GCI Trading is an old broker (founded in 2002) that provides diverse account types, along with a demo option, designed to cater to a variety of trading preferences. GCI broker offers convenient deposit methods such as Bitcoin, PerfectMoney, and bank wire transfers.

Supporting a high leverage cap of 1:1000, the company allows traders flexibility in strategy with an accessible minimum order size. In this comprehensive review, we'll explore GCI's features, account types (MT4, ActTrader), platforms, and more to help you decide if it fits your trading needs correctly.

Company Information & Regulation Status

GCI Financial Limited has operated as an online forex and CFD broker since 2002, providing traders access to global financial markets. While the company boasts over two decades of experience, it's crucial to note that the broker lacks regulation from central financial authorities. This lack of oversight raises some concerns about trader protection and fund safety.

The table below goes through the broker's company details:

Entity Parameters/Branches | GCI Financial Limited |

Regulation | Not Regulated |

Regulation Tier | N/A |

Country | St. Lucia |

Investor Protection Fund / Compensation Scheme | N/A |

Segregated Funds | N/A |

Negative Balance Protection | Yes |

Maximum Leverage | 1:1000 |

Client Eligibility | Global |

Summary of Specifics

Let's take a closer look at the Forex broker's key features and offerings:

Broker | GCI |

Account Types | ActTrader, MT4, Demo |

Regulating Authorities | Not regulated |

Based Currencies | USD |

Minimum Deposit | $500 |

Deposit Methods | Crypto, Bank Wire Transfer |

Withdrawal Methods | Wire transfer, eCash |

Minimum Order | 0.01 |

Maximum Leverage | 1:1000 |

Investment Options | No |

Trading Platforms & Apps | MT4, ActTrader, cTrader |

Markets | Commodities, Stocks, Futures and Bonds, Forex, Indices |

Spread | From 0 |

Commission | $2 per lot |

Orders Execution | Market |

Margin Call/Stop Out | No |

Trading Features | Zero spread, Trading Signals, Forex Economic Calendar |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Phone, Email, Contact form, Live chat |

Customer Support Hours | 24/7 |

GCI Trading offers a range of features catering to both new and experienced traders. However, the limited deposit and withdrawal options may be inconvenient for some users.

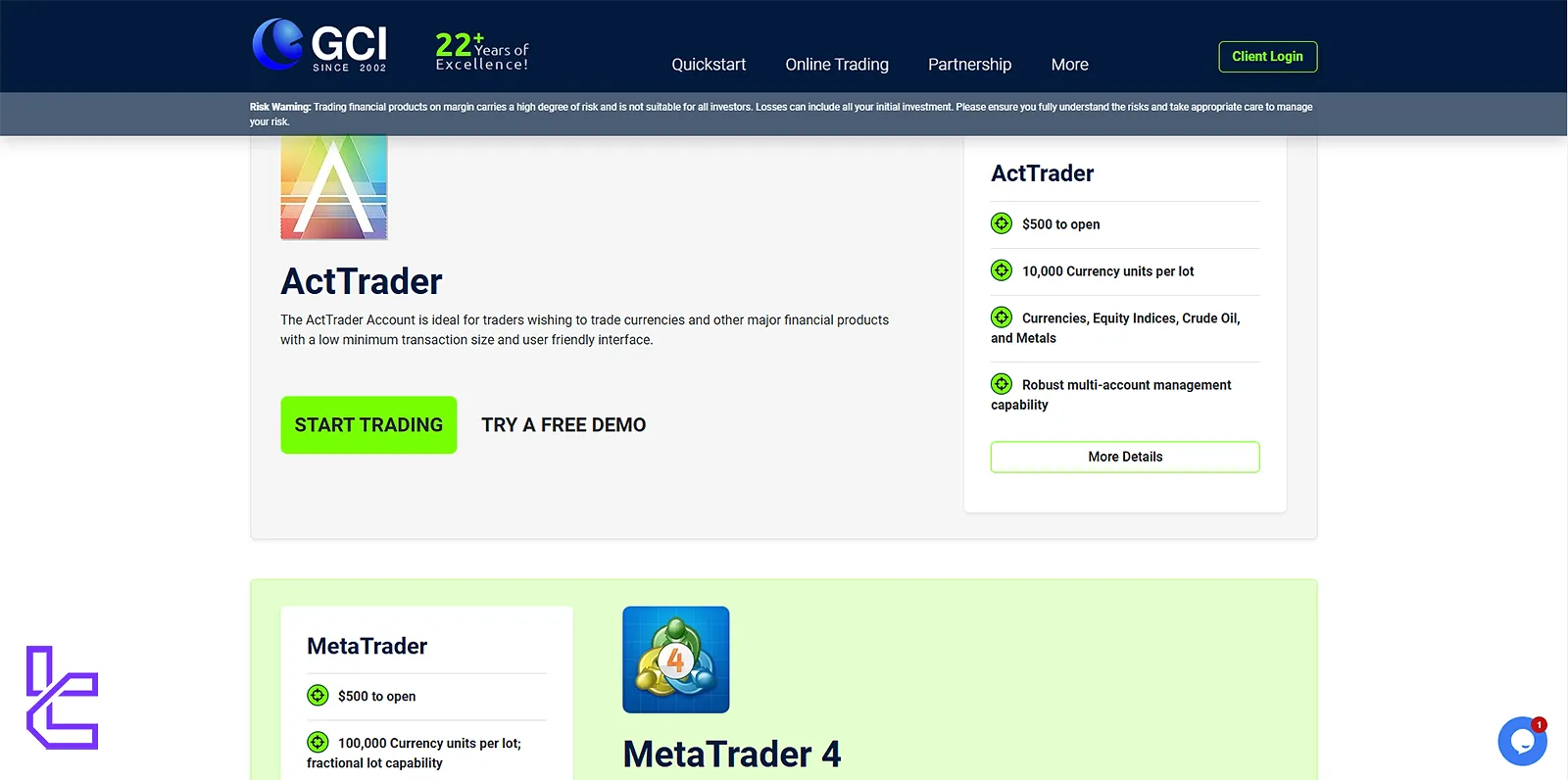

GCI’s Types of Accounts

GCI broker provides several account types to suit different trading styles and preferences:

Account | Min deposit | assets |

ActTrader | $500 | Currencies, Equity Indices, Crude Oil, and Metals |

$500 | Currencies, Equity Indices, Crude Oil, Metals, and Shares | |

Demo Account | $0 | Same as real |

All account types offer:

- Robust multi-account management

- "No Dealing Desk" instant execution

- Unlimited charting and programmable trading signals

GCI’s Advantages and Disadvantages

Let's weigh the pros and cons of trading with GCI:

Advantages | Disadvantages |

Raw spreads from 0 pips | High minimum deposit |

High leverage up to 1:1000 | Limited deposit/withdrawal options |

Multiple trading platforms | Lack of regulation |

While GCI offers attractive trading conditions, the lack of regulation and limited payment options are significant drawbacks.

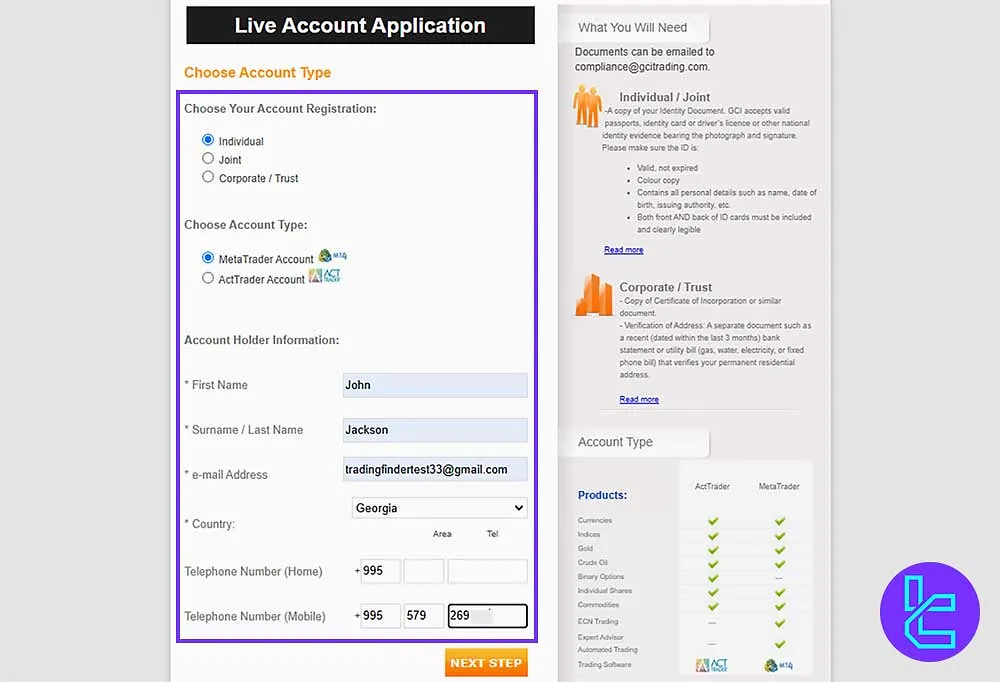

Signing Up & Verification Process

GCI registration and verification process takes just a few minutes and involves 5 phases.

#1 Choose Account Settings

After visiting the website, select your preferred account structure (Individual, Joint, Corporate/Trust) and trading platform. You'll need to input details such as:

- Name

- Country

- Phone number

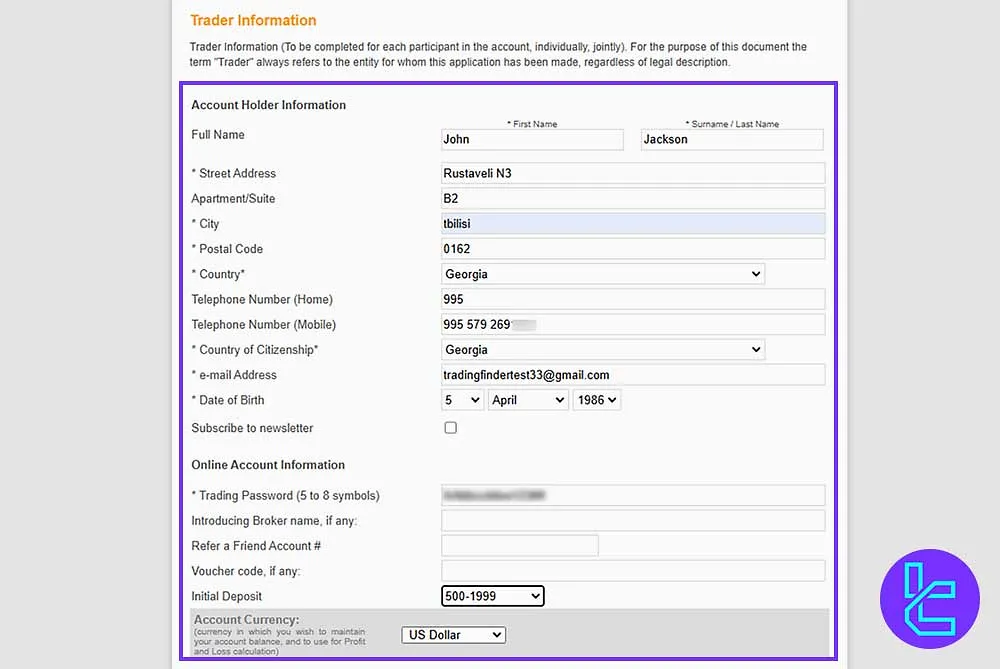

#2 Complete Personal and Trading Info

Provide these data:

- Address details

- Date of birth

- Nationality

- Home telephone number

Then, set your account password, declare your deposit amount, and preferred base currency.

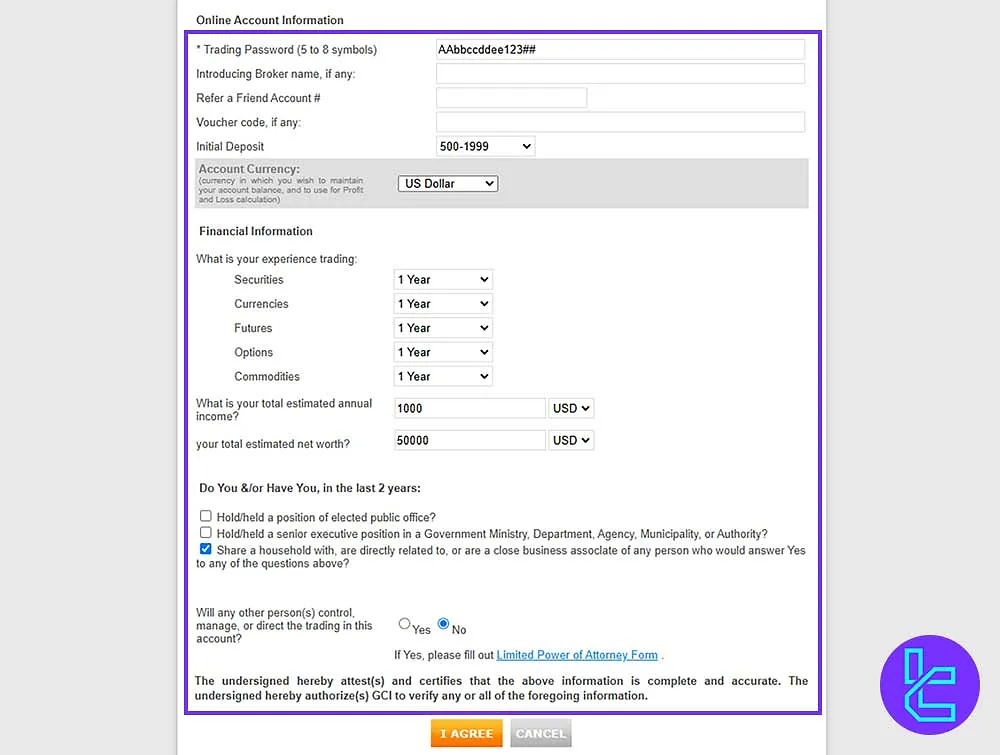

#3 Submit Financial Background

Fill in your trading experience, financial status, and risk tolerance by answering a short questionnaire.

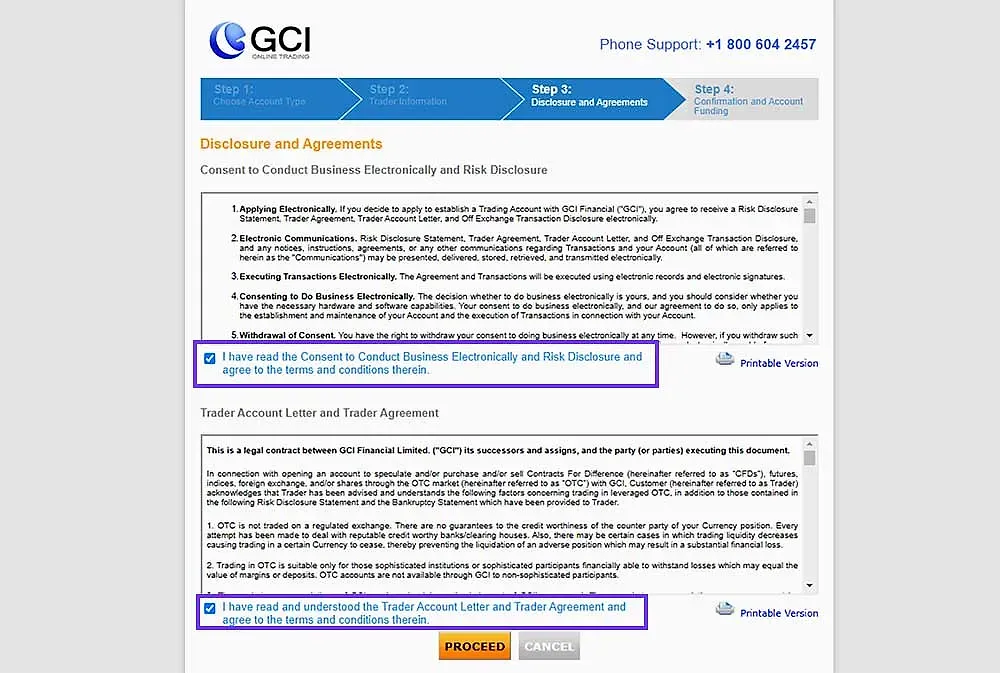

#4 Accept Terms and Finalize Registration

Review and agree to GCI Trading’s terms and conditions to complete the registration.

#5 Verification

Log into the broker's website and submit the required verification documents (ID, proof of address).

Note: Verification typically takes 1-2 business days. Ensure all documents are precise and up-to-date to avoid delays.

GCI’s Trading Platforms

GCI Trading offers 3 leading trading platforms:

- MetaTrader 4 (MT4)

- ActTrader

All platforms provide the following:

- Instant execution

- Multiple order types

- Risk management tools

- Access to various markets

TradingFinder has developed various MT4 indicators that you can use for free.

Spreads and Commission Structure

GCI offers competitive pricing with variable spreads based on market conditions:

Market | Spread from | Commission |

Commodities | 2 cents | N.A |

Forex futures | 3 pips | N.A |

Foreign Exchange | 1 pip | N.A |

Asia Pacific Shares | 3 cents | N.A |

European Shares | 3 cents | N.A |

North American Shares | 2 cents | N.A |

Stock Market Indices | 3 ticks | N.A |

Actual spreads may vary depending on market volatility and liquidity. Always check the current spreads before trading.

Swap Fees

The broker has a somehow different approach towards trading swaps. The following sections will review the matter.

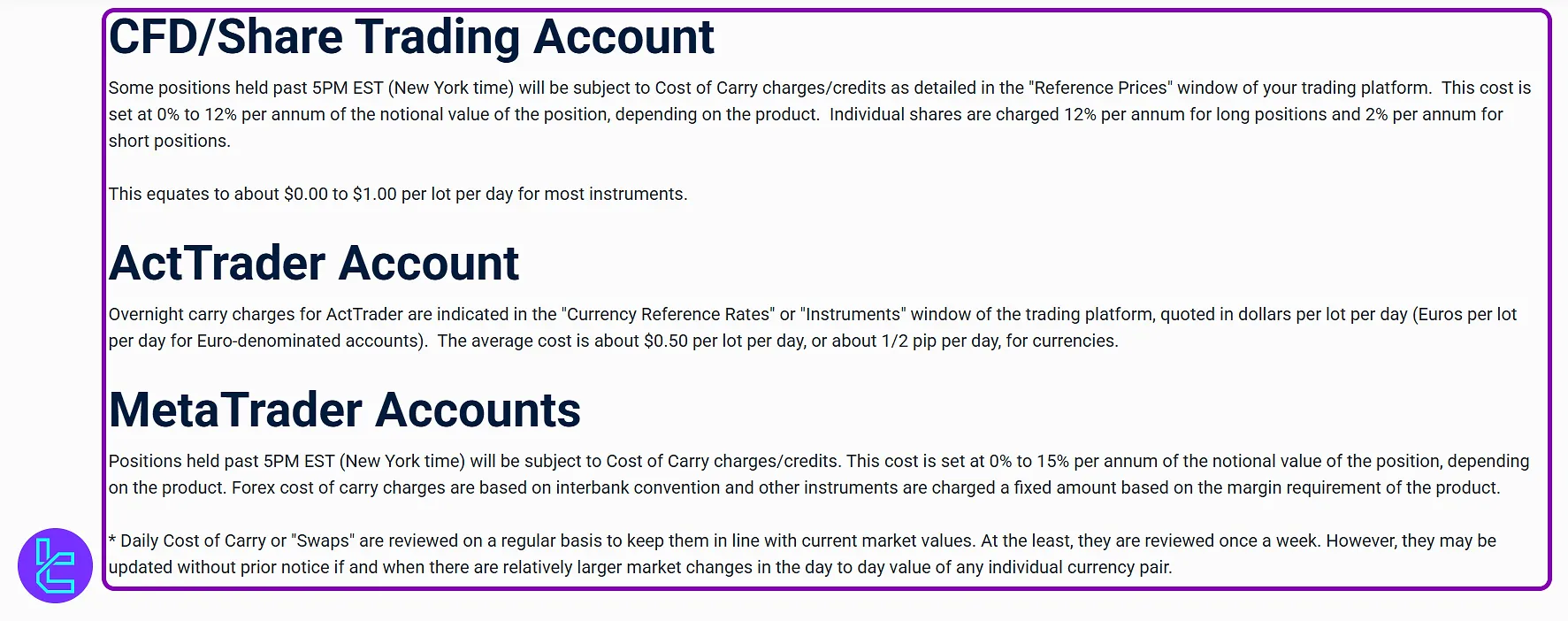

CFD and Share Trading Accounts

Positions that remain open after 5 PM EST (New York time) may incur Cost of Carry charges or credits, as specified in the “Reference Prices” section of the trading platform.

Depending on the instrument, the annualized rate ranges from 0% to 12% of the notional value. For individual shares, the rate is 12% per year for long positions and 2% per year for shorts, which generally translates to $0.00–$1.00 per lot per day for most products.

ActTrader Accounts

Overnight financing costs on ActTrader are displayed in the platform’s “Currency Reference Rates” or “Instruments” window.

These rates are quoted per lot per day, in USD for dollar accounts and in EUR for euro-denominated accounts. The typical cost is about $0.50 per lot per day, approximately half a pip per day for currency pairs.

MetaTrader Accounts

MetaTrader users holding positions past 5 PM EST are also subject to daily Cost of Carry (Swap) adjustments.

These can range between 0% and 15% annually, depending on the product. Forex swaps follow interbank market conventions, while other instruments use fixed charges calculated on their margin requirements.

Regular Review of Swap Rates

All daily swap rates are reviewed frequently to reflect current market conditions. At a minimum, rates are updated weekly, but they may be revised sooner without prior notice if there are significant market fluctuations affecting a specific instrument or currency pair.

Non-Trading Fees and Other Costs

Beyond trading activity, GCI is cost-efficient in its non-trading fees. The broker does not charge for deposits, withdrawals, or inactivity, which positions it favorably for both active and passive traders seeking low-cost trading infrastructure.

Deposit & Withdrawal Methods

GCI offers limited options for funding and withdrawing from your account. The following sections will cover them.

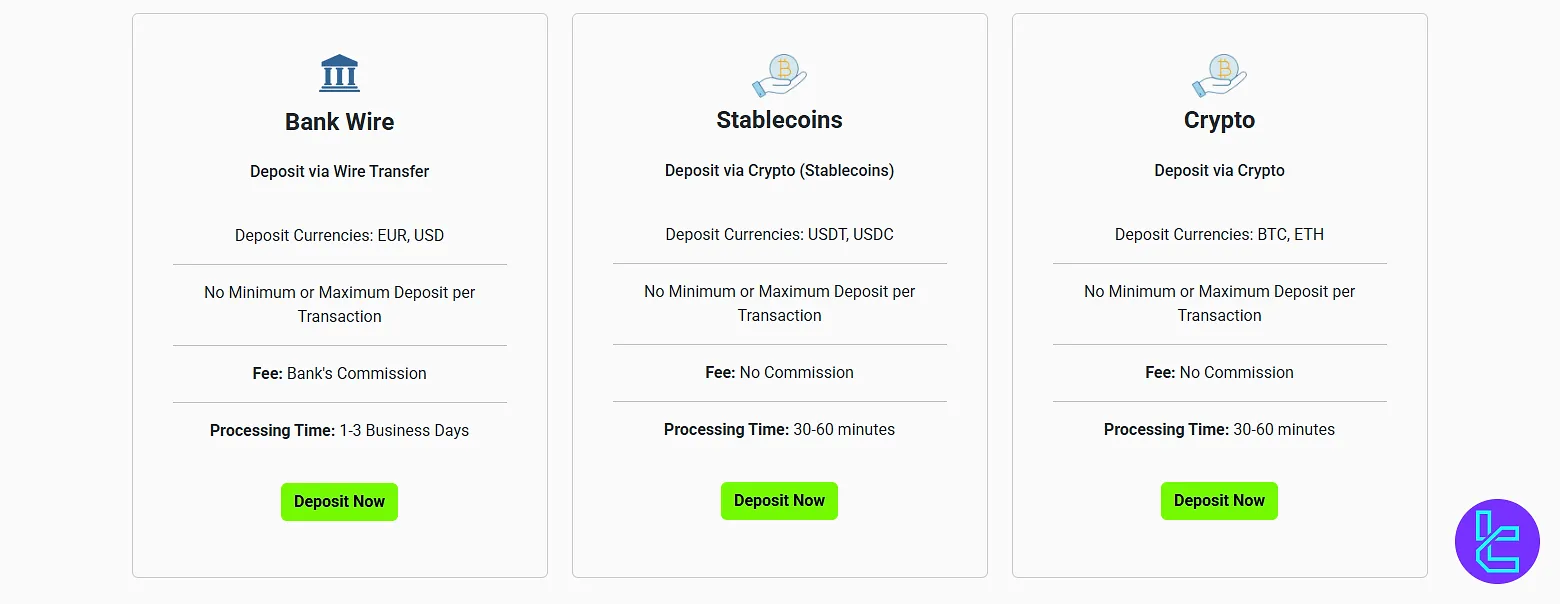

GCI Deposit Options

There are two solutions for clients' deposits on the broker:

Deposit Method | Min. Amount | Processing Time |

Bank Wire | None | 1 to 3 Business Days |

Crypto (BTC, ETH, USDT, USDC) | None | 30 to 60 Minutes |

Note that GCI does not permit third-party deposits.

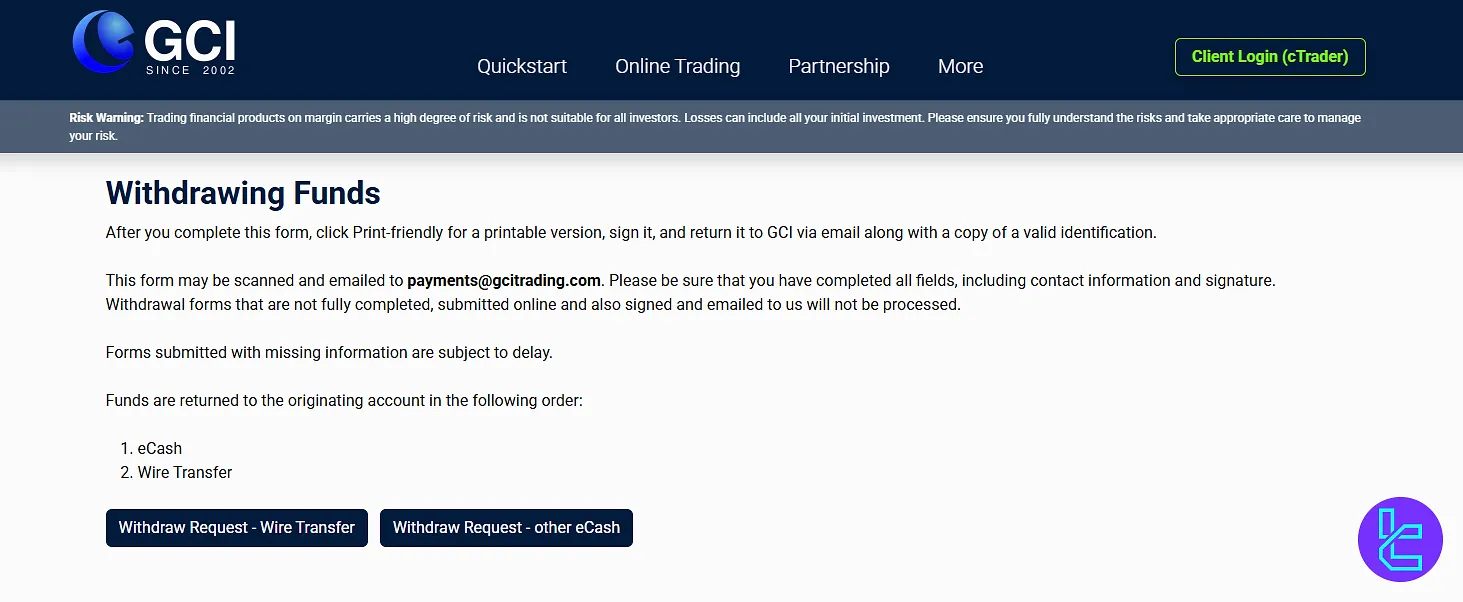

GCI Withdrawal Solutions

To request a withdrawal from GCI, clients must complete the official withdrawal form and ensure all required fields, such as contact details and signature. are filled in.

After completing the form, a print-friendly version should be signed and emailed, together with a valid ID, to payments@gcitrading.com.

Incomplete or unsigned submissions can lead to processing delays. Once approved, withdrawals are sent back to the original funding source in this order:

- eCash

- Wire Transfer

Copy Trading & Investment Options Offered by the broker

GCI provides copy trading features, allowing less experienced traders to mimic the strategies of successful traders.

While this option can be profitable, it also carries risks. Always research thoroughly before copying any trader. About PAMM accounts, it is worth noting that this feature is not provided by the broker.

Tradable Markets & Symbols Overview

GCI offers a wide range of tradable instruments across various asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Standard, Micro, ECN accounts | 60+ Currency Pairs | 50–70 currency pairs | 1:1000 | |

Indices | CFDs on global stock market indices | 15+ Global Indices | 10–20 indices | 1:1000 |

Commodities | CFDs on precious metals (Gold, Silver), energies (Oil, Gas) | Multiple commodity instruments | 10–20 instruments | 1:1000 |

Stocks & ETFs | CFDs on global company shares and ETFs | 500+ Stocks & ETFs | 800–1200 (varies by broker) | 1:20 |

Bonds | CFDs on global bonds | Major international bonds | Limited availability | 1:200 |

Futures | CFDs on S&P 500, DJIA, NASDAQ futures | Key US futures contracts | Limited availability | 1:1000 |

Bonus Offerings and Promotions

GCI is currently running a 22nd Anniversary Promotion, offering traders a deposit bonus of up to 50%.

This limited-time offer is designed to celebrate their years in the trading industry, providing an additional incentive for new and existing clients looking to increase their capital.

The broker has also established two ways of earning extra income for their clients. These options include:

- Refer a friend

- IB (Introducing Broker) program

For the most recent allocations, visit the website and read the conditions in detail.

GCI Awards

GCI has been active in online trading for more than two decades, earning multiple industry recognitions across different regions. The company has received awards for brokerage excellence, customer service, and introducing broker (IB) programs, reflecting its presence in the global Forex market.

Key Industry Awards:

- Most Trusted Broker LATAM (2024)

- 20 Years of Excellence – Industry Recognition (2022)

- 20 Years of Outstanding Service (2022)

Introducing Broker Program Awards:

- Most Valuable IB Program (2022)

- Best Support to Introducing Brokers (2022)

- Best Introducing Broker Program (2014)

GCI Broker Support

GCI provides customer support through multiple channels:

- Phone: +1(800) 604 2457

- Email: info@gcitrading.com

- Contact form

- Live chat

Support is available 24/7, assisting with account issues, platform queries, and general inquiries. However, some users need more response times and quality of support.

List of Restricted Countries

GCI does not accept clients from certain jurisdictions due to regulatory restrictions:

- Afghanistan

- Belarus

- Bosnia and Herzegovina

- Canada

- Cuba

- Eritrea

- Ethiopia

- Iran

- Iraq

- Kyrgyzstan

- Lao PDR

- Libya

- North Korea

- Pakistan

- Russia

- South Sudan

- Sudan

- Syria

- Tanzania

- Vanuatu

- Yemen

- Uganda

- United States of America

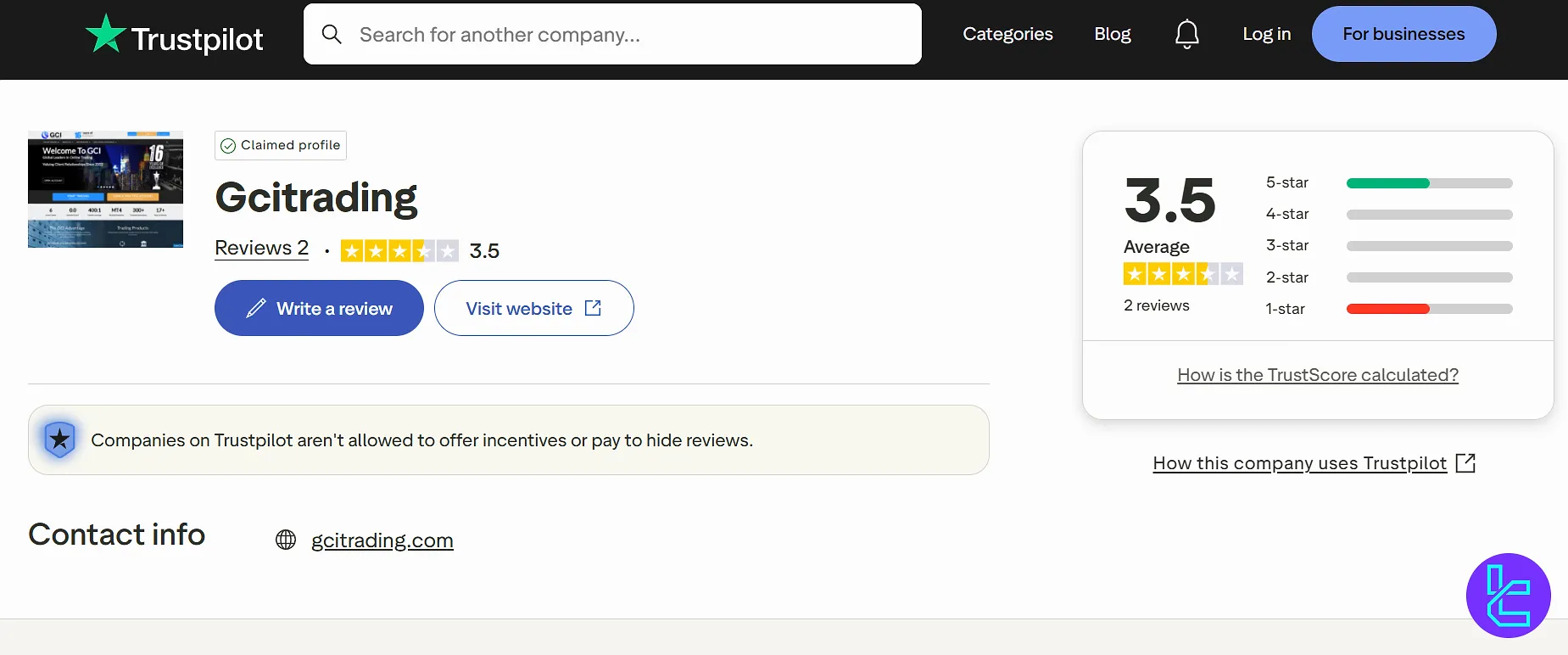

GCI’s Trust Scores & Reviews on Trustpilot

The GCI Trustpilot profile has received mixed reviews from traders, with a trust score of 3.5 out of 5.

This rating is sourced from only two reviews in total, meaning that it is not enough to have a proper judgment. Always do your own research despite the positivity or negativity of the reviews.

Educational content on GCI

GCI provides a range of educational resources for traders:

- Forex education section on the website;

- Free e-books on trading strategies and platform usage;

- Video tutorials for the ActTrader platform;

- Daily market research and analysis;

- Glossary of forex terms.

These resources cater to both beginners and experienced traders, covering topics such as:

- Forex market overview;

- Trading Strategies;

- Risk management;

- Technical and fundamental analysis.

While the educational content is comprehensive, always supplement it with information from other reputable sources.

Compare GCI Trading with Other Brokers

Look at the table below for an exhaustive comparison between GCI and its peers:

Parameter | GCI Trading Broker | |||

Regulation | None | None | FCA, FSCA, CySEC, SCB | Cent, Zero, Pro, Premium |

Minimum Spread | 0.0 Pips | 0.1 Pips | 0.0 Pips | 0.0 Pips |

Commission | $2 per Lot | None | From Zero | From Zero |

Minimum Deposit | 50,000 TRY | $10 | $100 | From $0 |

Maximum Leverage | 1:1000 | 1:3000 | 1:500 | 1:2000 |

Trading Platforms | MT4, ActTrader, cTrader | MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, Mobile App |

Account Types | ActTrader, MT4, Demo | Standard, Premium, VIP, CIP | Standard, Pro, Raw+, Elite | Cent, Zero, Pro, Premium |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 600+ | 50+ | 270+ | 1,000+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and final words

GCI Trading offers attractive features, including competitive spreads (from 0 pips), multiple trading platforms(MT4, cTrader, ActTrader),and extensive educational resources.

However, the lack of regulation, limited payment options, and mixed user reviews raise significant concerns. While experienced traders might find value in GCI's offerings, beginners should approach cautiously. Give your feedback on the GCI review in the comments.