FBS EU is a Forex broker with a cent account requiring a minimum deposit of €10 and a leverage of up to 1:500 (Pro). The trading spreads start from 0.7 pips.

The order volume ranges from 0.01 to 500 lots. MetaTrader 5 is the trading platform utilized by the brokerage. This platform is available on Android, iOS, Mac, Windows, and also on the web.

FBS EU Information & Regulation

FBS EU is the European arm of the global FBS brand in the European Union market, represented by Tradestone Ltd, a Cyprus Investment Firm (CIF) registered under the number HE 353534.

In the table below, you can find the key basic information about this broker:

Entity Parameters / Branches | Tradestone Ltd |

Regulation | CySEC (License 331/17) |

Regulation Tier | 1 |

Country | Cyprus |

Investor Protection Fund / Compensation Scheme | ICF (up to €20,000) |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:500 |

Client Eligibility | EU / EEA clients |

The company is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 331/17. Other Key Points:

- Established in 2017;

- Office Address located at 89, Vasileos Georgiou Street, 1st Floor, Office 101, Potamos Germasogeias, 4048 Limassol, Cyprus;

- Registered at Arch. Makariou 111 & Vyronos Р. LORDOS CENTER, BLOCK В, 2nd floor, Office 203 3105, Limassol, Cyprus;

- Adheres to MiFID II regulations and GDPR compliance;

- Member of the Investor Compensation Fund (ICF) of Cyprus (clients from outside the EU do not receive such protections;)

- Ensures segregation of client funds.

Summary of Key Specifics

Let's take a quick look at the key features that make FBS EU what it is in the forex broker landscape:

Broker | FBS EU |

Account Types | Standard, Cent, Demo Standard, Demo Cent |

Regulating Authorities | CySEC |

Based Currencies | USD, EUR |

Minimum Deposit | 10 EUR |

Deposit Methods | Credit/Debit Card, Skrill, Neteller, Wire Transfer, Rapid Transfer |

Withdrawal Methods | Credit/Debit Card, Skrill, Neteller, Wire Transfer, Rapid Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:500 |

Investment Options | MT5 Copy Trading |

Trading Platforms & Apps | MetaTrader 5 |

Markets | Forex, Stocks, Indices, Energies, Metals |

Spread | Floating from 0.7 Pips |

Commission | None on Trading and Deposits/Withdrawals |

Orders Execution | Market, Limit, Stop, and Stop-Limit |

Margin Call/Stop Out | Not Specified |

Trading Features | Economic Calendar, Forex Calculators, Currency Converter, Glossary |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Callback, Email |

Customer Support Hours | 24/5 |

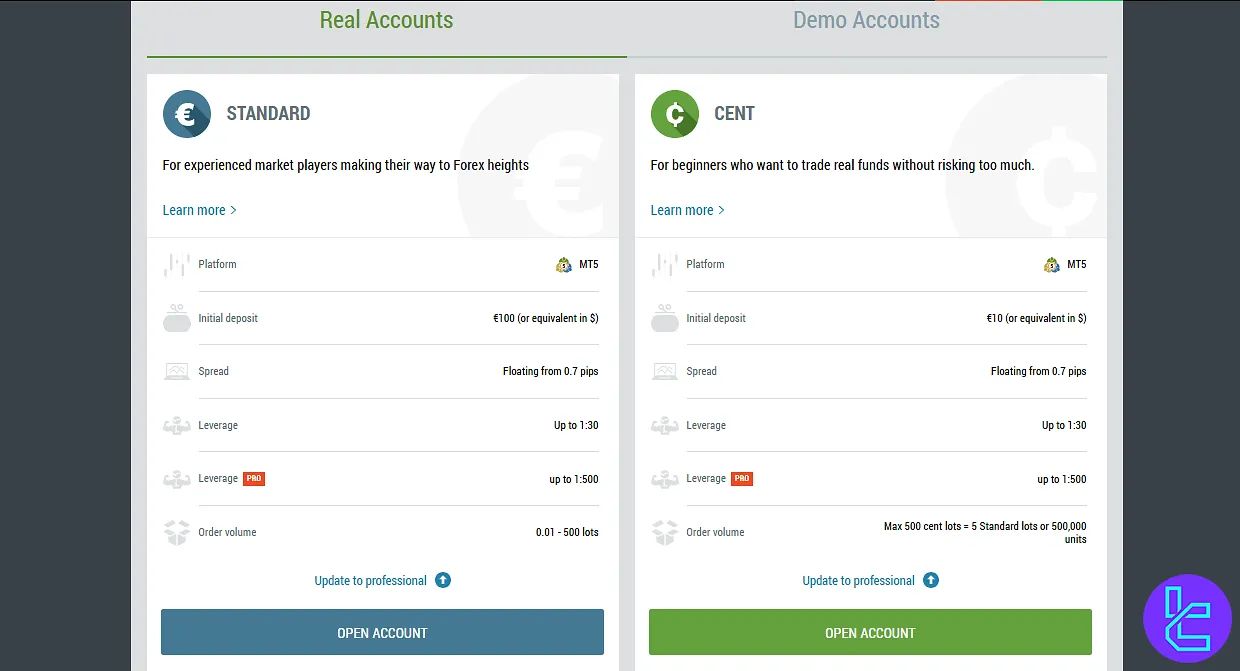

Account Types and Specifics

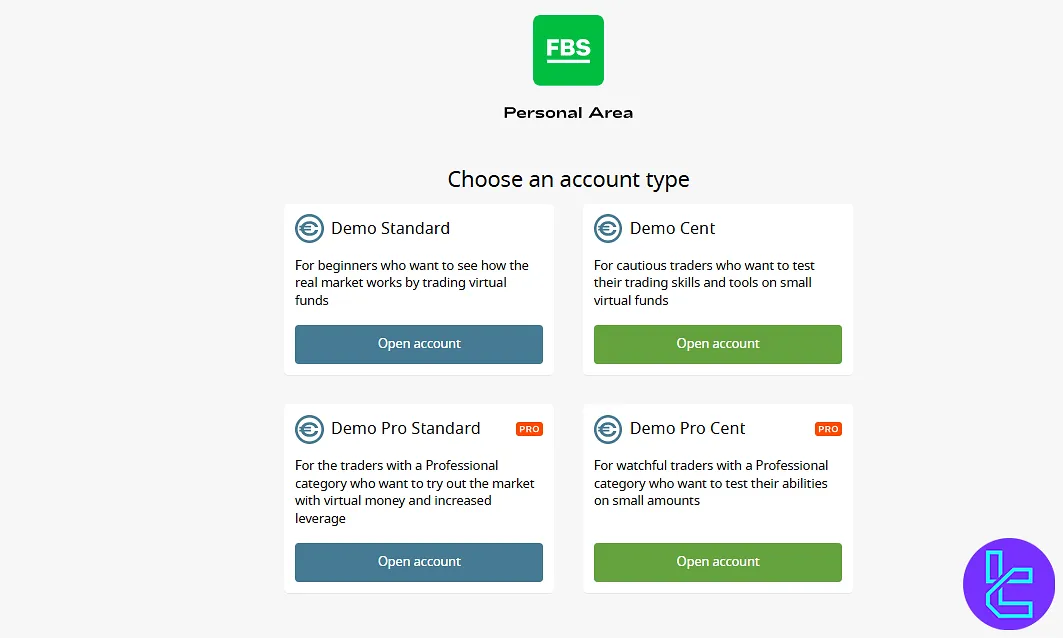

FBS EU mainly offers 4 account types, with two of them being live accounts. Let's go through the specifics of each one in the table below:

Account Type | Cent | Standard | Demo Cent | Demo Standard |

Min. Deposit | €10 (or Equivalent in USD) | €100 (or Equivalent in USD) | N/A | |

Trading Platform | MT5 | |||

Max. Leverage | 1:30 | 1:30 | ||

Max. Leverage (Pro) | 1:500 | N/A | ||

Order Volume | Max. 500 Cent Lots or 5 Standard Lots | 0.01 – 500 Lots | Max. 500 Cent Lots or 5 Standard Lots | 0.01 – 500 Lots |

Available Instruments | Forex, Metals, Indices | Forex, Metals, Stocks, Energies, Indices | Forex, Metals, Indices | Forex, Metals, Stocks, Energies, Indices |

Also, there's an Islamic account available with no interest fees on overnight positions, suitable for Muslims. In order to change an account status to Professional and access benefits such as a higher leverage, you must pass a certain survey.

Notable Benefits and Drawbacks

To help you see a clear picture of the broker and its services, let's evaluate the pros and cons of trading with FBS EU broker:

Benefits | Drawbacks |

CySEC regulation | Limited account types compared to some competitors |

Low minimum deposit of 10 EUR | Limited leverage options for retail clients |

Access to MetaTrader 5 | - |

Negative Balance Protection | - |

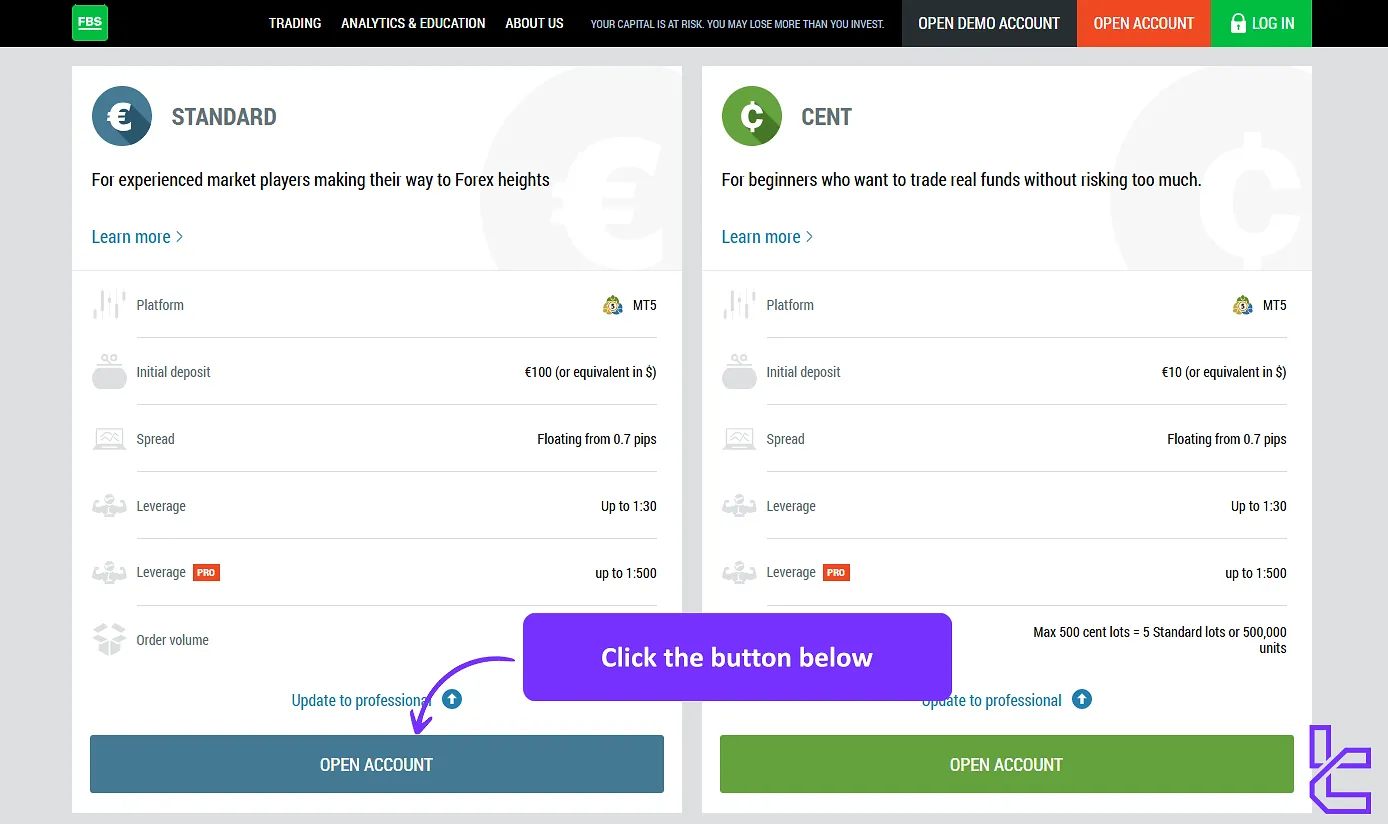

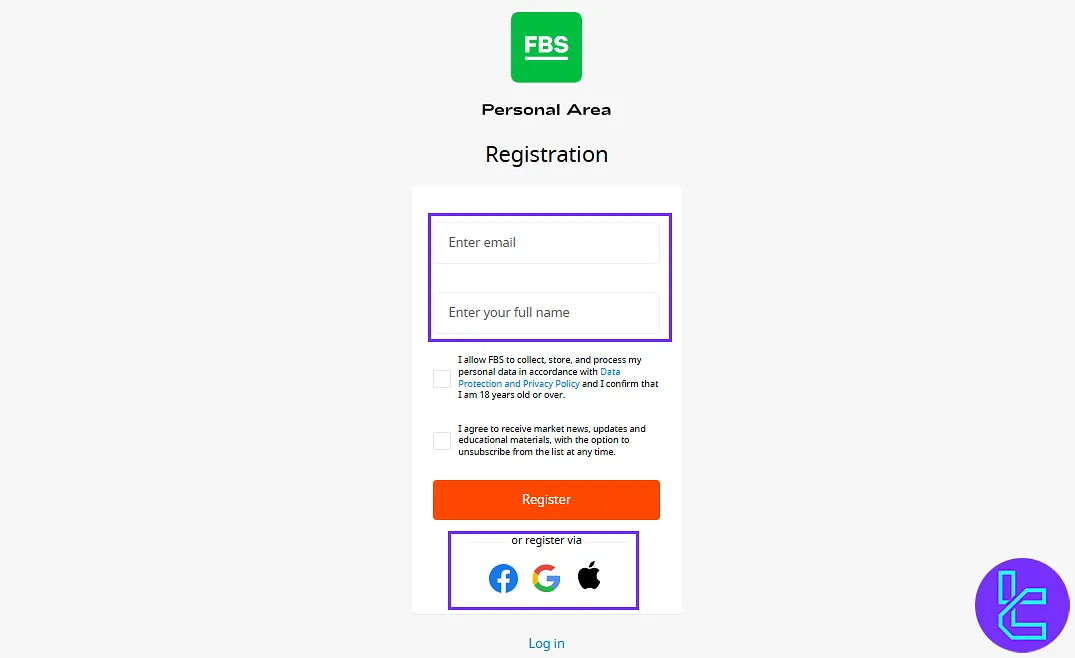

Registration and Account Verification

Creating an account with FBS EU is quick and intuitive. The process is similar to other regulated brokers and includes identity verification to comply with European standards.

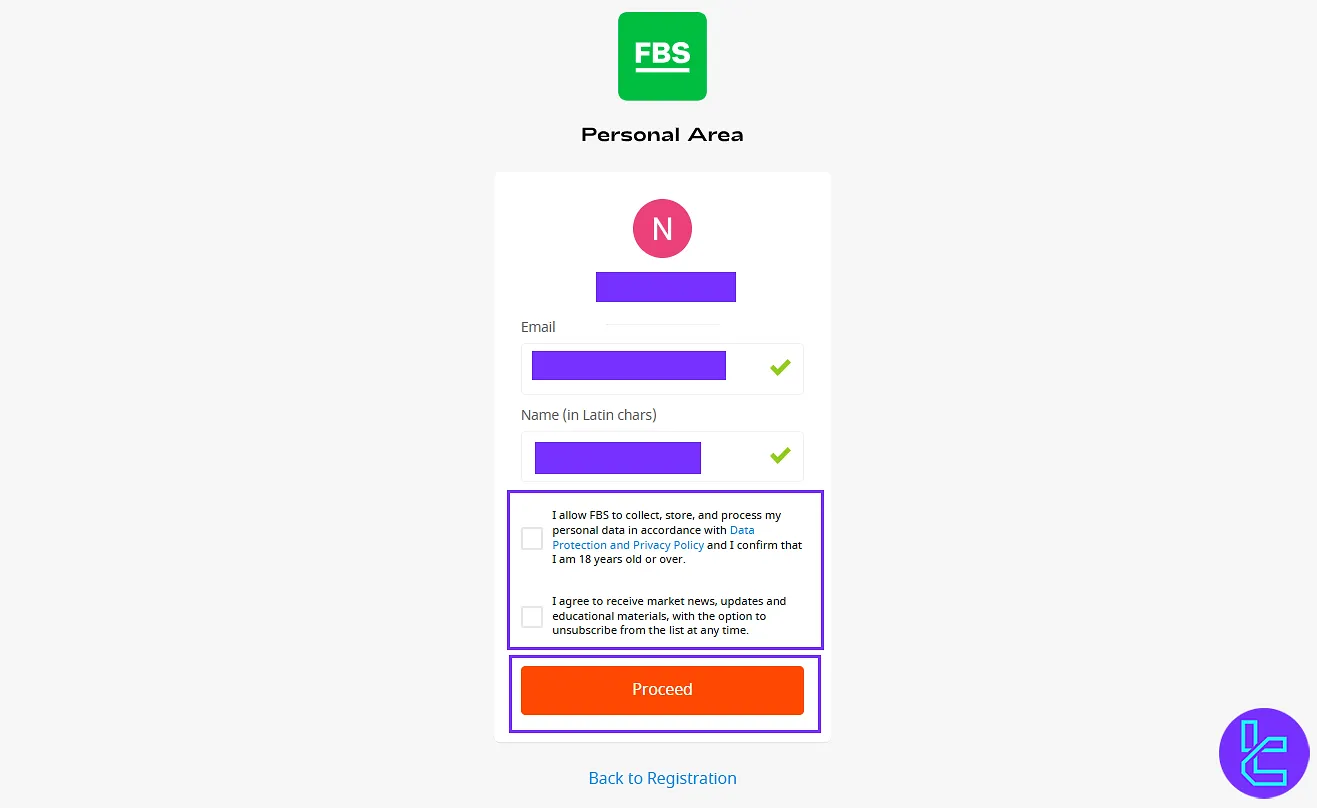

#1 Begin FBS EU Registration

Visit the official FBS EU website and click “Open Account.”

#2 Enter Your Details on FBS EU

Fill in your email address and full name, or sign up instantly using your Google, Facebook, or Apple account.

#3 Agree to the FBS EU Terms

Confirm your consent to the Client Agreement, Data Collection Policy, and Key Information Documents, then click “Register.”

#4 Choose an FBS EU Account Type

Select the most suitable account type based on your trading goals and strategy.

#5 FBS EU Account Verification Process

To fully activate your account and begin trading:

- Take a quick compliance questionnaire;

- Upload a government-issued ID (passport or national ID;)

- Submit a proof of residence (utility bill or bank statement;)

- Provide financial proof (such as a tax document or income slip.)

Trading Platforms: Does FBS EU Provide A Proprietary Option?

This broker offers the industry-standard MetaTrader 5 (MT5) platform, known for its useful features and familiar interface.

You can download or access the platform via these operating systems and facilities:

- MetaTrader Android

- MetaTrader iOS

- MetaTrader Web

- Windows

- MacOS

The FBS Trader app provides a mobile-first trading experience with intuitive navigation, fast execution, and comprehensive market access.

While it includes a safe login protocol and robust search capabilities, it currently lacks support for price alerts and biometric logins like Touch ID or Face ID.

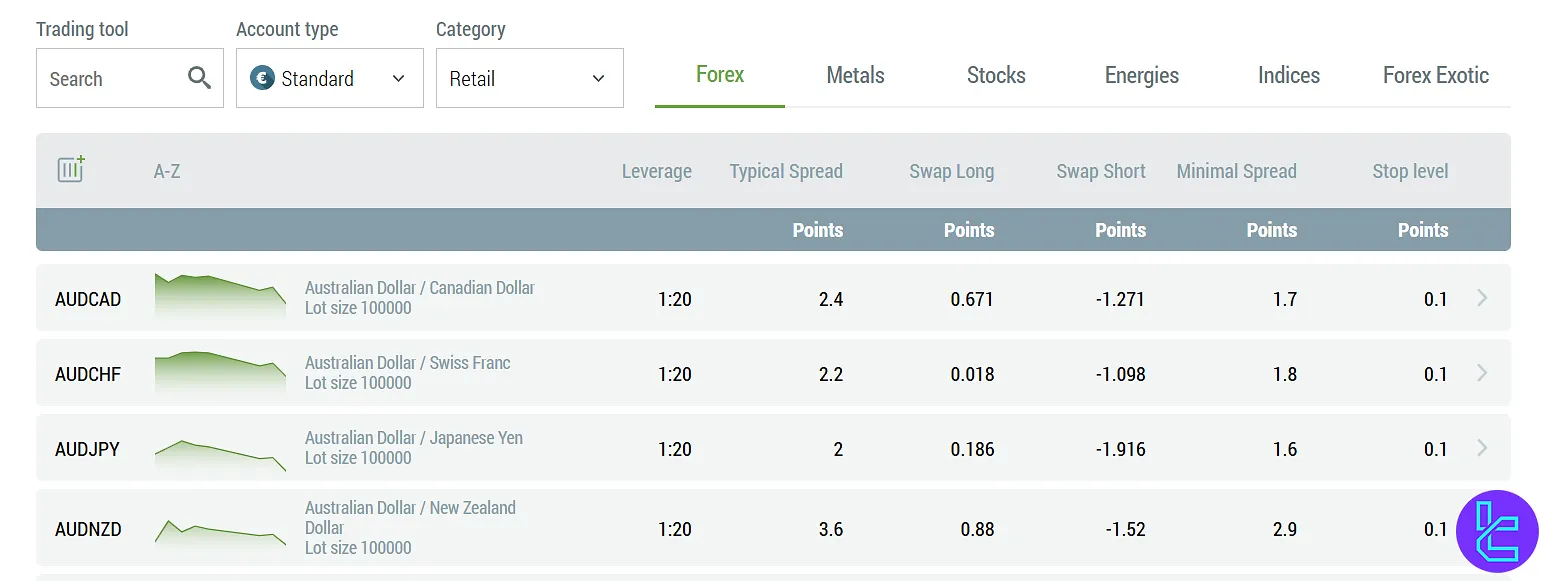

Trading Spreads, Commissions, and Other Costs

Brokerages charge their clients with commissions in various services such as trading, deposits, withdrawals, and so on. Trading Fees in FBS EU:

Account Type | Standard | Cent |

Spread | Floating from 0.7 Pips | |

Commission | None | |

Based on the investigations done by our team on the website, deposits and withdrawals normally do not incur any fees, regardless of the payment system used.

FBS EU does not apply any inactivity fees. This is particularly beneficial for low-frequency traders or investors who maintain long-term positions without the need for regular trading activity.

Use an FX profit calculator tool to estimate a trade's profit/loss considering commissions.

FBS EU incorporates its CFD trading fees directly into the spread. For instance, the average spread on Apple stock CFDs is approximately 0.1, while trading the S&P 500 index incurs a $0.09 spread cost.

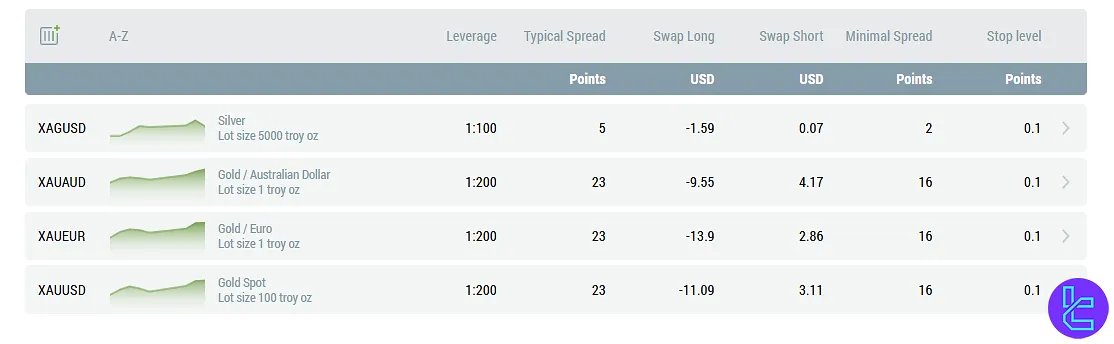

Swap Fee at FBS EU

FBS EU applies swap (rollover) charges based on the interest rate differential of the two currencies in a pair, adjusted per day and multiplied by volume and price.

The broker also offers a Swap Free / Islamic account type in which no swap is charged or credited.

Below are key details you should know:

- On Wednesdays, a 3-day swap is charged (to cover the weekend) for positions held over the rollover;

- In the Islamic account, you neither pay nor receive swap on eligible positions, provided the account is activated as such;

- For example, on the EUR/USD pair: you pay the USD interest (e.g. 1.5 %) and receive the EUR interest (e.g. 0.5 %), resulting in a net −1 % differential for long positions;

- Swap values for specific instruments are shown in the specifications pages (for instance, USD/SEK shows “Swap Long: 0 pt, Swap Short: – 34.7 pt”);

- Swap Free applies only for Muslim / Islamic traders and must be requested via support after account opening.

Non-Trading Fees at FBS EU

FBS EU’s non-trading charges are minimal and they explicitly state they do not charge for deposit or withdrawal under normal circumstances.

Below are key non-trading cost features you should know:

- Dormant / Inactivity Fee (Account fee): If an account is inactive (no logins, no trades, no deposits/withdrawals) after 2 years, the company may apply a dormant fee;

- Currency Conversion Fee: If profits or losses are in a currency different from the account’s base currency, a conversion charge may apply;

- Chargeback / Dispute Fee: The company may charge a fixed fee of € 30 to cover investigation costs for a chargeback request;

- Withdrawal Penalty if No Trading Activity: If withdrawal is requested on an account without any trading, FBS reserves the right to charge up to 3% of the withdrawn amount or cover bank costs.

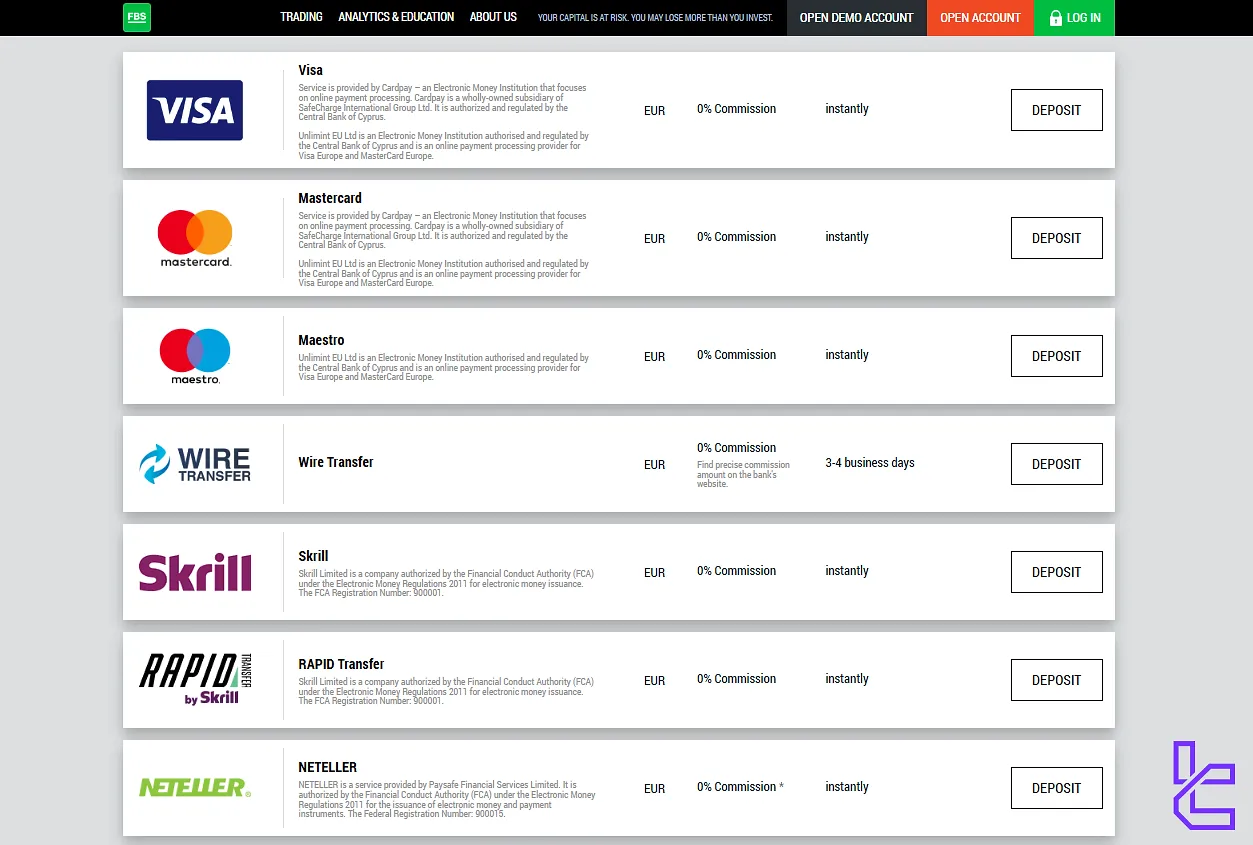

Available Payment Methods on the Broker

FBS EU provides 7 different funding options for deposits and withdrawals to its clients. Here are the methods:

- Credit/Debit Cards: Visa, Mastercard, Maestro

- E-wallets: Skrill & Neteller

- Wire Transfer: Via banks, could take3-4 business days for deposits

- Rapid Transfer: Provided by the Skrill company

How to Deposit Funds into FBS EU?

FBS EU supports several deposit channels including bank cards, e-wallets, and bank transfers, and typically imposes no commission fees on deposits from the client side.

Their “Fast Deposit” option also allows clients to fund up to €2,000 before full verification is completed.

Here are the deposit method details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit / Debit Card (Visa, Mastercard, Maestro) | EUR | N/A | 0% | Instant |

E-wallets (Skrill, Neteller) | EUR | N/A | 0% | Instant |

Wire / Bank Transfer | EUR | N/A | 0% | 3–4 business days |

Rapid Transfer (for EU) | EUR | N/A | 0% | Instant |

Fast Deposit (pre-verification) | EUR | N/A | 0% | Instant |

How to Withdraw Funds from FBS EU?

FBS EU offers several withdrawal channels like bank cards, wire transfers, e-wallets (Skrill, Neteller), and Rapid Transfer for EU users, often with zero commission and relatively fast processing times.

The company also reserves the right to charge a 5 % fee under certain conditions (e.g. withdrawing without prior trading).

Below are concrete details to help you compare options:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Visa / MasterCard / Maestro | EUR | N/A | 0% | ~15–20 min (max up to 2 days) |

Wire Transfer (Bank) | EUR | N/A | 0% | up to 48 hours internal + bank time (5–7 days) |

Skrill | EUR | N/A | 0% | ~15–20 min (max 48 hours) |

Neteller | EUR | N/A | 0% | ~15–20 min (max 48 hours) |

Rapid Transfer | EUR | N/A | 0% | ~15–20 min (max 48 hours) |

Copy Trading and Passive Earning Options on FBS EU

Per our investigations on the broker's website, it doesn't directly provide any passive income methods; however, it offers copy trading through the MT5 platform.

Traders can find their preferred signal provider on this terminal and copy the strategies. This feature is particularly beneficial for beginners or those with limited time to actively trade.

Tradable Symbols and Financial Markets

FBS EU provides access to over 300 trading instruments across 5 asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage (Retail / Professional) |

Majors, Minors, Exotics | 50+ pairs | 30–75 pairs | 1:500 | |

Metals | Gold, Silver, and others | 4 symbols | 5–10 metals | 1:200 |

Indices | Global Indices (S&P500, DAX, NASDAQ) | 11 indices | 5–10 indices | 1:100 |

Energies / Commodities | Oil (WTI, Brent) and related assets | 3 instruments | 2–5 instruments | 1:100 |

Stocks / Shares | CFDs on global companies | 120+ stocks | 200–300 stocks | 1:25 |

FBS EU offers access exclusively to CFD instruments. This means clients cannot purchase or hold physical stocks, ETFs, or other spot instruments through this broker.

The platform caters strictly to derivative-based trading across forex, metals, energies, indices, and stock CFDs.

Bonuses and Promotions

Based on the examinations at the time of writing, FBS EU does not offer any bonuses or promotions due to regulatory restrictions. This is common among CySEC-regulated brokers, as bonus offers can potentially conflict with fair trading practices.

FBS EU Awards

According to the official FBS website, the broker’s mobile application FBS Trader received the “Best Mobile Trading Platform Europe 2021” award from Global Banking & Finance Awards.

This FBS EU award was given for the platform’s user-friendly design, functional trading tools, and accessibility for European traders.

The announcement also mentioned that FBS continued improving the app by adding advanced analytical tools, multilingual support, and enhanced order management features.

Support Team Contact Options and Working Hours

FBS EU offers its support services through 4 common channels:

- Phone: +357 25 313540

- Email: info@fbs.eu

- Callback: Request form on the website

- Live Chat: Accessible from any page on the website

Support is available 24/5, Monday to Friday. Also, there's an option to visit the company at its office, located in Limassol, Cyprus. The address was mentioned earlier in the article.

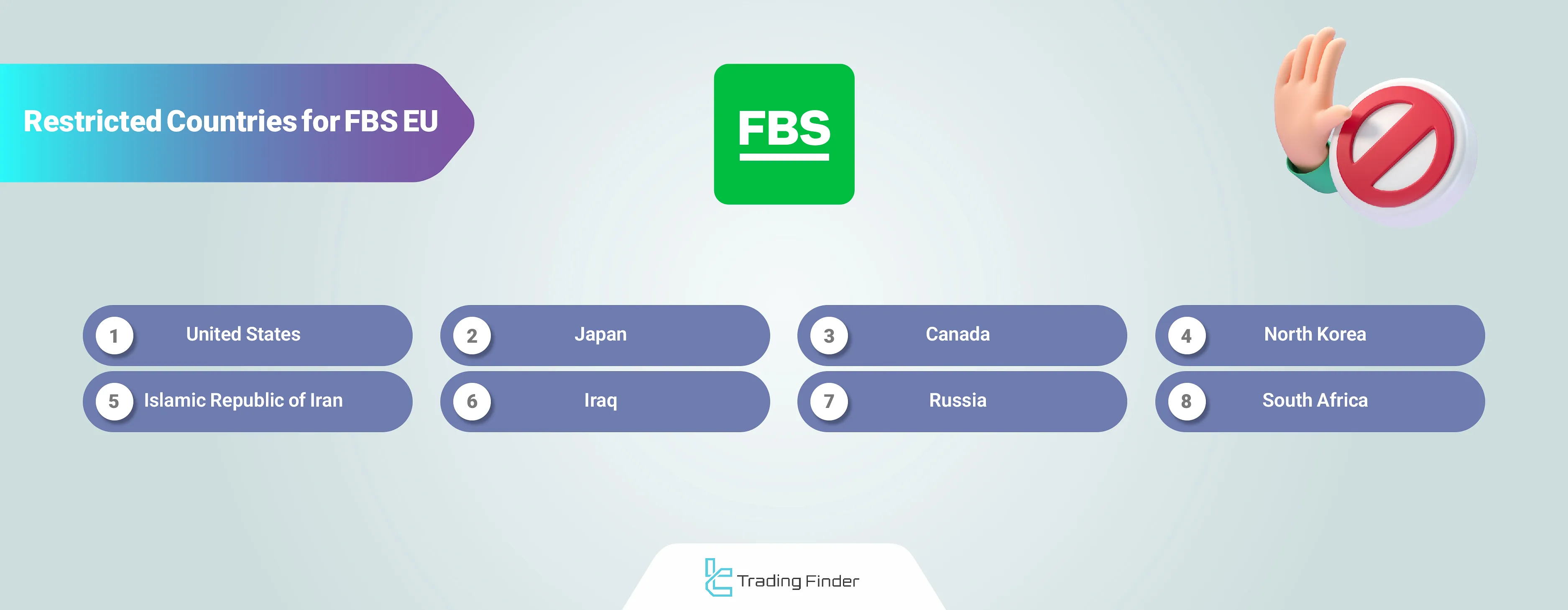

Restricted Countries and Regions

As you can guess, FBS EU operates specifically for European countries and offers its services to clients from Europe; therefore, traders from other countries cannot register on the broker. The list includes, but is not limited to:

- United States

- Japan

- Canada

- North Korea

- Iran

- Iraq

- Russia

- South Africa

- And so on

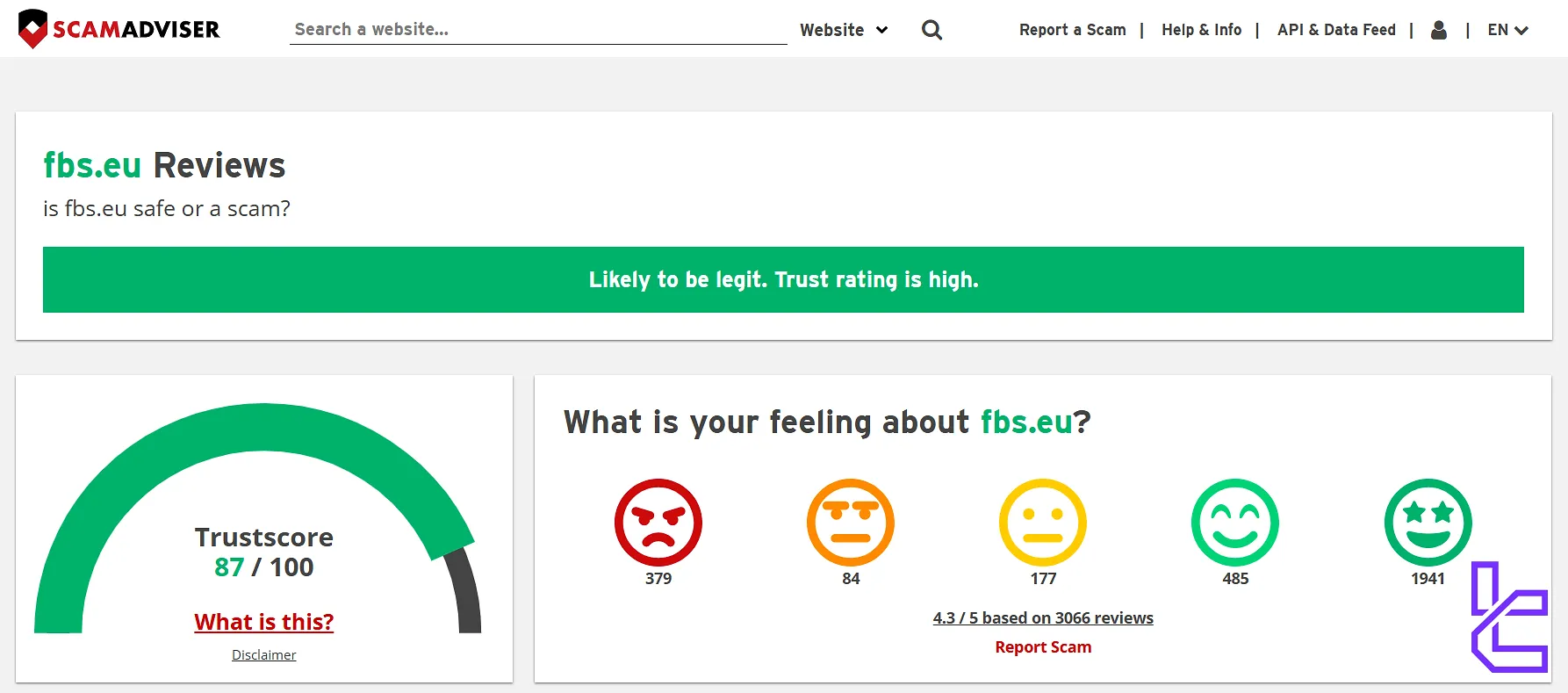

Trust Scores and Evaluations

FBS EU itself doesn't have any trust scores on typical websites such as Trustpilot and REVIEWS.io. However, ScamAdviser has submitted a trust score for its domain and received reviews from users:

- Trustscore is 87/100;

- 3/5 rating based on more than 3,000 reviews from users.

Over1,900 5-star ratings have been submitted for the broker by the users on this website.

Educational Resources and Content

FBS EU offers a decent array of educational resources in 7 sections to help traders improve their skills:

- Forex Guidebook: Articles of forex trading in Beginner, Elementary, Intermediate, and Experienced levels

- Trading Ideas: Strategies and potential trade setups

- Webinars: Live sessions with FBS professionals

- Glossary: Dictionary of trading terms

- Forex News: Market news and analysis (Not updated since 2023)

- Daily Market Analysis: Technical and fundamental analysis

- Forex Intensive: Free in-depth course for various trading levels

These resources aim to create a well-rounded learning experience for traders of all backgrounds.

FBS EU vs Other Brokers

Let's see what the differences are between FBS EU and some of the top brokers; FBS EU Comparison:

Parameter | FBS EU Broker | HFM Broker | FxPro Broker | FXGlory Broker |

Regulation | CySEC | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | 0.7 Pips | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | $0 | From $0 | From $0 | $0 |

Minimum Deposit | 10 EUR | From $0 | $100 | $1 |

Maximum Leverage | 1:500 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | MetaTrader 5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Cent, Demo Standard, Demo Cent | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 550+ | 1,000+ | 2100+ | 45 |

Trade Execution | Market, Limit, Stop, and Stop-Limit | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and Final Words

FBS EU provides 4 support channels [Phone Call, Email, Callback Request, Live Chat] to its users with a 24/5 schedule.

You can trade more than 300 instruments across 5 markets [Forex, Stocks, Indices, Metals, Energies] in this broker.

This brokerage enables access to trading tools such as an economic calendar, a currency converter, and Forex calculators.