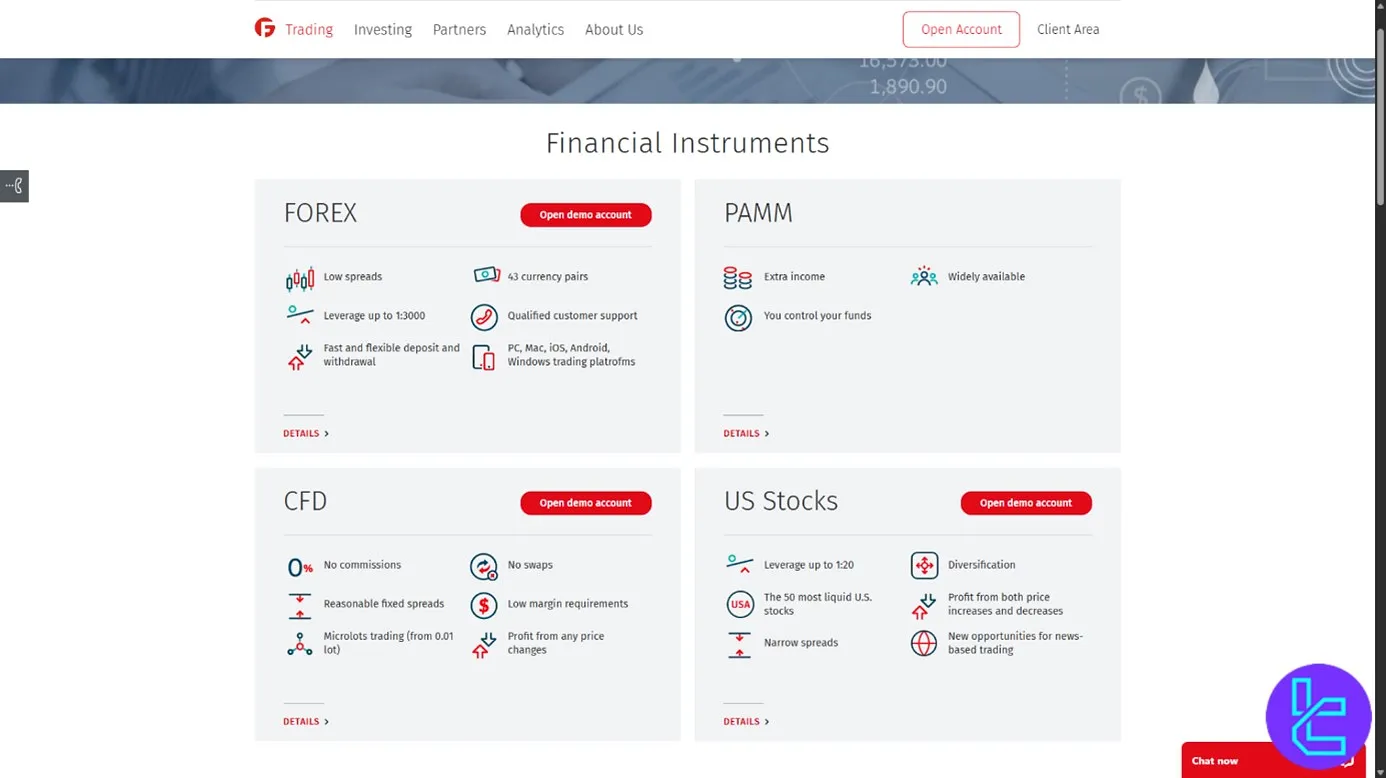

Fibo Group, founded in 1998, is a Forex and CFD broker offering MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms with leverage up to 1:1000.

The broker provides access to 60+ currency pairs, indices, commodities, and cryptocurrencies, serving clients across Europe and Asia.

Fibo Group is regulated by entities such as FSC and CySEC, ensuring a secure trading environment for global clients.

The broker offers multiple account types, including MT4 Cent, MT4 Fixed, and MT5 NDD, tailored for both beginners and professional traders.

With competitive spreads starting from 0.0 pips and commission-based or commission-free models, it appeals to diverse trading styles.

Company Information & Regulation

Fibo Group operates through several regulated entities that provide different levels of protection depending on client jurisdiction.

The broker’s main entity, FIBO Group Ltd, is incorporated in the British Virgin Islands under license number SIBA/L/14/1063.

Its European branch, FIBO Group Holdings Ltd, is authorized by the Cyprus Securities and Exchange Commission (CySEC) with license number 118/10.

This structure allows the company to serve clients in both offshore and EU markets, ensuring compliance with international standards.

Fibo Group operates under multiple regulatory entities, with different protections, leverage limits, and eligibility criteria depending on jurisdiction:

Parameter / Branches / Entity | Fibo Group (CySEC entity) | Fibo Group (BVI FSC entity) |

Regulation | CySEC, Cyprus (license 118/10) | BVI Financial Services Commission (FSC), license SIBA/L/13/1063 |

Regulation Tier | Tier-1 (EU regulation under CySEC) | Regulated (BVI FSC) but considered Tier-2 / offshore for many jurisdictions |

Country / Jurisdiction | Cyprus (Limassol) | British Virgin Islands |

Investor Protection Fund | Up to €20,000 under ICF scheme for EU/CySEC clients | No Investor Compensation Fund for BVI FSC branch |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes, for CySEC clients (retail) | Limited / not always available for some BVI clients or professional clients |

Maximum Leverage | Up to 1:30 (for retail EU clients under CySEC rules) | Up to 1:1000 on major currency pairs under BVI entity (for eligible clients) |

Client Eligibility | EU/EEA residents for CySEC-regulated branch, with retail safeguards | Clients outside EU under BVI branch, subject to local laws and restrictions |

Summary of Specifications

Fibo Group delivers tailored account structures and technology for global traders. Clients can open ECN, MT4 Fixed, or cTrader accounts with execution models designed for both retail and professional use.

Deposits start at $50, and base currencies include USD, EUR, and CHF. Fibo Group specifications:

Broker | Fibo Group |

Account Types | MT4 Cent, MT4 Fixed, MT4 NDD, MT4 NDD No Commission, MT5 NDD, cTrader NDD |

Regulating Authorities | CySEC, FSC (BVI) |

Based Currencies | USD, EUR, CHF, GBP, GLD |

Minimum Deposit | $0 (Cent Account), $50 (others) |

Deposit Methods | Bank Transfer, Visa/MasterCard, Neteller, Skrill, Crypto, E-wallets |

Withdrawal Methods | Bank Transfer, Visa/MasterCard, Neteller, Skrill, Crypto, E-wallets |

Minimum Order | From 0.01 Lot |

Maximum Leverage | Up To 1:1000 (Cent), 1:400 (others) |

Investment Options | PAMM Accounts, Copy Trading |

Trading Platforms & Apps | MT4, MT5, cTrader (Desktop & Mobile) |

Markets | Forex, Metals, Commodities, Indices, Cryptocurrencies, US Stocks |

Spread | From 0.0 Pips (NDD), Fixed ~2.0 Pips (Fixed Account) |

Commission | $3–$10 per lot (depending on account) |

Orders Execution | Market, Instant, No Dealing Desk |

Margin Call/Stop Out | 50% / 20% (varies by account) |

Trading Features | Copy Trading, PAMM Service |

Affiliate Program | Yes |

Bonus & Promotions | Occasional Deposit Bonuses, Loyalty Rewards |

Islamic Account | Yes (Swap-Free Available) |

PAMM Account | Yes |

Customer Support Ways | Email, Phone, Live Chat |

Customer Support Hours | 24/5 |

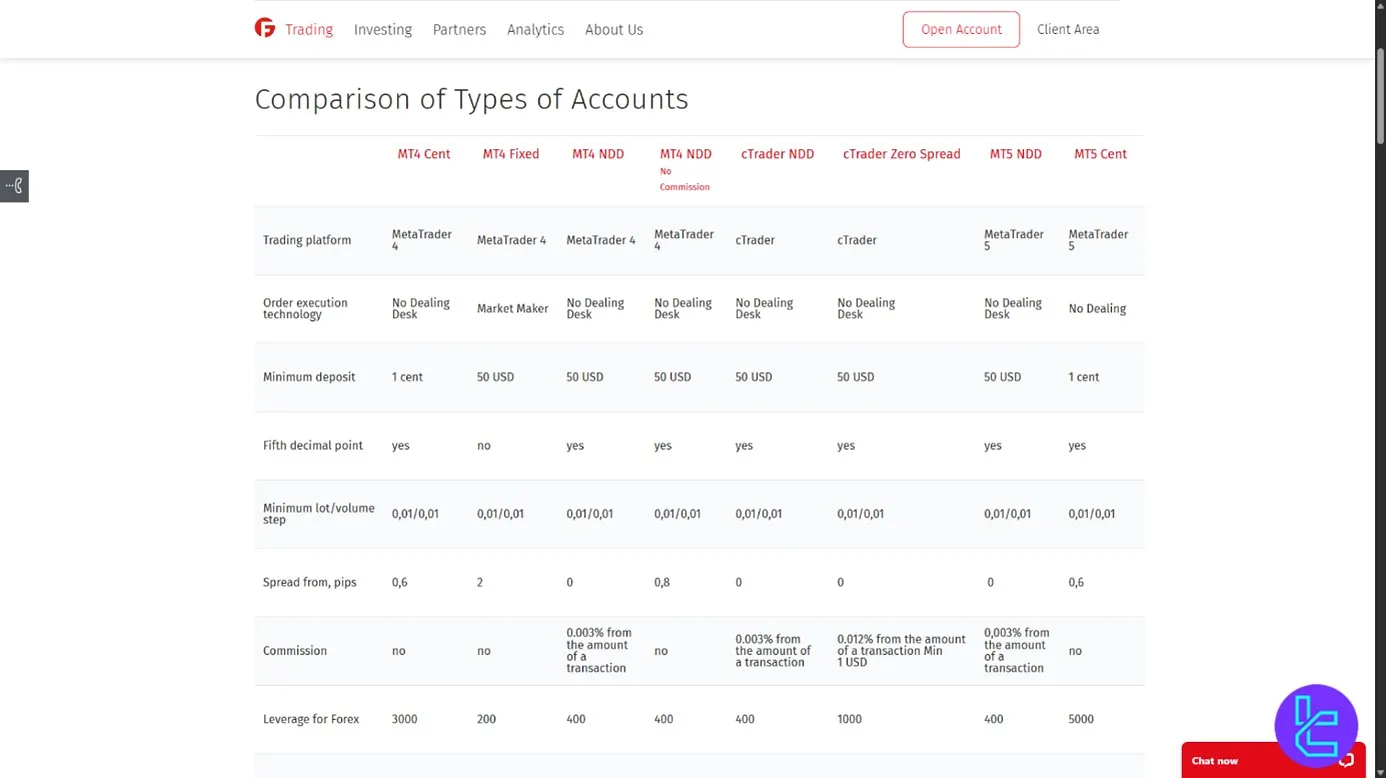

Account Types

Fibo Group offers multiple account structures designed to match different trading styles and levels of experience.

Clients can choose between the MT4 Cent Account for beginners, the MT4 Fixed Account for stability in Spreads, the MT4 NDD Account for no dealing desk execution, or the cTrader NDD Account for advanced trading with raw spreads.

Each option carries distinct features in terms of spreads, commissions, and leverage.

Account Type | MT4 Cent | MT4 Fixed | MT4 NDD | MT4 NDD No Commission | MT5 NDD | cTrader NDD |

Commission | None | None | ~$3 per lot round-turn | None | ~$10 per lot | ~$3 per lot |

Leverage | Up To 1:3000 | Up To 1:200 | Up To 1:400 | Up To 1:400 | Up To 1:400 | Up To 1:400 |

Minimum Deposit | $0.01 (1 cent) | $50 | $50 | $50 | $50 | $50 |

Spread | From ~0.6 pips | Fixed ≈2 pips | From 0 pips | From ~0.8 pips | From 0 pips | From 0 pips |

Pros & Cons

When analyzing Fibo Group, traders find both strong benefits and notable drawbacks. On the positive side, the broker offers PAMM account investments, raw spread trading via cTrader, and multilingual support.

Below is a clear breakdown of the pros and cons:

Pros | Cons |

PAMM and copy trading options | Higher commissions on ECN accounts |

Access to MT4, MT5, and cTrader | 24/5 support, no weekend service |

Multilingual customer service | Regional restrictions (no U.S. clients) |

Regulated by CySEC & FSC | Limited promotional offers |

Raw spreads from 0.0 pips | Negative balance protection not in all regions |

How to Sign Up?

Opening a trading account with Fibo Group is quick and straightforward. The process involves only four steps: providing your email, entering personal details, completing authentication, and finally recharging your account to begin trading.

The streamlined process ensures traders can access their chosen platform without unnecessary delays.

Fibo Group registration steps:

- Enter your email

- Add first and last name plus phone number

- Complete authentication process

- Recharge account and start trading

#1 Enter Your Email

The first step when signing up with FIBO Group is entering a valid email address on the registration page.

This email becomes your primary login credential and the main communication channel for verification codes, account updates, and trading notifications.

It is important to use an active and secure email address, as it will be linked to both your trading account and customer support communications.

#2 Provide Personal Details

After confirming your email, you’ll be directed to a form where you must enter your first and last name along with a valid phone number. These details are essential for verifying your identity and securing your profile.

Additionally, the phone number will be used for two-factor authentication and SMS alerts, ensuring a higher level of account safety.

- Enter full first and last name;

- Provide valid phone number for authentication;

- Confirm details to proceed.

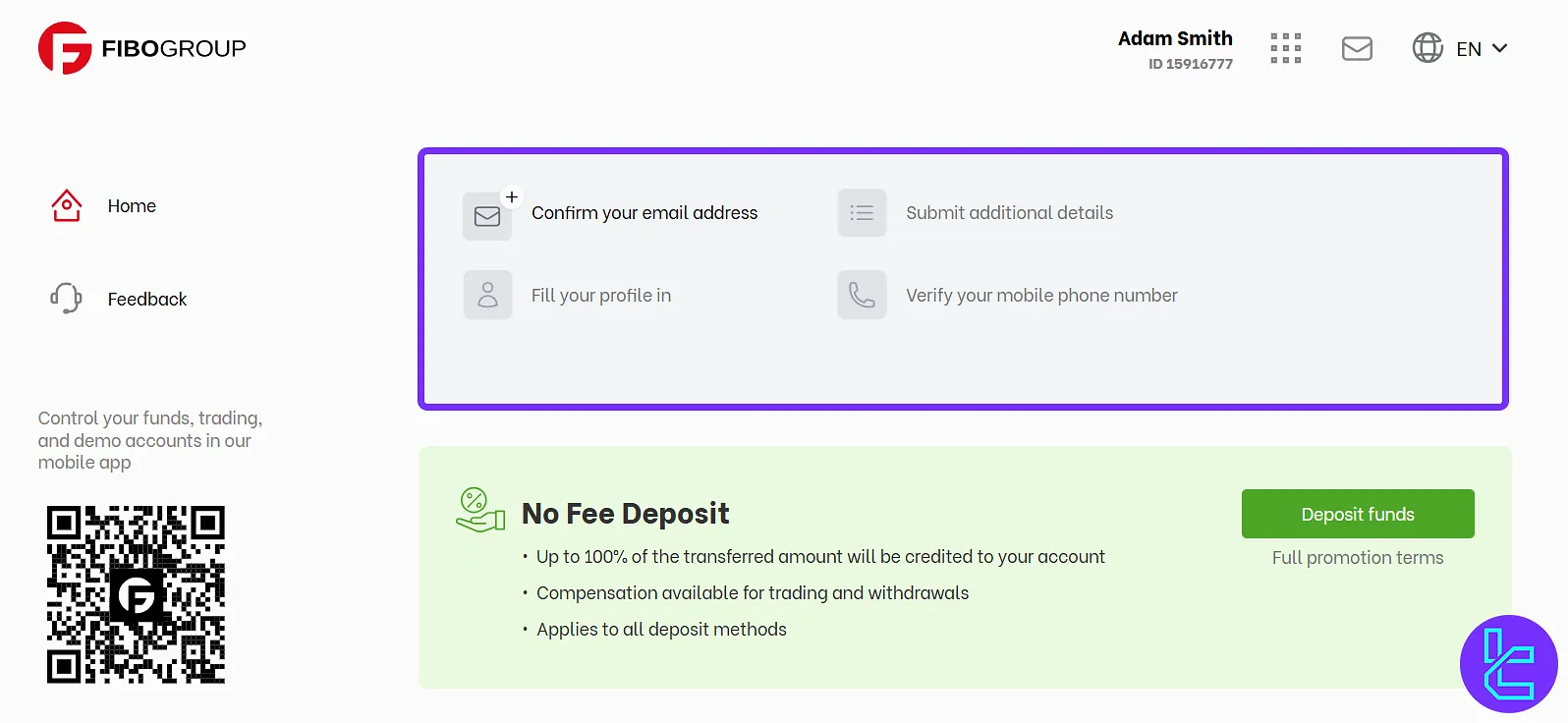

#3 Complete Authentication

The third step is the authentication process, where FIBO Group requests proof of identity and account verification.

This step ensures compliance with international regulations and protects your funds.

By submitting the required documents, traders gain full account access, including withdrawals and platform activation.

- Upload government-issued ID (passport, ID card, or driver’s license);

- Provide proof of residence such as utility bill or bank statement;

- Submit documents through the secure client portal;

- Await approval notification via email.

Fibo Group Forex Broker Bonuses

Fibo Group currently attracts traders with a 100% deposit bonus available on the MT4 Cent account, doubling the client’s initial deposit up to $1,000.

In addition, the broker offers a cashback program that rewards up to $15 per lot traded, depending on monthly volumes.

Seasonal incentives, such as reduced spreads on EUR/USD during major economic releases, are also available for active traders.

These bonuses are structured to support both beginners and experienced investors, though terms and eligibility vary by region and account type.

What Platforms are Available on Fibo Group?

Fibo Group gives traders access to multiple professional platforms suited for both manual and automated strategies.

The broker supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering algorithmic trading via Expert Advisors, multi-asset coverage, and customizable charting.

For traders who prefer modern interfaces, TradingView is available with integrated analytics, advanced indicators, and social trading features to share or copy strategies.

Additionally, cTrader provides Level II pricing, ultra-fast execution, and advanced order types, making it ideal for scalpers and high-frequency traders.

Fibo Group Spreads and Commissions Overview

Fibo Group offers both commission-free (fixed/floating) and commission-based NDD/ECN accounts, so trading costs depend on the account selected.

Standard accounts show EUR/USD spreads around 0.1–0.2 pips, while ECN/RAW accounts offer market-driven spreads from ~0.1 pips plus a ≈$3 per-lot commission; MT5 and cTrader ECN variants carry slightly different per-lot fees.

These costs are consistent with Fibo’s multiple account tiers (Cent, Fixed, NDD, cTrader) and vary by instrument and jurisdiction.

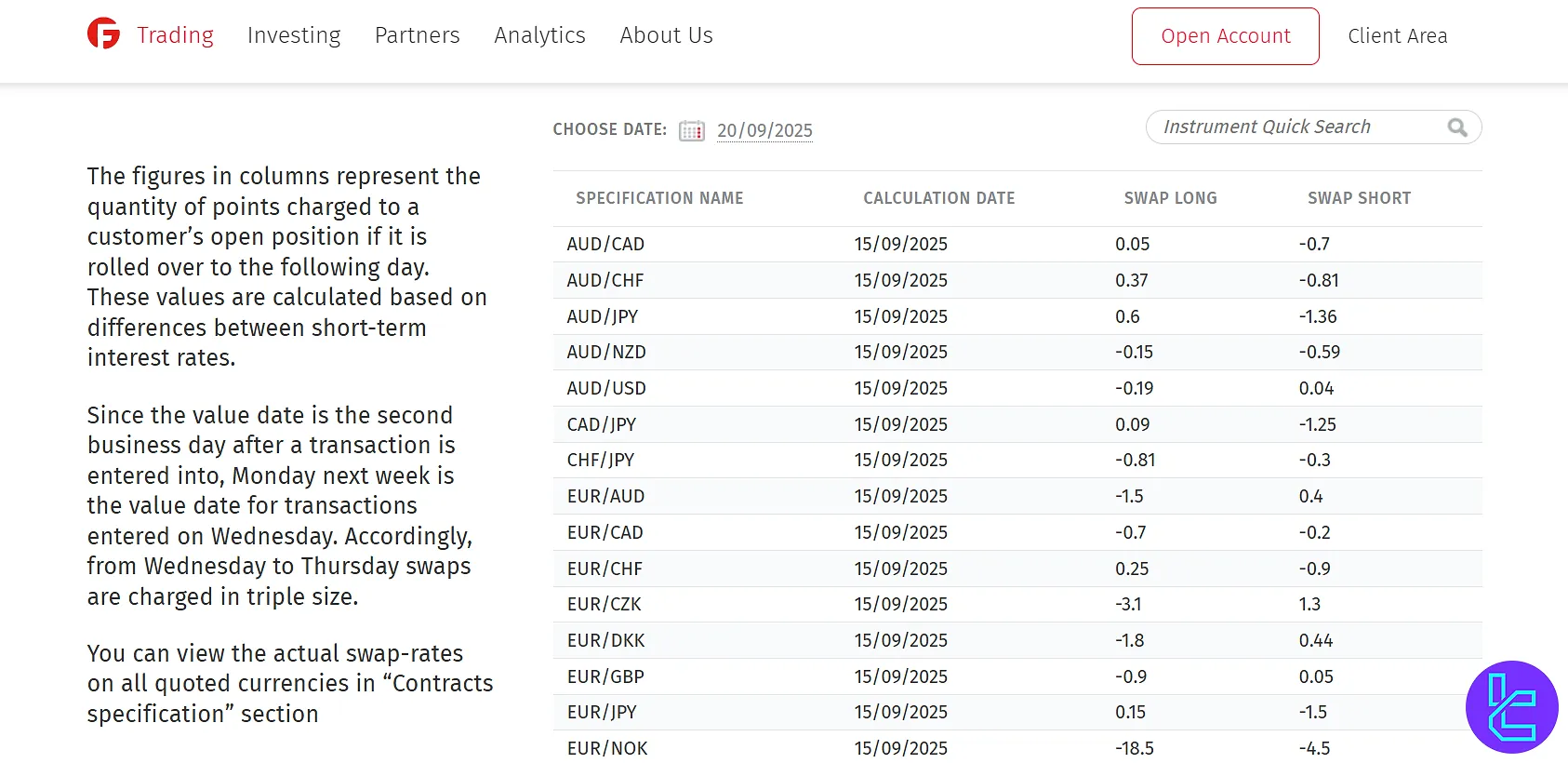

Swap Fees

Overnight swap rates at Fibo Group depend on the currency pair, trade direction (long/short) and prevailing interbank rates; swaps can be positive or negative and are displayed in each platform’s instrument specification.

Fibo also offers swap-free (Islamic) accounts on eligible account types for clients who qualify.

Non-Trading Fees

- Deposit fees vary by method (card/e-wallet typically charged by provider; bank wires may incur bank fees);

- Withdrawal fees depend on method (e-wallets often free; bank wires reported $35–$50 in some cases);

- Crypto network fees apply and are not reimbursed by Fibo Group;

- Inactivity fee: generally no monthly inactivity charge reported in recent evaluations; check your client agreement for country-specific terms.

For transparency, always review the live Fees & Conditions page in your client area before funding or trading.

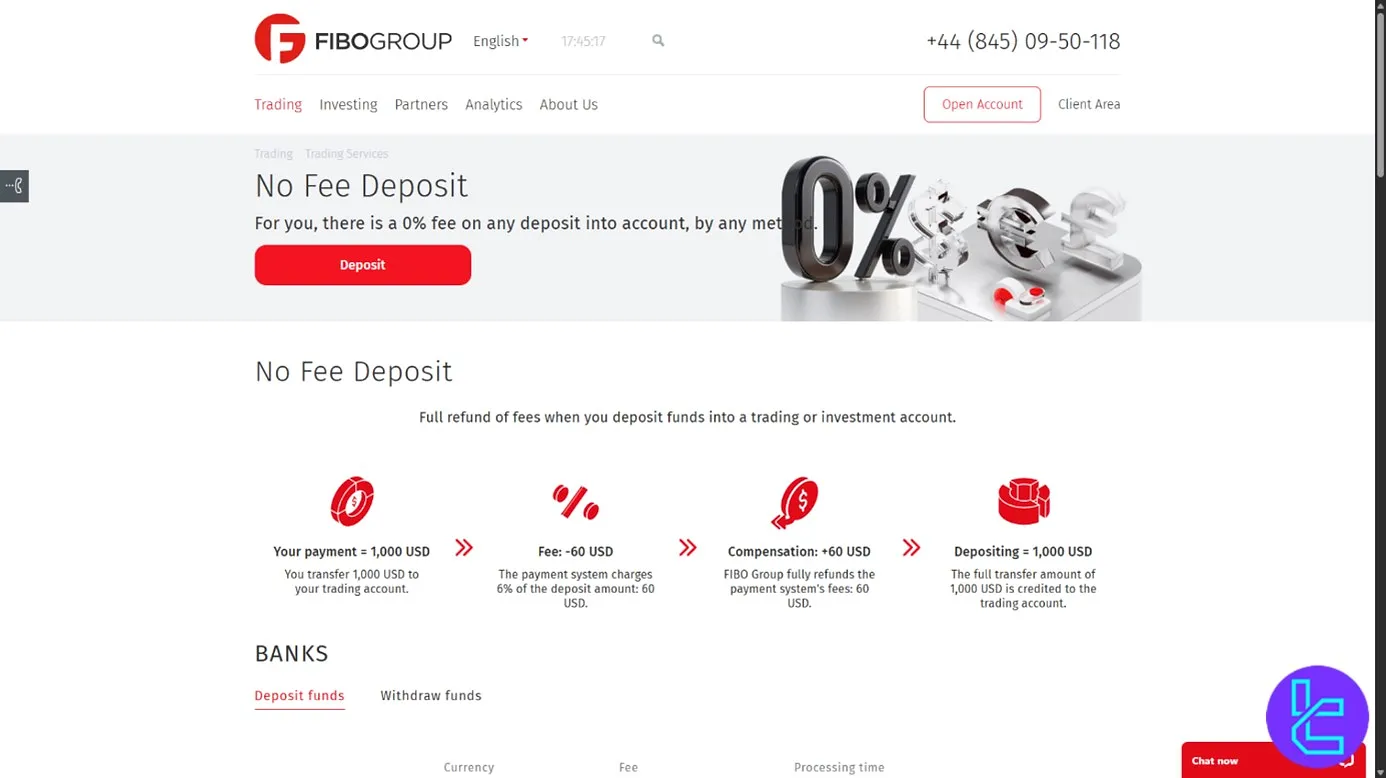

Deposit & Withdrawal Methods on Fibo Group

Fibo Group offers a diverse range of deposit and withdrawal methods to cater to its global clientele.

Clients can fund their accounts using traditional methods such as bank transfers (SEPA, SWIFT), major credit and debit cards (Visa, Mastercard), and popular e-wallets (Skrill, Neteller, WebMoney).

Additionally, Fibo Group supports cryptocurrency payments through platforms like BitPay, Raido, and Blockchain, allowing for faster and more flexible transactions.

Withdrawals can be processed through the same methods, with varying fees and processing times depending on the chosen option.

Deposit Options

Fibo Group provides multiple deposit options to accommodate traders worldwide. From traditional bank transfers to modern e-wallets and cryptocurrencies, clients have the flexibility to choose the method that best suits their needs.

It's important to note that while some deposit methods are instant, others may take longer to process. Fibo Group deposit methods:

Option | Accepted Currencies | Deposit Fee | Processing Time |

SEPA | EUR | Free | 1–2 business days |

SWIFT | USD, EUR, GBP, CHF | Free | 2–5 business days |

Visa/Mastercard | USD, EUR | Free | Instant |

Neteller | USD, EUR | 4.9% | Instant |

Skrill | USD, EUR | 3.9% | Instant |

WebMoney | USD, EUR | 0.8% | Instant |

Cryptocurrencies | BTC, ETH, USDT | Network fee | Instant to hours |

Withdrawal Solutions

When it comes to withdrawals, Fibo Group offers various methods, each with its own processing times and fees.

Cryptocurrency withdrawals are often the fastest and may have lower fees, while traditional methods like bank transfers and card payments might take longer and incur higher fees. Fibo Group withdrawl solutions:

Withdrawal Solution | Processing Time | Withdrawal Fee |

SEPA | 3–5 business days | 35–50 USD |

SWIFT | 3–5 business days | 35–50 USD |

Visa/Mastercard | 1–5 business days | 2.5% + 1.5 EUR |

Neteller | 2 business days | 2% (min 1 USD/EUR) |

Skrill | Several minutes | 1% |

WebMoney | 2 business days | 0.8% (max 50 USD/EUR) |

Cryptocurrencies | Instant to hours | Network fee |

Fibo Group Copy Trading

Fibo Group provides Copy Trading services through its cTrader platform, enabling traders to replicate the strategies of experienced professionals.

This feature is particularly beneficial for beginners or those with limited time to trade, as it allows them to leverage the expertise of seasoned traders.

It's important to note that a 15% commission is charged on the profits earned from copy trading, which is automatically deducted when funds are withdrawn from the trading account.

- Platform: cTrader

- Commission: 15% of profits earned from copied trades

- Accessibility: Available on desktop and mobile devices

- Strategy Selection: Ability to choose from a variety of strategy providers

- Performance Metrics: Detailed statistics to evaluate potential strategy providers

- Automation: Automatic copying of trades from selected strategy providers

- Risk Management: Options to set stop-loss and take-profit levels for copied trades

- Account Types: Compatible with various Fibo Group account types, including MT4 and MT5

What Instruments and Assets are Tradable on Fibo Group?

Fibo Group provides a wide range of financial instruments designed for both retail and professional traders.

The broker offers Forex trading with access to major, minor, and exotic pairs, alongside commodities like gold, silver, and crude oil.

Clients can also diversify through global indices such as DE40, US500, and JP225, or trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin with competitive leverage.

Additionally, CFDs on international shares allow investors to gain exposure to global equity markets without direct ownership.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, Minor, and Exotic Currency Pairs | 50+ Pairs | 50–70 Pairs | Up to 1:1000 |

Shares | CFDs on International Stocks | 800+ Stocks | 800–1200 | Up to 1:50 |

Commodities | CFDs on Precious Metals & Energies | 15 Instruments | 10–20 Instruments | Up to 1:200 |

Indices | CFDs on Global Indices (DE40, US500, JP225) | 14 Indices | 10–20 Indices | Up to 1:100 |

Cryptos | CFDs on BTC, ETH, LTC, and More | 30+ Coins | 20–40 Coins | Up to 1:20 |

Restricted Countries

Fibo Group adheres to regulatory requirements and legal restrictions that limit its services in certain jurisdictions.

As a result, individuals residing in specific countries are not eligible to open trading accounts or access the broker's services.

These restrictions are in place to comply with international financial regulations and ensure that Fibo Group operates within the legal frameworks of various regions.

For the most accurate and up-to-date information, prospective clients should refer to the "Documents" section on Fibo Group's official website, where the full list of restricted countries is provided.

- United Kingdom

- United States

- North Korea

- Australia

- Israel

- Japan

- Belgium

- Iraq

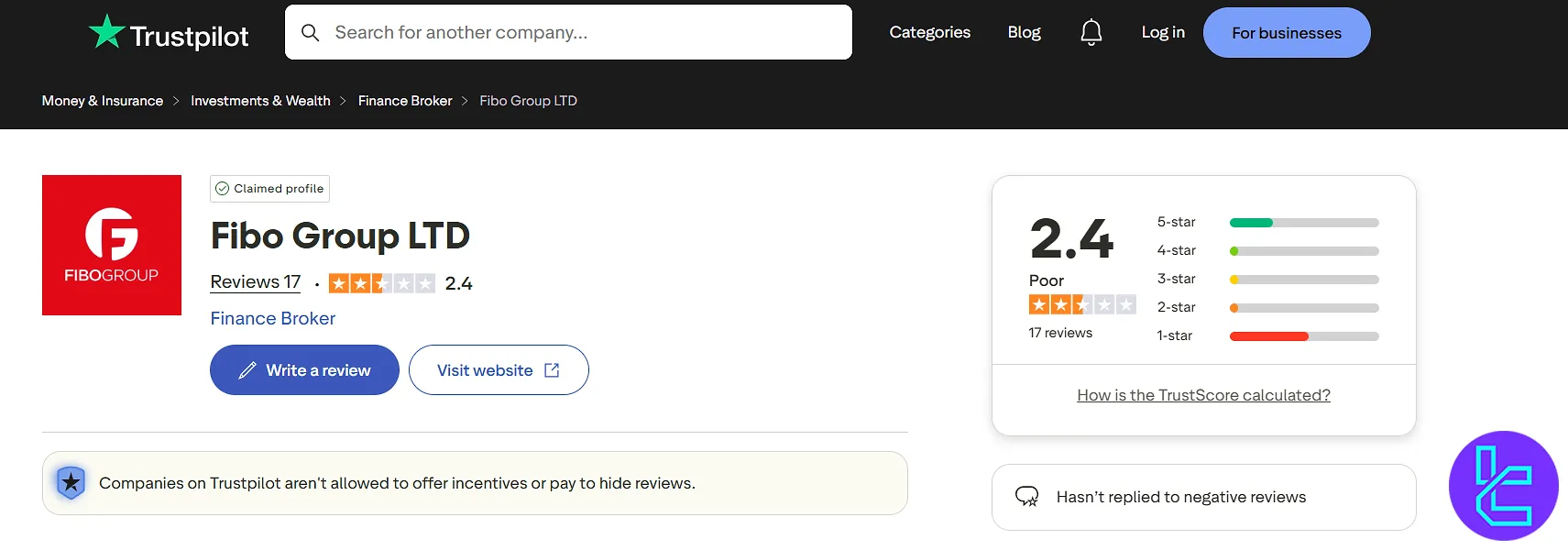

Trust Scores

Fibo Group has garnered mixed reviews across various platforms, reflecting a diverse range of trader experiences.

On Fibo Group Trustpilot, the broker holds a rating of 2.0 out of 5 based on 14 reviews, with 42.86% awarding it five stars Traders Union.

Conversely, on Myfxbook, Fibo Group receives a solid rating of 5 out of 5, with users praising its platform, pricing, customer service, and features Myfxbook.com.

Additionally, Traders Union assigns Fibo Group a TU Overall Score of 6.82 out of 10, indicating a moderate trust level Traders Union.

These varying scores suggest that while some traders have positive experiences, others have encountered challenges.

Awards

Fibo Group has earned several accolades over the years, recognizing its excellence in various aspects of financial services.

In 2015, at the Moscow Forex Expo, Fibo Group was honored with three awards: Best Forex Broker in Russia and CIS, Best Standard Forex Broker, and Best Analytical Support Service GlobeNewswire.

Additionally, in 2014, the company received the Best PAMM Service Broker award at the China International Online Trading Awards Topbrokers.

These recognitions highlight Fibo Group's commitment to providing quality services and support to its clients.

Notable Fibo Group awards:

- 2015 Moscow Forex Expo

- Best Forex Broker in Russia and CIS

- Best Standard Forex Broker

- Best Analytical Support Service

- 2014 China International Online Trading Awards: Best PAMM Service Broker

- 2013 Forex Expo: Best 24/5 Customer Service

- 2013 MENA Forex Expo Dubai: Best Forex Execution House

Customer Services

Fibo Group provides comprehensive customer support to assist traders across various regions.

Their support channels include telephone, email, and a callback service, available 24/5 in multiple languages such as English, Spanish, Italian, Portuguese, Polish, Indonesian, and Vietnamese Sashares.

- Email Support: service@fibogroup.com

- Phone Support: +357 25 030 930

- Callback Service: Available upon request via the website

- Discord Community: Fibo Group Discord Server

- Live Chat: Accessible through the official website

- Social Media: Active on platforms like Telegram, YouTube, Twitter, Instagram, LinkedIn, and Facebook

Fibo Group Educational Resources

Fibo Group offers a comprehensive suite of educational tools designed to support traders at all levels.

Their resources include video courses, expert analyses, and a dedicated academy platform. These materials aim to enhance traders' understanding of the financial markets and improve their trading strategies.

Additionally, Fibo Group provides a frequently updated FAQ section to address common client inquiries.

- Video Courses: Free Forex training covering basics and advanced strategies

- Fibo Academy: Structured learning for comprehensive market understanding

- Expert Analyses: Daily market insights and forecasts from seasoned professionals

- FAQ Section: Detailed answers to common client questions

- Trading Glossary: Comprehensive terms and definitions for traders

- Webinars and Workshops: Interactive sessions for real-time learning

- Analytical Reviews: In-depth articles and reports on market trends

- Mobile App Resources: Access to educational content via the Fibo Forex Drive app

Fibo Group in Comparison with Others

When comparing Fibo Group with other prominent brokers, key metrics such as regulation, spreads, and account types highlight the differences and strengths of each broker.

This comparison helps traders evaluate options based on their trading style and requirements.

Parameters | Fibo Group Broker | |||

Regulation | VFSC, ASIC | FSC, CySEC | FCA, CySEC | CySEC, FSCA |

Minimum Spread | From 0.3 Pips | From 0.2 Pips | From 0.1 Pips | From 0.5 Pips |

Commission | From $18 per 100k units | From $10 per 100k units | From $15 per 100k units | From $5 per 100k units |

Minimum Deposit | $50 | $5 | $100 | $10 |

Maximum Leverage | 1:500 | 1:1000 | 1:500 | 1:1000 |

Trading Platforms | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 |

Account Types | Standard, ECN, Demo | Standard, Premium, VIP | Standard, ECN | Standard, ECN, Micro |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 50+ | 300+ | 250+ | 200+ |

Trade Execution | STP, ECN | Market | Market | Market |

Conclusion

Fibo Group provides a diverse range of account types, including MT4 NDD, MT4 Cent, MT4 Fixed, MT5 NDD, and cTrader NDD, catering to various trading preferences.

The broker offers competitive spreads, with some accounts featuring spreads from 0 pips, and commissions as low as 0.003% per transaction.

Traders benefit from high leverage options up to 1:1000, depending on the account type.

Additionally, Fibo Group supports multiple deposit and withdrawal methods, including SEPA, SWIFT, MasterCard, Neteller, Skrill, BitPay, and cryptocurrencies.

While the broker offers Islamic accounts and copy trading services, it's important to note that certain regions, such as the United Kingdom, North Korea, and the United States, are restricted from accessing Fibo Group's services.