BlueSuisse broker offers Forex and CFD trading services for 130+ instruments to residents of over 20 EU countries. This broker has 3 primary accounts, including Denim Blue, Sky Blue, and Sapphire Blue, with floating spreads from 0.9 pips and $3 commissions.

Clients can trade using MT4, MT5, and TradeMaster platforms in 6 base currencies (USD, EUR, GBP, TRY, SEK, CHF), with minimum deposits ranging from $500 to over $50,000 depending on the account tier.

BlueSuisse Broker Company Information & Regulation Overview

BlueSuisse is a reputable broker regulated by the Malta Financial Services Authority (MFSA) under the IS/59928 license number and operates in compliance with the Markets in Financial Instruments Directive (MiFID) standards.

This regulatory framework ensures that BlueSuisse adheres to strict financial guidelines, providing a secure trading environment for its clients.

The broker's commitment to building long-term relationships with clients is evident in its focus on competitive trading conditions, excellent service, and continuous innovation.

The regulatory details of the broker are as follows:

Entity | Blue Suisse Limited (EU Entity) | BlueSuisse Markets Ltd (Seychelles Entity) |

Regulation | Regulated by MFSA (Malta Financial Services Authority) — Category 2 Investment Service License (IS 59928). Operates under MiFID II | Licensed by FSA Seychelles under Securities Dealers Licence SD158 |

Regulation Tier | N/A | N/A |

Country | Malta | Seychelles |

Investor Protection Fund / Compensation Scheme | Member of the Investor Compensation Fund (ICF) under EU Directive 97/9. Compensation up to €20,000 or 90% of the claim (whichever is lower) | No |

Segregated Funds | Yes | Yes |

Negative Balance Protection | N/A | Yes |

Maximum Leverage | 1:30 | N/A |

Client Eligibility | EU clients under MiFID rules | International clients outside the EU |

BlueSuisse Broker Specifications

Let’s provide you with a brief overview of BlueSuisse broker:

Broker | BlueSuisse |

Account Types | Denim Blue, Sky Blue, Sapphire Blue |

Regulating Authorities | MFSA, FSA Seychelles |

Based Currencies | EUR, USD, GBP, TRY, SEK, CHF |

Minimum Deposit | $500 |

Deposit Methods | Visa/MasterCard, Bank wired |

Withdrawal Methods | Visa/MasterCard, Bank wired |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:30 |

Investment Options | MAM and PAMM |

Trading Platforms & Apps | MT4, MT5, Trade Master |

Markets | Forex, indices, commodities, stocks |

Spread | Floating from 0.9 pips |

Commission | $3 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, phone |

Customer Support Hours | Monday-Friday, 08:00-17:00 |

Restricted Countries | Iran, Syria, North Korea, USA, Cuba and more |

BlueSuisse Broker Accounts

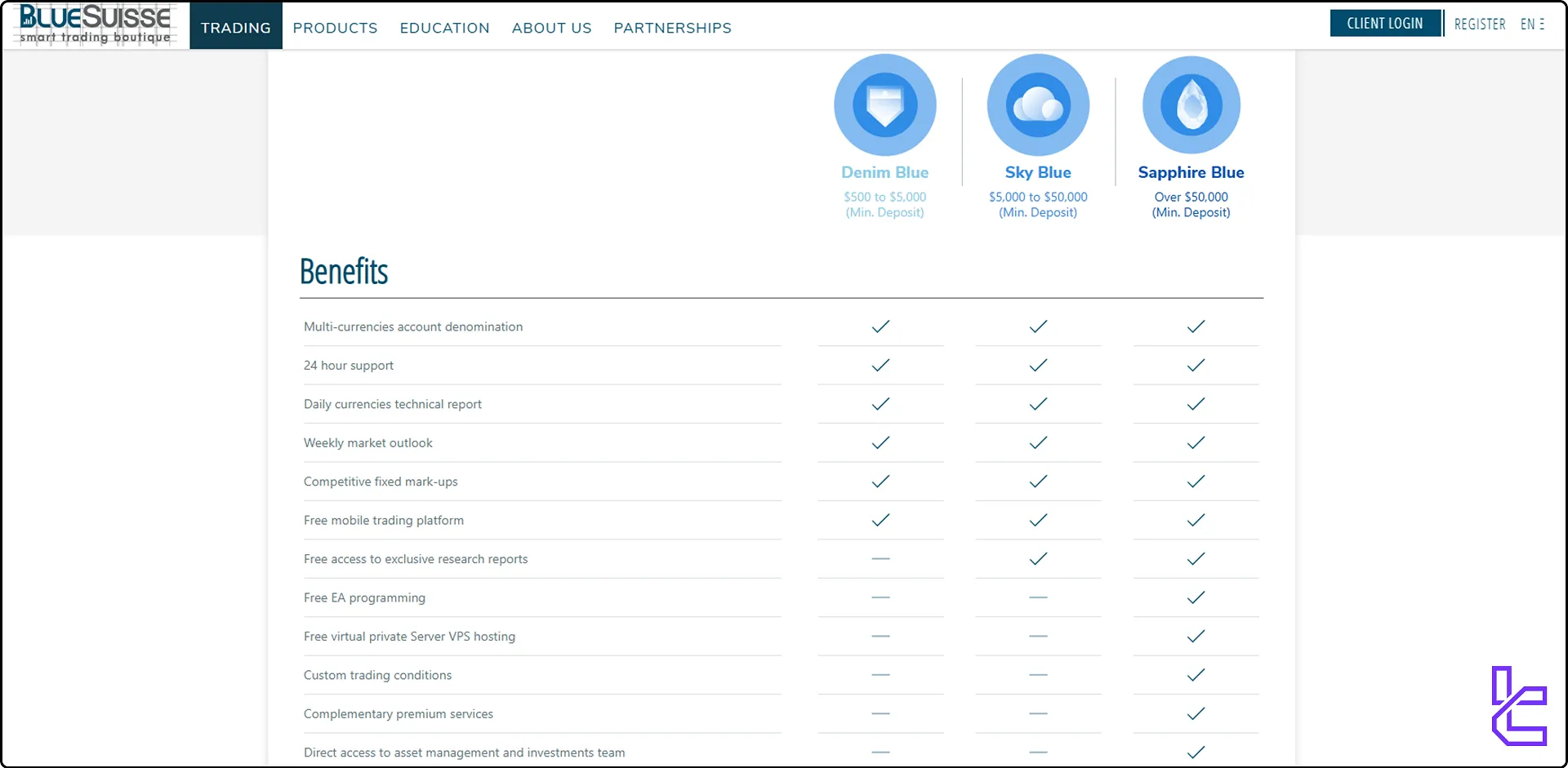

BlueSuisse offers 3 account types to cater to different trading needs and investment sizes:

BlueSuisse provides three live trading accounts tailored to different investor profiles:

- Denim Blue: Requires a deposit between $500 and $5,000. Suitable for entry-level traders, this account allows access to all major instruments including forex, indices, and commodities via MT4, MT5, and TradeMaster platforms

- Sky Blue: Designed for intermediate traders, this account demands an initial deposit of $5,000 to $50,000. In addition to standard trading features, it includes complimentary access to premium research materials

- Sapphire Blue: This is a high-tier offering requiring deposits above $50,000. It includes personalized conditions such as free VPS, custom EA development, and the tightest spreads (as low as 0.9 pips on EUR/USD). No commissions are charged on most instruments except oil

All accounts feature market execution, micro lot trading (from 0.01), and support multiple base currencies (USD, EUR, GBP, TRY, SEK, CHF). However, none of the accounts are ECN-type, and leverage is capped at 1:30 for retail clients.

BlueSuisse Broker Pros and Cons

It’s time to give you a balanced look at the benefits and drawbacks in our BlueSuisse review:

Advantages | Disadvantages |

Regulated by MFSA, FSA Seychelles and MiFID compliant | Limited available trading products |

Advanced trading platforms (MT4, MT5) | High minimum deposit |

Suitable for institutional grade clients | Higher than average trading costs |

Mobile trading options | Inactivity fee |

- | Lack of transparency in trading costs |

BlueSuisse Broker Account Sign-Up & Verification

Traders can easily open a new trading account with BlueSuisse and begin trading various instruments in no time. BlueSuisse registration:

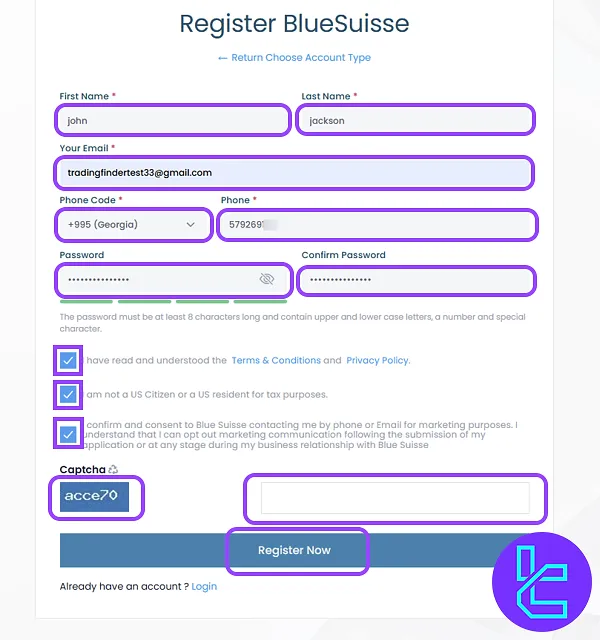

#1 Access the Blue Suisse Official Website

Navigate to the broker’s main website and click on “Register” to initiate the account setup.

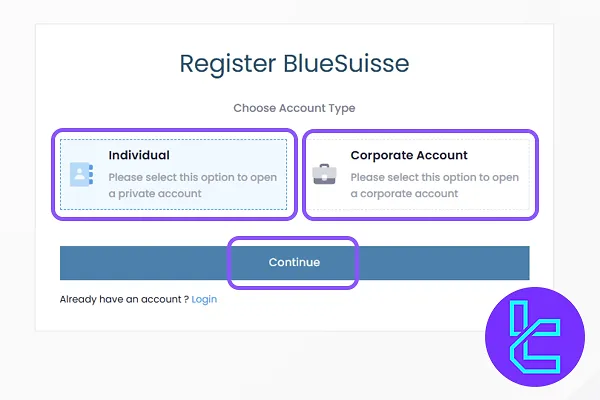

#2 Select Account Type

Choose between an Individual or Corporate account. This selection affects your trading privileges and verification requirements.

#3 Enter Personal Details

Provide your full name, email, phone number, and set a strong password. Confirm your agreement to the broker’s terms and complete the captcha.

#4 Email Verification

Check your inbox and click the verification link sent by Blue Suisse to activate your account.

#5 Complete the KYC Process

Traders can verify their accounts by providing proof of identity and proof of address documents. The broker will review your documents and verify your account in 48 hours. To learn about the details of BlueSuisse verification process, check the YouTube video below.

BlueSuisse Broker Trading Platforms and Applications

BlueSuisse provides a robust platform suite tailored for both beginner and experienced traders:

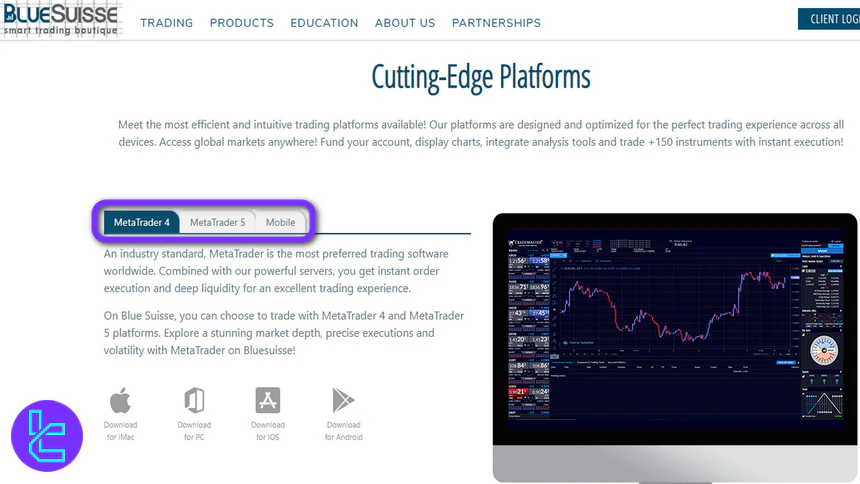

- MetaTrader 4 (MT4): Ideal for newer traders, MT4 offers a stable trading environment with powerful charting, automated strategies (EAs), and broad broker compatibility. It’s accessible via desktop, web browser, and mobile devices

- MetaTrader 5 (MT5): MT5 enhances the MT4 experience with additional technical indicators, 21 chart timeframes, Market Depth, and built-in economic news, making it suitable for multi-asset and strategy-diverse traders

- TradeMaster: A proprietary platform exclusive to BlueSuisse clients. Though less known in the market, TradeMaster supports all core trading functions and is available on both desktop and mobile devices

All platforms offer cross-device access, ensuring flexibility in trading from any environment. However, there is no mention of WebTrader or cTrader integration, which may limit choice for traders who prefer those environments.

BlueSuisse Trading Costs (Spreads and Commissions)

BlueSuisse’s trading cost structure is primarily built into the spread, as it does not offer ECN or Raw Spread accounts. For Standard account holders, spreads on EUR/USD range from 0.9 to 2.1 pips depending on market volatility.

GBP/USD spreads can peak at 2.2 pips, placing BlueSuisse above the industry average in terms of trading costs.

While commissions are generally absent, oil trading is the exception, where undisclosed fees apply. This lack of transparency around specific commission levels, especially for commodities, is a concern.

There are no fees for deposits or withdrawals, which adds convenience for funding operations. However, BlueSuisse charges a $20 monthly inactivity fee for accounts that remain dormant, increasing long-term holding costs for passive traders.

In total, BlueSuisse’s fee profile is adequate for casual traders but less competitive for scalpers or high-frequency strategies that require tighter spreads and institutional-grade pricing.

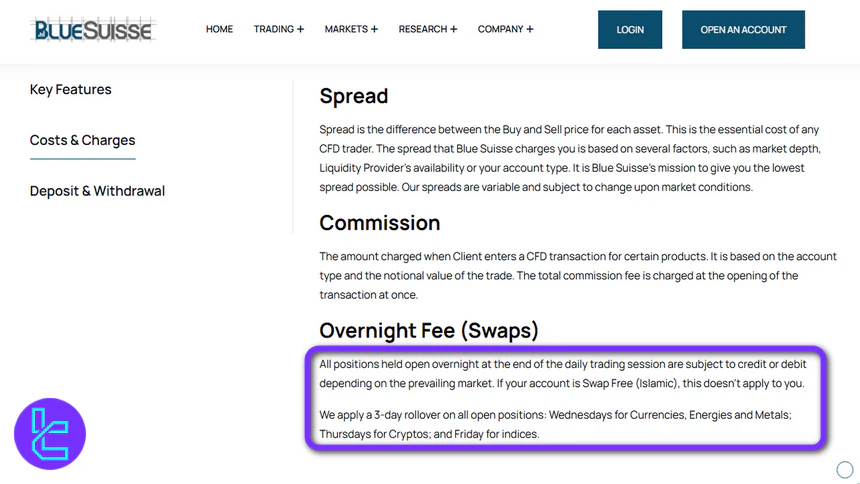

BlueSuisse Swap Fees

Trading positions that remain open beyond the daily market close incur overnight financing adjustments, which may be credited or charged based on current market conditions. Accounts designated as Swap-Free (Islamic) are exempt from these overnight swaps.

BlueSuisse applies a triple rollover on specific days of the week: Wednesdays for Currency pairs, Energy products, and Metals; Thursdays for Cryptocurrency instruments; and Fridays for major Index CFDs.

BlueSuisse Non-Trading Fees

BlueSuisse conducts periodic reviews of client accounts to ensure compliance and operational security. An account is categorized as Dormant when there has been no trading activity for six months or when the balance remains below EUR 10 for the same duration.

Once an account enters Dormant status, trading access on the MetaTrader platform is suspended until the client’s information and documentation are revalidated. A Dormant Account fee applies in accordance with the company’s official Terms and Conditions.

If a Dormant account remains unchanged for an additional six months, it transitions into Inactive status. During this phase, the client is contacted with a final notice regarding the account’s future.

Depending on the client’s response, the account may require further documentation for reactivation or be closed entirely. Restoring an inactive profile requires a new deposit, a withdrawal request, or the execution of a trade.

While inactive, the account becomes subject to a 70 USD (or EUR equivalent) inactivity fee, charged every three months as outlined in the company’s Online Trading Agreement.

BlueSuisse itself does not impose withdrawal or deposit fees, though clients may incur costs from external financial institutions, such as correspondent banks or payment processors, involved in the transfer process.

Deposit and Withdrawal Methods in BlueSuisse Broker

BlueSuisse offers a range of payment methods for both deposits and withdrawals, ensuring flexibility for most traders. Supported channels include:

- Bank Wire

- Skrill & Neteller

- Visa/MasterCard

- Rapid Transfer & Paysafe

- Bitcoin (BTC)

The broker supports multi-currency account funding in USD, EUR, GBP, TRY, SEK, CHF, and BTC, minimizing conversion costs for international users.

Deposits start at $500, which is relatively high compared to the industry average. Withdrawals must be at least $100, and are typically processed within 1–2 business days, with funds arriving in 3–5 days depending on the method.

BlueSuisse does not charge deposit or withdrawal fees, and only processes payments where the account holder’s name matches the payment source. Third-party transactions are not permitted.

BlueSuisse Deposit

BlueSuisse allows clients to fund their trading accounts through multiple channels, including credit and debit cards, bank wire transfers, SEPA transfers, and selected e-wallets. Availability of specific deposit methods may vary depending on the client’s country.

All deposits must be initiated either directly via the company’s website or through an authorized representative with the client’s consent. Third-party funding is not permitted, and the name on the funding account must exactly match the trading account holder’s name.

The minimum initial deposit is defined under the Account Types section on BlueSuisse’s website, though the broker may allow trading to start even if the initial transfer is below the minimum threshold.

Deposits are processed on the day they are received, with actual clearance times influenced by the sender bank.

Funds can be held in USD, EUR, or CHF, each in a dedicated Wallet, and internal transfers between Wallets are possible, with currency conversion performed at current market rates and potential additional charges applied.

Here are the deposit methods available:

Deposit Method | Key Notes / Conditions | Deposit Fee |

Credit / Debit Cards | Must be in the client’s name; processed same day; third-party cards not accepted | $0 |

Bank Wire Transfer | Processed on receipt; sender bank processing times may apply; name must match trading account | $0 (Bank fees may apply) |

SEPA Transfer | Same rules as bank wire; availability may vary by region | $0 |

E-Wallets | Selected wallets approved by BlueSuisse; must match the client’s trading account name | $0 |

Internal Transfers (Wallet to Wallet) | Allows moving funds between USD, EUR, and CHF Wallets; subject to currency conversion at market rates | $0 |

BlueSuisse Withdrawal

Withdrawals at BlueSuisse follow a strict “Originating Account/Card” principle, meaning that funds can only be returned to the same payment source used for depositing.

Exceptions may be allowed under specific circumstances, such as inheritance, at the broker’s discretion and with proper documentation. All withdrawal requests must meet full KYC and AML requirements to ensure compliance with regulatory standards.

Once a valid withdrawal request is submitted, BlueSuisse aims to process it within one business day, with a maximum processing window of two working days.

Clients typically receive the funds in three to five business days, depending on the transfer method and the intermediary financial institutions involved.

While BlueSuisse does not charge fees for withdrawals, third-party banks, credit card companies, or payment processors may apply their own charges.

Profit withdrawals are subject to an additional rule: only the original deposit can be returned to the initial funding method, while any gains from trading must be sent to a verified bank account.

Clients are responsible for providing accurate payment information; any errors may delay or compromise the withdrawal process.

You can see the withdrawal methods in the table below:

Withdrawal Method | Description | Withdrawal Fee |

Credit / Debit Card | Returns funds to the same card used for deposit; profits cannot go to card | $0 |

Bank Wire / SEPA Transfer | Sends funds to a verified bank account; used for profits or when card withdrawal isn’t possible | $0 (Bank fees may apply) |

E-Wallet | Withdrawals back to the same e-wallet used for deposit | $0 |

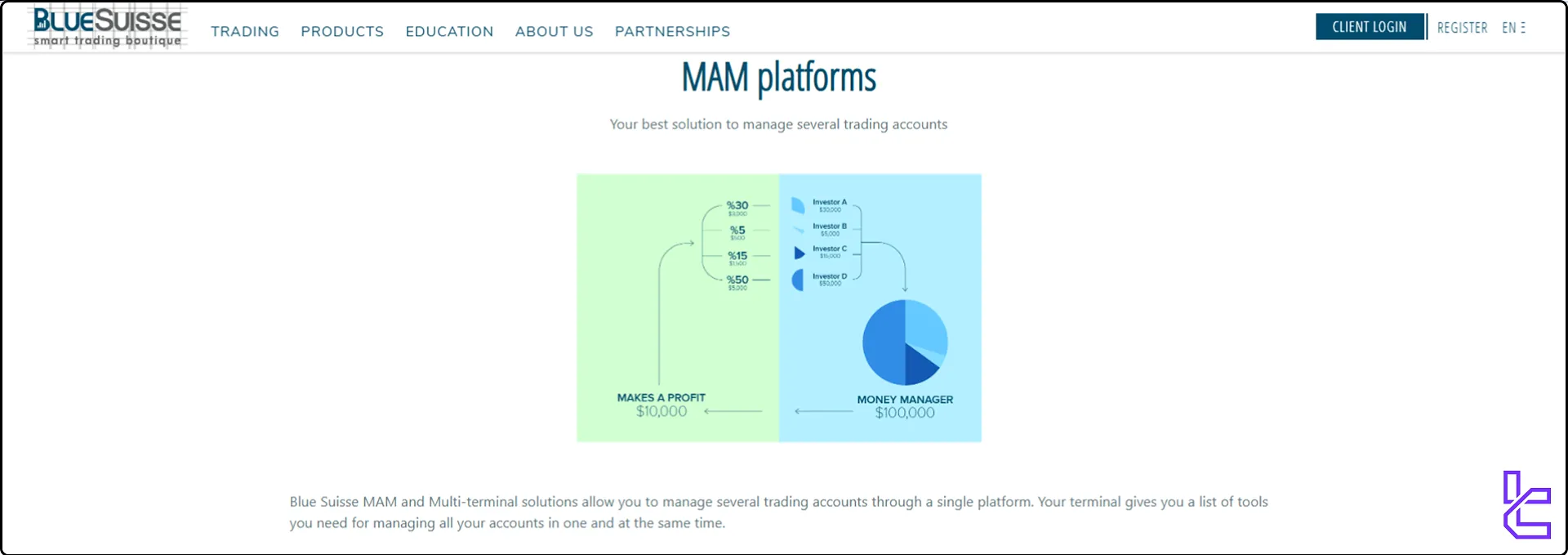

Copy Trading & Investment Options On BlueSuisse Broker

BlueSuisse provides copy trading and investment options to cater to different trading preferences:

MAM (Multi-Account Management) Accounts:

- Allow fund managers to trade multiple client accounts simultaneously

- Customizable allocation methods and risk management

- Ideal for professional traders managing multiple portfolios

PAMM Accounts: BlueSuisse also offers a PAMM account; however, it doesn’t provide the necessary information for Forex traders seeking a passive income source.

These options provide flexibility for investors to leverage expert trading strategies or manage multiple accounts efficiently. It’s worth mentioning that BlueSuisse also allows Expert Advisers.

BlueSuisse Tradable Markets & Instruments

BlueSuisse offers a range of tradable markets and symbols:

Category | Type of Instruments | Number of Symbols / Examples | Competitor Average | Maximum Leverage |

Forex | Major, minor, and exotic currency pairs | 80+ currency pairs | 50–70 currency pairs | 1:30 |

Stocks | CFDs on US and EU company stocks | Over 1000 global stocks | 800–1200 | 1:1 |

Commodities | CFDs on precious metals (gold, silver) and energies (oil, natural gas) | 25+ instruments | 10–20 instruments | 1:20 |

Indices | CFDs on global indices (e.g., Dow Jones, S&P 500) | 15+ indices | 10–20 indices | 1:20 |

Traders can access these markets through the MetaTrader 4 and MetaTrader 5 platforms, as well as mobile apps. Although BlueSuisse offers various tradable instruments, its range of products is not as extensive as other brokers.

BlueSuisse Promotions and Bonuses

BlueSuisse doesn’t provide retail bonuses or affiliate programs. However, high end clients can use BlueSuisse services to provide their products and services to retail clients. BlueSuisse offers partnership programs through its Tied Agent, White Labels, FIX API, and Money Manager plan.

BlueSuisse Awards

BlueSuisse does not provide any information about awards on its official website, suggesting that the broker either has not received notable industry awards or chooses not to disclose them publicly.

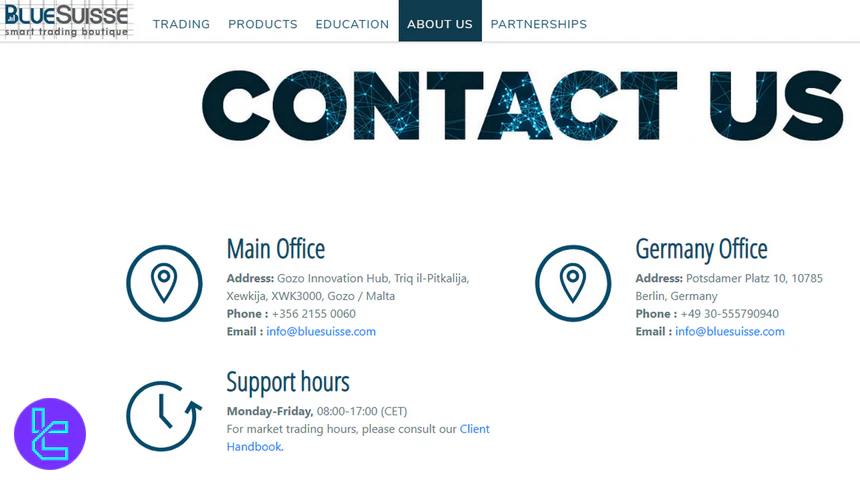

BlueSuisse Broker Customer Support

BlueSuisse provides various support channels to assist clients with their trading needs:

Malta office:

- Phone: +356 2155 0060

- Email: info@bluesuisse.com

Germany Office:

- Phone: +49 30-555790940

- Email: info@bluesuisse.com

Support Hours: Monday-Friday, 08:00-17:00

BlueSuisse aims to provide prompt and efficient support to its clients. However, the lack of live chat support is a major drawback for inexperienced traders who need urgent support.

BlueSuisse Broker Restricted Countries

While specific restricted countries are not explicitly mentioned in the provided information, it's important to note that BlueSuisse is an EU-regulated broker, which impacts its ability to offer services in certain jurisdictions. Here’s a list of BlueSuisse restricted countries:

- Iran

- Cuba

- North Korea

- Syria

- Russia

- South Sudan

- Belarus

- Venezuela

- USA

- Japan

- Israel

- Yemen

- Myanmar

- Syria

- Belgium

- Malaysia

- pakistan

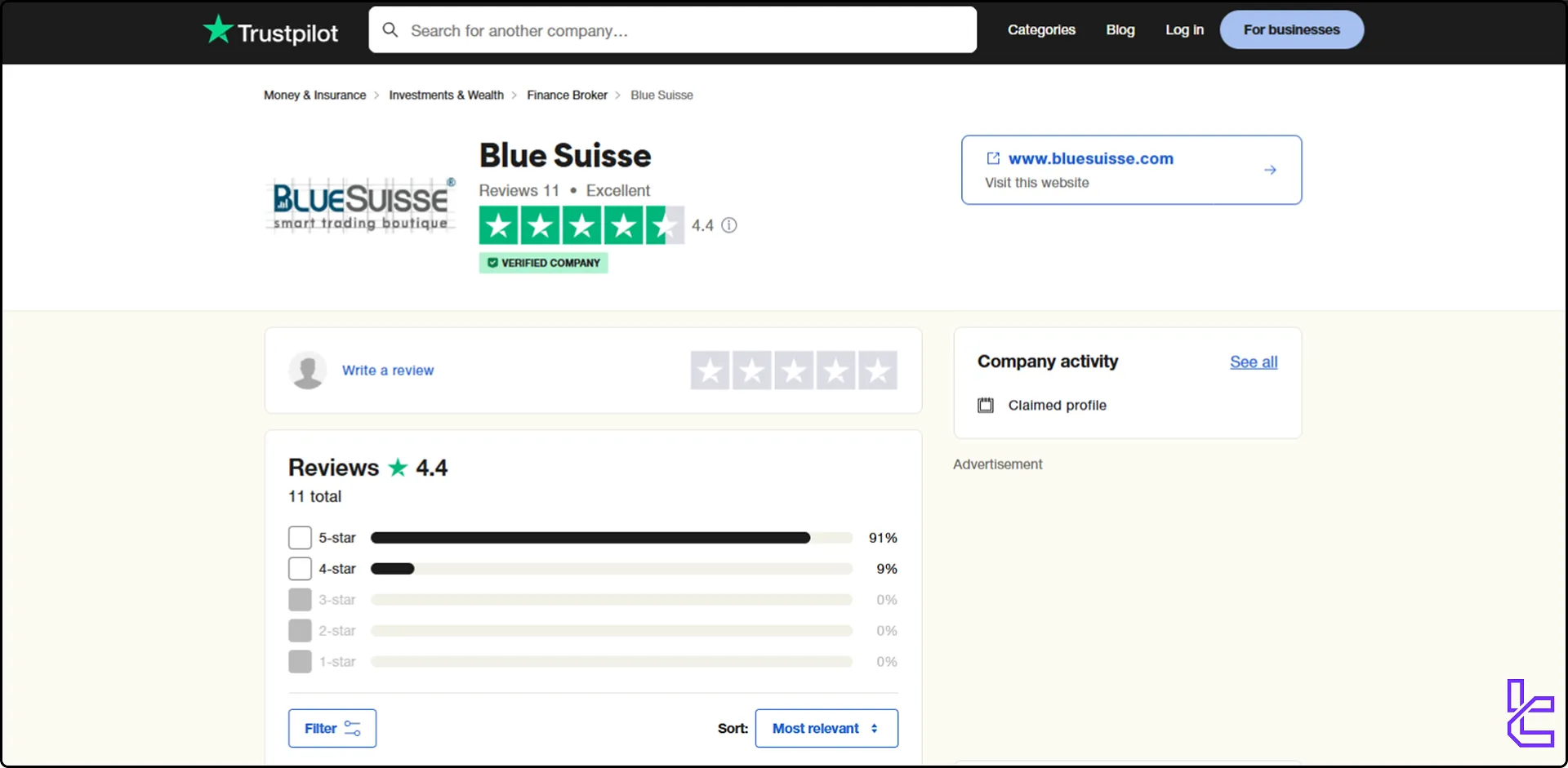

BlueSuisse Broker User Reviews and Trust Score

BlueSuisse has garnered positive reviews from its clients on the BlueSuisse Trustpilot website, but the number of reviews is low:

- Rating: 4.4 out of 5 stars

- Total number of reviews: 11

Traders must contact broker clients and gather information before creating an account with BlueSuisse broker.

BlueSuisse Educational Resources

BlueSuisse offers a comprehensive educational suite to support traders at all levels:

CFD Trading Articles:

- Introduction to CFDs

- Risk management in CFD trading

- Advanced CFD strategies

Currency Trading for Beginners:

- Forex market basics

- Understanding currency pairs

- Fundamental and technical analysis introduction

How to Improve Trading:

- Developing a trading plan

- Psychological aspects of trading

- Advanced chart analysis techniques

BlueSuisse's educational offerings aim to empower traders with the knowledge and skills needed to navigate the world of financial markets confidently.

TF Expert Suggestion

BlueSuisse introduces itself as a Forex broker for institutional traders with its high minimum deposit ($500) and direct access to asset managers in the Sapphire Blue account.

Even so, the broker’s $70 inactivity fee and lack of transparency in trading costs make it less desirable for individual investors.