi Broker Trading Platforms

Regarding trading platforms, the company has put all its eggs in one sturdy basket: MetaTrader 4 (MT4). This decision to focus on one trading solution might seem limiting initially, but there's a method to this madness.

MT4 is arguably the most popular trading platform in the Forex world, renowned for its robust features and user-friendly interface. It’s accessible across various devices and operating systems, including:

- Windows

- macOS

- iOS

- Android

- Axi MetaTrader4 Webtrader

Axi Fee Structure (Commission and Spread)

Axi follows a clear and competitive pricing model across its account types:

- Standard Account: Commission-free trading with spreads starting at 0.9 pips, ideal for traders preferring simplicity and zero transaction costs;

- Pro Account: Access to raw spreads from 0.0 pips with a $7 commission per round-turn per standard lot (equivalent to $3.5 per side) designed for cost-sensitive and active traders.

Beyond trading costs, Axi distinguishes itself with zero deposit and withdrawal fees across all payment methods. While Axi does not impose fees for fund transfers, users should note that intermediary banks or payment providers might charge service fees independently.

Additionally, Axi maintains a zero-inactivity fee policy and avoids all hidden costs, reinforcing its commitment to full transparency in pricing.

If you're interested in reducing your trading costs by earning Axi rebates, we recommend checking TradingFinder's IB services.

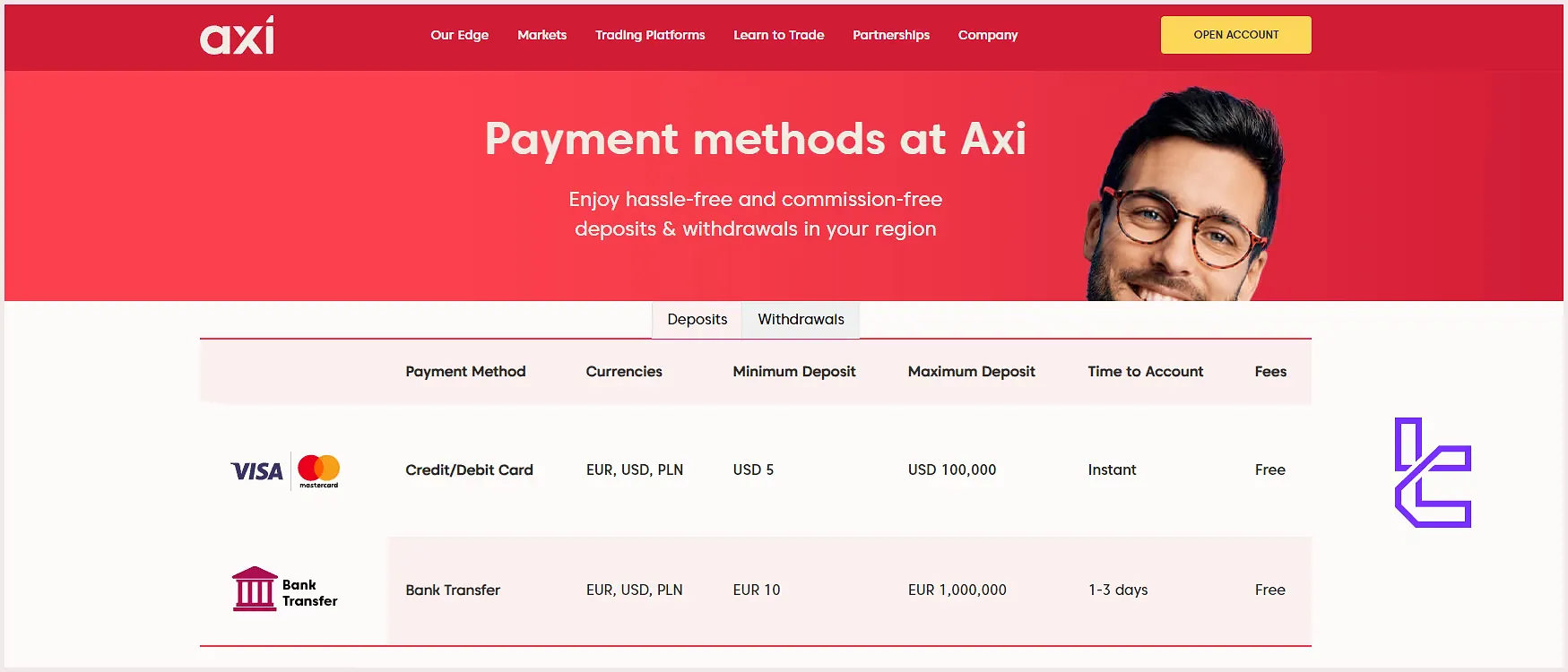

Available Payment Methods on Axi Broker

The company offers two main options for funding and payouts to cater to the diverse needs of its global client base.

Deposits

Method | Currencies | Min Deposit | Max Deposit | Processing Time |

Credit/Debit Card | EUR, USD, PLN | $5 | $100,000 | Instant |

Bank Transfer | EUR, USD, PLN | €10 | €1,000,000 | 1-3 days |

Withdrawals

Method | Currencies | Min Deposit | Max Deposit | Processing Time |

Credit/Debit Card | EUR, USD, PLN | $5 | $50,000 | Instant |

Bank Transfer | EUR, USD, PLN | €30 | €1,000,000 | 1-3 days |

One thing to remember is the $50,000 monthly fee-free limit for credit card deposits. After this limit, Axi reserves the right to pass on credit card transaction fees to the client. This is something to consider if you're planning to make large deposits via credit card.

Copy Trading and Growth Plans on Axi

Axi enhances its platform offering through a suite of premium tools and plugins:

- Autochartist: Offers real-time technical pattern recognition to help identify high-probability trade setups;

- PsyQuation: An AI-powered performance analytics platform that helps traders optimize risk, strategy, and behavioral patterns;

- Trading Central: Institutional-grade analytics with actionable market insights and expert commentary;

- Axi Copy Trading: A standalone mobile app (powered by Pelican) that allows clients to mirror trades from professional traders in real-time. Available for both iOS and Android.

Available Markets on Axi broker

The company offers a diverse range of markets for traders to explore, catering to various trading preferences and strategies.

- Forex: Over 70 currency pairs, including majors, minors, and exotics;

- Indices: 30+ index CFDs from US, UK, Europe, Asia, and Australia with leverage up to 1:20;

- Commodities: the most popular Metals (Gold and Silver), Energies (Oil and Natural Gas), and Agricultural products (Cocoa and Coffee) with leverage up to 1:20;

- Shares: CFDs on 100 most popular stocks from the US, UK, and European markets with leverage up to 1:5;

- Cryptocurrencies: 24/7 CFDs on 30 of the most popular coins, such as BTC, XRP, ETH, DOG, and DOT, with leverage up to 1:2.

Axi Broker Bonus Offerings

In an industry where sign-up bonuses and promotional offers are commonplace, Axi takes a different approach. The broker offers no traditional bonus programs or welcome incentives for new traders, due to regulatory compliance.

However, there is an Affiliate program in place that enables individuals to earn commissions by referring new clients to the broker. Key features of Axi referral:

- Up to $1000 CPA for each qualified client introduced;

- A 10% commission on sub-affiliate earnings for Master Affiliates;

- Marketing materials and support to help affiliates promote the broker effectively;

- Real-time tracking of referrals and earnings.

Axi Broker Customer Support

Quality customer support is crucial in online trading, and Axi understands this well. The broker offers a comprehensive multilingual support system to assist traders at various journey stages 24/5 via several channels, including:

service.eu@axi.com | |

Phone | +61 2 9965 5830 |

Chat Bot | Available on the official website |

Live Chat | Make a request to the chat bot |

Ticket | Use the "Contact Us" page |

Axi Geo-Restrictions

As a global broker, Axi serves clients from many countries around the world. However, like all financial service providers, they are subject to certain geo-restrictions based on regulatory requirements and business decisions. Restricted countries on Axi:

- United States of America

- Ontario, Canada

- Iran

- Israel

- Libya

- Syria

- Cuba

- Belgium

Axi Trust Scores

One of the most important topics in this Axi broker review is trust score. User satisfaction is paramount in online trading, and the company has made significant strides in establishing itself as a reputable broker.

4.2 out of 5 based on 2,064 reviews | |

Forex Peace Army | 2.8 out of 5 based on 157 reviews |

Reviews.io | 2.4 out of 5 based on 13 reviews |

Does Axi Broker Provide Educational Materials?

Education is a crucial component of successful trading, and Axi doesn’t perform very well in this regard. The broker offers a five-part forex trader eBooks series that covers various subjects, including:

- Forex

- MT4

- Indicators

- Price Action Playbook

- Trading Strategies

There are also other free ebooks among the broker’s offerings with some attractive titles, including:

- 7 Lessons for Understanding Forex Market Types

- 13 Exclusive Pro Tips for Using Chart Setups

- Hat Trick! 3 Easy Entry and Exit Strategies

- 3 Ways to Achieve Your Objectives with Position Sizing and System Monitoring

- Panic Over, 3 Rescues for When Your System Stops Working

How Axi Compares to Other Brokers

To determine whether Axi is the right broker for you, refer to the table provided below.

Parameters | Axi Broker | AvaTrade Broker | Tickmill Broker | FxGrow Broker |

Regulation | ASIC, FCA, DFSA, CySEC | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA | CySec, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Spread | 0.9 Pips | Depending on the Asset | 0.0 Pips | 0.00001 pips |

Commission | $0 | No Commission on Deposits/Withdrawals Inactivity Fees Overnight Fees | $0 | $8 for FX |

Minimum Deposit | $5 | $100 | $100 | $100 |

Maximum Leverage | 1:30 | 1:400 | 1:1000 | 1:300 |

Trading Platforms | MetaTrader 4, Axi Copy Trade | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 5 |

Account Types | Standard, Pro | Retail, Professional, Islamic, Demo | Classic, Raw | ECN, ECN Plus, ECN VIP, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 280+ | 1250+ | 600+ | 160+ |

Trade Execution | Market, Limit, Stop-Loss, Trailing Stops, Stop | Instant | Market | Market |

Conclusion and Final Words

Axi provides access to leverage options of 1:30 and spreads from 0.0 pips with a minimum deposit of $5. While the broker has a TrustPilot score of 4.2 and a strong regulatory status (ASIC, FCA, DFSA, and CySEC), it can’t provide services in the United States of America.