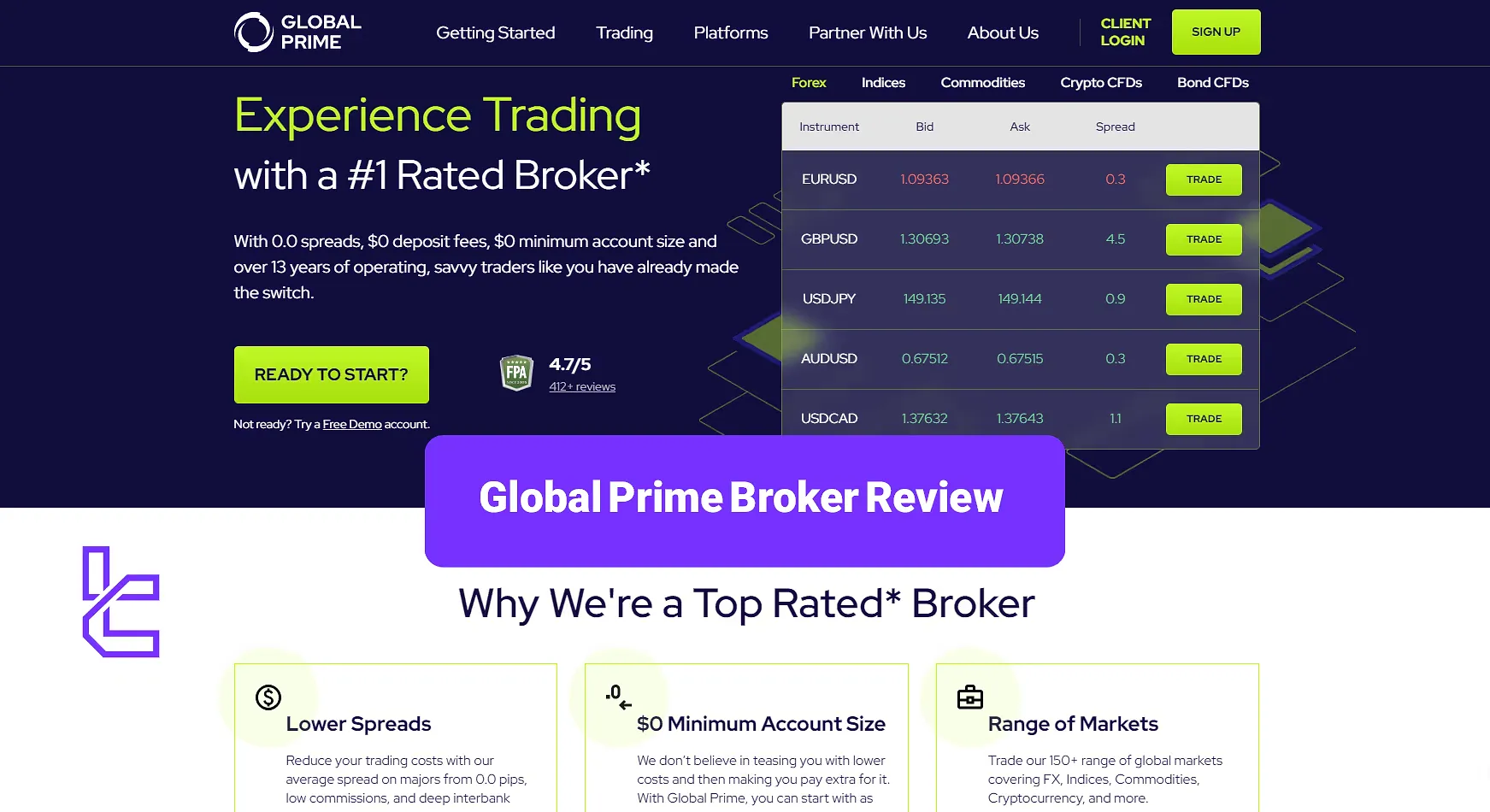

Global Prime provides trading services on 150+ financial instruments with raw spreads from 0.0 pips and no commissions. The broker also offers various promotions, including TradingView Premium membership, FT newspaper subscription, and access to Autochartist signals.

This broker is regulated by the reputable Australian Securities and Investments Commission (ASIC). In addition, it also holds a VSFC license, allowing the company to offer its services to clients across different regions worldwide.

Global Prime (Company Information and Regulation)

Global Prime was founded in Australia by Jeremy Kinstlinger in 2010, according to Crunch Base. The company’s approach to regulatory compliance is mind-easing, since it’s licensed by multiple financial authorities, including the tier-1 ASIC.

Here you can read important details about Global Prime branches:

Entity Parameters / Branches | FMGP Trading Group Pty Ltd | Gleneagle Securities Pty Ltd |

Regulation | ASIC | VFSC |

Regulation Tier | 1 | N/A |

Country | Australia | Vanuatu |

Investor Protection Fund / Compensation | Yes | No |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | No |

Maximum Leverage | 1:30 | 1:500 |

Client Eligibility | Australia only | International clients (wide coverage, excl. restricted list) |

The company aims to democratize access to global financial markets by offering a wide range of products with competitive trading costs and no minimum account size. Key points about Global Prime:

- clients’ money in segregated accounts with HSBC (Europe's largest bank by total assets) and National Australia Bank (NAB)

- 24/7 Customer Support

- Current Owner: Phil Horner (also the owner of Fusion Markets broker)

- 20+ payment methods

- Execution time from 10MS

- Commission-free deposits and withdrawals

Specifics of Global Prime Broker

The Forex broker has established itself as a leading broker by offering a range of features and services tailored to meet the needs of diverse traders. Here's a closer look at what sets Global Prime apart.

Broker | Global Prime |

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Based Currencies | USD, AUD, GBP, EUR, CAD, SGD, JPY |

Minimum Deposit | Unlimited |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | Autochartist Trading Signals, Social Trading via ZuluTrade |

Trading Platforms & Apps | MT4 |

Markets | Forex, Indices, Commodities, Crypto, Bonds |

Spread | Standard from 0.9 pips Raw from 0.0 pips |

Commission | Standard $0 Raw $3.5 |

Orders Execution | Market, Stop Loss, Take Profit, Limit |

Margin Call / Stop Out | 100% / 50% (ASIC) 90% / 20% (VFSC) |

Trading Features | Signals, Pro Trading, VPS |

Affiliate Program | Yes |

Bonus & Promotions | FT Subscription, TradingView Premium, Referral |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone, Ticket |

Customer Support Hours | 24/7 |

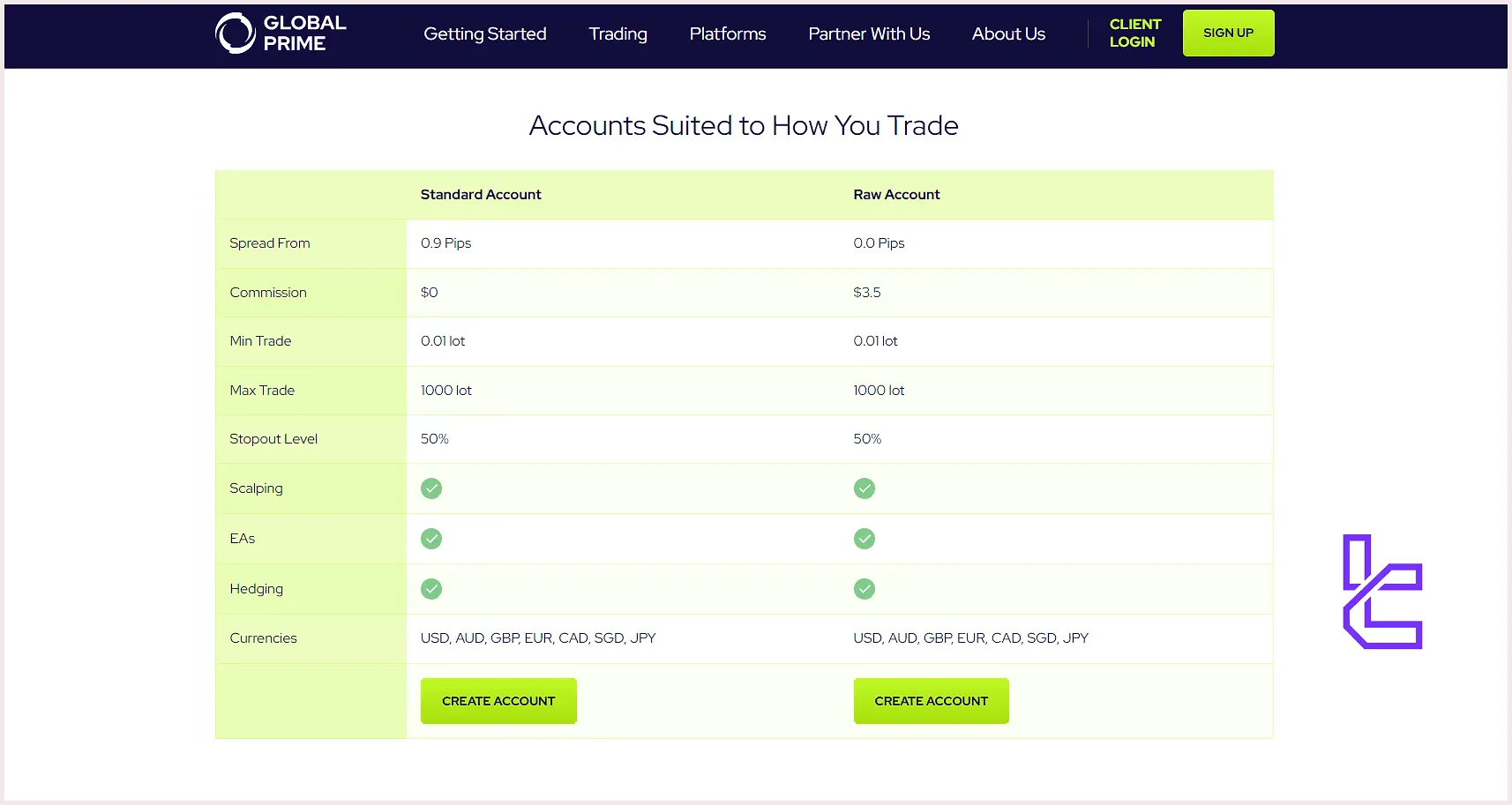

Global Prime Account Types

The next topic we must discuss in this Global Prime review is the account type. The company have two main account offering alongside a “Pro Trading” feature to cater to different styles and preferences.

Features | Standard | Raw |

Currencies | USD, AUD, GBP, EUR, CAD, SGD, JPY | USD, AUD, GBP, EUR, CAD, SGD, JPY |

Commission | $0 | $3.5 |

Spread | From 0.9 pips | From 0.0 pips |

Leverage | Up to 1:500 | Up to 1:500 |

Min Trade | 0.01 lots | 0.01 lots |

Max Trade | 1000 lots | 1000 lots |

Stop out | 50% | 50% |

Margin | 100% | 100% |

Scalping, Hedging | Yes | Yes |

EAs | Yes | Yes |

For Australian traders, the maximum leverage options are set to 1:30. However, the broker offers the “Pro Trading” mode for these clients which enables them to use leverage up to 1:500. Note that in Pro trading, the stop out level reduces to 20%.

Global Prime offers a Demo trading account with real market conditions, and has no minimum deposit requirements

Global Prime offers a Demo trading account with real market conditions, and has no minimum deposit requirements

Global Prime Upsides and Downsides

A dedicated trading expert, 24/7 support, technical, fundamental, news, and trade ideas are some of the benefits of Global Prime accounts. However, we should talk about the downsides, too, in order to have a balance look.

Pros | Cons |

Regulated by reputable authorities (ASIC, VFSC) | MT4 is the only supported platform for now |

Competitive trading conditions with low spreads and fast execution | Restricted access for traders from certain countries |

24/7 customer support | Relatively low maximum leverage (1:500) |

Segregated client funds for enhanced security | Lack of frequent trading bonuses or promotions |

Registration and KYC Verification on Global Prime

Global Prime registration involves a straightforward process followed by a Know Your Customer (KYC) verification.

New users can register using just an email address and a secure password.

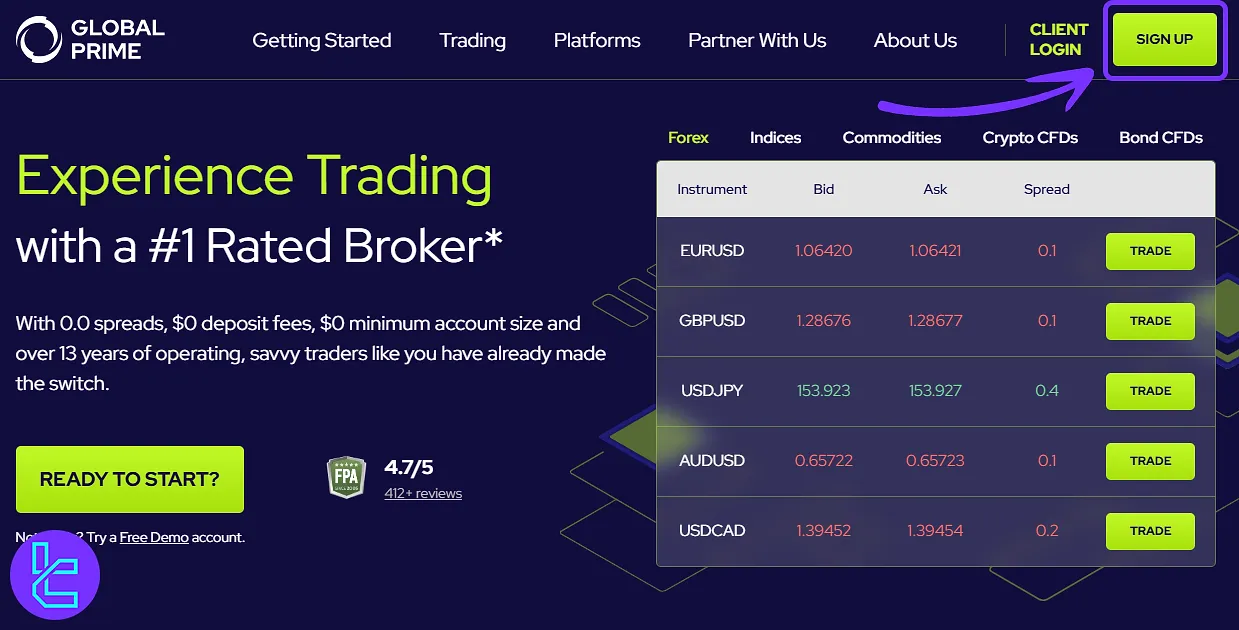

#1 Access the Broker’s Official Website

Navigate to the Global Prime homepage via TradingFinder or directly through your browser.

#2 Initiate Registration

Click on the “Sign Up” button to begin creating your account.

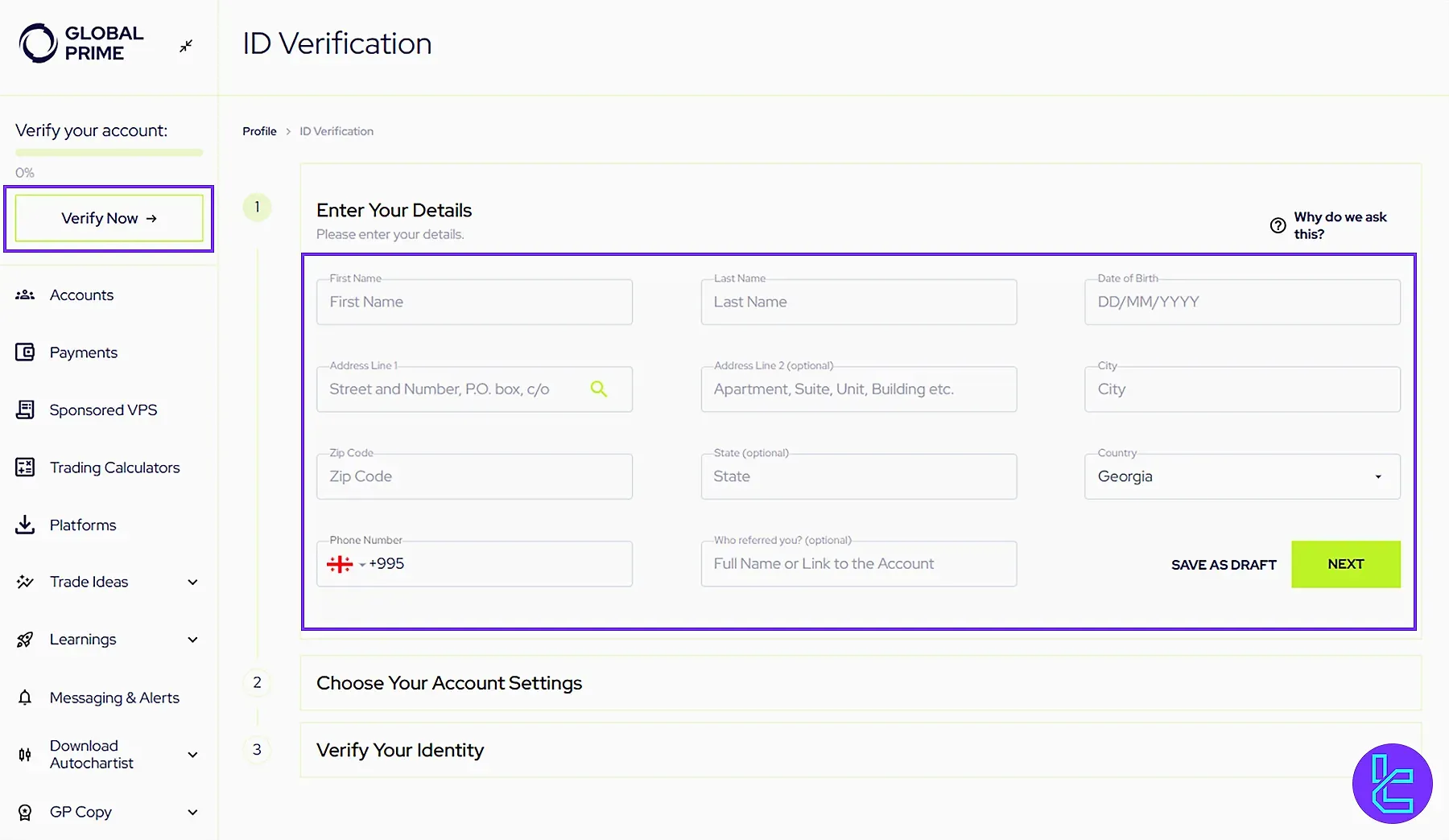

#3 Global Prime Verification

Completing the Global Prime verification process is straightforward and involves submitting personal and identification information through their KYC (Know Your Customer) procedure.

This ensures account security and compliance with regulatory standards. The verification can be completed entirely online and typically receives confirmation within one business day.

Below is a step-by-step outline of the Global Prime KYC process:

#1 Log into Your Global Prime Trading Cabin

To begin the verification process, first log in to your Global Prime trading account.

- Access your Global Prime account through the trading dashboard;

- Click “Verify Now” to initiate the verification process.

#2 Enter Personal Information for Global Prime KYC

At this step, you need to enter your personal details as they appear on your identification documents.

- Provide essential details including full name, date of birth, address, postal code, country, and contact number;

- Click “Next” to proceed.

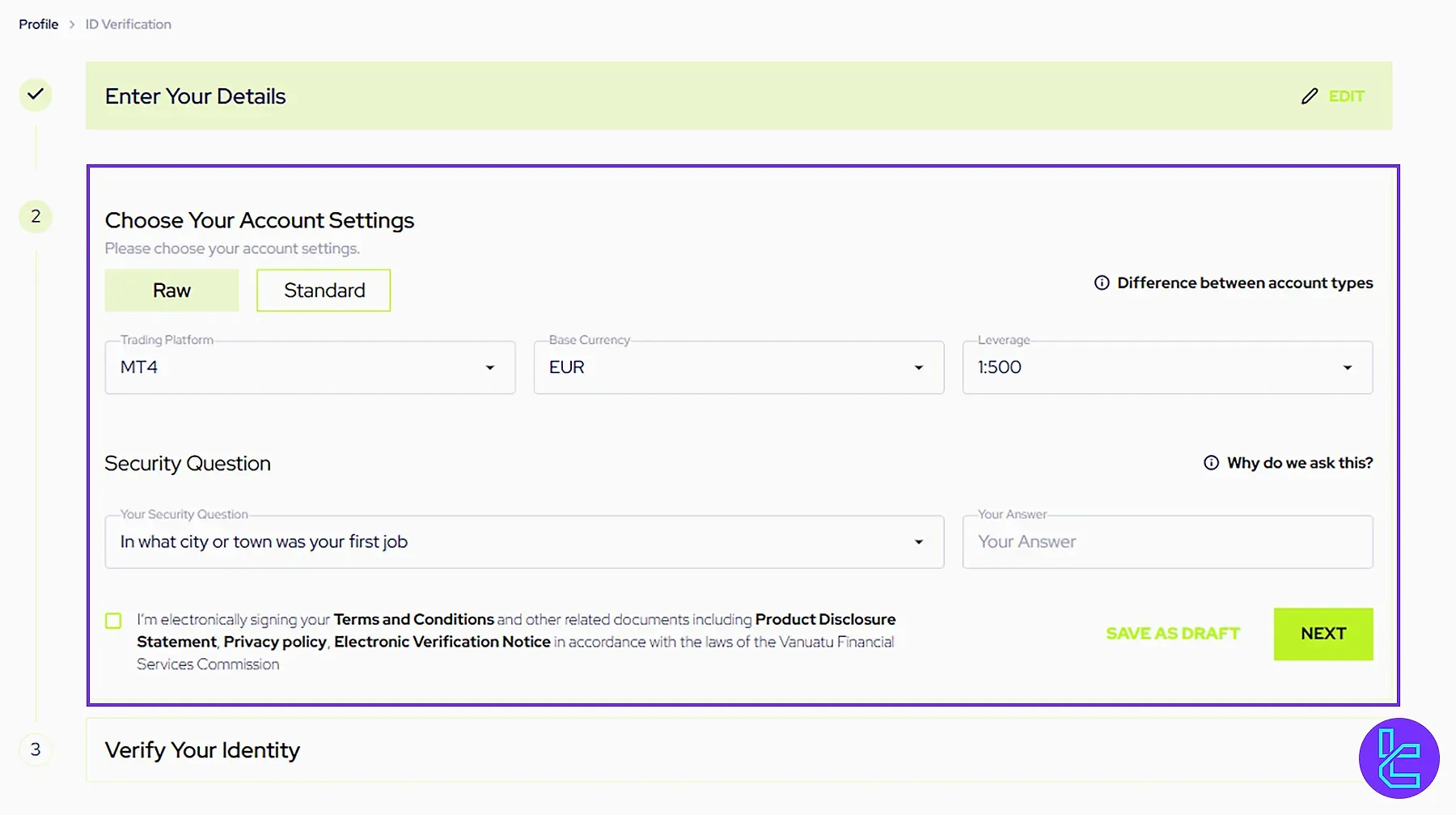

#3 Choose Your Global Prime Account Settings

In this step, you’ll set up the key preferences for your Global Prime trading account before proceeding.

- Select your preferred account type;

- Choose a trading platform, such as MT4;

- Specify the account’s base currency and desired leverage;

- Accept the terms and conditions;

- Click “Next” to continue.

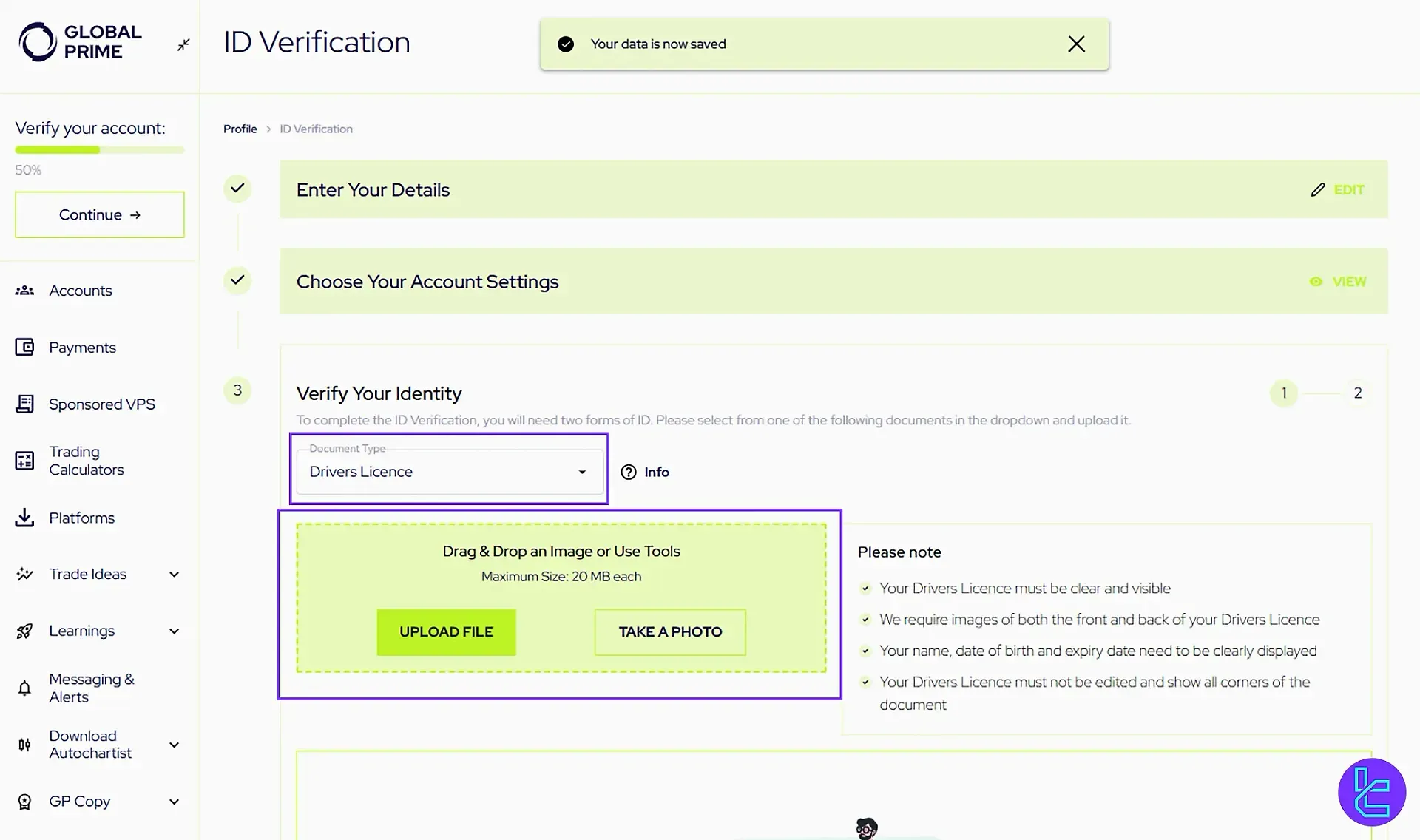

#4 Upload Primary Identification Document in Global Prime

Now, you need to upload your main identification document to verify your identity.

- Choose the type of document to upload: driver’s license, passport, or ID card;

- Upload both the front and back images;

- Click “Next” after ensuring all files are submitted.

#5 Upload a Second Identification Document for the Global Prime Broker

To strengthen your verification, you must provide an additional supporting document.

- Provide an additional form of ID, such as a passport, ID card, bank statement, utility bill, or birth certificate;

- Upload both front and back images before moving forward.

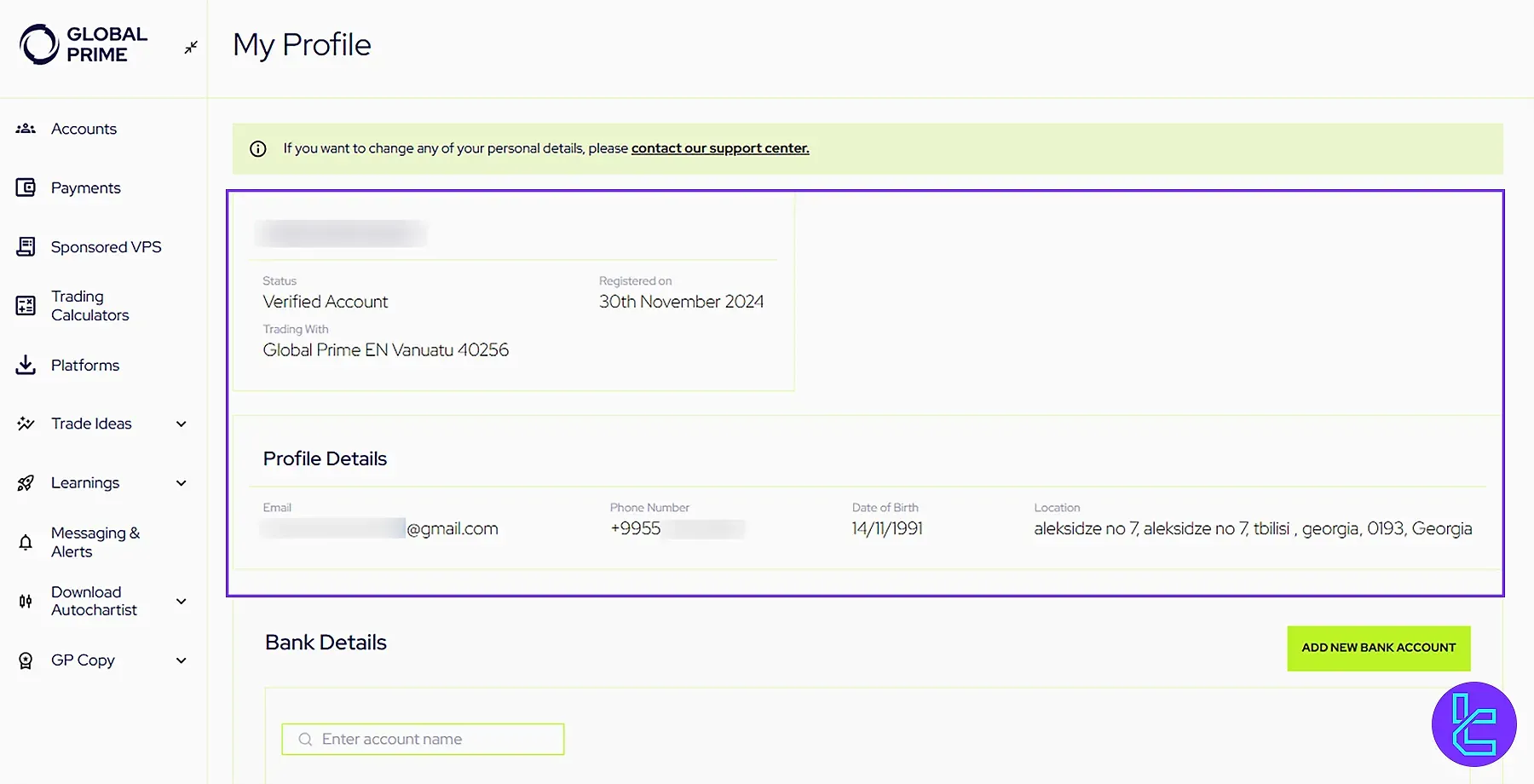

#6 Submit and Await Global Prime Verification

Once all your details and documents are uploaded, you can finalize the verification process.

- Click “Verify My Account” to submit your documents for review;

- A confirmation email will be sent once the verification is complete;

- After one business day, check the profile section to confirm that your account has been successfully verified.

Global Prime Broker Trading Platforms

The company offers a sturdy trading solution for its clients, MT4. MetaTrader 4 is one of the oldest and most popular platforms in the market and is available across various systems and devices, including:

- Windows

- macOS

- Web

- MT4 Android

- MT4 iOS

While no specific date hasn’t been indicated, the broker announces that it’s going to launch TradingView, and cTrader as its trading platforms pretty soon.

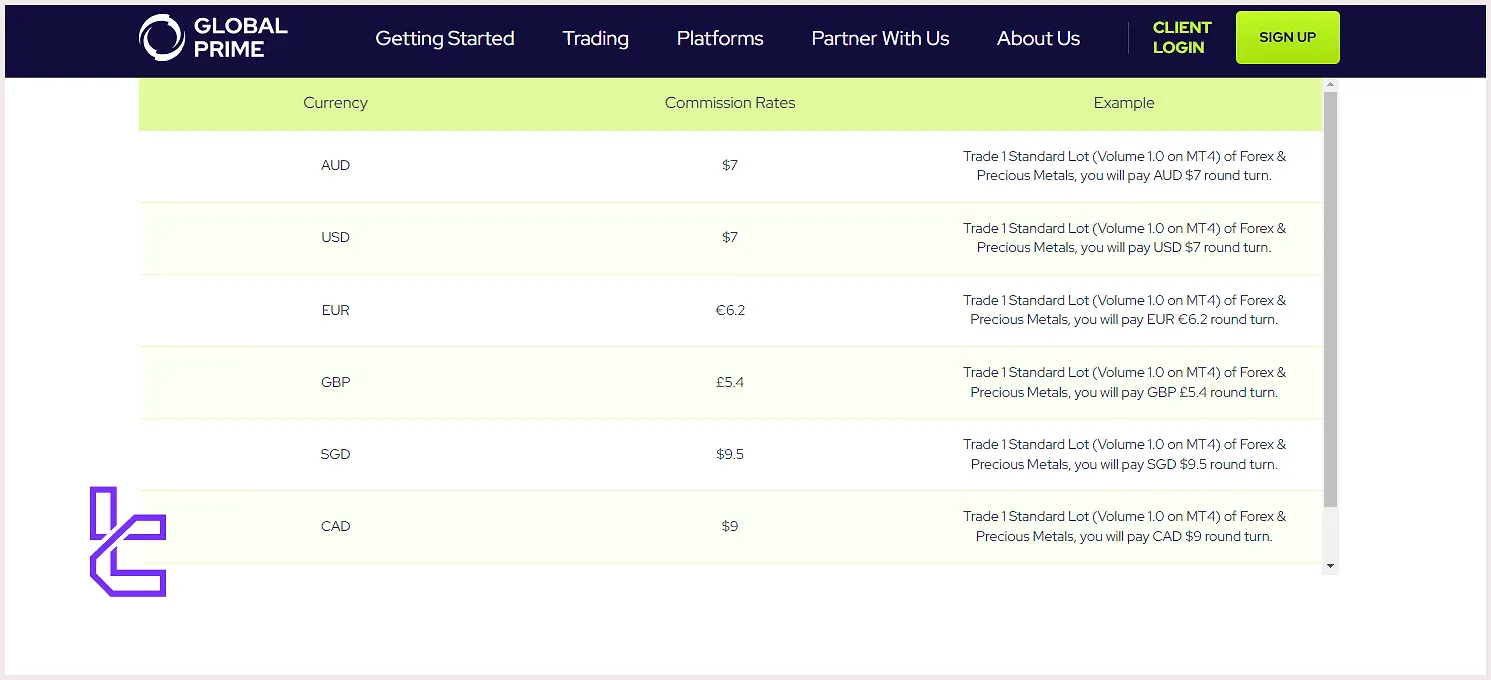

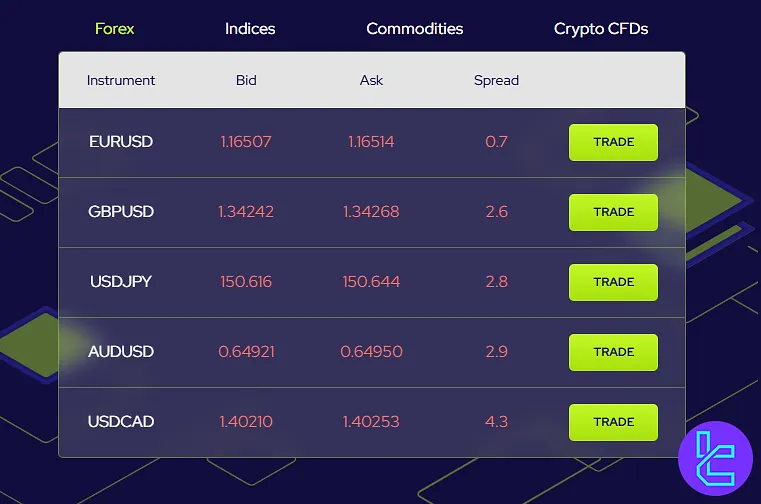

Global Prime Fee Structure

Exploring commissions and spreads is an important aspect of the Global Prime review. The broker offers a transparent and competitive fee structure. Average spread and commission for some financial instruments:

Asset | Avg. Spread (Pips) | Commission on Raw Account (per round lot) |

EUR/USD | 0.06 | $7 |

GBP/USD | 0.22 | $7 |

XAU/USD | 1.08 | $7 |

BTC/USD | 139.8 | $0 |

US500 | 3.95 | $0 |

UKGILT | 3.2 | $0 |

Swaps are also charged for holding positions overnight. Rates vary depending on the instrument and direction of the trade. The broker charges no deposit/withdrawal or inactivity fees.

Swap Fee at Global Prime

Holding a FX or CFD position overnight triggers a swap cost that is calculated daily based on the inter-bank interest differential and the lot size.

Swaps for FX and metals are derived from Global Prime’s liquidity providers and are applied each trading day.

Here are the key points to note:

- Swap rates are applied per 1.0 lot basis; they are calculated as “Swap Rate × Lot Size × Pip Value”;

- For FX and metals, Wednesday is a triple-swap rollover day to cover the weekend;

- For CFDs and indices, Friday night incurs a triple financing fee/adjustment;

- Example: Long 1 lot of NAS100 with a swap rate of −0.89 USD equals USD −0.89 cost for holding overnight;

- Global Prime does not offer Islamic / Swap-free accounts; all clients are subject to standard overnight swap/financing charges.

Non-Trading Fees at Global Prime

In essence, Global Prime does not levy typical account-maintenance or inactivity charges, and deposits and withdrawals via standard methods are shown as zero brokerage fees.

Below are the definitive details:

- Currency conversion or intermediary bank fees may apply when transferring funds across different currencies or payment providers;

- No account-opening or account-maintenance fee.

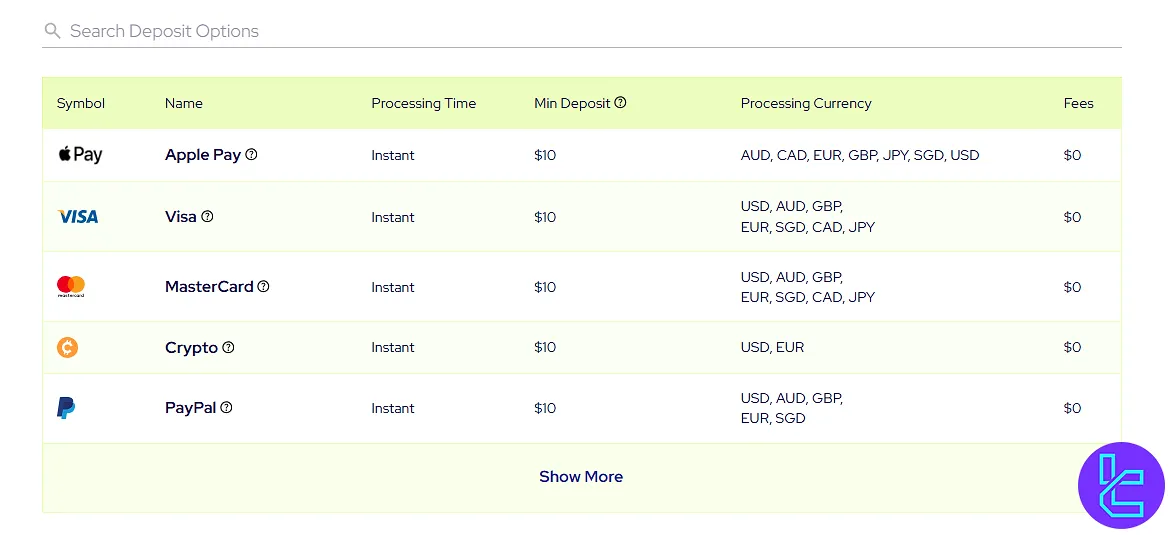

Supported Payment Options on Global Prime

The company offers a variety of payment methods to facilitate easy deposits and withdrawals. Note that these transactions include no charges from the broker.

The broker offers 15+ payment options, including GATE8, DragonPay, VNPay, FasaPay, Pagsmile, Bpay, POLi, AstroPay, Interac, PayID, Perfect Money, XPay, Mifinity, and Jetonbank.

Deposit Methods at Global Prime

Funding your Global Prime account is fast, flexible, and completely fee-free.

The broker supports a wide range of global and local payment options, covering traditional banking, e-wallets, crypto, and regional gateways, all processed through the GP Hub for secure deposits.

Below is a full summary of the available deposit methods and their details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Apple Pay | AUD, CAD, EUR, GBP, JPY, SGD, USD | $10 | $0 | Instant |

Visa | USD, AUD, GBP, EUR, SGD, CAD, JPY | $10 | $0 | Instant |

Master Card | USD, AUD, GBP, EUR, SGD, CAD, JPY | $10 | $0 | Instant |

Crypto | USD, EUR | $10 | $0 | Instant |

Pay Pal | USD, AUD, GBP, EUR, SGD | $10 | $0 | Instant |

Neteller | USD, AUD, GBP, EUR, SGD, JPY | $10 | $0 | Instant |

Skrill | USD, AUD, GBP, EUR, SGD, JPY | $10 | $0 | Instant |

GATE8 | MYR, IDR | $10 | $0 | Instant |

Dragon Pay | PHP | $10 | $0 | Instant |

VN Pay | VND | $10 | $0 | Instant |

Fasa Pay | USD, IDR | $10 | $0 | Instant |

QR Code (THB) | THB | $10 | $0 | Instant |

Pagsmile | BRL | $10 | $0 | Within 24 hours (during business days) |

Bank Wire | USD, AUD, GBP, EUR, SGD, CAD, JPY | $10 | $0 | 1–2 business days (Australia); 3–5 business days (International) |

Interac | CAD | $10 | $0 | 30 mins – 3 hours |

PayID | AUD | $1 | $0 | Instant |

Jeton Bank | AUD, USD, EUR, GBP, JPY, SGD, CAD | $10 | $0 | Instant |

X Pay | THB, IDR, VND, MYR, JPY | $10 | $0 | Instant |

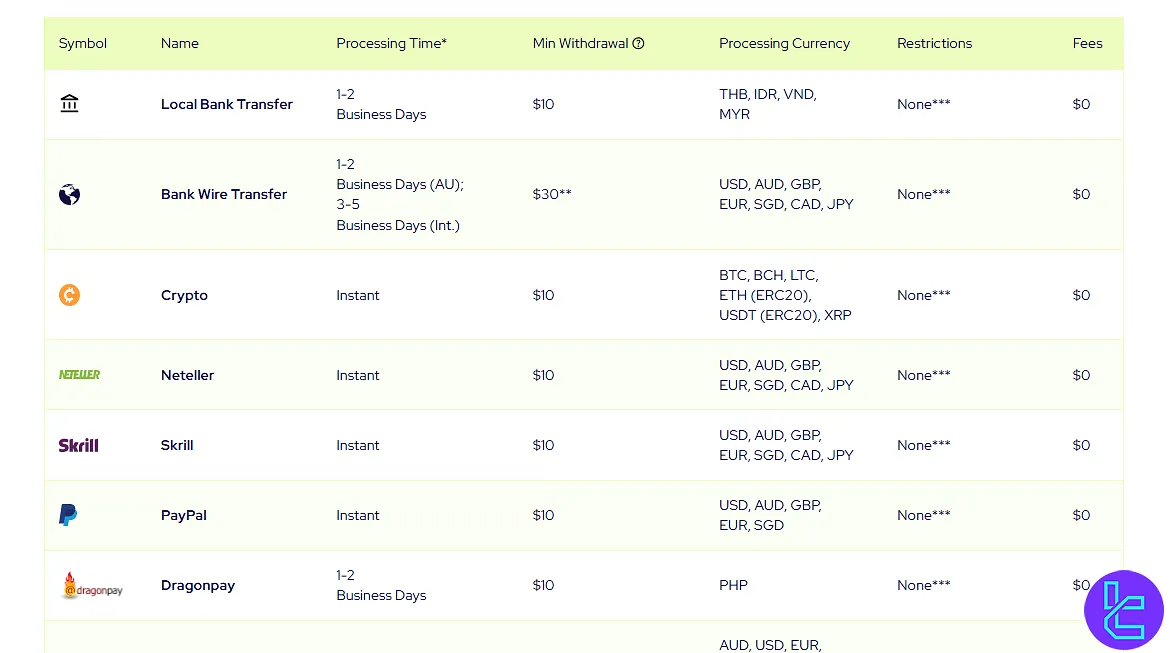

Withdrawal Methods at Global Prime

The broker provides a diverse set of global and local withdrawal options including traditional bank transfers, e-wallets, and crypto, all processed via the GP Hub for transparency and efficiency.

Importantly, Global Prime does not charge any internal withdrawal fees, and most methods are completed within the same or next business day.

Below is a detailed breakdown of all supported withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Local Bank Transfer | THB, IDR, VND, MYR | $10 | $0 | 1–2 Business Days |

Bank Wire Transfer | USD, AUD, GBP, EUR, SGD, CAD, JPY | $30 | $0 | 1–2 Business Days (AU); 3–5 Business Days (Intl.) |

Crypto | BTC, BCH, LTC, ETH (ERC20), USDT (ERC20), XRP | $10 | $0 | Instant |

Neteller | USD, AUD, GBP, EUR, SGD, CAD, JPY | $10 | $0 | Instant |

Skrill | USD, AUD, GBP, EUR, SGD, CAD, JPY | $10 | $0 | Instant |

Pay Pal | USD, AUD, GBP, EUR, SGD | $10 | $0 | Instant |

Dragon Pay | PHP | $10 | $0 | 1–2 Business Days |

Jeton Bank | AUD, USD, EUR, GBP, JPY, SGD, CAD | $10 | $0 | Instant |

Interac | CAD | $10 | $0 | 1–3 Business Days |

Gate8 | MYR | 50 MYR | $0 | 1 Business Day |

VN Pay | VND | 100 000 VND | $0 | 1 Business Day |

X Pay | MYR, THB, IDR, VND | $10 (USD equivalent) | $0 | 1 Business Day |

Does Global Prime Offer Copy Trading and Growth Plans?

The company recognizes its clients' growing demand for social trading and copy trading features. While the broker doesn't offer its own proprietary copy trading system, it does provide integration with third-party services, like ZuluTrade.

ZuluTrade is a dedicated social trading platform with the “Profit Sharing” model. It charges a $30 monthly fee for the first month and a 25% rate of profits for the following months. To use the platform, you need to create a Global Prime MT4 account.

While Global Prime doesn't offer specific "Growth Plans," they provide various tools and resources to support trader development, including trading signals from “Autochartist”, Economic Calendar, and Trading Calculators.

Global Prime Broker Financial Markets

The company offers access to a wide range of financial markets (Over 150 tradable instruments), catering to diverse trading interests.

Here is a summary of the trading instrument markets at Global Prime, tailored for serious traders exploring the breadth and leverage of access.

Category | Type of Instruments | Number of Symbols | Competitor Average* | Max. Leverage |

Currency pairs (majors, minors, exotics) | 56 | ~50–80 | 1:500 | |

US Share CFDs | U.S. equities via CFD format | 100+ | 100+ | 1:20 |

Indices | Global stock market indices via CFD | 15+ | 10–30 | 1:100 |

Commodities | Precious metals, energy, soft commodities | 20+ | 15–25 | 1:100 |

Crypto CFDs | Cryptocurrency derivatives (coins) | 35+ | 30–50 | 1:5 |

Global Prime offers a diverse range of trading instruments across Forex, Cryptocurrencies, US shares CFDs, Indices, and Commodities, giving traders access to both global and niche markets.

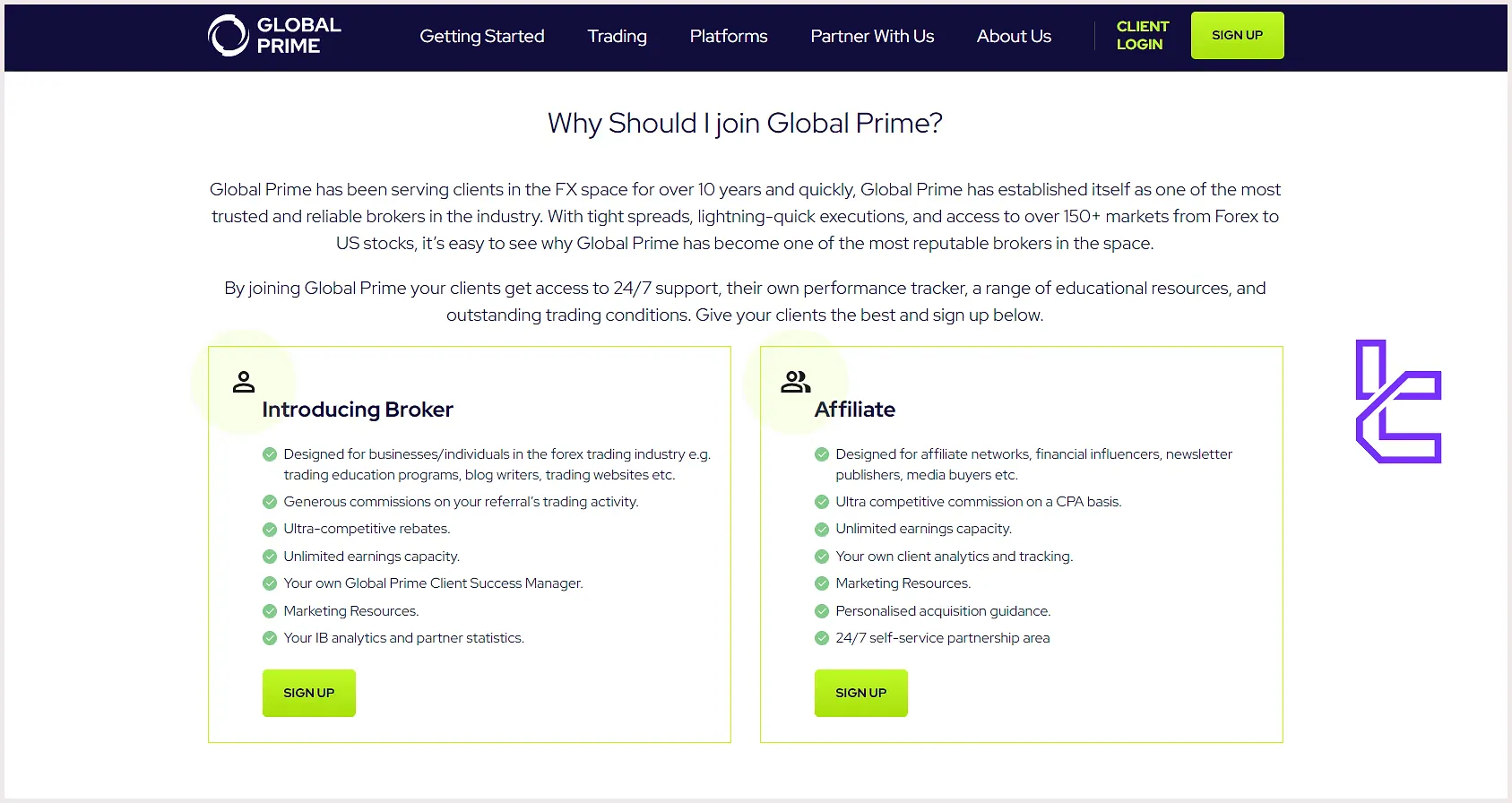

Bonus and Promotional Programs on Global Prime

It’s time to discuss one of the most attractive topics in the Global Prime review: the bonus offering. The company doesn’t offer traditional bonus plans and emphasizes its resources on providing very low trading costs. However, it offers two “Partner Programs” with the following features.

- Affiliate: Suitable for influencers and publishers to earn competitive commissions on a CPA basis

- IB: Commissions on your referred clients as rebates with unlimited earning potential

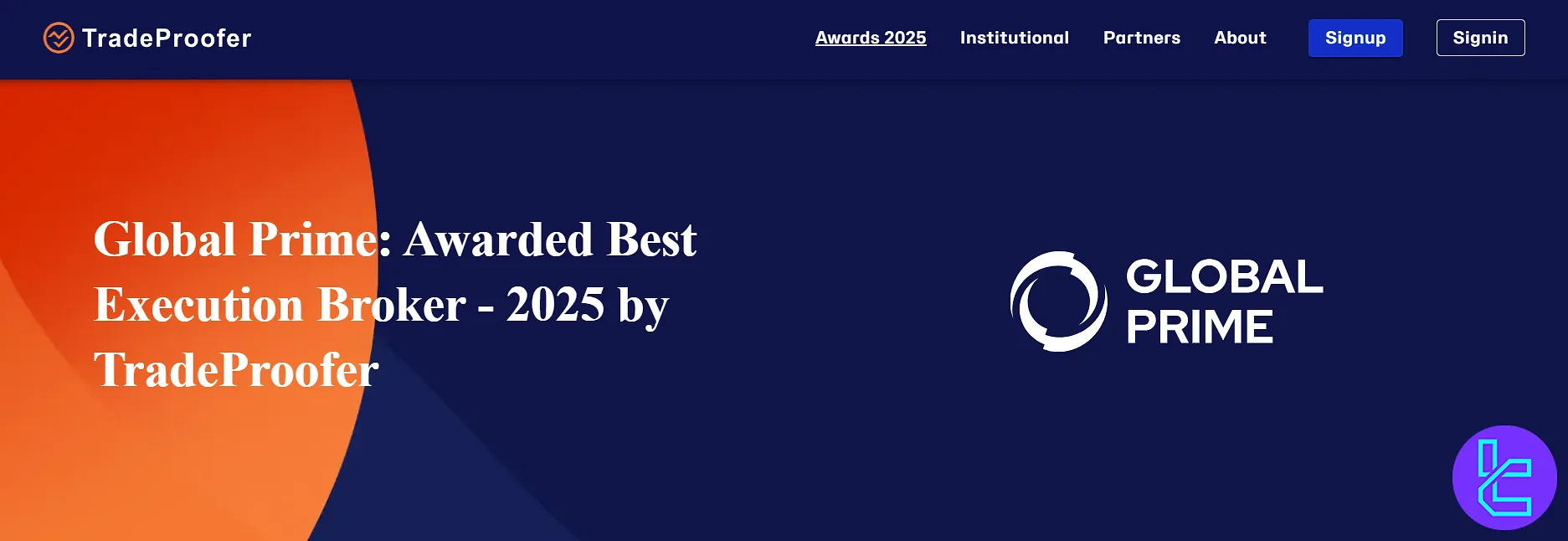

Global Prime Awards

Global Prime has been recognized as the “Best Execution Broker – 2025”, highlighting its commitment to fast, accurate, and reliable trade execution. This Global Prime award reflects the broker’s focus on providing a professional trading environment with high-quality service.

Global Prime Customer Support

The company prides itself on providing excellent 24/7 customer support to its clients through various channels, including:

support@globalprime.com | |

Phone | +61 (2) 8379 3622 |

Live Chat | Very responsive and quick |

Call Request | Through the “Contact Us” form in your profile |

Address | Global Prime EN, Govant Building, BP 1276 Port Vila, Vanuatu |

Users' reviews and opinions on internet sources show mostly positive experiences with the support team.

Global Prime Broker Geo-Restrictions

While the company aims to serve a global clientele, there are certain geographical restrictions due to regulatory compliance. Restricted countries on Global Prime:

- Afghanistan

- Congo

- Iran

- Iraq

- Myanmar

- New Zealand

- North Korea

- Palestine

- Russia

- Somalia

- Sudan

- Syria

- Ukraine

- Ontario

- Yemen

- Japan

- United States or its territories

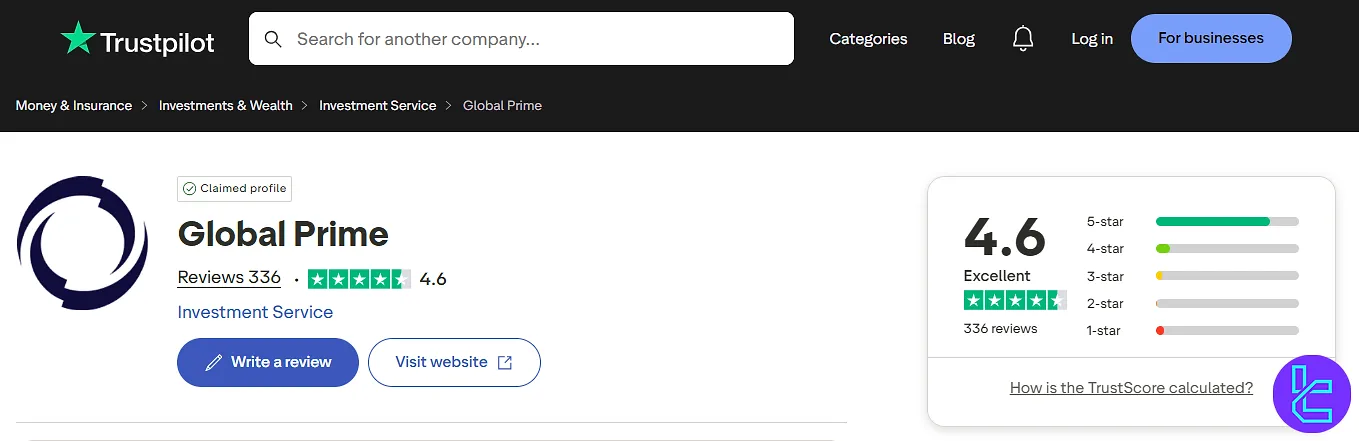

Global Prime Trust Scores

User satisfaction may be the most important subject of the Global Prime review. Trust is a crucial factor in choosing a broker, and the company has garnered positive trust scores from various sources.

4.6 out of 5 based on 240 reviews | |

Forex Peace Army | 4.8 out of 5 based on 424 comments |

Google Reviews | 4.4 out of 5 based on 42 comments |

Over 75% of the scores submitted on "Trustpilot" are5-star. As the website states, Global Prime has replied to 100% of the negative reviews, with an average response time of 48 hours.

Does Global Prime Provide Educational Content?

The broker places a strong emphasis on trader education, offering a comprehensive suite of educational resources through its “Trading Guides”. This section of the Global Prime website covers various topics, including:

- Beginner's guide to forex trading

- Advanced technical analysis techniques

- Risk management strategies

- Introduction to Indicators and Candlesticks

Global Prime in Comparison to Top Brokerages

Here's a table mentioning the differences between the discussed broker and its competitors:

Parameter | Global Prime Broker | |||

Regulation | VFSC, ASIC | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | Standard, Standard Cent, pro, Raw Spread, Zero |

Minimum Spread | 0 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From Zero | Average $1.5 | From Zero | From $0.2 |

Minimum Deposit | None | $200 | $100 | $10 |

Maximum Leverage | 1:500 | 1:500 | 1:500 | Unlimited |

Trading Platforms | MT4 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Raw | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 150+ | 2,250+ | 270+ | 230+ |

| Trade Execution | Market, Stop Loss, Take Profit, Limit | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Global Prime provides access to Forex market through MetaTrader 4. It also utilizes the ZuluTrade platform to offer social trading services with a 25% commission rate. While the broker is regulated by multiple entities, including ASIC and VFSC, it’s not available in the United States.