Key To Markets is a multi-asset broker headquartered in the United Kingdom. This company is regulated by the FCA (527809) and FSC (GB19024503).

There are 9 payment options [SWIFT, SEPA, VISA, MasterCard, Skrill, Neteller, SticPay, Union Pay, AliPay] for deposits and withdrawals (except VISA and MasterCard, which are available only for deposits).

Company Introduction & Regulating Bodies

Based on the data gathered from the Crunchbase website and official sources, this company goes by the legal name "Key To Markets International Limited". Other Key Information:

- Founded in 2010

- Headquartered in Mauritius, 6th floor, Tower 1, Nexteracom Building, Ebene 72201

- Regulated by the Financial Services Commission in Mauritius by the number GB19024503

Below you can see the regulatory information of the broker:

Parameter / Branch | Key To Markets International Limited |

Regulation | Financial Services Commission (FSC) of Mauritius |

Regulation Tier | Tier 5 |

Country / Location | Mauritius |

Investor Protection Fund / Compensation Scheme | N/A |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:500 |

Client Eligibility | International clients accepted (except residents of restricted jurisdictions such as the U.S., North Korea, etc.) |

FCA is considered one of the reputable top-tier financial authorities in the world, and usually, brokers regulated by it are trustworthy.

Key Features and Parameters

Like any other Forex broker review article published in TradingFinder, in this section, we are going to have an overview of the main specifics in a table:

Broker | Key To Markets |

Account Types | Standard, Pro, Demo |

Regulating Authorities | FCA, FSC |

Based Currencies | USD, EUR |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfers, Credit/Debit Card, E-payment Systems |

Withdrawal Methods | Bank Transfers, E-payment Systems |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading, Social Trading, PAMM |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Commodities, Indices, Shares |

Spread | From zero |

Commission | Zero for Standard Account €6 / $8 per Lot for Pro Account |

Orders Execution | Not Specified |

Margin Call/Stop Out | 120%/100% |

Trading Features | Free VPS, Myfxbook AutoTrade |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Ticket, Phone Call, Email |

Customer Support Hours | From 9:00 to 18:00 GMT on Weekdays |

Trading Accounts on Key To Markets

There are 2 main account types offered by the broker for traders. Both of them are marked as ECN and are available for all platforms. Account Types Specifics on Key To Markets:

Account Type | ECN MT4 & MT5 Standard | ECN MT4 & MT5 Pro |

Min. Trade Size | 0.01 Lot | |

Max. Trade Size | Unlimited | |

Instruments | Forex, Indices, Commodities, and Shares | |

Min. Deposit | $100 | |

Margin Call/Stop Out | 120%/100% | |

Scalping/News Trading | Allowed | |

The only real difference between these 2 accounts is the trading commission and the market spread in each, which will be discussed later in this article.

In addition to the mentioned accounts, a demo account is offered for practicing trading without the risk of losing money.

Important Pros and Cons

There are two sides to the advantages and disadvantages of every company's services. Let's investigate those of Key To Markets:

Pros | Cons |

Regulated by FCA in the UK | Relatively High Minimum Deposit |

Negative Balance Protection for Clients | Limited Range of Trading Instruments |

High Leverage Up to 1:500 | - |

Registration and Verification on Key To Markets

As stated by the company, the process of Key To Markets registration is done through three stages: "Fill in the form", "Send the requested documents", and "Open your MT4 real account".

#1 Access the Key To Markets Platform

Begin by navigating to the official Key To Markets website and clicking on the “Open an Account” button, prominently located on the homepage.

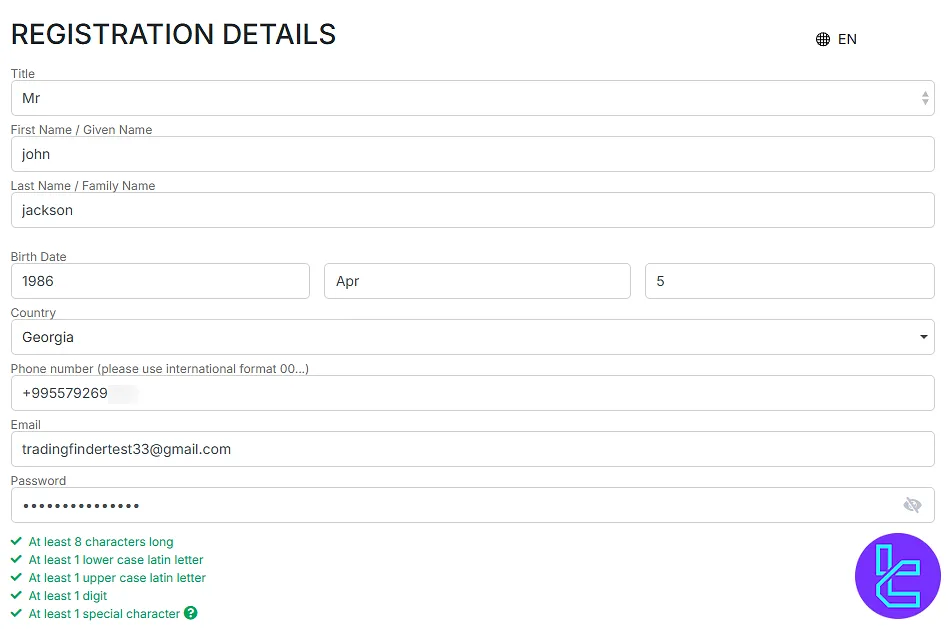

#2 Enter Personal Information

Fill in the form with these details of yours:

- Full name

- Date of birth

- Residential country

- Email address

- Mobile number

You must also choose a secure account password and agree to the broker’s terms and conditions before continuing.

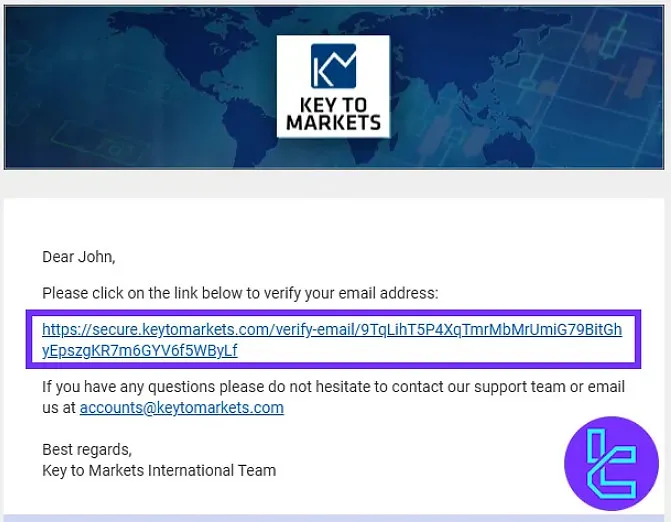

#3 Verify Your Email

Within your dashboard, click on “Send Verification Email”. Open the message sent to your inbox and confirm your email by selecting the activation link provided.

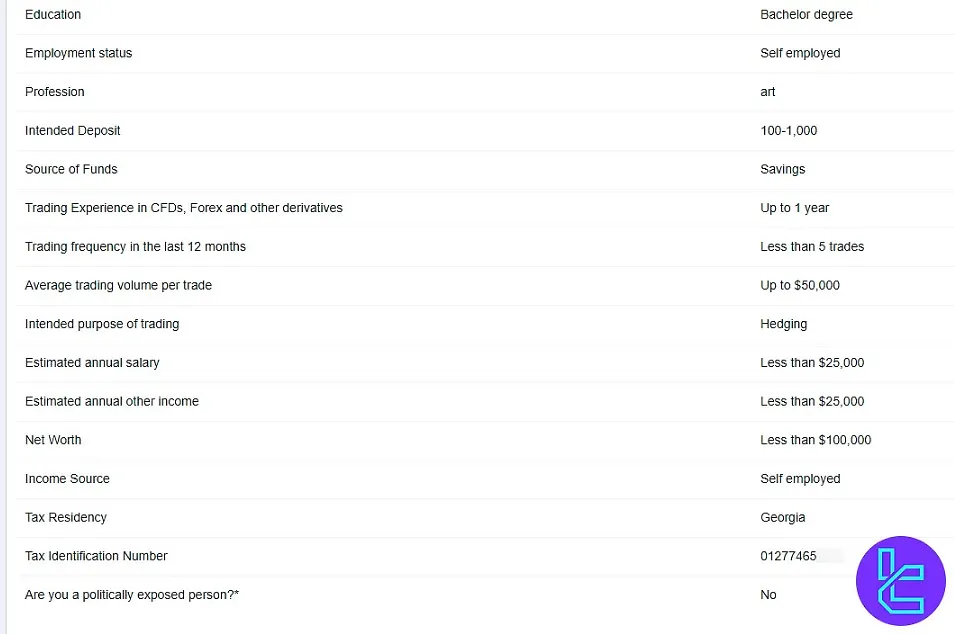

#4 Complete the Suitability Questionnaire

Respond to questions about your educational background, financial status, preferred account type, and PEP status (Politically Exposed Person). Submit the answers.

#5 Verify Your Identity

Submit the documents required for the Key To Markets verification. Then, wait for them to be approved.

Available Trading Platforms on Key To Markets

The broker supports two of the most popular trading platforms in the financial industry, which are MetaTrader 4 and MetaTrader 5. Platform Key Features:

- Access to Expert Advisors

- Custom indicators and MQL language

- An extensive list of technical indicators and tools

- One-click trading

Download the platforms for your mobile phones via the links provided in the table below:

Operating System | Android | iOS |

MetaTrader 4 Link | ||

MetaTrader 5 Link |

Spreads And Commissions

Trading fees are a critical aspect of a broker when it comes to choosing one. In the table below, we will mention the commissions and spreads for two main accounts:

Account Type | ECN MT4 & MT5 Standard | ECN MT4 & MT5 Pro |

Spreads | 1.0 Pip + ECN Raw Spread | ECN Raw Spread |

Commissions | 0 | 6 EUR / $8 per Lot |

The fees for trading with this company are above-average compared to other brokerages.

Also, there's a 2.5% commission for withdrawals and a 1% fee for deposits charged by the broker for payments via methods other than bank transfers. Your account on Key To Markets will face no inactivity fees.

However, an overnight swap is applied once per day. The rate is different for each asset.

Also, note that currency conversion fees may apply when operating in currencies other than USD or EUR.

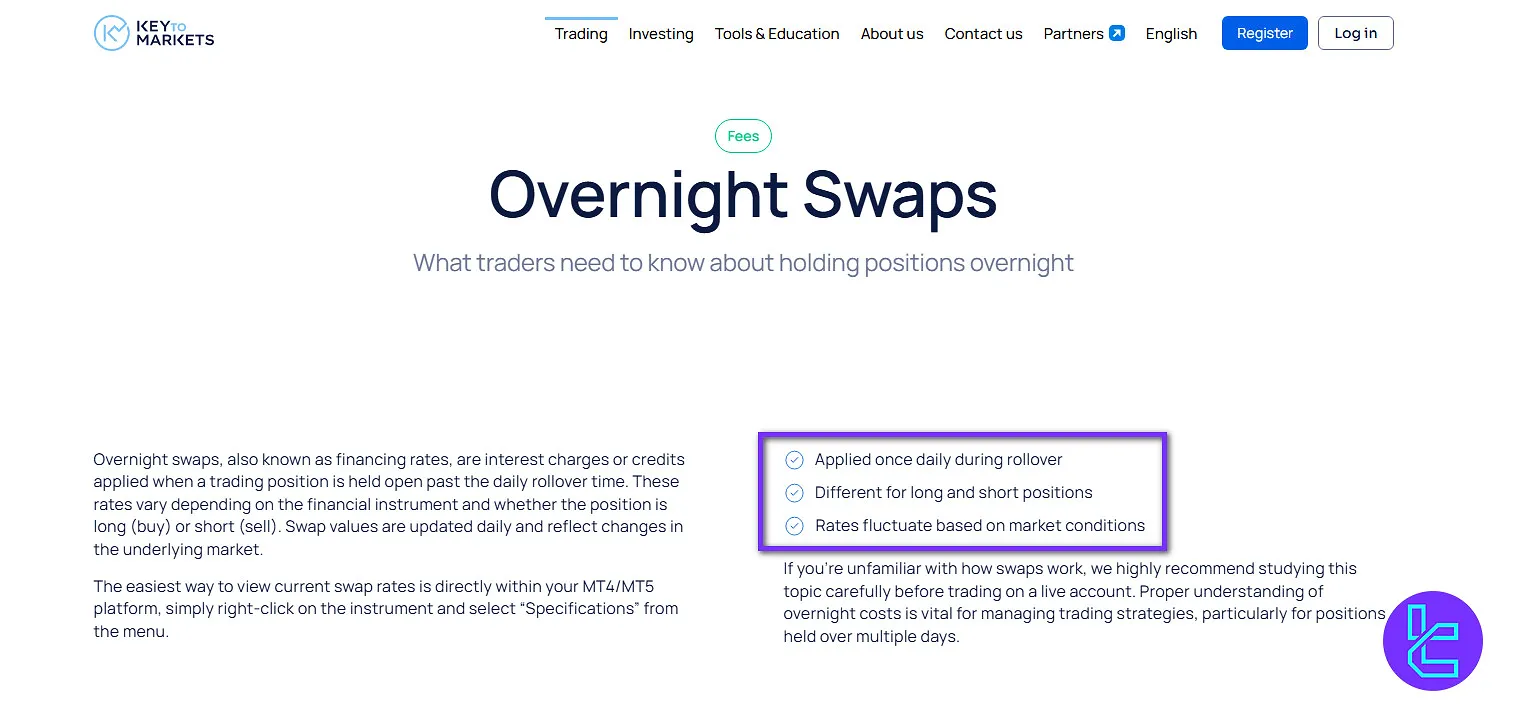

Key To Markets Swap Fees

Overnight swap fees, often referred to as financing rates, represent the cost or credit applied when a trader keeps a trading position open beyond the daily rollover period.

The exact rate depends on the instrument being traded and the direction of the position, whether it’s long (buy) or short (sell).

These swap values are subject to daily adjustments, reflecting interest rate differentials and shifts in broader market conditions. Each rollover applies the relevant swap charge once per trading day.

Traders can easily check the most up-to-date swap rates within the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform by right-clicking on the chosen symbol and selecting “Specifications.”

Key To Markets Non-Trading Fees

Key to Markets does not impose inactivity fees, allowing traders to pause their activity without any account-related charges. Whether positions are opened frequently or the account remains idle, no penalties are applied.

All deposits and withdrawals made via credit card are processed without additional costs from Key to Markets.

The broker absorbs any third-party processing fees, though clients should note that banks or payment service providers may still apply their own charges.

Key To Markets Broker Funding Methods

The broker does a good job when it comes to payment options and offers a diverse list. We will mention these methods here:

- Bank Transfers: SWIFT, SEPA

- Credit/Debit Cards: VISA & MasterCard (Not available for withdrawals)

- E-payments: Skrill, Neteller, SticPay, Union Pay, AliPay

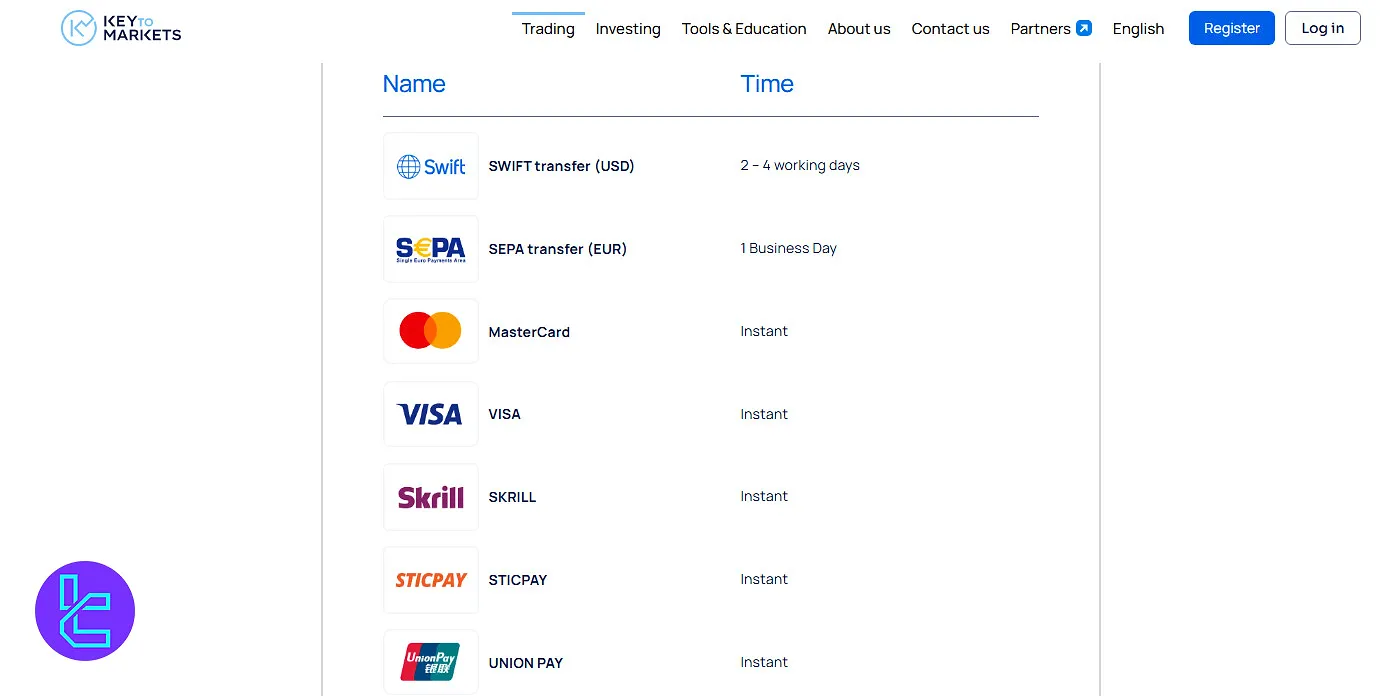

Key To Markets Deposit

Key to Markets provides traders with a variety of secure funding options, ensuring that all deposits are processed efficiently and that client funds remain protected in segregated bank accounts at reputable financial institutions.

Below is a table outlining the available deposit methods and their typical processing times:

Deposit Method | Processing Time | Deposit Fee |

SWIFT Transfer (USD) | 2–4 working days | $0 |

SEPA Transfer (EUR) | 1 business day | $0 |

Master Card | Instant | $0 |

VISA | Instant | $0 |

Skrill | Instant | $0 |

Stic Pay | Instant | $0 |

Union Pay | Instant | $0 |

Cryptocurrency | Up to 30 minutes | $0 |

Korapay | Instant | $0 |

Pay Retailers | Instant | $0 |

The broker emphasizes transparency and security, with no tolerance for third-party payments. Only accounts registered under the same name as the trading account are accepted, and corporate card deposits are not allowed.

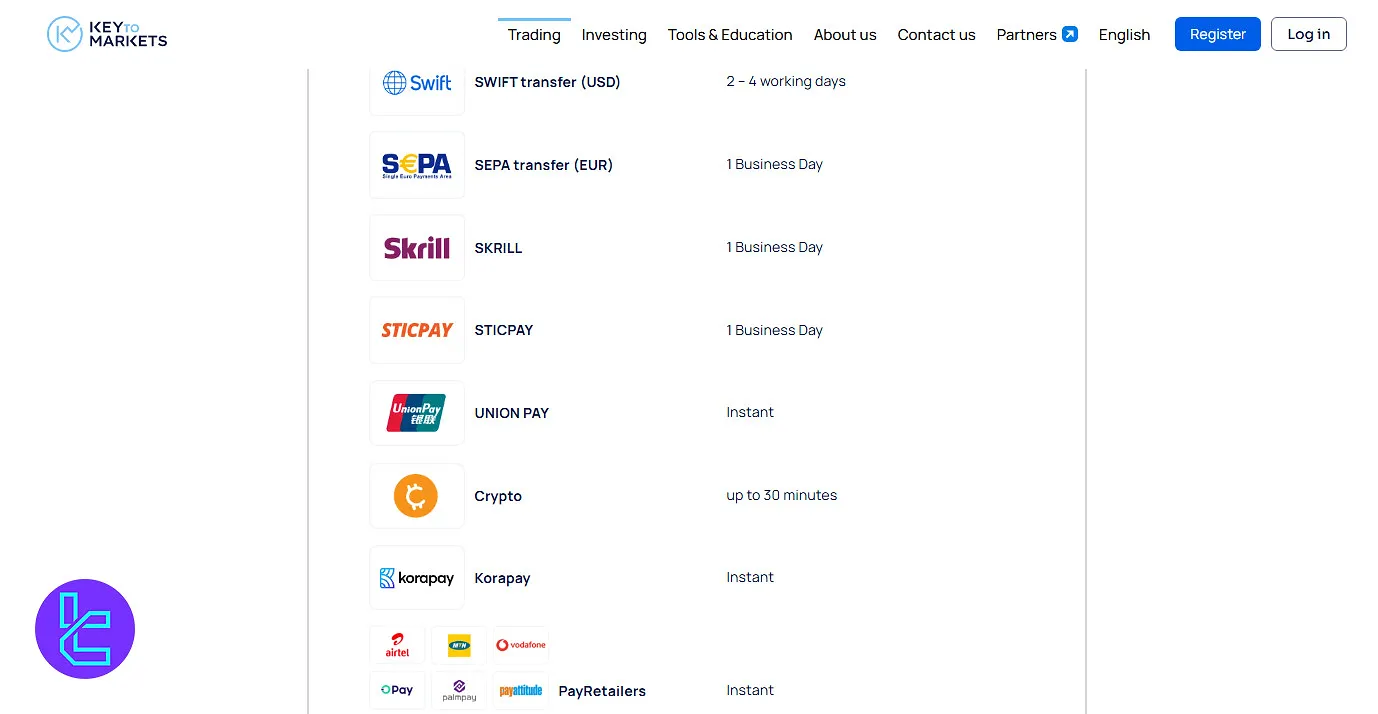

Key To Markets Withdrawal

Key to Markets ensures that all withdrawal requests are handled swiftly and securely, returning funds only to the original payment source used for deposits.

Below is a table detailing the available withdrawal methods and their expected processing times:

Withdrawal Method | Processing Time | Withdrawal Fees |

SWIFT Transfer (USD) | 2–4 working days | $0 |

SEPA Transfer (EUR) | 1 business day | $0 |

Skrill | 1 business day | $0 |

Stic Pay | 1 business day | $0 |

Union Pay | Instant | $0 |

Cryptocurrency | Up to 30 minutes | $0 |

Korapay | Instant | $0 |

Pay Retailers | Instant | $0 |

With segregated client accounts and robust security protocols, traders can rely on a transparent and efficient withdrawal process.

Copy Trading & Passive Earning

Some Forex Brokers provide investment programs, such as a PAMM account, as a way of earning passive income in addition to active income from trading in markets.Investment Options in Key To Markets:

- PAMM Account

- Copy Trading

- Social Trading

These programs are mainly based on copying trades, strategies, and signals from professional and more experienced traders. Key To Markets does not charge any fees for joining these programs.

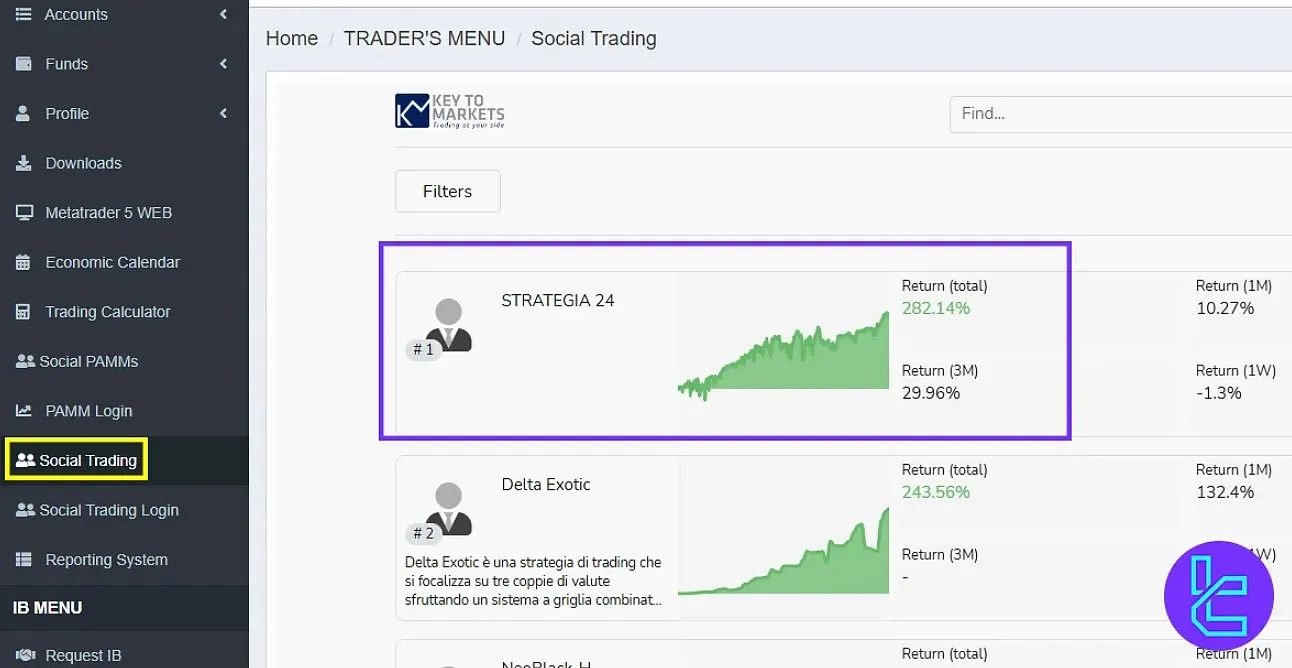

Find the Investment Options from the Key To Markets Dashboard

The Key to Markets dashboard offers more than 20 integrated features, including access to PAMM accounts, social trading, and a Download section for platforms such as MetaTrader 4 and MetaTrader 5.

Users can customize their experience by switching between light and dark themes, changing the interface language, and searching for specific traders or strategies.

Within the Social PAMMs and social trading sections, investors can review traders’ performance, apply filters by timeframe or rating, and track metrics like returns and drawdowns.

By selecting “Invest” users can easily allocate funds, link their MetaTrader accounts, and confirm participation in chosen strategies or PAMM accounts.

Tradable Instruments and Trading Markets

Key To Markets does not offer a diverse range of symbols and assets, and the number of trading instruments on this brokerage is lower than other brokers:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | CFDs on major, minor, and exotic currency pairs | 65+ currency pairs | 50–70 currency pairs |

Indices | CFDs on global stock indices (e.g., CN50, XEU50, XUS30, and others) | 10+ indices | 10–20 indices |

Commodities | CFDs on precious metals, energy products, and soft commodities | 12+ instruments | 10–20 instruments |

Shares | CFDs on global company stocks available via MT4/MT5 | Over 60 shares | 800–1200 (for multi-asset brokers) |

Are There Any Available Bonuses on Key To Markets?

Currently, the broker maintains a no-bonus policy, adhering to strict regulatory guidelines. This is not necessarily a drawback since promotions are not part of the main services of a broker. Nevertheless, always check the official sources for any changes regarding this matter.

To Markets Awards

Key to Markets has been acknowledged within the global financial industry for its commitment to transparency, client-oriented service, and reliable trading conditions.

Over the years, the broker has received multiple honors from respected organizations, recognizing its strong operational standards and quality of service across different regions.

Below is a summary of the key awards achieved by Key to Markets:

- Best Customer Support Service 2023 Rankia

- Most Trusted Forex Broker LATAM 2022 Global Forex Awards

- Best Forex Introducing Broker Programme LATAM 2022 Global Forex Awards

- Best Forex Trading Platform Asia 2022 Global Forex Awards

- Best ECN Broker Global 2021 Global Forex Awards

- Best Forex Trade Execution Global 2021 Global Forex Awards

- Best Forex ECN Broker Global 2022 Global Forex Awards

Key To Markets awards highlight the broker’s consistent performance and reliability across diverse global markets.

Support Contact Channels and Schedule

Customer support is one of the most important sections in a company, especially a financial broker, since there's always a change of losing access to your funds. Key To Markets provides customer support through these channels:

- Email: info@keytomarkets.com

- Phone Call: +230 215 8020

- Ticket: On the official website

The broker does not offer a live chat option, which is a total disappointment. Also, the support team is available only on weekdays from9:00 to 18:00 GMT. Therefore, no 24/7 service is offered.

Which Countries Are Restricted from Key To Markets Services?

There are countries and regions in the world where brokers' services are not provided. This is usually because of the local regulations or international sanctions. Key To Markets cannot accept clients from:

- United States

- Canada

- North Korea

- Iran

- Syria

- Cuba

- Sudan

The company does not provide a full list, and asks clients to contact them for one.

Trust Scores & Reviews

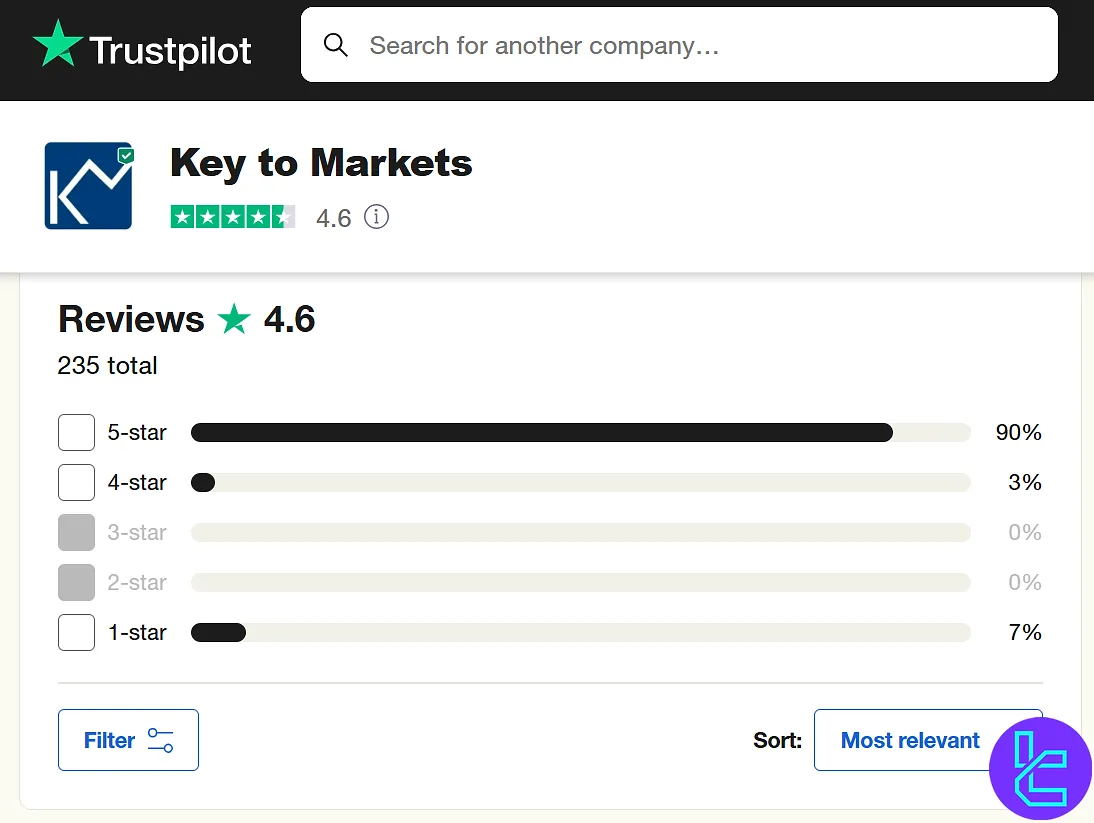

The broker maintains strong trust ratings across major review platforms, including Trustpilot and ForexPeaceArmy. Scores of Key To Markets

- Key to Markets Trustpilot: 4.6 out of 5, based on more than 230 scores, no reply from the broker to negative reviews

- ForexPeaceArmy: 4.2/5 with 80 ratings

Overall, there are positive ratings from users on these platforms, but the lack of replies from the company to negative reviews should be considered.

Education Resources

Key To Markets tries to provide educational content and help traders with improving their skills, but there's a catch. Here are the resources provided on the broker's website:

- Market Analysis

- Articles on trading Forex, CFDs, and shares

The catch is that these resources are offered in Spanish, which is strange considering that it's introduced as a British company.

Key To Markets Against Its Peers

Here's a table that compares the reviewed Forex brokers with others:

Parameter | Key To Markets Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FCA, FSC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | Zero | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | Zero for Standard Account €6 / $8 per Lot for Pro Account | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $100 | $200 | $5 | $50 |

Maximum Leverage | 1:500 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Standard, Pro, Demo | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | No | Yes | Yes | No |

Number of Tradable Assets | 140+ | 2,250+ | 1400+ | N/A |

Trade Execution | N/A | Market | Market, Instant | Market |

Conclusion And Final Words

Key To Markets has received a 4.6 out of 5 score on the Trustpilot website based on over 230 reviews. Furthermore, the exchange's users on ForexPeaceArmy have given it a 4.2/5 rating.

However, the ScamAdviser platform gives a 10/100 trustscore to the discussed exchange. The user review score on this website is 4.6/5.