Eightcap is a Forex broker offering a maximum leverage of 1:500 with 6 tradable markets [Forex, commodities, metals, crypto, indices, shares.] There are 3 account types [Standard, Raw, TradingView] with spreads starting from 1.0 pip on the first one.

Also, the brokerage provides access to 3 trading tools [Capitalise.ai, FlashTrader, AI-powered economic calendar.]

Eightcap; Company Information & Regulation

Eightcap was founded in 2009 in Melbourne, Australia. This company claims this as its sole clear objective: "to provide exceptional financial services to clients worldwide".

Over the years, this commitment has paid off handsomely, with Eightcap winning numerous awards for their services, platforms, tools, and educational resources.

Perhaps most notably, they were crowned Global Broker of the Year 2023 at the prestigious Global Forex Awards - a testament to their dedication to excellence.

One of the key factors that contributes to Eightcap's stellar reputation is its robust regulatory framework. The broker is regulated in multiple jurisdictions, including:

- Australian Securities and Investments Commission (ASIC)

- UK Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Securities Commission of The Bahamas (SCB)

These regulatory licenses ensure that Eightcap operates under strict compliance standards, safeguarding client interests across multiple regions. The following table provides a detailed breakdown of Eightcap’s regulatory coverage and corresponding entities.

Entity Parameters/Branches | Eightcap Global Limited | Eightcap Pty Ltd | Eightcap Group Ltd | Eightcap EU Ltd |

Regulation | SCB | ASIC | FCA | CySEC |

Regulation Tier | 3 | 1 | 1 | 1 |

Country | Bahamas | Sydney, Australia | London, United Kingdom | Limassol, Cyprus |

Investor Protection Fund/ Compensation Scheme | N/A | No | Up to £85,000 under FSCS | Up to €20,000 under ICF |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:200 | 1:30 | 1:2000 | 1:30 |

Client Eligibility | Bahamas | Only Australia | Only the United Kingdom | Only EU/EEA Residents |

CEO of Eightcap

Tim, as the CEO and Executive Director of Eightcap Holdings, is recognised for his expertise in operational excellence and financial strategy, steering the company with a strong focus on efficiency, scalability, and sustainable growth.

Since joining Eightcap in 2017, he has played a pivotal role in shaping its financial foundation through a strategic vision paired with a hands-on management style.

A Chartered Accountant with over 15 years of industry experience, Tim’s career includes key positions at Pepperstone Financial, ABN AMRO, and FXCM.

His extensive background in financial services allows him to blend deep technical knowledge with forward-thinking strategies, optimising performance and enabling the organisation to expand its operations effectively.

Summary of Specifications

To give you a comprehensive overview of what Eightcap offers, let's break down their key specifications:

Broker | Eightcap |

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Based Currencies | USD, GBP, AUD, EUR, NZD, CAD, SGD |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Minimum Order | 0.01 pips |

Maximum Leverage | 1:500 |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, TradingView |

Markets | Forex, crypto, indices, commodities, metals, shares |

Spread | From 0 pips |

Commission | From 0 |

Orders Execution | Market Execution |

Margin Call/Stop Out | 80%/50% |

Trading Features | Demo account Assistive tools for traders Educational resources |

Affiliate Program | Yes |

Bonus & Promotions | Sign-in bonus |

Islamic Account | None |

PAMM Account | None |

Customer Support Ways | Email, phone, live chat |

Customer Support Hours | 24/5 |

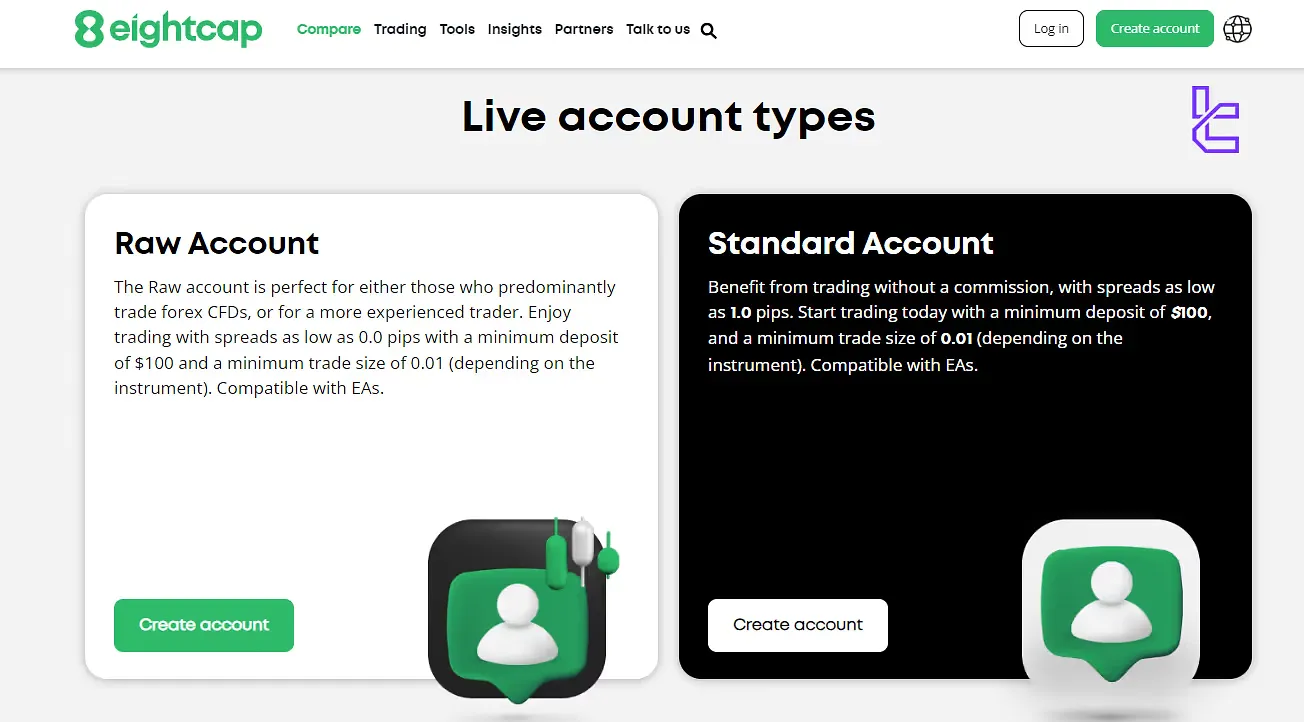

Account Types

Eightcap offers 3 main account types to meet different trading styles and preferences. You can choose one of these according to your own way of trading:

- Standard

- Raw

- TradingView account

- Demo

At the table below, we will discuss each live account's specifications and compare them together:

| Account Type | Raw | Standard | TradingView Account |

Minimum spreads | 0 pips | 1.0 pips | 1.0 pips |

Available instruments | Over 800 | Over 800 | Over 800 |

Commission & fees | for each side per standard lot traded: 3.5 USD, CAD, NZD, SGD, AUD 2.25 GBP 2.75 EUR | None | None |

For all these accounts, the minimum deposit is $100, the margin call level is 80%, and the stop-out level is 50%. The minimum and maximum order sizes are 0.01 and 100 pips, respectively. Additionally, scalping is allowed on all accounts. Also, you can use Eightcap demo account for practicing your skills and testing your strategies.

Benefits and Drawbacks

Being aware of the pros and cons while choosing a good broker is important. As with any broker, Eightcap has its strengths and weaknesses. In the table below, we will have an overview of the advantages and disadvantages:

Pros | Cons |

Strong Regulation | Basic Educational Resources |

Third-Party Platform Integration | Platform Restrictions |

Competitive Spreads | High minimum deposit |

High Leverage | - |

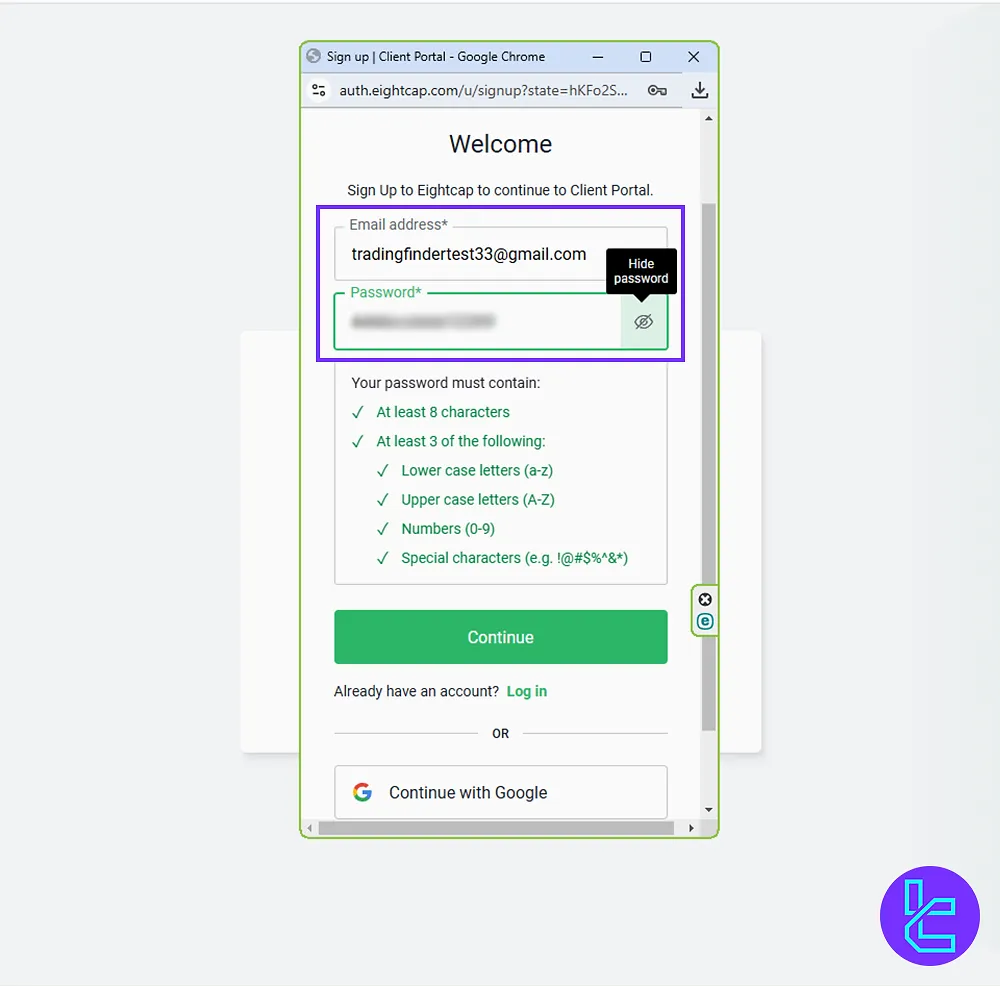

Opening an Account and Verification

The Eightcap registration is seamless and fast. Whether you choose to register via email or Google, the process is designed to be completed in just a few steps.

#1 Visit the Official Site

Head to the Eightcap homepage and click “Create Account.”

#2 Choose Your Sign-Up Method

Select “Continue with Email” or sign up using your Google account.

#3 Enter Your Info

Submit your email address, create a secure password, and provide your country, full name, and mobile number.

#4 Verify Your Email

Check your inbox for the activation link and click “Verify Email Address” to complete the process.

#5 Eightcap Verification

For verification, you will need to upload the required documents, such as your passport and bank statement. Eightcap's compliance team will review your application and documents. This process usually takes up to 24 hours.

Go to the Profile section, look for the KYC/Verification button, and follow the instructions.

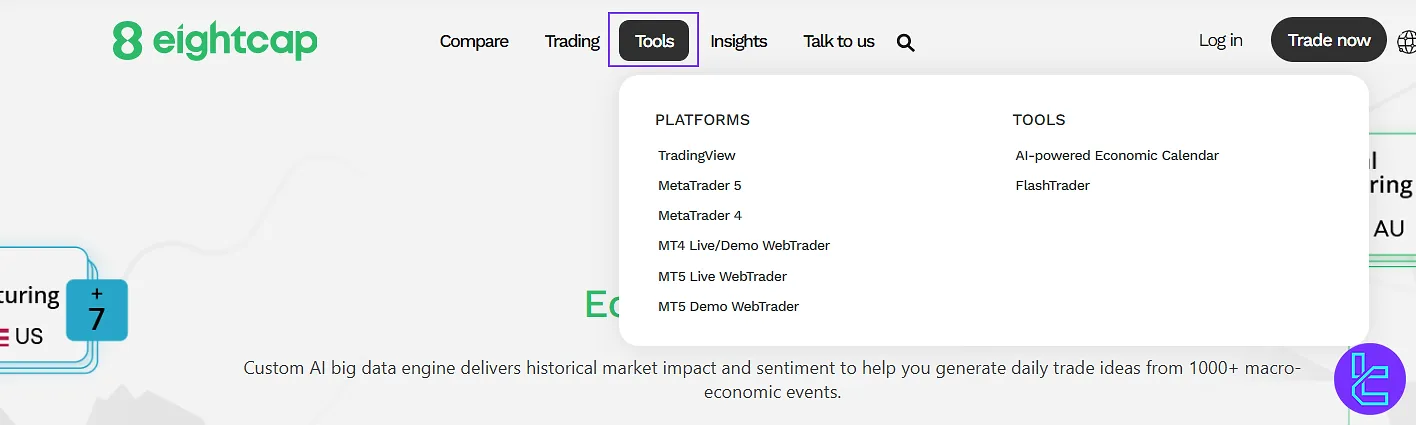

Platforms and Applications

Eightcap offers a range of popular trading platforms to suit different trader preferences:

MetaTrader 4 (MT4)

- Industry-standard platform

- Advanced charting capabilities

- Automated trading with Expert Advisors (EAs)

- Custom indicator support

- MetaTrader 4 is available on desktops, browsers (WebTrader), and smartphones

MetaTrader 5 (MT5)

- Next-generation platform with enhanced features

- More timeframes and graphical objects than MT4

- Economic calendar integration in the MetaTrader 5 platform

- Advanced Market Depth feature

- Available for desktop, web (webTrader), and mobile

TradingView

- Access to more than 15 customizable chart types

- Over 100,000 community-built indicators

- Extensive library of custom indicators

- Accessible from different devices

- Attractive interface with advanced options

- Real-time access to a data feed

- Alerts and notifications with a high level of customizability

Commissions and Spreads

Eightcap prides itself on offering competitive trading costs. You should consider that the spreads vary based on the traded asset or market conditions. Here's a breakdown of their commission and spread structure:

Account Type | Spreads | Commissions |

Standard | From 1.0 pip | None (Except Shares) |

Raw | From 0 pip | $7 per standard lot traded (round turn) |

TradingView | From 1.0 pip | None (Except Shares) |

If you are interested in lowering your trading costs, visit the Eightcap rebate page to sign up for the cashback program.

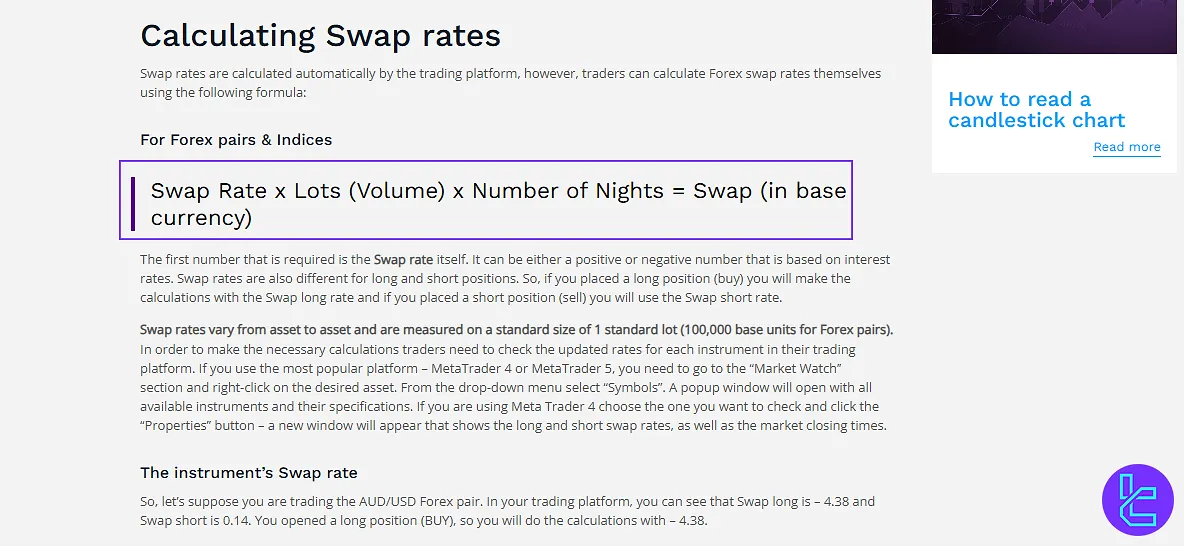

Swap Fees

Swap rates reflect the interest rate differential between currencies or assets and are charged or credited daily. They differ for long (buy) and short (sell) positions and are usually calculated automatically by platforms like MetaTrader 4 and MetaTrader 5.

Formula (Forex & Indices):

Example – AUD/USD:

- Long swap: –4.38

- Volume: 2 lots

- Holding: 5 nights (includes triple swap on Wednesday)

Calculation:

–4.38 × 2 = –8.76 AUD –8.76 × 5 = –43.8 AUDIf the account is in USD and 1 USD = 1.42 AUD, then:

43.8 ÷ 1.42 = 30.85 USDNon-Trading Fees

A trading account will be classified as inactive if no trading activity occurs for a continuous period of three (3) calendar months, or as otherwise stated on the Company’s website.

For the purposes of this definition, inactivity occurs when:

- No deposits have been made within the last three (3) months (or the timeframe specified on our website), and/or

- No trades, open positions, or pending orders have been executed during the same period.

When an account remains inactive for over three (3) months, the Company may apply a monthly inactivity fee of 10 EUR/GBP/USD.

The applicable fee amount is set out in the Costs and Charges Policy and on the Company’s website, covering administrative maintenance and any associated banking costs.

If a client maintains multiple trading accounts, the inactivity fee will not be charged provided that at least one account is active, even if others are dormant.

Clients with accounts inactive for more than three (3) months should contact Customer Support to reactivate access.

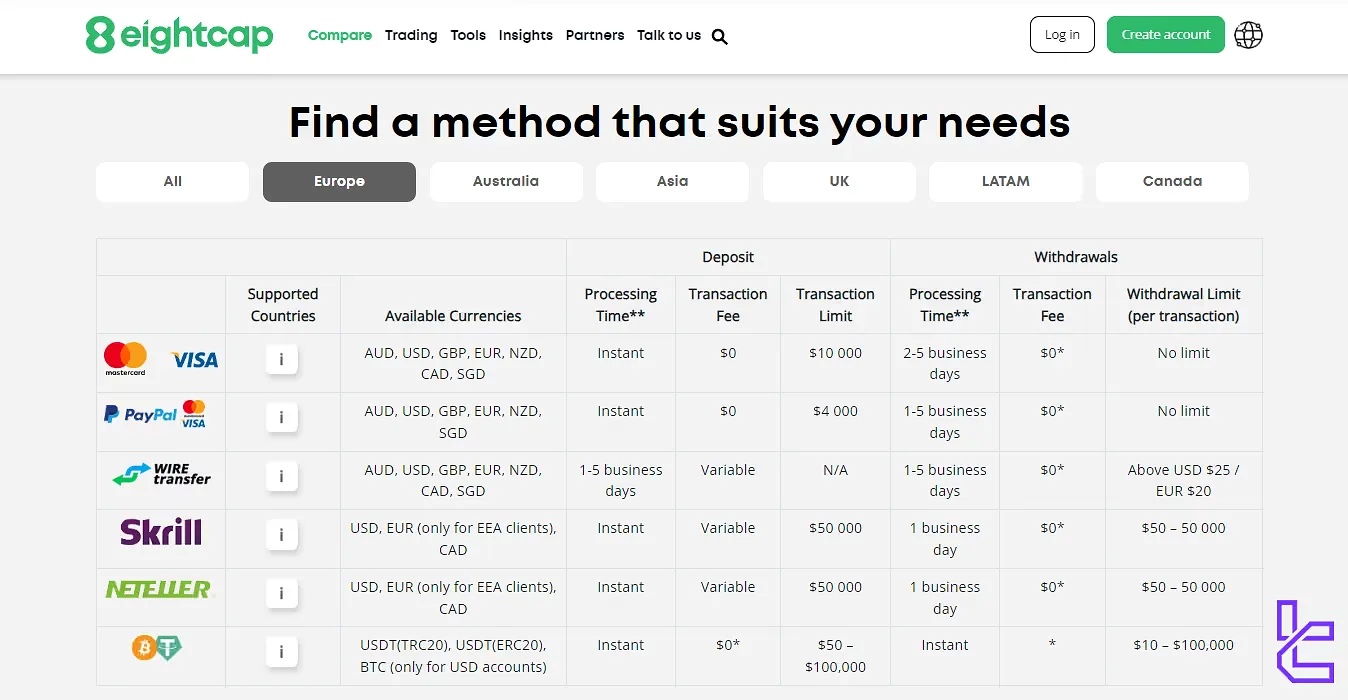

Deposit and Withdrawal Options

Eightcap offers a variety of deposit and withdrawal methods to provide suitable options for traders from different regions. Here are the methods available on the broker:

- Credit/Debit Cards (Visa, Mastercard)

- Bank Wire Transfer

- E-wallets (Skrill, Neteller)

- Online Payment Systems (PayPal)

- Cryptocurrencies (Bitcoin, Ethereum, Tether)

Deposit

Eightcap offers a wide range of payment methods to fund your trading account, including international and local bank transfers, credit/debit cards, e-wallets, and cryptocurrencies.

Most methods provide instant funding with zero transaction fees, allowing you to start trading without delays. Your choice of deposit method will depend on your location, base account currency, and transaction limits.

Deposit Methods Table:

Deposit Method | Supported Currencies | Processing Time | Transaction Fee | Transaction Limit |

Mastercard / Visa | AUD, USD, GBP, EUR, NZD, CAD, SGD | Instant | $0 | $10,000 |

PayPal (Visa / Mastercard) | AUD, USD, GBP, EUR, NZD, SGD | Instant | $0 | $4,000 |

Wire Transfer | AUD, USD, GBP, EUR, NZD, CAD, SGD | 1–5 Business Days | Variable | N/A |

BPAY | AUD | 1–2 Business Days | $0 | $50,000 |

Skrill | USD, EUR (EEA only), CAD | Instant | Variable | $50,000 |

Neteller | USD, EUR (EEA only), CAD | Instant | Variable | $50,000 |

Orbital (USDT TRC20/ERC20, BTC) | USD | Instant | $0* | $50 – $100,000 |

Withdrawal

Eightcap provides multiple withdrawal options, including bank transfers, credit/debit cards, e-wallets, and cryptocurrency transfers. Most withdrawals are fee-free, and processing times range from instant to 5 business days, depending on the chosen method.

Minimum and maximum limits vary, so it’s essential to check before submitting your request.

Withdrawal Methods Table:

Withdrawal Method | Supported Currencies | Processing Time | Transaction Fee | Withdrawal Limit |

Mastercard / Visa | AUD, USD, GBP, EUR, NZD, CAD, SGD | 2–5 Business Days | $0* | No Limit |

PayPal (Visa / Mastercard) | AUD, USD, GBP, EUR, NZD, SGD | 1–5 Business Days | $0* | No Limit |

Wire Transfer | AUD, USD, GBP, EUR, NZD, CAD, SGD | 1–5 Business Days | $0* | Above USD $25 / EUR $20 |

BPAY | AUD | 1–3 Business Days | $0 | Above USD $25 / EUR $20 |

Skrill | USD, EUR (EEA only), CAD | 1 Business Day | $0* | $50 – $50,000 |

Neteller | USD, EUR (EEA only), CAD | 1 Business Day | $0* | $50 – $50,000 |

Orbital (USDT TRC20/ERC20, BTC) | USD | Instant | $0* | $50 – $100,000 |

Copy Trade and Investment Options

Eightcap does not offer any kinds of tools and platforms for earning passive income, such as copy trading, PAMM accounts, etc. Therefore, if you are looking to copy from professional traders, you need to look elsewhere.

What Markets and Symbols are Available on Eightcap?

At this section of the Eightcap broker review, we discuss the tradable markets.

This broker is focused mostly on CFDs, and covers various markets and instruments through these contracts. Instruments and markets available on Eightcap:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | Forex currency pairs (CFDs) | 56 FX Pairs | ~60 (Varies by Broker) |

Commodities | Commodity CFDs (e.g. energy, metals) | 14–16 Commodities | ~15 (Average CFA offering) |

Precious Metals | Precious metal CFDs (gold, silver, etc.) | Included within the Commodity Count (e.g. Gold, Silver) | ~2–5 (Most Brokers offer at Least Gold & Silver, some add Platinum/Palladium) |

Cryptocurrencies | Crypto CFDs (derivatives) | 100+ to over 200 Crypto CFDs | ~50–150 (in CFD Segment) |

Indices | Index CFDs | 17 indices | ~15–25 (common broker range) |

Shares | Share CFDs (equity instruments) | 590–660 stock CFDs | ~500–1,000 (varies by broker scope) |

Eightcap offers over 800 tradable symbols, including 56 forex pairs and more than 200 cryptocurrency CFDs - one of the most extensive crypto offerings in the retail CFD industry.

However, crypto assets are available exclusively as derivatives (CFDs), and not as physical coins. Retail traders in the U.K. are restricted from accessing crypto CFDs due to regulatory constraints.

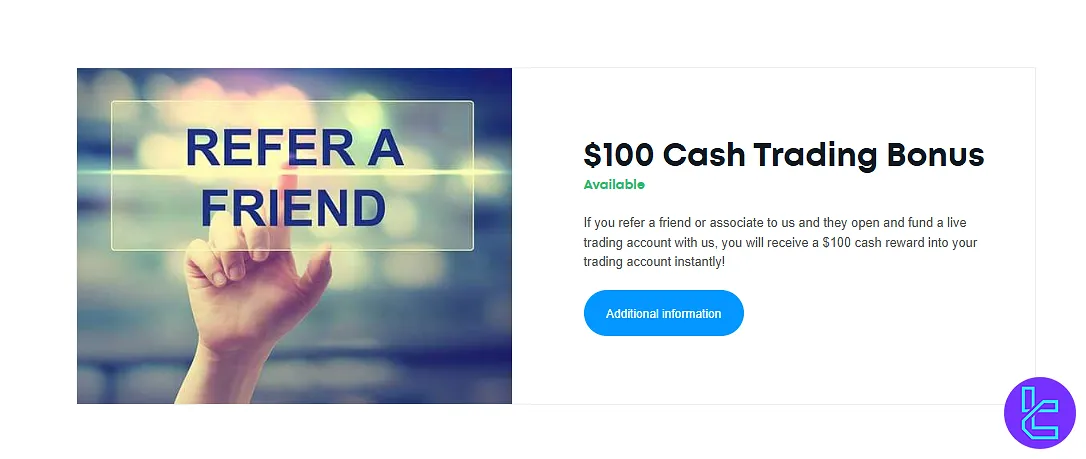

Broker Bonus and Promotions

Eightcap offers several attractive bonuses and promotions to both new and existing clients.

Here's a breakdown of their current offerings:

- Sign up bonus: a personal client-specific bonus that depends on the user and can be discussed with the personal account manager

- Referral Program: Rewards both the referrer and the referred client, with varying specifics. Check the website for current details

- Trading Challenges: regular competitions with attractive prizes

It's important to note that bonuses and promotions in the Forex industry are subject to strict regulations and may not be available in all jurisdictions. Always read the terms and conditions carefully before participating in any promotional offers.

Awards

Eightcap has received the Best Global CFD/Forex Broker award in the Best by Asset Classes category at the TradingView Broker Awards.

This recognition, based on votes from the TradingView community, highlights brokers with strong capabilities in delivering a wide and well-managed range of asset classes.

As the only UK-based broker dedicated to the TradingView platform, Eightcap offers access to over 800 CFD markets globally (600+ in the UK), including forex, indices, commodities, shares, and, outside the UK retail market, cryptocurrencies.

The broker also provides an auto-subscription feature for UK clients, granting TradingView Plus plan access upon account funding.

Through its integration with TradingView, Eightcap combines advanced charting and analysis tools with multi-asset trading, enabling participants to explore opportunities across global markets.

Customer Services and Support

Eightcap prides itself on providing excellent customer service, which has contributed to its numerous industry awards. Here's how you can contact the support team:

- Phone

- Live chat

You can expect the support team to answer your questions on 24/5. Unfortunately, unlike some other brokers, this one does not offer customer service on weekends.

Banned Countries: Can You Trade on Eightcap?

Eightcap is a global broker that serves clients from many countries around the world. However, due to regulatory restrictions and company policies, Eightcap is unable to offer its services in certain jurisdictions. While the broker doesn't publicly list all banned countries, some of the countries restricted from this brokers' services are as follows:

- Iran

- North Korea

- Congo

It's important to note that the list of countries where Eightcap can or cannot operate may change over time due to evolving regulations and company policies. If you're unsure about your eligibility to open an account with Eightcap, the best course of action is to contact their customer support directly or check the terms and conditions on their website.

Tools for Trading

Eightcap provides a suite of powerful trading tools to enhance the trading experience for its clients:

- Capitalise.ai: Code-free automation tool, create, test, and automate trading strategies using natural language

- FlashTrader: Quick order placement tool for targeting multiple profits, calculating position size, and placing stops/limits with one click

- AI-powered Economic Calendar: Historical market impact data and sentiment analysis to help generate trade ideas from over 1000 macroeconomic events

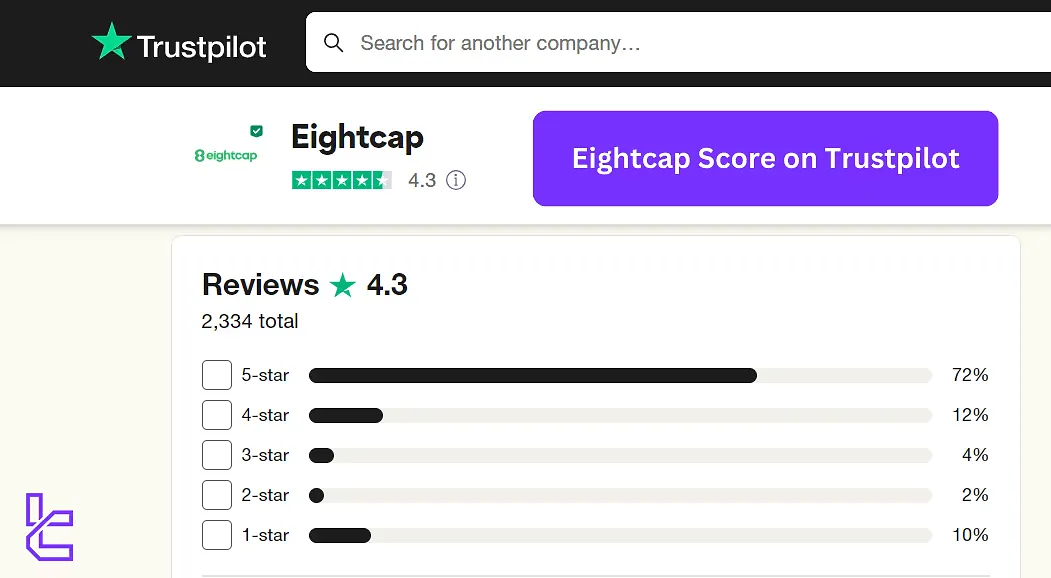

Trust Scores

Eightcap has established itself as a trusted broker in the industry, with several factors contributing to its reliability. At this section of Eightcap broker review, we will have an overview of the brokerage's score on reputable websites, the Eightcap Trustpilot score: 4.3 out of 5, based on more than 2,300 reviews

Education Materials and Resources

Eightcap provides a range of educational materials to help traders improve their skills and knowledge.

This broker offers these resources in the form of a separate section called "Eightcap Labs":

- Platform walkthrough tutorials and guides

- Trading Fundamentals guide

- educational materials on Trading Strategies:

- E-books and lectures from professionals in financial markets

- Events and Webinars

- Video Tutorials and analysis

While Eightcap's educational offerings are comprehensive, they lack some advanced features, such as content filtering by experience level or progress tracking. However, the broker's commitment to education is evident, and these resources can be valuable for traders at various stages of their journey.

Eightcap in Comparison with Others

In the table below, you can see a comprehensive comparison between the Eightcap broker and its rivals;EightcapComparison:

Parameters | Eightcap Broker | TMGM Broker | FBS Broker | Alpari Broker |

Regulation | ASIC, FCA, CySEC, SCB | ASIC, VFSC, FSC, FMA | FSC, CySEC | MISA |

Minimum Spread | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $0 | $3.5 in EDGE, $0.0 in CLASSIC | From $0 | From 0 on Trading (depending on the account type and payment method) |

Minimum Deposit | $100 | $100 | $5 | $50 |

Maximum Leverage | 1:500 | 1:1000 | 1:3000 | 1:3000 |

Trading Platforms | MT4, MT5, TradingView | MetaTrader 4, MetaTrader 5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App | MetaTrader 4, MetaTrader 5, WebTrader |

Account Types | Standard, Raw, TradingView, Demo | EDGE, CLASSIC | Standard | Standard, ECN, Pro ECN, Demo |

Islamic Account | None | Yes | Yes | Yes |

Number of Tradable Assets | 800+ | 12000+ | 550+ | 750+ |

Trade Execution | Market | Market Execution, Limit Order, ECN | Market | Market |

Trading Finder Conclusion and Final Words

Eightcap, a financial trading broker, requires a minimum deposit of $100 for getting started. It provides 3 trading platforms [MetaTrader 4, MetaTrader 5, TradingView] for trading with 0 spreads on the Raw account.

There are no trading commissions for Standard and TradingView accounts (except for shares).