FXCess verification is a mandatory 4-step process that unlocks full access to deposits, withdrawals, and trading. Users need to upload valid proof of identity (POI), and a proof of address (POA) documents.

FXCess KYC Process Overview

After completing the FXCess registration, follow these four essential steps to activate all financial features in the FXCess broker.

FXCess Verification key steps:

- Access the "Verify Profile" section;

- Upload identity confimation documents;

- Provide proof of address documents;

- Check account status via the "Client Status".

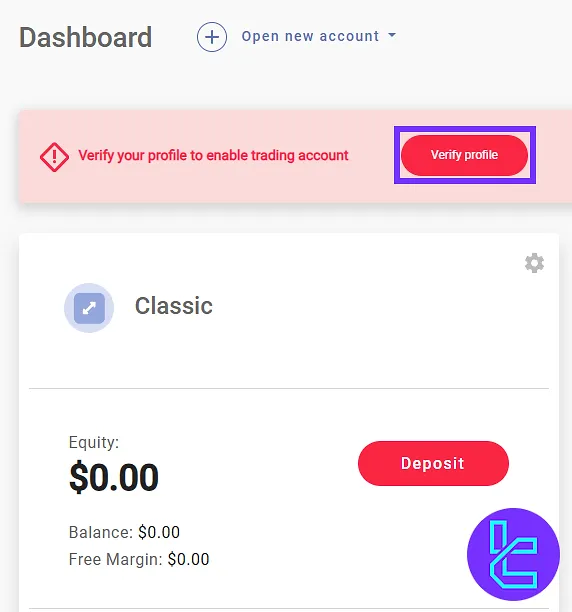

#1 Accessing the FXCess KYC Section

To begin this process, follow these steps:

- Log in to the FXCess dashboard;

- Click on the "Verify Profile".

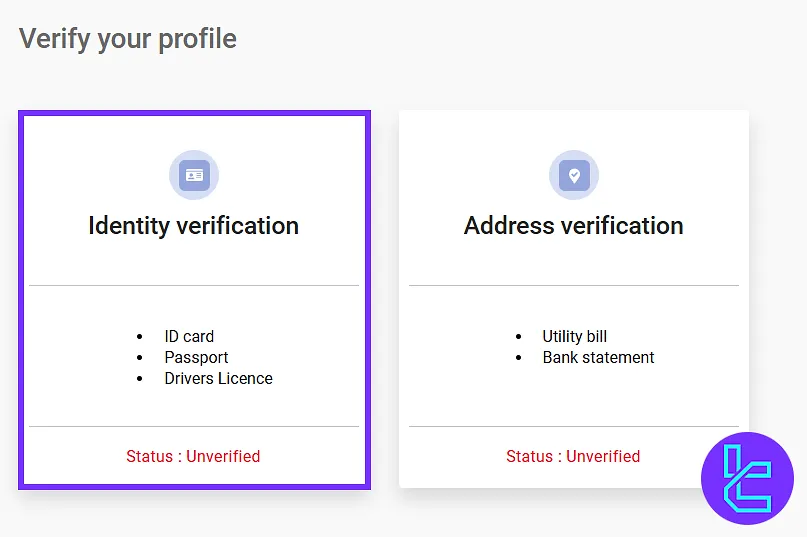

#2 Uploading Identity Confirmation Documents

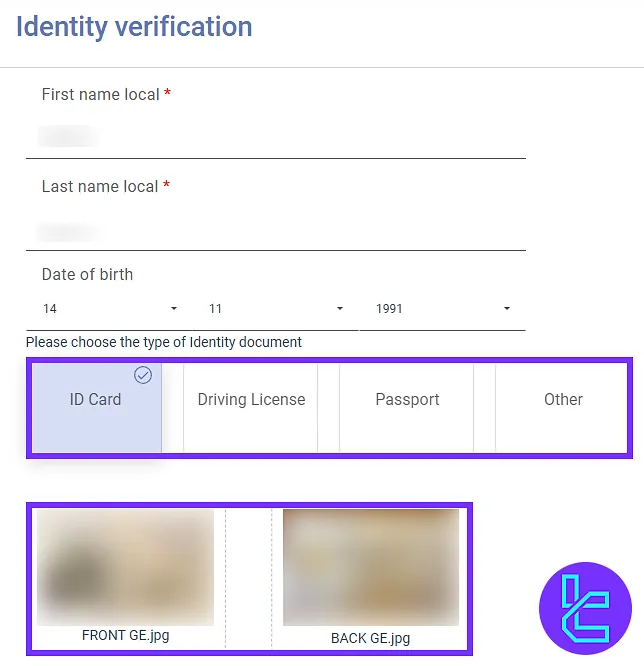

First, click on the "Identity Verification" section to provide personal details.

Enter your first and last name in your local language, your date of birth, and select the document type. Accepted identity documents include:

- National ID card

- Passport

- Driver’s license

Upload a clear image of your selected identity document to proceed.

#3 Uploading Proof of Address Documents

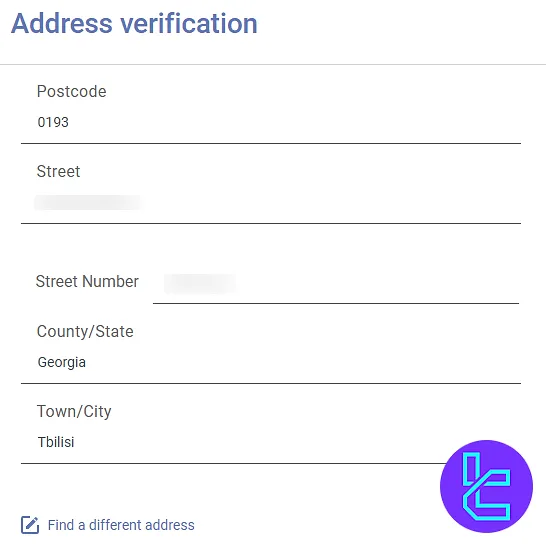

Click on "Address Verification" option to proceed to address confirmation. Enter your full address, including street number, house number, postal code, etc.

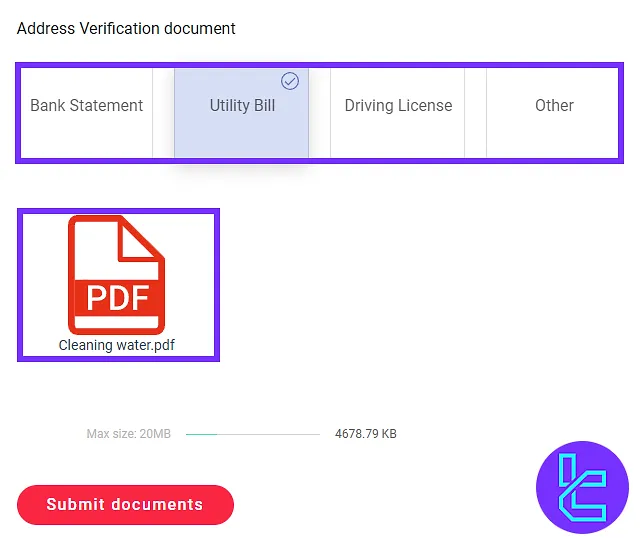

Next, select the proof of address document from the following options:

- Utility bill

- Bank statement

- Driver’s license

- Additional valid documents

Upload the selected document and click "Submit Documents".

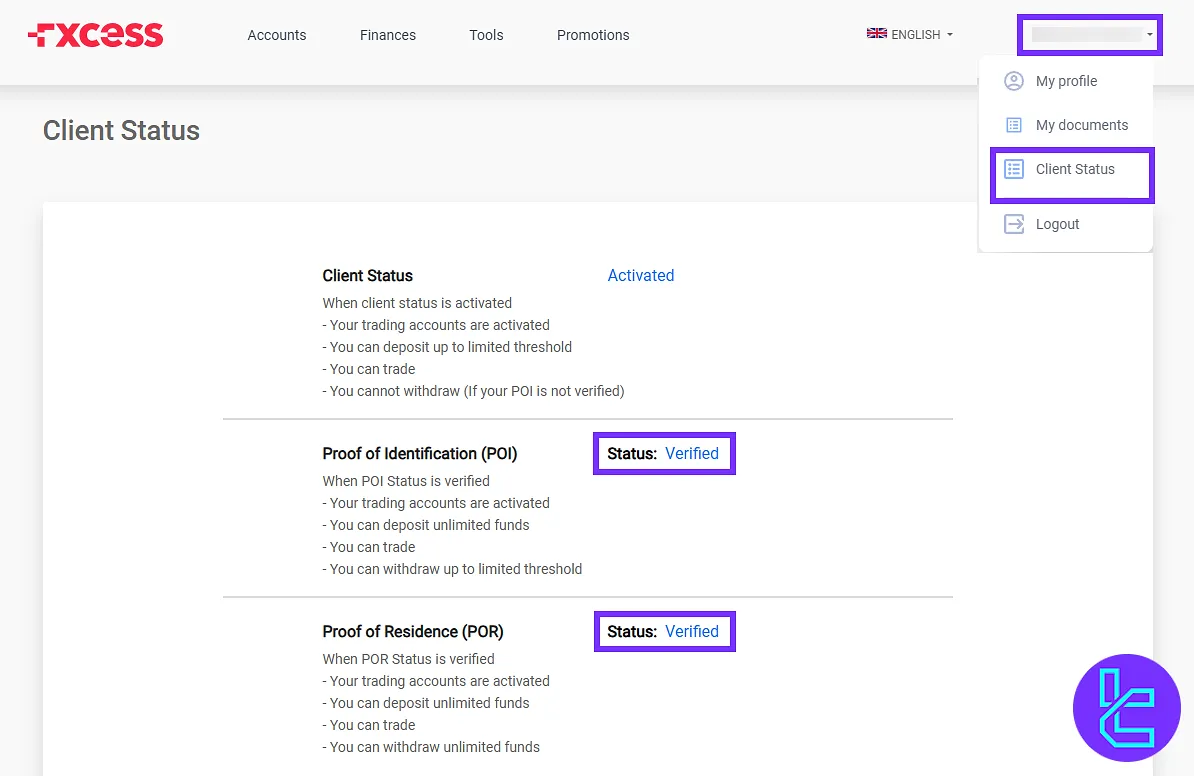

#4 Checking FXCess Authentication Status

After submitting documents, go to the dashboard and click on "Profile". Then, select "Client Status" to check the authentication status and confirm account approval.

TF Expert Suggestion

The FXCess verification process takes less than 10 minutes when users have their documents prepared in advance.

The required documents include a proof of identity (ID card, passport, or driver’s license) and proof of residence (utility bill, bank statement, or driver’s license), dated within the last 3-6 months.

With a fully approved account, users can manage their funds by utilizing various FXCess deposit and withdrawal methods. Comprehensive instructions for these financial transactions are available on the FXCess tutorial page.