FXOpen offers commission-free trading on Gold, Silver, and 28 Cryptocurrencies with a minimum deposit of $1 and leverage options of up to 1:500. The ECN/STP broker supports both MT5 and TradingView.

FXOpen (Company Introduction and Regulatory Status)

FXOpen is a Forex broker that has been providing online trading services since 2005. However, it was operating since before as an educational platform. The broker offers its services in various jurisdictions and is licensed by different regulatory bodies.

Region | Regulation | License Number | Company Name |

EU | CySEC | 194/13 | FXOPEN EU LTD |

UK | FCA | 579202 | FXOPEN LTD |

Australia | ASIC | AFSL 412871 – ABN 61 143 678 719 | FXOPEN AU PTY LTD |

International | The Financial Commission | - | FXOPEN MARKETS LIMITED |

The companies’ services differ in fields like safety measures, client protection, compensation schemes, minimum deposits, payment methods, and supported languages based on the client’s residential region.

The table below provides more details regarding the various entities of the company:

Entity Parameters/Branches | FXOPEN EU LTD | FXOPEN LTD | FXOPEN AU PTY LTD | FXOPEN MARKETS LIMITED |

Regulation | CySEC | FCA | ASIC | N/A |

Regulation Tier | 1 | 1 | 1 | N/A |

Country | Limassol, Cyprus | London, United Kingdom | Sydney, Australia | Nevis |

Investor Protection Fund / Compensation Scheme | Up to €20,000 under ICF | Up to £85,000 under FSCS | No | No |

Segregated Funds | Yes | Yes | Yes | No |

Negative Balance Protection | Yes | Yes | Yes | No |

Maximum Leverage | 1:30 | 1:2000 | 1:30 | 1:500 |

Client Eligibility | Only EU/EEA Residents | Only the United Kingdom | Only Australia | Global |

The company's core offering revolves around its Electronic Communications Network (ECN) business model, which provides traders with direct access to the interbank market. This model ensures deep liquidity, tight spreads, and fast order execution – features particularly appealing to scalpers, high-frequency traders, and those employing automated trading strategies.

FXOpen Summary of Specifications

To give you a quick overview of what the firm offers, here's a summary of its key specifications:

Broker | FXOpen |

Account Types | ECN, STP, Micro |

Regulating Authorities | CySEC, ASIC, FCA |

Based Currencies | USD, AUD, CHF, EUR, GBP, JPY, SGD, GLD |

Minimum Deposit | From $1 |

Deposit Methods | Bank Transfer, Visa/MasterCard, Instant Bank Transfer |

Withdrawal Methods | Easy bank transfer, VISA/MasterCard, Wire transfer |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:500 |

Investment Options | PAMM Accounts |

Trading Platforms & Apps | MT4, MT5, TickTrader, TradingView |

Markets | Forex, Commodities, Indices, Cryptocurrencies, ETFs, Shares |

Spread | Floating from 0.00 pips |

Commission | Zero for STP accounts Variable in ECN |

Orders Execution | Market, Stop, Stop-limit, Limit, OCO, Iceberg |

Margin Call/Stop Out | Margin call 100% Stop out 50% |

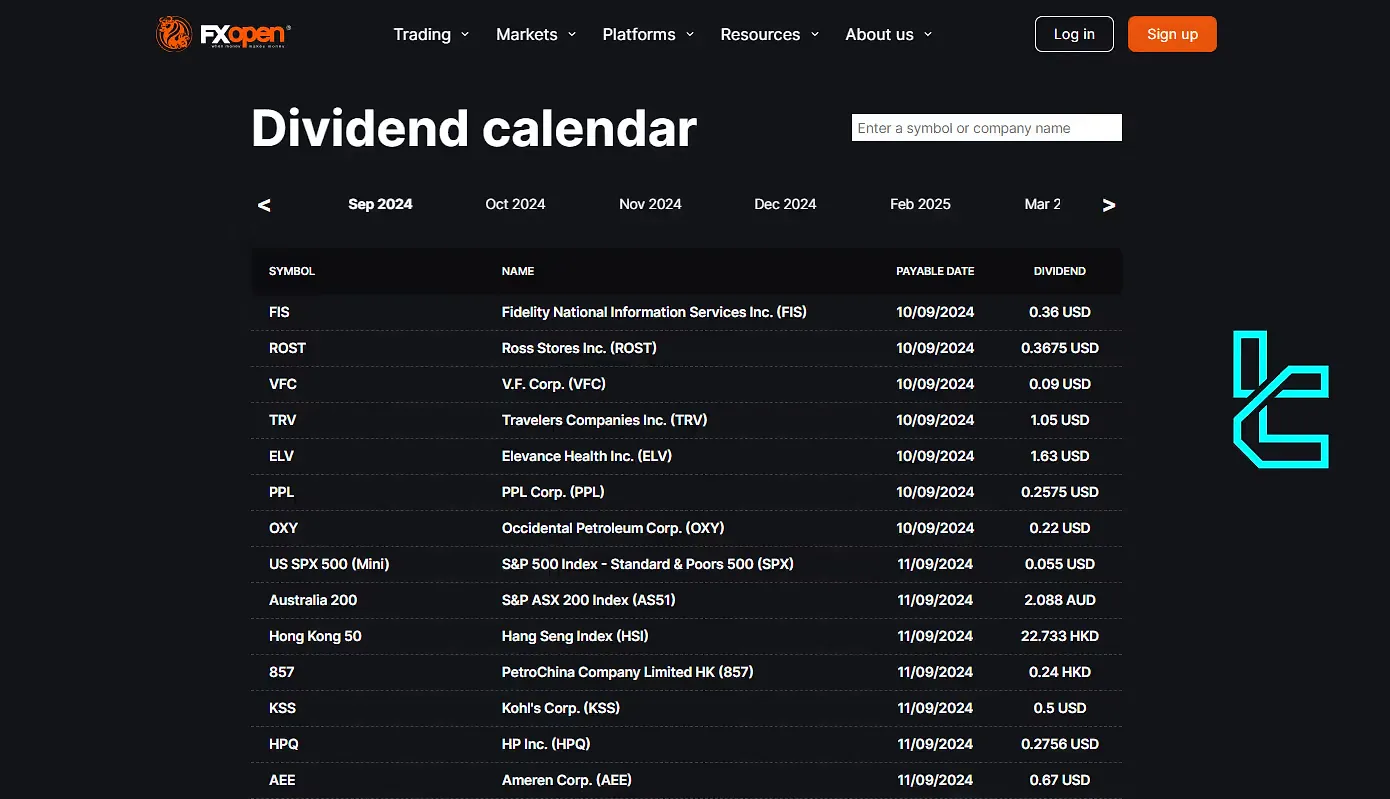

Trading Features | Economic calendar, Margin calculator, Dividend calendar |

Affiliate Program | Yes |

Bonus & Promotions | $10 no deposit bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Phone, Online chat, Mail |

Customer Support Hours | 24/5 |

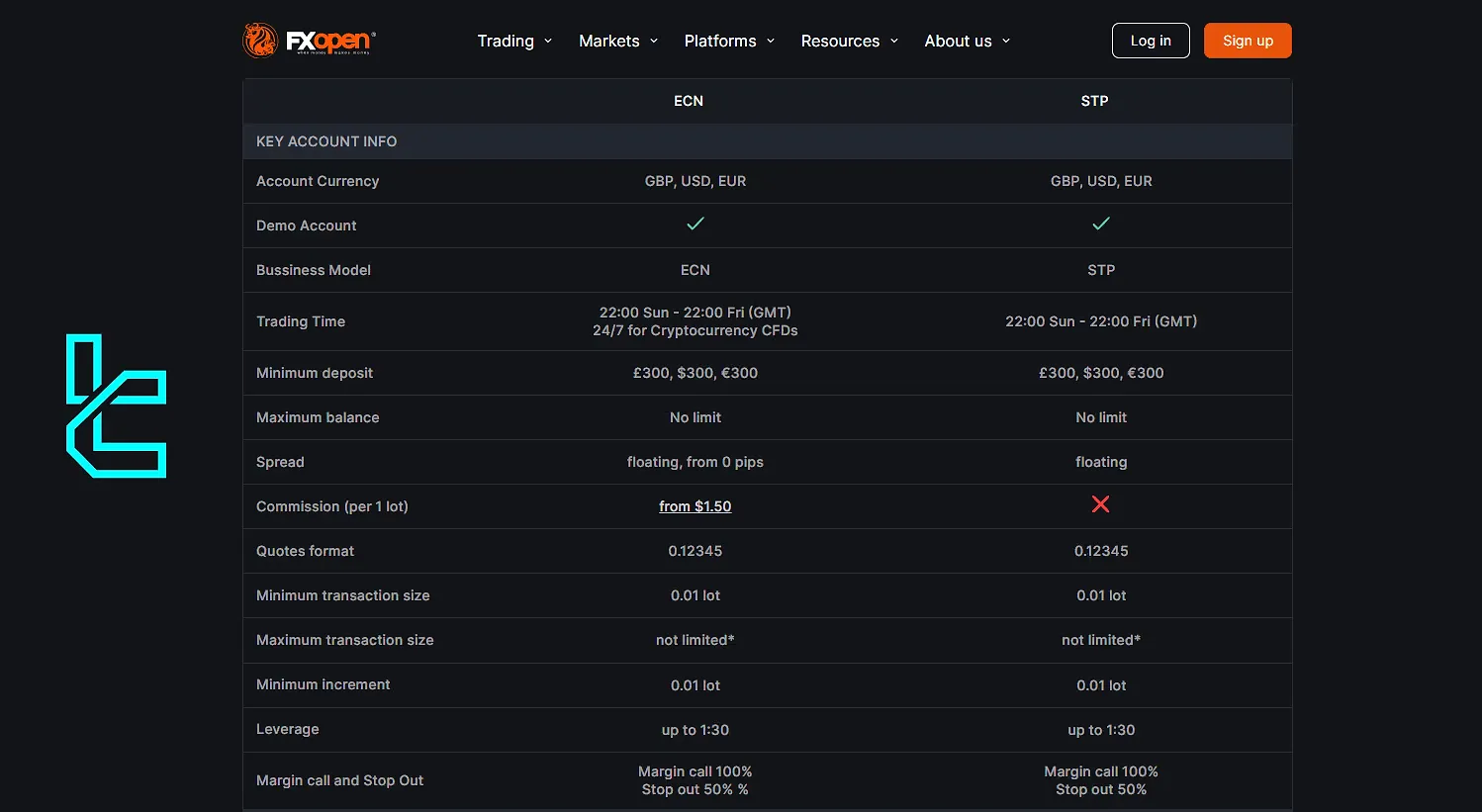

FXOpen Account Types

FXOpen provides a variety of account types tailored to different trading needs and experience levels.

The flagship ECN account offers raw spreads starting from 0.0 pips with commission ranging from $1.5 to $3.5 per lot, depending on account balance.

With a minimum deposit of $100 and leverage up to 1:1000, this account is ideal for high-frequency, algorithmic, and professional traders. Supported platforms include MetaTrader 4, MetaTrader 5, TickTrader, and TradingView.

The STP account requires only $10 to open and charges no commission (spreads are marked up instead). It’s better suited for beginners or casual traders who prefer a simplified cost structure. Leverage goes up to 1:500.

The Micro (cent) account is designed for new traders looking to test strategies in a low-risk environment. It features a minimum deposit of $1, leverage up to 1:500, and supports trading in gold, silver, and 28 currency pairs, with a balance cap of $3,000.

All account types support demo versions, and Islamic (swap-free) options are available on request. ECN and STP accounts also support copy trading through PAMM structures.

Why FXOpen? (Pros & Cons)

The broker’s regulatory status and account offerings are very persuasive, but to help you decide if it is the right firm for you, let's examine its advantages and disadvantages.

Pros | Cons |

Regulated by reputable authorities | High entry barrier |

ECN execution with deep liquidity | Limited account currencies in some regions |

Tight spreads starting from 0.0 pips | Inactivity fees |

Low commissions | Limited supported languages |

Overall, FXOpen's strengths lie in its competitive pricing, advanced technology, and diverse product offerings. However, traders should consider the higher minimum deposit and potential fees when evaluating the company.

How to Sign Up and Verify My Identity on FXOpen?

To begin trading with FXOpen, traders must first create an account with this broker. FXOpen registration:

#1 Begin at the FXOpen Website

Head to the official FXOpen EU site, select your country, and start registration. Provide your email, set a secure password, and hit “Create Account”.

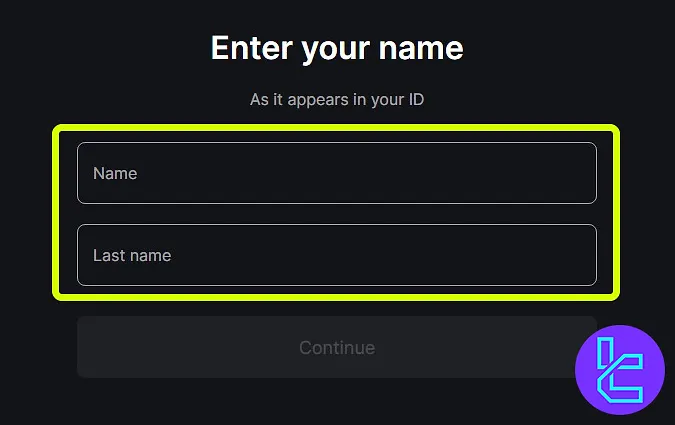

#2 Submit Identity Details

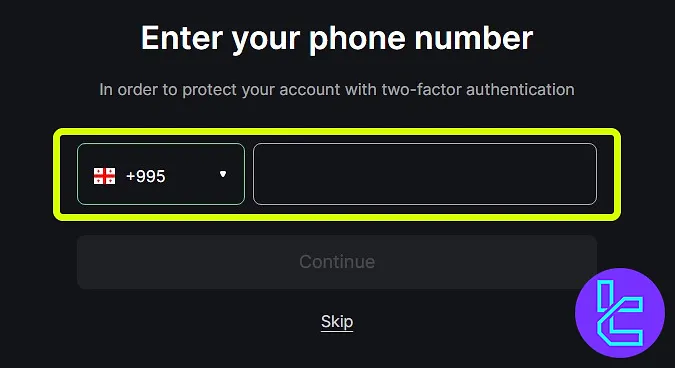

Enter your full name and mobile number to proceed.

#3 Confirm via SMS

Use the verification code sent to your phone to activate your account.

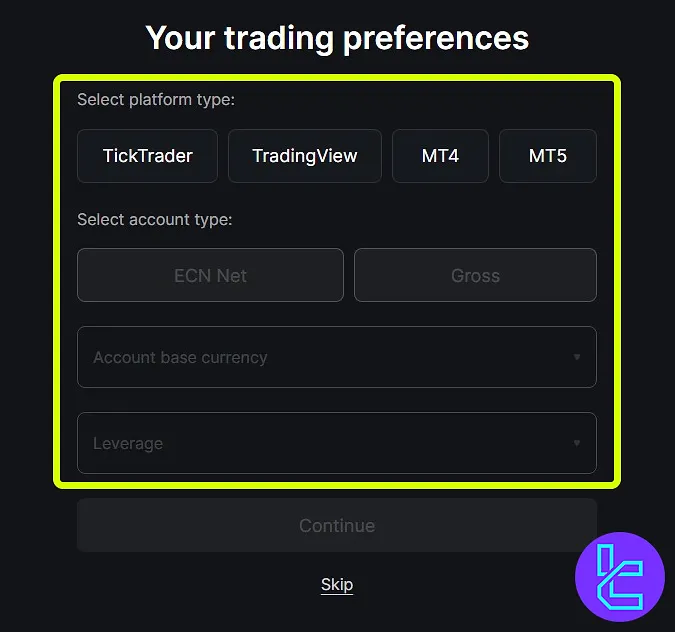

#4 Configure Trading Preferences

Pick your account type, preferred trading platform, base currency, and desired leverage. Accept the broker’s terms to complete the setup.

#5 Complete User Identification Process

In this step, you must provide the following documents to complete the FXOpen verification procedure:

- Proof of Identity: A valid government-issued ID, passport, or driver's license

- Proof of Address: A recent utility bill or bank statement (not older than three months)

FXOpen Trading Platform Offerings

FXOpen provides access to four robust trading platforms, each tailored to different trading preferences:

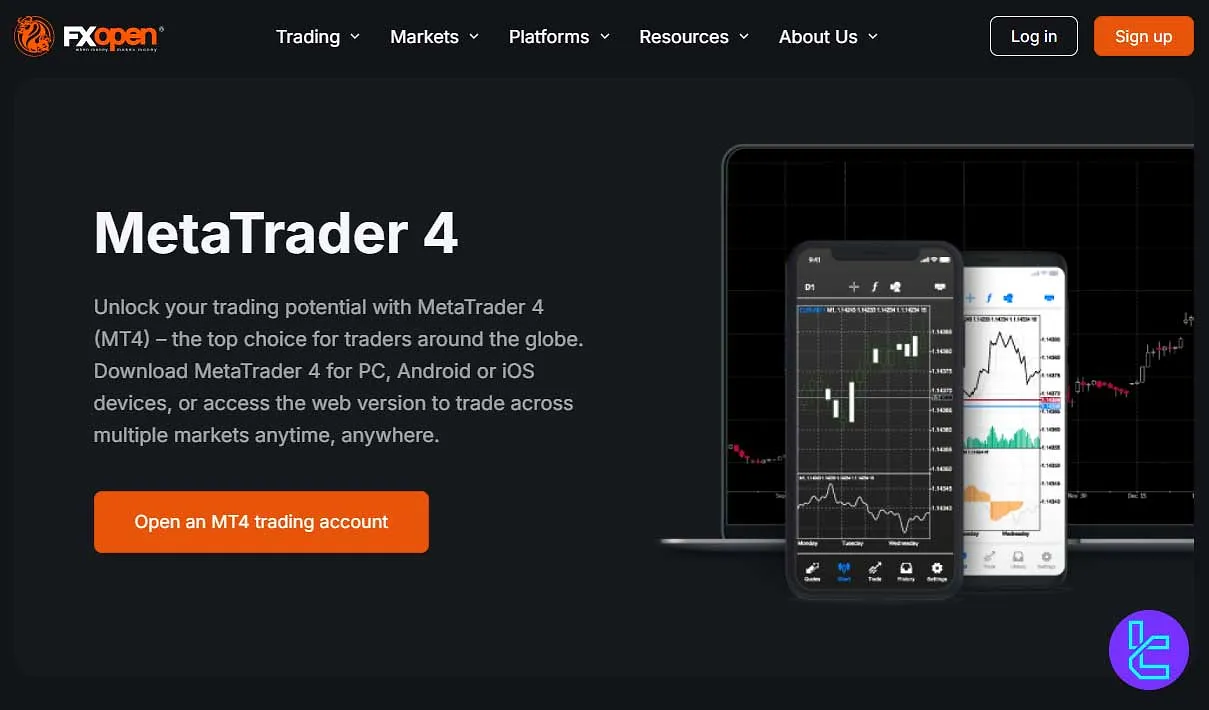

- MetaTrader 4 (MT4): Known for stability and simplicity, MT4 is ideal for forex trading. It supports Expert Advisors (EAs), custom indicators, and mobile/web access, though it lacks support for Net accounts and an integrated economic calendar;

- MetaTrader 5 (MT5): The successor to MT4 adds support for Net accounts, more timeframes, improved execution types, and a built-in economic calendar. It’s ideal for multi-asset traders seeking deeper analytics;

- TradingView: Introduced in 2022, this platform offers powerful, community-driven charting tools, real-time sentiment data, and cross-device compatibility. However, it doesn’t support crypto trading or automation at FXOpen;

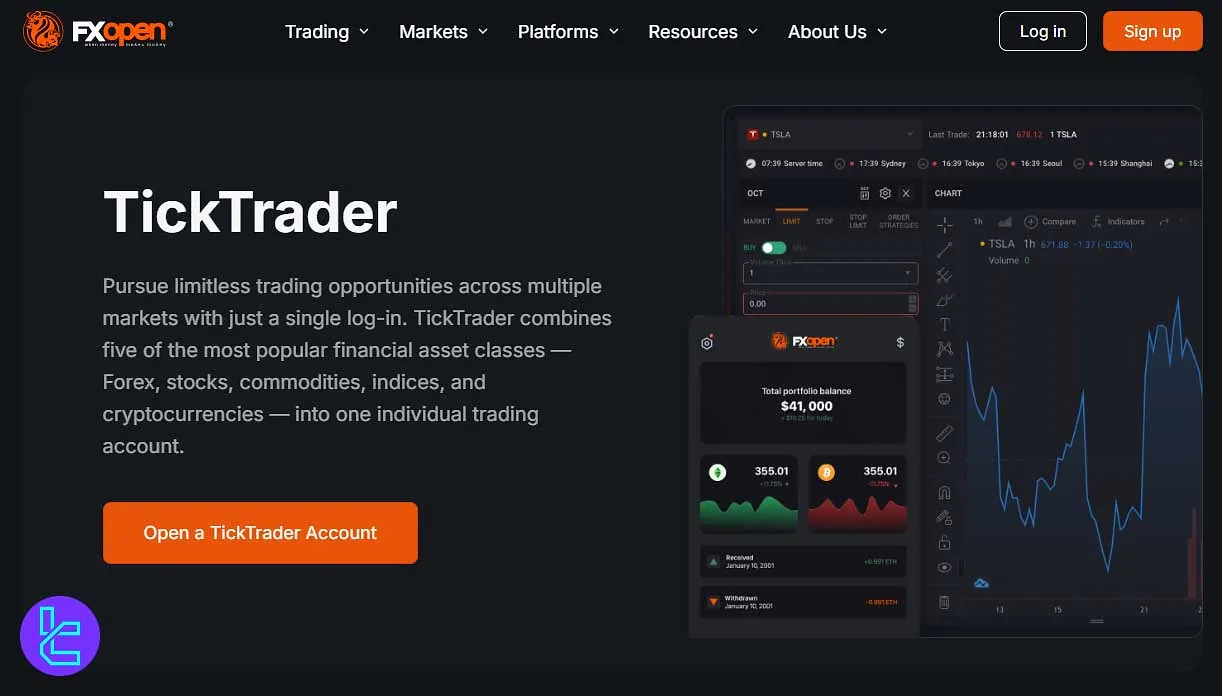

- TickTrader: FXOpen’s proprietary platform was upgraded in 2024 and includes Level 2 pricing, one-click trading, 1,200+ trading tools, and advanced order types like One-Triggers-Another (OTA) and Order-by-Date (OBD).

Additional tools include a free VPS (2GB RAM, 40GB SSD) for qualifying ECN, Crypto, and STP accounts, an economic calendar, pip and margin calculators, and a blog and forum offering daily market insights. However, TickTrader still lacks a trailing stop order — one of the few missing pieces in its toolkit.

FXOpen Costs (Fees & Spreads)

FXOpen’s pricing model is competitive, particularly for high-volume traders and scalpers using the ECN account structure. Commissions are applied on a tiered basis:

- $3.50 per lot for accounts under $1,000

- $2.50 per lot for balances between $1,000 and $25,000

- $1.80 per lot for $25,000 to $250,000

- $1.50 per lot for accounts exceeding $250,000

For cryptocurrency CFDs, a fixed commission of 0.5% per side is charged. In contrast, index CFD trading has been commission-free since 2023, making the broker particularly appealing to cost-sensitive traders.

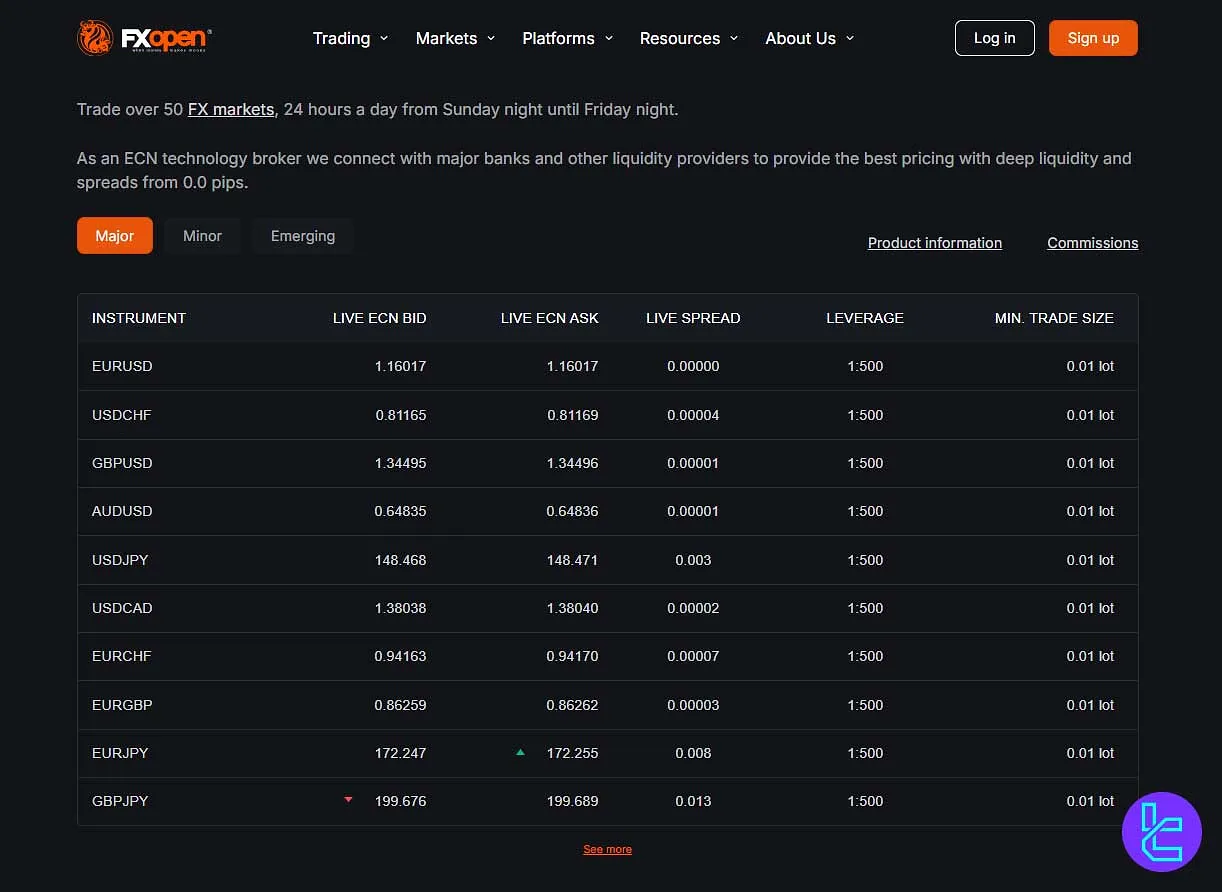

Spreads are extremely tight, with EUR/USD averaging around 0.2 pips.

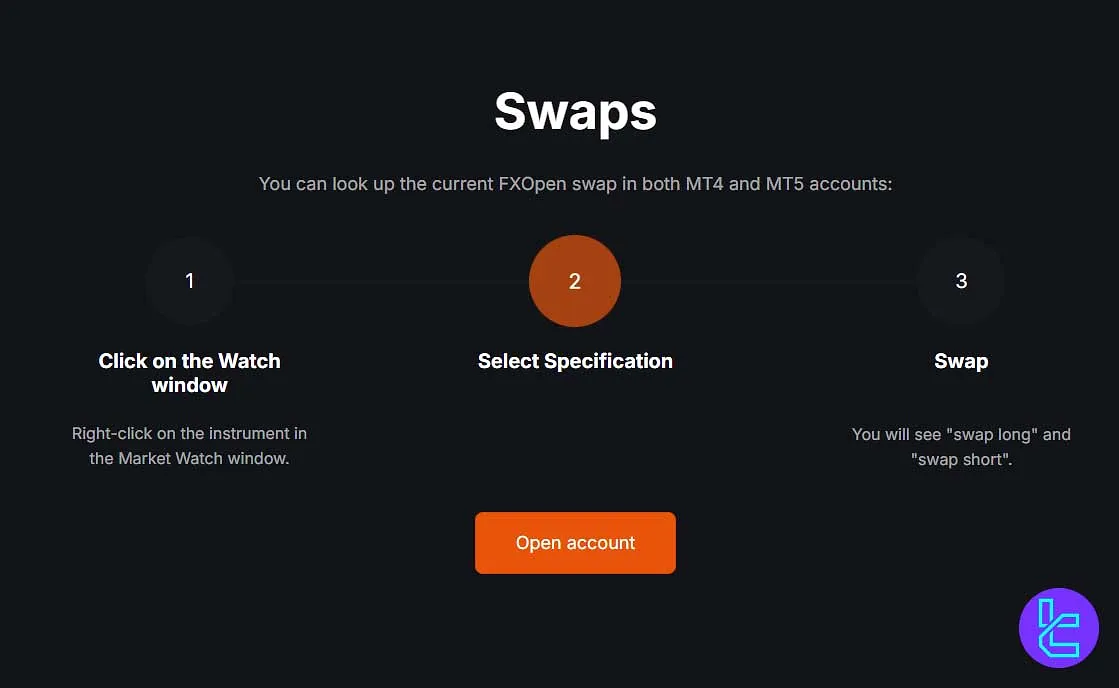

Swap Fees

Swap fees apply for overnight positions on various instruments. However, the brokerage's website does not mention a specific structure or formula on how the numbers are calculated in this regard.

Non-Trading Costs

Based on valid data, traders with inactive accounts may incur a $10 monthly fee after 90 days. A $50 reactivation fee applies if the account is disabled.

Additionally, currency conversion charges may apply when funding in a currency that differs from your account's base currency.

What Payment Methods Are Available on FXOpen?

The firm offers a variety of payment methods to accommodate traders from different regions. The following sections will review these options.

If you need more details about the FXOpen deposit and withdrawal methods, check our detailed article.

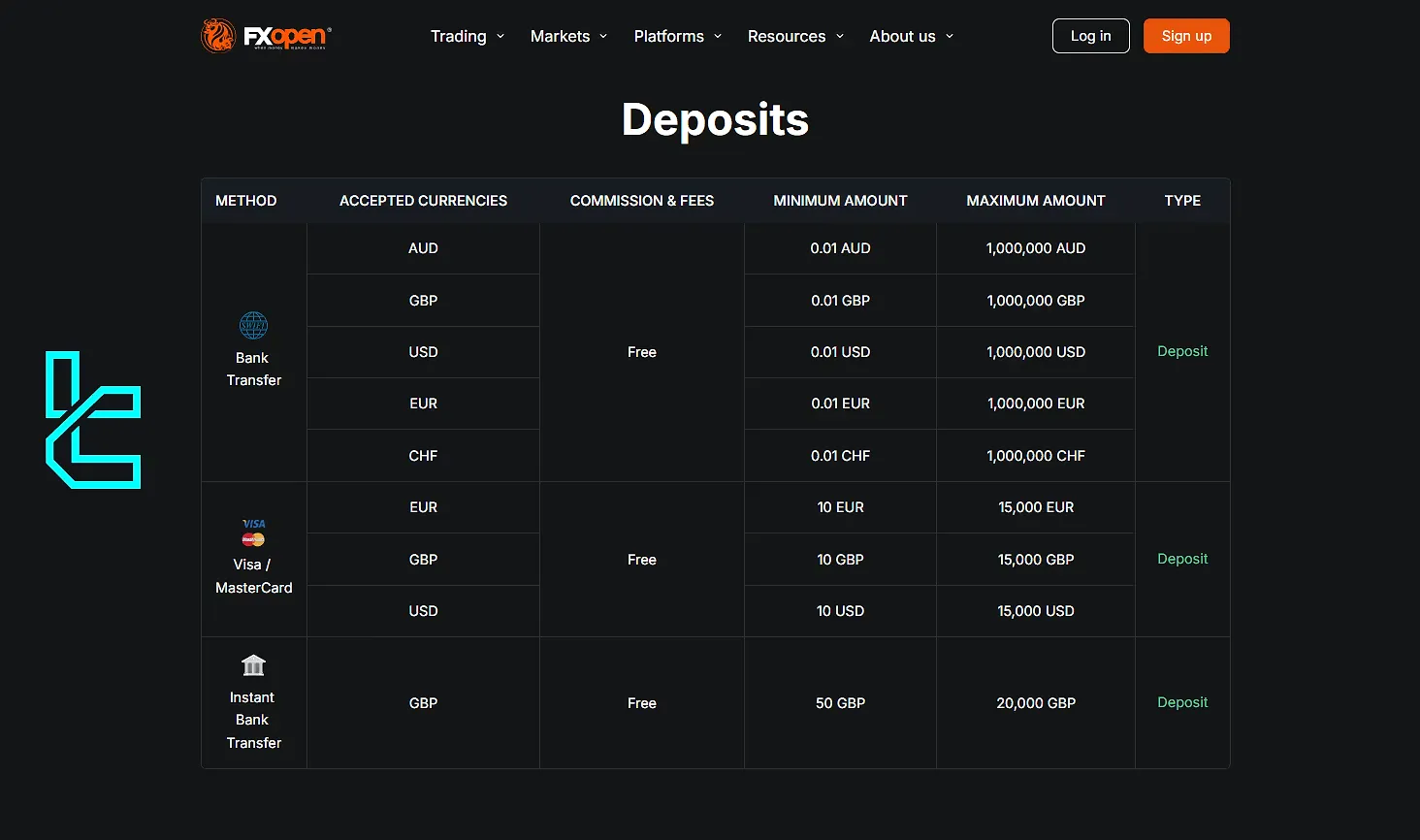

Account Charging Solutions

You can fund your account instantly, and it will not come with any costs. Here's a table of specifics:

Method | Currency | Fees | Min. Deposit Size |

Bank Transfer | AUD | Free | 0.01 AUD |

GBP | 0.01 GBP | ||

USD | 0.01 USD | ||

EUR | 0.01 EUR | ||

CHF | 0.01 CHF | ||

Visa / MasterCard | EUR | 10 EUR | |

GBP | 10 GBP | ||

USD | 10 USD | ||

Instant Bank Transfer | GBP | 50 GBP |

You can only make deposits via bank accounts in your name. The transaction may take up to 1 hour to appear on your account balance.

Withdrawal Choices

Now, let’s see what the withdrawal methods are. There is not much difference between deposit and withdrawal options on this broker:

Option | Accepted Currency | Fees | Max. Withdrawable Amount |

Bank Transfer | EUR | €15 | No limit |

USD | $30 | ||

GBP | £15 | ||

Visa/MasterCard | EUR | Free | €1,000 |

USD | $1,000 | ||

Easy Bank Transfer | EUR | Free | €20,000 |

GBP | £20,000 |

Withdrawal requests on FXOpen are processed within 24 hours on business days, and bank transfers typically take 1-3 business days to be applied.

Copy Trading and Investment Plans on FXOpen

The firm offers a Percentage Allocation Master Module (PAMM) service, allowing investors to copy experienced traders' moves in the market. You can open ECN or STP PAMM accounts, but the minimum deposits vary based on the master’s requirements. Key Features ofFXOpen's Copy Trading Service:

- Segregated funds for PAMM account trading

- Detailed performance metrics for each master

- Ability to invest in multiple offers

- Offer a Migration feature to switch between masters

- Real-time equity reports and analytics

- Shorter trading intervals (7 days) for more frequent profit withdrawals

The broker also offers several earning options through the partnership program. You can earn up to 90% of trading commissions by introducing the firm and attracting new customers.

What Markets and Symbols Are Available on FXOpen Broker?

Now is the time to explore asset offerings in the FXOpen review. The firm provides access to over 600 trading instruments across several asset classes. You can trade non-stop with the broker’s diverse asset offerings. Table of asset details:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Standard, Micro, Ultra Low Accounts | 55 Currency Pairs | 50–70 Currency Pairs | 1:500 | |

Stocks | CFDs on Shares (via MT5 Platform) | Over 1000 Global Stocks | 800–1200 | 1:5 |

Commodities | CFDs on Commodities | Around 15 Instruments | 10–20 Instruments | 1:100 |

Indices | CFDs on Global Indices | Around 14 Indices | 10–20 Indices | 1:100 |

ETFs | Exchange-Traded Funds Tracking Various Sectors and Indices | N/A | N/A | 1:5 |

CFDs on Major Cryptocurrencies | N/A | N/A | 1:3 |

Note that the leverage and availability of assets may differ based on the region of your residence.

FXOpen Bonus and Promotion Plans

The broker occasionally offers bonuses and promotions to attract new clients and reward existing ones. However, these programs are usually available only on FXOpen Markets due to regulatory guidelines.

Currently, the broker only offers a $10 no-deposit bonus for traders who open ECN accounts on the TickTrader platform. Steps to claim the FXOpen No Deposit bonus:

- Create your eWallet on the broker;

- Complete the grade 1 verification process;

- Open a TickTradr ECN account.

How to Contact FXOpen Customer Support? (Service Hours)

Knowing your financial firm on a human level and not a corporate relationship is mind-easing, especially when the support team is attentive and helps you through all issues. FXOpen provides customer support through various channels, including:

support@fxopen.com | |

Phone | +357 25024000 |

Online chat | Available on the website |

38 Spyrou Kyprianou Street, CCS BLDG - Office N101, 4154 Limassol, Cyprus |

FXOpen Broker Geo-Restrictions

We should mention the restricted countries in the FXOpen review. The firm operates under different regulatory entities to serve clients globally. However, due to varying regulatory requirements, it’s obligated to refuse services in some regions, including:

- USA

- Iran

- North Korea

- Syria

FXOpen Special Offerings

While the broker doesn’t offer any eye-catching bonus and promotion plans, it distinguishes itself with several special offerings.

- Margin and Pip Value Calculator: Gain access to exact margin and pip data on ECN FX Spot, STP, Crypto, Stock, and ECN Index CFD

- One Click Trading and Level2 Plugin: Access 5 levels of market depth and place orders with one mouse click

- VPS Hosting: Free Virtual Private Server for qualifying accounts with 40 GB SSD disk space and 2 GB RAM memory

- Fixed API: Direct access to FXOpen ECN and applicable to all asset classes

- Economic Calendar: Use what’s happening all around the world to your advantage and earn profits

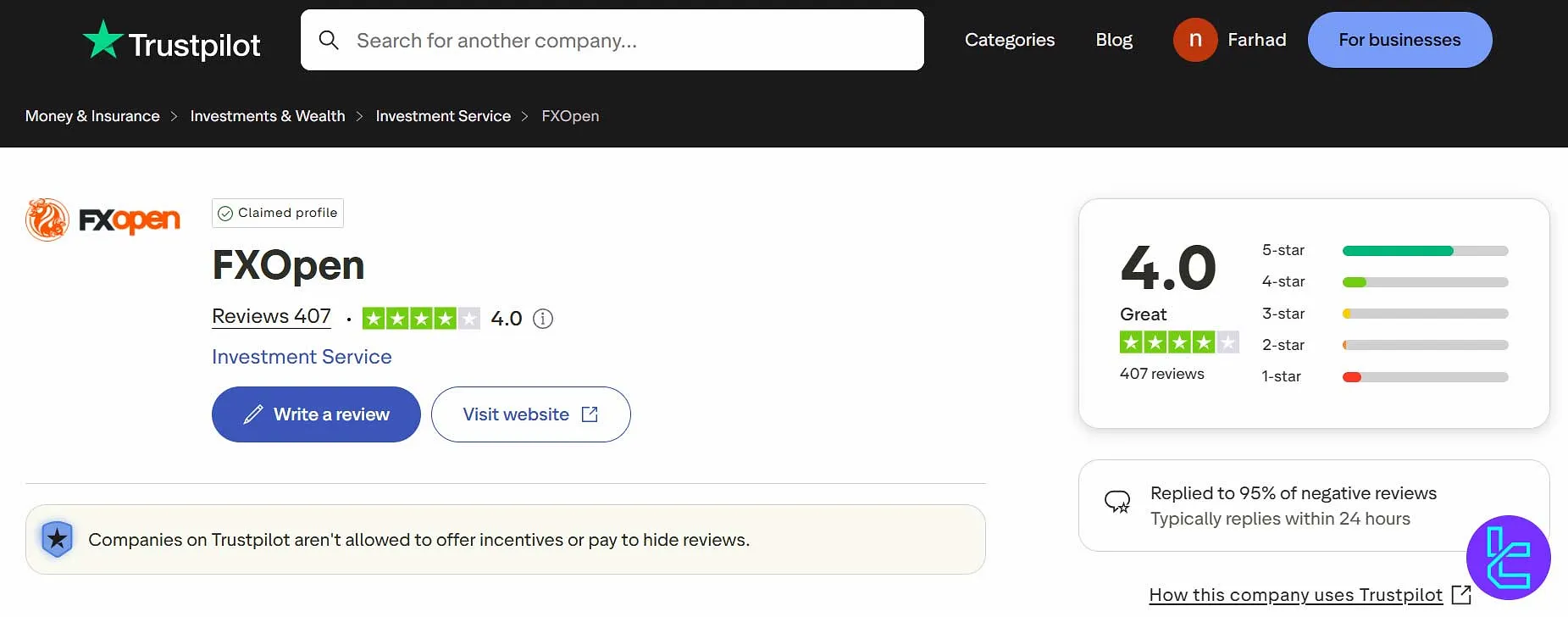

FXOpen Broker on Trustpilot and Other Review Websites

Trust score may be the most important subject in the FXOpen review. The firm has received generally positive feedback across various platforms. It’s usually praised for regulatory compliance, responsive support, and competitive spreads, while there are complaints about the time-consuming registration process, limited educational materials, and payment methods.

Here's a summary table of trust scores and ratings given to the brokerage:

4 out of 5 | |

3 out of 5 |

Does FXOpen Provide Educational Materials?

The broker recognizes the importance of trader education and offers a variety of educational resources to help users enhance their skills and knowledge. Here's an overview of the educational materials provided by the firm.

- Blog: Regular articles on market analysis, trading strategy tips, platform tutorials, and feature explanations

- Knowledge Base: A collection of articles, user guides, and FAQs about FXOpen

- Video Tutorials: Explanations of trading concepts and techniques are available on FXOpen's YouTube channel

FXOpen Comparison Table

The table below assists traders in understanding the pros and cons of trading with FXOpen in comparison to other competitors.

Parameters | FXOpen Broker | |||

Regulation | CySEC, ASIC, FCA | FSA, FSC, Misa, FinaCom | CySEC, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Spread | From 0.0 pips | From 0.0 pips | From 0.00001 pips | From 0.0 Pips |

Commission | From $0.0 | $8 | $0 | |

Minimum Deposit | $1 | $100 | $100 | $100 |

Maximum Leverage | 1:500 | 1:3000 | 1:300 | 1:400 |

Trading Platforms | Zero for STP accounts and Variable in ECN | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrader 5 | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

Account Types | ECN, STP, Micro | Standard, ECN, Fixed, Crypto, Demo | ECN, ECN Plus, ECN VIP, Demo | Standard, Demo, Professional |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | +700 | 550+ | 120+ | 1250+ |

Trade Execution | Market, Stop, Stop-limit, Limit, OCO, Iceberg | Instant, Market | Market | Instant |

Conclusion and Final Words

FXOpen offers Spot, Futures, Margin, and PAAM trading on 600+ financial instruments across 6 asset classes, including Forex and ETFs. The company provides these features through its ECN and STP accounts with floating spreads from 0.0 pips. FXOpen broker has a great Trustpilot score of 4.0 out of 5.0.