CMTrading offers various account types, including Basic, Trader, Gold, Premium, and Islamic, to cater to different trader levels.

The broker has no commission on standard accounts and offers competitive spreads starting from 1.9 pips for the Gold and Premium accounts.

CMTrading Company Information & Regulation Status

CMTrading, founded by traders for traders, has built a solid reputation over the past decade. The company primarily provides a secure, transparent, and educational trading environment.

With operations spanning across Africa, the Middle East, and other regions, CMTrading has indeed become a global entity. Key highlights of CMTrading include:

- Established in 2012, headquartered in Africa

- Multi-award winning broker, named "Best Financial Broker in Africa"

- Regulated by the Financial Services Authority (FSA) in Seychelles and the Financial Sector Conduct Authority (FSCA) in South Africa

CMTrading's dual regulation ensures traders' compliance and security. The FSCA oversight in South Africa provides additional protection, especially for African traders.

Entity Parameter / Branches | GCMT South Africa (FSCA) | GCMT Limited (Seychelles, FSA) |

Regulation | FSCA | FSA (Seychelles) |

Regulation Tier | Tier-2 | Tier-3 / offshore |

Country | South Africa | Seychelles |

Investor Protection / Compensation Scheme | None | None |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:400 | Up to 1:400 |

Client Eligibility | All countries except restricted ones (e.g., USA, North Korea) | All countries except restricted ones (e.g., USA, North Korea) |

CMTrading Broker Summary of Specifics

To give you a quick overview of CMTrading's offerings, here's a concise table summarizing the critical specifics:

Broker | CMTrading |

Account Types | Basic, Trader, Islamic, Gold, Premium |

Regulating Authorities | FSCA, FSA |

Based Currencies | USD |

Minimum Deposit | $100 |

Deposit/ Withdrawal Methods | MasterCard, Visa, Diners Card, Discover, Visa Electron, Standard ZAR, Nedbank ZAR, Cryptopayments, Skrill, EFTPay, Neteller, Perfect Money, Google Pay |

Minimum Order | 0.01 |

Maximum Leverage | 1:200 |

Investment Options | No |

Trading Platforms & Apps | MT4, WebTrader |

Markets | Forex, Commodities, Indices, Stocks, Cryptocurrencies |

Spread | 1.9 for Gold & Premium |

Commission | N/A |

Orders Execution | Market |

Margin Call/Stop Out | From 20% |

Trading Features | CopyTrading, Economic Calendar |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | YES |

PAMM Account | No |

Customer Support Ways | Phone, Email, WhatsApp |

Customer Support Hours | 24/5 |

The low spreads and instant execution make CMTrading suitable for various trading styles, including scalping and day trading.

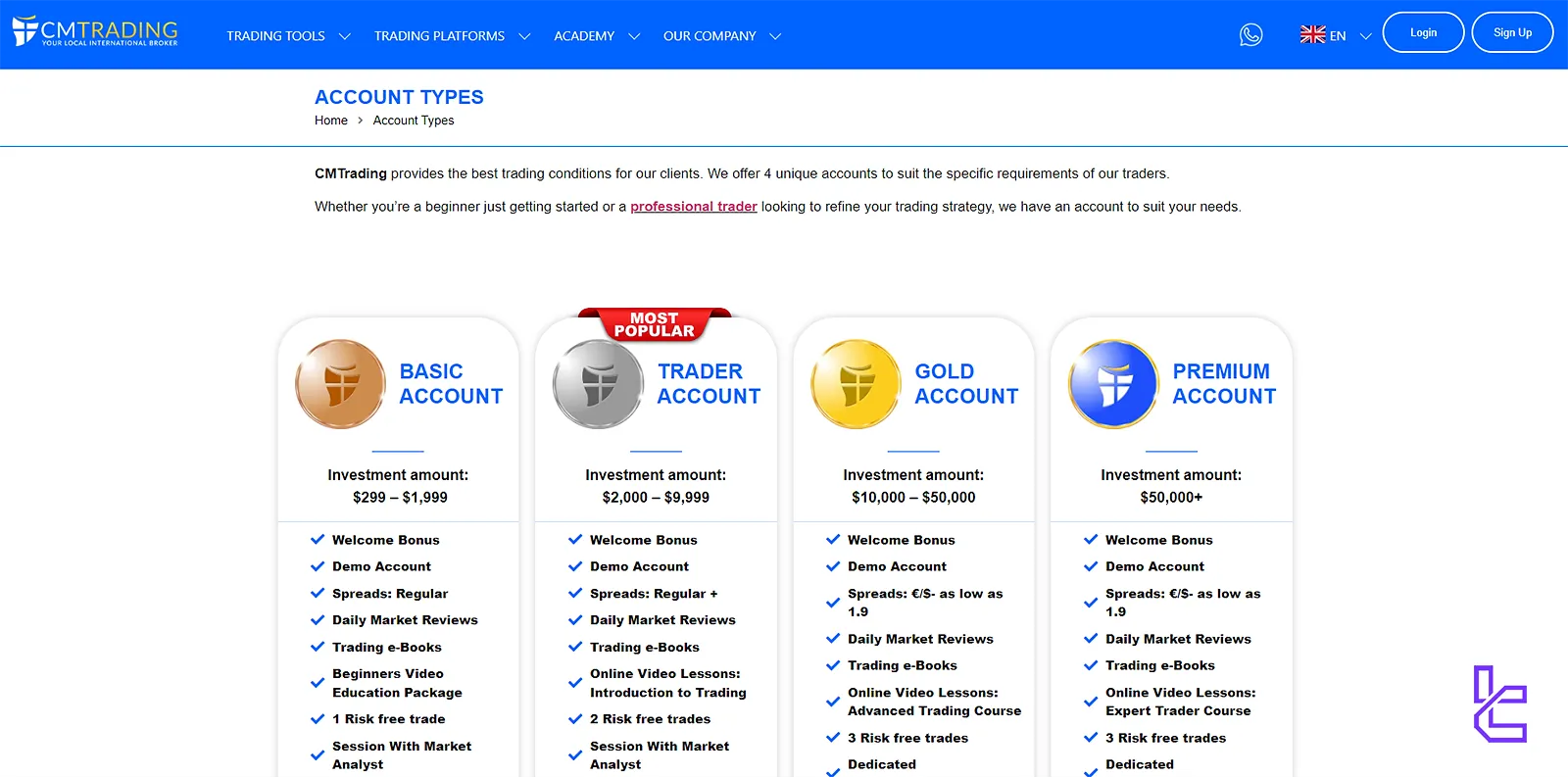

CMTrading Types of Accounts

As with many Forex Brokers, CMTrading offers a range of account types to cater to different trader profiles and investment capacities. Here's an overview of the available options:

Account Type | Min. Deposit | Welcome Bonus |

Basic | From $299 | Yes |

Trader | From $2,000 | Yes |

Gold | From $10,000 | Yes |

Premium | From $50,000 | Yes |

Islamic | Varies | Yes |

Each account type has its benefits, allowing traders to choose the one that best suits their trading style and capital.

This broker also offers a demo account suitable for beginners to practice trading strategies without risking real money.

CMTrading Advantages and Disadvantages

To help you make an informed decision, let's examine the pros and cons of trading with CMTrading:

Advantages | Disadvantages |

Regulated by FSCA and FSA | Relatively high minimum deposit |

Excellent customer support | Wide spreads on entry-level |

Comprehensive educational resources | - |

Daily Trading Signals | - |

While CMTrading offers a solid trading experience with good regulatory oversight, the higher costs associated with some account types and transactions may deter some traders.

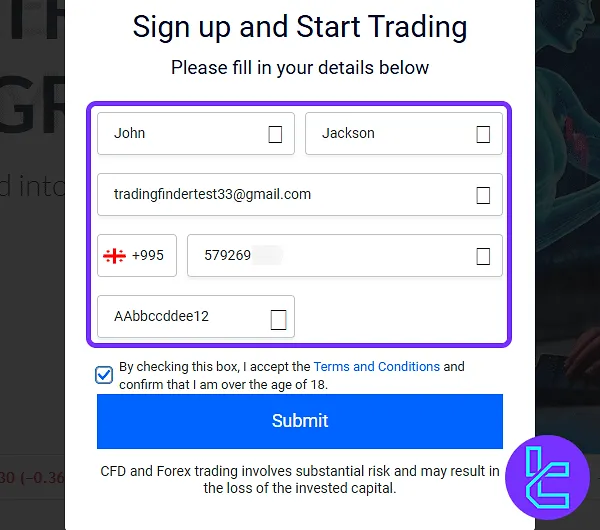

CMTrading Broker Signing Up & Verification Process

Creating a new account with the CMTrading broker is a straightforward and easy process. CMTrading registration:

#1 Create Your Account

Visit the official CMTrading website and click “Open an Account.” Enter your full name, email, mobile number, and a strong password (use letters and numbers).

Accept the terms and confirm you're 18+ to continue.

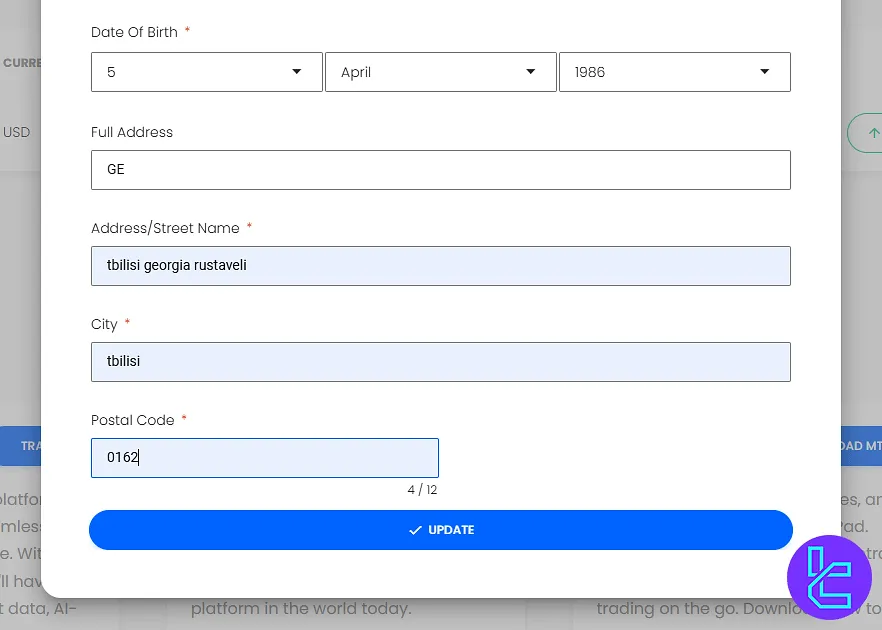

#2 Complete Personal Details

Fill in your date of birth, full residential address, including city, region, street name, and postal code. Submit to complete your profile.

#3 Verify Your Account

To verify your newly created trading account, you must provide a picture of your proof of identity (ID card, driver's license, or passport) and proof of address (utility bill or bank statement).

CMTrading Trading Platforms

As with many forex brokers, CMTrading provides traders with 2 primary trading platforms:

- MetaTrader 4 (MT4)

- CMTrading Webtrader

Both platforms offer mobile versions, allowing traders to manage their positions.

The advanced MT4 indicators and the integration of Trading Central signals provide an additional layer of market analysis, particularly beneficial for newer traders.

CMTrading Spreads and Commission Structure

CMTrading uses a spread-based pricing model with commissions and fees varying by account tier and instrument type:

- Basic & Trader Accounts: Standard spreads (e.g. EUR/USD: ~1.5–2.6 pips) with no additional commissions;

- Gold & Premium Accounts: Tighter spreads from 1.9 pips (not 0.0) with commissions applicable (varies by account type and instrument).

Other applicable fees include:

- Inactivity Fee: $15/month after 90 days of dormancy

- Rollover/Swap Fees: Applied to overnight positions, varies by instrument

- Currency Conversion Fee: Applies when deposit/withdrawal currency differs from the trading account currency

- Withdrawal Fees: 2% on most methods, 4% on cryptocurrency withdrawals

Traders can also benefit from live trading signals and cash-back rebates, which help offset some transactional costs.

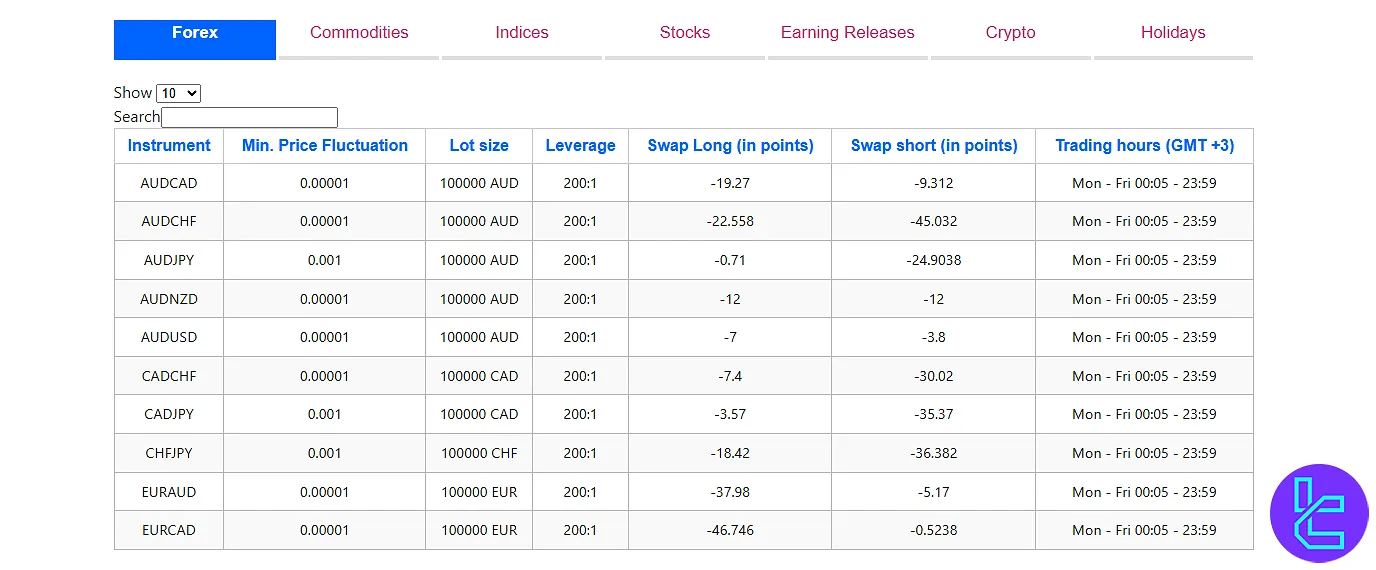

Swap Fee at CMTrading

CMTrading applies overnight interest, commonly known as swap fees, on positions held open beyond the trading day’s close.

The broker specifies different swap conditions for each asset class, including forex pairs and commodities.

These rates are reviewed periodically and may vary depending on instrument type, direction of trade, and market volatility.

Below are the essential points traders should be aware of regarding CMTrading’s swap policy:

- Swaps are displayed in “points” for each instrument within CMTrading’s trading-conditions tables;

- Separate daily swap rates are published for both buy and sell positions in forex instruments;

- Swap values are automatically converted into the base currency of the client’s trading account;

- CMTrading provides Islamic or swap free account options that eliminate overnight charges;

- Swap fees are applied automatically at 22:00 GMT and are visible within the trading platform before execution.

Non-Trading Fees at CMTrading

CMTrading’s client agreement outlines a set of fees that apply even when clients are not actively trading. These charges are tied to account inactivity, dormancy, and certain withdrawal conditions.

In short, beyond spreads and swaps, traders should also factor in maintenance and hidden costs.

Below are the key non-trading fee rules:

- Withdrawal fee: Up to USD/EUR 50 if no trading activity has occurred after deposit;

- Inactivity fee: USD15/month after 90 days of dormancy;

- Dormant fee: Up to USD/EUR 100 for accounts unused for 12 months with zero balance;

- Activity or deposits reset inactivity status;

- Fees apply separately to each inactive or dormant account.

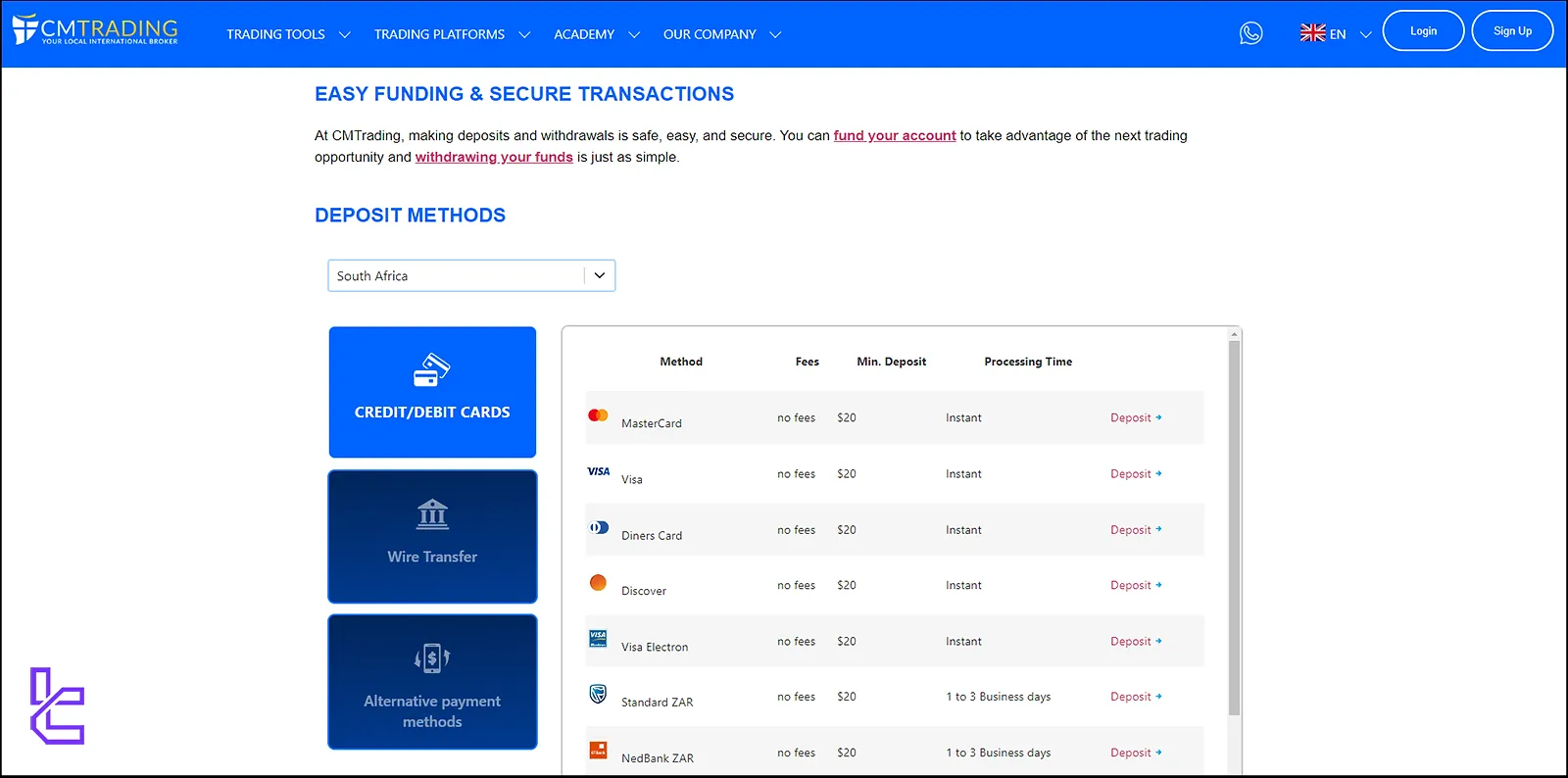

CMTrading Deposit & Withdrawal Methods

CMTrading offers a broad range of deposit and withdrawal options tailored to regional preferences: Deposit Methods:

- Bank Wire (Standard ZAR, Nedbank ZAR)

- Credit/Debit Cards (Visa, MasterCard, Diners, Discover)

- E-wallets (Skrill, Neteller, Perfect Money, Google Pay, EFTPay)

- Cryptocurrencies (BTC, ETH, USDT, TRC20, BEP20, etc.)

- Mobile Payments (MPesa, Local Mobile Money, OZOW)

Deposit Requirements:

- Minimum deposit: $100 for most methods

- Most deposits are instant; bank wires may take 1–3 business days

- No deposit fees (except crypto, which incurs a 4% fee)

Withdrawal Process:

- Withdrawals are typically processed within 2–10 business days

- Card withdrawals are limited to the deposited amount; profits must be withdrawn via e-wallets or bank wire

- Withdrawal fees: 2% for standard methods, 4% for crypto

- Currency conversion fees may apply if the account and transaction currencies differ

CMTrading’s system is functional but lacks full transparency on transaction limits per method.

Traders should also factor in processing delays and conversion costs when planning fund movements.

CMTrading Deposit Methods

CMTrading offers a diverse range of deposit methods to accommodate traders worldwide.

These options include traditional bank transfers, credit/debit cards, e-wallets, mobile money services, and cryptocurrencies.

The availability of specific methods may vary depending on the trader's location.

For detailed information on each deposit method, please refer to the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | USD, EUR, GBP, ZAR, others | $20 | Free | 1–3 business days |

Credit/Debit Card | USD, EUR, GBP, others | $20 | Free | Instant |

Skrill | USD, EUR, GBP, others | $20 | Free | Instant |

Neteller | USD, EUR, GBP, others | $20 | Free | Instant |

Pay Unit | ZAR, others | $20 | Free | Instant |

Ozow | ZAR | $20 | Free | Instant |

Tingg | ZAR, others | $20 | Free | Instant |

M-Pesa | ZAR | $20 | Free | Instant |

Cryptocurrency | BTC, ETH, USDT | $20 | Free | Varies by network |

CMTrading Withdrawal Methods

CMTrading provides a diverse array of withdrawal options to accommodate traders globally.

These methods encompass traditional bank transfers, credit/debit cards, e-wallets, mobile money services, and cryptocurrencies.

The availability of specific methods may vary depending on the trader's location.

For detailed information on each withdrawal method, please refer to the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Transfer | USD, EUR, GBP, ZAR, others | $20 | Up to 2% | 2–10 business days |

Credit/Debit Card | USD, EUR, GBP, others | $20 | Up to 2% | 2–5 business days |

Skrill | USD, EUR, GBP, others | $20 | Up to 2% | Instant |

Neteller | USD, EUR, GBP, others | $20 | Up to 2% | Instant |

Pay Unit | ZAR, others | $20 | Up to 2% | Instant |

Ozow | ZAR | $20 | Up to 2% | Instant |

Tingg | ZAR, others | $20 | Up to 2% | Instant |

M-Pesa | ZAR | $20 | Up to 2% | Instant |

Cryptocurrency | BTC, ETH, USDT | $20 | Up to 4% | Varies by network |

Copy Trading & Investment Options Offered on CMTrading Broker

CMTrading provides a copy trading feature through their CopyKat program. This allows less experienced traders to replicate the trades of successful traders automatically. Key points include:

- Access to a pool of experienced traders

- Ability to view historical performance

- Real-time copying of trades

While CMTrading doesn't offer PAMM (Percent Allocation Management Module) accounts, the copy trading feature provides a similar way for traders to benefit from others' expertise.

CMTrading Tradable Markets & Symbols Overview

CMTrading offers a modest selection of around 165 tradable instruments across five primary asset classes.

While the platform lacks ETFs, options, bonds, or futures markets, it provides sufficient coverage for short-term speculation and portfolio diversification.

Available instruments include:

You have access to a wide range of financial markets and trading instruments at CMTrading, allowing you to execute successful trades based on your strategy and preferences.

Below, you can find practical information about the broker’s instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency Pairs | 50+ | 40–60 | 1:400 | |

Commodities | CFD Metals, Energy, Livestock, Agricultural | 20+ | 15–25 | 1:100 |

Indices | Global Stock Indices | 16 | 15–20 | 1:50 |

Stocks | Global Equities | 100+ | 80–100 | 1:20 |

Cryptos | Major Cryptocurrencies | 10+ | 8–12 | 1:5 |

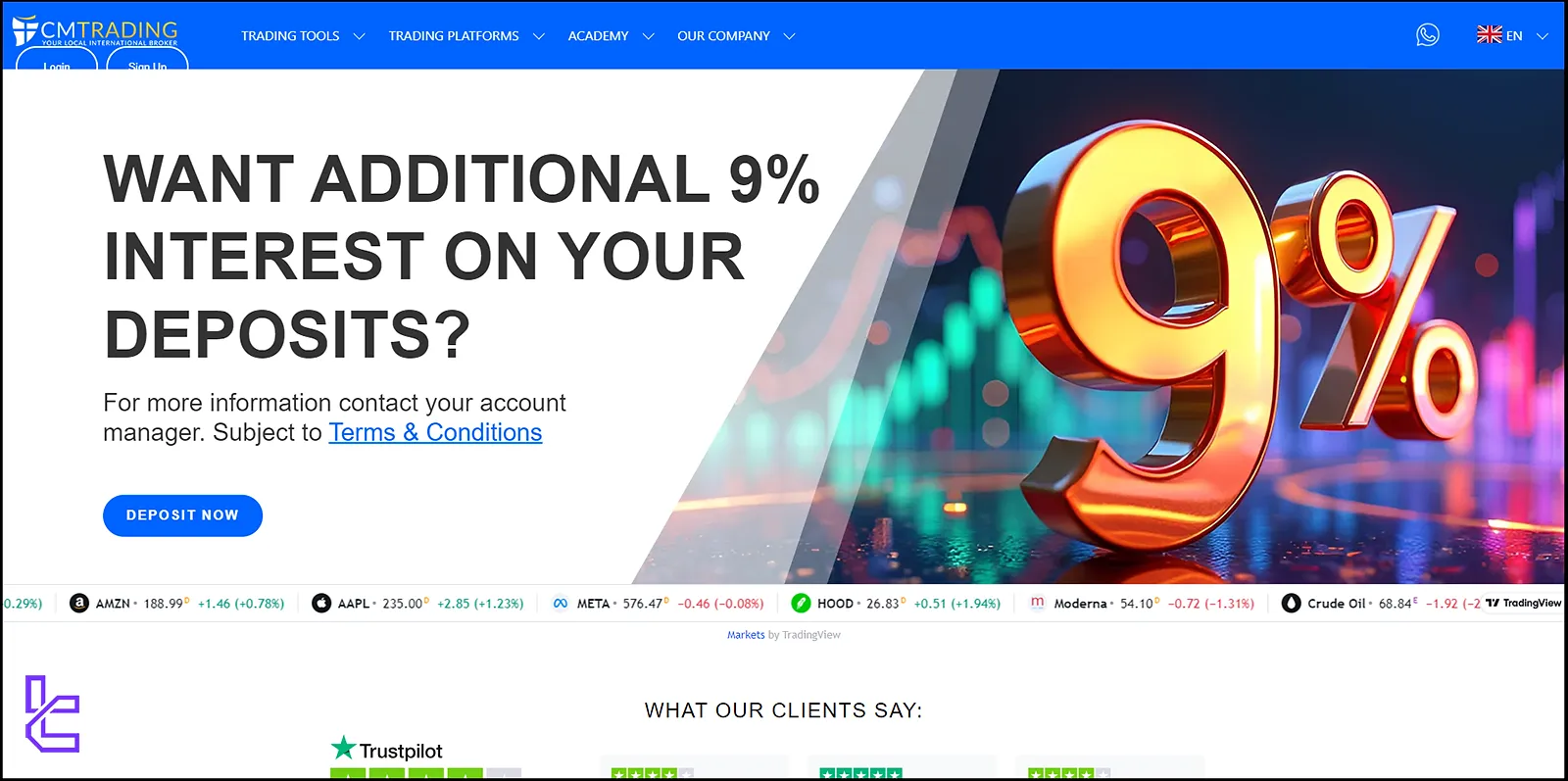

CMTrading Bonuses and Promotions

CMTrading offers several bonuses and promotional offers:

- Welcome Bonus

- $100 Deposit Bonus

- 9% Interest Promo (9% for $10K Deposit)

- $200 referral bonus

While these offers can be attractive, traders should carefully review the terms and conditions associated with each promotion.

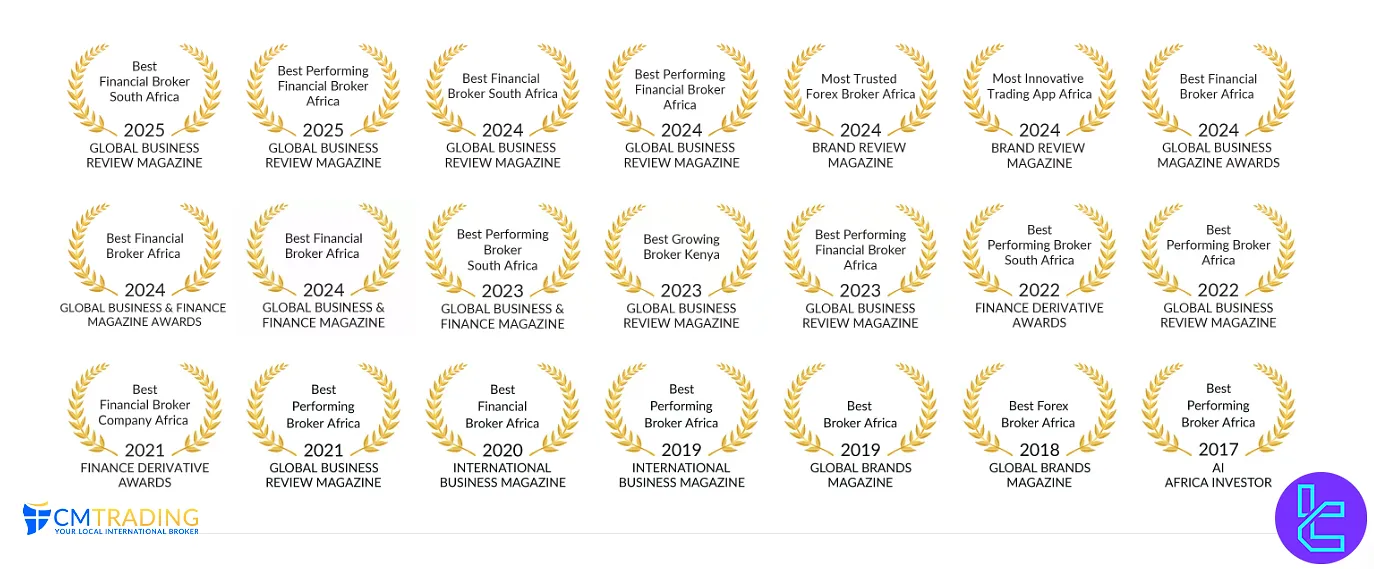

CMTrading Awards

CMTrading has earned multiple industry accolades, highlighting its excellence in trading platforms, customer service, and educational support.

he broker’s achievements, highlighted in CMTrading Awards, reflect recognition regionally and internationally for innovation, reliability, and partner programs.

Here are 8 of the top awards received by CMTrading:

- Best Financial Broker in Nigeria (2025) Financial Services

- Best Financial Broker GCC (2025) Financial Services

- Best Partner Program GCC (2025) Affiliate Programs

- Best Financial Broker Africa (2024) Global Business Magazine Awards

- Best Growing Broker Kenya (2023) Global Business Review Magazine

- Best Financial Broker Africa (2020) International Business Magazine

- Best Forex Broker Africa (2018) Global Brands Magazine

CMTrading Support Team and Hours

CMTrading provides comprehensive customer support through multiple channels:

- WhatsApp: +27 60 138 0155

- Email: support@cmtrading.com

- Phone: +44 161 388 3321

The support team is available 24/5, ensuring assistance during all trading hours.

CMTrading Broker List of Restricted Countries

While CMTrading accepts clients from many countries, restrictions are based on regulatory requirements.

Unfortunately, the information did not provide a specific list of restricted countries. Traders should check with CMTrading directly for the most up-to-date information on country restrictions.

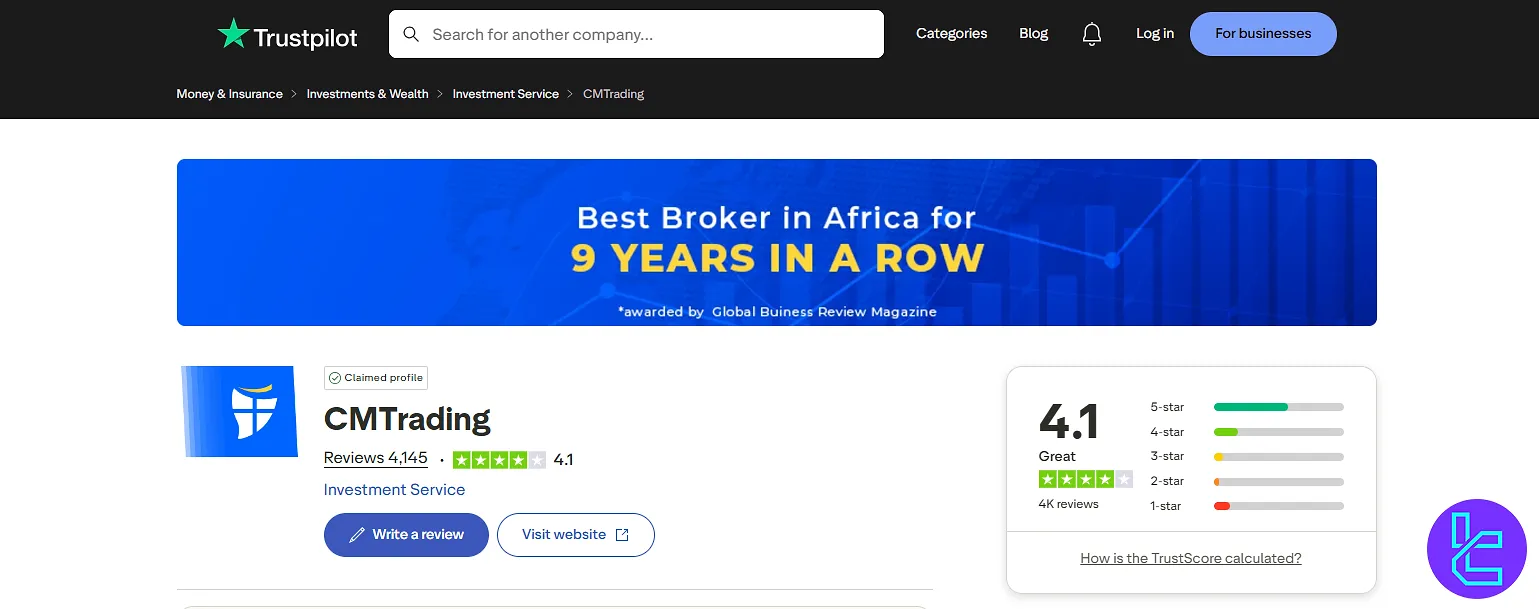

CMTrading Trust Scores & Reviews

The CMTrading Trustpilot score reflects strong trader satisfaction; the broker has garnered positive reviews from many users, with an average rating of 4.1 out of 5 on the Trustpilot website.

Traders appreciate CMTrading's educational resources, customer support, and user-friendly platform. However, some users have noted concerns about accounts being blocked and profits vanishing.

Education on CMTrading Broker

CMTrading places a strong emphasis on trader and Forex education, offering a comprehensive suite of resources; CMTrading Education:

- Training Videos: Covering topics from basics to advanced

- Weekly Webinars: Live sessions with market experts

- E-Books: Downloadable guides on various trading topics

The CMTrading Academy is structured into three levels:

- Intro to Trading (42 videos)

- Intermediate Course (40 videos)

- Advanced Trading (48 videos)

Comparing CMTrading with Other Forex Brokers

The table below provides a comprehensive comparison of the key features of CMTrading with those of other brokers.

Parameters | CMTrading Broker | |||

Regulation | FSCA, FSA | FSA, CySEC, ASIC | No | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | 1.9 for Gold & Premium | From 0.0 Pips | From 0.1 Pips | From 0.0 Pips |

Commission | N/A | From $3 | $0 | From $0 |

Minimum Deposit | $299 | $200 | $1 | From $0 |

Maximum Leverage | 1:200 | 1:500 | 1:3000 | 1:2000 |

Trading Platforms | MT4, WebTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App |

Account Types | Basic, Trader, Gold, Premium | Standard, Raw Spread, Islamic | Standard, Premium, VIP, CIP | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 165+ | 2,250+ | 45 | 1,000+ |

Trade Execution | Market | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and final words

Its trading platforms, MT4 and WebTrader, allow traders to access different markets and tools.

While some concerns, such as wider spreads on lower-tier accounts, exist, the broker offers a variety of trading features like CopyTrading and a welcome bonus.