IC Markets is an international multi-asset brokerage with 10 options for base currency [USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, CAD]. The broker asks for a minimum of $200 deposit.

You have access to over 2,100 stock CFDs on this brokerage. The standard account incurs no trading fees with spreads from 0.8 pips.

IC Markets forex broker [Company Information + Regulation]

IC Markets' parent company was established in 2007 in Australia, but since 2018, it has obtained the required licenses for providing its services to traders from Europe. The company is authorized and regulated by the Financial Services Authority (FSA) of Seychelles, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC), ensuring a safe and flexible trading environment for its clients.

Key points about IC Markets' regulation and company information:

- Undergoes external audits for operational and accounting processes

- Segregates client funds in top-tier banking institutions

- Implements anti-money laundering policies and procedures

- CySEC clients are covered by the Investor Compensation Fund up to €20,000

The table below summarizes the various entities of the company and their respective regulating authorities:

Entity Parameters/Branches | IC Markets (EU) Ltd | International Capital Markets Pty Ltd | Raw Trading Ltd |

Regulation | CySEC | ASIC | FSA |

Regulation Tier | 1 | 1 | 3 |

Country | Cyprus | Australia | Seychelles |

Investor Protection Fund | Max. €20K | N/A | N/A |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | No |

Compensation Scheme | Up to 20,000 EUR | N/A | Up to $1 million |

Maximum Leverage | 1:30 | 1:30 | 1:500 |

Client Eligibility | Only EU/EEA Residents | Only Australian Residents | Global Clients Excluding Those from Select Restricted Regions |

Table of Summary

IC Markets stands out as a reputable online Forex market and CFD broker, offering competitive pricing, low spreads, and fast execution. Here's a quick overview of what makes this broker unique:

Broker | IC Markets |

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Based Currencies | USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, CAD |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:500 |

Investment Options | Passive Income, Partnership |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

Markets | Forex CFDs, Index CFDs, Bond CFDs, Crypto CFDs, Stocks CFDs, Commodity CFDs |

Spread | From 0 pips |

Commission | Average $1.5 |

Orders Execution | Market |

Margin Call/Stop Out | 50%/100% |

Trading Features | Scalping, Expert advisors |

Affiliate Program | Yes |

Bonus & Promotions | Yes |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Phone, chat, email, social media |

Customer Support Hours | 24/7 for live chat |

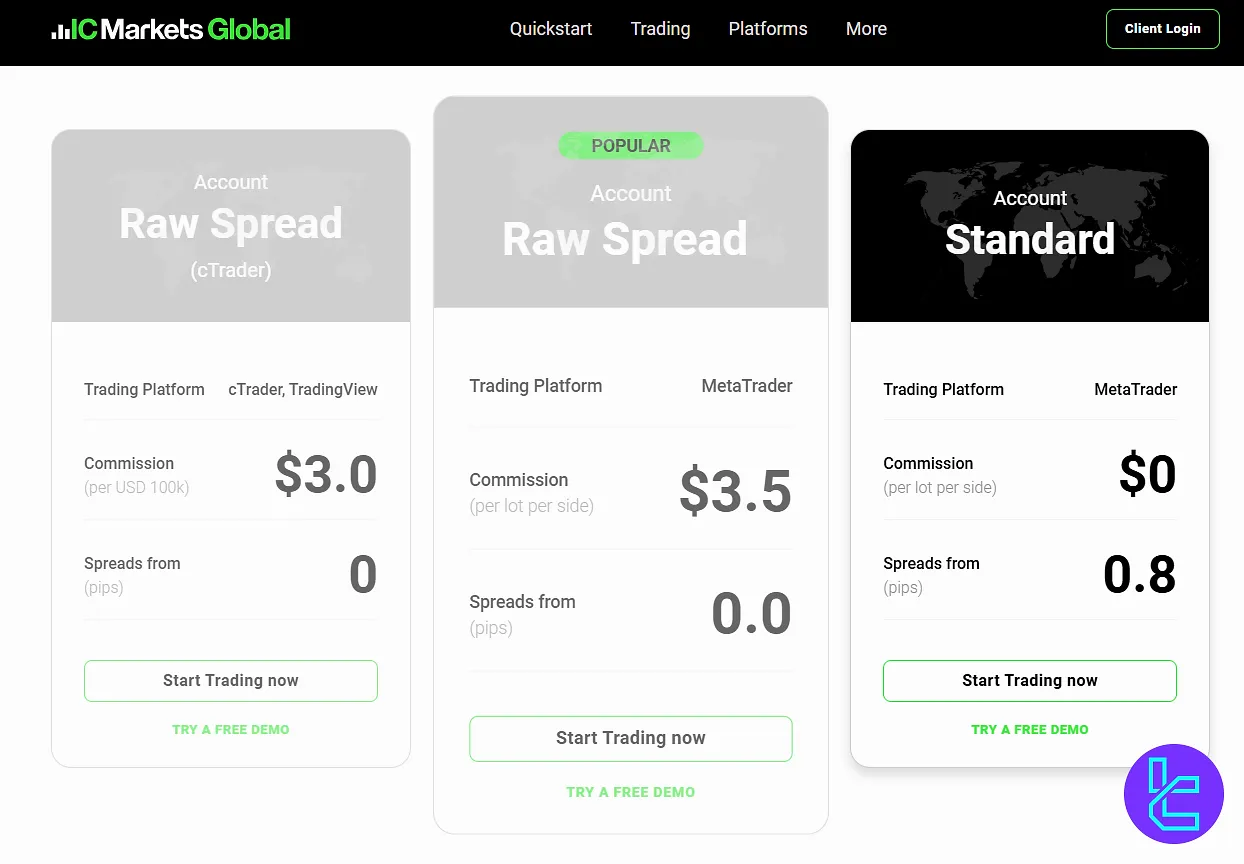

Account Types

IC Markets offers three main account types to cater to different trading styles and preferences. We will discuss each type's main features to help you choose one:

- Standard Account: No commissions, trading spreads from 0.8 pips, fast order execution, $200 minimum deposit, leverage up to 1:500

- Raw Spread Account (MetaTrader 4/5): No spreads, commission of $3.5 per lot per side, ideal for active traders, scalpers, and EA users

- cTrader Raw Spread Account: No spreads, commission of $3 per lot side, leverage up to 1:500, tailored for day traders and scalpers

IC Markets offers Islamic (swap-free) accounts on all major platforms, including MT4, MT5, and cTrader, specifically designed for traders who comply with Sharia law.

These accounts are structurally identical to Standard and Raw Spread accounts but exclude overnight interest (swap) on positions in forex, indices, and metals. For other asset classes, a fixed administration fee ranging from $5 to $80 per lot may apply.

IC Markets Forex Broker Pros & Cons

Let's examine the advantages and disadvantages of trading with IC Markets as a Forex broker:

Advantages | Disadvantages |

Competitive pricing with low average spreads | Offers limited leverage in Europe and offices regulated by ASIC and CySEC |

Wide range of trading platforms | Minimum deposit could be high for some traders |

Scalable execution for algorithmic traders | - |

Extensive market offering (2,250+ tradable symbols) | - |

Despite some limitations, IC Markets remains an excellent choice for algorithmic and high-frequency traders due to its low costs, fast execution, and advanced platform offerings.

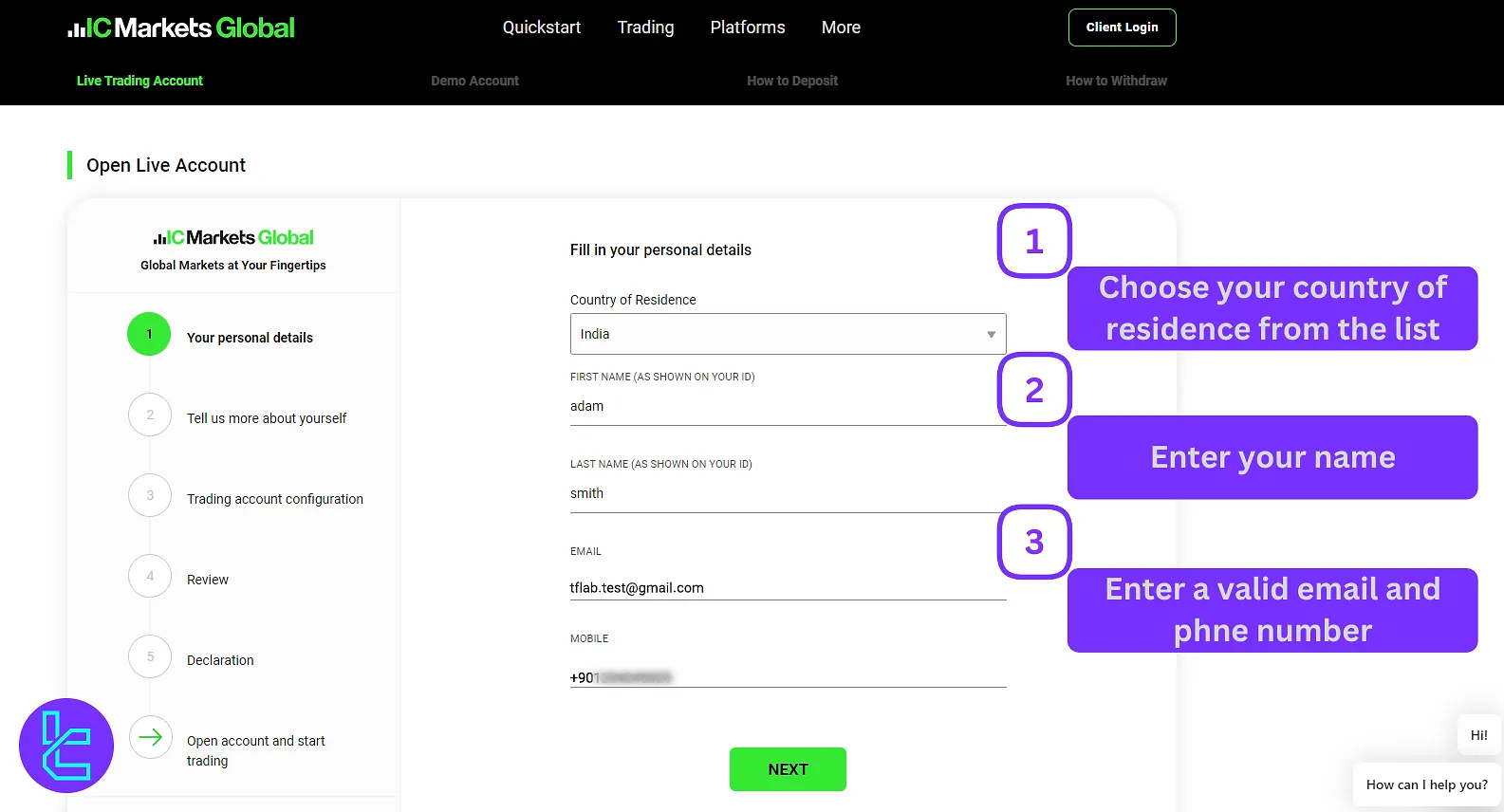

How to Open and verify an account

Opening and verifying an account with IC Markets is a straightforward process. Follow the tutorial in the following sections.

#1 Navigate to the Website

Visit the IC Markets website and click on "Client login". Then, click on "open an account" to access the registration form.

#2 Provide Details in the Forms

In the application form, enter these details:

- name

- Phone number

- Country

Then, in later stages, fill in the additional necessary details about your identity.

Afterwards, select your trading platform and account type. Eventually, review your information and finalize signing up with the brokerage.

#3 Verification

For account verification, you will need to provide proof of address or proof of identity.

What Platforms and Applications does IC Markets offer?

The broker provides a range of trading platforms to suit different trading styles and preferences among users:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Raw Spread accounts available, institutional-grade pricing, spreads from 0.0 pips

- cTrader: Order execution with 1 click, user-friendly interface, advanced charting, and trading tools

- Mobile trading apps: Available for iOS and Android devices, provides monitoring markets and execute trades on the go

Commissions and Spreads Overview

IC Markets is known for its attractive pricing policies. However, commissions, fees, and spreads in a broker could change depending on the conditions.

- Average: EUR/USD spread: 0.1 pips

- Raw Spread account: Spreads from 0.0 pips

- Standard account: Spreads from 0.8 pips

- Commission on cTrader: $3 per 100,000 USD traded

- Commission on MetaTrader 4: $3.50 per lot traded

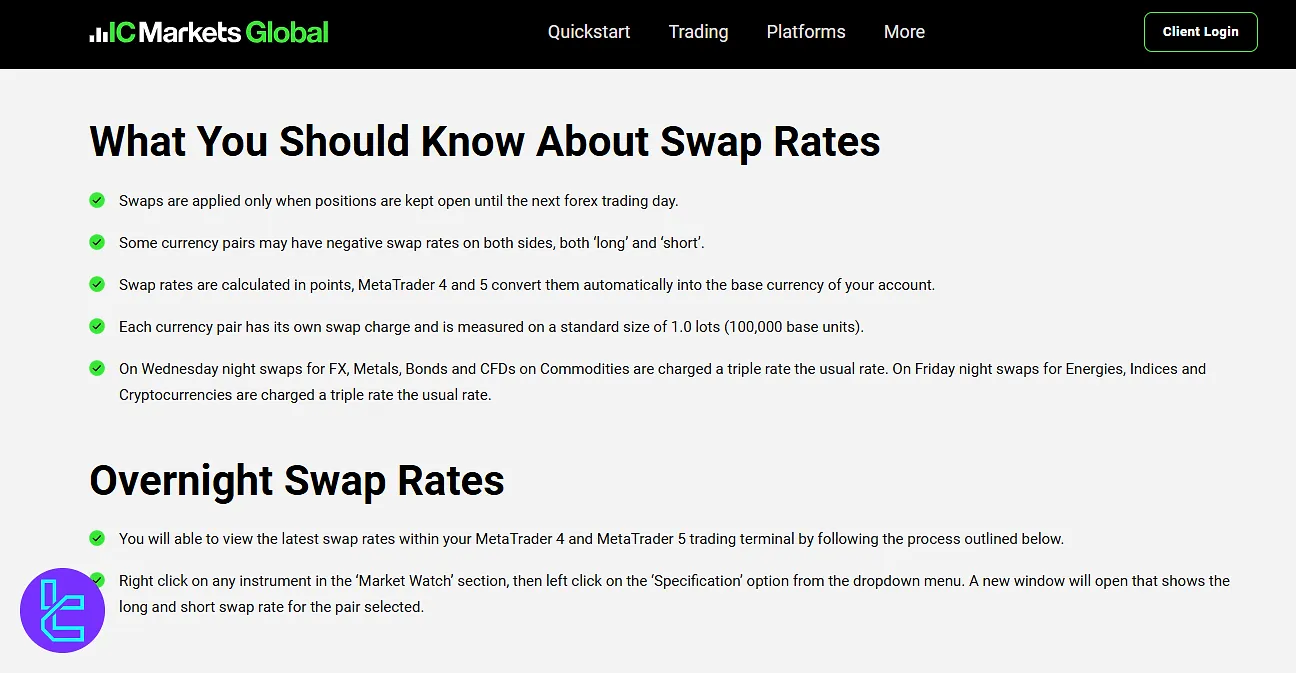

Swap Fees

Swap charges are not uniform throughout the week. For FX, Metals, Bonds, and CFDs on Commodities, triple swaps are applied on Wednesdays to cover weekend rollover.

For Energies, Indices, and Cryptocurrencies, triple charges occur on Fridays.

To access current swap rates in MetaTrader platforms, navigate to ‘Market Watch,’ right-click on the asset, select ‘Specification,’ and review the listed long and short swap points.

Non-Trading Commissions

Per our investigations, there are no inactivity fees charged by the brokerage. Also, no deposit/withdrawal commissions are incurred.

Deposit and Withdrawal Options

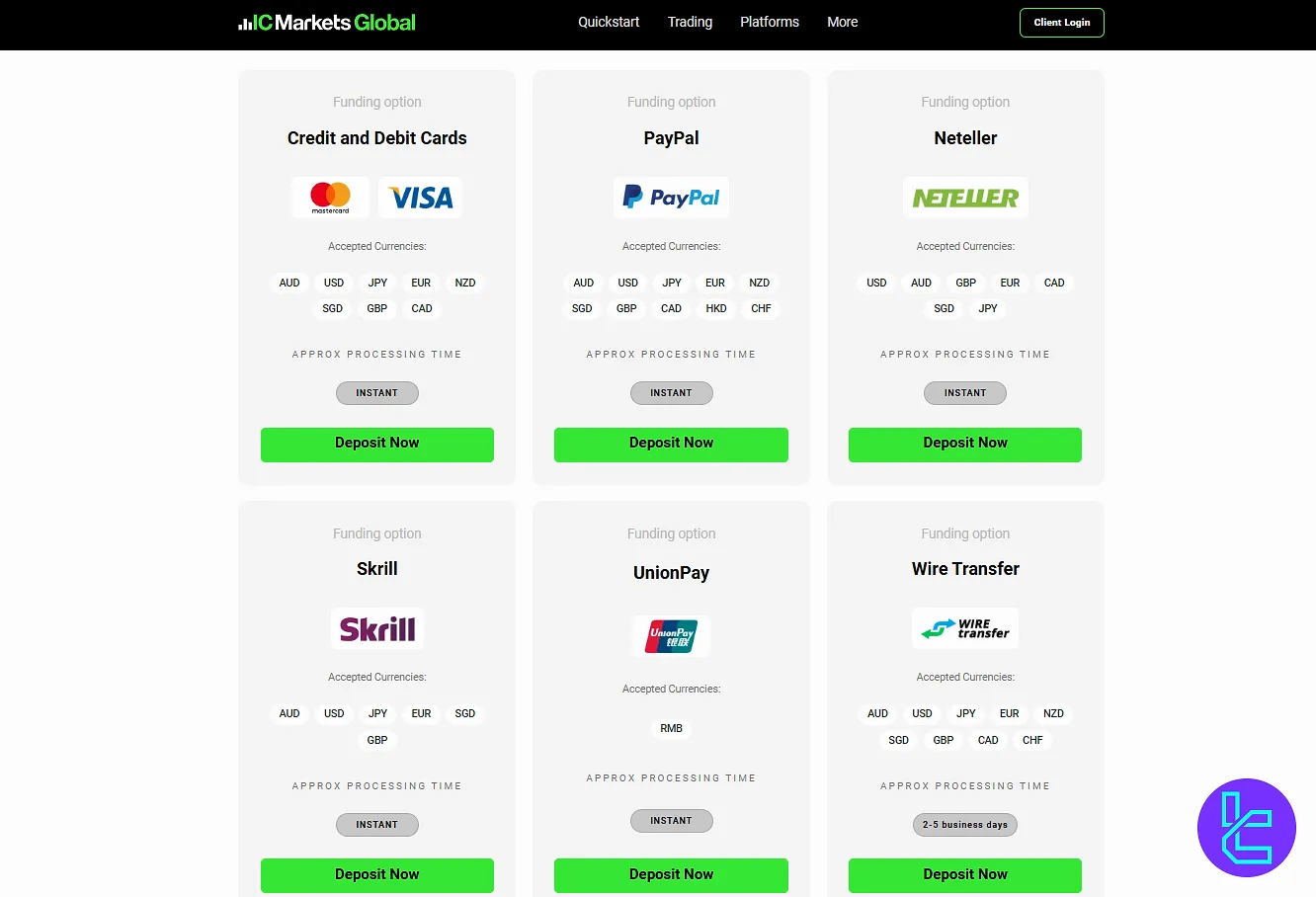

IC Markets provides a vast range of deposit and withdrawal options:

- Bank Cards: VISA, MasterCard

- Wire Transfer

- Electronic Payment Platforms: Skrill, Neteller, PayPal, etc.

- UnionPay, Bpay, POLI, and other additional methods

Deposit Methods

The table in this section will go through the available options for making deposits on the broker:

| Payment Method / Parameter | Accepted Currencies | Approx. Time |

| VISA/Mastercard | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD | Instant |

| PayPal | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF | Instant |

| Neteller | USD, AUD, GBP, EUR, CAD, SGD, JPY | Instant |

| Skrill | AUD, USD, JPY, EUR, SGD, GBP | Instant |

| UnionPay | RMB | Instant |

| Wire Transfer | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, CHF | 2 - 5 Business Days |

| Bpay | AUD | 12 - 48 Hours |

| Broker to Broker | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, CHF, HKD | 2 - 5 Business Days |

| POLI | AUD | Instant |

| Thai/Vietnamese Internet Banking | USD | 15 - 30 Minutes / Instant |

| Rapidpay | EUR, GBP | Up to 2 Business Days |

| Klarna | EUR, GBP | Up to 2 Business Days |

Withdrawal Options

IC Markets provides multiple withdrawal channels, including bank wire transfers, credit/debit cards, and electronic wallets such as Pay Pal, Skrill, and Neteller.

Requests must be submitted through the Secure Client Area, and all withdrawals are required to be sent to accounts registered under the same name as the trading account holder.

Supported Channels

- Bank Transfers: Widely accessible, though may take up to 14 business days to complete;

- Cards: Both credit and debit cards are eligible for withdrawals, a service not universally available across brokers;

- E-wallets: The platform supports a broad range including Visa Direct, Safe Charge, Transact365, eComm Pay, Card Pay, Bpay, Fasa Pay, Poli, Rapid Pay, and Klarna.

Key Policies and Requirements

- Ownership Verification: Payouts must be directed to personal accounts only;

- Processing Speed: Card transactions are typically quicker than bank transfers;

- Deadline for Requests: Withdrawal requests must be submitted before 12:00 AEST/AEDT to be processed the same day;

- Fees: No direct withdrawal fees apply to card payouts, but third-party charges may occur, especially if deposited funds haven’t been used for trading activity;

- Verification Documents: Additional documentation might be required, particularly for first-time bank withdrawals or when using Thai or Vietnamese internet banking;

- Refund Protocol: In specific scenarios, funds may be returned to the original deposit method.

Copy Trade and Investment Options

This broker offers unique copy trading opportunities through Spotware's cTrader platform. Key features include:

- Automation of high-performance trading strategies

- Complete transparency and control

- Intelligent risk management tools

- Advanced analysis and insights

- Comprehensive strategy profiles

- Multiple platform options (web/desktop/mobile)

- Social trading platform.

Tradable markets and Symbols

The broker provides access to a wide range of global markets. Here's a complete table:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Forex CFDs (Standard, Micro, Ultra Low accounts) | Over 60 currency pairs | 50–70 currency pairs | 1:500 |

Stocks | CFDs on shares (via MT5 platform) | Over 2100 global stocks | 800–1200 | 1:20 |

Bonds | CFDs on global bonds | 9 bonds | 5–15 bonds (approx.) | 1:200 |

CFDs on cryptocurrencies | More than 10 cryptocurrencies | 5–15 cryptocurrencies (approx.) | 1:200 | |

Commodities | CFDs on commodities | More than 25 instruments | 10–20 instruments | 1:500 |

Indices | CFDs on global indices (e.g. S&P 200, FTSE 100, DJIA, S&P 500) | 4 major indices | 10–20 indices | 1:200 |

Bonus and promotions

IC Markets Global offers several promotional bonuses for new clients in select Southeast Asian countries:

- Welcome Bonus: New clients from Malaysia, Thailand, Vietnam, Indonesia, Singapore, Philippines, and Laos can receive a $30 bonus for opening an account with a minimum $200 deposit and completing 10 qualifying trades;

- Limited Time 10% Deposit Bonus: New clients from the same countries can receive up to $200 bonus (10% of their deposit) for deposits between $200 and $2,000;

- Exclusive Redeemable Bonus: New clients can receive bonuses of $25 or $150 for deposits between $200 and $2,000 (or more) and completing specified qualifying trades.

However, these bonuses have expired, and they are currently unavailable.

IC Markets Awards

IC Markets has been named the Best Forex/CFD Broker in the APAC region for 2024 by TradingView, a platform widely used by global traders for technical analysis and charting.

The annual TradingView Broker Awards evaluate brokers based on user feedback and platform performance, highlighting those with a consistent track record of high service quality.

Tony Philip, Chief Marketing Officer at IC Markets, emphasized that the broker’s priorities remain unchanged since its establishment in 2007: delivering robust infrastructure, competitive trading conditions, and ongoing platform improvements to support traders in a dynamic market environment.

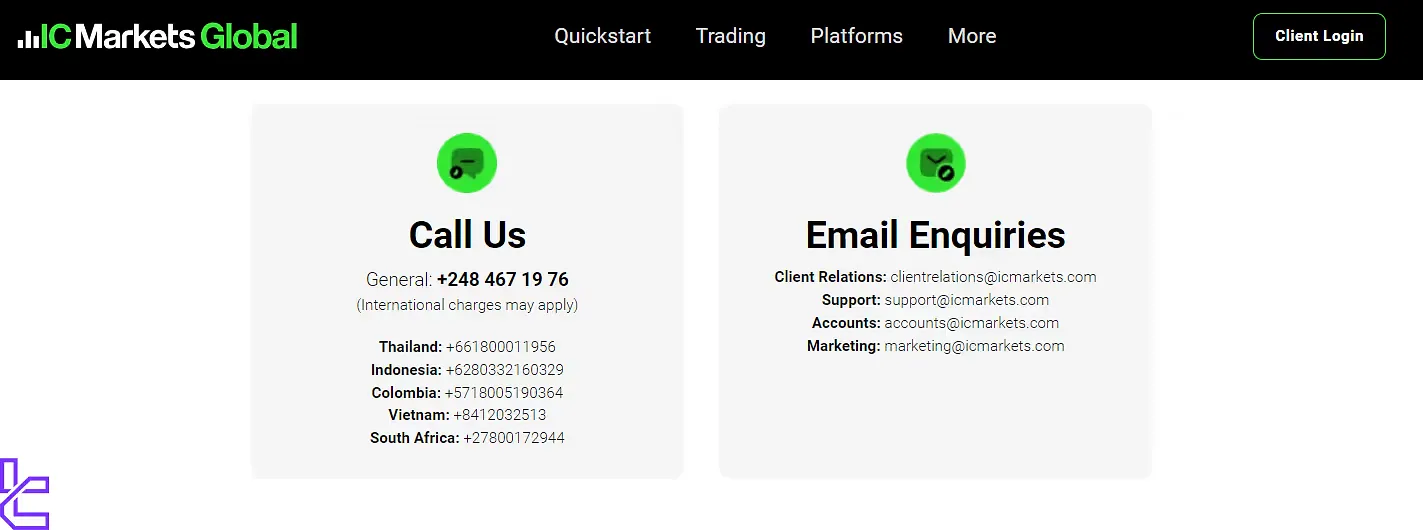

Support and customer services

IC Markets prides itself on providing excellent customer support:

- 24/7 customer service

- Multiple contact channels: live chat, phone, and email

- Toll-free numbers for several countries, including Australia, the UK, Thailand, Indonesia, Germany, Spain, Brazil, Malaysia, South Africa, and Poland

- Dedicated departments for Client Relations, Support, Accounts, and Marketing

- Office locations in Seychelles, Cyprus, and Australia to serve global clients

Banned Countries

Unfortunately, the mentioned broker does not offer its services to all regions in the world. In some countries, it is restricted or banned and the residents cannot register or verify their accounts in them. These countries might be some of those restricted form IC Markets' services:

- US

- Israel

- Korea

- New Zealand

- Abkhazia

- Iraq

- Iran

- Yemen

- Congo

- Central African Republic

- Afghanistan

- Cuba

- Libya

- Somalia

- Sudan

Office Addresses

IC Markets maintains a strong online presence to serve its global clientele. The broker's main office address:

- Main office address: Eden Plaza, Office 222, Eden Island, Mahe, Seychelles

- Cyprus office address: 86 Franklin Roosevelt, 4th floor, Office 401, 3011 Omonoia, Limassol, Cyprus

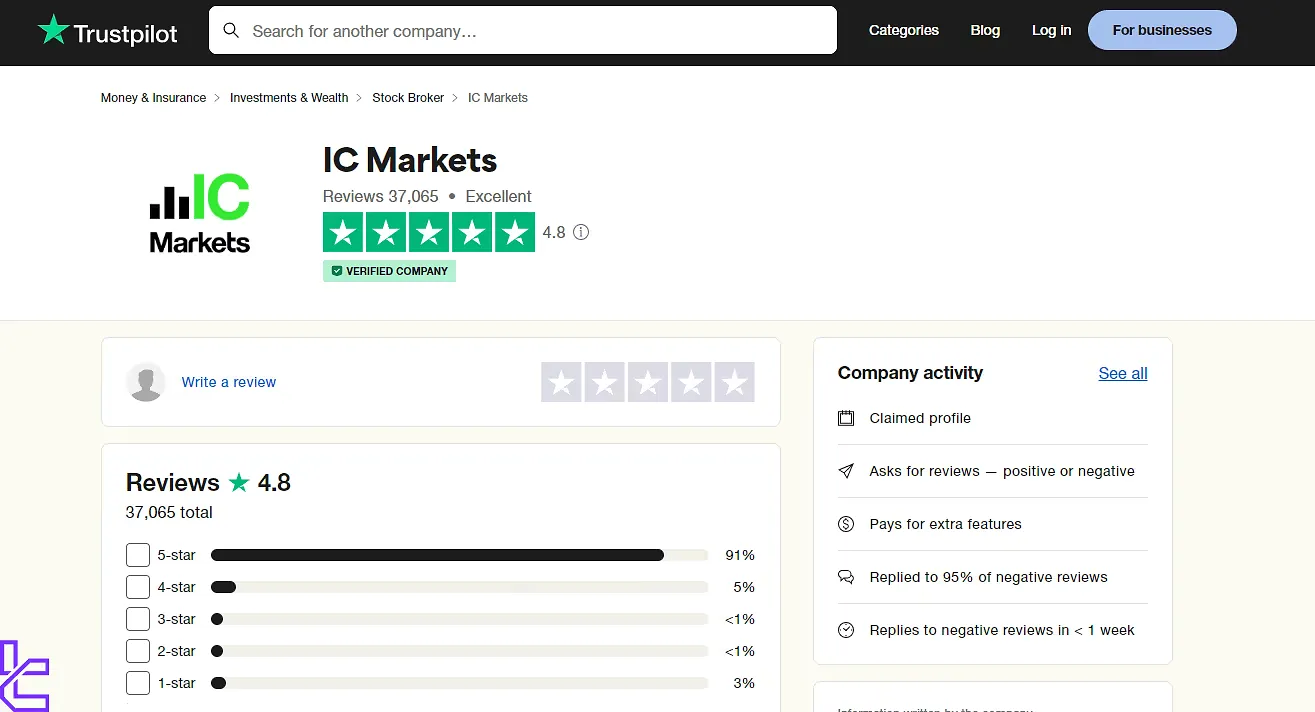

Trust Scores

IC Markets is one of the most reputable and trusted forex brokers, and it has achieved a high place on a famous review website. Some of the scores:

- Trustpilot User Score: 4.8 out of 5

- REVIEWS.io Score: 2.6 out of 5

People have mentioned the good service on the live chat, great support, and excellent overall experience as the broker's strengths.

Education Content and Tools

IC Markets offers a comprehensive education section on its website, designed to support traders of all levels:

- Overview of the forex market

- Advantages of forex and CFD trading

- Video tutorials

- Getting started guides

- Technical and fundamental analysis resources

- Insights into factors influencing currency movements

The education materials cover over 200 trading markets, explaining the advantages of forex and CFD trading, such as market transparency and fair price discovery. Video tutorials guide traders on effectively using the trading platforms.

IC Markets Compared to Major Brokers

We will investigate how IC Markets fares against thetop brokerages in the industry in the table below:

Parameter | IC Markets Broker | |||

Regulation | FSA, CySEC, ASIC | FSC | FCA, FSCA, CySEC, SCB | Standard, Standard Cent, pro, Raw Spread, Zero |

Minimum Spread | 0.0 Pips | From 6 Cents in ADVANTAGE STOCKS, From 0.0 Pips in ADVANTAGE, From 1.5 Pips in ADVANTAGE PLUS | 0.0 Pips | 0.0 Pips |

Commission | Average $1.5 | Varies by Account | From Zero | From $0.2 |

Minimum Deposit | $200 | $200 | $100 | $10 |

Maximum Leverage | 1:500 | 1:3000 | 1:500 | Unlimited |

Trading Platforms | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, FXTM Trader App | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Raw Spread, Islamic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, Pro, Raw+, Elite | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 2,250+ | 1,000+ | 270+ | 230+ |

Trade Execution | Market | Market | Market, Instant | Market, Instant |

TF expert suggestions

IC Markets is a global company with a Trustpilot score of 4.8/5, based on more than 37,000 reviews. The broker provides access to more than 2,200 tradable instruments.

The maximum leverage in these markets is 1:500, with a 50% margin call level and a 100% stop-out level.