Lightyear broker, founded in 2020, offers 5,000+ tradable stocks, ETFs, and Money Market Funds for clients in 22 countries.

Up to 4.38% APY is available through the “Savings” service managed by “BlackRock” via this broker. The company covers up to €20,000 of client funds through the Estonian Investor Protection Sectoral Fund.

Lightyear Company Info & Regulation

Lightyear is a European investment platform and financial broker offering services to clients from the UK and select European countries. Here is an overview:

- Founded: 2020

- Founders: Martin Sokk and Mihkel Aamer

- Headquarters: London, England, UK

- Offices: Europe and UK

- Registered UK Office: Lightyear UK Ltd, 256-260 Old Street, London EC1V 9DD, United Kingdom, under the number 14367910

- Registered Europe Office: Lightyear Europe AS, Volta 1, Tallinn 10412, Estonia, under the number 16235024

- Regulation: Licensed investment firm regulated by the Estonian Financial Supervision Authority (4.1-1/31) and FCA in the U.K. (FRN 775330)

- Number of Employees: 51-100

- Customer Protection: Assets held in separate accounts, coverage up to €20,000 through the Estonian Investor Protection Sectoral Fund

Lightyear Broker Summary of Specifications

The Forex broker enables access to a large number of stocks for the clients. Here's a quick overview of what Lightyear offers:

Broker | Lightyear |

Account Types | Personal, Business |

Regulating Authorities | EFSA, FCA |

Based Currencies | EUR, GBP, USD, HUF |

Minimum Deposit | $0 |

Deposit Methods | Bank Transfer, Visa/MasterCard, Apple Pay, Google Pay |

Withdrawal Methods | Bank Transfer |

Minimum Order | N/A |

Maximum Leverage | 1:1 |

Investment Options | Savings |

Trading Platforms & Apps | Proprietary Platform |

Markets | Stocks, Funds, ETFs |

Spread | No |

Commission | Varies by Instrument Starting from $0.1 |

Orders Execution | Market |

Margin Call/Stop Out | No |

Trading Features | N/A |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | |

Customer Support Hours | N/A |

Restricted Countries | USA, North Korea, Iraq, Iran, etc. |

The brokerage offers a “Savings” service managed by “BlackRock” that provides up to 4.38% annual percentage yield (APY) to the clients. The customers’ funds are held in BlackRock’s Money Market Funds.

Lightyear Broker Account Types

Unfortunately, there is no clear information about Lightyear accounts. This broker offers Personal and Business accounts for individual and company investors.

Lightyear's commitment to fair pricing extends to its regulatory offerings, including the Estonian investment account and the Hungarian tax-advantaged TBSZ account.

This approach positions Lightyear as one of the most competitively priced options on the market, making global markets accessible to a wide range of investors.

Lightyear Pros and Cons

While Lightyear broker offers many compelling features, it's important to consider both the advantages and disadvantages before deciding to use the platform:

Pros | Cons |

Low, Transparent Fees | Limited Instrument Variety Compared to Some Competitors |

User-Friendly Interface | No Demo Account Available |

Access to Global Markets | Relatively New Platform |

Interest on Uninvested Cash | - |

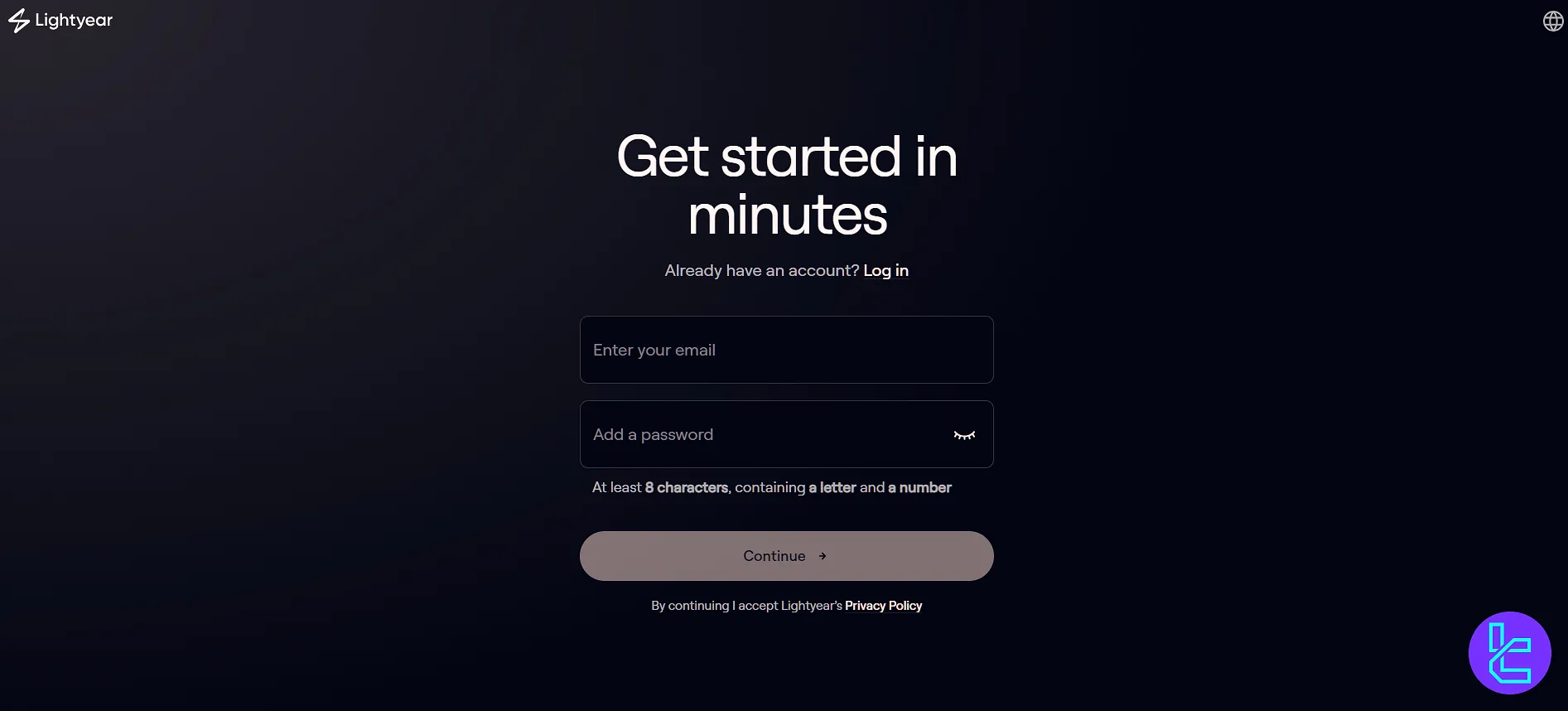

Sign Up and Verification on Lightyear

Opening an account with Lightyear is a straightforward process designed to get you trading quickly and efficiently. Next sections will go through the process:

#1 Navigate to the Website

Enter the Lightyear broker website or download Android or iOS apps. Then, find and click on the “Sign up” button.

#2 Provide Your Email

Enter your email and create a password for your account. Afterwards, click on the link Lightyear sent to your email to verify your account.

Enter your phone number to receive the authentication code.

#3 Enter Additional Data

Submit your personal data, including name, date of birth, etc. Next, enter your address of residence and provide tax information.

#4 Verify Your Identity

Upload your ID verification, address verification documents, and a selfie.

Lightyear will then review your documents and verify them within 24 hours.

Lightyear Apps and Trading Platforms

Lightyear broker offers a modern and intuitive trading platform that is accessible via both web and mobile applications. Key features include:

- Asset Types: Stocks, ETFs, etc.

- Markets: U.S., E.U., U.K., and Baltic region

- Pricing: Simple, fair, and transparent with low fees

- High-Yield Savings: Interest rates track central bank benchmarks

- User Experience: Friction-free access to global financial markets

You can download the platform’s applications via these links:

The platform is designed to cater to beginners and experienced investors, offering a clean interface and essential trading tools for market analysis and portfolio management.

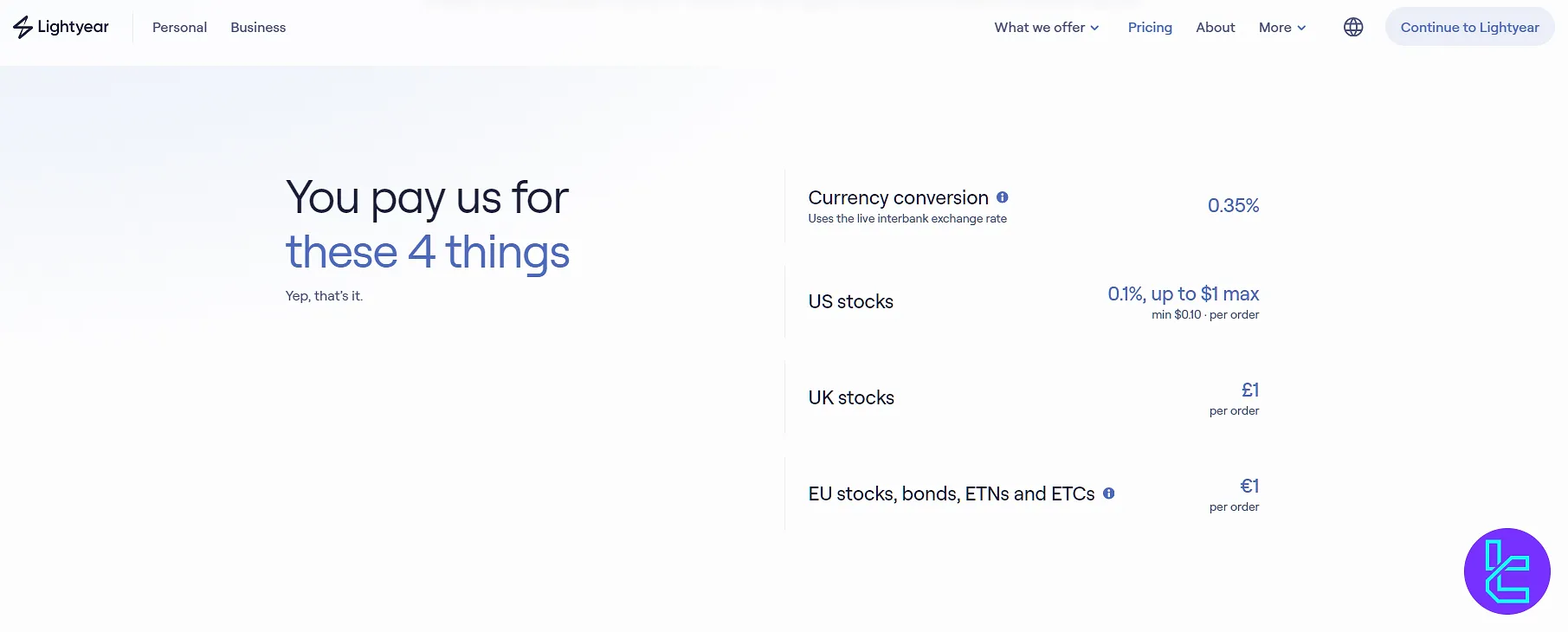

Lightyear Broker Fees overview

Lightyear prides itself on offering competitive pricing compared to its closest competitors. Here's a breakdown of their fee structure:

Instrument | Commission |

U.S. shares | Starting from $0.1 per order up to $1 Max |

U.K. shares | £1 per trade |

E.U. shares | €1 per trade |

Nasdaq Baltic | €1 per trade |

Non-trading Fees:

- Deposit: Free

- Withdrawal: Free

- Inactivity: No fee

- Currency Conversion: 0.35%

- FastCard Deposit Transfer: 0.5%

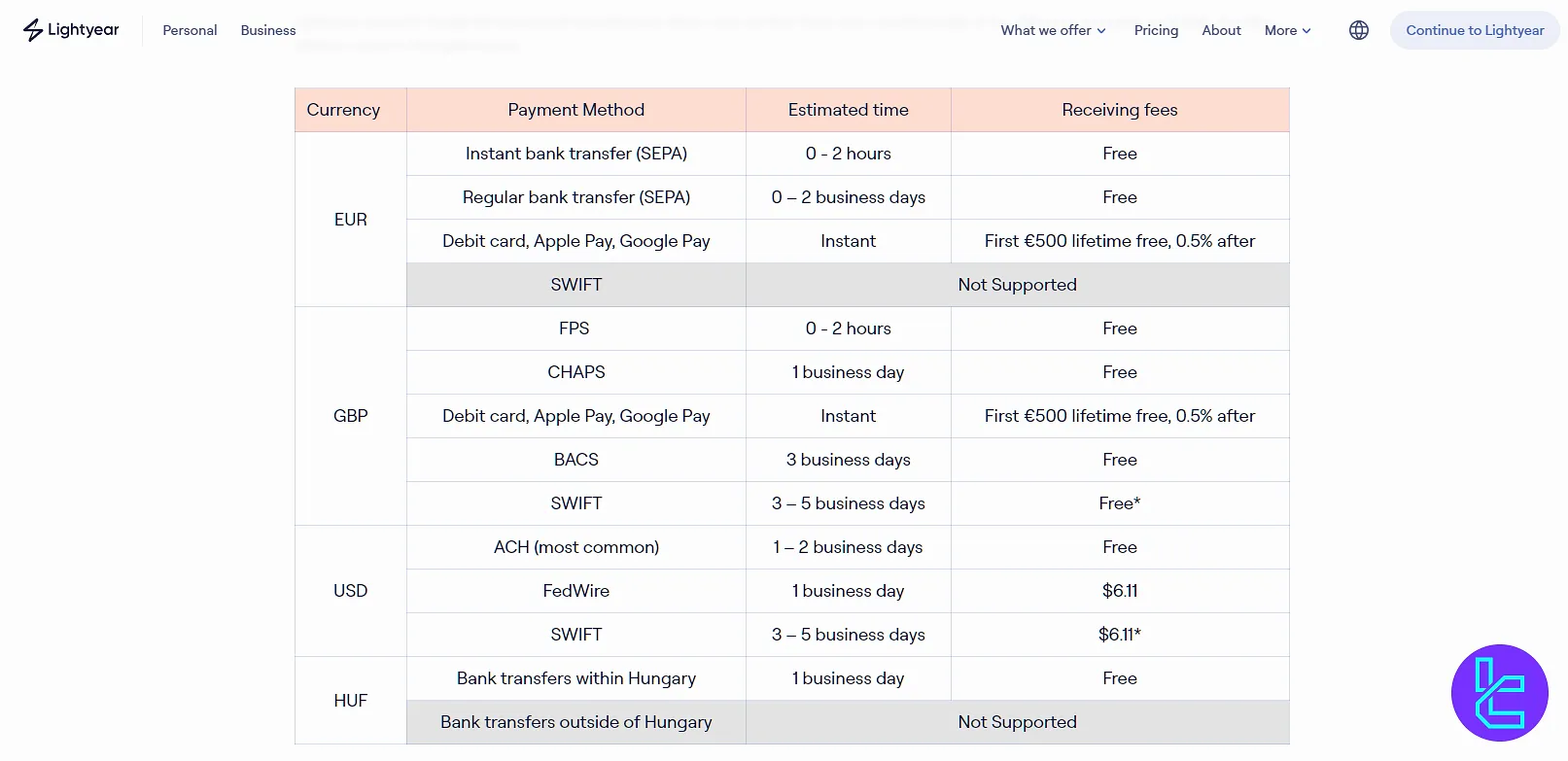

Lightyear Broker Deposit and Withdrawal Overview

Lightyear offers a flexible multi-currency account system to facilitate easy deposits and withdrawals:

- Supported Currencies: EUR, GBP, USD, HUF

- Deposit Methods: Bank transfers, credit/debit card payments, Apple Pay and Google Pay

- Deposit Times: Varies by payment method and currency

- Fees: No charge for local bank transfers, potential fees from sending bank or for certain payment methods

- Third-Party Deposits: Not allowed, account holder name must match the Lightyear account

- Withdrawals: Processed to linked bank accounts, typically taking 1-2 business days

Note that deposits made via credit/debit cards and e-payment systems are processed instantly.

Investment Options Offered on Lightyear Broker

While Lightyear focuses on providing a straightforward investment platform, it currently does not offer a dedicated copy trading feature.

However, the broker provides access to a “Savings” feature that allows clients to earn yearly yields based on the funds held in the account:

- Dollars: 4.32% APY

- Euros: 2.09% APY

- Pounds: 4.38% APY

If you want to have more investment options, we suggest you take a look at what Pepperstone, AvaTrade, eToro, and Vantage Markets have to offer.

Lightyear Markets & Symbols

Lightyear provides access to a diverse range of markets and investment instruments:

- Stocks: 5,000+ U.S., U.K., and European markets

- ETFs: Wide range of commission-free ETFs

- Money Market Funds: Options for short-term, low-risk investments

- Baltic Bonds: Bonds in Estonian, Latvian, and Lithuanian markets

Lightyear Broker Bonuses and Promotions Options

Based on our comprehensive investigations on the platform, currently, Lightyear does not offer any promotions and bonuses.

Lightyear Support Overview

Traders can contact Lightyear support using support@lightyear.com email and receive help for their issues.

Unfortunately, Lightyear doesn’t offer any other support channel which is a major drawback for this famous investment platform. Lightyear email support is not active 24/7.

Lightyear Banned Countries

While Lightyear aims to provide global access to financial markets, it's important to note that the service is not available worldwide due to regulatory constraints and business decisions.

Unfortunately, Lightyear doesn’t offer services outside of EU zone and U.K., and traders must look for other alternatives.

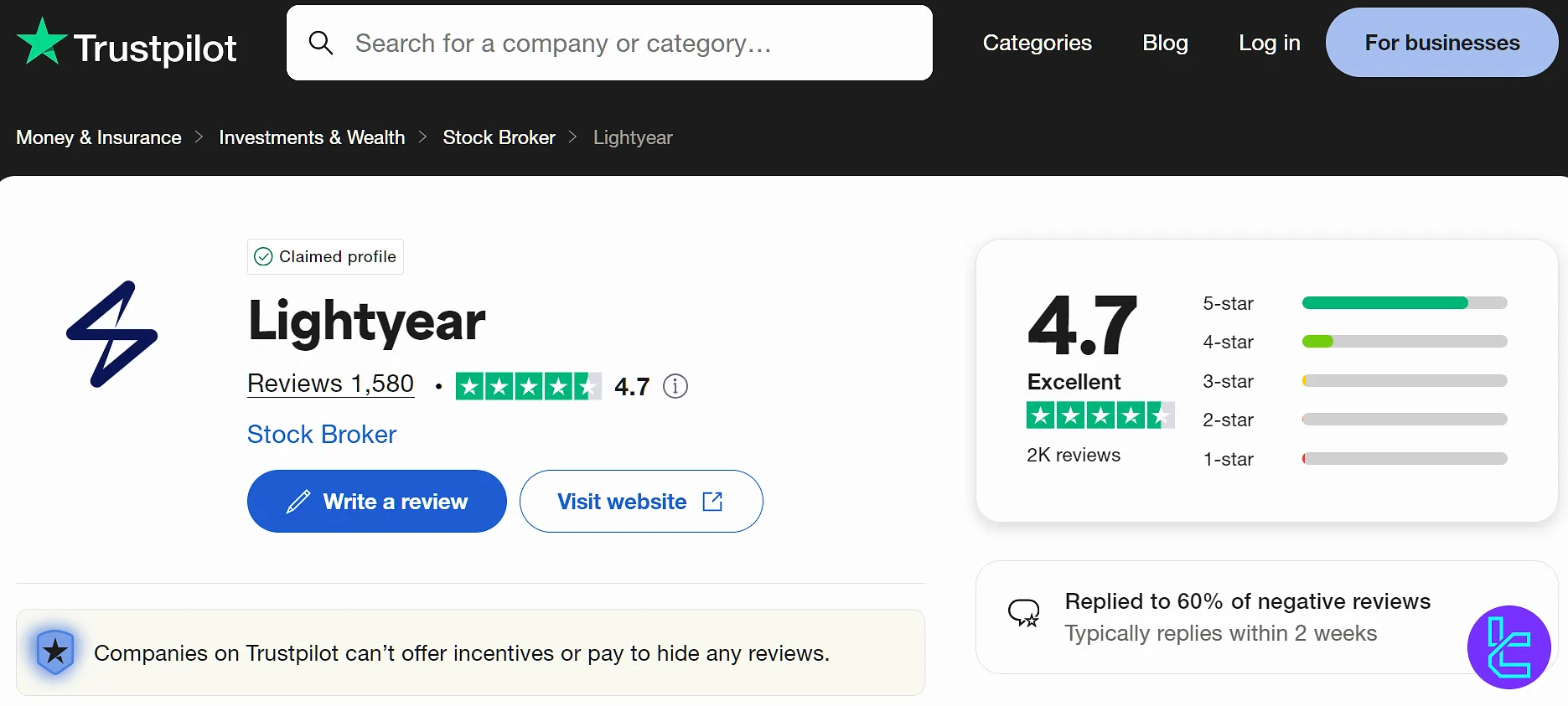

Lightyear Broker Reviews and Trust scores

Lightyear has garnered positive feedback from its user base, as evidenced by reviews on reliable platforms. Lightyear Trustpilot Scores:

- Total Number of Reviews: 1,500+

- Lightyear Rating: 4.7 out of 5

- Percentage of 5 Star Reviews: over 80%

So far, the brokerage has replied to 60% of negative reviews on the aforementioned website. It typically takes 2 weeks for Lightyear to respond to reviews.

Overall, Lightyear appears to be building a strong reputation as a trustworthy and reliable investment platform, particularly appealing to those looking for a straightforward, low-fee approach to global market investing.

Lightyear Education Resources and Materials

Lightyear doesn’t provide educational resources for stocks and ETF traders. This is a prominent downside since beginner traders with limited experience in financial markets can’t unlock the full potential of using Lightyear broker.

Comparison with Top Brokers

This section compares the discussed brokerage with some of the most notable names in the industry:

Parameter | Lightyear Broker | |||

Regulation | EFSA, FCA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | None | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0.1 | From $0 | From $0 | $0 |

Minimum Deposit | None | From $0 | $100 | $1 |

Maximum Leverage | 1:1 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | Proprietary | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Personal, Business | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 5,000+ | 1,000+ | 2100+ | 45 |

Trade Execution | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

TF Expert Suggestion

Lightyear broker provides US stocks trading with fees as low as $0.1 through its proprietary platform. Having a 4.7/5 Trustpilot rating with over 1,500 user reviews, the company provides its support services only through email, with no specific schedule mentioned.