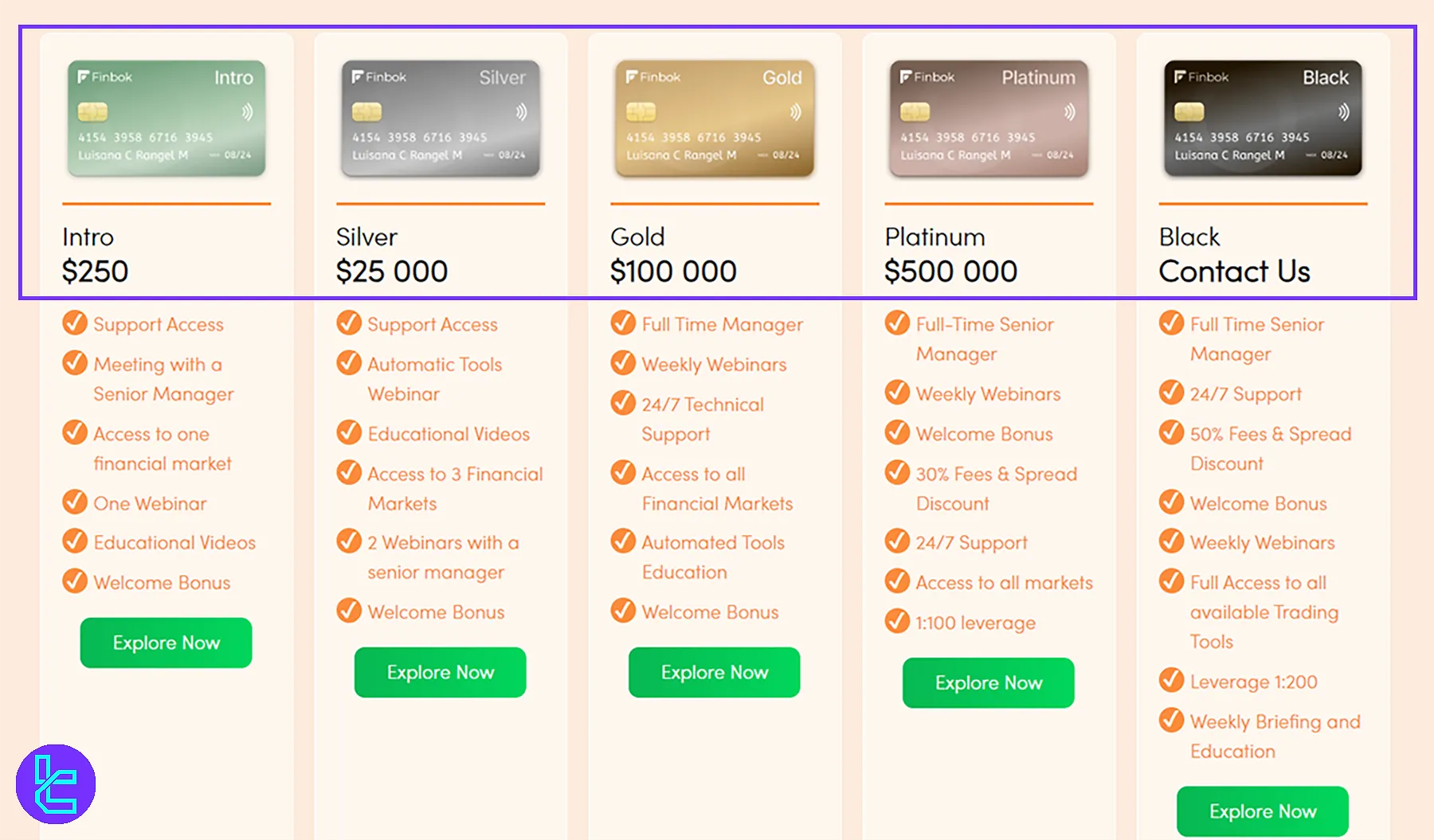

Finbok broker offers 5 different account types, including the Intro Account starting at $250, the Silver at $25,000, the Gold at $100,000, the Platinum at $500,000, and the Black, which requires direct consultation.

The trading platform is web-based and integrates TradingView charts. Traders can benefit from 0% commission.

Deposit and withdrawal methods are fee-free, and withdrawals are processed within3-4 working days. The broker also offers a 30% bonus on additional trading volume, with a volume requirement of (Deposit + Bonus) * 20,000.

Finbok Broker Company Information & Regulation Status

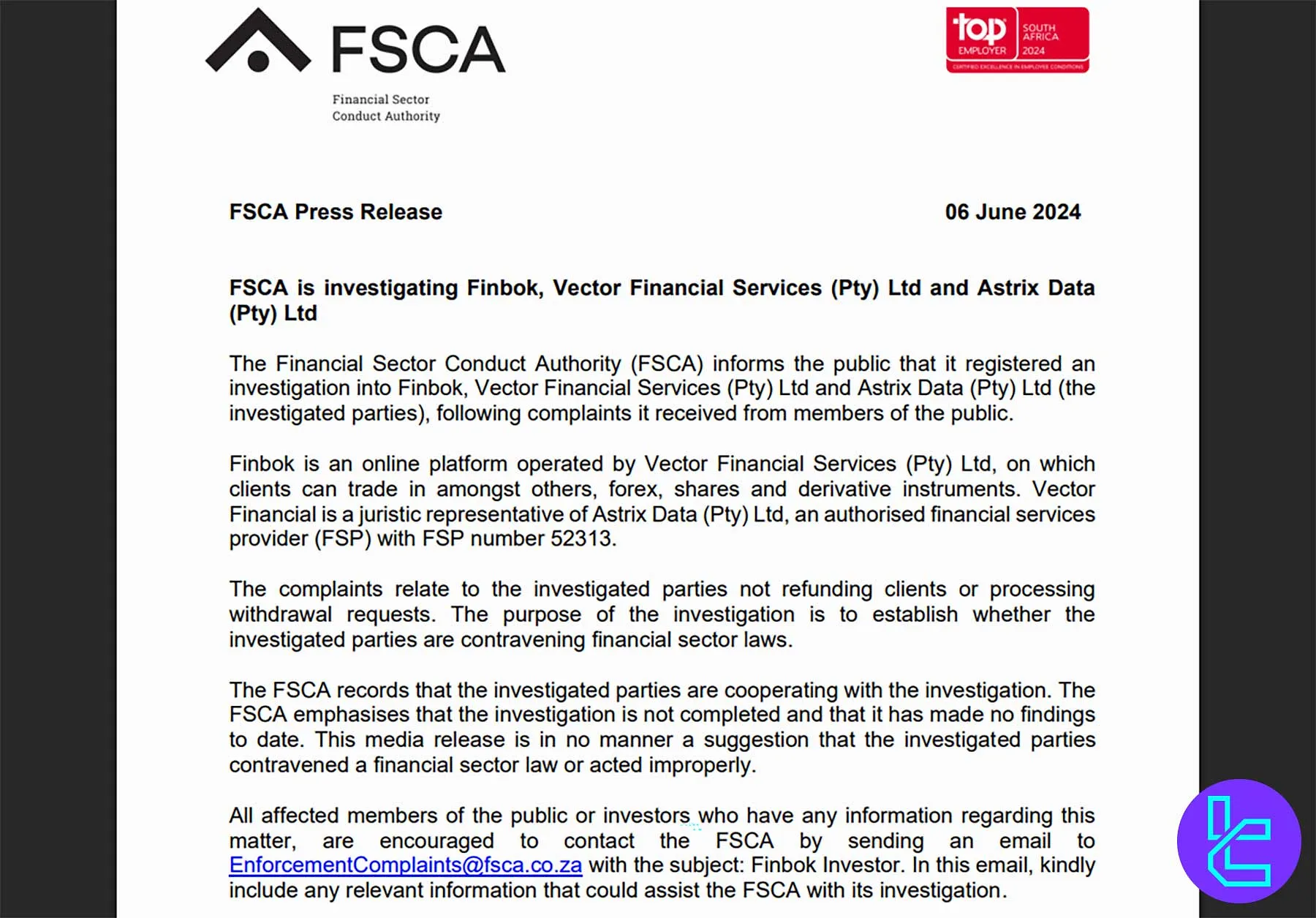

Founded in 2018, Finbok began as a South Africa-based forex and CFD contracts broker regulated by the Financial Sector Conduct Authority (FSCA). In 2024, the FSCA publicly confirmed an ongoing investigation into Finbok, Vector Financial Services (Pty) Ltd, and Astrix Data (Pty) Ltd following client complaints about withdrawal delays.

- Previous Oversight: FSCA of South Africa (FSP 52313)

- Investigation Status: Active FSCA investigation (June 2024) regarding withdrawal and refund concerns

- Current Operator: Nova Capital Ltd (Reg. No. 15693)

- Regulator: Anjouan Offshore Finance Authority (AOFA)

- License Number: L15693/NC

- Registered Address: Hamchako, Mutsamudu, The Autonomous Island of Anjouan, Union of Comoros

- Trading Instruments: Forex, commodities, indices, stocks, and cryptocurrencies

The Forex broker emphasizes a dual focus on usability and depth, providing enough flexibility for beginners while equipping professionals with advanced capabilities.

Finbok places high importance on account safety by implementing industry-standard encryption technologies and two-factor authentication (2FA).

These safeguards ensure that personal information and funds remain protected at all times. With continuous monitoring and secure infrastructure, the broker creates a trustworthy environment for digital trading.

| Entity Parameters/Branches | Nova Capital Ltd |

Regulation | AOFA |

Regulation Tier | 4 |

Country | Comoro Islands |

Investor Protection Fund/Compensation Scheme | No |

Segregated Funds | No |

Negative Balance Protection | No |

Maximum Leverage | 1:200 |

Client Eligibility | Global |

Finbok Broker Summary of Specifics

Let's break down Finbok's key specifics; Finbok Features:

Broker | Finbok |

Account Types | Intro, Silver, Gold, Platinum, Black |

Regulating Authorities | AOFA |

Based Currencies | N/A |

Minimum Deposit | $250 |

Deposit/Withdrawal Methods | Visa, Mastercard, Visa, DPO pay, Ozow, AstroPay, Wire Transfer, |

Minimum Order | N/A |

Maximum Leverage | 1:200 |

Investment Options | No |

Trading Platforms & Apps | Own Platform |

Markets | Forex, Indices, Stocks, Commodities |

Spread | Varies |

Commission | $0 |

Orders Execution | Market, Pending Orders |

Margin Call/Stop Out | N/A |

Trading Features | Economic Calendar, Daily News |

Affiliate Program | N/A |

Bonus & Promotions | YES |

Islamic Account | YES |

PAMM Account | No |

Customer Support Ways | Email, Online, Ticket, Phone Call |

Customer Support Hours | N/A |

Finbok Types of Accounts

The broker offers a tiered account structure with 5 different account types to choose from. Finbok accounts:

Account Type | Cost | Leverage | Webinars |

Intro Account | $250 | N/A | One Webinar |

Silver Account | $25,000 | N/A | Automatic Tools Webinar |

Gold Account | $100,000 | N/A | Weekly |

Platinum Account | $500,000 | 1:100 | Weekly |

Black Account | Contact Broker | 1:200 | Weekly |

It's worth noting that demo accounts are available for all but the highest deposit accounts (Platinum and Black). This lets new traders get a feel for the platform before committing to real funds.

Finbok’s Advantages and Disadvantages

Finbok's strengths make it a good choice for beginners. However, more experienced traders might find the lack of some advanced features less appealing; Finbok Pros and Cons:

Advantages | Disadvantages |

User-friendly platform | Higher than average trading fees |

Wide range of trading instruments | Limited advanced features |

Regulated by FSCA | No mobile app or desktop platform |

Negative balance protection | Customer support focused on SA |

Segregated client funds | - |

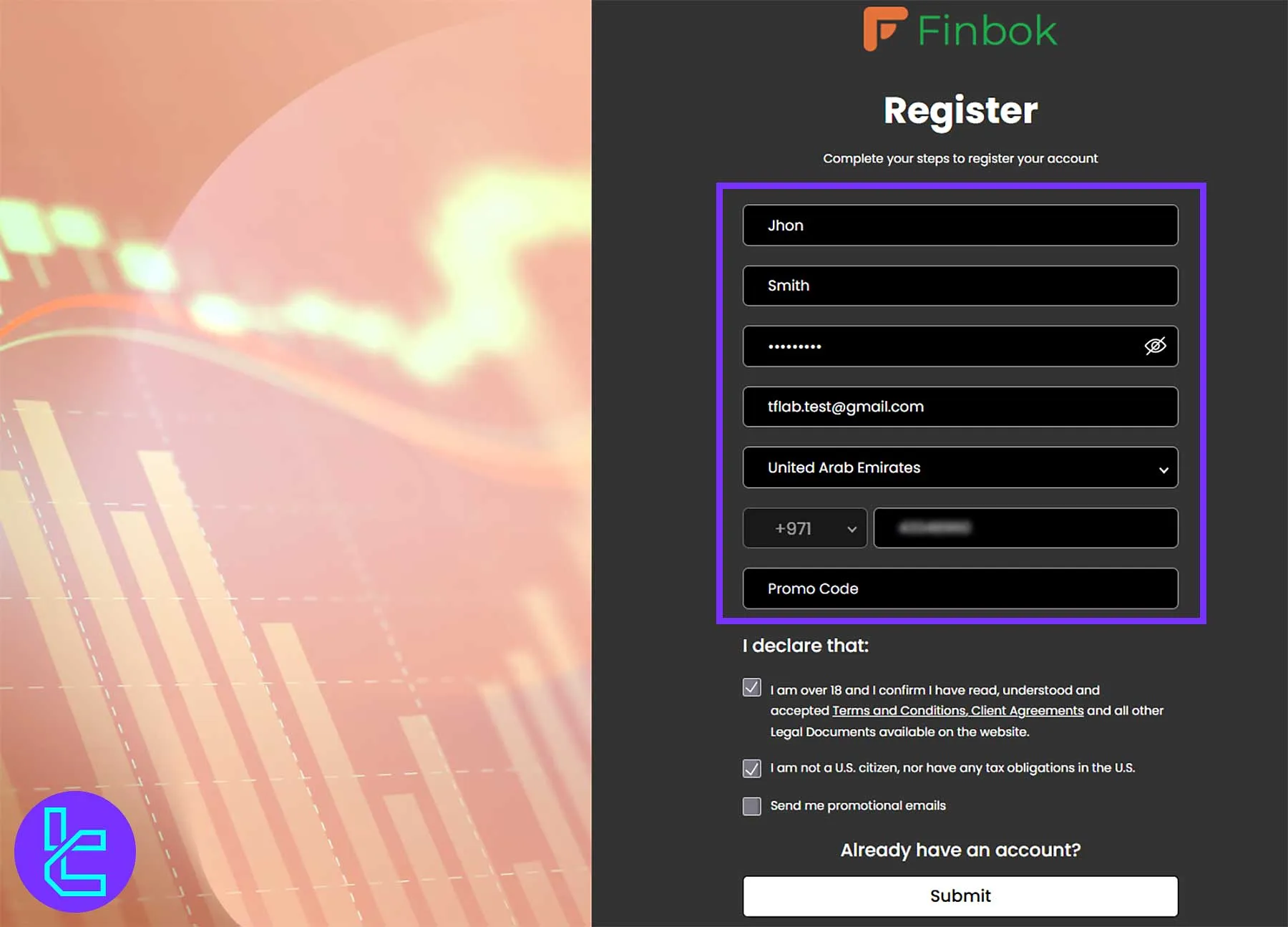

Finbok Broker Signing Up & Verification Process

Registering on Finbok is fast and secure, with a built-in KYC (Know Your Customer) process designed to ensure platform integrity and regulatory compliance. Once verified, users can fund their accounts and start trading without delays.

#1 Register on the Platform

Go to the official Finbok website and click “Register”. Fill out the form with your personal information, including:

- Name

- Phone number

- Password

#2 Log in and Access the Document Section

After registration,log in to your account. From the user menu, navigate to the “Documents” section to begin the verification process.

#3 Complete KYC Verification

Upload the following documents:

- Proof of Identity: Passport or Driver's license

- Proof of Address: Utility bill or Bank statement

#4 Fund and Trade

Once your documents are verified, you can deposit funds and gain full access to Finbok’s trading platform.

Finbok’s Trading Platforms

Finbok broker has developed its proprietary trading platform, which is web-based and designed with simplicity in mind; Finbok platform features:

- Web-based: No need for downloads or installations

- User-friendly interface: Ideal for beginners

- Integrated TradingView charts: For technical analysis

- Access to multiple asset classes: Forex, commodities, indices, stocks, and cryptocurrencies

While the platform is easy to use, it's worth noting that it lacks some advanced trading tools that experienced traders might expect.

Additionally, Finbokdoesn't offer a mobile app or desktop version of its platform, which could be a drawback for traders who prefer these options.

Finbok Spreads and Commissions Structure

The broker offers a transparent spread and commission structure, ensuring that traders are well-informed about the costs involved.

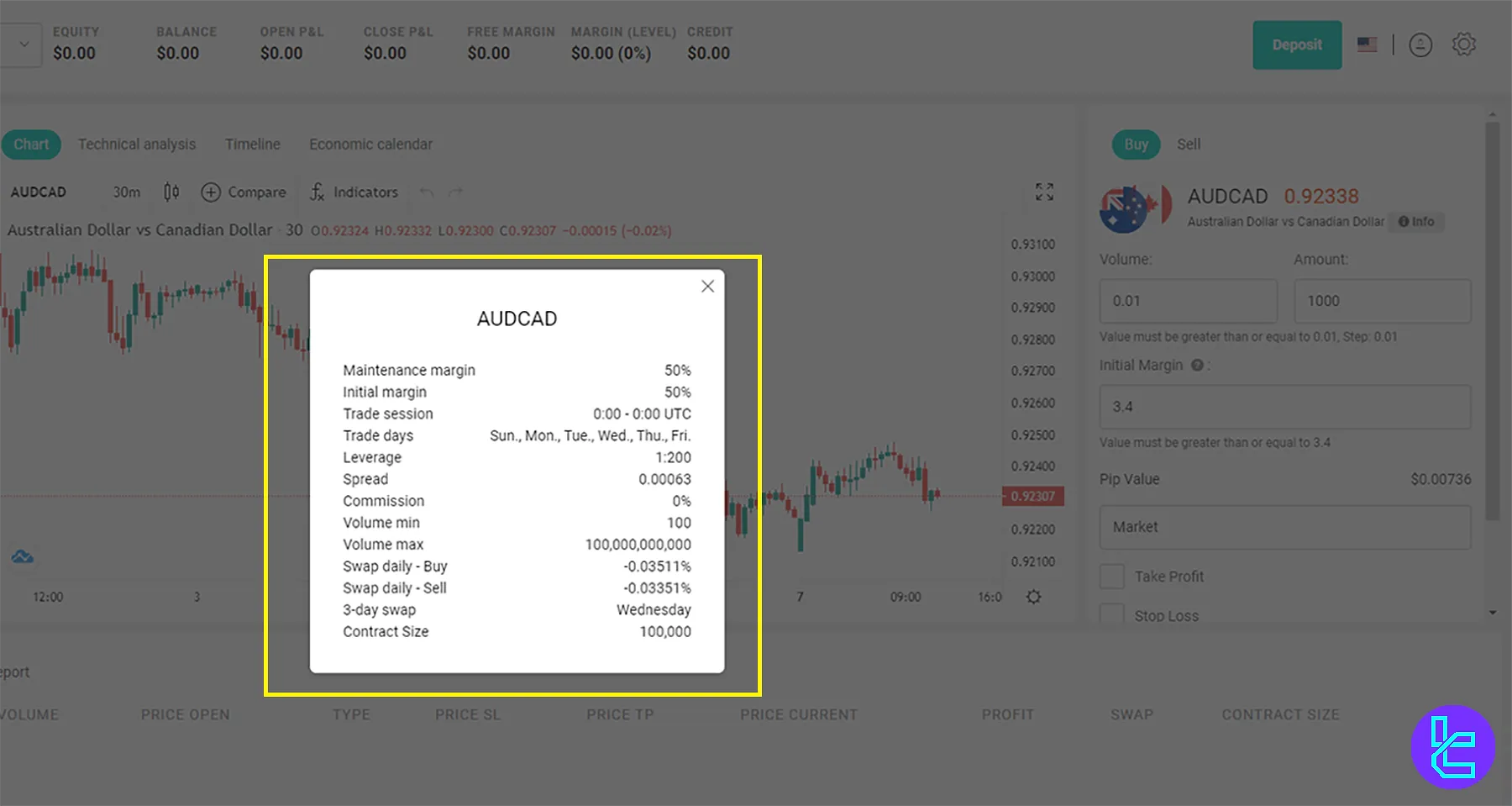

By simply opening a chart—such as AUDCAD—and clicking on the “info” icon, traders can easily view key pricing details.

For instance, the spread for AUDCAD is 0.00063, with no additional commission applied. This clarity in pricing enables traders to make better decisions and manage their trades more effectively. Finbok Fees on AUDCAD:

- Maintenance margin: 50%

- Initial margin: 50%

- Trade session: 0:00 - 0:00 UTC

- Trade days: Sun, Mon, Tue, Wed, Thu, Fri

- Leverage: 1:200

- Spread: 0.00063

- Commission: 0%

- Volume min: 100

- Volume max: 100 billion

- Swap daily - Buy: -0.03511%

- Swap daily - Sell: -0.03351%

- 3-day swap: Wednesday

- Contract Size: 100,000

Finbok Swap Fees

Finbok applies swap fees (rollover charges) on CFD positions held overnight, reflecting the cost or gain of carrying trades beyond the trading day. These fees depend on market conditions, liquidity provider rates, and instrument type, ensuring transparent overnight interest calculations for all traders.

- Applicable Instruments: Forex, indices, commodities, and other CFDs

- Weekend Rollovers: Charged as triple swaps on Wednesdays to account for non-trading days

- Calculation Methods by Interest:

- Variation: Swap rates may change based on market conditions and liquidity provider adjustments

Finbok Non-Trading Fees

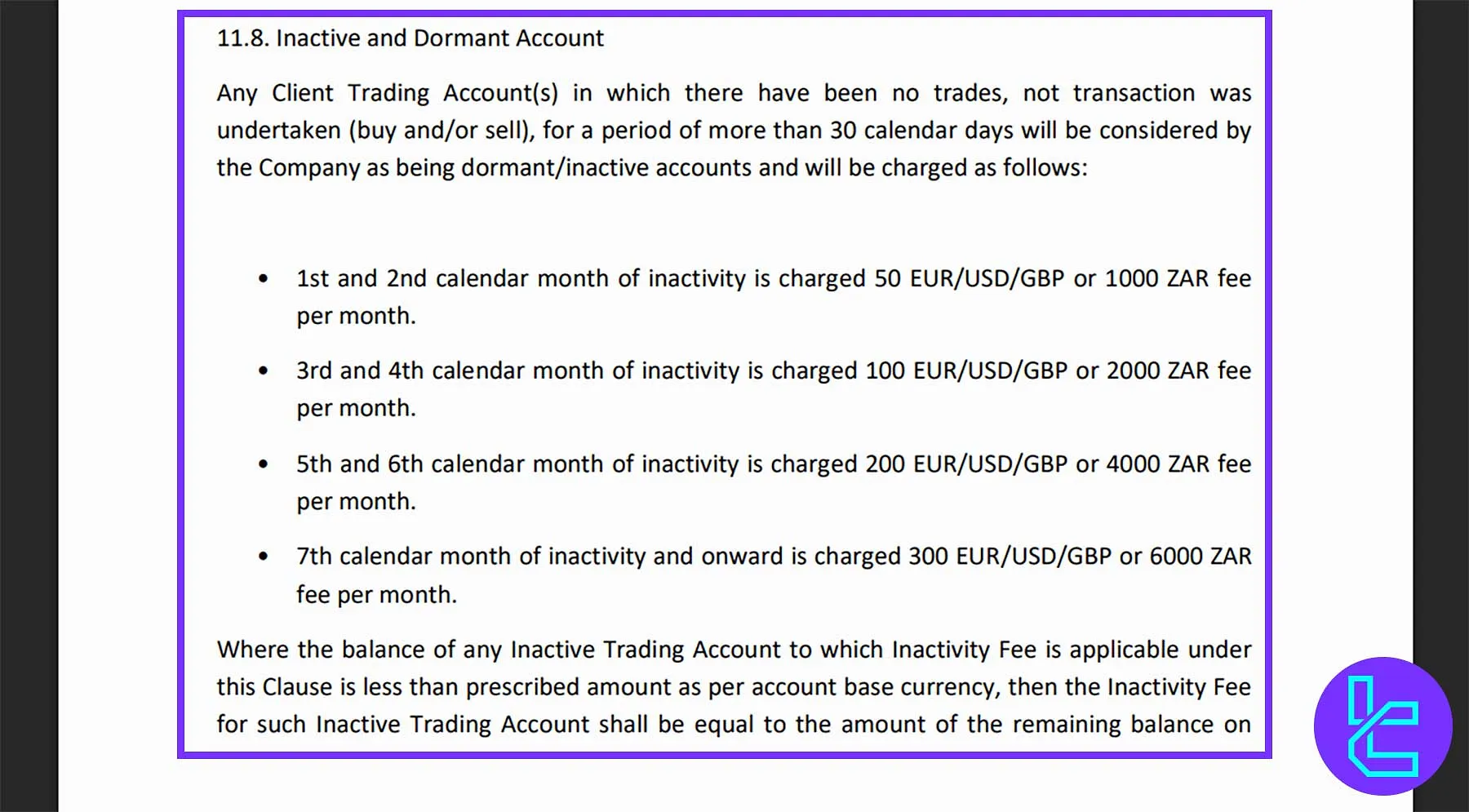

Finbok maintains a transparent fee structure with zero charges for deposits and withdrawals. However, inactivity and administrative costs are managed through specific non-trading fees designed to encourage active account usage and cover application processing expenses.

- Deposit & Withdrawal Fees: No charges apply;

- Inactivity Fees:

- 1st–2nd month: €50 / $50 / £50 or 1000 ZAR monthly

- 3rd–4th month: €100 / $100 / £100 or 2000 ZAR monthly

- 5th–6th month: €200 / $200 / £200 or 4000 ZAR monthly

- 7th month onward: €300 / $300 / £300 or 6000 ZAR monthly

- Application Fee: €50 / $50 / £50 or 1000 ZAR, applied at the company’s discretion;

- Retroactive Charges: May apply for missed inactivity periods.

Finbok Broker Deposit & Withdrawal Methods

Finbok offers several options for depositing and withdrawing funds; Finbok Payment Methods:

Deposit/Withdrawal Methods | Fees |

Visa | No |

Mastercard | No |

Visa | No |

DPO pay | No |

Ozow | No |

AstroPay | No |

Wire Transfer | No |

The range of payment methods and the absence of fees are positive points. However, the processing times for deposits and withdrawals are somewhat longer than what you might find with other brokers.

Finbok Deposit Methods

Finbok ensures secure and fee-free deposits across a variety of trusted channels. Deposits are generally processed within a few hours, allowing traders to start trading quickly after account verification.

- Available Methods: Visa, Mastercard, DPO Pay, Ozow, AstroPay, Wire Transfer

- Fees: No deposit charges on any payment option

- Processing Time: Usually within a few hours, depending on the chosen method

- Security: All deposits are encrypted and verified through secure payment gateways

- Minimum Deposit: May vary by account type and currency

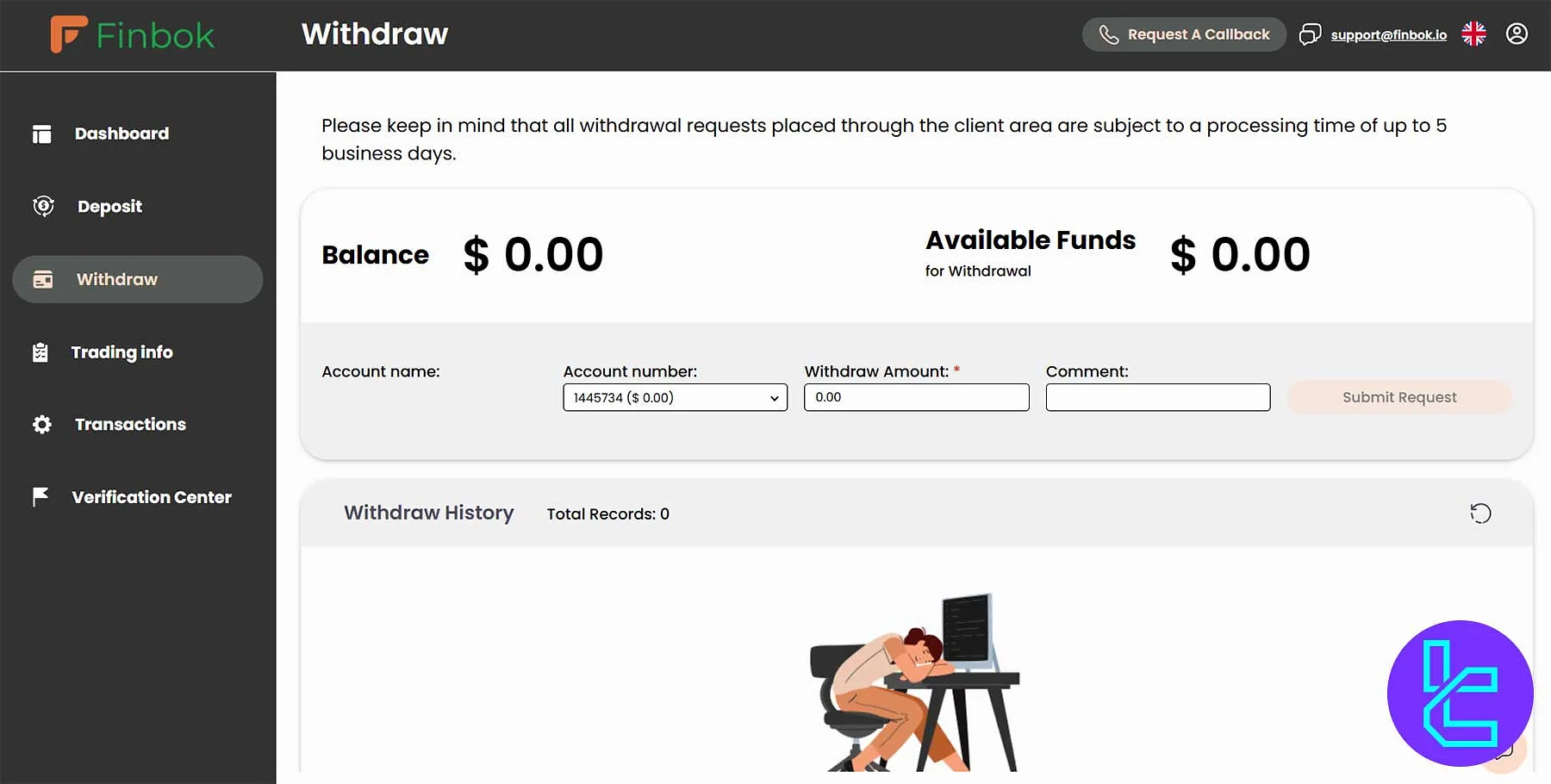

Finbok Withdrawal Methods

Withdrawals at Finbok are processed through the same methods as deposits, ensuring convenience and compliance with anti-fraud regulations. Although withdrawals take longer than deposits, they remain fee-free and fully transparent.

- Available Methods: Visa, Mastercard, DPO Pay, Ozow, AstroPay, Wire Transfer

- Fees: No withdrawal fees across all options

- Processing Time: Typically within 1–5 business days

- Policy: Withdrawals must match the deposit method for security reasons

- Verification: Traders may be required to confirm identity before withdrawal approval

Copy Trading & Investment Options Offered on Finbok Broker

Unlike some forex brokers, Finbok does not currently offer traditional copy trading or standard investment management services, which are often popular among traders looking to replicate the strategies of successful investors.

However, Finbok provides some accounts (Gold, Platinum, Black) that include Full-Time Manager-Access features.

This allows for more personalized account management, where a manager can make trades on behalf of the account holder, providing an alternative to fully automated systems like copy trading.

Finbok Forex Broker Tradable Markets & Symbols Overview

Finbok offers a diverse range of tradable instruments; Finbok Available Assets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | 67 | 50 - 70 currency pairs | 1:200 |

Indices | CFDs | 29 | 10 - 20 instruments | 1:50 |

Stocks | CFDs | 71 EU Stocks 33 GB Stocks 300+ US Stocks | 800 - 1200 | 1:10 |

Commodities | CFDs | 23 | 15 - 30 instruments | 1:50 |

With over 500 tradable instruments, Finbok's offering is above the industry average. The selection of commodities and indices is particularly impressive.

This broad selection enables traders to build diversified portfolios and apply a wide array of trading strategies tailored to different market sectors.

Finbok Forex Broker Bonuses and Promotions

The broker offers attractive bonuses and promotions; Finbok Bonus Offerings:

Feature | Details |

Expanded Capital | Traders receive an additional 30% to increase trading volume and exposure |

Volume Requirement | Withdrawal possible after trading volume equals (Deposit + Bonus) * 20,000 |

Withdrawal Conditions | Early withdrawal before meeting the volume requirement results in the bonus being voided |

Bonus Duration | The bonus is available for a limited time, and traders must meet the volume requirement within this period |

Note: The Finbok 30% deposit bonus is only available to new customers.

Finbok Broker Support Teams

Finbok provides customer support through multiple channels:

Support Channel | Contact Information |

support@finbok.com | |

Phone | +27 21 109 4720, |

Ticket | Within 48 hours |

Here you can find more numbers to contact the broker:

- Switzerland: +41 4 470 718 01

- United Arab Emirates: +971 4 560 4916

The support team is available to help users with onboarding, platform issues, and technical troubleshooting, ensuring a smooth and supportive trading experience.

While the broker is committed to providing good customer service, some users have reported slow response times during peak hours.

Finbok Broker List of Restricted Countries

Finbok broker does not accept clients from certain countries due to regulatory restrictions; Finbok Restricted Countries:

- Afghanistan

- Central African Republic

- Congo

- Guinea-Bissau

- Haiti

- Iran

- Iraq

- North Korea

- Lebanon

- Libya

- Mali

- Russia

- Somalia

- South Sudan

- Sudan

- Syria

- Yemen

If you're a resident of any of these countries, you won't be able to open an account with Finbok. Always check the most up-to-date information on the broker's website, as this list may change over time.

Finbok Broker Trust Scores & Reviews on Trustpilot

During our investigation into the rates and reviews for Finbok broker, we noticed a significant gap in available feedback on Trustpilot, a widely used platform for assessing the reliability and experiences of various services.

The absence of reviews or ratings on Trustpilot raises some questions about the broker's visibility and reputation among traders.

This lack of information could suggest several things: Finbok may have a limited presence in certain markets, or it might not have attracted enough user feedback to generate reviews on Trustpilot.

For potential clients, the absence of reviews on such a prominent platform may warrant further investigation and caution, as traders often rely on community insights to gauge the credibility and quality of a broker's services.

Education on Finbok Broker

The broker offers a selection of educational resources, primarily in the form of instructional videos. These are categorized for Beginner, Intermediate, and Advanced traders; Finbok Education:

- Basic forex concepts

- Technical analysis

- Trading Strategies

While these videos can serve as a good introduction, especially for new traders, Finbok's educational offerings are not as comprehensive as those provided by some other brokers.

You can also check TradingFinder's Forex education for additional learning materials.

Comparison of Finbok with Other Brokers

The table below provides a comprehensive overview of Finbok's services in comparison with those of other brokerage companies:

Parameter | Finbok Broker | TMGM Broker | AvaTrade Broker | Tickmill Broker |

Regulation | FSCA | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Spread | N/A | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | From $0.0 | $0 | From $0.0 |

Minimum Deposit | $250 | $100 | $100 | $100 |

Maximum Leverage | 1:200 | 1:1000 | 1:400 | 1:1000 |

Trading Platforms | Proprietary platform | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Account Types | Intro, Silver, Gold, Platinum, Black | EDGE, CLASSIC | Standard, Demo, Professional | Classic, Raw |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 12000+ | 1250+ | 620+ |

Trade Execution | Market, Instant | Market, Instant | Instant | Market |

Conclusion and final words

Finbok offers client protections, such as segregated accounts and negative balance protection. Leverage options range from 1:100 for the Platinum Account to 1:200 for the Black Account.

The broker also features webinars tailored to each account type, with weekly webinars for Gold, Platinum, and Black accounts.

However, experienced traders may find the lack of advanced tools, such as MT4 or MT5, mobile applications, and a limited leverage range for most accounts, to be a disadvantage.

The broker's restricted countries list (e.g., Russia, North Korea) may further limit its global reach.