FBS is a brokerage firm with more than 27 million users. The company offers a proprietary mobile application for trading with +90 technical indicators.

The spreads on this broker are floating, starting at a minimum of 0.7 pips. No additional trading commissions are charged for clients.

FBS Forex Broker; Company Information & Regulation

FBS is a solid company in the online forex trading industry, operating as a broker since 2009. With over a decade of experience, FBS has established itself as a trusted name in the forex world.

But what really sets FBS apart is its rock-solid regulatory framework. The Forex broker is owned and operated by Tradestone Limited, a Cyprus-based entity licensed by the Cyprus Securities and Exchange Commission (CySEC) under license number 331/17.

It's also regulated by the Financial Services Commission of Belize (FSC). This authority controls the global branch, and FBS EU, a CySEC-regulated entity, operates in the European market.

The broker offers access to over 550 tradable CFD instruments across forex, indices, commodities, shares, and cryptocurrencies. Known for its reliable customer support, intuitive account setup, and fast execution speeds, FBS is suitable for traders at all levels. FBS regulatory information:

Entity Parameters/Branches | FBS Markets Inc. | Tradestone Ltd. | Intelligent Financial Markets Pty Ltd. |

Regulation | ASIC | CySec | FSC |

Regulation Tier | 1 | 1 | 3 |

Country | Sydney, Australia | Cyprus, Limassol | Belize |

Investor Protection Fund/Compensation Scheme | No | Up to €20,000 under ICF | No |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:500 | 1:500 | 1:3000 |

Client Eligibility | Only Australia | Only EU/EEA Residents | Global |

FBS Summary Of Specifications

In this section, we will have all the key specifics of the broker at a glance. FBS specifics table:

Broker | FBS |

Account Types | Standard |

Regulating Authorities | FSC, CySEC |

Based Currencies | USD, EUR |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Minimum Order | 0.01 Cent Lot |

Maximum Leverage | 1:3000 |

Investment Options | No |

Trading Platforms & Apps | MT4, MT5, Mobile App |

Markets | Forex, Energies, Indices, Shares, Metals |

Spread | From 0.7 Pips |

Commission | $0 |

Orders Execution | Market |

Margin Call/Stop Out | 40/20% |

Trading Features | EAs, Hedging |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Email |

Customer Support Hours | 24/7 |

FBS Trading Account Features

This broker previously offered six different account types. Unfortunately, this has changed, and you only have one trading option. Trading account specifications:

Features | Standard Account |

Min. Deposit | $15 |

Leverage | Up to 1:3000 |

Max. Open Positions | 500 (200 Pending Orders) |

Order Volume | From 0.01 to 500 Lots |

In addition, it provides a swap-free (Islamic) account option that complies with Sharia law.

Traders can also test the platform using a demo account, available on MetaTrader 4, MetaTrader 5, and the proprietary FBS mobile app. There are no managed or PAMM accountsoffered.

Pros and Cons

Brokers with great features come with some negative points, too, similar to any average brokerage. Let's break them down:

Pros | Cons |

Low Minimum Deposit | No Service Available For Some Countries |

Regulated By A Top-Tier Authority | Only One Trading Account Offered |

Fast Order Execution (0.01 Seconds) | - |

User-Friendly Mobile App | - |

Registration & Verification on FBS Complete Guide

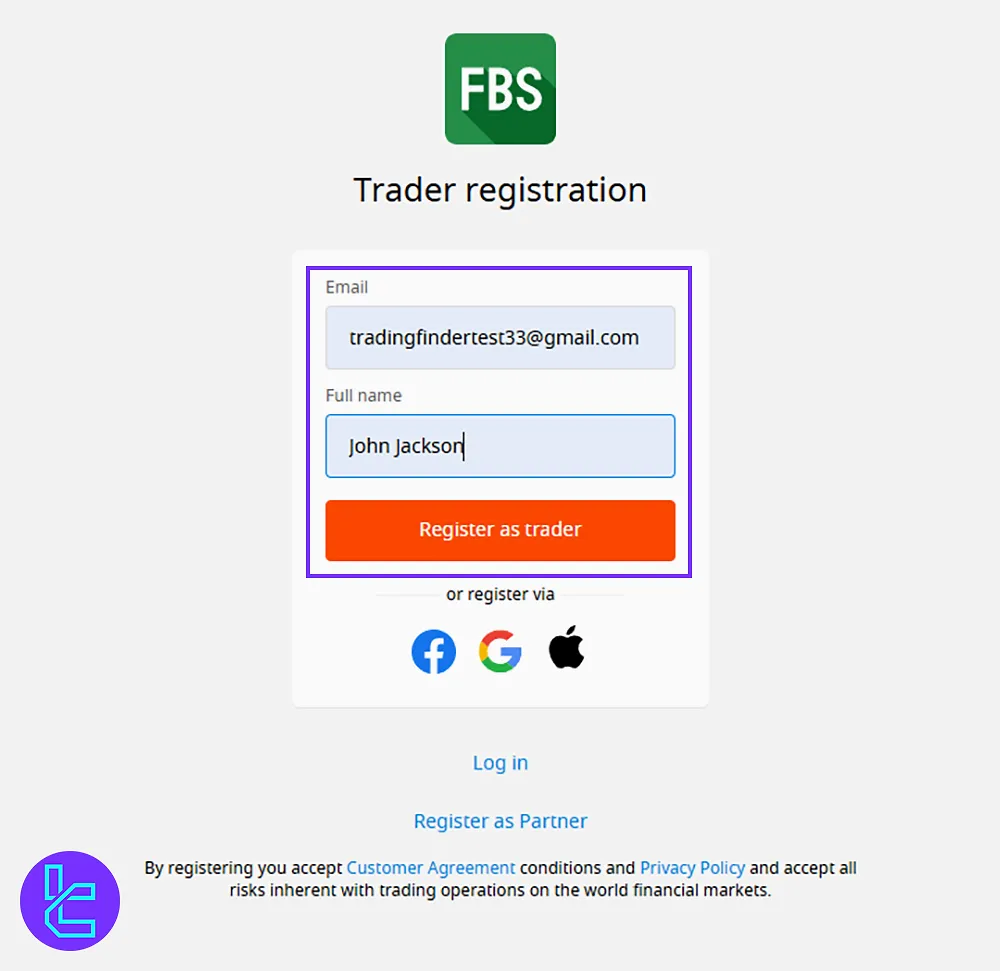

Getting started with FBS is quick and flexible, offering both standard and express verification methods. Traders can open an account in minutes by signing up with an email or linking social accounts.

Full access is granted after verifying either through document upload or simplified profile information. The process is secure, user-friendly, and tailored for a smooth onboarding experience. FBS registration:

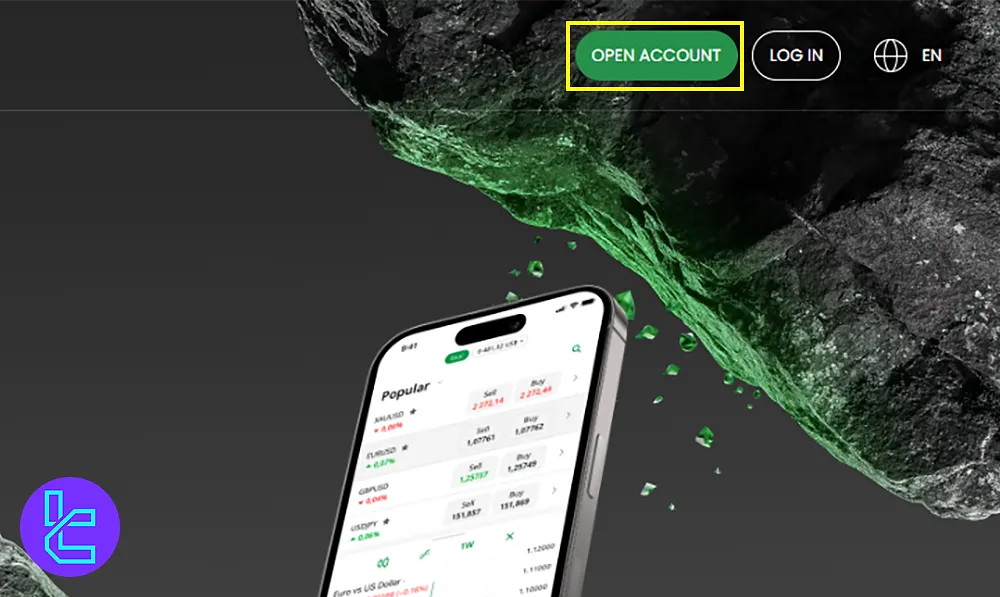

#1 Start the Registration

Visit the FBS official website and click on “Open Account”. You can register using youremail and name, or log in instantly via Google, Facebook, or Instagram.

#2 Set Up Login Credentials

Use the temporary password provided by FBS, or set a personal one that meets platform security requirements.

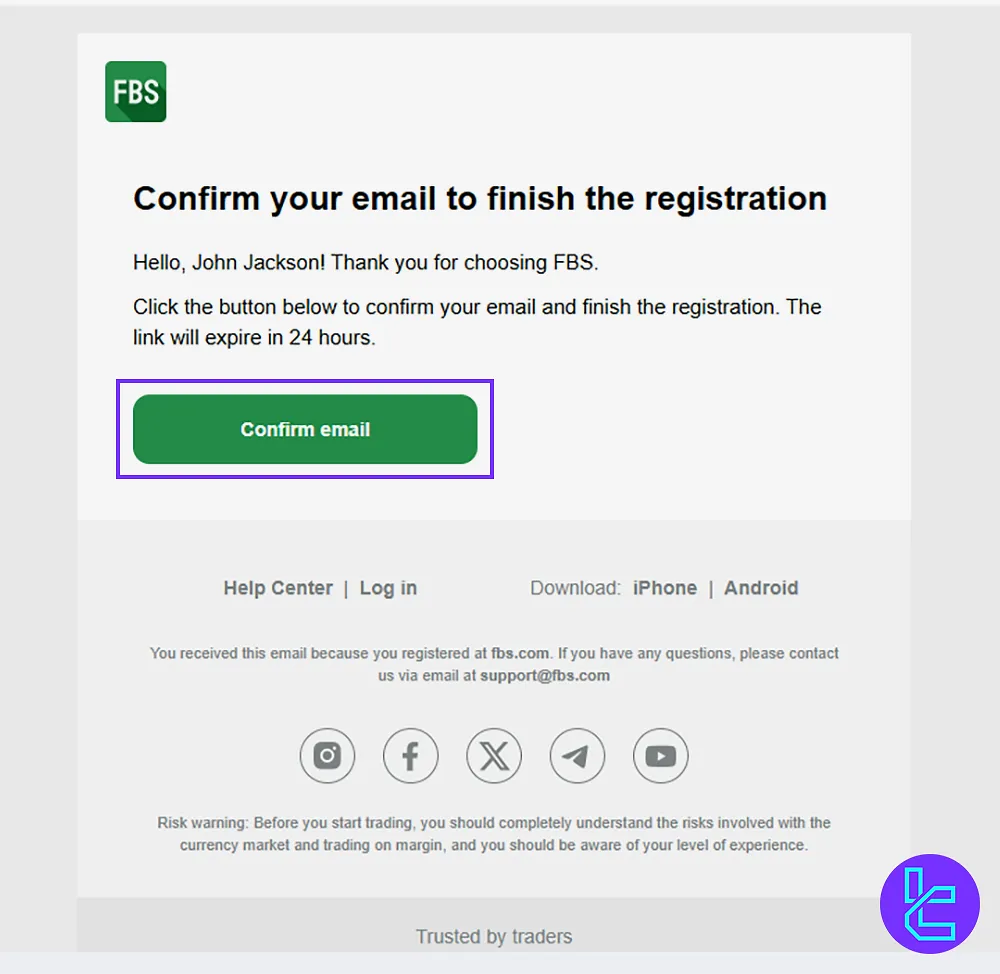

#3 Confirm Your Email

Open your inbox and click the confirmation link sent by FBS to activate your trading account.

#4 Choose Your Verification Method

Access the Profile Settings to complete identity verification. Either:

- Upload your KYC documents, or

- Use the express option by entering your date of birth and country of residence.

Platforms & Apps on FBS

This broker offers 3 platforms on different devices and operating systems. We will discuss each platform in the next parts.

Metatrader 4

The classic MetaTrader 4 is available for desktop, web, and mobile devices. It offers:

- 50 indicators and tools for charts

- 4 types of pending orders

- Support for VPS hosting

- One-click trading

Metatrader 5

The next-generation MetaTrader 5 platform builds on MT4's features and adds:

- More timeframes and indicators

- Built-in economic calendar

- More types of pending orders

- Market Depth

- Access to a set of higher-level Expert Advisors

- Hedging option for better risk management

FBS Mobile App

The broker's proprietary mobile application is "the app that makes you stronger". It offers:

- Fast registration and straightforward verification

- Simple deposits

- Access trading and account stats with one tap

- Over 90 indicators for technical analysis

Download Links:

These platforms cover the needs of both beginners and advanced traders, with fast execution and a responsive user interface.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Spreads and Commission on FBS

FBS delivers relatively competitive trading costs. The Standard account comes with floating spreads starting from 0.7 pips and zero commission on most instruments.

Live testing during peak trading hours revealed:

- EUR/USD spreads averaged around 1.0–1.1 pips

- Gold spreads ranged from 30–38 cents

- Bitcoin spreads ranged from $38–$43

- Index spreads, such as Dow Jones, are wider than industry norms (5.8–6.1 pips)

If you are interested in lowering your trading costs with this broker via cashback, we suggest checking the FBS rebate page.

Swap Fees

FBS applies overnight financing rates (also known as swap rates) on leveraged positions held beyond a single trading day. These rates contribute to the overall trading cost, particularly for medium- to long-term strategies. The following are current indicative rates for selected instruments on the FBS platform:

- EUR/USD: 1.9%

- GBP/USD: 0.8%

- S&P 500 CFD: 4.7%

- Euro Stoxx 50 CFD: 3.9%

- Apple CFD: 6.9%

- Vodafone CFD: 7.0%

Financing charges are typically applied daily and may vary based on market conditions, instrument type, and position direction. Traders are advised to monitor the latest swap rates within the FBS trading platform before holding positions overnight.

Non-Trading Fees

FBS maintains a low-cost structure by waiving most non-trading charges typically applied by brokers. The platform does not impose fees for account maintenance, inactivity, deposits, or withdrawals under standard conditions.

However, users should be aware that third-party service providers, including banks or payment gateways, may apply independent processing charges. Additionally, currency conversion fees may apply if the deposit or withdrawal is made in a currency different from the account’s base currency. FBS does not control these external costs and may vary depending on the selected payment method.

FBS Payment Options

Deposit and withdrawal methods on this broker vary from one region to another, but in most countries, these options are available:

- E-payment Systems: Skrill, Neteller, Sticpay, Perfectmoney, Fasapay, etc.

- Bank Transfers: Depending on the region

- Credit/Debit Cards: Visa, Maestro, Mastercard, etc.

- Local Payment Options: PIX, JCB, Banco Santander, etc.

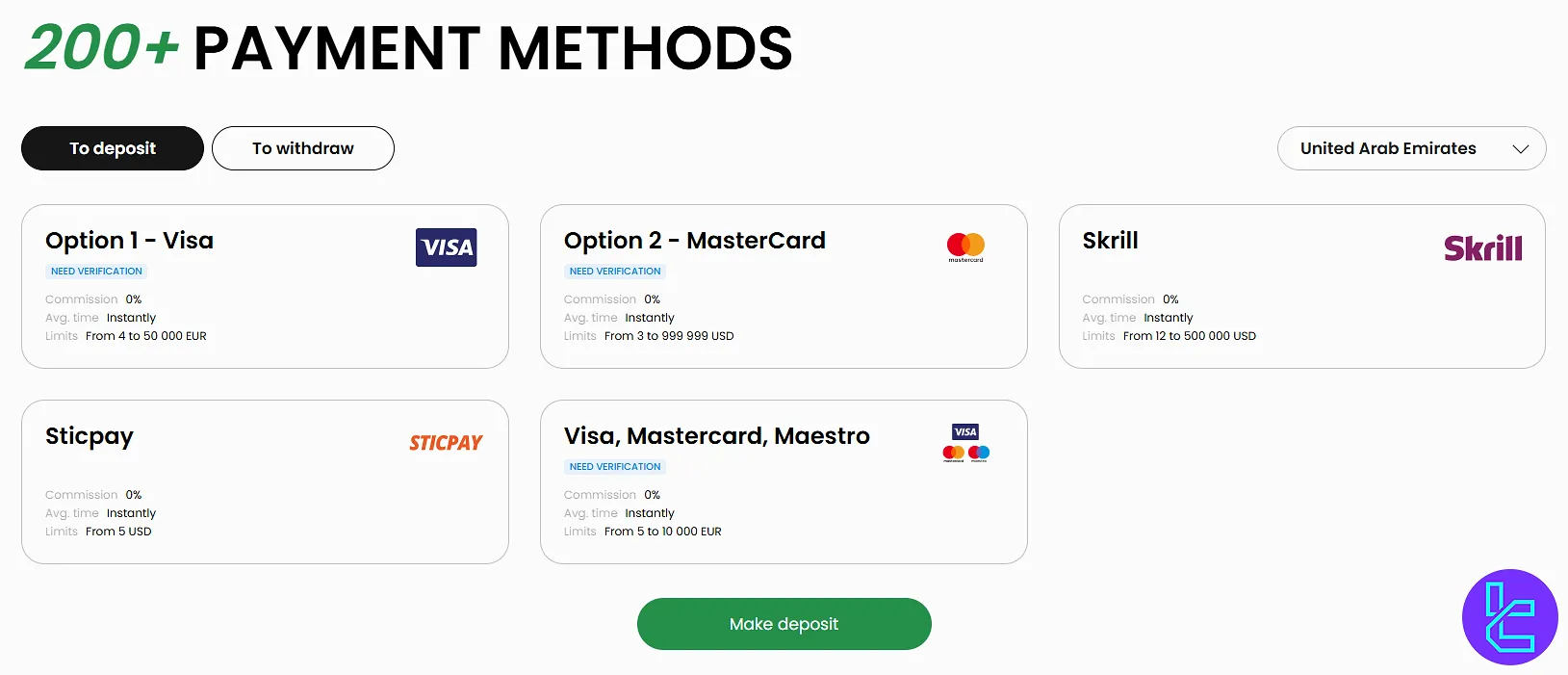

FBS Deposit

The FBS broker provides a wide variety of options to all traders to easily fund their trading accounts and begin trading. The payment options on this broker include:

Method | Minimum Deposit Amount | Commission | Processing Time |

Visa/MasterCard/Maestro | $4 | 0% | Instant |

Skrill | $12 | 0% | Instant |

Sticpay | $5 | 0% | Instant |

Neteller | $10 | 0% | Instant |

First National Bank (South Africa) | 100 ZAR | 0% | 15 to 30 minutes |

PIX (Brazil) | $1 | 0% | Instant |

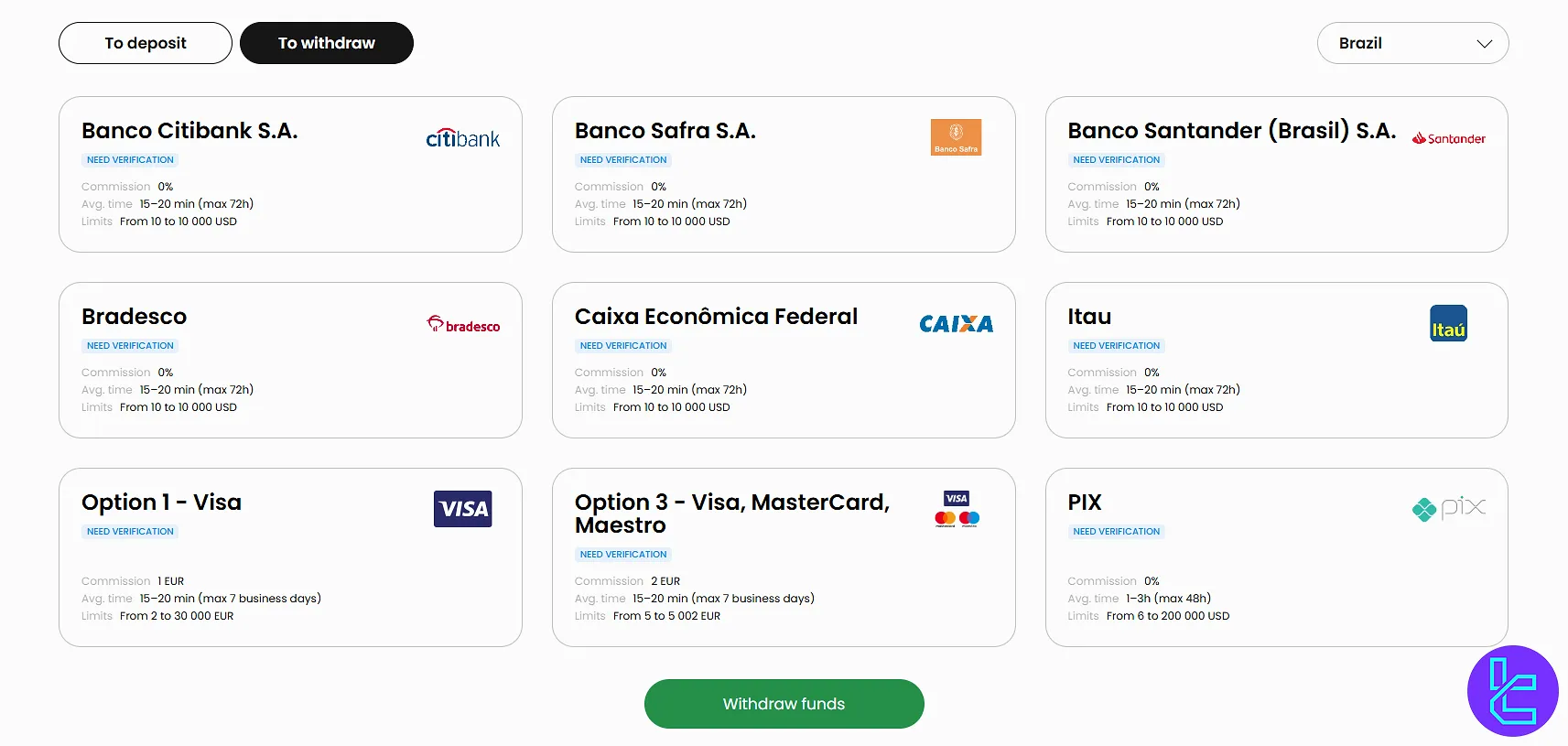

FBS Withdrawal

Just like deposits, FBS provides various payment methods which is specific to each country. Many of the available options are fee-free; however, some might incur fees that traders must consider before submitting this request.

Method | Minimum Deposit Amount | Commission | Processing Time |

Visa/MasterCard/Maestro | $1 | €1 | 15-20 Minutes (7 Days Maximum) |

Skrill | $10 | 1-2% + €0.29 | 15-20 minutes (48 Hours Maximum) |

Sticpay | $3 | 0% | 15-20 minutes (48 Hours Maximum) |

Neteller | $4 | 2% | 5-7 Minutes (48 Hours Maximum) |

Local Banks of South Africa | 30 ZAR | %2.5 + 7.2 ZAR | 15 to 20 minutes (7 Days Maximum) |

PIX (Brazil) | $6 | 0% | 1-3 Hours (48 Hours Maximum) |

FBS Copy Trading & Investment Options

Previously, the brokerage had a specific app designed for copy trading, but it was shut down in September 2022. Currently, the FBS broker does not offer any facilities or platforms for PAMM accounts and copy trading. Check the official website for any updates regarding this matter.

Tradable Markets and Instruments on FBS

FBS offers over 550 trading instruments across five asset classes, from the Forex market to Metals and Stocks.

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | CFDs on major, minor & exotic currency pairs | 30–40 pairs | 50–70 currency pairs | 1:2000 |

Stocks | CFDs on individual shares (via MT5) | Over 350 | 800–1,200 global stocks | 1:2000 |

Commodities & Metals | CFDs on metals (gold, silver, etc.) and energies (oil etc.) | 5–10 metal/energy instruments | 10–20 instruments | Not Specified |

Indices | CFDs on global indices (e.g. S&P 500, NASDAQ, DAX, YM) | 10+ Indices | 10–20 indices | Not Specified |

CFDs on crypto-to-fiat, crypto-to-crypto, crypto-to-metal | Over 100 crypto instruments | Varies (often 5–15) | Not Specified |

FBS Bonuses and Promotions

Based on our investigations, this brokerage does not seem to be offering any bonuses and promotions currently.

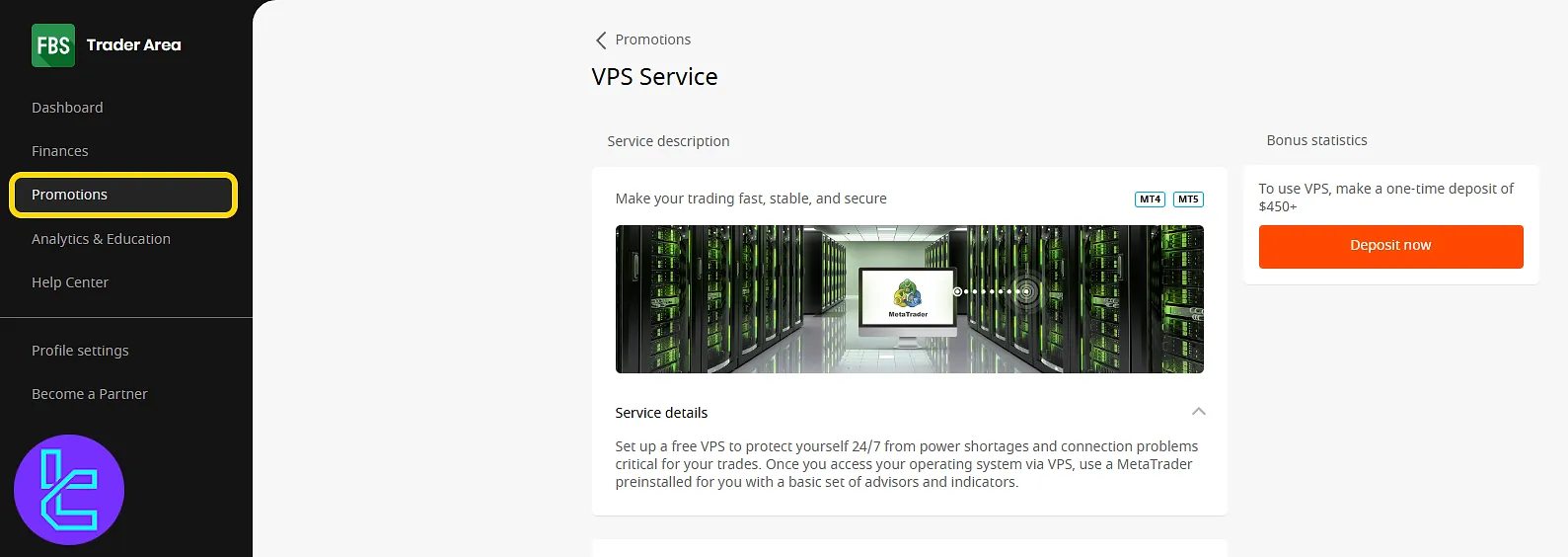

Promotion Section On the Dashboard

Traders can check the available bonuses on the FBS dashboard by accessing the "Promotions" section. FBS clients who meet the eligibility criteria can request access to the VPS service by making a minimum qualifying deposit of $450 or more.

FBS Awards

FBS has been acknowledged by several independent organizations for its technology, user interface, and client services. Recent recognitions include “Best Mobile Trading App Global” by UF Awards and “Best Client-Centric Broker, Asia” from Global Brands Magazine.

Additional honors have been granted by World Business Outlook, FXDaily Info, and Brands Review Magazine, reflecting the broker’s focus on platform usability, customer support quality, and the development of functional trading tools.

Customer Support Services

One of the strengths of the FBS broker is its 24/7 customer service offering. It also supports multiple languages, such as English, French, and German. The contact channels are as follows:

- Live Chat: through the website or social media accounts

- Email: [support@fbs.com]

- Phone Call: +357 22 010970

Based on reports and investigations, the team responds quickly to messages and inquiries.

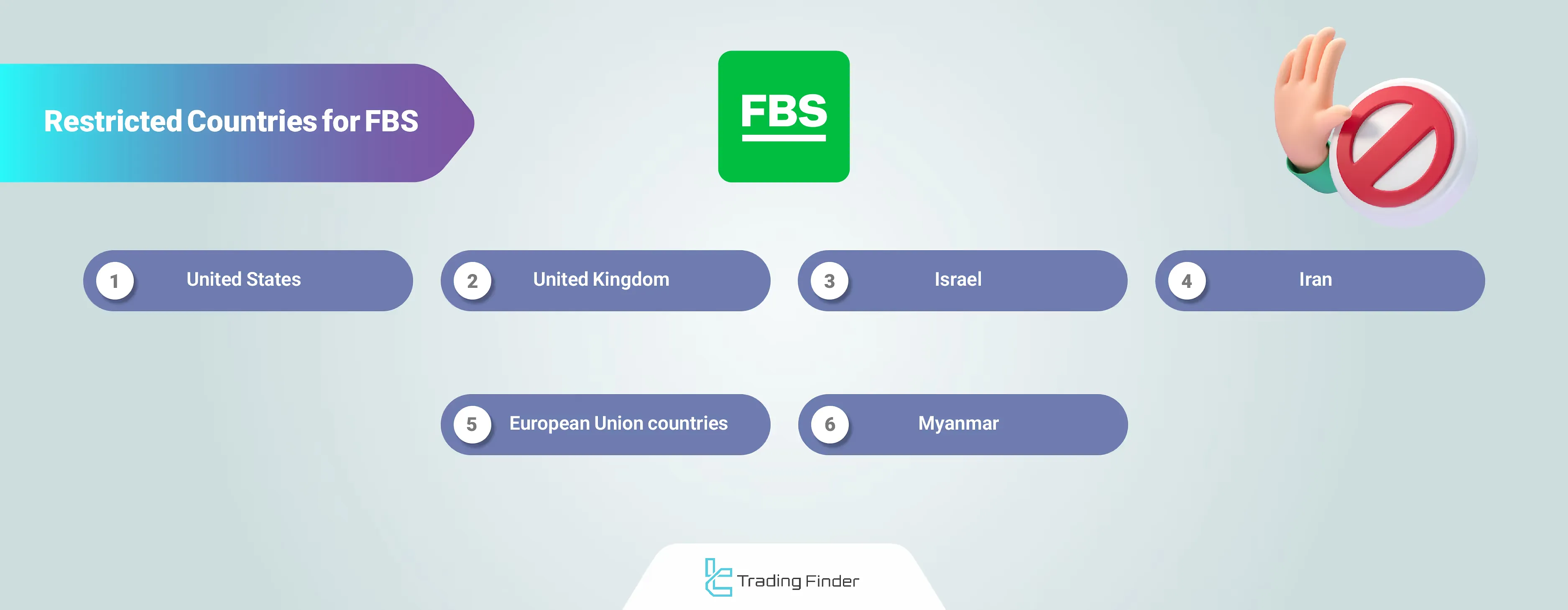

Which Countries are Restricted from FBS Services?

While FBS operates globally, it cannot provide services to some countries due to certain regulations, international sanctions, etc. Notable restrictions include:

- United States

- European Union countries

- United Kingdom

- Myanmar

- Israel

- Iran

Always contact customer support to confirm availability in your country.

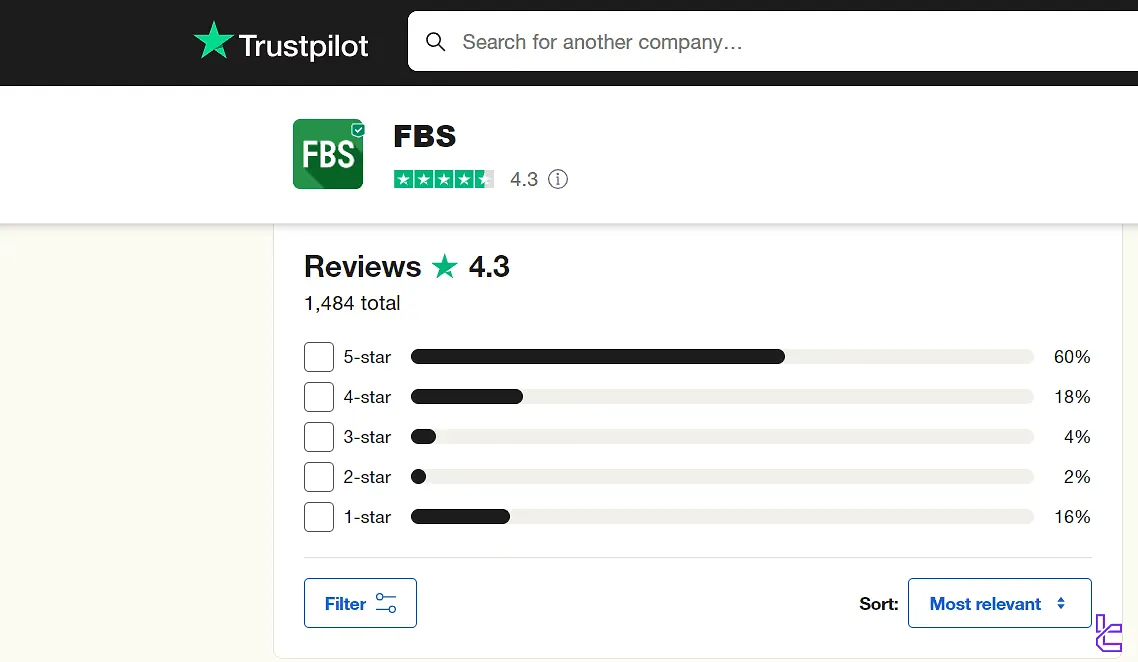

FBS Trust Scores & Reviews

In this section, we examine the broker's user score and experts' evaluations of it on reputable websites such as FBS Trustpilot. Some of the available trust scores:

- Trustpilot: 4.3 out of 5, based on over 1400 reviews

- ForexPeaceArmy: 2.527 out of 5, based on more than 360 user reviews

- REVIEWS.io: 4.3 out of 5, based on around 110 reviews

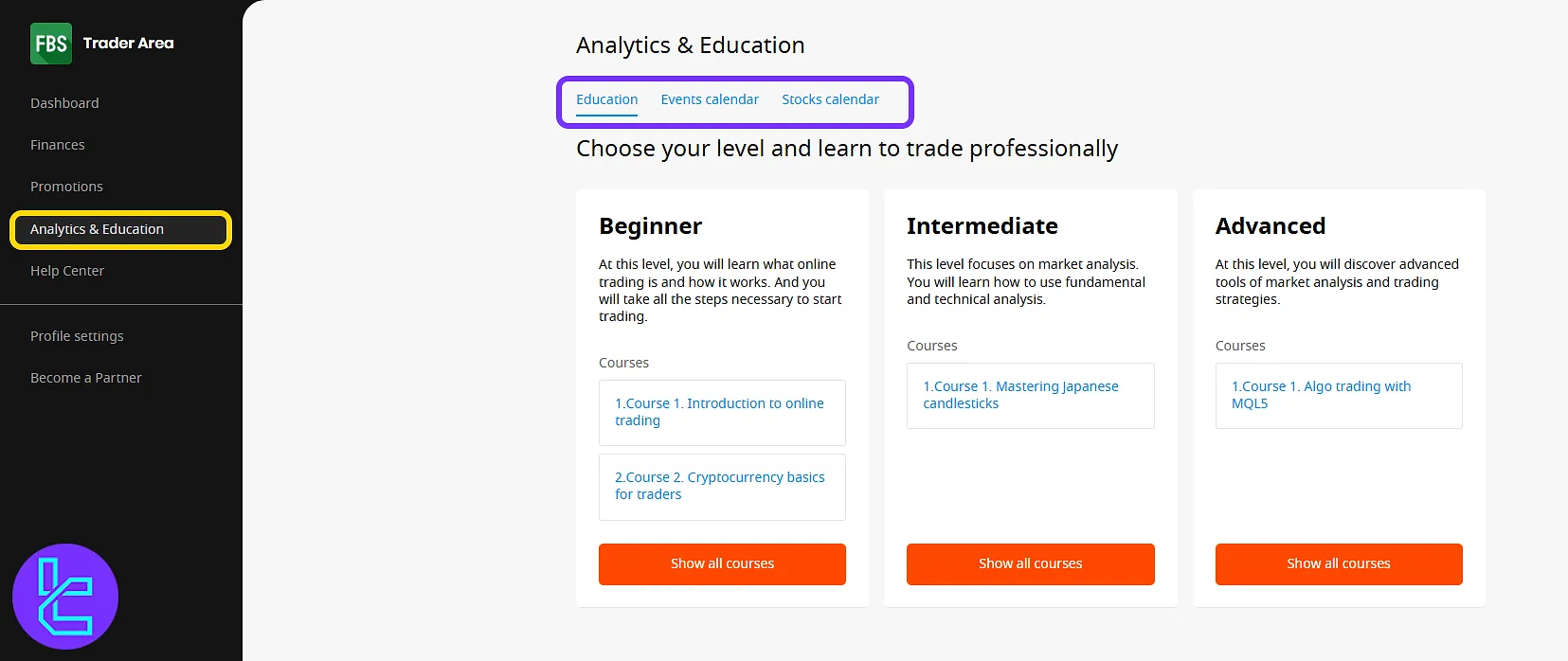

FBS Educational Section Review

The broker's website provides enough educational content to tutor everyone to trade successfully. It consists of these types of materials:

- Video tutorials

- Webinars

- E-books

- Trading glossary

- Economic calendar

- Market analysis

The education section on FBS is divided into different levels for beginners, intermediate clients, and advanced users.

FBS Educational Content on the Dashboard

Educational materials are available for all trader levels in the "Analytics & Education Section" of the dashboard, categorized into Beginner, Intermediate, and Advanced sections, with access to both economic event and stock calendars for market insights.

FBS Compared to Other Brokers

Here's a comparison between FBS's offerings and those of other brokers:

Parameter | FBS Broker | HFM Broker | FxPro Broker | FXGlory Broker |

Regulation | FSC, CySEC | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | From 0.7 Pips | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | $0 | From $0 | From $0 | $0 |

Minimum Deposit | $5 | From $0 | $100 | $1 |

Maximum Leverage | 1:3000 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | MT4, MT5, Mobile App | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 550+ | 1,000+ | 2100+ | 45 |

Trade Execution | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and final words

FBS is a global multi-asset broker that has restricted its services to 6 regions [United States, EU countries, United Kingdom, Myanmar, Israel, Iran.] More than 110 users on REVIEWS.io have given an average score of 4.3/5 to the company.

The broker allows a maximum of 500 open positions. The minimum order volume is 0.01 lots.