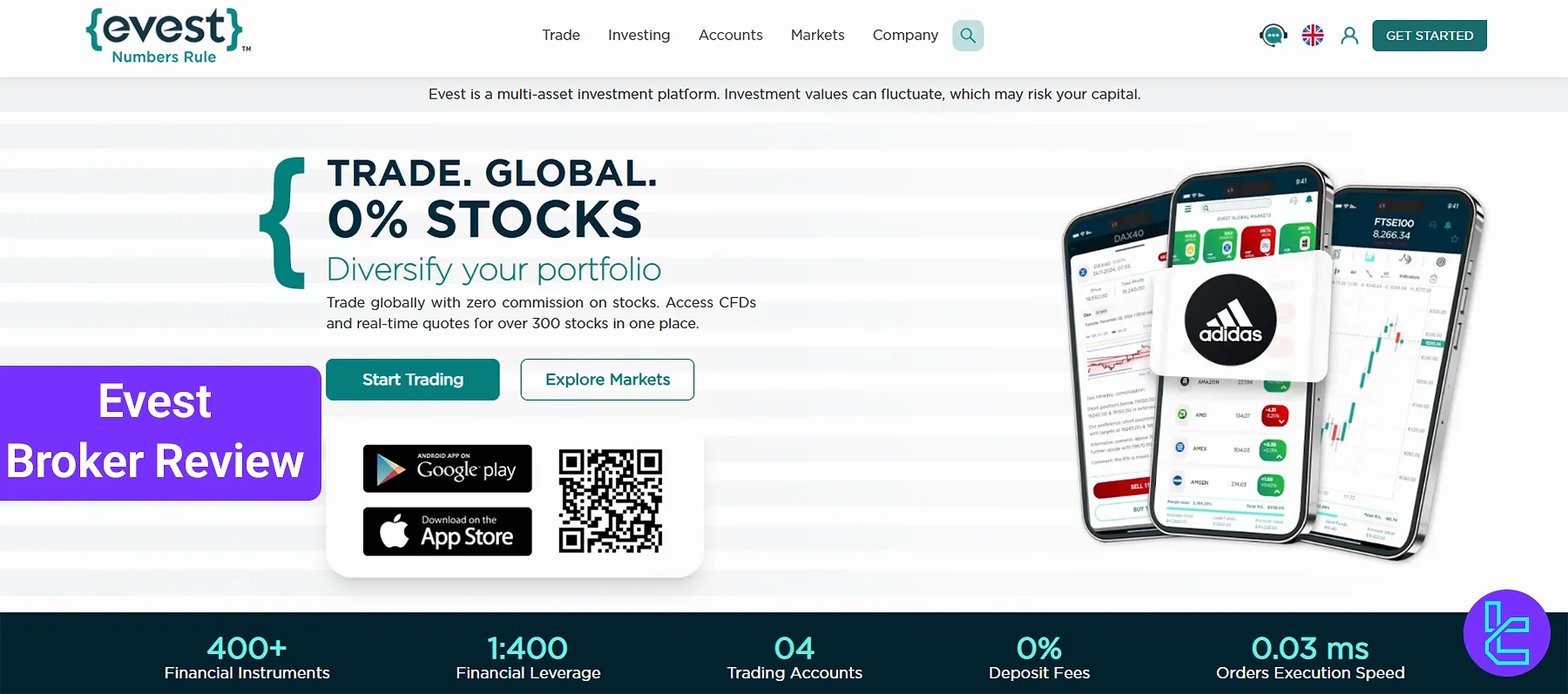

Evest provides +400 trading symbols in 4 main account types [Silver, Gold, Platinum, Diamond], with minimum deposits ranging from $250 to $50,000.

The spreads are floating, starting from 1.8 pips on Silver accounts and from 0.5 pips on the Diamond account type.

Evest broker also provides multiple payment and withdrawal methods for its clients, including Visa Electron, MasterCard, and Skrill.

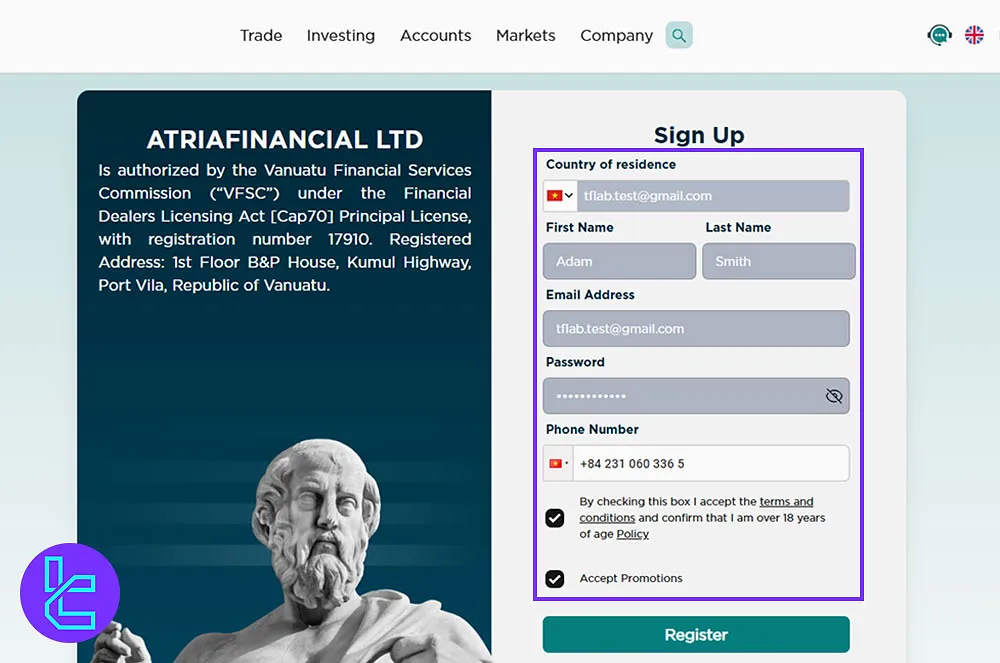

Evest Company Information and Regulation

Founded in 2020 and led by CEO Ali Hassan, Evest is a multi-asset broker with offices in Vanuatu, South Africa, the United Kingdom, and Comoros.

Evest is a brand owned by ATRIAFINANCIAL HOLDINGS LTD, "a company incorporated in the United Kingdom with registration number 12745548", as stated on the broker's official website.

A summary of the information related to this broker is provided below:

Entity Parameters / Branches | ATRIAFINANCIAL LTD | ATRIAFINANCIAL SA (PTY) LTD | ATRIAFINANCIAL (COMOROS) LTD |

Regulation | VFSC (License 17910) | FSCA (FSP 36060) | MISA (License T2023414) |

Regulation Tier | N/A | 2 | N/A |

Country | Vanuatu | South Africa | Comoros |

Investor Protection Fund / Compensation Scheme | None | None | None |

Segregated Funds | No | No | No |

Negative Balance Protection | No | No | No |

Maximum Leverage | 1:400 | 1:400 | 1:400 |

Client Eligibility | All countries except restricted ones (e.g. United States, Iran) | All countries except restricted ones (e.g. United States, Iran) | All countries except restricted ones (e.g. United States, Iran) |

Evest Key Specifications and Details

The table below mentions the most important specifics of the company as a Forex broker:

Broker | Evest |

Account Types | Silver, Gold, Platinum, Diamond, Ramadan Diamond, Demo |

Regulating Authority | FSCA, VFSC, MISA |

Based Currencies | USD |

Minimum Deposit | $250 |

Deposit Methods | Neteller, Skrill, VISA, MasterCard, VISA Electron, Wire Transfer |

Withdrawal Methods | Neteller, Skrill, VISA, MasterCard, VISA Electron, Wire Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:400 |

Investment Options | Copy Trade |

Trading Platforms & Apps | Proprietary |

Markets | Forex, Stocks, Commodities, Indices, Future Indices, Crypto |

Spread | Floating, Varies by Account Type |

Commission | No Trading Commissions |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Trading Central, Tip Ranks, Event Analytics, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Phone Call, Live Chat |

Customer Support Hours | Mon-Fri: 08:00 - 00:00, Sunday: 09:00-18:00 |

Trading Account Types

At the time of writing this article, Evest offers 4 real account types [Silver, Gold, Platinum, Diamond] in addition to a demo for practice.

The live accounts differ in terms of fees and specific trading features, such as once-per-day daily SMS signal, access to a senior account manager, and more.

The higher your deposit, the more features you have access to. Minimum Deposits For Each Account Type:

- Silver: $250

- Gold: $5,000

- Platinum: $20,000

- Diamond: $50,000

Currently, there is also a Ramadan Diamond account available as a promotional offer to clients with a minimum deposit of $5,000 and access to all Diamond features.

- Ramadan Diamond: $5,000

Noteworthy Pros and Cons

We have mentioned some of the most significant advantages and disadvantages of Evest in terms of trading in the table below:

Pros | Cons |

Wide Range of 400+ Trading Instruments | No 24/7 Support Provided |

High Leverage Up to 1:400 | No MetaTrader Platforms Available |

Fast Order Execution Speed of 0.03ms (Claimed) | - |

Account Opening & Verification Guide

The Evest Registration can be completed in 2 minutes. You need only basic details, such as your name and contact number.

#1 Access the Evest Signup Page

Go to the official website and click the "Sign Up" button.

#2 Provide your Details on Evest

Enter the following information to access the trading dashboard:

- Country of residence

- First name

- Last name

- Email address

- Password

- Phone number

After all, agree to the terms, check the "I'm not a robot" box, and click "Register."

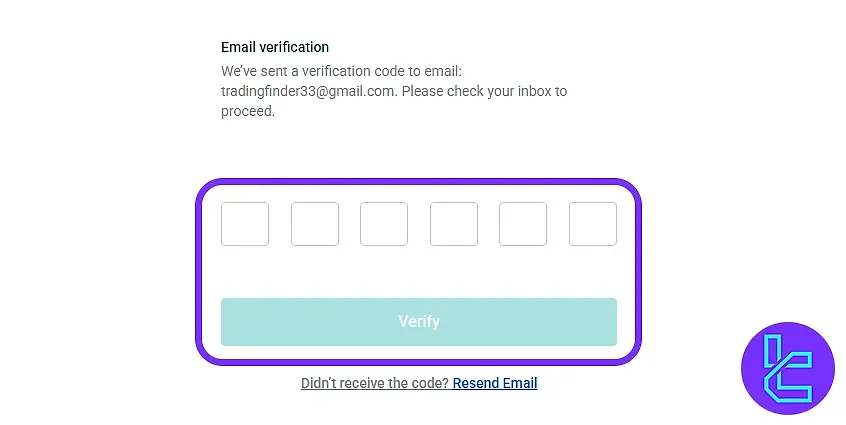

#3 Verify Email Address

Receive a verification code sent to your registered email and input it into the designated field to confirm your Evest account.

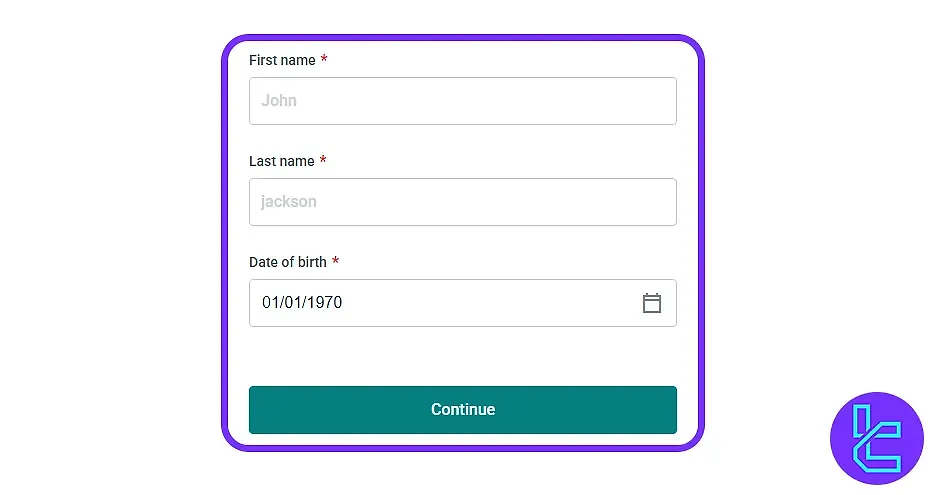

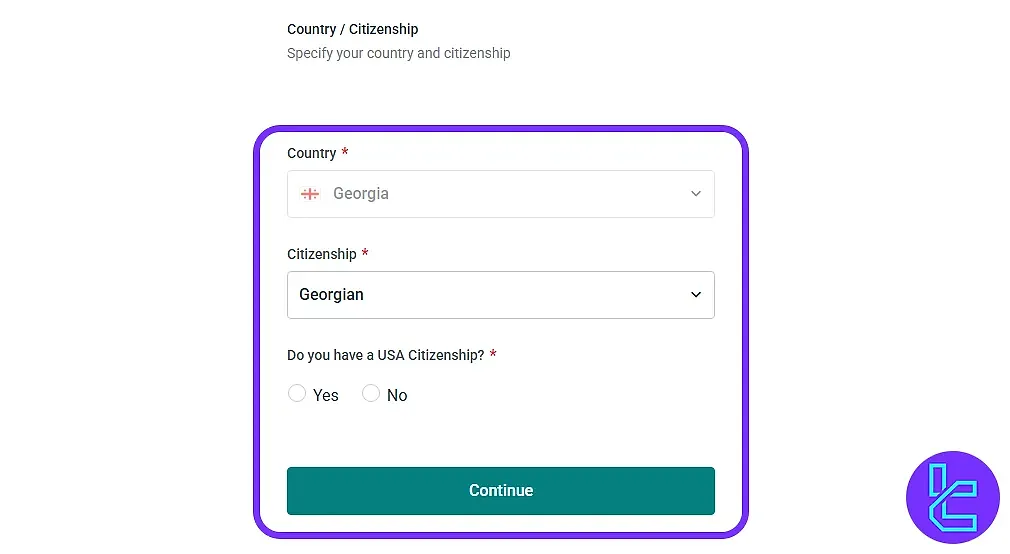

#4 Submit Date of Birth and Citizenship

Enter your date of birth on the initial page of the registration form.

Next, specify your citizenship and mark the checkbox if you are a US citizen.

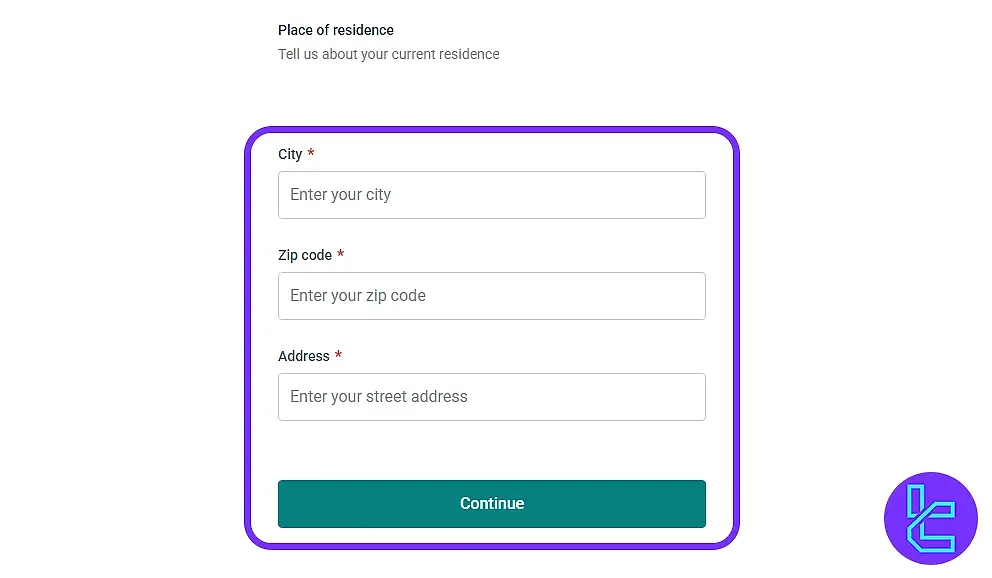

#5 Enter Address Details

Provide complete residential information, including:

- City

- Zip code

- Full street address

Then, select "Continue" to move to the next step.

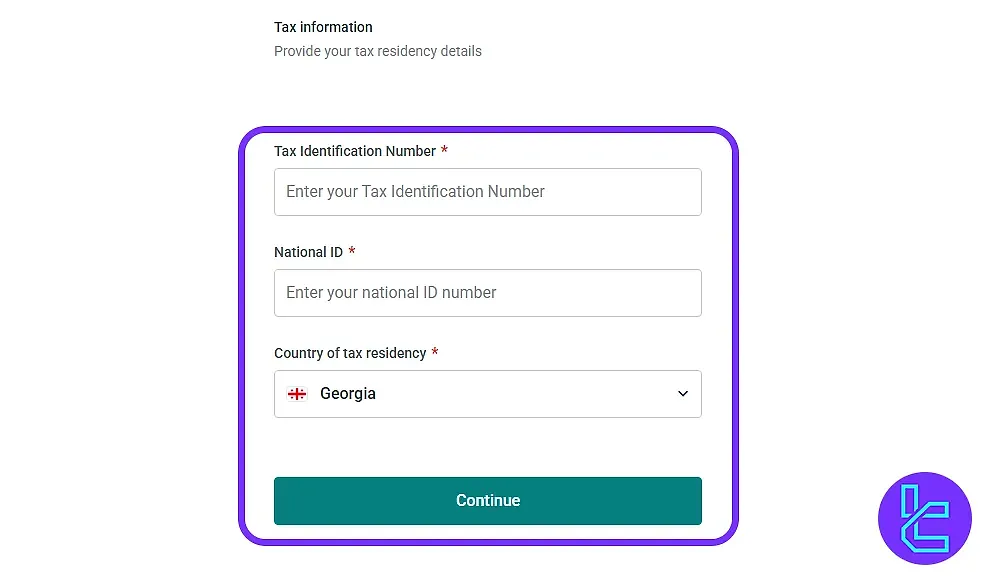

#6 Provide Tax ID and National ID

Enter your tax identification number along with your national ID and specify your country of tax residency.

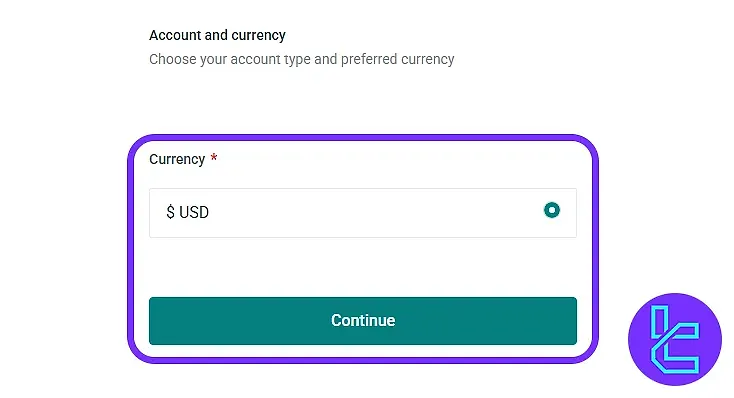

#7 Choose Account Currency

Pick your preferred trading account currency, such as USD, EUR, or GBP. Finally, tick the confirmation box that you are over 18 years old and accept the terms and conditions.

The Trading Platform in Evest Broker

Based on the investigations done by our team, the brokerage has developed a proprietary platform called Evest Global Markets.

In addition to essential tools and options for trading, the terminal provides these features:

- User-friendly interface

- Priority of security and safety

- Expert analysis and research in the Trading Central section

- And more

Evest's proprietary platform is available on the web and mobile devices. Download the application for your phone via the links below:

While it lacks support for industry-standard platforms like MetaTrader 4 or MetaTrader 5, Evest’s in-house terminal aims to provide a user-friendly interface tailored for beginners, along with real-time pricing and essential order types.

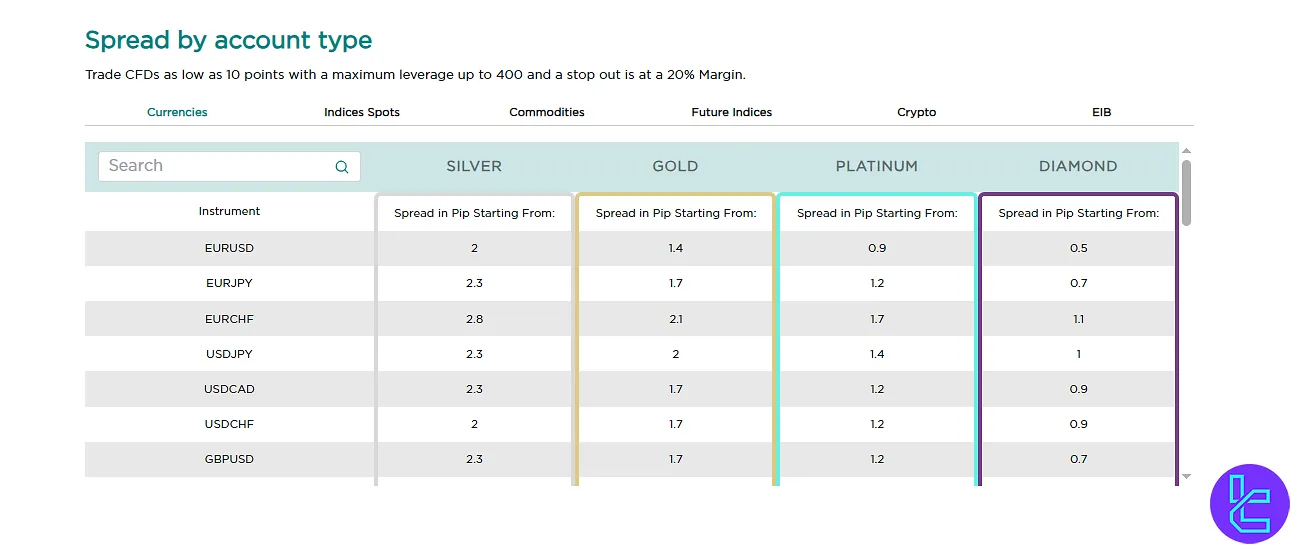

Spreads, Commissions, and Other Fees

Evest operates on a spread-based pricing model, with no additional commissions charged on trades. Spreads vary depending on the account type:

Account Type | Min. Spread (Pips) |

Silver | 1.8 |

Gold | 1.4 |

Platinum | 0.9 |

Diamond | 0.5 |

There is no deposit fee, but a withdrawal commission applies varying based on the condition.

Also, an $75 inactivity fee applies "after the end of the second month", which is lowered to $50 after the 4th month starts. Finally, a 2% conversion fee is charged for currencies.

Swap Fee at Evest

Evest applies overnight financing costs (swap/rollover) to CFD positions, and the exact charge depends on both the instrument traded and the account tier (Silver, Gold, Platinum, Diamond).

For clients seeking Islamic conditions, Evest also provides swap-free or Islamic accounts where overnight swaps are waived under specific rules.

Below are a few key points regarding Evest’s swap policy:

- EURUSD swaps: range from –8 / –3.7 (Silver) to –4.1 / –2.0 (Diamond), showing lower costs at higher account tiers;

- USDJPY swaps: fall from –8 / –6.7 (Silver) to –1.9 / –4.8 (Diamond), again reflecting reduced charges as tier increases;

- Cross pairs like EURCHF incur higher costs, e.g. –8 / –12.1 (Silver) versus –4.0 / –10.3 (Diamond);

- Account tier matters: every upgrade (Silver → Gold → Platinum → Diamond) reduces both long and short swap rates;

- Swap-free option: traders on Islamic accounts can avoid these charges entirely, though holding positions beyond the permitted grace period may lead to administrative adjustments.

Non-Trading Fees at Evest

Evest imposes certain non-trading costs beyond just spreads and commissions, including inactivity charges, withdrawal processing, currency conversion, and related fees.

These charges are transparently disclosed in their “Trading Fees” and “Deposit & Withdrawal” sections.

To tie it all together, here are the most important non-trading cost points:

- Inactivity charge: USD 75 is levied if the account remains dormant by the end of the second month;

- Lowered inactivity cost: from the third month onward, inactivity fee is reduced to USD 50;

- Withdrawal fee: a flat USD 5 is charged on withdrawals (unless exempt under account tier terms);

- Minimum withdrawal threshold: you cannot withdraw less than USD 25;

- Currency conversion cost: a 2 % conversion fee applies when funds or trades use a currency different from your account base currency;

- Deposit cost: no fee is charged on deposits (i.e. funding the account) by Evest itself.

Evest Payment and Withdrawal Options

The brokerage offers a list of 6 convenient payment options:

- Neteller

- Skrill

- VISA

- MasterCard

- VISA Electron

- Wire Transfer

Withdrawals incur a $5 fee with a $25 minimum.

Deposit Methods at Evest

Evest supports a range of deposit options including credit/debit cards, e-wallets (e.g. Skrill), and bank (SWIFT/IBAN) transfers, with zero fee on deposits.

Their mobile app also confirms support for VISA/MasterCard and various global payment solutions.

All deposit methods are processed securely via SSL and comply with PCI DSS standards.Here’s a summary of the main deposit methods and their key parameters:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit / Debit Card (VISA, MasterCard) | USD (or account base currency) | N/A | Free | Instant / near-instant |

Bank Transfer (SWIFT / IBAN) | USD / major currencies | N/A | Free | Up to 7 business days |

Withdrawal Methods at Evest

Evest allows withdrawals via bank transfers (SWIFT/IBAN) and credit/debit cards, subject to processing fees and currency conversion charges.

The broker sets a minimum withdrawal amount of USD 25 and applies a flat USD 5 withdrawal fee in many cases. Withdrawal requests may require KYC validation and can take several business days to complete.

With that in mind, here are the main withdrawal options and their terms:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Transfer (SWIFT / IBAN) | USD / major currencies | USD 25 | USD 5 (if not exempt) | Up to 7 business days |

Credit / Debit Card | USD (or account base currency) | USD 25 | USD 5 (if not exempt) | Several business days |

Does Evest Offer Copy Trading or Other Investment Services?

This broker offers a copy trading feature, allowing traders especially beginners to automatically copy the positions of successful investors and earn profits passively.

This service provides allocation adjustments, risk management tools, and more without any costs.

Trading Markets and Instruments

Evest provides access to a decent range of over 400 financial symbols and assets, including:

- Forex: Popular and minor currency pairs

- Commodities: Metals, energies, and agricultural symbols

- Cryptocurrencies: BTC, ETH, XMR, XRP, LTC, and more

- Indices: Major global stock market indices

- Stocks: CFDs on shares of public companies

Future Indices: Futures contracts on indices

Are Any Bonuses Offered on Evest?

At the time of writing, Evest does not offer any deposit bonuses or welcome promotions. However, a "Ramadan Diamond" account is available as a promotional offer, which was discussed earlier in the article.

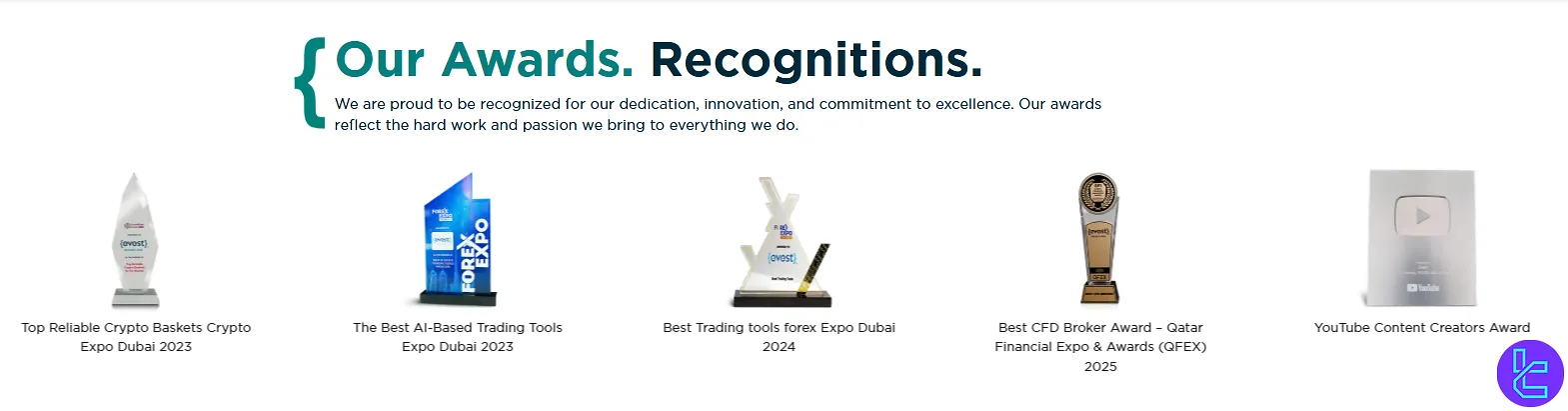

Evest Broker Awards

Evest Broker has received various awards, most of which recognize excellence in customer service, user-friendly trading platforms, and innovation in artificial intelligence.

These Evest Awards have been granted by reputable international platforms, such as the Qatar Financial Expo & Awards, giving them significant credibility.

Here are some of the awards:

- Fastest Growing Forex Broker Forex Expo Dubai 2021

- Most Trusted Broker Cairo Investment Expo Cairo 2021

- Conqueror of the Trading Industry Expo Dubai 2022

- Top Reliable Crypto Baskets Crypto Expo Dubai 2023

- The Best AI-Based Trading Tools Expo Dubai 2023

- Best Trading Tools Forex Expo Dubai 2024

- Best CFD Broker Award Qatar Financial Expo & Awards (QFEX) 2025

Customer Support Channels and Schedule

Evest offers 4 support contact options to traders, which are listed below:

- Email: support@evest.com

- Support Ticket System: On the website

- Phone Call: +971-521-733-716

- Live Chat: Accessible via WhatsApp and site

The team's working hours are as follows:

Days | Hours |

Monday to Friday | 08:00 - 00:00 |

Sunday | 09:00 - 18:00 |

Banned Regions and Countries

Based on the available information and our investigations on the website, traders from these countries are not accepted by the discussed broker:

- United States

- Canada

- Russian Federation

- Israel

- Iran

- Pakistan

- Turkey

- EU Countries

- And more

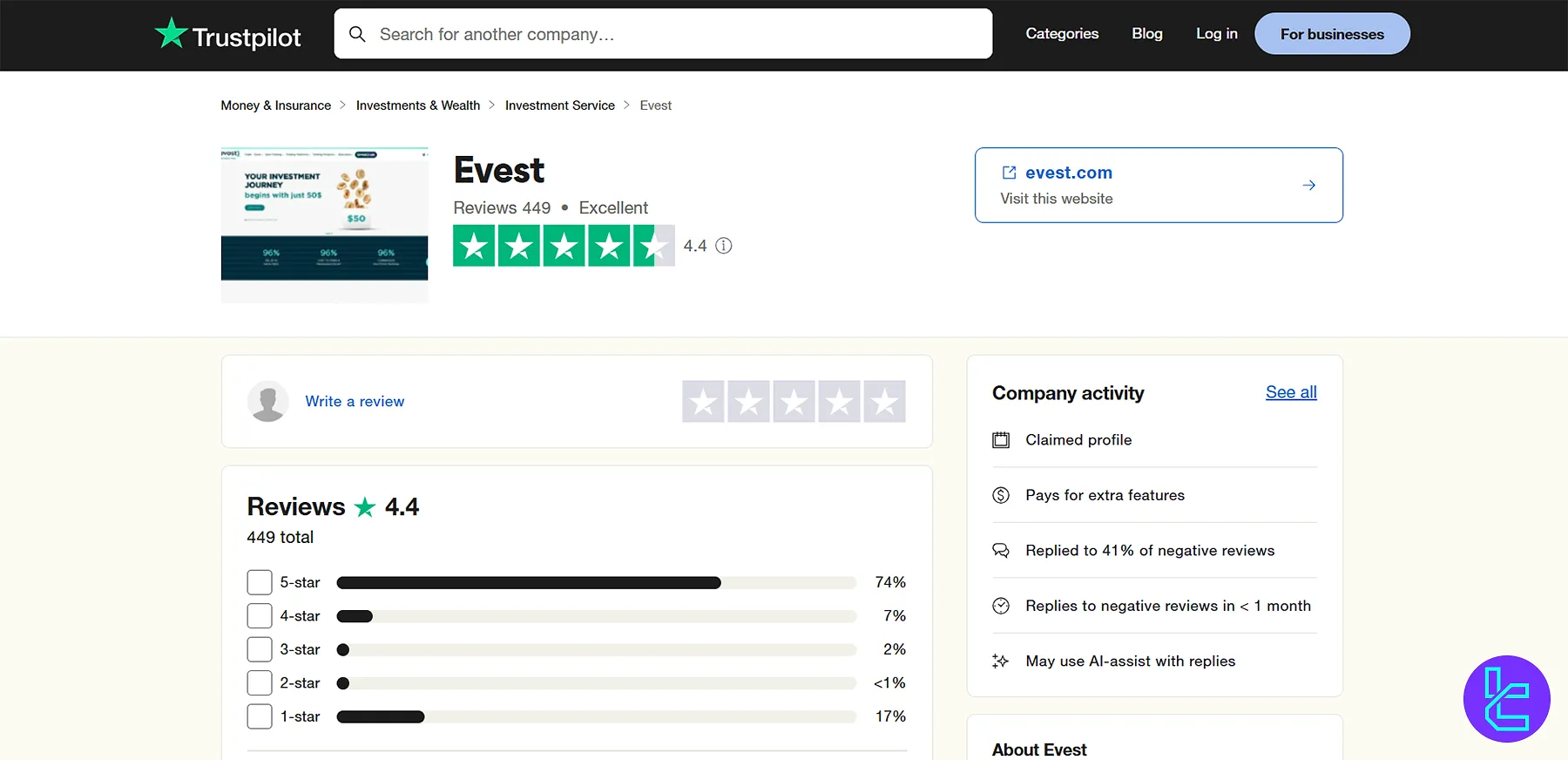

Trust Scores and User Reviews

Evest's page on Trustpilot shows high ratings and scores from users. Also, it has received a great evaluation from ScamAdviser. Here's an overview:

- Trustpilot: 4.4/5 stars based on 440+ reviews

- ScamAdviser: 100/100 trust score

Based on the numbers above, the broker seems a reliable option for trading assets.

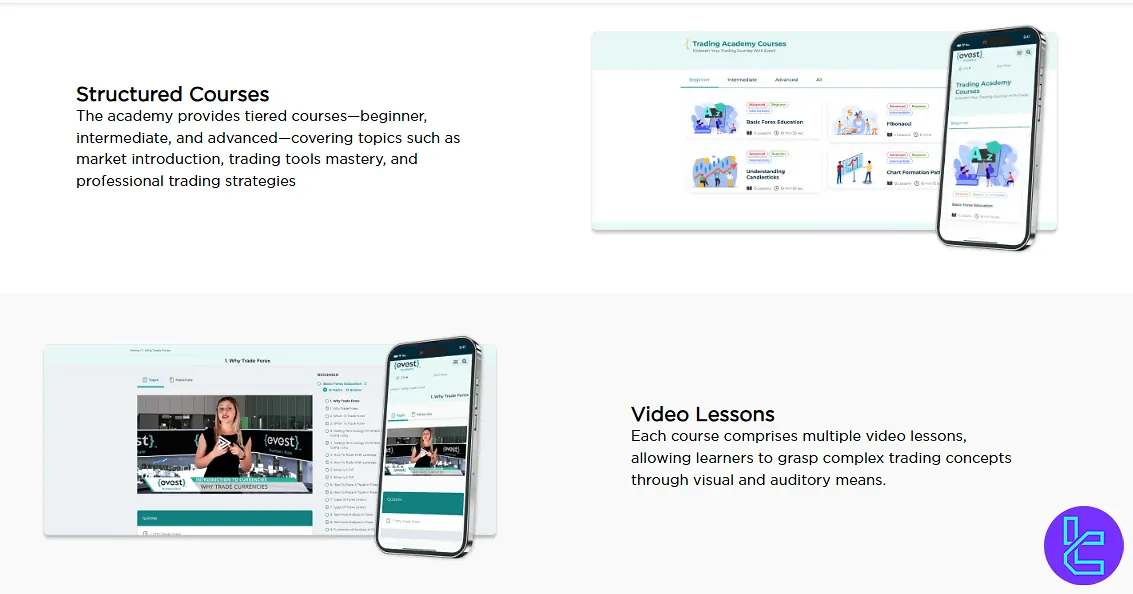

Evest Educational Materials

The broker offers a comprehensive educational platform called "Evest Academy", which includes:

- Beginner to advanced courses

- Video lessons and e-books

- Technical analysis tutorials

- Daily market news and webinars

- Trading signals and tools

The educational content is available in 3 languages [English, Spanish, Arabic].

Evest Comparison Table

Let's compare the features of the Evest with those of other brokers; Evest Comparison:

Parameter | Evest Broker | XM Broker | LiteForex Broker | FXGlory Broker |

Regulation | FSCA, VFSC, MISA | ASIC, FSC, DFSA, CySEC | CySEC | No |

Minimum Spread | 0.5 pips | From 0.6 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0.01 | $0 (except on Shares account) | From $0.0 | $0 |

Minimum Deposit | $250 | $5 | $50 | $1 |

Maximum Leverage | 1:400 | 1:1000 | 1:30 | 1:3000 |

Trading Platforms | Proprietary | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MetaTrader 4, MetaTrader 5 |

Account Types | Silver, Gold, Platinum, Diamond, Ramadan Diamond, Demo | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | 400+ | 1400+ | N/A | 45 |

Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion And Final Words

Evest provides 4 support channels [email, ticket, phone call, live chat] with the team available on specific hours.

Users on "Trustpilot" have given an average of 4.4/5 to the broker with 440+ reviews.