ETO Markets offers 89+ trading instruments with spreads from 0.0 pips and commissions from $0.0. The PRO account has a $3.5 commission per side available on MT4 and MT5 platforms. NAB, UBS, and HSBC are some of the broker’s business partners.

ETO Markets; An Introduction to the Company and Its Regulatory Status

ETO Markets is a trading name of ETO Group. The company was founded in Australia in 2013, offering services in 100 countries across four continents.

The broker is registered in Seychelles with company No. 850672-1 and licensed by the country’s Financial Services Authority (FSA) with license No. SD062. ETO Markets key specifications:

- Social Trading

- PAMM Solutions

- MetaTrader support

ETO Markets Broker Key Features

The Forex broker provides 10+ payment solutions, micro lot trading, and commissions from $0.0. Let’s take a quick look at the ETO Markets’ offerings:

Broker | ETO Markets |

Account Types | PRO, BASIC, PRIME, STD |

Regulating Authorities | FSA |

Based Currencies | USD, USD Cent (MT5 only) |

Minimum Deposit | $100 |

Deposit Methods | UnionPay, Bank Transfer, USDT (ERC20, TRC20), SEPA Instant Transfer, SEPA Instant Banking |

Withdrawal Methods | UnionPay, USDT (ERC20, TRC20), SEPA Instant Transfer, SEPA Instant Banking |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | Social Trading |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Indices, Metals, Energies, Cryptos, Stock CFDs |

Spread | From 0.0 pips |

Commission | From $0.0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Mobile Trading, Commissions from $0.0, Market insights, ETO Plus |

Affiliate Program | No |

Bonus & Promotions | $2,500 Welcome Bonus (ETO Plus) |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Call Center, Ticket, Email, Physical Address |

Customer Support Hours | N/A |

ETO Markets Trading Accounts

The platform features 4 account types, including PRO, BASIC, PRIME, and STD, with different fee structures.

Features | PRO | BASIC | PRIME | STD |

Min Deposit | $100 | $100 | $100 | $100 |

Min Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

Max Leverage | 1:500 | 1:500 | 1:500 | 1:500 |

Stop Out | 50% | 50% | 50% | 50% |

Spreads from | 0.0 pips | 1.0 pips | 1.7 pips | 1.7 pips |

Commission | $3.5 | $0 | $0 | $0 |

Additionally, ETO Markets provides demo accounts for traders to practice and familiarize themselves with the platform before committing real funds.

ETO Markets Upsides and Downsides

The wide range of account types and tight spreads are among the advantages in this ETO Markets review. However, the lack of a live chat feature can be disappointing.

Pros | Cons |

Flexible account options | High entry barrier ($100) |

Support for both MT4 and MT5 trading platforms | Not regulated by a top-tier financial authority |

Alternative earning opportunities through PAMM accounts and social trading | Limited support channels |

Extensive educational resources | Geo-restrictions |

ETO Markets has partnered with companies such as JPMorgan, Morgan Stanley, and UBS to provide segregated accounts, deep liquidity, and tight spreads.

ETO Markets Broker Registration and Verification

Opening an account with ETO Markets is a straightforward process followed by a KYC procedure. The following sections will guide you through it.

#1 Go to the Website

Visit the broker’s official website. Ensure that you are on the legitimate site, not a phishing webpage. Then, click on “Open live account”.

#2 Provide Details in the Form

Fill out personal details, adjust the account settings, and provide financial information about yourself.

Your account is created. Use the credentials sent to your email to access the client dashboard.

#3 Verification

Click “Upload Document”, and provide proof of identity (passport or national ID) and proof of address (credit card statement or utility bill).

ETO Markets App and Trading Platforms

MetaTrader support and a dedicated PAMM solution are among the advantages in this ETO Markets review.

In addition to MetaTrader 4 and MetaTrader 5, ETO Markets offers a social trading platform and the CRM app designed for account management.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can access for free.

ETO Markets Fees Explained

The broker offers spreads from 0.0 pips and commissions from $0.0. The fee structure varies based on the account type.

Account Type | Spreads from (Pips) | Commissions |

PRO | 0.0 | $3.5 |

BASIC | 1.0 | $0 |

PRIME | 1.7 | $0 |

STD | 1.7 | $0 |

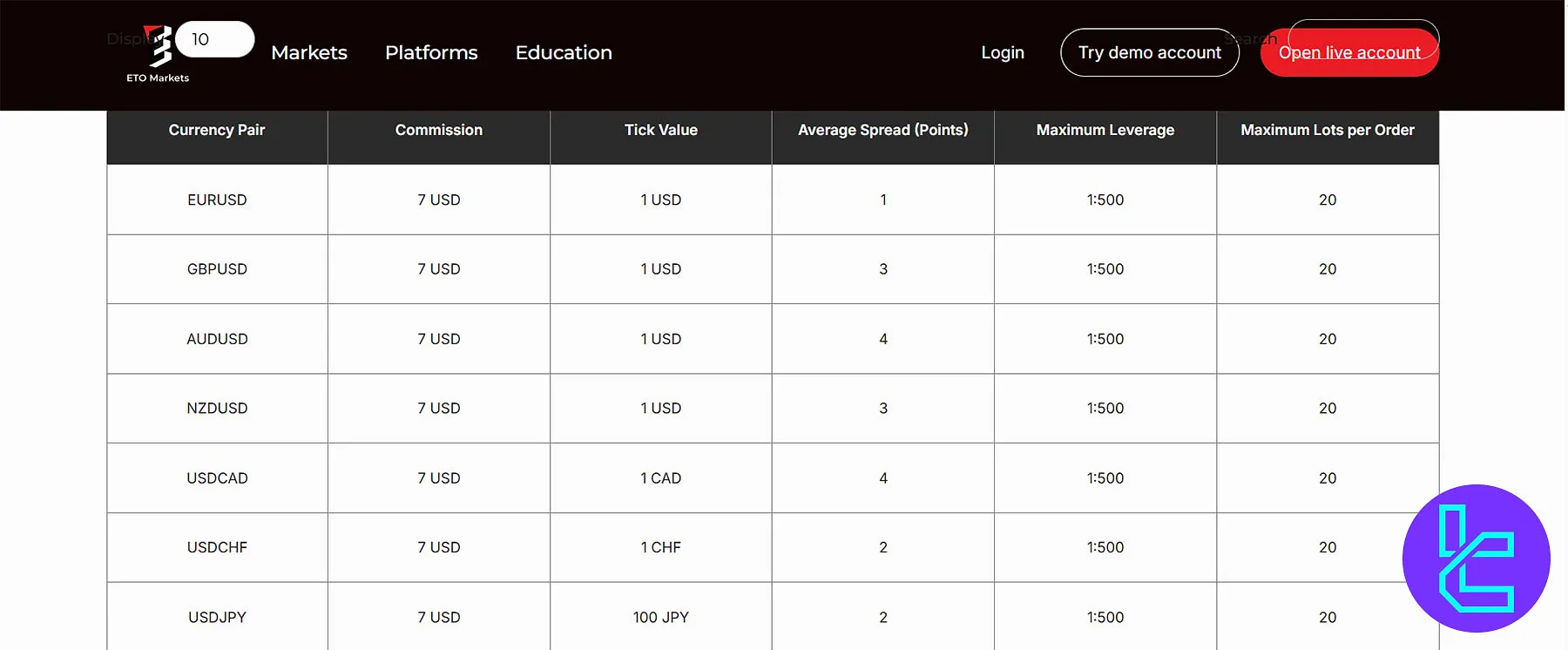

For major pairs:

- EUR/USD spread typically ranges from 0.6 to 1.2 pips (Standard);

- GBP/USD spread ranges from 0.5 to 1.5 pips.

Note that the STD spread on Gold (XAU/USD) starts from 2.9 pips. While the broker charges no deposit fees, withdrawal requests below $100 incur a $10 fee.

It's worth mentioning that there are no inactivity fees charged by the comapny.

ETO Markets Broker Deposit and Withdrawal

The platform supports various payment methods, from UnionPay to Cryptocurrencies.

Payment Method | Min Deposit | Min Withdrawal |

UnionPay | $200 | None |

Bank Transfer (USD) | $100 | Not Available |

USDT (ERC20) | 80 USDT | $100 |

USDT (TRC20) | 2 USDT | $100 |

SEPA Instant Payment | $100 | None |

SEPA Instant Banking | $200 | None |

ETO Markets Investment and Growth Plans

While the broker doesn’t provide dedicated copy trading software for crypto or other markets, it features a social trading platform. It allows users to copy the investment strategies of successful traders.

The broker’s social trading platform, ETO Plus, offers seamless integration with MT4 and MT5 for strategy providers and followers. Key benefits of ETO Markets' social trading:

- Access to a community of traders sharing ideas and strategies

- Ability to view and copy trading signals from top performers

- Gaining insights into market sentiment

- Automatic trade execution based on copied strategies

- Over 150 trading strategies

ETO Markets Trading Instruments

The company provides access to a wide range of trading instruments across 6 asset classes, from the Forex market to Stocks and digital assets.

- Forex: 50+ major, minor, and cross currency pairs with a 1:500 max leverage

- Indices: 12 major global stock indices, such as HK50, US30, NAS100, and JP225, with leverage options of up to 1:100

- Metals: Gold (XAUUSD) and Silver (XAGUSD) with a 1:500 maximum leverage

- Energies: WTI and BRENT with leverage options of up to 1:500

- Cryptocurrencies: CFDs on BTC, ETH, and DOG with a 1:20 maximum leverage

- Stock CFDs: Shares of 20 global companies, including Apple, AMD, Amazon, and Meta, with leverage options of up to 1:10

ETO Markets Bonus and Promotion

The company previously offered a $40 no-deposit bonus promotion for new clients. However, the promotion expired in June 2024.

Another attractive promotional offering is the $2,500 welcome bonus for new accounts on the ETO Plus platform. Note that there is information regarding an affiliate program on the broker’s official website.

ETO Markets Support Channels

While the company offers a hotline, email, and a ticket system for client assistance, the lack of a live chat feature is one of the biggest letdowns in this ETO Markets review.

- Email: info@eto.group

- Phone: 248 4374772

- Ticket: Through the “Help Center”

- Physical Address: No. 20, Abis Centre Providence, Mahe, Seychelles

There have been some positive comments and reviews about the customer service and the quality of their responses on the web.

ETO Markets Prohibited Countries

ETO Markets has regional restrictions and does not allow residents from certain countries to open trading accounts, including:

- Afghanistan

- Belarus

- Central African Republic

- Crimea

- Cuba

- Democratic Republic of Congo (DRC)

- Ethiopia

- Guinea-Bissau

- Iran

- Iraq

- Lebanon

- Libya

- Mali

- Myanmar

- Nicaragua

- North Korea

- Somalia

- Sudan

- South Sudan

- Syria

- Russia

- Ukraine

- United States

- Venezuela

- Yemen

- Zimbabwe

User Satisfaction

There are 33 ETO Markets reviews on Trustpilot, most of which are positive, praising the good support, fast withdrawals, and tight trading conditions.

While 73% of comments on the ETO Markets Trustpilot profile are positive (5-star and 4-star), 27% are negative (1-star and 2-star). The result is an average score of 3.4 out of 5.

Negative comments are typically about erasing account profits, withdrawal issues, and account closures.

Educational Offerings

ETO Markets broker provides a range of educational resources to support traders, including:

- ETO Blog: Market insights

- Trading Guides: MT4 platform tutorials

- Webinars: Market prediction and analysis

You can check TradingFinder’s Forex education section for additional learning materials.

ETO Markets Compared to Other Brokers

Here's a comparison of the reviewed broker with some other major brokers in the industry:

Parameter | ETO Markets Broker | |||

Regulation | FSA | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | Standard, Standard Cent, pro, Raw Spread, Zero |

Minimum Spread | 0 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From Zero | Average $1.5 | From Zero | From $0.2 |

Minimum Deposit | $100 | $200 | $100 | $10 |

Maximum Leverage | 1:500 | 1:500 | 1:500 | Unlimited |

Trading Platforms | MetaTrader 4, MetaTrader 5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | PRO, BASIC, PRIME, STD | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 2,250+ | 270+ | 230+ |

| Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

ETO Markets provides access to 6 asset classes, including Forex and Crypto, with leverage options of up to 1:500. The broker supports USDT ERC20/TRC20 withdrawals with a minimum requirement of $100.

It has a score of 3.4 out of 5 on Trustpilot. ETO Markets doesn’t accept clients from the USA.