DEGIRO charges 1 EUR as commission and another EUR as a handling fee for executing trades in the US stock market.

The financial brokerage has received over 100 international awards, including Best International Stock Broker 2025, Best Neo Broker 2024/25, and so on.

DEGIRO Information and Regulation

DEGIRO's journey began in Amsterdam in 2008, but it wasn't until 2013 that the company started offering its stock brokerage services to retail investors.

Since then, DEGIRO has expanded its reach across Europe, now operating in 15 countries and serving over 3 million customers.

Key points about DEGIRO's regulatory status and company information include:

- Regulated by the Netherlands Authority for the Financial Markets (AFM)

- Under prudential supervision of De Nederlandsche Bank (DNB)

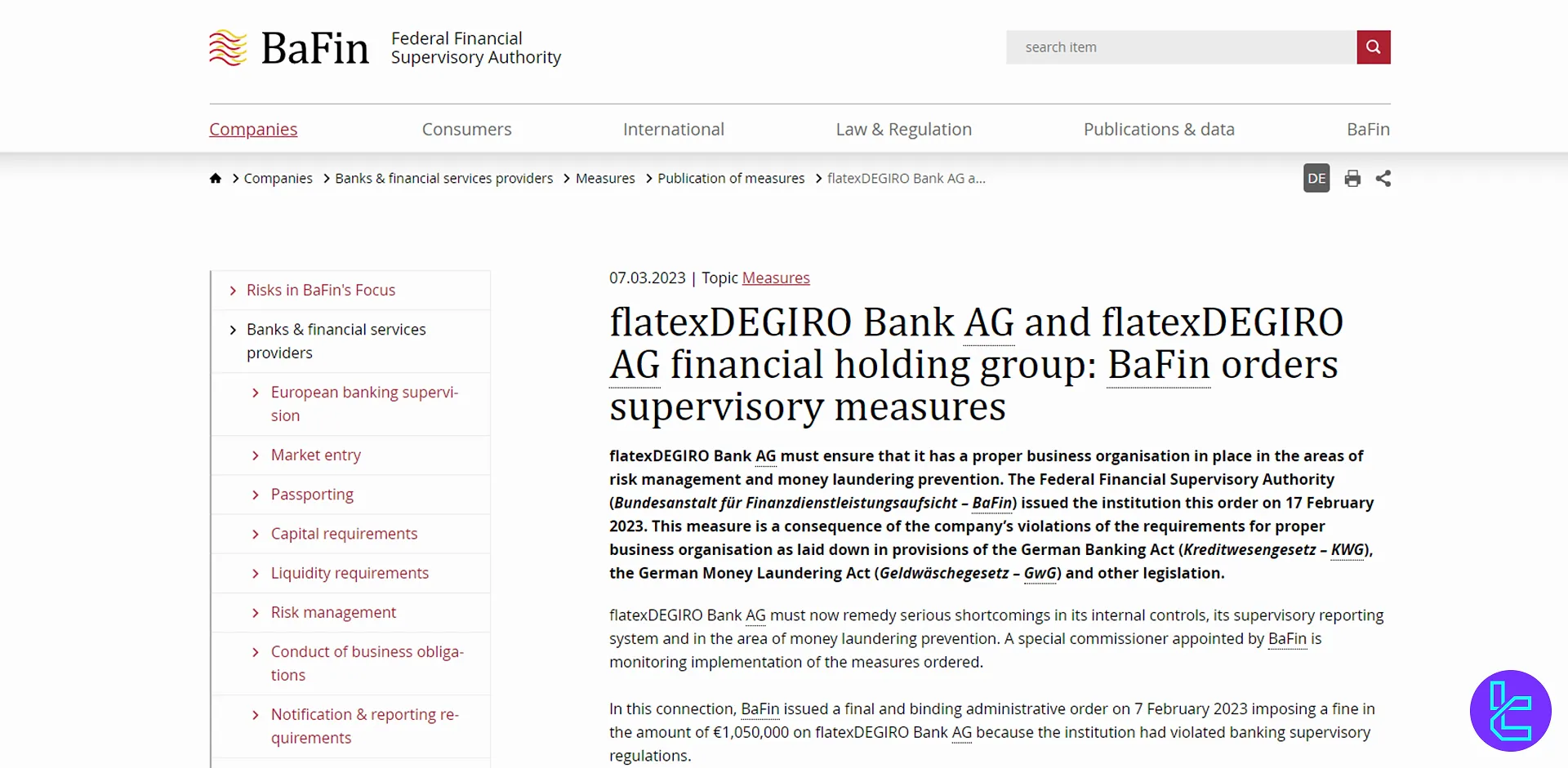

- Primary regulation by the German financial regulator BaFin

The broker’s website claims that they have received over 100 international awards for their financial services, including:

- Best International Stock Broker 2025, Rankia (Italy)

- Broker of the year award 2024, IEX Gouden Stier (The Netherlands)

- Best Neo Broker 2024/25, Le Figaro (France)

- Best Customer Service 2023-2024, Corriere della Sera (Italy)

- And so on

DEGIRO’s head office is located at Rembrandt Tower - 10th floor, 1096 HA Amsterdam, The Netherlands.

DEGIRO Broker Summary

Here's a quick overview of what the Forex broker brings to the table:

Broker | DEGIRO |

Account Types | N/A |

Regulating Authorities | BaFIN, AFM, DNB |

Based Currencies | Client's Country of Residence Currency |

Minimum Deposit | $0 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | N/A |

Maximum Leverage | N/A |

Investment Options | No |

Trading Platforms & Apps | Proprietary Platform |

Markets | Stocks, ETFs, Bonds, Commodities, Options, Funds |

Spread | N/A |

Commission | Varies by the Instrument, Starting from €0.75 |

Orders Execution | N/A |

Margin Call/Stop Out | N/A |

Trading Features | Access to 45 Markets Across 30 Countries, Cost Calculator |

Affiliate Program | Yes |

Bonus & Promotions | Transaction Fee Reimbursement |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Phone |

Customer Support Hours | Monday to Friday from 7am to 9pm |

Restricted Countries | USA, UK, Countries Outside the EU Zone |

DEGIRO Account Types Overview

The brokerage does not provide any details regarding the available account types on its website. We will keep you informed by updating this article as needed in the event of any changes.

Upsides and Downsides of DEGIRO Broker

DEGIRO charges fair commissions based on a transparent structure. Let's break down the other key advantages and disadvantages:

Advantages | Disadvantages |

Access to over 45 exchanges across 30 countries | Currency Conversion Fees for Foreign Trades |

Transparent Fee Structure | No Demo Account Available |

Low Fees Compared to Traditional Brokers | Limited Variety in Asset Types Compared to Some Competitors |

DEGIRO Registration & Verification Complete Guide

Setting up your DEGIRO account involves identity verification, tax compliance, and regulatorysteps aligned with European market standards.

You’ll need valid identification, a SEPA-zone bank account, and must meet DEGIRO’s residency and age criteria. Investors in U.S. equities must also submit a W-8BEN form.

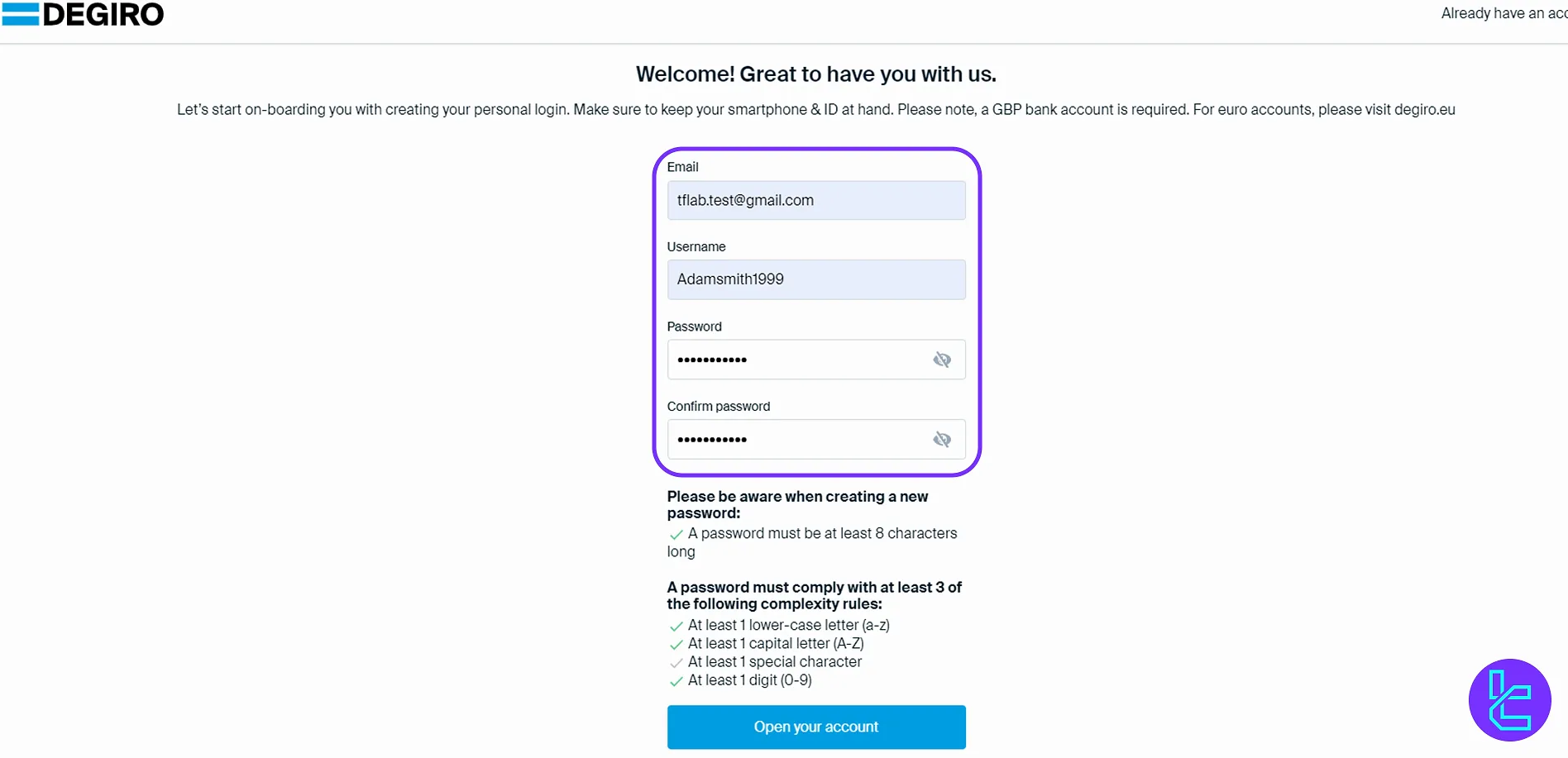

#1 Sign-Up and Email Verification

Start by visiting DEGIRO’s official website. Register using your email, set a password, and confirm the verification link sent to your inbox.

#2 Provide Personal and Tax Information

Enter full legal details—name, date of birth, contact number—and submit your tax identification information, required under KYC and AML regulations.

#3 Accept Terms and Choose Account Type

Review DEGIRO’s legal agreements and select the account type that fits your trading goals.

#4 Complete the Suitability Assessment

Take the appropriateness test to validate your investment knowledge before gaining full access to trading features.

DEGIRO Platforms

DEGIRO's has developed a proprietary trading platform that is available on mobile devices and web. Key features include:

- Custom watchlists

- Interactive charts and deep order books

- Access to 45 markets

- Secure login with Touch/Face ID and two-factor authentication

- ESG ratings and analyst views for stock assessment

- Intuitive interface for easy navigation and trading

- Market news, economic calendars, and global market overviews

Download Links:

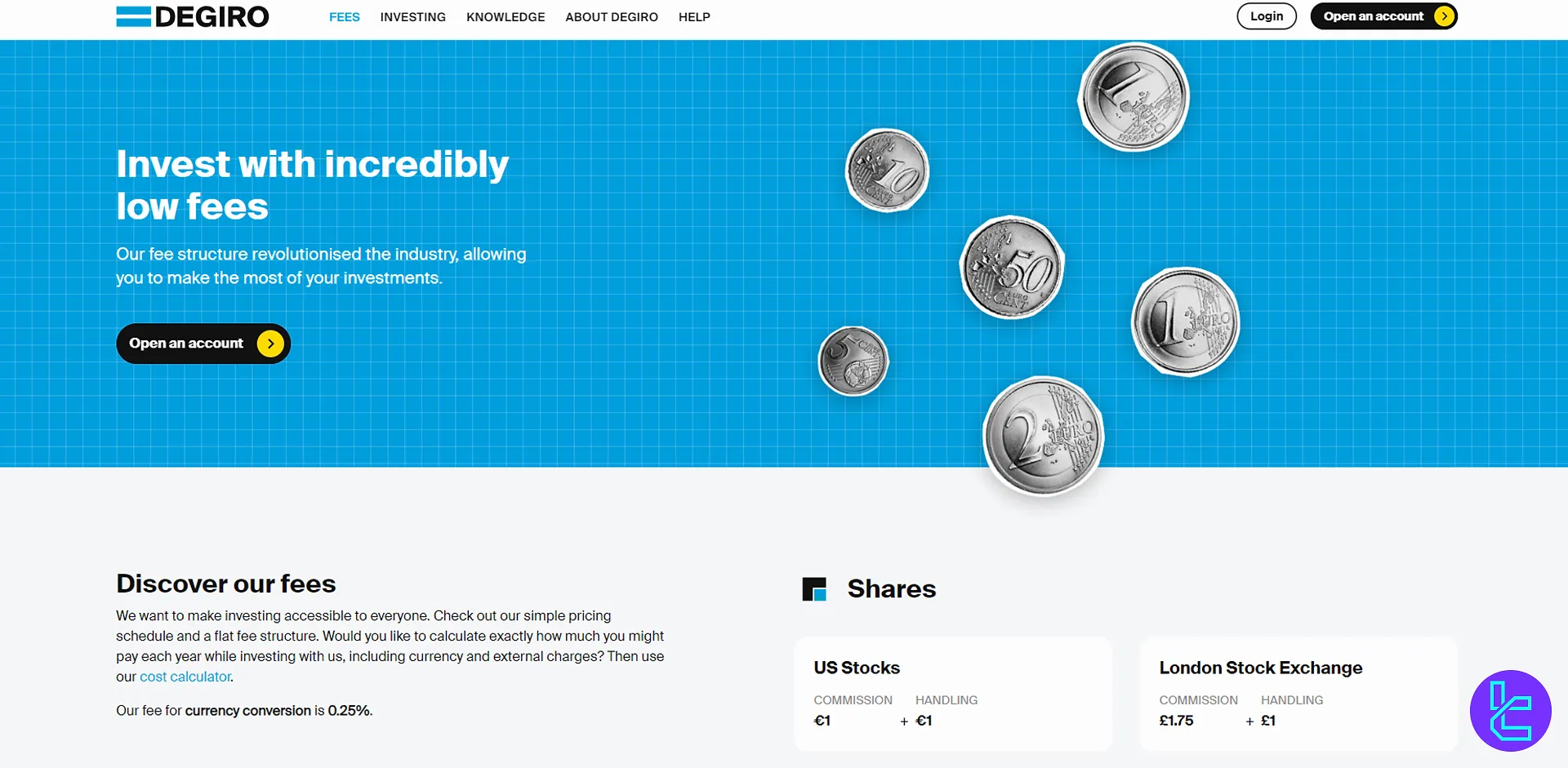

DEGIRO Commissions and Fees

DEGIRO has designed a specific fee model for each market. Here are the trading commissions on the broker:

Instrument | Commission | Handling Fee |

US Shares | €1 | €1 |

London stocks | £1.75 | £1 |

Selected ETFs | €0 | €1 |

Global ETFs | €2 | €1 |

Options | €0.75 | - |

Bonds | €2 | €1 |

Additional fees to consider:

- 25% currency conversion fee

- Noinactivity fees, withdrawal fees, or custody fees

The broker does not provide any information regarding spreads, etc.

DEGIRO Deposit and Withdrawal

DEGIRO offers two primary methods for depositing funds:

- Manual bank transfers

- Direct deposit (SOFORT)

Important notes:

- To make deposits, you will need to verify your identity first;

- DEGIRO only allows deposits and withdrawals from/to accounts in your own name;

- Bank transfers could take up to 3 business days;

- If you encounter issues with transfers, contact DEGIRO support for assistance.

DEGIRO Investment Options Review

Based on our experts’ investigations, unlike some brokers, DEGIRO does not offer built-in copy trading, PAMM, or other features alike. If you are specifically looking for earning passive income, you should seek elsewhere.

Tradable Instruments and Assets on DEGIRO

DEGIRO provides access to over 45 markets in 30 countries, consisting of instruments in these categories:

- Stocks

- ETFs

- Bonds

- Options

- Structured Products

- Commodities

- Futures

DEGIRO Promotions

Currently, the broker offers a transaction fee reimbursement promotion. For DEGIRO investment accounts that have been activated before June 30, 2025, the broker reimburses any commissions and fees up to 100 GBP for new clients until July 31, 2025.

The customers need to make their first deposit of at least£0.01 for this promotion.

DEGIRO Support channels

DEGIRO provides 2 main channels for customer support:

- Email: clients@degiro.com (available 24/7)

- Phone: +49 69 5060419 50 (Monday to Friday, 7 am to 9 pm CET)

Also, you can visit the broker in-person at Rembrandt Tower - 10th floor, 1096 HA Amsterdam, The Netherlands.

Per the reports and comments made by users, the customer service of this broker is quick at responding to inquiries.

DEGIRO Prohibited Countries

DEGIRO limits its services to traders in the European Union countries, and has banned traders from certain regions and countries from opening an account on this platform, including:

- USA

- UK

- Other countries outside of the EU zone

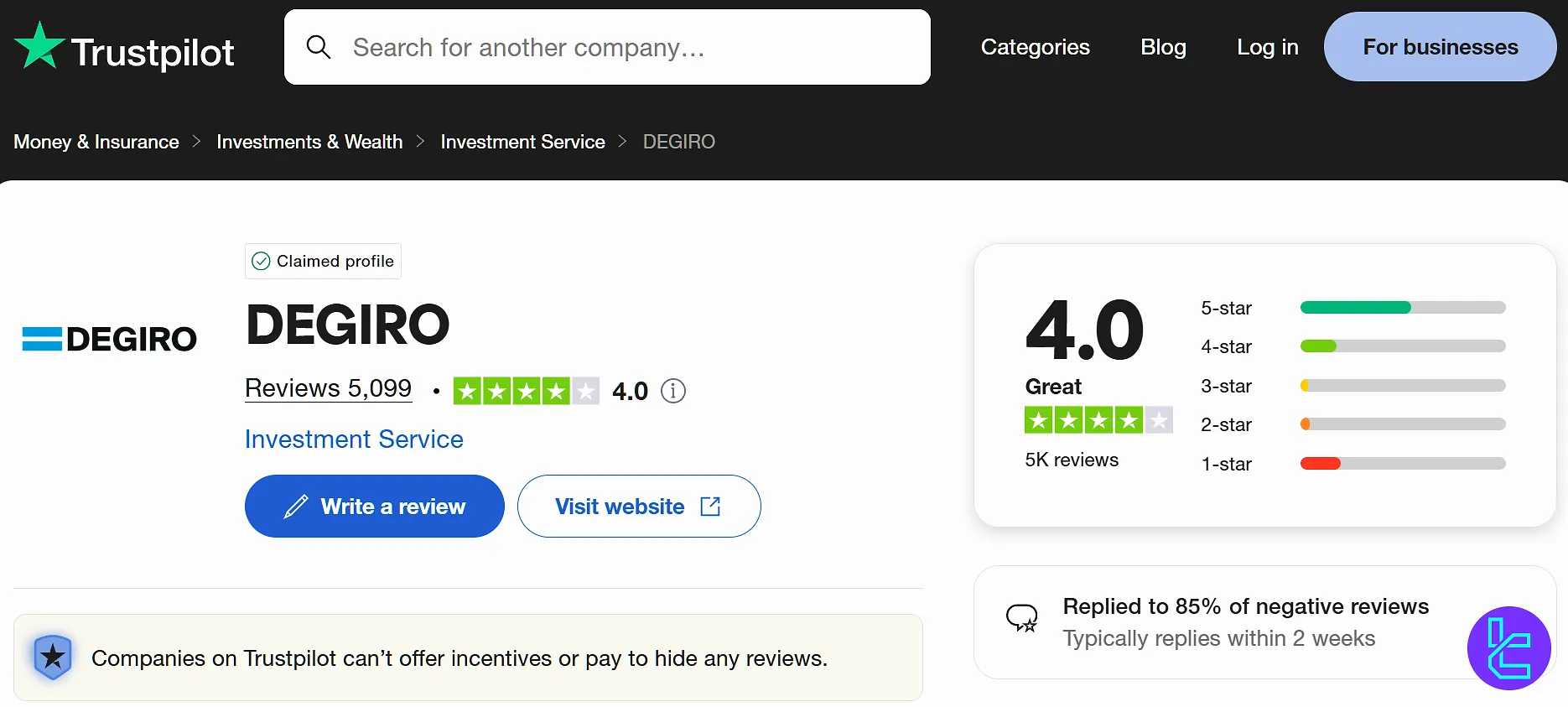

DEGIRO Reviews and Ratings

DEGIRO generally receives positive feedback from its users and evaluation platforms. Here are some ratings and scores:

- DEGIRO Trustpilot Score: 0 out of 5 based on 5,000+ reviews

- DEGIRO ScamAdviser Trustscore: 81/100 according to reliable sources and algorithms

On Trustpilot, approximately 20% of the reviews are 1-star, while more than 70% of the user ratings are 4- and 5-star.

The company has replied to over 85% of the negative reviews, with an average response time of 2 weeks.

DEGIRO Education Materials

DEGIRO provides educational resources through a section called “Investor's Academy”, covering topics such as:

- Types of investors

- What a broker is

- Fundamental and complex financial products

- Factors determining stock prices

- Choosing your first investment

- Order types

- Diversification strategies

- Long-term thinking

- Creating an investment plan

It also offers deep knowledge about various trading strategies, including DCA, defensive investing, offensive investing, and so on. Furthermore, educational articles about various financial products, along with a Blog page, are provided.

DEGIRO Compared to Other Brokers

The table below compares the reviewed brokerage to its competitors in the industry:

Parameter | DEGIRO Broker | |||

Regulation | BaFIN, AFM, DNB | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | N/A | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | Varies by the Instrument, Starting from €0.75 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | None | $200 | $5 | $50 |

Maximum Leverage | 1:1 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | Proprietary | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | N/A | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | No | Yes | Yes | No |

Number of Tradable Assets | N/A | 2,250+ | 1400+ | N/A |

Trade Execution | N/A | Market | Market, Instant | Market |

Expert Suggestion

As an online brokerage operating since 2008, DEGIRO offers trading in stocks, bonds, ETFs, commodities, and more products to residents in 30 countries.

Over 5,000 users have submitted their reviews for DEGIRO on Trustpilot with an average rating of 4 out of 5. Over 50% of the scores are 5-star.