Fullerton Markets belongs to "Fullerton Group" and is regulated by the Saint Vincent & the Grenadines (FSA). It has won 15+ industry awards because of offering 1:500 maximum leverage and tight spreads [starts from 0.1 pips.]

In the Fullerton Markets review, we'll explore everything you need to know about this award-winning broker.

Fullerton Markets is one of the leading Asian brokers started its work in 2015

Fullerton Markets is one of the leading Asian brokers started its work in 2015

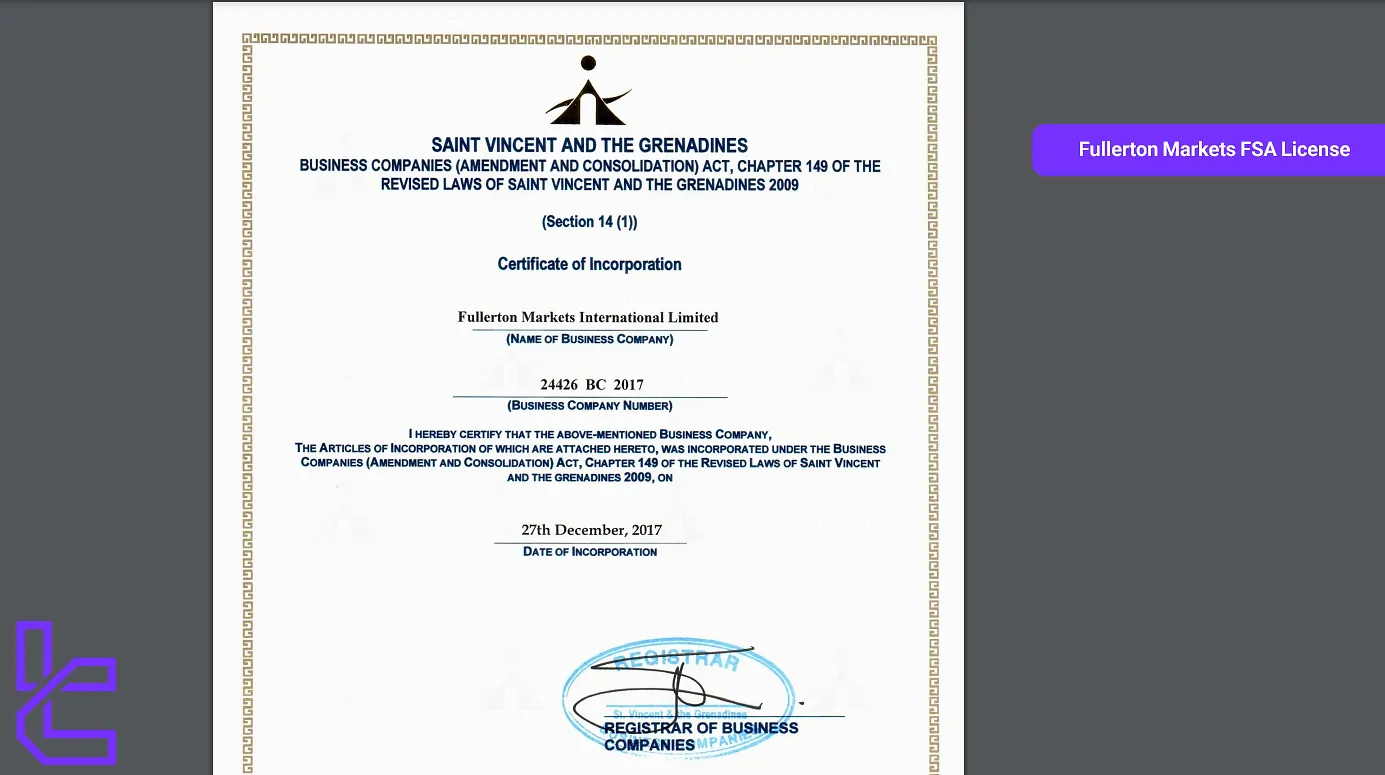

Fullerton Markets Broker Company Information & Regulation

Fullerton Markets is a forex broker incorporated in the British Virgin Islands, with an office located in Singapore. However, it's important to note that the company does not provide services to individuals who are residents or legal entities based in Singapore, as stated in their important notice. Key points about Fullerton Markets:

- Regulated by Saint Vincent & The Grenadines (FSA)

- Offers trading services for various financial instruments

- Provides leverage up to 1:500

- Spreads starting from 0.1 pip

- 24-hour customer support

- Won 15+ industry awards

- Offers "unparalleled fund safety" and "global credibility"

Fullerton Markets provides access to a diverse range of financial markets, including forex, metals, indices, cryptocurrencies, and equities, all accessible through MetaTrader 4 and MetaTrader 5 trading platforms.

With up to 1:500 leverage, both LIVE and DEMO accounts, and a wide selection of funding methods (credit cards, e-wallets, crypto, bank wire), it aims to support both novice and experienced traders.

The broker implements internal safety measures, including segregated client accounts and limited internal insurance coverage for losses related to fraud or employee misconduct.

Here's a summary table of the company details and information:

Entity Parameters/Branches | Fullerton Group |

Regulation | FSA |

Regulation Tier | 2 |

Country | Saint Vincent and the Grenadines |

Investor Protection Fund / Compensation Scheme | Up to €20,000 under Financial Commission |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:500 |

Client Eligibility | Global |

Fullerton Markets CEO Introduction

Rahul Sodhy has been serving as the CEO of Fullerton Markets since March 2022, overseeing the company’s global strategy.

With a strong background in financial services, including senior roles at FXPrimus, he is recognized for his contributions to the trading industry.

At Fullerton, he is responsible for leading global business strategy, launching innovative products and services, and driving growth in the FinTech sector. You can follow him through this link:

Summary of Specifics

Let's take a closer look at the specific details of Fullerton Markets and what it offers to traders:

Broker | Fullerton Markets |

Account Types | Standard, Demo |

Regulating Authorities | FSA |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $100 |

Deposit Methods | STICPAY, Visa, MasterCard, Neteller, Skrill, Fasapay, Cryptocurrency |

Withdrawal Methods | STICPAY, Visa, MasterCard, Neteller, Skrill, Fasapay, Cryptocurrency |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | Copy trading [CopyPip] |

Trading Platforms & Apps | MT4, MT5, FM App |

Markets | Forex, Cryptocurrency, Crude Oil, Metals, Indices, Stocks |

Spread | Floating from 0.1 pips |

Commission | Varies by Spread Type |

Orders Execution | Market Execution |

Margin Call/Stop Out | No Information Provided |

Trading Features | 1:500 Maximum Leverage, Demo Trading, CopyPips, 130+ Tradable Assets, $100 Minimum Deposit |

Affiliate Program | Yes |

Bonus & Promotions | KryptoPips Loyalty Program, Accelerator Bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Phone Call, Indoor Meeting, Live Chat on Social Media |

Customer Support Hours | 24/5 |

Restricted Countries | United States, Iran, Cuba, Sudan, Syria, North Korea |

These specifications provide a solid foundation for understanding the trading conditions offered by Fullerton Markets.

What Are Fullerton Markets Broker Account Types?

Unlike many brokers such as Windsor, LiteForex, and Alpari, Fullerton Markets provides only one real trading account [Standard] to traders, and there is practically no variety. Another account offered in this brokerage is a demo account. Fullerton Standard Account Features:

- $100 minimum deposit

- 1:500 maximum leverage

- 0.01 lot minimum position size

- MT4, MT5, FM App trading platforms

- Scalping allowed

- Market execution

- No commission per standard lot

While straightforward, this limited account structure may not suit traders seeking diverse account features or segmentation by experience level.

Advantages and Disadvantages

Like all brokerages, using Fullerton Markets also has advantages and disadvantages you should consider before choosing. Advantages and Disadvantages of Fullerton Markets Broker:

Advantages | Disadvantages |

Free trading tools available on their website | Not regulated by major authorities (offshore license) |

$0 deposit and withdrawal commission | Higher risks compared to brokers under strict oversight |

Offers investment programs for additional income opportunities | - |

Provides swap-free Islamic accounts | - |

Segregated client funds and client insurance | - |

Positive customer reviews for user-friendly platforms and responsive support | - |

Transparent fee structure with no account maintenance fees | - |

While Fullerton Markets offers several attractive features, the lack of robust regulation is a significant consideration for traders when choosing a broker.

Fullerton Markets Sign Up Manual; Registration Guide!

Creating an account takes just a few minutes and unlocks access to trading platforms like MT4 and MT5. Traders can choose between Variable Spread, Pro Spread, or Raw Spread accounts.

The Fullerton Markets registration process includes email verification and setting key trading preferences like base currency, leverage, and account type (Personal or Business). For full functionality, identity verification is required after registration.

#1 Visit the Registration Page

Go to the Fullerton Markets website and click on “Open Live Account” to begin the process.

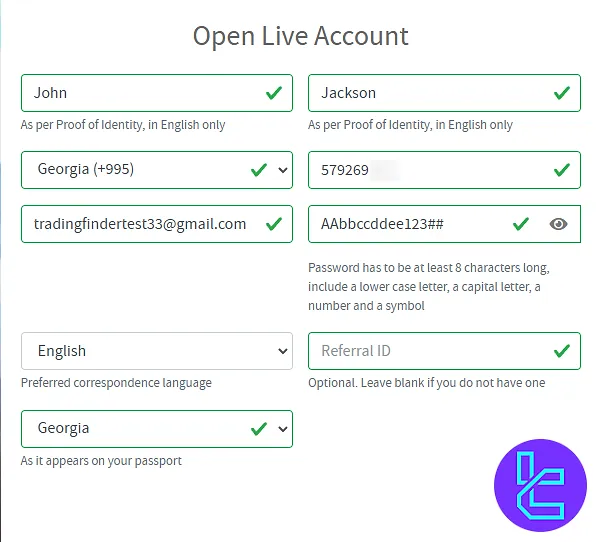

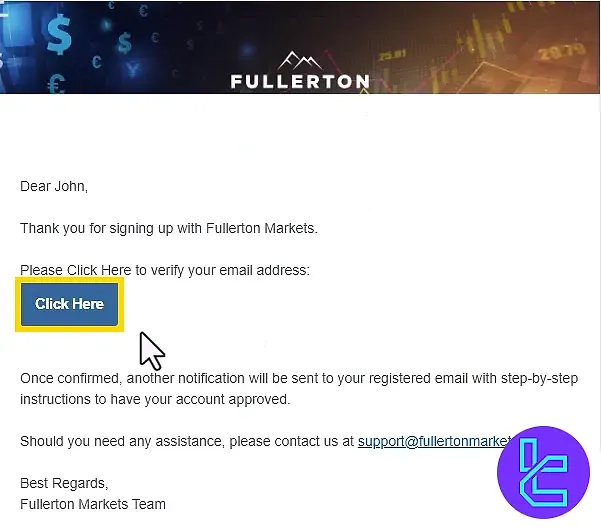

#2 Fill in the Form & Verify Email

Fill out the application form with the following details:

- Name

- Country

- Phone number

- Password

Choose a language, add a referral code if available, and verify your email through the confirmation link sent to your inbox.

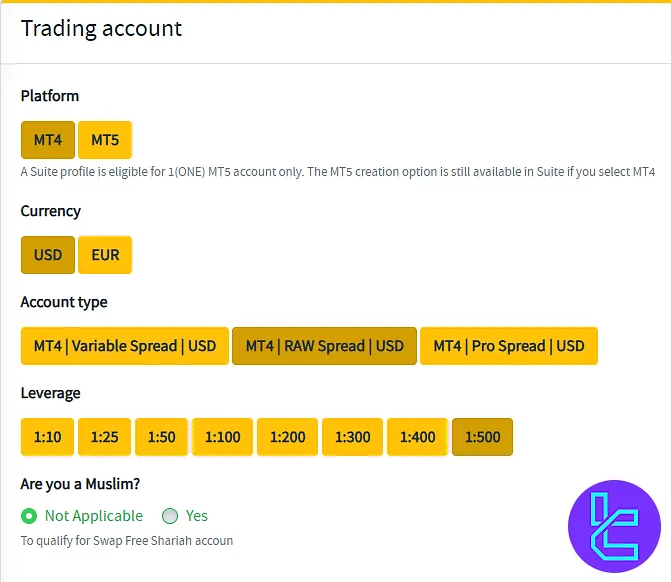

#3 Finalize Account Preferences

Log in, then adjust your trading account settings:

- Account type

- Trading platform (MT4/MT5)

- Base currency

- Leverage

Answer regulatory questions to complete the setup.

#4 Proceed with the KYC Procedure

Provide supporting documents in compliance with KYC and AML policies:

- Proof of Identity: Passport or Driver's license

- Proof of Residence: Utility bill or Bank statement

What Trading Platforms Are Available to Use in Fullerton Markets?

Fullerton Markets provides traders with multiple options, including robust MetaTrader 4and MetaTrader 5 platforms.

- MetaTrader 4 (MT4): The classic platform used by many traders worldwide

- MetaTrader 5 (MT5): The more advanced successor to MT4, offering more time frames and pending order types

- FM App: Fullerton Markets' proprietary mobile trading app for on-the-go trading

Fullerton Markets Forex Broker Spreads and Commissions Overview

In Fullerton Markets Review, we discovered that this company has three types of spreads or fees for traders, each with its own figure and commission.

Variable Spreads

- Derived from Tier-1 Liquidity Providers

- No additional commissions

- Spread includes brokerage fee

Raw Spreads

- Direct from multiple liquidity providers

- Flat commission of $8 per lot for the forex market

- Spreads as low as 0.0 pips

PRO Spreads

- Lower spreads with no commissions or additional fees

- Available for forex and metals trading

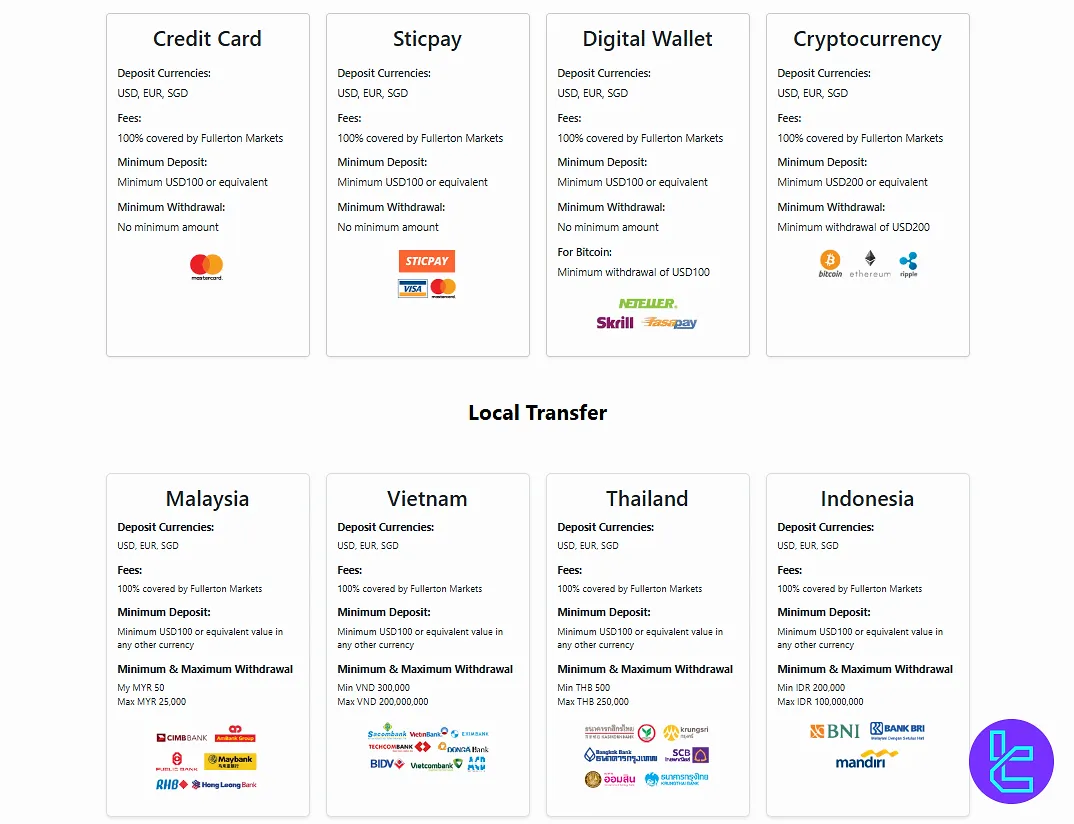

Fullerton Markets Deposit & Withdrawal Methods

Fullerton Markets Broker provides a variety of deposit and withdrawal options. The following sections will include a detailed overview.

Deposit Options

Look at the table below for information about the methods:

| Funding Option | Deposit Currencies | Fee |

| Credit/Debit Cards | USD, EUR, SGD | Fully Covered by The Broker |

| Sticpay | USD, EUR, SGD | Fully Covered by The Broker |

| Digital Wallets | USD, EUR, SGD | Fully Covered by The Broker |

| Cryptocurrecies | USD, EUR, SGD | Fully Covered by The Broker |

| Local Transfers | USD, EUR, SGD | Fully Covered by The Broker |

Withdrawal Methods

According to our investigations and the available data, the options available for deposits and withdrawals are similar:

| Funding Option | Min. Withdrawal | Fee |

| Credit/Debit Cards | None | Fully Covered by The Broker |

| Sticpay | None | Fully Covered by The Broker |

| Digital Wallets | None | Fully Covered by The Broker |

| Cryptocurrecies | $200 | Fully Covered by The Broker |

| Local Transfers | Varies | Fully Covered by The Broker |

Does Fullerton Markets Provides Any Investment Options?

Fullerton Markets offers a copy trading feature called “CopyPip”, allowing traders to:

- Automatically copy trades and positions of experienced traders;

- Benefit from collective intelligence and successful trading strategies;

- Save time and potentially achieve higher returns.

While Fullerton Markets does not offer PAMM accounts, CopyPipprovides an alternative for those interested to use investment plans.

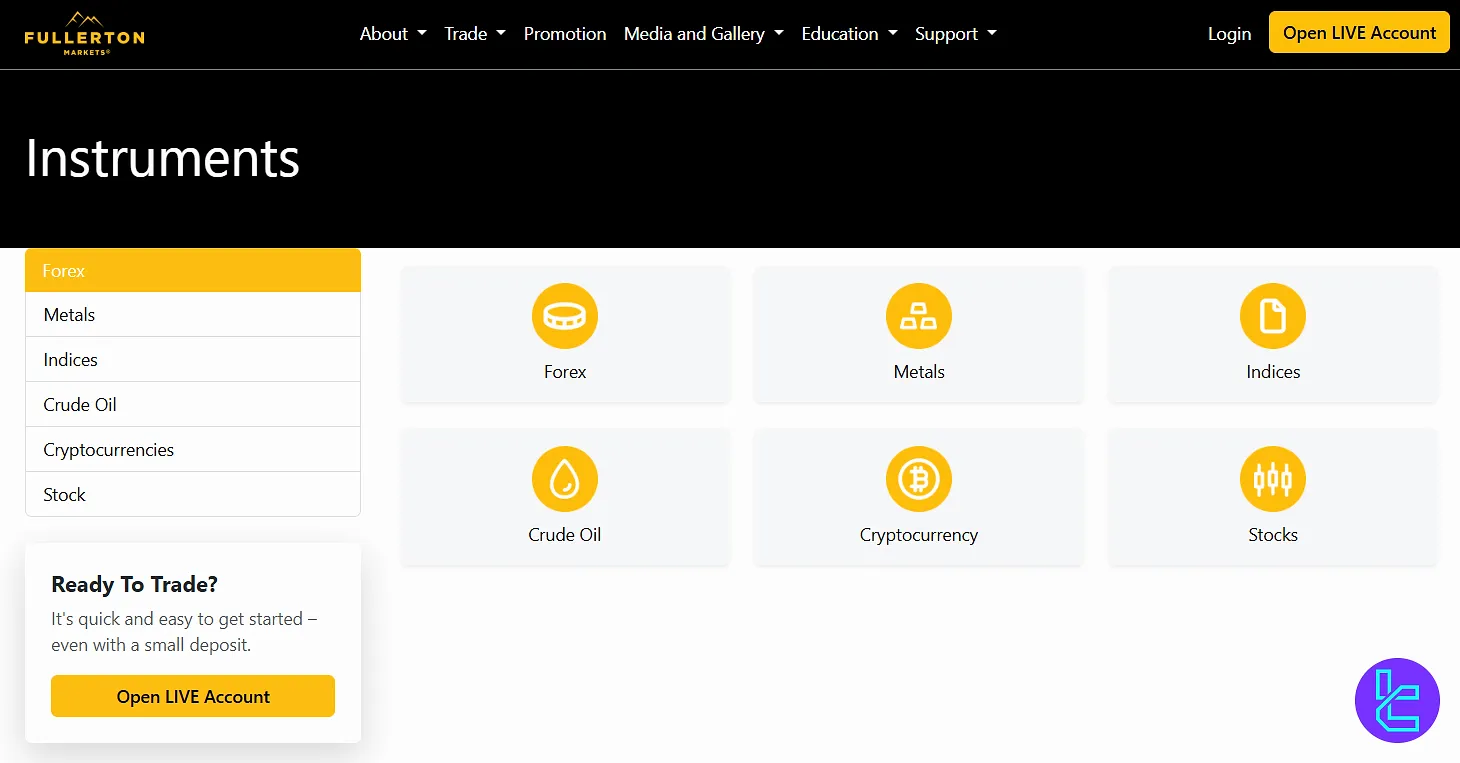

What Markets and Assets Are Available to Trade in Fullerton Markets?

Fullerton Markets delivers access to over 130 assets across six major categories:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | Major, Minor, and Exotic Currency Pairs | 50+ Currency Pairs | 50–70 Currency Pairs |

Metals | Gold, Silver, and Other Precious Metals | 4–6 Metals | 5–10 Metals |

Indices | CFDs on Global Stock Market Indices | Around 10–15 Indices | 10–20 Indices |

Crude Oil | CFDs on Energy Commodities (E.G., Brent, WTI) | 2 Main Crude Oil Contracts | 2–5 Contracts |

Stocks | CFDs on International Company Shares (via MT5) | 300+ Global Stocks | 800–1200 Stocks |

Cryptocurrency | CFDs on Bitcoin (BTC) and Major Altcoins | 10–15 Major Cryptocurrencies | 20–40 Cryptocurrencies |

Bonuses and Promotions

In reviewing the pages of Fullerton Markets, we discovered that this brokerage regularly considers promotion and bonus plans for traders; Right now, two of them are active. FM Bonus:

KryptoPips Loyalty Program

- Rewards traders with cryptocurrency;

- Perks includelower trading fees, higher rebates, and cashbacks.

Accelerator Bonus

- Matches trader's deposit up to $10,000 in bonus credits;

- Converts credits to cash at a rate of $100 per 50 lots traded;

- Minimum deposit of $100 to qualify;

- Available for both new and existing clients.

These promotions provide traders with additional incentives and opportunities to enhance their trading experience.

Fullerton Markets Awards & Industry Recognition

Over the years, Fullerton Markets has earned multiple international awards across different categories of financial services, reflecting its presence in global brokerage, technology innovation, and leadership within the trading industry.

Here are some of the Fullerton Markets awards received over time:

- Multi-Asset Brokerage Recognition: Named Best Multi-Asset Broker Global in both 2022 (World Business Outlook) and 2023 (Gazet International Awards);

- Executive Leadership: Rahul Sodhy, CEO since 2022, was awarded Best CEO in Multi-Asset Broker Global 2023 (Gazet International Awards) and Brokerage CEO of the Year 2022 (World Business Outlook);

- Loyalty & Affiliate Programs: The firm’s Kryptopips-based rewards system received the Most Innovative Loyalty Program Global 2022 award, while its affiliate framework was recognized as Best Affiliate Program Global 2021;

- Copy & Social Trading: TheCopyPip platform earned Best Copy Trading Platform Global 2022, Best Copy-Trading Platform Asia Pacific 2021, and Best Social Trading Platform Asia Pacific 2021;

- Fund Safety: The Best Fund Safety Global 2021 award acknowledged the Fullerton Shield, a triple-layer protection system for client funds;

- Trade Execution: Honored with Most Innovative Trade Execution Asia Pacific 2021, the broker was recognized for its low-latency execution supported by global server infrastructure;

- Regional Achievements: Titles such as Best Forex Broker Asia Pacific 2021 and Best Forex Broker – Asia (Go Trading Asia) underline its footprint in the region;

- Education & Insights: Acknowledged as Best Forex Education Provider, the firm continues to deliver market analysis and training resources through its team of strategists.

Customer Support

Fullerton Markets offers 24-hour customer support (Monday-Friday) through various channels:

- Email: support@fullertonmarkets.com

- Phone: +44 20 3808 8261

- Live Chat: Available on social media [Telegram, Viber, WhatsApp, and Line]

- Indoor Meeting: Available by appointment, Trust Scores, & Reviews

Although the broker does not currently support live chat on its website or callback options, its multi-channel approach ensures that clients can get help through their preferred platforms.

Fullerton Markets Restricted Countries

Due to regulatory restrictions, Fullerton Markets cannot accept clients from the following countries:

- United States

- Iran

- Cuba

- Sudan

- Syria

- North Korea

Trust Scores & Reviews

Positive reviews have been submitted on the Fullerton Markets Trustpilot page, with an overall rating of 4.3 out of 5. Key points from customer reviews include:

- Fast deposit and withdrawal rates

- Good customer service

- Reliable trading platform

The Fullerton Markets Reviews.io profile has gained 2.9 out of 5 stars. Some customers have reported issues with unfavorable exchange rates during deposits and withdrawals.

Education on Fullerton Markets

In this section of Fullerton Markets Review, we must say that this brokerage has performed relatively well in providing educational resources. FM Educational Resources:

- Blog with regular market updates and technical analysis

- Extensive video library covering Weekly Trading Class Tutorial Videos, IB Masterclass Tutorial Videos, Forex, MT5, and MT4 Tutorial Videos.

These educational resources cater to traders of all skill levels, from beginners to experienced professionals.

You can also check TradinFinder's Forex education and Crypto tutorial sections, which you can use for free.

Fullerton Markets Comparison Table

Let's compare Fullerton Markets' services with other brokers:

Parameter | Fullerton Markets Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | FSA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | $100 | $10 | From $0 | $100 |

Maximum Leverage | 1:500 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MT4, MT5, FM App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Standard, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 130+ | 200+ | 1,000+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Trading Finder Conclusion and Final Words

Over 130 assets are available to trade in 2 account types [Standard and Demo] of Fullerton Markets.It also provides innovative features like CopyPip system, proprietary platfrom called FM app and diverse bonuses [KryptoPips Loyalty Program, Accelerator Bonus.]

Fullerton Markets is not available for US traders and its minimum deposit is $100; which is higher than some Competitors.