BlueSuisse broker offers Forex and CFD trading services for 130+ instruments to residents of over 20 EU countries.

This broker has 3 primary accounts, including Denim Blue, Sky Blue, and Sapphire Blue, with floating spreads from 0.9 pips and $3 commissions.

BlueSuisse Broker Company Information & Regulation Overview

BlueSuisse is a reputable broker regulated by the Malta Financial Services Authority (MFSA) under the IS/59928 license number and operates in compliance with the Markets in Financial Instruments Directive (MiFID) standards.

This regulatory framework ensures that BlueSuisse adheres to strict financial guidelines, providing a secure trading environment for its clients.

The broker's commitment to building long-term relationships with clients is evident in its focus on competitive trading conditions, excellent service, and continuous innovation.

BlueSuisse Broker Specifications

Let’s provide you with a brief overview of BlueSuisse broker:

Broker | BlueSuisse |

Account Types | Denim Blue, Sky Blue, Sapphire Blue |

Regulating Authorities | MFSA |

Based Currencies | EUR, USD, GBP, TRY, SEK, CHF |

Minimum Deposit | $500 |

Deposit Methods | Visa/MasterCard, Bank wired |

Withdrawal Methods | Visa/MasterCard, Bank wired |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:30 |

Investment Options | MAM and PAMM |

Trading Platforms & Apps | MT4, MT5, Trade Master |

Markets | Forex, indices, commodities, stocks |

Spread | Floating from 0.9 pips |

Commission | $3 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, phone |

Customer Support Hours | Monday-Friday, 08:00-17:00 |

Restricted Countries | Iran, Syria, North Korea, USA, Cuba and more |

BlueSuisse Broker Accounts

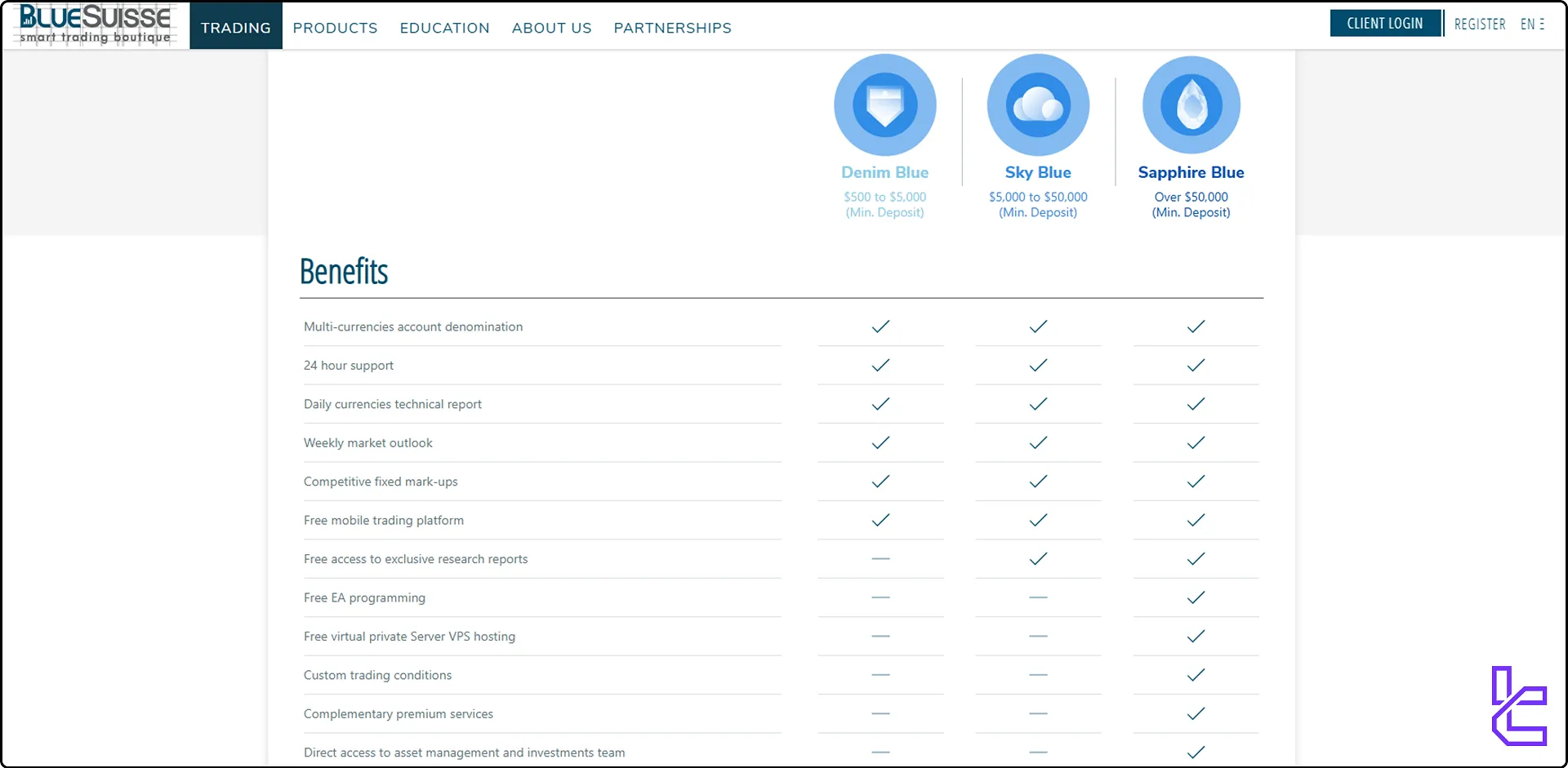

BlueSuisse offers 3 account types to cater to different trading needs and investment sizes:

Denim Blue Account:

- Minimum deposit: $500

- Suitable for beginners and small-scale traders

Sky Blue Account:

- Minimum deposit: $5,000

- Ideal for intermediate traders with more capital

- Free access to research reports

Sapphire Blue Account:

- Minimum deposit: Over $50,000

- Designed for high-volume traders and institutional clients

- Free EA programing

- Free VPS hosting

- Direct access to asset management and investment experts

Key points about BlueSuisse accounts:

- Multi-currency denomination

- 24/7 customer support

- Daily technical reports and weekly market outlooks

- Competitive fixed mark-ups

- Free mobile trading platforms

While BlueSuisse explains its account features, it doesn’t provide necessary information about spreads, commissions, leverage, and other key factors of a trading account.

BlueSuisse Broker Pros and Cons

It’s time to give you a balanced look at the benefits and drawbacks in our BlueSuisse review:

Advantages | Disadvantages |

Regulated by MFSA and MiFID compliant | Limited available trading products |

Advanced trading platforms (MT4, MT5) | High minimum deposit |

Suitable for institutional grade clients | Higher than average trading costs |

Mobile trading options | Inactivity fee |

- | Lack of transparency in trading costs |

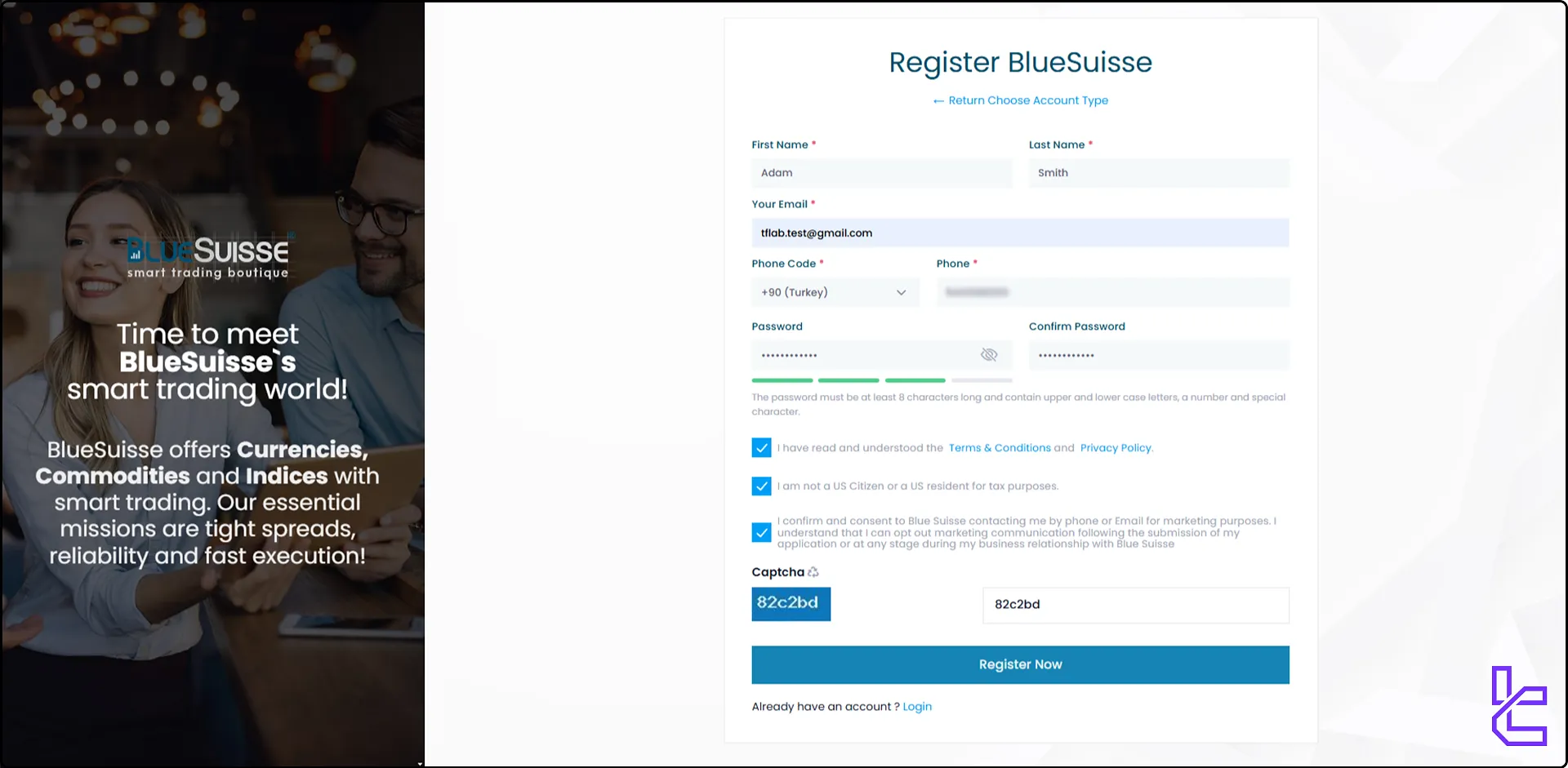

BlueSuisse Broker Account Sign-Up & Verification

Opening an account with BlueSuisse is a straightforward process:

- Visit the BlueSuisse website and click on “Register;”

- Choose between Real/demo and individual/corporate accounts;

- Enter your personal information in BlueSuisse registration form;

- Verify your email address;

- Complete the KYC process by submitting the required documentation (ID, proof of address);

- Fund your account and start trading.

BlueSuisse Broker Trading Platforms and Applications

BlueSuisse offers industry-leading trading platforms to provide a seamless trading experience:

MetaTrader 4 (MT4)

MT4 is the industry standard for modern and old-fashioned traders. Key features of Metatrade 4 trading platform:

- User-friendly interface

- Advanced charting tools

- Expert Advisors (EAs) for automated trading

- Available for desktop, web, and mobile devices

Links:

MetaTrader 5 (MT5)

MT5 is the enhanced version of MetaTrader 4 with a wide variety of added features. Key points about MetaTrader 5:

- 21 timeframes and analytical tools

- Supports a wider range of markets

- Advanced Market Depth feature

- Integrated economic calendar

Links:

BlueSuisse also provides trading services through Trade Master which is an unheard-of Forex trading platform.

BlueSuisse Trading Costs (Spreads and Commissions)

Unfortunately, BlueSuisse doesn’t provide specific information regarding its trading costs. However, our interactions with the broker revealed that the broker has relatively high spreads, even on major currency pairs.

They also charge a $70 inactivity fee for accounts that had no movements for over 3 months. BlueSuisse accounts also have commissions for trading Oil products. Overall, BlueSuisse doesn’t provide the cheapest trading experience for most traders.

Deposit and Withdrawal Methods in BlueSuisse Broker

BlueSuisse offers various options for depositing and withdrawing funds:

- Credit/Debit Cards

- Bank transfer

Key Points:

- Minimum initial deposit varies by account type (starting from $500)

- No deposit or withdrawal fees

- No acceptance of third-party funds

- The account holder's name must match the funding source

- Withdrawals typically processed within 1-2 working days

BlueSuisse prioritizes security and compliance in its financial operations, ensuring a safe and efficient process for managing client funds.

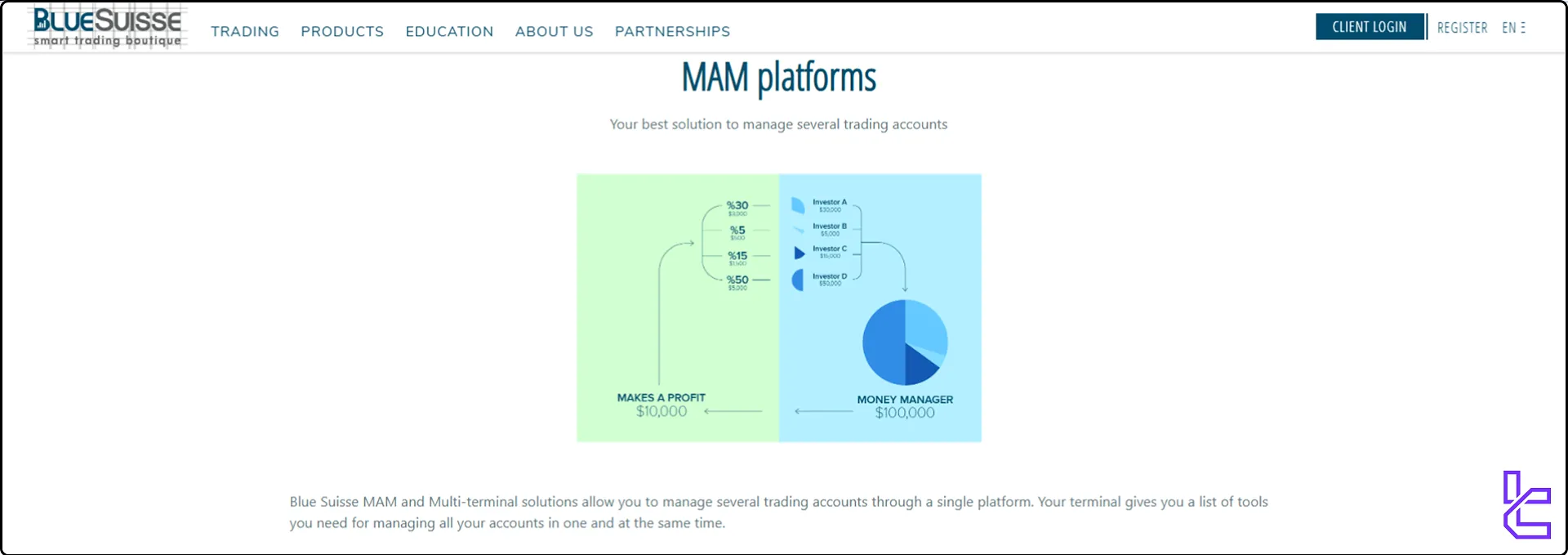

Copy Trading & Investment Options On BlueSuisse Broker

BlueSuisse provides copy trading and investment options to cater to different trading preferences:

MAM (Multi-Account Management) Accounts:

- Allow fund managers to trade multiple client accounts simultaneously

- Customizable allocation methods and risk management

- Ideal for professional traders managing multiple portfolios

PAMM (Percentage Allocation Management Module) Accounts: BlueSuisse also offers a PAMM account, but it doesn’t provide the necessary information for Forex traders who want to have a passive income source.

These options provide flexibility for investors to leverage expert trading strategies or manage multiple accounts efficiently. It’s worth mentioning that BlueSuisse also allows Expert Advisers.

BlueSuisse Tradable Markets & Instruments

BlueSuisse offers a range of tradable markets and symbols:

- Forex: A wide variety of Major, minor, and exotic

- Stocks: Best US and EU company stocks

- Indices: Variety of indices from global stock markets, including Dow Jones and S&P500

- Commodities: Precious metals (gold, silver) and Energies (oil, natural gas)

Traders can access these markets through the MetaTrader 4 and MetaTrader 5 platforms, as well as mobile apps. Although BlueSuisse offers various tradable instruments, its range of products is not as extensive as other brokers.

BlueSuisse Promotions and Bonuses

BlueSuisse doesn’t provide retail bonuses or affiliate programs. However, high end clients can use BlueSuisse services to provide their products and services to retail clients. BlueSuisse offers partnership programs through its Tied Agent, White Labels, FIX API, and Money Manager plan.

BlueSuisse Broker Customer Support

BlueSuisse provides various support channels to assist clients with their trading needs:

Malta office:

- Phone: +356 2155 0060

- Email: info@bluesuisse.com

Germany Office:

- Phone: +49 30-555790940

- Email: info@bluesuisse.com

Support Hours: Monday-Friday, 08:00-17:00

BlueSuisse aims to provide prompt and efficient support to its clients. However, the lack of live chat support is a major drawback for inexperienced traders who need urgent support.

BlueSuisse Broker Restricted Countries

While specific restricted countries are not explicitly mentioned in the provided information, it's important to note that BlueSuisse is an EU-regulated broker, which impacts its ability to offer services in certain jurisdictions. Here’s a list of BlueSuisse restricted countries:

- Iran

- Cuba

- North Korea

- Syria

- Russia

- South Sudan

- Belarus

- Venezuela

- USA

- Japan

- Israel

- Yemen

- Myanmar

- Syria

- Belgium

- Malaysia

- pakistan

BlueSuisse Broker User Reviews and Trust Score

BlueSuisse has garnered positive reviews from its clients on the Trustpilot website, but the number of reviews is low:

- Rating: 4.4 out of 5 stars

- Total number of reviews: 11

Traders must contact broker clients and gather information before creating an account with BlueSuisse broker.

BlueSuisse Educational Resources

BlueSuisse offers a comprehensive educational suite to support traders at all levels:

CFD Trading Articles:

- Introduction to CFDs

- Risk management in CFD trading

- Advanced CFD strategies

Currency Trading for Beginners:

- Forex market basics

- Understanding currency pairs

- Fundamental and technical analysis introduction

How to Improve Trading:

- Developing a trading plan

- Psychological aspects of trading

- Advanced chart analysis techniques

BlueSuisse's educational offerings aim to empower traders with the knowledge and skills needed to navigate the world of financial markets confidently.

TF Expert Suggestion

BlueSuisse introduces itself as a Forex broker for institutional traders with its high minimum deposit ($500) and direct access to asset managers in the Sapphire Blue account.

Even so, the broker’s $70 inactivity fee and lack of transparency in trading costs make it less desirable for individual investors.