Equiti is a Forex broker with 2 live accounts [Standard, Premier]. Regulated by some of the top-tier authorities such as FCA and SCA, this brokerage provides economic calendar and signal centre services..

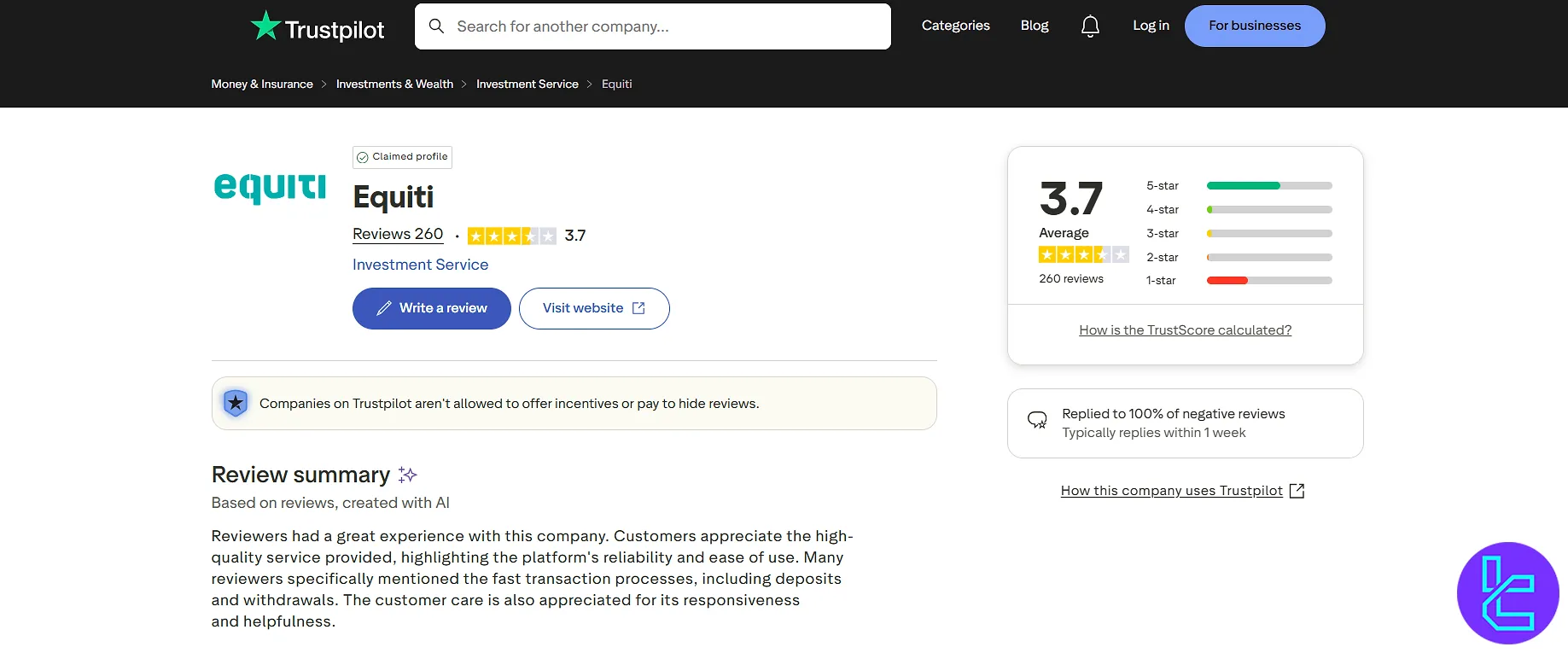

The company has received 3.7/5 based on 260 reviews on the "Trustpilot" website.

The Broker's Company Information & Regulation

Equiti stands out as a multi-regulated forex broker with a strong global presence. Founded in 2008 with offices in Dubai, Amman, Limassol, and more, it's headquartered in London, United Kingdom, based on the data from Crunchbase. Regulating Bodies of Equiti:

- Financial Conduct Authority (FCA) in the UK

- Financial Services Authority (FSA) in Seychelles

- Securities and Commodities Authority (SCA) in the UAE

- Jordan Securities Commission (JSC)

- Capital Markets Authority (CMA) in Kenya

- Central Bank of Armenia (CBA)

In the table below, practical and up-to-date information about the Equiti broker is provided to help you become familiar with the main features of this broker.

Entity Parameters / Branches | Equiti Capital UK Ltd | Equiti Group Limited (Jordan) | Equiti Securities Currencies Brokers LLC | EGM Securities Ltd (Kenya) | Equiti AM CJSC (Armenia) | Equiti Brokerage (Seychelles) Ltd |

Regulation | FCA | Jordan Securities Commission | SCA | CMA (Kenya) | CBA | FSA Seychelles |

Regulation Tier | 1 | 2 | 2 | 2 | 4 | 4 |

Country | UK | Jordan | UAE | Kenya | Armenia | Seychelles |

Investor Protection Fund / Compensation | FSCS (£85k) | JSC investor protection (local fund) | None | CMA Investor Compensation Fund | None | None |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:2000 | 1:2000 | 1:500 | 1:2000 | 1:2000 | 1:2000 |

Client Eligibility | UK only | Jordan only | UAE only | Kenya Only | Armenia Only | All countries except restricted (e.g., Belgium, Japan). |

Key Specifications

In this section, we will have an overview of the main features and specifics of Equiti:

Broker | Equiti |

Account Types | Standard, Premier, Demo |

Regulating Authorities | FCA, FSA, SCA, JSC, CMA, and CBA |

Based Currencies | USD, EUR, GBP, AED |

Minimum Deposit | None |

Deposit Methods | Credit/Debit Card, Cryptocurrencies, Bank Transfers, E-Wallets |

Withdrawal Methods | Credit/Debit Card, Cryptocurrencies, Bank Transfers, E-Wallets |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:2000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Indices, Commodities, Shares, ETFs, Crypto |

Spread | Average of 1.4 Pips on Standard Account From Zero on Premier Account |

Commission | Zero on Standard Account $7 per Lot on Premier Account |

Orders Execution | Market |

Margin Call/Stop Out | 100%/30% |

Trading Features | Economic Calendar, Signal Centre |

Affiliate Program | No |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Email, Phone Call |

Customer Support Hours | 24/6 |

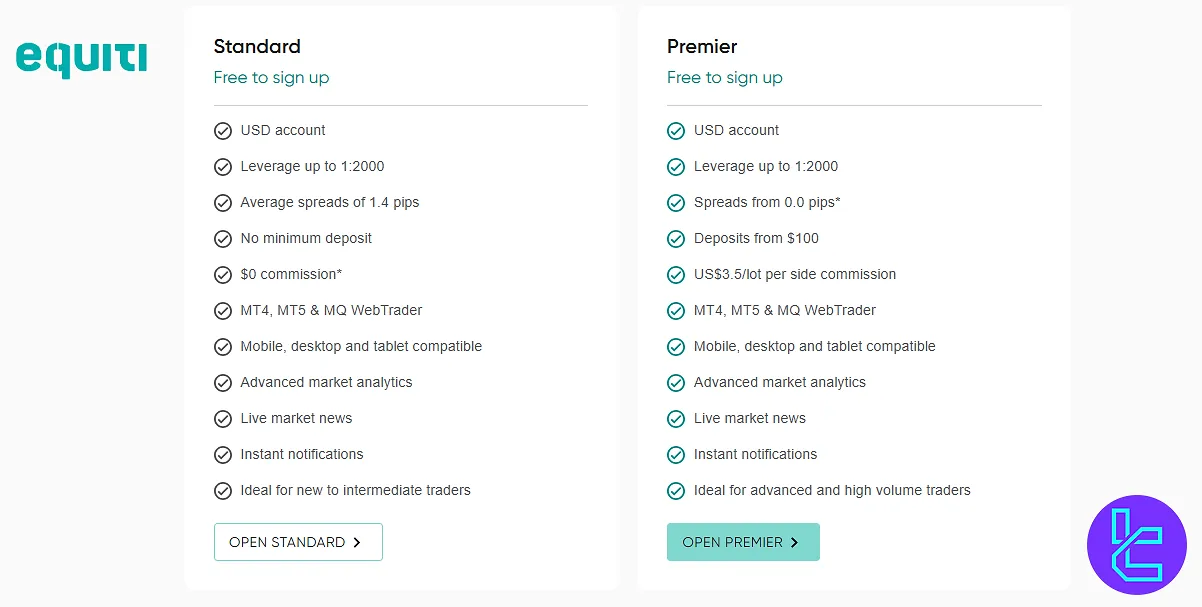

Account Types Specifics + Comparison

Equiti offers two primary account types for trading:

- Standard: Recommended for beginners and intermediate traders

- Premier: Suggested to professionals and advanced clients

In the table below, we will investigate each account's details and compare them:

Account Type | Standard | Premier |

Currency | USD | |

Leverage | Up to 1:2000 | |

Min. Deposit | None | From $100 |

Trading Platform | MT4 & MT5 | |

There's not much difference between these2 trading accounts. They're different in terms of commissions and spreads, though, which will be discussed later in this article.

In addition to these 2 live accounts, there's also a demo trading account with unlimited usage for clients who want to practice without the risk of losing money.

Strengths and Weaknesses

There are two positive and negative sides to every company. Let's examine the pros and cons of trading with Equiti:

Strengths | Weaknesses |

Multi-Regulated By Reputable Authorities | No Referral Program |

Attractive Level Of Spreads And Leverage | No Promotional Offers |

Extensive Educational Resources | Low Quality of Support Services |

Long List Of Deposit And Withdrawal Methods | - |

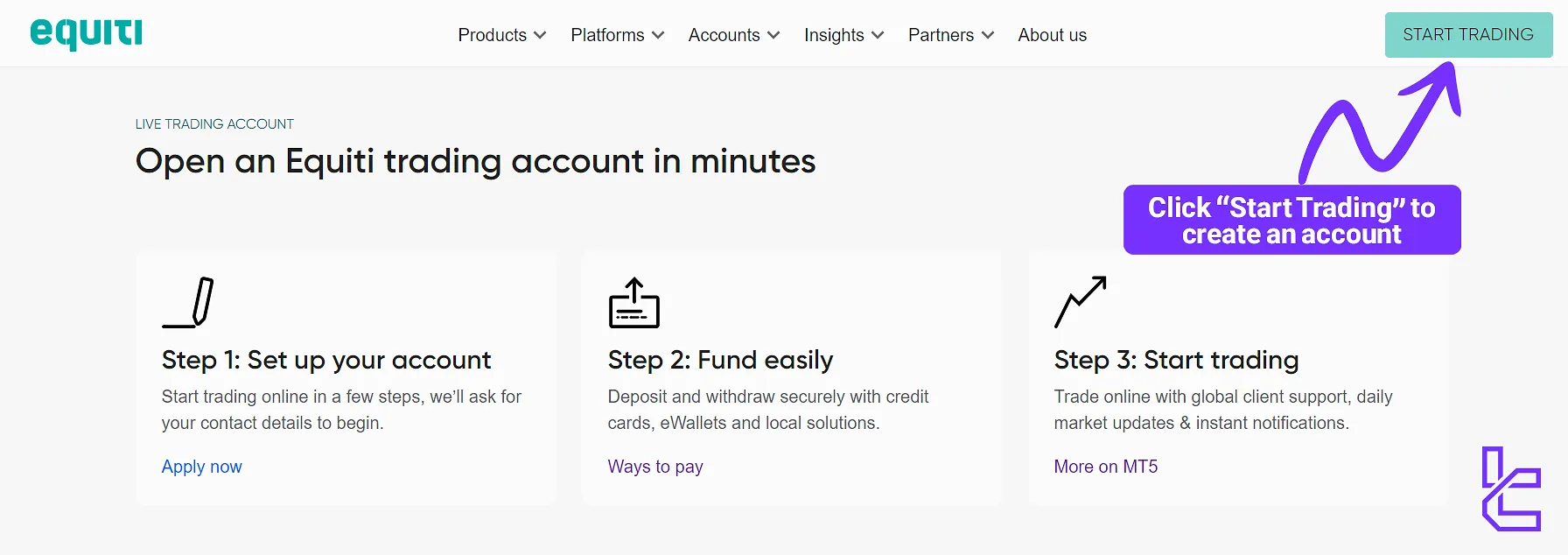

How Can I Create an Account and Verify on Equiti?

Opening an account on Equiti takes about 5 minutes and involves quick identity validation to ensure account security and compliance. As soon as the Equiti registration is completed, users can access a wide range of trading instruments.

#1 Start Your Equiti Application

Visit the Equiti website and click “Start Trading” to launch the sign-up process.

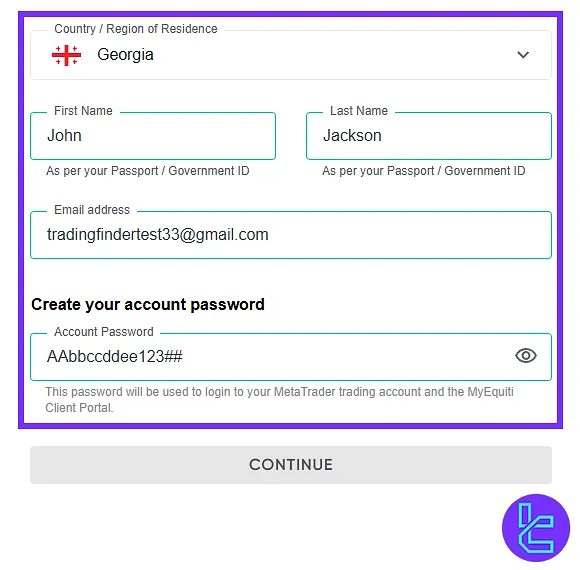

#2 Submit Basic Info on Equiti

Choose your country of residence, then provide your full name, email address, and create a secure password.

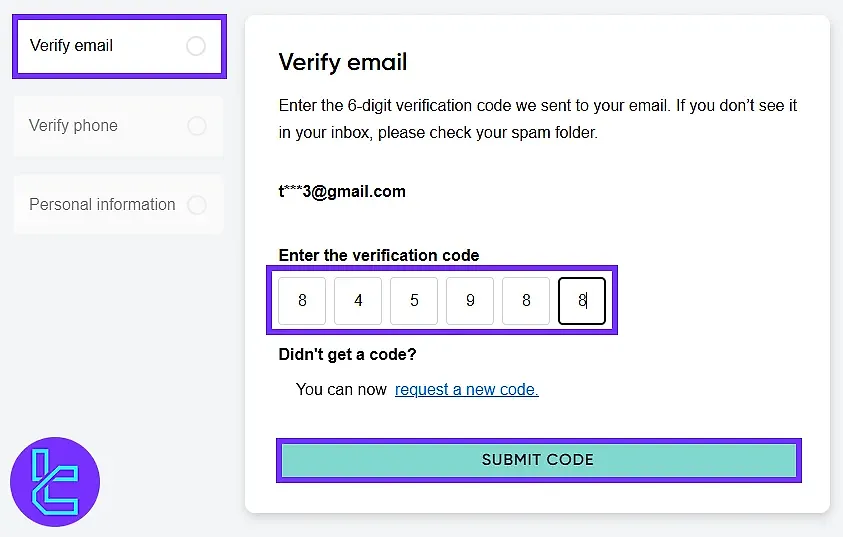

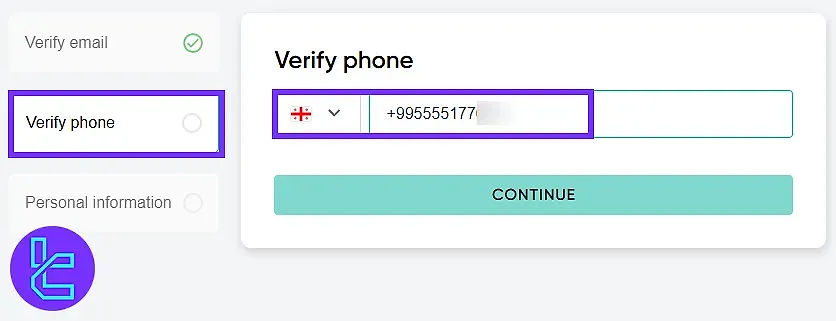

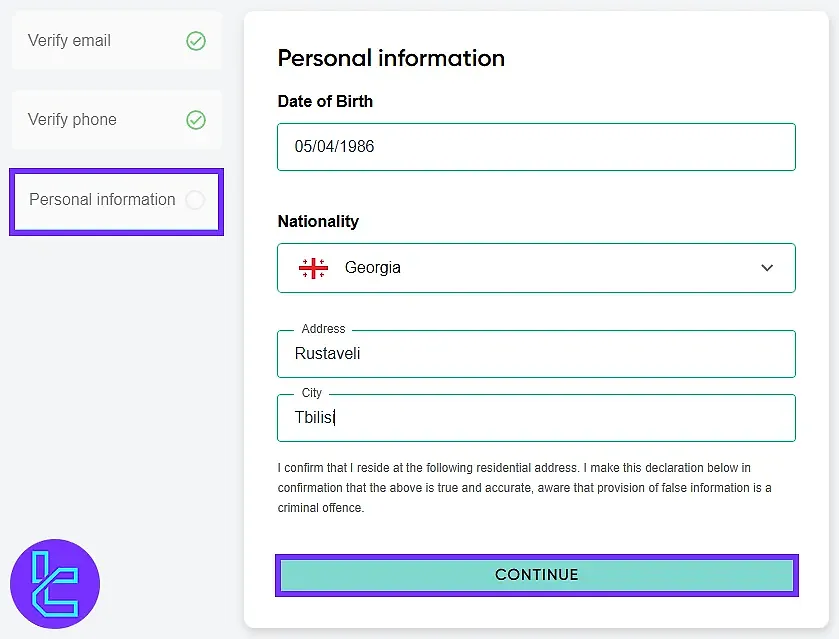

#3 Verify Your Email and Phone in Equiti

- After submitting your details, you must first validate the contact details. Start by selecting “Verify Email” and request a confirmation code. Check your inbox, retrieve the code, and enter it into the designated field to complete email verification.

- Following this, phone number verification is required. Input your mobile number along with the appropriate country code and confirm the code sent via SMS to continue the registration process.

- Once both email and phone verifications are completed, provide essential personal details, including date of birth, nationality, and full residential address, to finalize the account setup.

#4 Equiti KYC

In order to verify your identity, upload the required verification documents (ID, proof of address) on the website. You can do this by accessing the KYC/Verification section from your profile.

Trading Platforms Overview & Links

Usually, brokers utilize third-party trading platforms to provide services. Equiti has employed two industry-leading and popular options:

- MetaTrader 4 (MT4): Fast execution, economic calendar, market news, a wide range of technical indicators, and more

- MetaTrader 5 (MT5): Includes features and benefits of MT4, plus extra market depth and additional tools

Both platforms provide real-time market data, advanced order execution, and a range of order types to suit various trading strategies.

Spreads And Commissions in Trading Accounts

Trading costs are so important when choosing a broker. Equiti offers competitive spreads and commissions across its 2 account types. We will investigate it in the table below:

Account Type | Standard | Premier |

Spreads | Average of 1.4 Pips | From 0 Pips |

Commission | Zero | $7 per Lot |

The exact spreads and commissions vary depending on the traded instrument and market conditions. Note that there are no other costs for inactivity or payments charged by the broker.

Equiti's transparent fee structure ensures that traders can easily understand and factor in trading costs when developing their strategies.

Swap Fee at Equiti

Equiti applies precise overnight (swap) or rollover charges per instrument, differentiated between long and short positions, and publishes a full swap-rate list (e.g. AUDUSD long = –3.527, short = 0.620).

These charges are automatically applied at 23:59 server time on positions held overnight on MT5.

In addition, Equiti offers Islamic account or Swap-Free Mini accounts that waive swap or admin fees for balances under a certain threshold.

Below are key details worth knowing:

- Swap rates differ by symbol: e.g. AUDJPY long = 1.802, short = –590 as per current published table Equiti Default;

- On Wednesdays, a triple (3×) rollover or administration charge is applied to reflect the weekend settlement period;

- For swap-free accounts, Equiti charges an administration fee on open positions after a grace period (up to 10 days), even for long or short sides;

- The administration fee and grace period vary per trading symbol, not uniformly applied across all instruments.

Non-trading Fees at Equiti

Equiti imposes certain non-trading charges such as withdrawal fees under special conditions, but generally advertises $0 deposit fees and no platform fees.

They also reserve the right to impose withdrawal fees between 0.5% and 1% when account activity is judged low, inactive, or irregular.

Below are several important official points you must know:

- Withdrawal requests are typically free, but if the account is deemed (low, inactive, non-performing or irregular), a fee of 0.5 % to 1 % may apply;

- For international bank withdrawals, Equiti notes a flat USD 30 fee (or equivalent) may apply;

- Demo accounts expire after 90 days of inactivity, so keeping your demo active is necessary to avoid expiration.

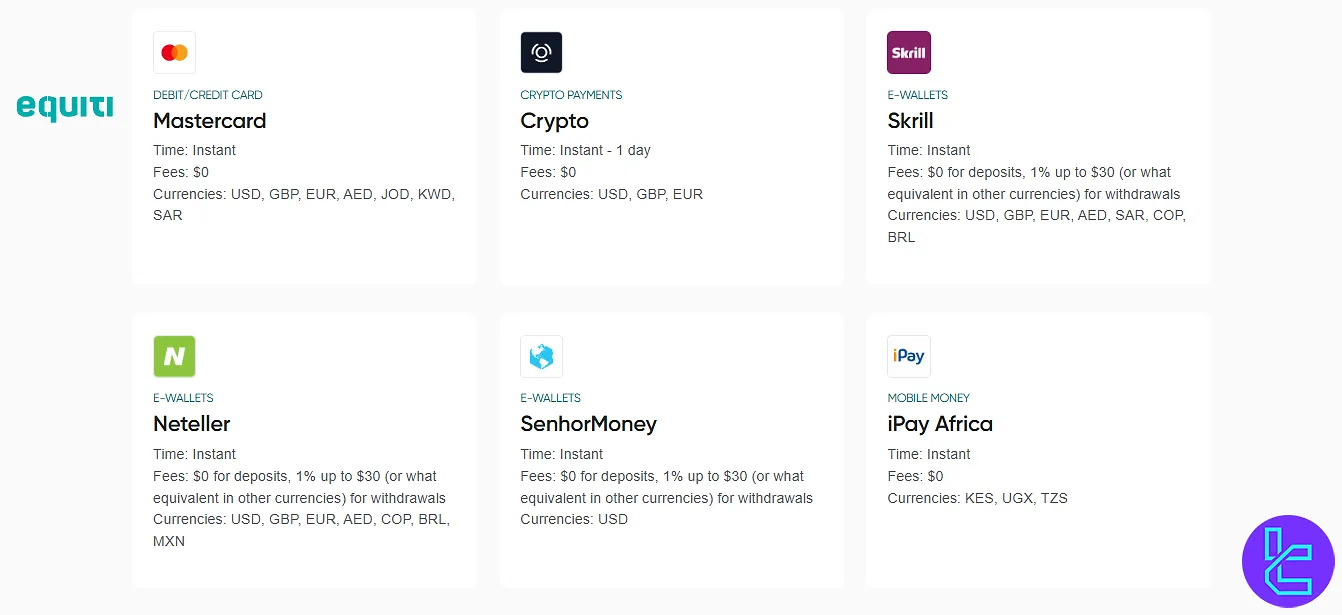

Broker's Payment Options

Equiti provides a wide range of deposit and withdrawal options to meet the needs of its global client base:

- Credit/Debit Cards (Visa, Mastercard)

- Bank Transfers

- E-wallets (Skrill, Neteller)

- Cryptocurrency wallets

The company does not charge fees for deposits, but some withdrawal methods may incur small processing fees.

Deposit Options at Equiti

Equiti supports multiple funding paths, including global and regional options, all with zero deposit fees from the broker’s side.

You can use credit/debit cards, bank transfers, eWallets, local payment solutions and crypto depending on your country and currency. Processing times and minimums vary by method and region.

Below is a unified view of the main deposit categories and their terms:

Deposit Method | Currency(s) | Minimum Amount | Deposit Fee | Funding Time |

Visa / Mastercard | USD, EUR, GBP, AED, JOD, etc. | USD 10 (or equivalent) | $0 | Instant (verified); up to 24 h first time |

Bank Transfer | USD, EUR, GBP, AED, JOD, etc. | N/A | $0 | Domestic: 1–3 days; International: 1–5 days |

eWallets (Skrill, Neteller) | USD, EUR, GBP, AED, etc. | N/A | $0 | Instant |

Local Payment Solutions | Varies by country (e.g. MYR, THB, ZAR, etc.) | N/A | $0 (broker side) | Instant |

Crypto | USD, EUR, GBP (via supported cryptos) | N/A | $0 | Instant to 1 day |

Withdrawal Options at Equiti

Equiti offers several withdrawal channels mirroring its deposit methods, with varying fees and processing times depending on the method and region.

Withdrawal requests are processed daily and usually return funds to the original funding source, except when that’s not possible.

Below is a consolidated view of the main withdrawal categories and their terms:

Withdrawal Method | Currency(s) Supported | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Transfer (Local / International) | USD, EUR, GBP, AED, JOD, others | Domestic: USD 30 / International: USD 50 | Domestic: $0; International: $30 | Domestic: 1 business day; International: 3–5 business days |

eWallets (Skrill, Neteller etc.) | USD, EUR, GBP, AED, BRL, etc. | N/A | 1 % of amount (capped at $30) | Instant to 1 day |

Mobile Money / Local Solutions | Local currencies (e.g. KES, UGX, NGN) | USD 30 or equivalent | $0 | Instant |

Debit / Credit Cards | USD, EUR, GBP, AED, etc. | N/A | $0 | 1–5 business days |

Crypto / Digital Wallets | USD, EUR, GBP (via supported cryptos) | N/A | $0 (subject to internal policy) | Instant to 1 day |

Copy Trading & Investment Options Offered On Equiti Broker

Equiti offers copy trading services, allowing clients to earn profit passively by replicating the strategies of successful traders. This feature provides several benefits:

- Access to expert trading strategies;

- Diversification of trading portfolio;

- Time-saving for busy individuals.

However, it's important to note that copy trading still carries risks, and past performance doesn't always repeat itself in the future.

Traders should carefully select signal providers and monitor their performance regularly.

Trading Assets

Having access to a wider range of tradable instruments allows traders to build more balanced and diversified portfolios.

Equiti enables trading across multiple global markets, from forex and commodities to indices and shares.

complete list of available instruments:

- Forex: XAUUSD, XAGUSD, USDJPY, etc.

- Indices: Us, UK, Asia-Pacific, and Europe instruments

- Commodities: Gold, silver, and oil

- Stocks: CFDs on international shares

- ETFs: Exchange-traded funds in biotech, Saudi Oil, etc.

- Crypto CFDs: Bitcoin, Ethereum, and other popular cryptocurrencies

Here’s a table summarizing Equiti’s trading instruments and markets based on official information:

Category | Type of Instruments | Approx. Number of Symbols | Competitor Average | Max. Leverage Offered by Equiti |

Forex / FX CFDs | Major, minor, exotic currency pairs | ~60 pairs | 60–100 pairs | 1:2000 |

Indices / Index CFDs | Global indices (rolling & futures) | 15 indices | 10–30 indices | 1:500 |

Commodities (Metals, Energy, Agriculture) | Gold, silver, oil, natural gas, crops | 20–30 instruments | 20–50 instruments | 1:2000 |

Shares / Stock CFDs | Stocks from US, EU, UK markets via CFDs | 200–300 symbols | 100–300 stocks | 1:20 |

ETFs / ETF CFDs | Exchange‑Traded Fund derivatives | 20–30 ETFs | 10–100 ETFs | 1:5 |

Crypto / Crypto CFDs | Bitcoin, Ethereum, other cryptocurrencies (CFDs) | 20–30 cryptos | 20–50 cryptos | 1:100 |

Bonuses And Promotions in Equiti

Per our latest investigations on the broker, it does not offer any bonuses or promotional incentives to its clients.

While some traders may find the lack of bonuses disappointing, it's worth noting that many regulatory bodies discourage forex brokers from offering deposit bonuses due to potential conflicts of interest.

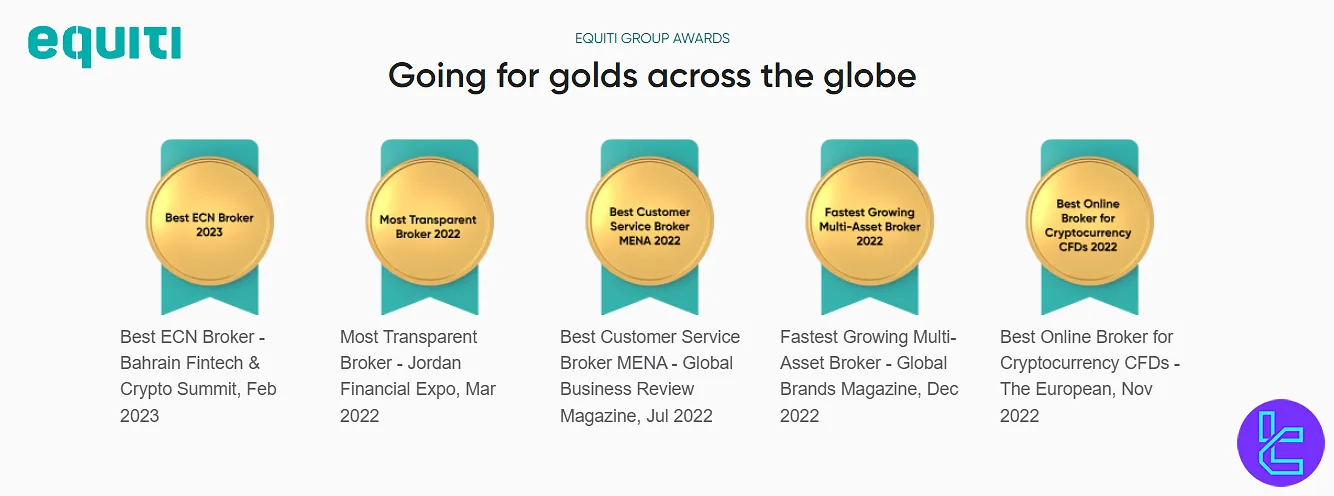

Equiti Broker Awards

Equiti is a multi-asset broker that has garnered recognition in the financial industry for its commitment to excellence and innovation.

The company has received several prestigious awards that highlight its dedication to providing top-tier trading services.

Here are some of the most notable Equiti awards:

- Best ECN Broker 2023

- Most Transparent Broker 2022

- Best Customer Service Broker MENA 2022

- Fastest Growing Multi-Asset Broker 2022

- Best Online Broker for Cryptocurrency CFDs 2022

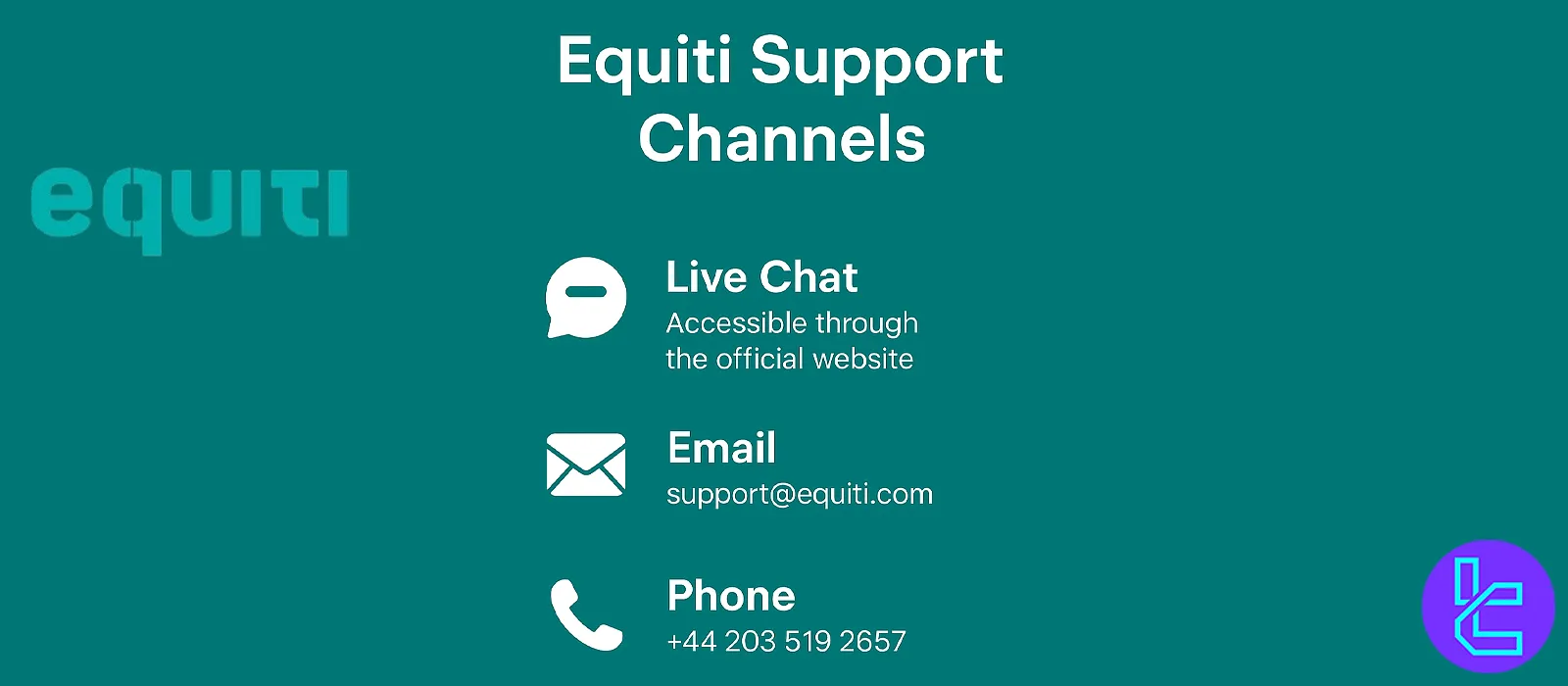

Support Team and Customer Services

Customer support is an essential part of every broker's services and should be considered as a serious factor when choosing one. Equiti provides its customer services through various channels:

- Live Chat: Accessible through the official website

- Email: support@equiti.com

- Phone: +44 203 519 2657

Based on the available data, the support team at the call center is available 24/6. During our attempt to contact them through live chat, the agent never came in to answer our inquiry, which is a huge drawback for the broker's support.

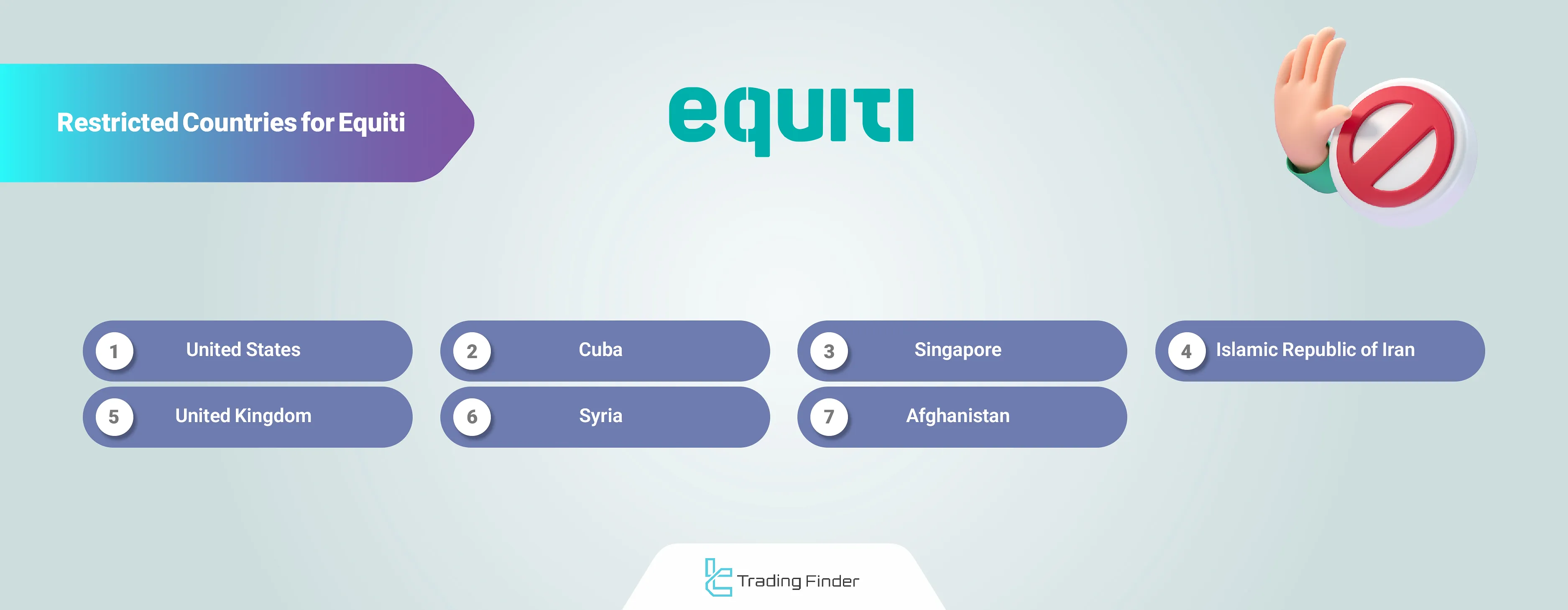

Which Countries Are Restricted from Equiti's Services?

While Equiti serves clients from most countries in the world, there are some restrictions due to regulatory and legal considerations. The list of restricted countries includes, but is not limited to:

- United States

- Singapore

- Syria

- United Kingdom

- Iran

- Afghanistan

- Cuba

Note that this list is not publicly available and may change over time. Potential clients should check the broker's website or contact customer support for the most up-to-date information regarding country restrictions.

Trust Scores on Reputable Websites

Trustpilot and ForexPeaceArmy are two established websites that have received user reviews of Equiti. These scores are discussed below:

- Equiti Trustpilot: 3.7/5 stars with over 260 reviews, over 30% of the ratings are 1-star;

- ForexPeaceArmy: 2.2/5 stars with only 10 scores.

According to the scores mentioned above, this broker provides mediocre services with some problems, one of which we faced when trying to contact them.

However, the number of scores on the ForexPeaceArmy is too low, so that one cannot be considered.

Education Materials Provided by Equiti

This broker offers a decent education section to help traders improve their skills. In other words, there are articles on the website regarding these topics:

- Trading from the very beginning

- Risk management

- Market analysis

- Trading strategies

Also, the company posts news articles and predictions. Moreover, it maintains a YouTube channel with tutorials and insightful videos, but it has not been updated for a long time.

Equiti Broker Comparison

Here is a quick overview of Equiti features and those of other brokers; Equiti Comparison:

Parameter | Equiti Broker | |||

Regulation | FCA, FSA, SCA, JSC, CMA, and CBA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | FSA, CySEC, ASIC |

Minimum Spread | 0.0 Pips | 0.0 Pips | Varies based on Account | 0.0 Pips |

Commission | From $0 | From $0.2 to USD 3.5 | Varies based on Account | Average $1.5 |

Minimum Deposit | None | $10 | $100 | $200 |

Maximum Leverage | 1:2000 | Unlimited (Subject to account) | 1:500 | 1:500 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Standard, Premier, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Standard, Raw Spread, Islamic |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 400+ | 500+ | Not specified | Not specified |

Trade Execution | Market | Market Execution, Instant Execution | Market Execution, Instant Execution | Market |

Conclusion And Final Words

Equiti is regulated by several authorities, including the CMA in Kenya and FSA in Seychelles.

The broker does not charge any trading commissions on the standard account but charges $7 per lot on the Premier.

There is no minimum deposit for the Standard account, but you will be required to deposit $100 for the Premier one.