BCS Forex provides online trading services on 500+ instruments across 5 markets, including Metals and Stocks. Leverage options of up to 1:200 are available for a minimum deposit of $1.

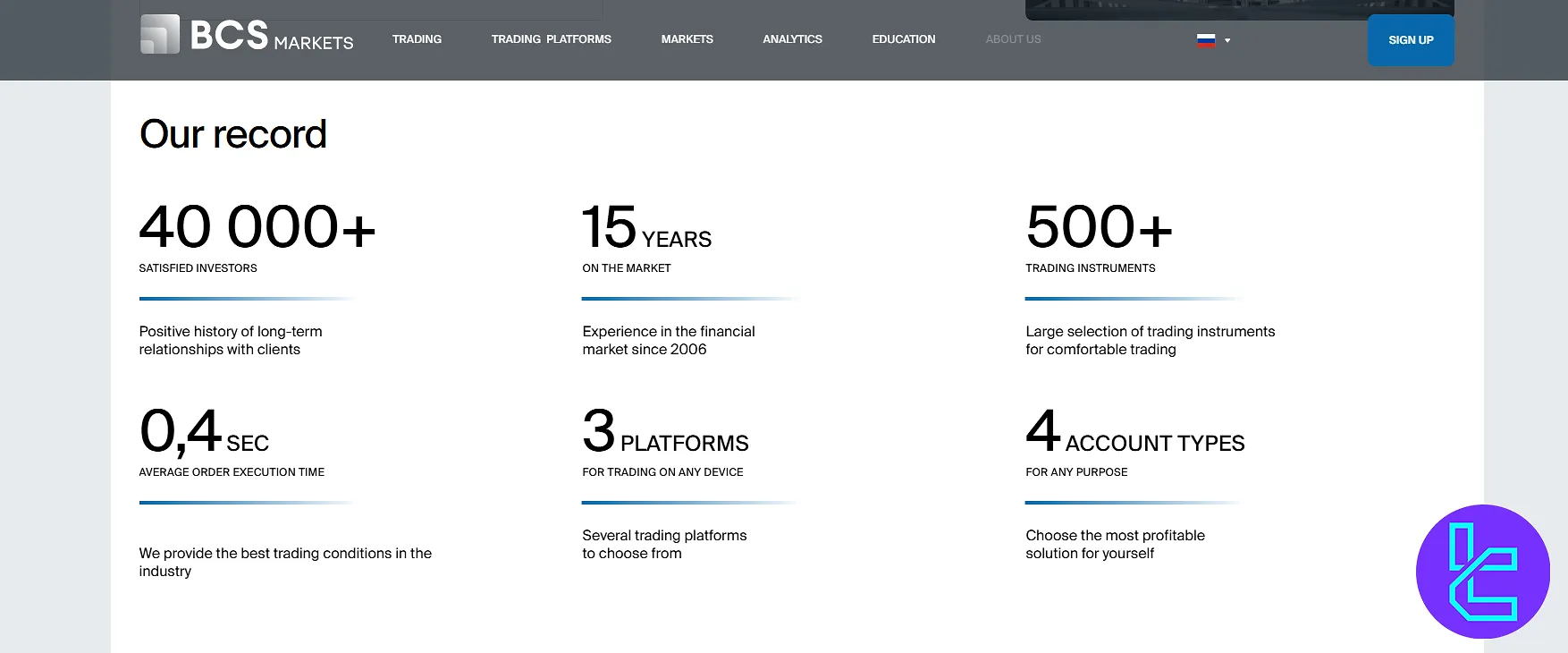

Established in 2006, BCS Markets has accumulated over 40,000 clients over 15 years of operation, largely through its association with the BCS Financial Group, a prominent Russian financial institution founded in 1995 by Oleg Mikhasenko.

BCS Forex; Company Regulation and Information

BCS Markets, formerly known as BCS Forex, is a Russian brokerage company registered in St. Vincent and the Grenadines. However, it’s not regulated by any financial authorities in Russia or SVG.

Key features of BCS Forex:

- No regulatory license

- Founded in 2006

- Average execution time of 0.4 sec

- 500+ trading instruments

- Access to the Russian stock market

Let’s check out the regulatory details of the BCS Markets:

Entity Parameters / Branches | BCS Markets LLC |

Regulation | Not regulated by any financial authority (no regulatory license) |

Regulation Tier | N/A |

Country | Registered in St. Vincent and the Grenadines (BCS Markets LLC) |

Investor Protection Fund / Compensation Scheme | N/A |

Segregated Funds | N/A |

Negative Balance Protection | N/A |

Maximum Leverage | 1:200 |

Client Eligibility | Does not accept clients from: Afghanistan, Algeria, Angola, Australia, Colombia, Côte d'Ivoire, Cuba, DR Congo, Eritrea, Great Britain, Iran, Iraq, Japan, Lebanon, Liberia, Libya, Myanmar, Nigeria, North Korea |

BCS Forex Specifications

BCS broker operates as a part of the BCS Financial Group, a well-known financial company in Russia, founded in 1995 by Oleg Mikhasenko. Let's take a closer look at what the Forex broker brings to the table.

Broker | BCS Forex |

Account Types | NDD, Pro, Direct |

Regulating Authorities | None |

Based Currencies | USD, EUR, RUB |

Minimum Deposit | $1 |

Deposit Methods | Bank Transfers, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Credit/Debit Cards |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:200 |

Investment Options | Stock Markets |

Trading Platforms & Apps | MT4, MT5, BrokStock |

Markets | Forex, Indices, Stocks, Metals, Energy |

Spread | From 0.2 points |

Commission | 0.003% For Forex on NDD accounts |

Orders Execution | Market, Instant |

Margin Call / Stop Out | Pro, Direct 100% / 20% NDD 100% / 50% |

Trading Features | Holiday Calendar, Market Analysis, Economic Calendar, Mobile Trading |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Phone, Email, Callback Request, Ticket |

Customer Support Hours | Monday through Friday from 9:00 to 18:00 Moscow time (GMT+3) |

BCS Forex Account Offerings

BCS caters to different trading styles and experience levels with its diverse account types, which offer different fee structures, execution types, and instruments.

Features | Direct | NDD | PRO |

Base Currency | USD, EUR, RUB | USD, EUR, RUB | USD, EUR, RUB |

Min Deposit | $1 | $1 | $1 |

Spread | Floating from 0.7 points | Floating from 0.2 points | Fixed from 1.0 point |

Forex Commission | $0 | 0.003% | $0 |

Max Leverage | 1:200 | 1:200 | 1:200 |

Min Order Size (lots) | 0.01 | 0.01 | 0.01 |

Margin Call | 100% | 100% | 100% |

Stop Out | 20% | 50% | 20% |

Execution Type | Instant | Market | Instant |

Instruments | 114 | 39 | 93 |

BCS Forex Broker Pros and Cons

Trading with the company involves more than average risks since it’s not regulated and originated in Russia.However, it also has some advantages.

Pros | Cons |

Low minimum deposit ($1) | Lack of licensing from any financial authorities |

Multiple account types | No copy trading or social trading features |

Advanced trading platforms (MT4 & MT5) | Limited educational resources |

Access to Russian stock market | Limited leverage options (up to 1:200) |

So, BCS Markets can be a suitable option if you are not looking for copy trading or high leverage trading.

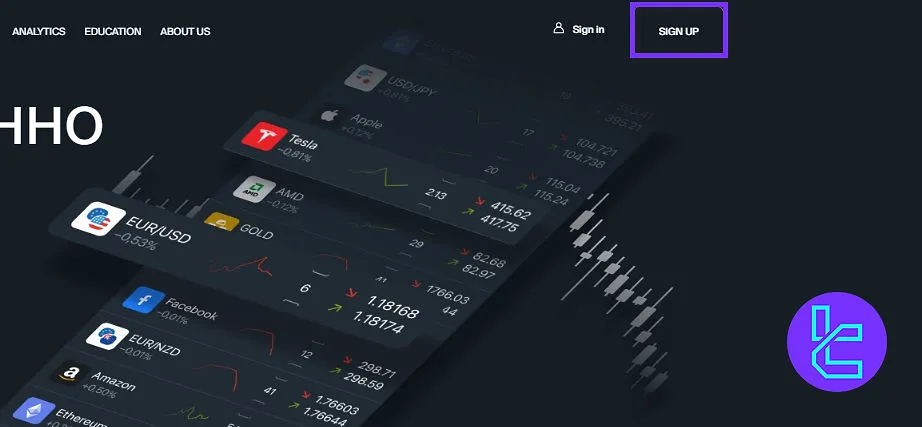

Account Opening and Verification on BCS Forex

To create an account with the BCS Forex broker, traders must complete several steps. BCS Forex registration:

#1 Access the Registration Section on the Official Website

First, search for BCS Forex broker on your preferred web browser. Then enter it and click on the “Sign Up” button.

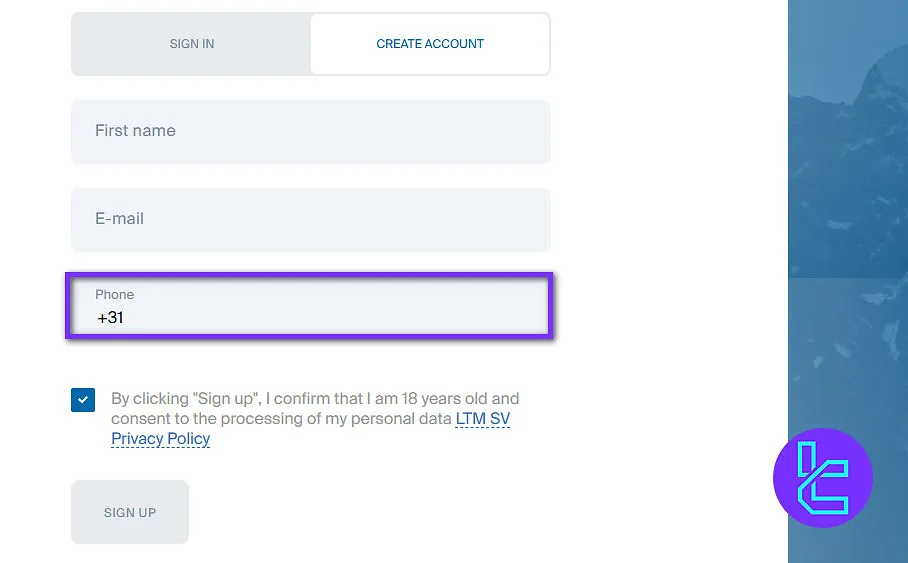

#2 Enter Your Phone Number

Now, you must provide your phone number and verify it using an OTP code.

#3 Login and Verify Your Account

After creating your account, log in and provide proof of identity (Passport or driving license) and proof of address (utility bill or bank statement) documents to verify your account.

BCS Forex Trading Platforms

We must discuss the trading platform in this BCS Forex review. The broker offers 3 main solutions, from MetaTrader to BrokStock.

Note that platform availability differs based on the account type. While BrokStock is available on all accounts, MetaTrader 4 is available on the NDD and PRO accounts, and MetaTrader 5 is accessible on the NDD and Direct accounts. All platforms offer several features, including:

- Real-time market quotes and price updates

- Advanced charting tools for technical analysis

- Multiple order types such as market, pending, stop-loss, and take-profit

- Fast and secure trade execution

- Access on desktop and mobile devices for flexible trading

- Account management features include balance, equity, and trade history

- Support for trading various financial instruments like forex and CFDs

- Customizable interface to match individual trading preferences

BCS Forex Broker Fee Structure

Understanding the fee structure is crucial for managing trading costs in BCS Markets. The broker offers zero-commission trading and average spreads from 0.2 points.

Account Type | EUR/USD Spreads | Commission for Forex | Commission for Metals | Commission for Stocks |

Direct | Floating from 0.7 points | $0 | $0 | 0.10% |

NDD | Floating from 0.2 points | 0.003% | 0.003% | - |

PRO | 1.0 point fixed | $0 | $0 | 0.10% |

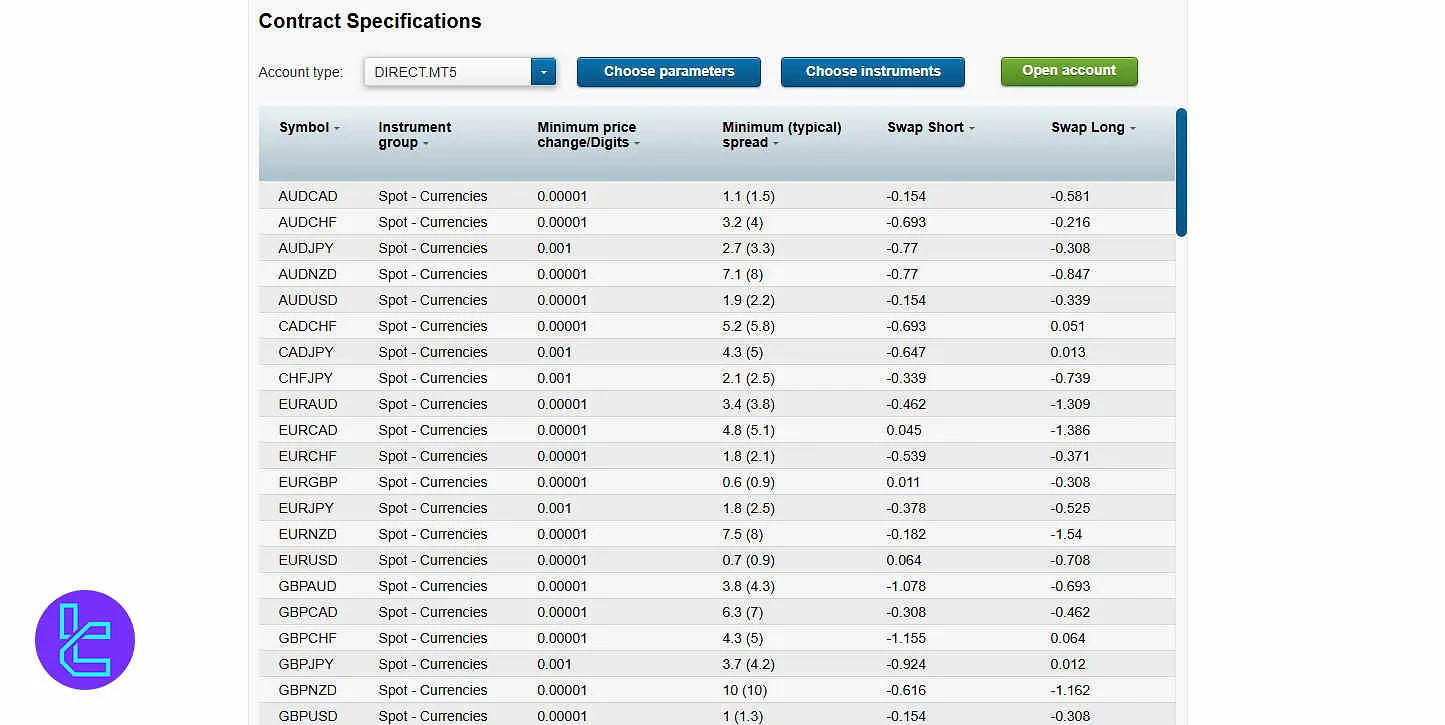

BCS Markets Swap Fees

BCS Markets applies overnight financing charges based on the instrument category, with rates defined in the broker’s Contract Specifications for the DIRECT.MT5 account.

For Forex pairs, swaps are quoted in points, and each symbol carries its own Swap Long and Swap Short values, for example, instruments such as EURUSD, GBPJPY, AUDUSD, and USDCAD show negative or positive rollover depending on direction.

Exotic currency pairs like USDMXN, USDZAR, USDSEK, or USDRUB may display significantly wider swap values. Precious metals including Spot Gold (XAUUSD), Spot Silver (XAGUSD), and Platinum (XPTUSD) use fixed-spread conditions with swaps also expressed in points.

In contrast, CFDs on US stocks and CFDs on Russian equities apply overnight charges as annualized percentages, typically around –6% / –5% for U.S. shares and –20% for most Russian instruments.

Equity indices such as US500, US30, DE40, UK100, EU50, and JP225 also rely on percentage-based financing, often within the –3.50% to –4.50% range.

Energy assets like Crude Oil (CL), Brent (LCO), and Heating Oil (HO) follow fixed-spread conditions with swap rates specified directly (e.g., –5.5 / –3.5), while Natural Gas (NG) includes larger point-based rollovers.

All rollover values follow the broker’s standard procedure: financing is applied at the daily close according to Eastern European Time, and Wednesday-to-Thursday swaps are tripled to account for the weekend.

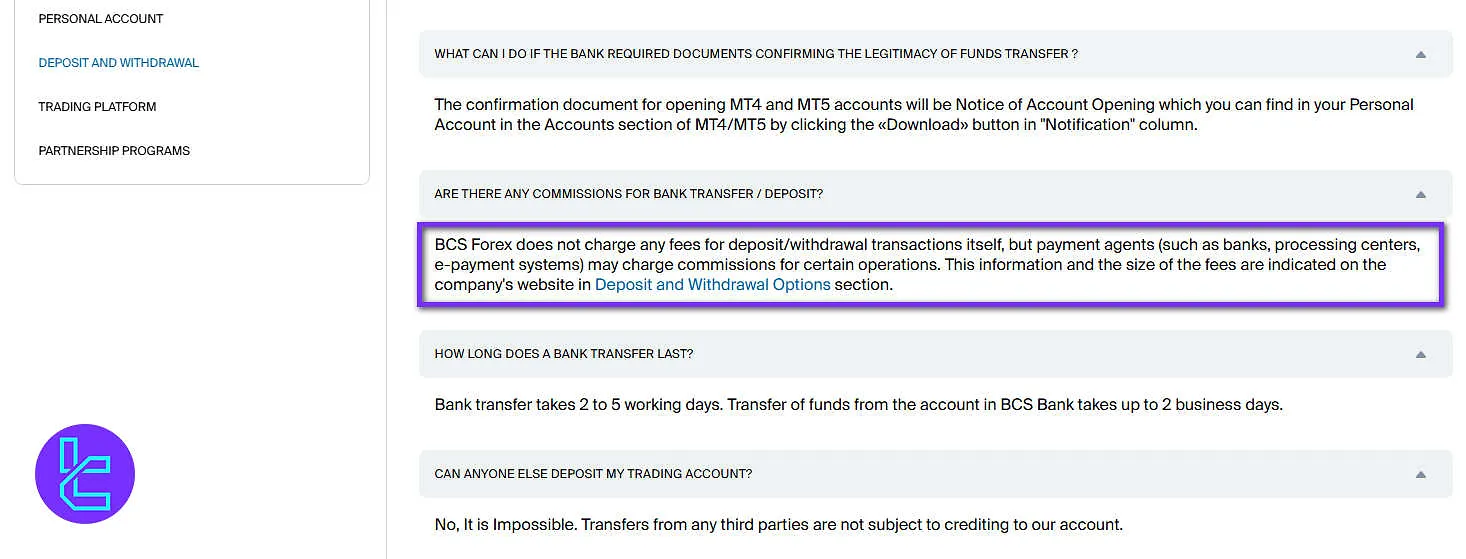

BCS Markets Non-Trading Fees

Accounts with a positive balance that remain inactive for six consecutive calendar months may be subject to a monthly maintenance charge. This fee is determined according to the broker’s Contract Specifications, although exact amounts are not publicly disclosed.

If the account balance falls below the fee, the remaining balance is deducted, and charges cease when the account reaches zero. This policy ensures that long-dormant accounts incur minimal cost while maintaining compliance with operational guidelines.

BCS Markets does not levy commissions on deposits. However, clients should note that third-party banks or payment processors may impose additional fees. Withdrawals to internal BCS Bank accounts are generally processed within 2–3 business days with no charges.

Transfers to external bank accounts incur fixed fees depending on currency: 30 RUB for Russian rubles, 35 USD for U.S. dollars, and 40 EUR for euros.

Withdrawal processing times can extend up to 5 business days in certain cases, depending on intermediary banks or system-specific delays.

This non-trading fee framework provides clarity for clients managing account activity, funding, and liquidity, and complements the broker’s trading-related costs such as swap fees and margin requirements across Forex pairs, precious metals, equities, indices, and energy products.

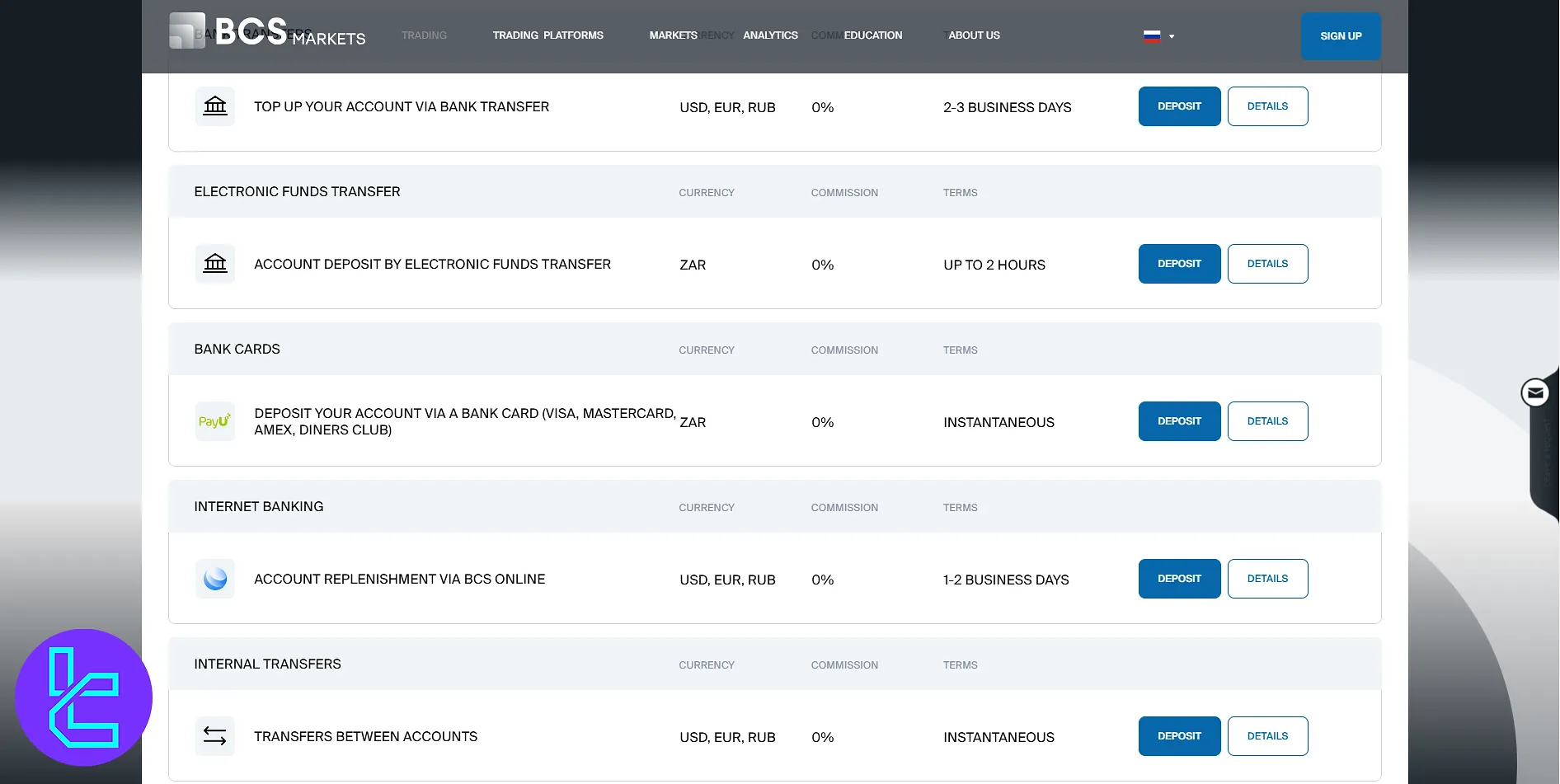

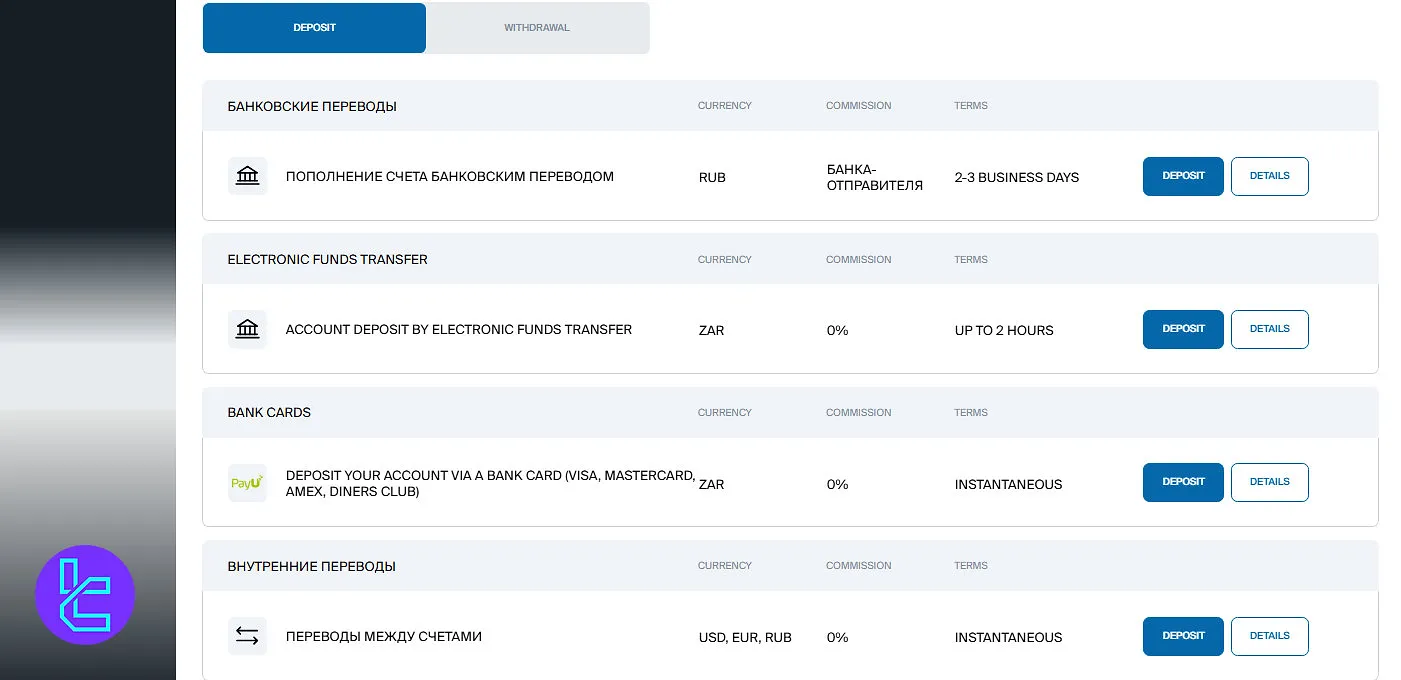

BCS Forex Broker Supported Payment Methods

BCS provides a limited range of deposit/withdrawal options. It supports two main methods: Credit/Debit Card and Bank transactions.

Here are the deposit and withdrawal fees for each method:

Method | Deposit Fee | Withdrawal fee |

Bank Wire | 0% | 0.075% (a minimum of 15,000 AMD) |

Electronic Funds Transfer | 0% | 0% |

Bank Cards (VISA, MasterCard, AMEX) | 0% | 2.5% |

BCS Online | 0% | Not Available |

Internal Transfers Between Accounts | 0% | 0% |

BCS Markets Deposit

BCS Markets provides multiple channels for funding trading accounts, supporting various currencies, and offering fast processing times. All deposit methods are designed to accommodate both local and international clients while minimizing fees.

Here is the detailed information about each deposit method available:

Method | Currency | Commission | Processing Time |

Bank Transfer | RUB | Sending bank fee only | 2–3 Business Days |

Electronic Funds Transfer (EFT) | ZAR | 0% | Up to 2 hours |

Bank Cards (Visa, MasterCard, Amex, Diners) | ZAR | 0% | Instantaneous |

Internal Account Transfers | USD, EUR, RUB | 0% | Instantaneous |

These methods ensure flexibility for clients while preserving access to Forex, equities, indices, metals, and energy instruments on the MT4 and MT5 platforms.

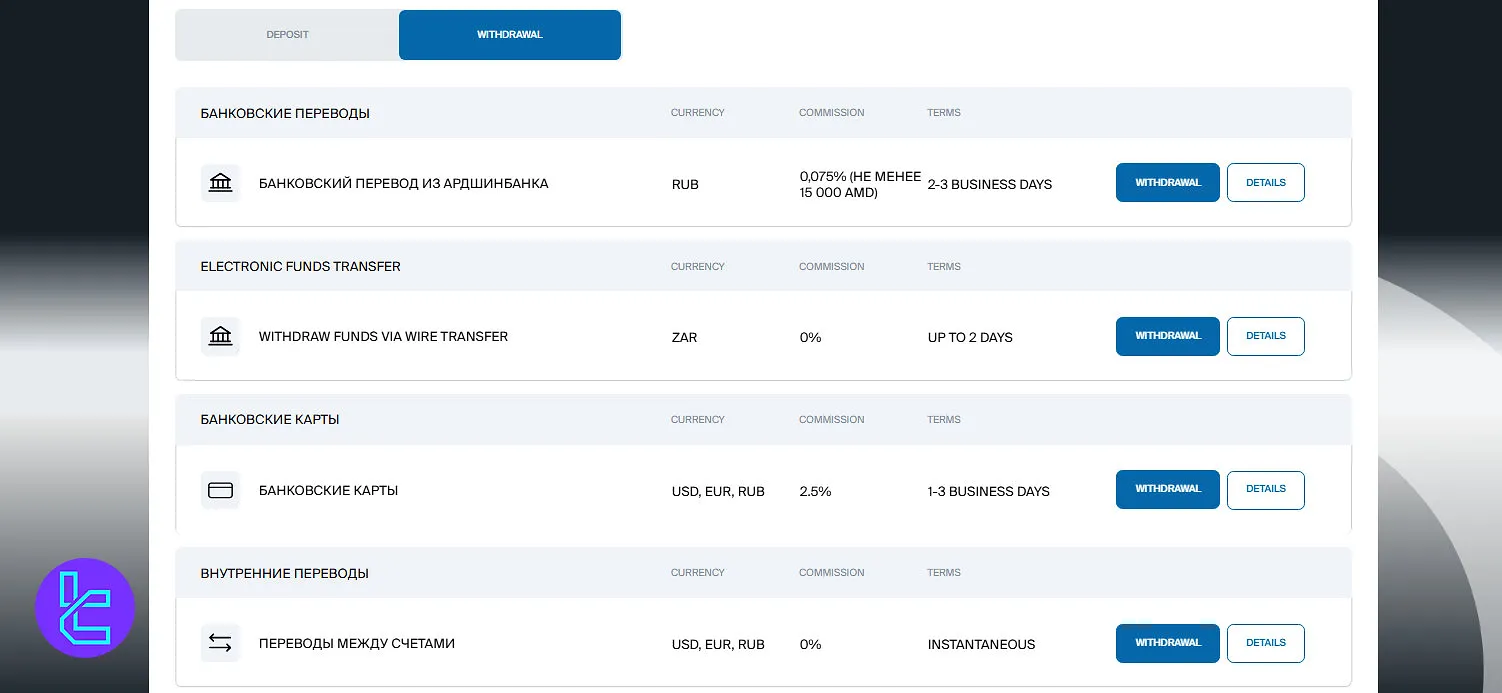

BCS Markets Withdrawal

BCS Markets offers a variety of withdrawal options to accommodate different client needs and currencies.

Processing times and fees vary depending on the chosen method, while all options maintain compliance with internal account and regulatory procedures.

Let’s check out the details of each withdrawal method available on BCS Markets:

Method | Currency | Commission | Processing Time |

Bank Transfer (Arshinbank) | RUB | 0.075% (min 15,000 AMD) | 2–3 Business Days |

Electronic Funds Transfer (EFT) | ZAR | 0% | Up to 2 days |

Bank Cards | USD, EUR, RUB | 2.5% | 1–3 Business Days |

Internal Account Transfers | USD, EUR, RUB | 0% | Instantaneous |

These withdrawal methods ensure liquidity and access across Forex pairs, metals, stocks, indices, and energy instruments via the MT4 and MT5 trading platforms.

Investment Plans and Copy Trading on BCS Forex

It's important to note that BCS does not offer investment plans or copy trading services. However, it enables you to invest in stock markets across the globe (Russia and other countries). You can buy and sell shares of the world’s largest companies on BCS Markets.

BCS Forex Trading Assets

The next topic in this BCS Forex review is financial instrument. The broker provides access to 100+ markets across 5 different asset classes.

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, Minor, and Exotic currency pairs | 36 | 50–70 currency pairs | Up to 1:200 |

Stocks | CFDs on shares of industry giants (Amazon, McDonald’s, JPMorgan, Google, etc.) | 59 | 800–1200 | N/A |

Energies | CFDs on energy futures (WTI, Brent, Heating Oil, Natural Gas) | 4 | 10–20 instruments | N/A |

Metals | Spot Metals (Gold, Silver, Platinum) | 3 | 10–20 instruments | N/A |

Indices | CFDs on index futures (US30, K100, DX, DE40, USTEC) | 11 | 10–20 indices | N/A |

Does BCS Forex Offer Bonus and Promotion?

BCS does not offer any traditional promotions like deposit bonuses or welcome gifts. However, it has a comprehensive partnership program with the following key features.

- Up to 50% commission on each trade of the referred client

- Profits even from one client

- No maximum award limitations

BCS Markets Awards

As of now, BCS Markets has not publicly listed any awards or recognitions on its official website.

There is no verifiable information indicating that the broker has received industry accolades, and no third-party award announcements have been confirmed by the company.

BCS Forex Customer Support

BCS Markets provides support from Monday to Friday from 9:00 to 18:00 Moscow time (GMT+3) through various channels, including:

support@bcsmarkets.com | |

Phone | +7 499 677 10 70 |

Callback Request | Available on the website |

Ticket | Through the personal area |

BCS Forex Restricted Countries

The company does not accept clients from certain jurisdictions due to regulatory restrictions and local laws. Here’s a list of red-flag countries on BCS Markets.

- Afghanistan

- Algeria

- Angola

- Australia

- Colombia

- Cote d'Ivoire

- Cuba

- Democratic Republic of the Congo

- Eritrea

- Great Britain

- Iran

- Iraq

- Japan

- Lebanon

- Liberia

- Libya

- Myanmar

- Nigeria

- North Korea

BCS Markets Trust Scores

User satisfaction may be the most important topic of the BCS Forex review. Despite having more than 15 years of experience in the markets, the company doesn’t have a profile on reputable review websites, such as TrustPilot and Forex Peace Army.

Lack of profiling on legitimate rating websites can be a drawback for potential clients since it shows the limited customer base of BCS.

BCS Forex Educational Resources

The broker doesn’t take traders’ education seriously since it only offers a trading glossary explaining Forex’s basic terms. However, you can use the BCS’s daily market analysis and trade signals.

BCS Forex in Comparison with Other Forex Brokers

To help you understand the advantages and disadvantages of trading with BCS Markets, we suggest checking the table below.

Parameters | BCS Markets Broker | |||

Regulation | Not Regulated | FSA, CySEC, ASIC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.2 points | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | 0.003% For Forex on NDD accounts | From $3 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $1 | $200 | $10 | $100 |

Maximum Leverage | 1:200 | 1:500 | Unlimited | 1:500 |

Trading Platforms | MT4, MT5, BrokStock | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | NDD, Pro, Direct | Standard, Raw Spread, Islamic | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 420+ | 2,250+ | 200+ | 2100+ |

Trade Execution | Market, Instant | Market | Market, Instant | Market, Pending |

Conclusion and Final Words

BCS Forex provides access to Russian stock market with a commission of 0.1% and floating/fixed spreads from 0.7 points. The company supports Visa, MasterCard, and AMEX payments with a 2.5% commission for withdrawals.

While BCS Forex broker offers its affiliates commissions of up to 50%, the lack of licensing from top-tier regulatory bodies and a TrustPilot profile may be drawbacks for some clients.