Errante EU began its operations in 2018 and has won more than 10 Forex market industry awards. Alongside significant advantages such as 1:1000 leverage, Expert Advisor (EA) support, $0 commission, 0.0 pips spreads, and Islamic accounts for Muslim traders, Errante EU also offers additional leverage options up to 1:80.

Complete Introduction and Regulatory Overview of Errante EU Broker

Errante EU is a forex broker firm established in 2018, with an office in Limassol, Cyprus.

In a short period, Errante EU gained the trust of many traders and became a popular option, especially among European users; Currently, over 200,000 users trade through this broker. In addition, Errante EU insures client funds up to €20,000.

However, what truly builds the credibility of a broker is its licenses and regulations. Errante EU holds the CySEC (Cyprus Securities and Exchange Commission) license; Recognized as one of the most reputable regulatory bodies globally, indicating the broker’s adherence to the strict standards of the European Union.

Specifications of Errante EU Broker

To gain a clearer view of Errante EU Broker, the table below outlines its complete specifications and service details:

Broker | Errante EU |

Account Types | Standard, Premium, VIP, and Tailor Made |

Regulating Authorities | CySEC |

Based Currencies | USD ($) and EUR (€) |

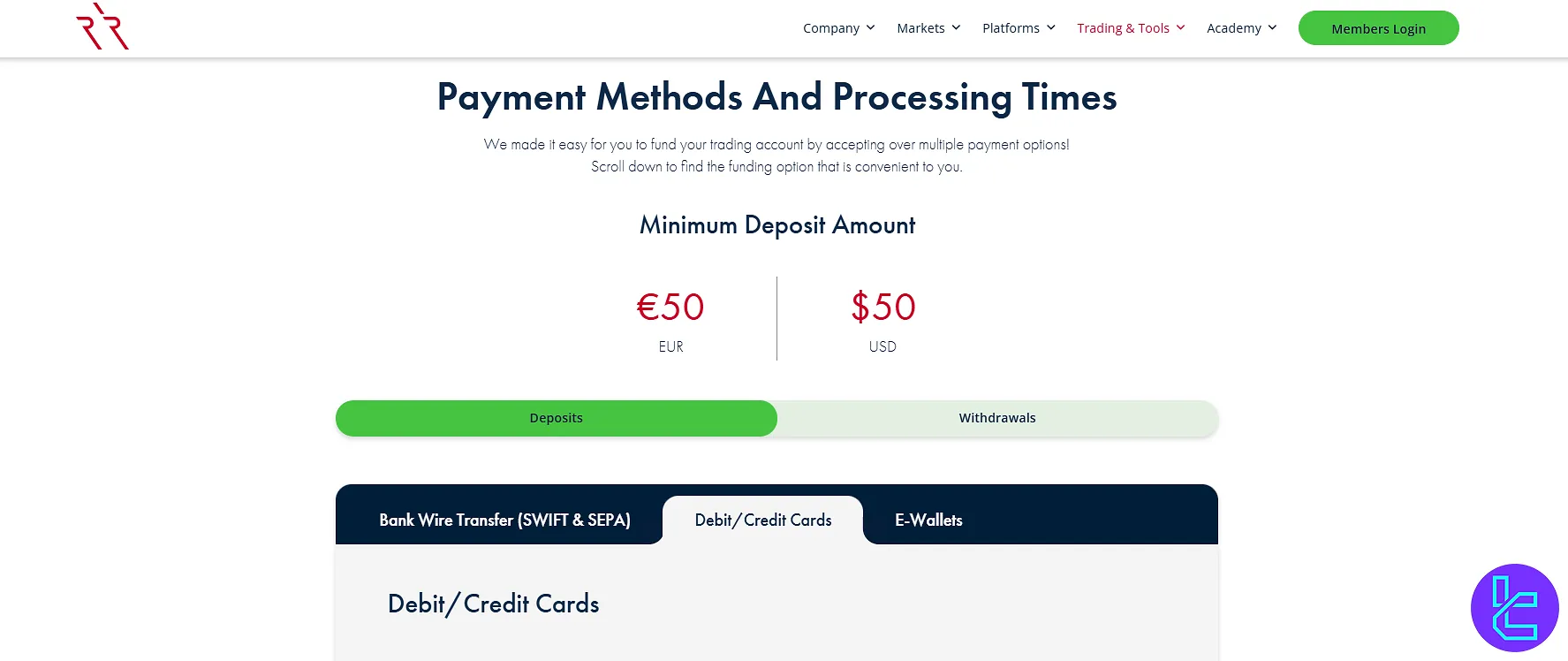

Minimum Deposit | €50 |

Deposit Methods | Bank Wire Transfer (SWIFT & SEPA), VISA, MasterCard, Skrill, Neteller, PayPal |

Withdrawal Methods | Bank Wire Transfer (SWIFT & SEPA), VISA, MasterCard, Skrill, Neteller, PayPal |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:80 |

Investment Options | N/A |

Trading Platforms & Apps | MetaTrader 5, TradingView |

Markets | Forex pairs, Metals, Indices, Energy, Stocks |

Spread | Varis By the Account [From 0.00 Pips] |

Commission | Starting From $3 |

Orders Execution | Market, ECN |

Margin Call / Stop Out | 100%/20% |

Trading Features | 1:80 Maximum Leverage, 100% Margin Call, ECN Order Execution, 0.01 Lots Minimum Order |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Phone Call, Email, In-door Meeting, Ticket |

Customer Support Hours | 24/7 |

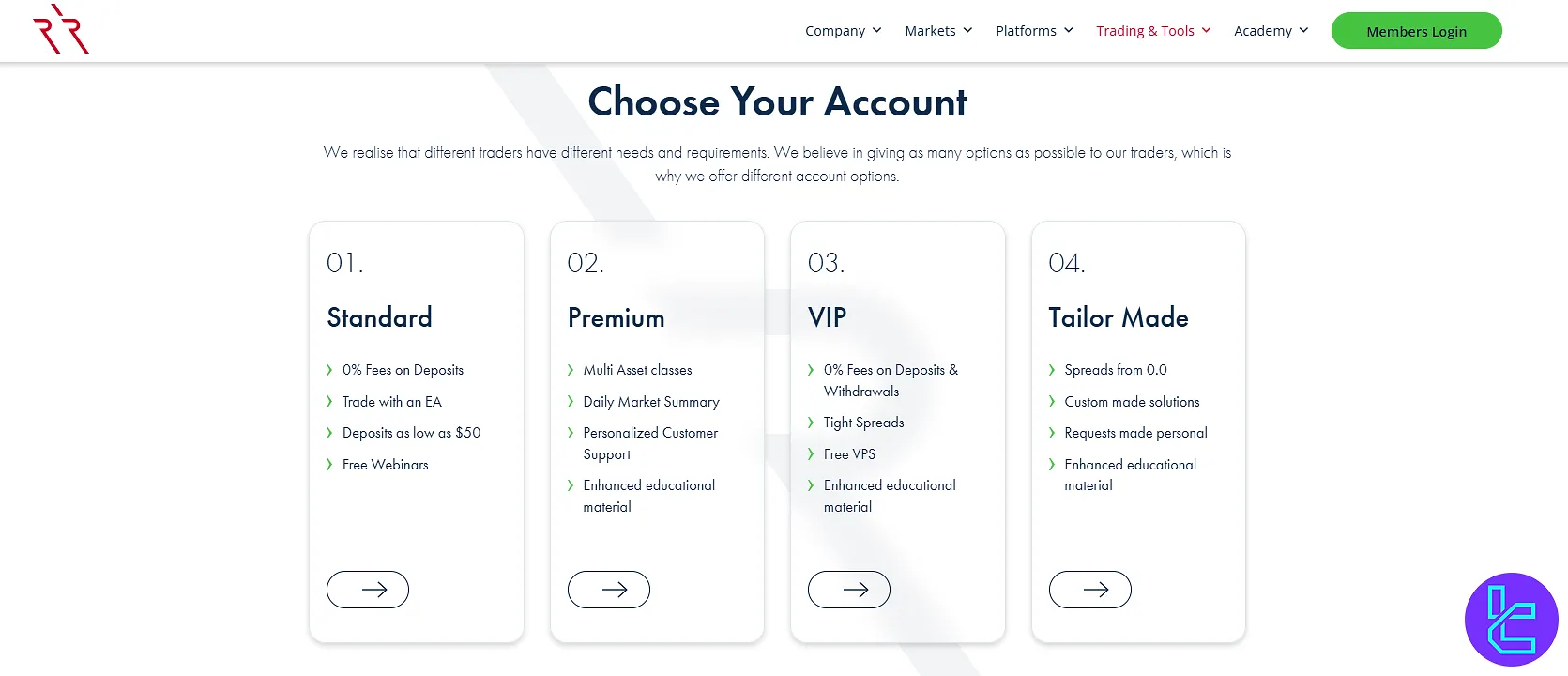

Types of Trading Accounts

Errante EU has introduced four account types to accommodate traders with various needs.

Each of these accounts comes with distinct features. Errante EU account types:

- Standard Account

- Premium Account

- VIP Account

- Tailor Made Account

Each of the above accounts is tailored to a specific group of traders. If you are unsure which account suits you best, the table below compares all Errante EU account types:

Specifications | Standard | Premium | VIP | Tailor Made |

Minimum Deposit | €50 | €100 | €5000 | €15000 |

Spreads | 1.8 pips | 1 pip | 0.8 pips | 0.0 pips |

Commission | 0 | 0 | 0 | Yes [exact figue is not clear] |

Leverage | 1:30 | 1:30 | 1:30 | 1:80 |

Minimum Position size | 0.01 Lot | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Financial Instruments | All asset classes | All asset classes | All asset classes | All asset classes |

Account Currency | USD, EUR | USD, EUR | USD, EUR | USD, EUR |

Maximum Volume in Lots per Trade | 50 | 50 | 80 | Upon Request |

Maximum Number of Orders | Unlimited | Unlimited | Unlimited | Unlimited |

Margin Call | 100% | 100% | 100% | 100% |

Stop Out | 20% | 20% | 20% | 20% |

Swap-Free (Islamic Account) | Upon Request | Upon Request | Upon Request | Upon Request |

Errante EU also offers Islamic accounts (swap-free) designed specifically for Muslim traders. These accounts allow trading without overnight interest (swap). However, there are limitations based on the trading instrument, detailed below:

- Major Forex Pairs: Up to 7 nights swap-free

- Minor Forex Pairs: Only 1 night swap-free

- Precious Metals (e.g., Gold and Silver): Up to 7 nights swap-free

- Indices and Energy: Up to 3 nights

- Cryptocurrencies: Up to 3 nights swap-free

After these periods, full swap fees will be charged for the entire trade duration. At Errante EU, users of VIP or Tailor Made accounts who deposit a minimum of $5,000, are eligible for free high-speed VPS servers.

These servers are ideal for running algorithmic and scalping strategy with low latency and no internet interruptions.

Pros and Cons of Errante EU Broker

While trusted regulation and a wide range of trading instruments are key strengths of Errante EU, the broker also has certain limitations. Errante EU Advantages and Disadvantages:

Pros | Cons |

2 Valid trading platforms | Relatively new broker |

Variety of instruments and symbols | No Cent accounts available |

Reliable regulation (CySEC) | Limited swap-free nights on Islamic accounts |

Competitive spreads (Starting from 0.0 pips) | - |

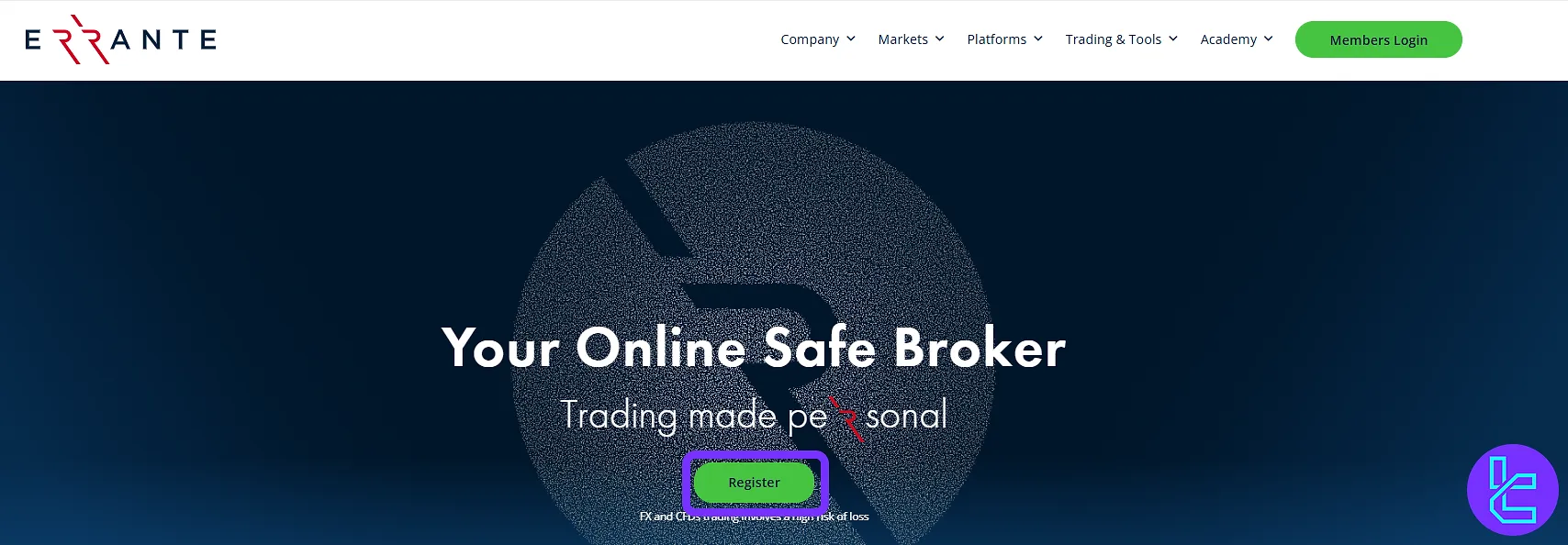

Errante EU Account Registration and Opening Guide

Trading with Errante EU Broker is not possible without registration; users must go through the account opening process, which consists of three main steps:

- Filling out the registration form

- Email address verification

- Answering the questionnaire

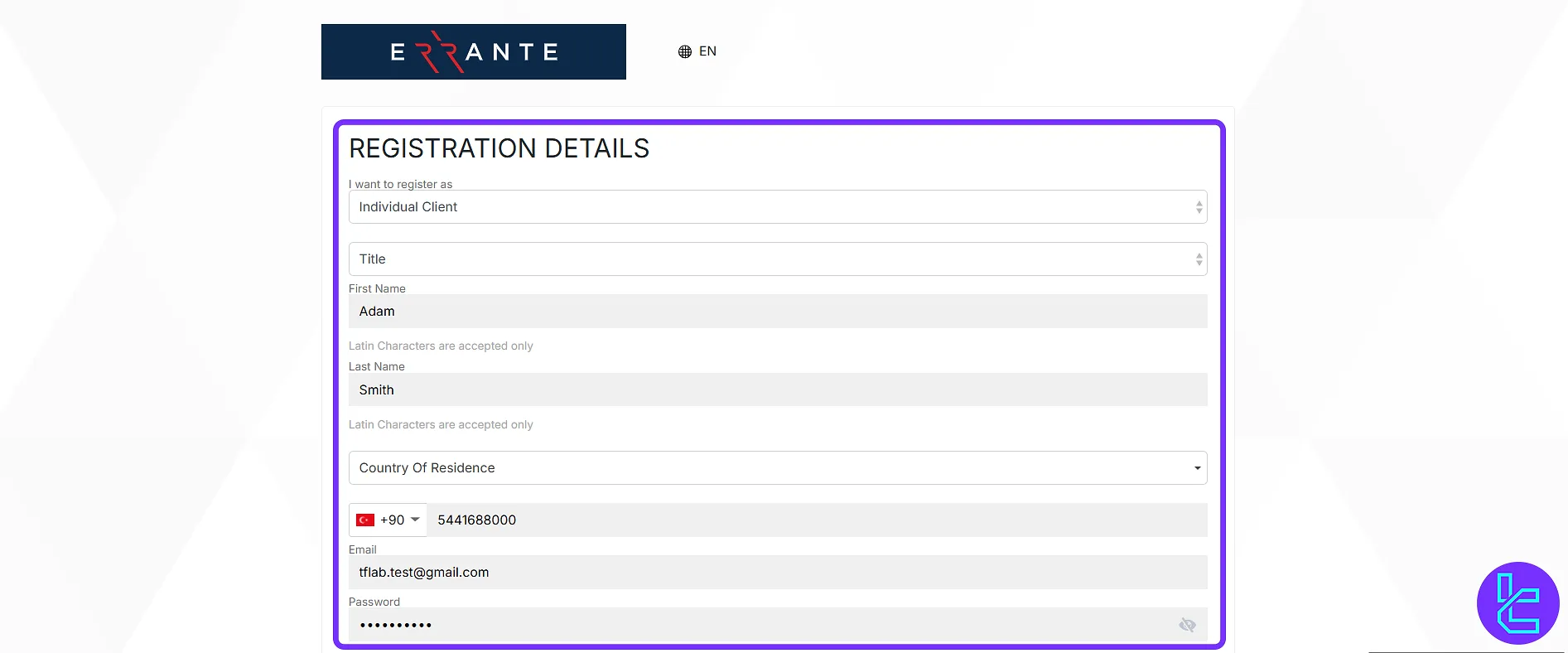

#1 Filling Out the Registration Form

To complete the first step of account creation, follow the instructions below:

- Click on the "Register" button at the top of the main page;

To start the sign up process in Errante EU, click on “Register” Button - Choose between "Individual" and "Corporate" client options;

- Provide the following details in the form:

- Title (Mr., Mrs., or Ms.)

- First Name

- Last Name

- Country of Residence

- Phone Number

- Email Address

- Password and Confirmation (8 characters minimum, including at least one lowercase letter, one uppercase letter, one digit, and one special character such as @, $, %, etc.)

Write your personal details in the designated fields.Agree to the terms and tick the relevant box at the bottom of the form; Click "Continue".

#2 Verifying Your Email Address

After completing the form, a verification code will be sent to your email and phone number. Enter the received code in the specified field and click "Continue" again.

Provide the verification code sent by Errante EU to confirm your phone number and email.

#3 Completing the Questionnaire

Lastly, you will be presented with a questionnaire that must be completed using the information below:

- Date of Birth

- Nationality

- Political Exposure

- Education Level

- Employment Status

- Occupational Field

- Source of Funds

- Annual Income (in USD)

- Approximate Net Worth (in Euro)

- Intended Investment Amount (in Euro)

After filling in the initial form, you must answer Errante EU’s compliance questionnaire.

Errante EU App & Trading Platforms

Errante EU only 2 trading platforms including MetaTrader 5 and TradingView. Errante trading platforms:

- MetaTrader 5: Over 38 indicators, 44 analytical objects, 3 chart types and 21 time frames

- TradingView: No dealing desk execution, competitive spreads and, multiple account types available

How to Connect Errante EU Accounts to TradingView?

Since 2024, Errante EU Broker has joined the select group of brokers connected to the TradingView platform. Users can open a dedicated TradingView account with ECN execution, floating spreads from 0.8 pips, and zero commissions, and place trades directly from the chart.

Clients depositing over $5,000 receive a free TradingView Plus subscription, and for deposits over $20,000, a Premium subscription is activated at no charge. This feature places Errante EU alongside brokers like ICMarkets and Pepperstone.

Commission and Spreads

Commissions on Standard, Premium and VIP accounts at Errante EU are zero, Tailor Made account is charged a commission fee per each trade. The lowest possible spreads are offered with the Tailor Made account. Details of Errante EU’s spreads and commissions:

Account Type | Spread | Commission |

Standard | From 1.8 pips | None |

Premium | From 1 pips | None |

VIP | From 0.8 pips | None |

Tailor Made | From 0.0 pips | Yes |

Spreads on Errante EU accounts are floating, meaning they may vary based on market conditions. Although Tailor Made accounts charge a commission, the lower spread often offsets this cost.

Deposit and Withdrawal Methods at Errante EU Broker

Errante EU provides local deposit and withdrawal options Alongside other methods.

Errante EU withdrawal and funding methods:

- E-wallets: Skrill, Neteller, PayPal

- Bank Wire Transfer: SWIFT, SEPA

- Debit/Credit Cards: VISA, MasetCard

Note: Minimum deposit/withdrawal amounts and applicable fees may vary depending on the chosen method. Be sure to check the details before making any transactions.

Copy Trading at Errante EU – What Indirect Investment Options Are Supported?

Currently, Errante EU does not support copy trading services. The broker does not offer any indirect investment and income generation services, including PAMM and MAM accounts.

Tradable Markets and Instruments

Over 100 trading instruments are available on the Errante EU Broker platform, and the number is growing steadily. But beyond just the instruments, what types of markets can you trade at Errante EU?

- Forex Currency Pairs: Over 50 major, minor, and exotic pairs, including EUR/USD, GBP/JPY, AUD/CAD

- Precious Metals: Gold and Silver

- Indices: S&P 500, FTSE 100, DAX 30, and DJIA

- Energy: Oil and Gas

- Stocks: AMZN, GOOG, AAPL

Errante EU Bonuses

Currently, Errante EU does not offer any bonuses to its users. This is due to strict EU and CySEC regulations. Thus, it is unlikely that bonuses will be added to the list of benefits of this broker in the future.

Errante EU Broker Support

Errante EU offers multiple ways to contact customer support, including live chat, phone, and email.

Errante EU’s support team is known for responding to inquiries in under 3 minutes; Support is available 24/7 (all days within the week).

Errante EU support channels:

- Live Chat

- Email: support@errante.eu

- Phone Call: +357 25 253300

- Ticket Submission: 67 Spyrou Kyprianou, 4042 Limassol, Cyprus

- In-person visit to Errante EU’s office in Cyprus:

Which Countries Are Restricted from Using Errante EU’s Services?

Errante EU does not serve traders outside of Europe and this happens because of strict EU regulations. Therefore, any other country in Asia, South and North America, Africa and Oceania is on the prohibited list of countries that can’t use Errante Europe services.

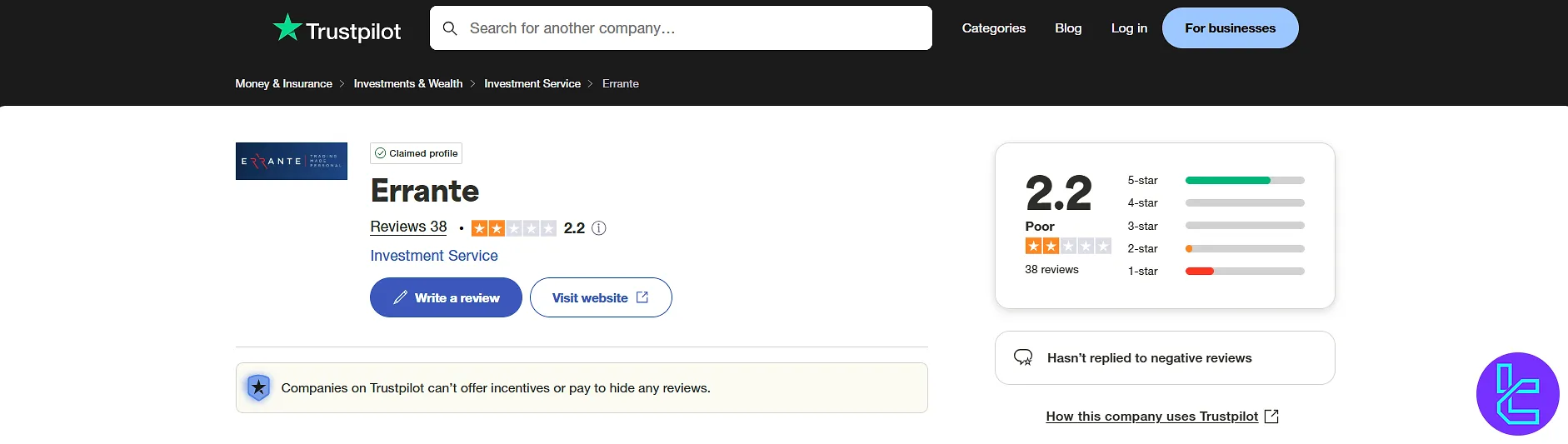

Errante EU Broker Ratings on Trusted Review Platforms

Although there are no ratings for Errante EU on review sites, we can rely to some extent on the ratings of its international branch. Brief look at Errante’s presence on reputable review websites such as Errante Trustpilot reveals a low performance. These scores demonstrate the broker’s overall credibility:

- Trustpilot: 2.2 out of 5 based on 35+ reviews

- ForexPeaceArmy: 2 out of 5 based on 5+ reviews

- io: 1.7/5 based on 30+ reviews

Educational Content by Errante EU Broker

Errante EU consistently produces educational videos and hosts regular webinars. Overall, the broker provides training materials in the following formats:

- Webinars

- Articles and Videos

- Economic Calendar

- Forex Glossary

- Structured Learning Courses

- Daily and Weekly Market Analysis

Note: Access to educational resources is free, and content is also available in multiple languages.

Comparison Table: How Does Errante EU Stack Up Against Leading Brokers?

In this section, Errante EU Broker is compared to three popular brokers in the world, based on the most important selection criteria:

Parameters | Errante EU | |||

Regulation | CySEC | ASIC, FSC, DFSA, CySEC | FCA, FSCA, CySEC, SCB | ASIC, VFSC, FSC, FMA |

Minimum Spread | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | $0 (except on Shares account) | From $0 | From $0.0 |

Minimum Deposit | €50 | $5 | $100 | $100 |

Maximum Leverage | 1:80 | 1:1000 | 1:500 | 1:1000 |

Trading Platforms | MT5, TradingView | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, IRESS, TMGM Mobile App |

Account Types | Standard, Premium, VIP, Tailor Made | Micro, Standard, Ultra Low, Shares | Standard, Pro, Raw+, Elite | EDGE, CLASSIC |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 100+ | 1400+ | 2100+ | 12000+ |

Trade Execution | Market, ECN | Market, Instant | Market, Pending | Market, Instant |

Expert Opinion by TradingFinder

Errante EU offers access to over 100 symbols across two major trading platforms [MetaTrader 5 and TradingView], and four account types [Standard, Premium, VIP, and Tailor Made].

The minimum deposit is just €50, though it does not qualify for bonuses at that level. However, Errante EU also has a few notable drawbacks, such as the absence of Cent accounts.