FXPrimus is a CySEC and VFSC-regulated Forex broker with offices in Limassol and the Republic of Vanuatu. This broker provides over 200 tradable instruments for traders who create a Classic, Pro, or Zero account with this broker.

FXPrimus supports various base currencies such as USD, EUR, GBP, SGD, and PLN.

FXPrimus General Information and Regulatory Status

FXPrimus has quickly risen to prominence in the online trading sphere. The broker offers a diverse range of financial instruments, including Forex, Equities, Indices, and Precious Metals. Here's what you need to know about FXPrimus:

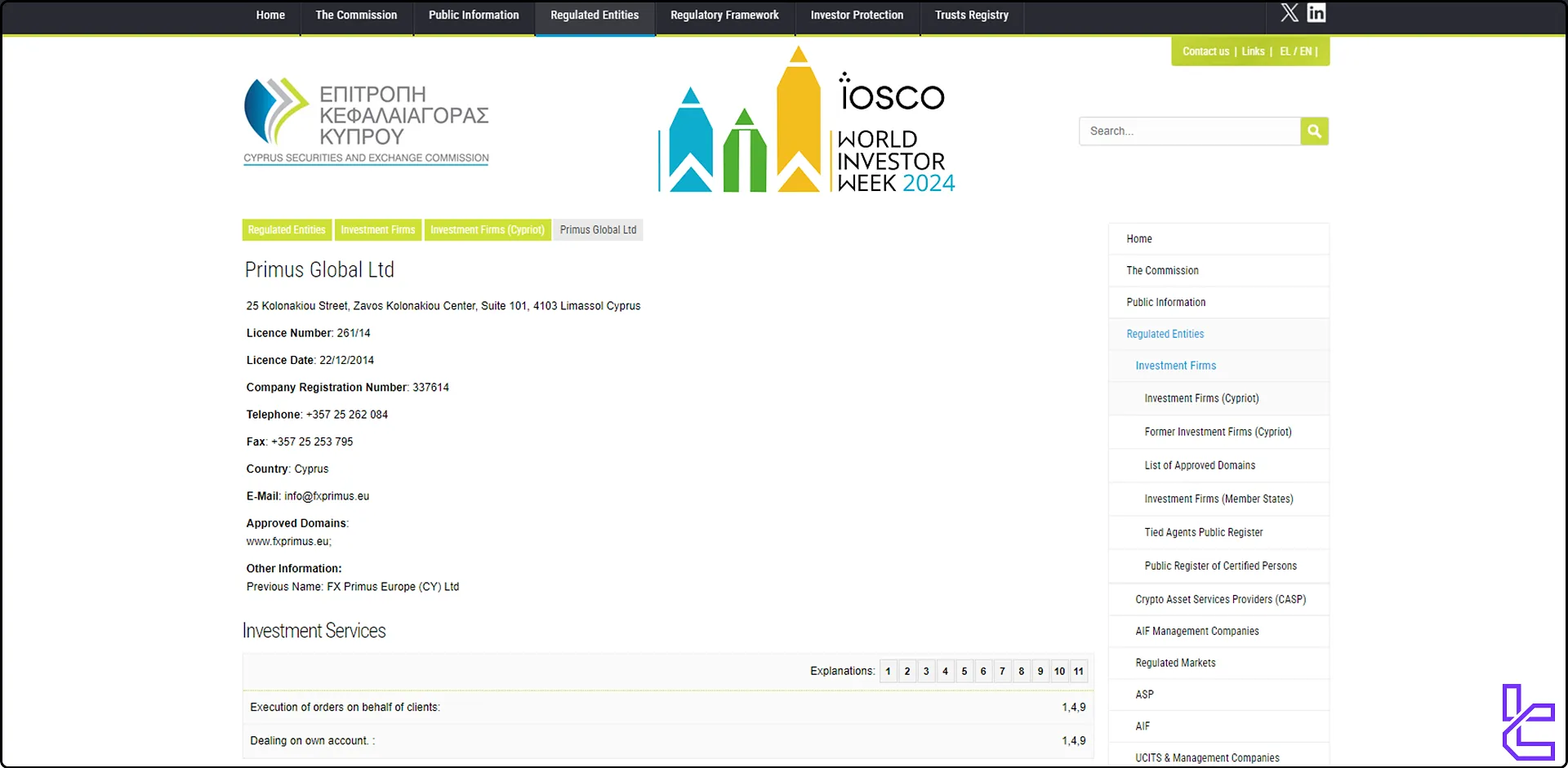

- Regulated by the Cyprus Securities and Exchange Commission (CySEC) (license number HE 337614)

- Regulated by Vanuatu Financial Services Commission (VFSC) (license number 14595)

- Terry Thompson is the CEO of Fxprimus

- FXPrimus has over 300,000 active clients

The table below demonstrates a summary of the brokerage's different entities' information:

Entity Parameters/Branches | Primus Markets INTL LTD | Primus Global LTD |

Regulation | VFSC | CySEC |

Regulation Tier | 4 | 1 |

Country | Vanuatu | Limassol, Cyprus |

Investor Protection Fund / Compensation Scheme | No | Up to €20,000 under ICF |

Segregated Funds | N/A | Yes |

Negative Balance Protection | No | Yes |

Maximum Leverage | 1:1000 | 1:30 |

Client Eligibility | Global | Only EU/EEA Residents |

Who is the CEO?

Terry Thompson serves as theCEO and President of FXPrimus, a brokerage he co-founded alongside his partners. With professional experience in the financial markets dating back to 2000, his expertise spans both equities and Forex trading.

FXPrimus Broker Summary

Let's take a closer look at what FXPrimus Forex broker has to offer:

Broker | FXPrimus |

Account Types | Classic, Pro, Zero |

Regulating Authorities | CySEC, VFSC |

Based Currencies | USD, EUR, GBP, SGD & PLN |

Minimum Deposit | $15 |

Deposit Methods | Bank Wire Transfer, Local Bank Payment, E-Wallets (Neteller, Skrill, etc.), Cryptocurrencies |

Withdrawal Methods | Bank Wire Transfer, Local Bank Payment, E-Wallets (Neteller, Skrill, etc.), Cryptocurrencies |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | Copy trading |

Trading Platforms & Apps | MT4, MT5, cTrader, WebTrader |

Markets | Forex, indices, commodities, crypto, equities, energies, metals, stocks |

Spread | Floating from 0.0 pips |

Commission | From $5 |

Orders Execution | Market |

Margin Call/Stop Out | 30%/30% |

Trading Features | Demo account, Forex calculator |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cashback bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, live chat, social media |

Customer Support Hours | 24/5 |

Restricted Countries | USA, Australia, Iran, North Korea, and Belgium |

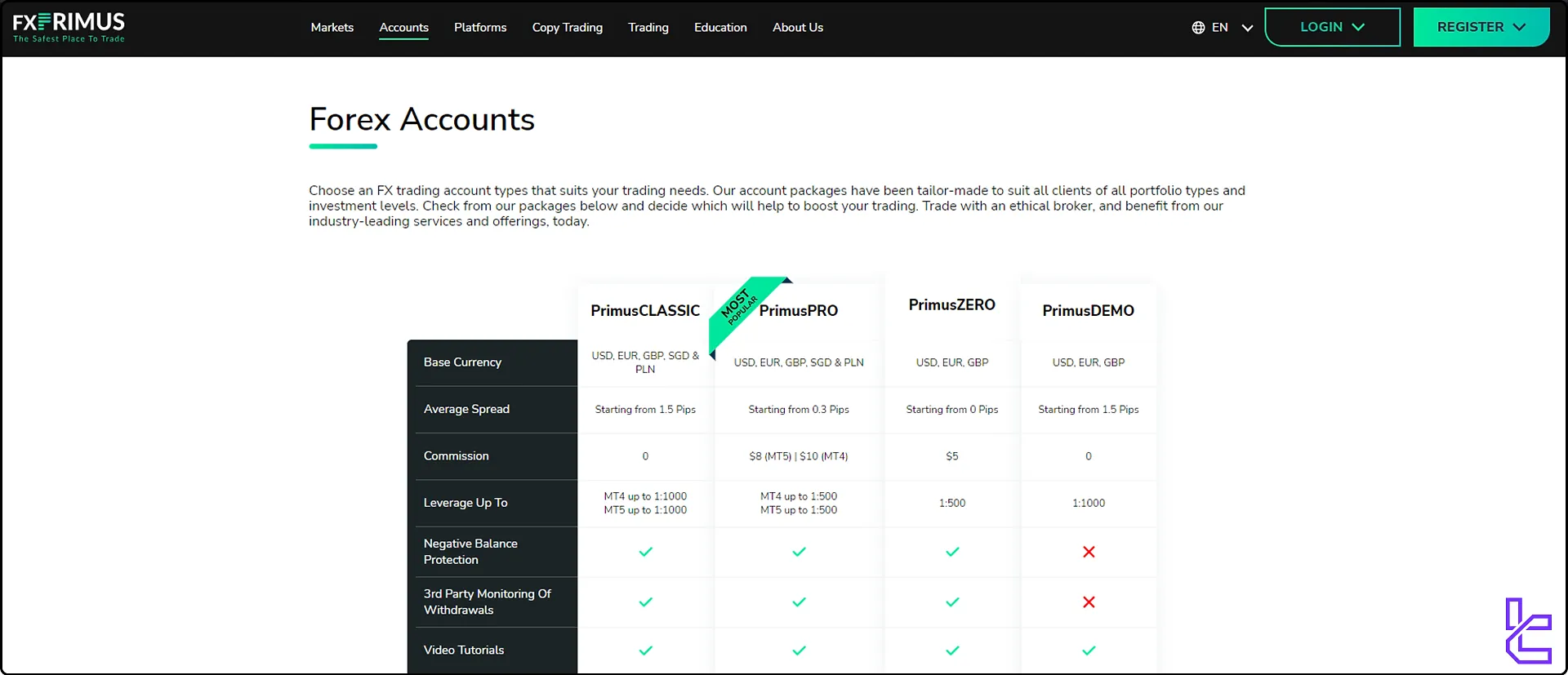

FXPrimus Broker Account Types Overview

FXPrimus offers a range of account types to suit different trading styles and experience levels:

Account types | Classic | Pro | Zero |

Minimum deposit | $15 | $500 | $1000 |

Minimum trading volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:1000 | 1:500 | 1:500 |

Spreads | Floating from 1.5 pips | Floating from 0.3 pips | Floating from 0 pips |

Commission | 0$ | $8 for on MT5 and $10 on MT4 | 5$ per lot per side |

This wide range of account types caters to traders with different trading goals and preferences.

FXPrimus also offers a demo account for beginner and professional traders to perform various trading strategies in a risk-free environment.

Advantages and Disadvantages of FXPrimus Broker

Here’s a balanced look at FXPrimus' key benefits and drawbacks:

Advantages | Disadvantages |

Regulated by CySEC and VFSC | High minimum deposit on Pro and Zero accounts |

Multiple trading platforms (MT4, MT5, cTrader) | Higher trading costs on entry-level accounts |

Tight spreads on higher deposit accounts | - |

Copy trading feature | - |

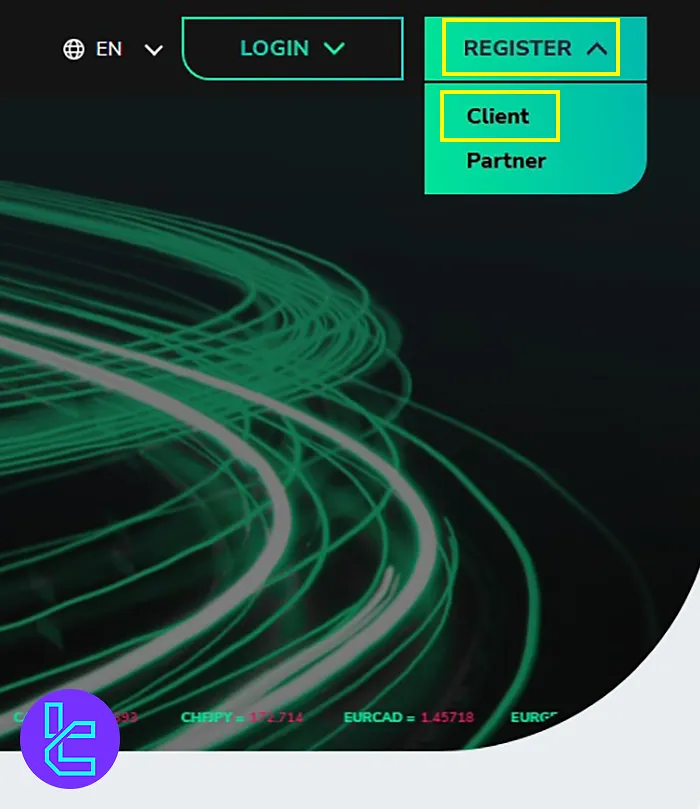

FXPrimus Broker Account Opening & Verification

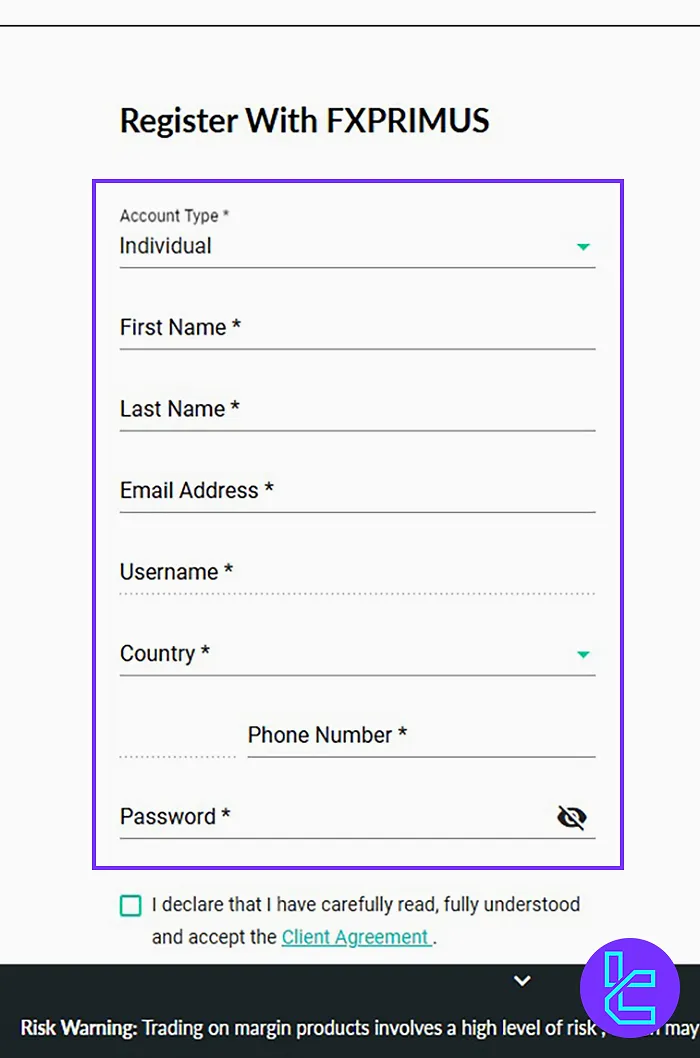

Traders can easily open an account with FXPrimus by following a simple 3-step process. FXPrimus registration:

#1 Start the Registration Process

Head to the official FXPrimus website and access the Client Registration page. Fill in your account type, name, email, phone number, country, and choose a secure password. Accept the terms to proceed.

#2 Verify Email & Provide Personal Information

Enter the PIN code sent to your email to verify it. Then, complete your residential address, date of birth, and answer questions on citizenship, tax residency, and PEP status. Provide a tax ID if applicable.

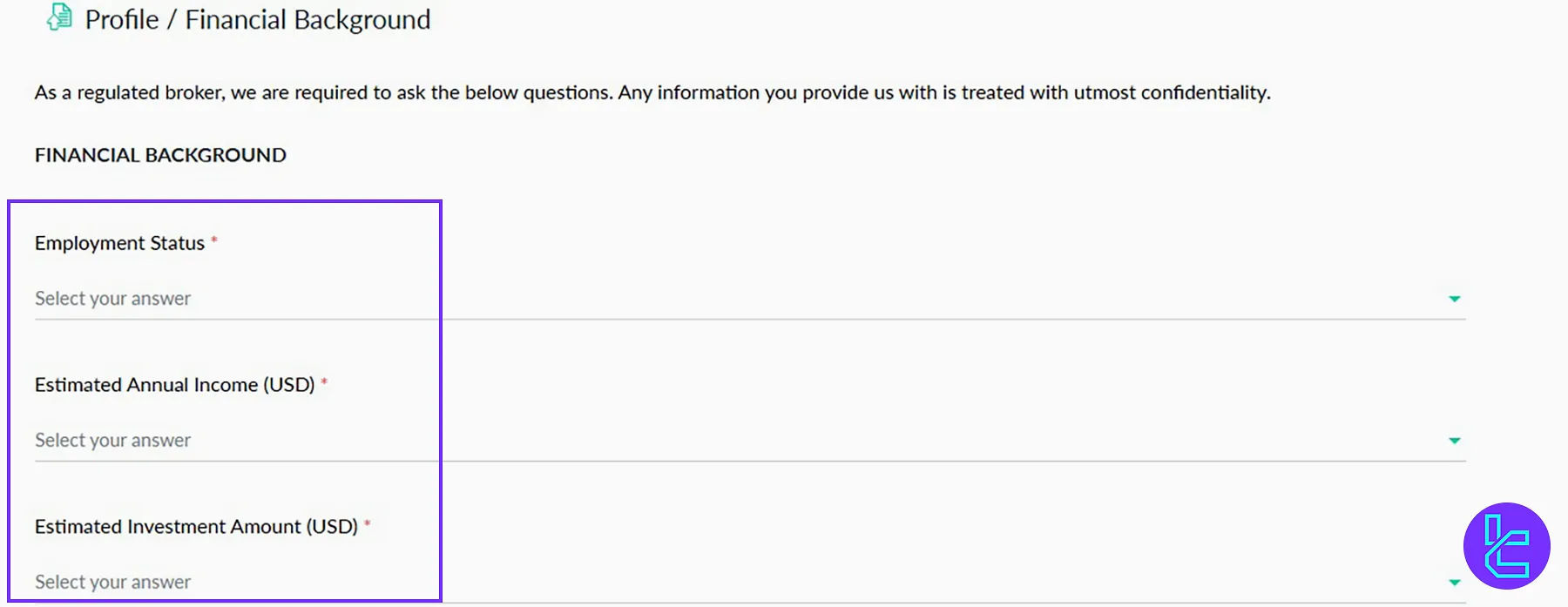

#3 Choose Trading Preferences & Complete Compliance

Select your preferred platform, account type, and leverage level. After that, answer the required questions related to your employment status and financial profile. You can skip the funding step and deposit later.

#4 Verify Your Trading Account

FXPrimus requires all traders to provide residential and identification information, along with valid documents (such as a utility bill, ID card, bank statement, or passport) to complete the KYC process.

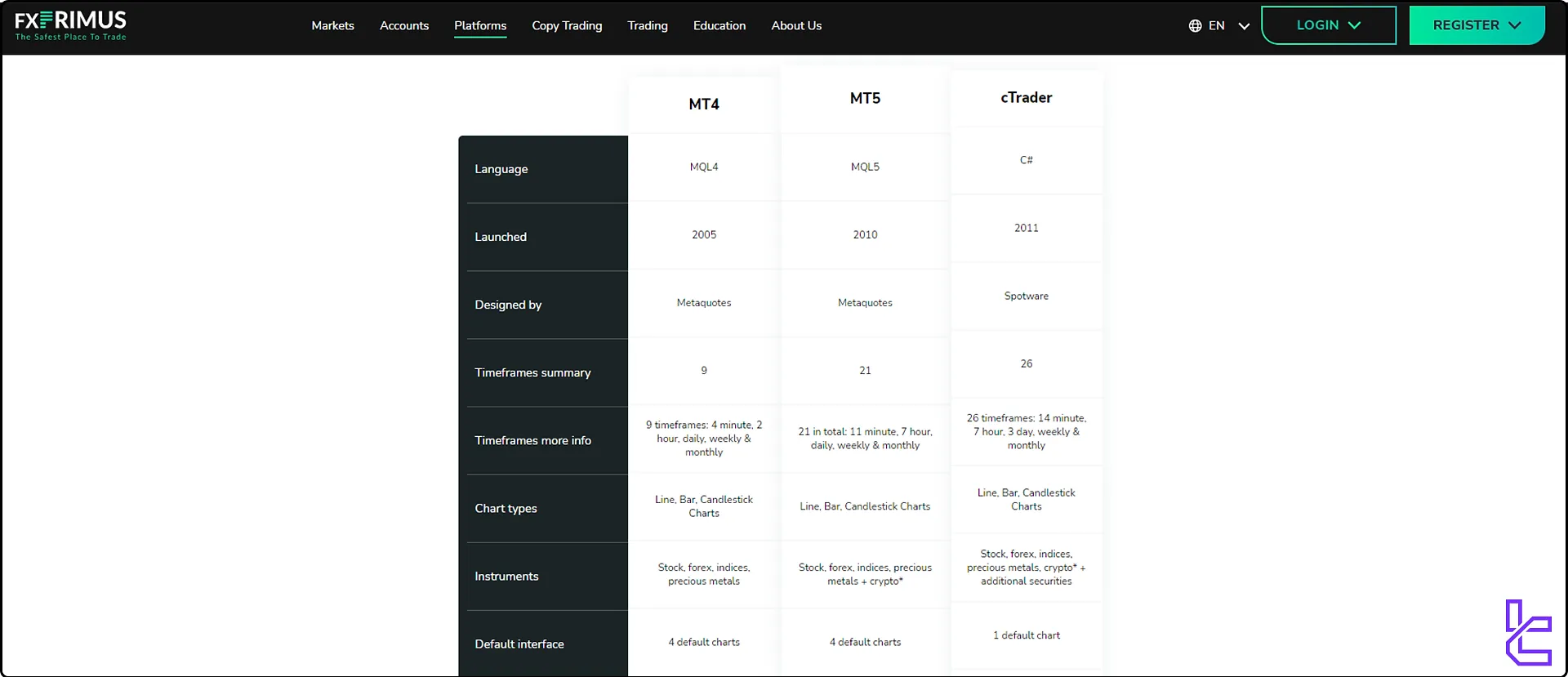

FXPrimus Trading Platforms and Applications

FXPrimus offers a variety of trading platforms, such as MetaTrader 4 and MetaTrader 5, to cater to different trader preferences:

MetaTrader 4

MT4 is an industry-standard platform known for its user-friendly interface and extensive customization options. This platform offers advanced charting tools, technical analysis, and automated trading capabilities through Expert Advisors (EAs).

Links:

MetaTrader 5

MT5 is the advanced version of MetaTrader 4 with additional features and improved functionality. This platform offers over 30 technical indicators and 21 timeframes.

Links:

cTrader

CTrader is a modern platform offering advanced charting tools and an easy-to-understand interface. This platform has customizable charts and automated trading features.

Links:

FXPrimus Spreads and Commissions

FXPrimus offers competitive pricing structures across its account types:

Account types | Spread | Commission |

Classic | From 1.5 Pips | No commission |

Pro | From 0.3 Pips | $8 on MT5 and $10 on MT4 |

Zero | From 0.0 Pips | $5 |

While the Classic account may have higher trading costs, the PRO and ZERO accounts offer tight spreads that can benefit active traders. The transparent fee structure allows traders to calculate their trading costs accurately.

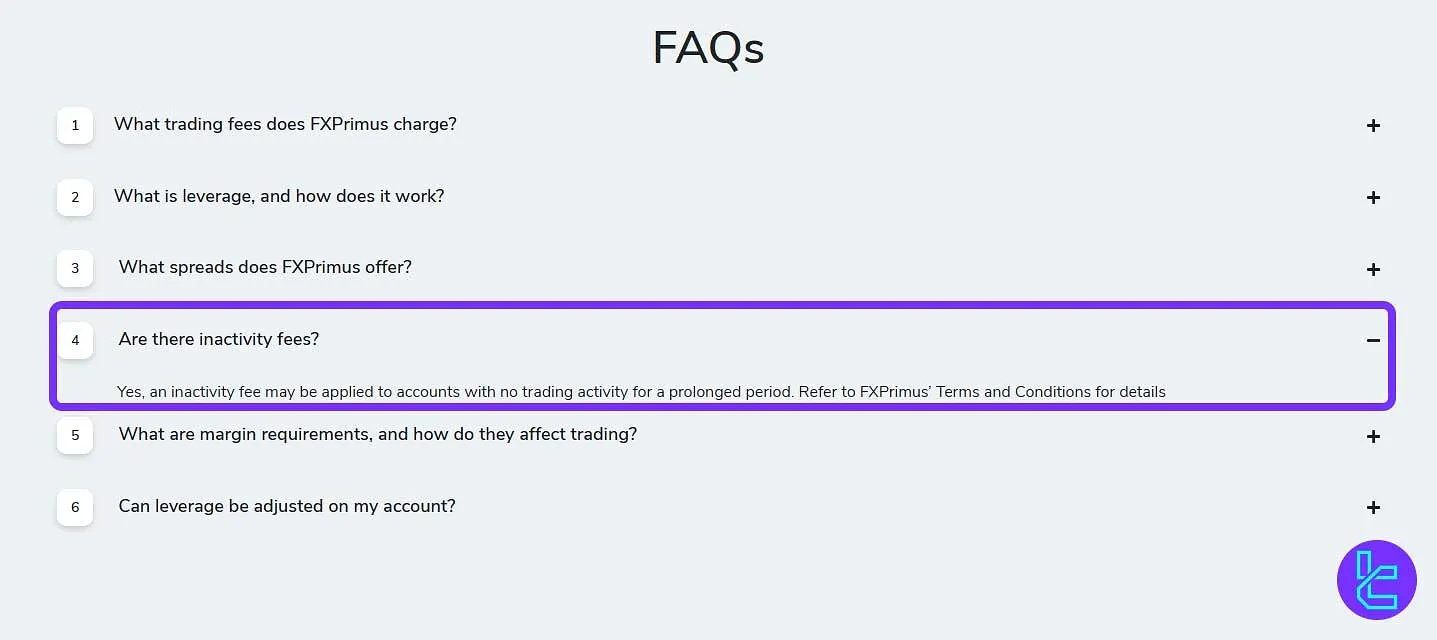

Non-Trading Fees

Per our investigations on the broker, an inactivity fee is charged for clients with accounts that are inactive for a "prolonged" period of time; no further details are provided.

Also, low currency conversion costs are incurred, and no deposit/withdrawal commissions are involved with FXPrimus.

FXPrimus Broker Deposit & Withdrawal Methods

FXPrimus supports various deposit and withdrawal methods to accommodate traders worldwide. The following sections will discuss the matter more deeply.

Deposit Methods

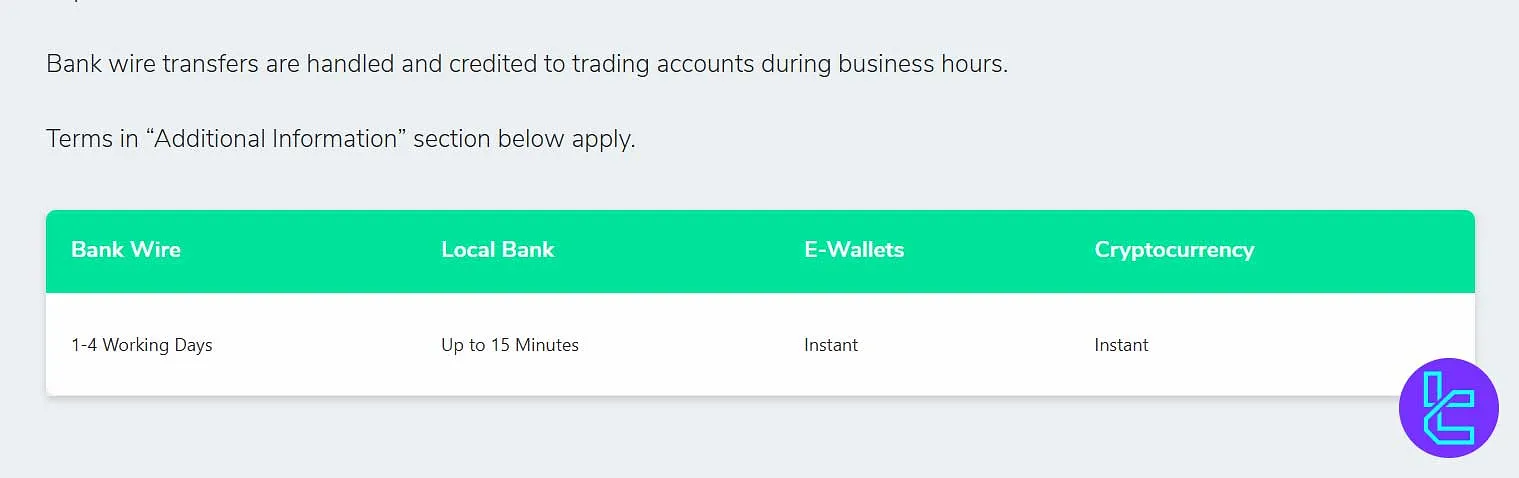

The brokerage provides four main solutions as payment systems for depositing funds into the account. Look at the table below for more information:

Funding Method | Processing Time | Fee |

Bank Wire Transfer | 1 to 4 Working Days | Free |

Local Bank Payment | Within 15 Minutes | |

E-Wallets (Neteller, Skrill, etc.) | Instant | |

Cryptocurrencies | Instant |

Withdrawal Systems

FXPrimus requires users to withdraw through the same method used for deposits for "security reasons". The broker mentions that withdrawals are typically processed in 24 business hours.

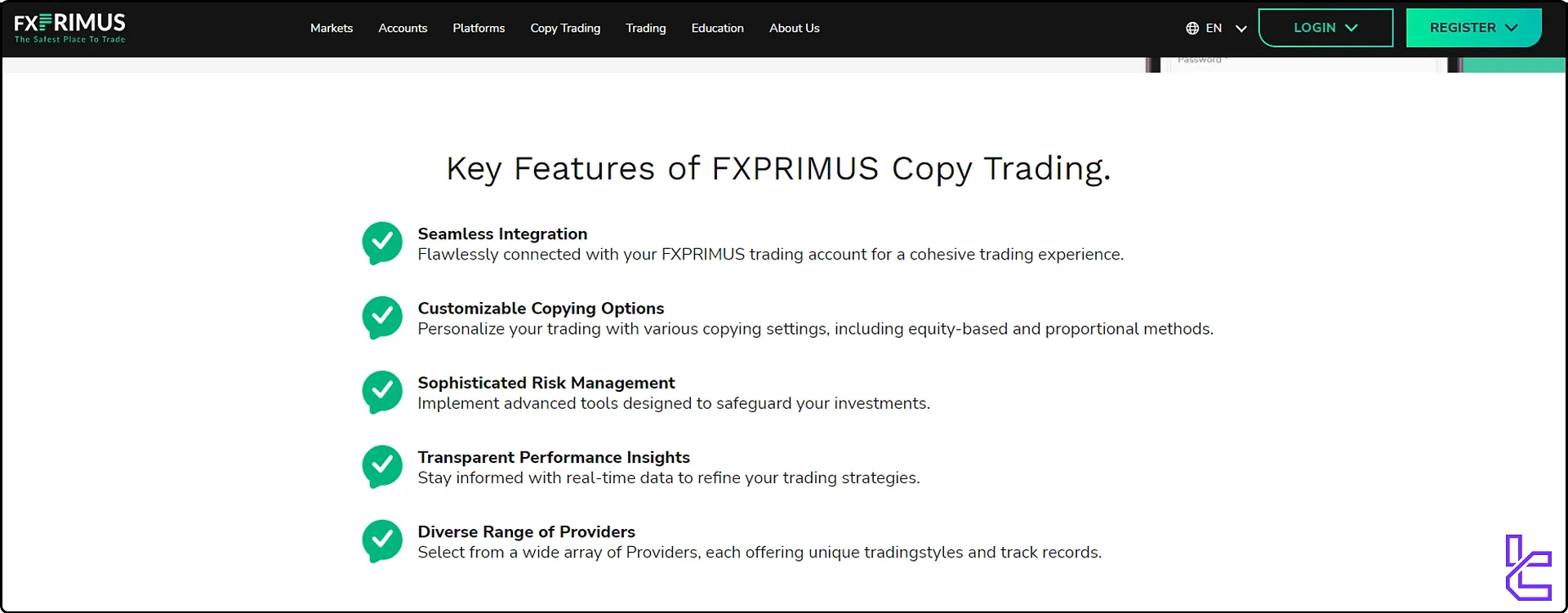

Copy Trading & Investment Options Offered on FXPrimus Broker

FXPrimus offers copy trading features, allowing less experienced traders to replicate the strategies of successful traders:

- Easy-to-use interface for selecting and copying traders

- Real-time updates on copied trades

- Ability to customize risk levels and investment amounts

- Diverse range of traders to choose from

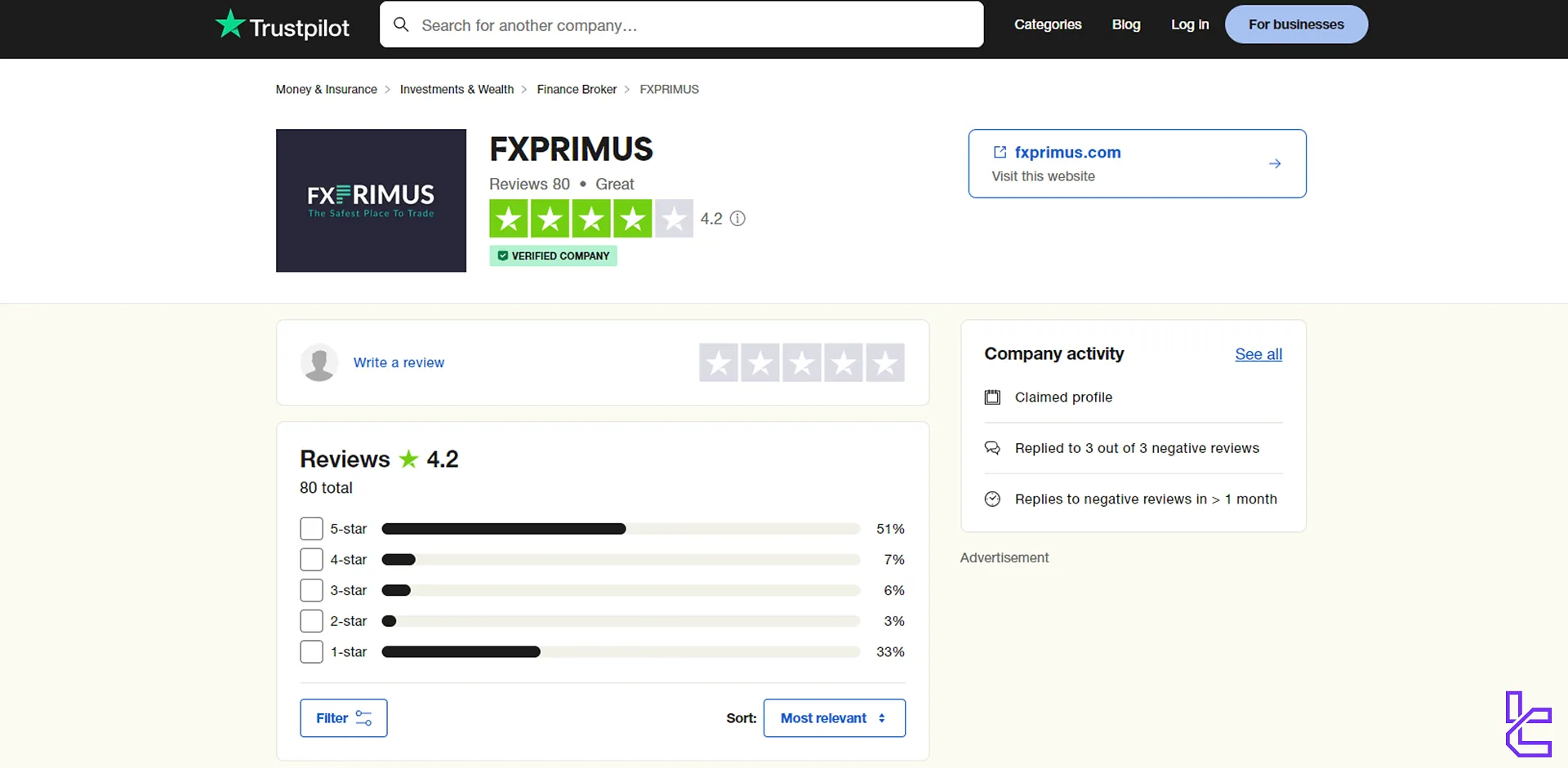

FXPrimus has a 4.2 trust score on the Trustpilot website

FXPrimus has a 4.2 trust score on the Trustpilot websiteCopy trading can be an excellent way for novice traders to learn and potentially profit from more experienced traders' strategies.

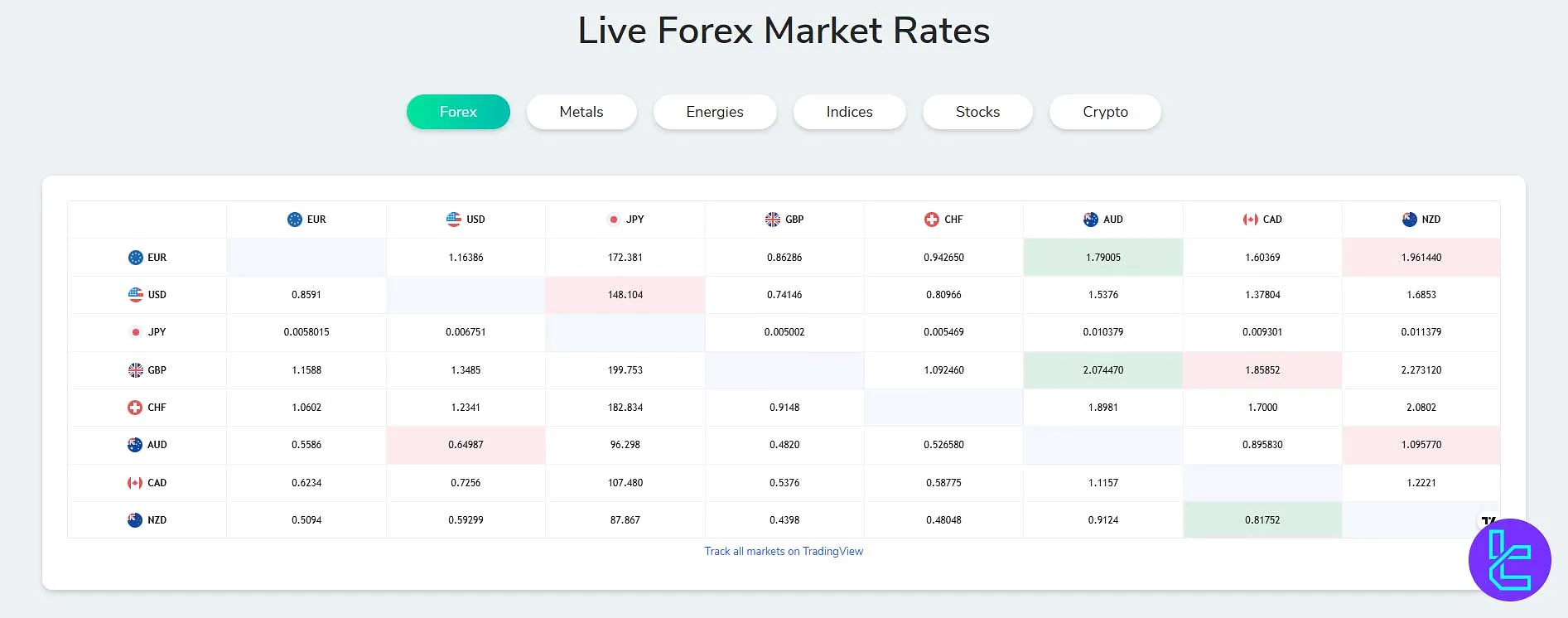

FXPrimus Tradable Assets and Symbols

FXPrimus offers access to over 140 tradable assets across a focused range of markets. While this number may be smaller than that of some industry peers, it provides sufficient coverage for traders targeting major instruments and strategies. Available markets are indicated in the table below with their corresponding information:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Major, minor, and some exotic FX pairs | 42 currency pairs | 50–70 currency pairs | |

Stocks | CFDs on selected global stocks | Selected major stocks | 800–1200 |

Indices | CFDs on global stock indices | Around 14 indices | 10–20 indices |

Commodities | CFDs on commodities, including crude oil and natural gas | Around 15 instruments | 10–20 instruments |

Precious Metals | CFDs on gold, silver, and platinum | 3 instruments | 3–5 instruments |

Cryptocurrency CFDs (no spot), including BTC and ETH | 2 major cryptocurrencies | 5–10 cryptocurrencies | |

ETFs | CFDs on Exchange-Traded Funds for broader market exposure | Selected ETFs | 10–30 ETFs |

FXPrimus does not currently support physical crypto assets, bonds, options, or managed accounts. Despite the narrower scope, the platform’s asset lineup is well-suited to both active traders and copy-based investors.

FXPrimus Bonuses and Promotion Plans

FXPrimus offers several attractive bonuses and promotions:

- 100% bonus on all deposits up to $20,000 (minimum deposit $200)

- Affiliate program

- 8% cashback up to $20,000 (from $4 to $8 per traded lot)

These promotions can provide additional trading capital and incentives for both new and existing clients.

FXPrimus Broker Customer Support

FXPrimus provides customer support through Email and live chat. Traders can send their inquiries to support@fxprimus.com and receive proper help from the FXPrimus expert client support. It is also worth noting that the live chat support is active 24 hours a day, Monday through Friday.

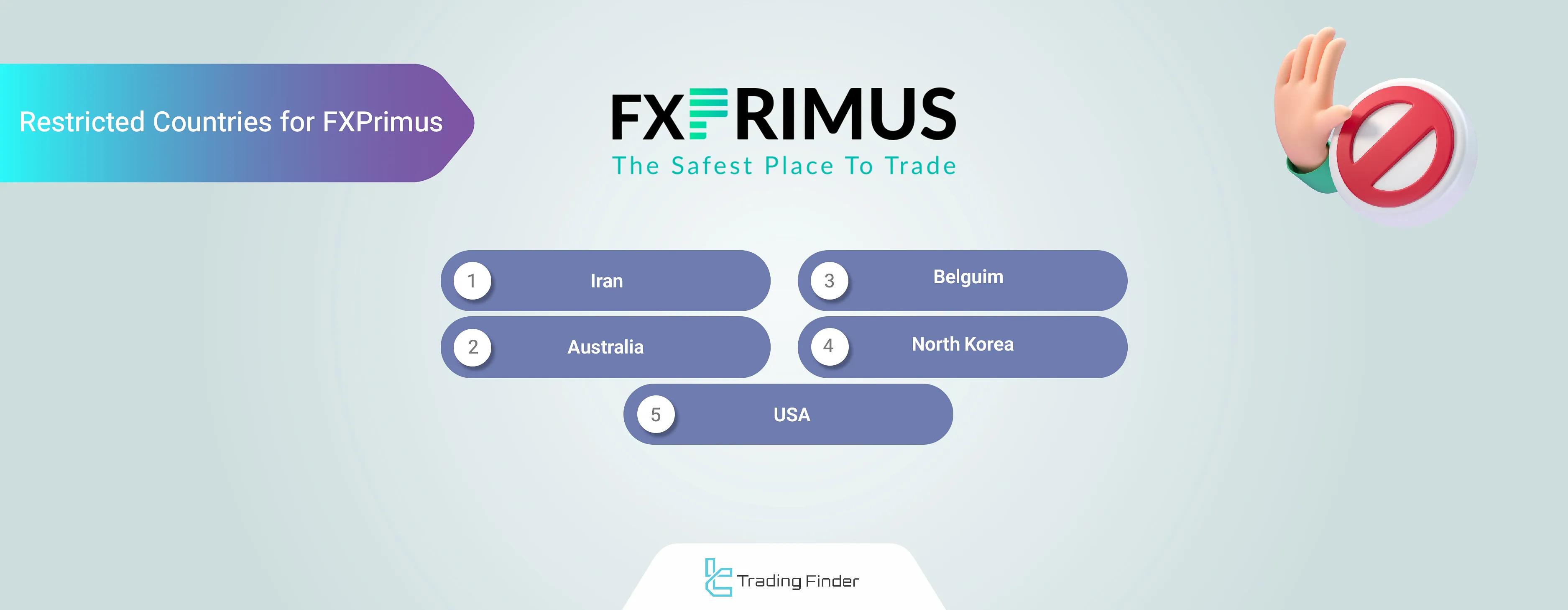

FXPrimus Restricted Countries

While FXPrimus operates globally, traders outside of its regulatory jurisdiction can’t use this platform to trade in capital markets. Traders from the countries listed below are banned from creating an account in the FXPrimus broker:

- Iran

- USA

- Australia

- North Korea

- Belgium

FXPrimus holds the right to add countries to the list above so check out your eligibility before creating an account with this broker.

FXPrimus Trust Scores and User Reviews

FXPrimus Trustpilot has received generally positive reviews on the website. FXPrimus received 4.2 stars out of 5 from over 80 reviews on this platform. while this rating is excellent, the high number of 1-star reviews (33%) is concerning.

Traders are advised to create a demo account and test out the FXPrimus broker offering before depositing funds and starting their trading journey on this broker.

FXPrimus Broker Education

FXPrimus offers Educational resources from beginner to advanced levels, combined with market news and blogs. From platform guides to technical analysis, FXPrimus provides all the materials traders need to succeed in financial markets.

FXPrimus in Comparison with Other Brokers

The table below provides key information about the advantages and disadvantages of trading with FXPrimus in comparison with other Forex brokers.

Parameters | FXPrimus Broker | |||

Regulation | CySEC, VFSC | No | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FSA, CySEC, ASIC |

Minimum Spread | From 0.0 Pips | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $5 | $0 | From $0.2 to USD 3.5 | From $3 |

Minimum Deposit | $15 | $1 | $10 | $200 |

Maximum Leverage | 1:1000 | 1:3000 | Unlimited | 1:500 |

Trading Platforms | MT4, MT5, cTrader, WebTrader | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Classic, Pro, Zero | Standard, Premium, VIP, CIP | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Raw Spread, Islamic |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1000+ | 45 | 200+ | 2,250+ |

Trade Execution | Market | Market, Instant | Market, Instant | Market |

TF Expert Suggestion

FXPrimus tight spreads (from 0.0 pips), no commission on deposits and withdrawals, and a high leverage option of 1:1000 are the main benefits of trading with this broker.

However, high minimum deposit on Pro ($500) and Zero ($1000) accounts and restricted access in some countries, including the USA, may be drawbacks for some traders.