LiteFinance provides access to a leverage of up to 1:1000 and an ECN account with zero-spread trading; However, fees apply; for example, FX major pairs come with $5 per lot commissions. On the other hand, trading pairs with the Classic account have spreads starting from 1.8 points, without any fees.

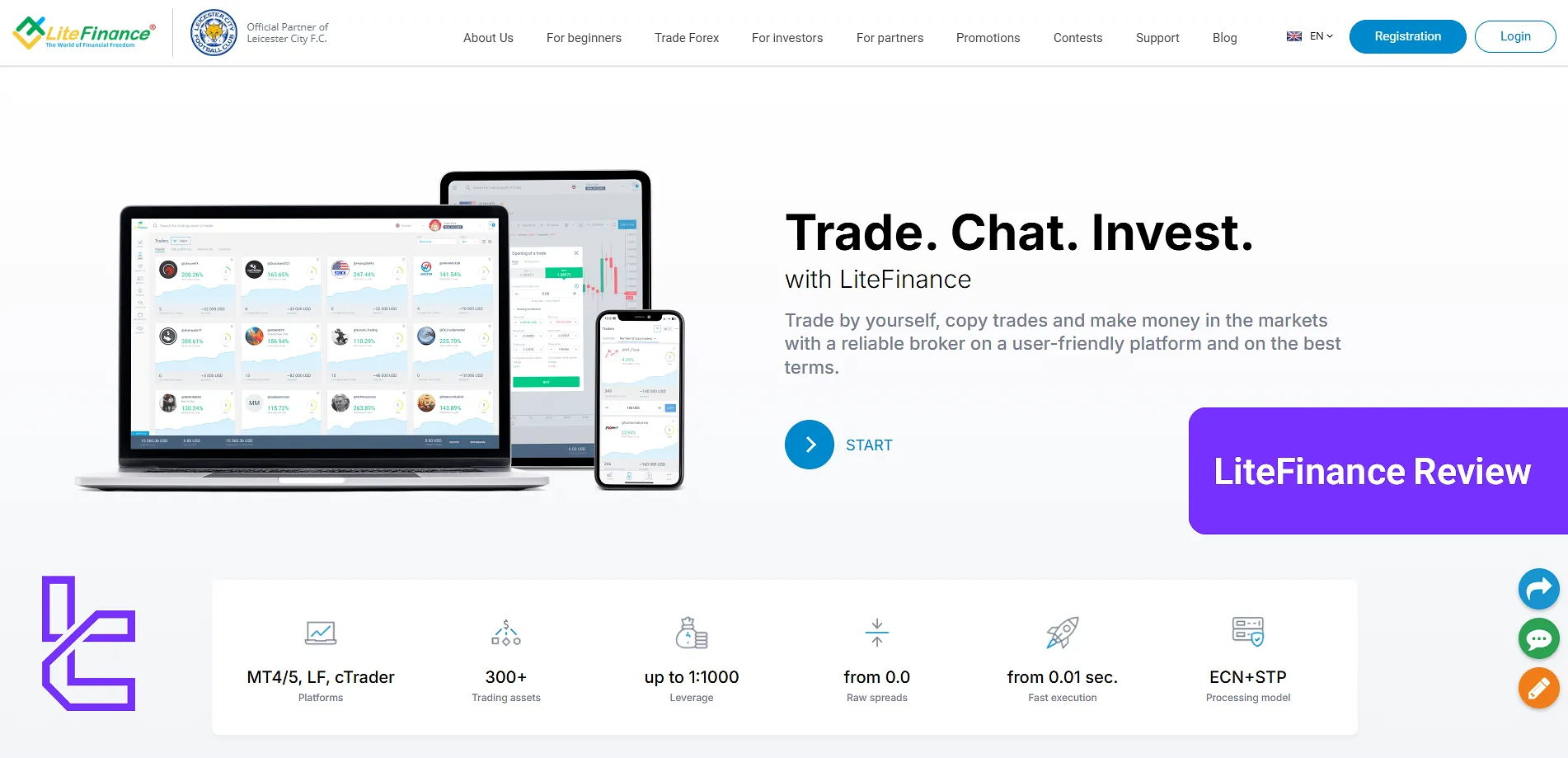

LiteFinance: An Introduction to the Company and Its Regulatory Status

LiteFinance has been providing access to various markets, such as Currency pairs, Stocks, and Metals, since July 2005. The company's longevity in this competitive sector speaks volumes about its reliability and adaptability. Kezy Points About The Brokerage:

- Regulated by the Mauritius Financial Services Commission (FSC)

- Offices in 15 countries, including St. Vincent & the Grenadines

- The first broker with $1 Cent accounts

- Over 3.01M clients worldwide

- Average daily trading volume of $24B

- 24/5 customer support in 15 languages

In the table below, the various entities of LiteFinance broker are examined, and the corresponding regulations for each are provided separately.

Entity Parameters/Branches | LiteForex (Europe) Ltd | LiteFinance Investment Limited |

Regulation | CySEC | (FSC) of Mauritius |

Regulation Tier | 1 | 3 |

Country | Cyprus, Limassol | Mauritius |

Investor Protection Fund/ Compensation Scheme | Up to €20,000 Under ICF | N/A |

Segregated Funds | Yes | No |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:30 | 1:1000 |

Client Eligibility | Only EU/EEA Residents | Global |

LiteFinance Broker Specifications

The company has established itself as a stable and innovative broker in the Forex trading industry. Here's a table summarizing the key specifications of LiteFinance.

Broker | LiteFinance |

Account Types | CLASSIC, ECN |

Regulating Authorities | FSC |

Based Currencies | USD, EUR |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5, cTrader, Mobile App |

Markets | Currency, Commodities, Indices, Stocks |

Spread | CLASSIC from 1.8 points ECN from 0.0 points |

Commission | Classic $0.0 ECN from $0.25 per lot |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Mobile Trading, Copy Trading, Tournaments |

Affiliate Program | Yes |

Bonus & Promotions | Trade Smart Challenge, ZERO Fees |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Telegram, Skype |

Customer Support Hours | 24/5 |

LiteFinance Account Types

The broker offers two primary account types to cater to trading styles and preferences: ECN and CLASSIC.

Features | CLASSIC | ECN |

Min Deposit | $50 | $50 |

Base Currency | USD, EUR | USD, EUR |

Spreads | From 0.0 points | From 1.8 points |

Commission | None | From $0.25 per lot |

Max Leverage | 1:1000 | 1:1000 |

Copy Trading | Available | Available |

Min Order Size | 0.01 lots | 0.01 lots |

Margin Call | 100 | 100 |

Stop Out | 20 | 20 |

Swap-free and demo accounts are also available. Each ECN and Classic account has a swap-free version with similar specifications.

LiteFinance Broker Pros & Cons

When considering LiteFinance as your brokerage, it's essential to weigh its strengths and weaknesses:

Pros | Cons |

Wide Range Of Trading Instruments | Limited account types |

Competitive Spreads And Fast Execution | Lack of 24/7 support |

Extensive Platform Options | - |

Copy Trading Feature | - |

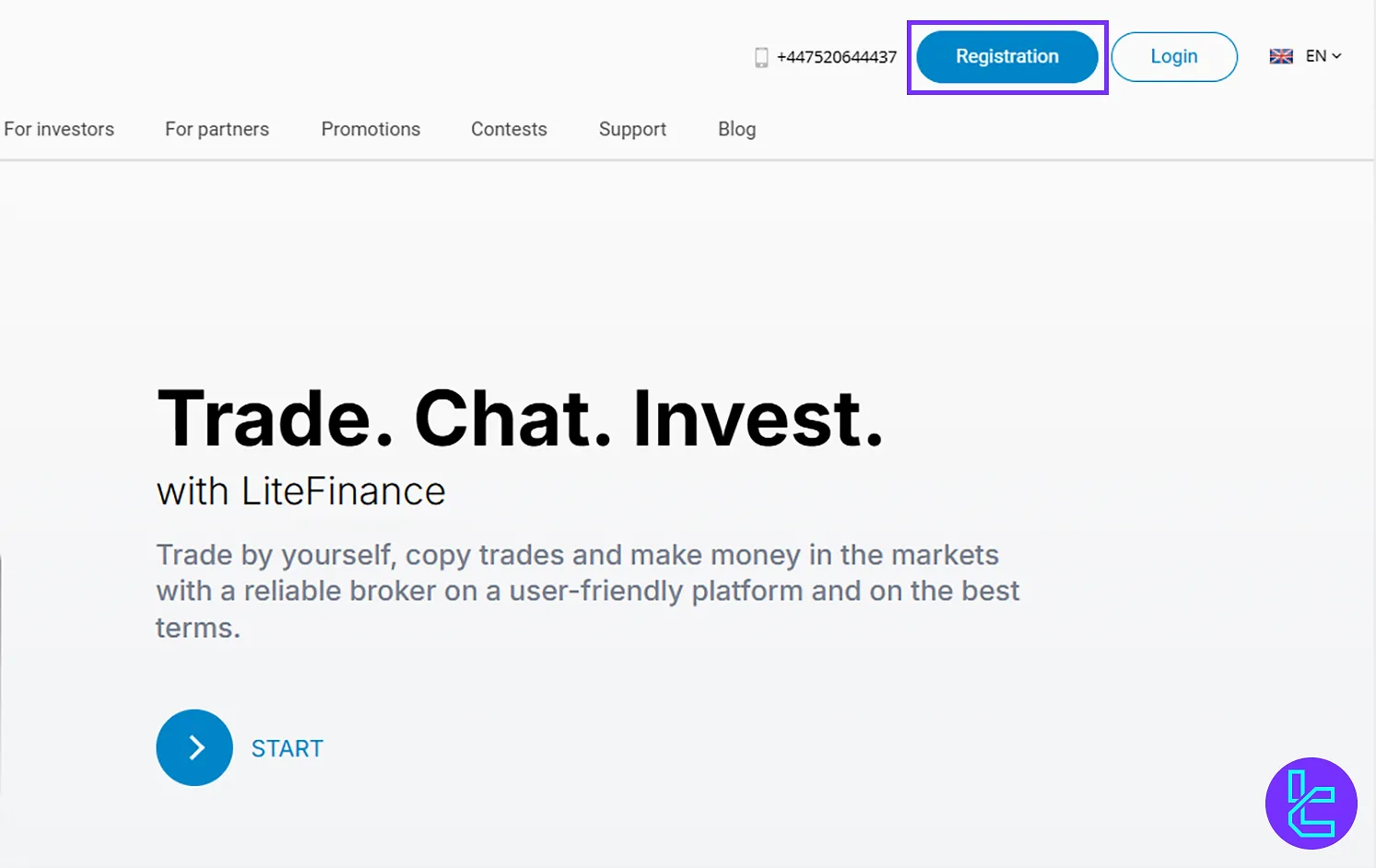

LiteFinance Registration and KYC Verification

We must discuss the LiteFinance verification in this section of the review. The broker maintains a robust anti-money laundering (AML) and know-your-customer (KYC) policy to ensure compliance with international standards and protect its platform's integrity. The next sections will go through the process of LiteFinance registration in detail.

#1 Visit the Official Libertex Website

Head to the verified Libertex homepage using your browser. Click on the “Registration” button, typically located in the top right corner of the main page.

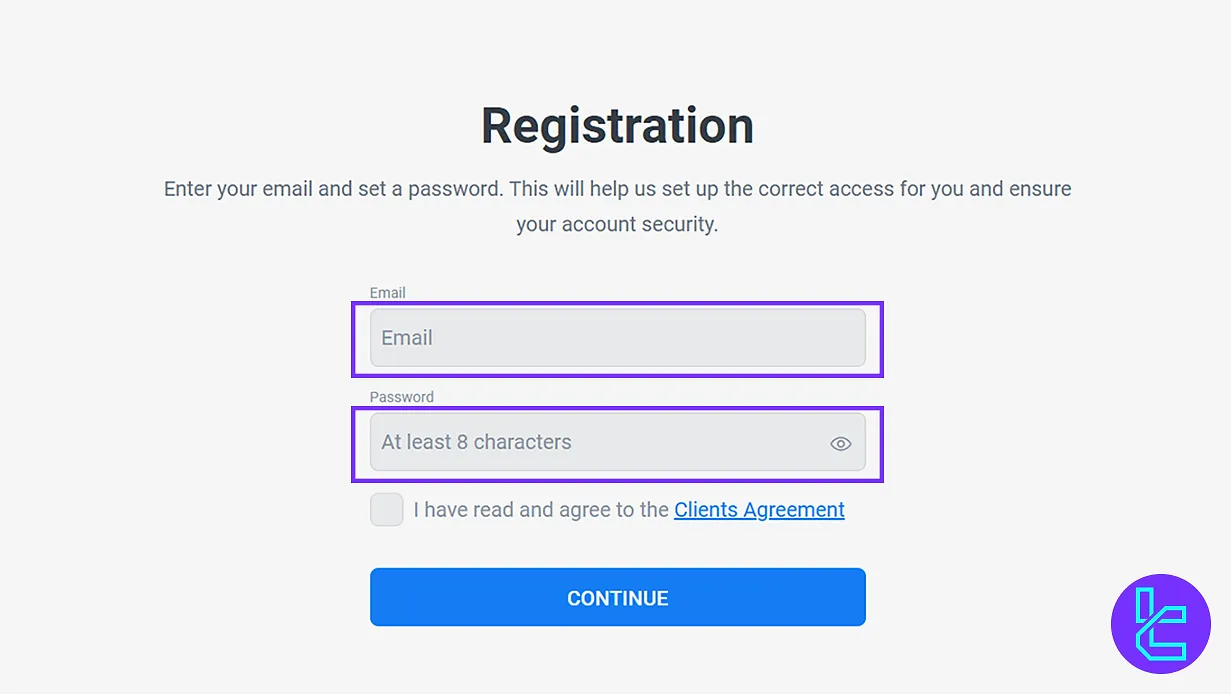

#2 Fill in the Registration Form

Input your email address and choose a secure password (include uppercase, lowercase, numbers, and symbols).

Then, provide your mobile number and enter the security code sent to your device. Accept the terms and conditions to proceed.

#3 Verify Your Email Address

Check your inbox for a confirmation email from Libertex. Click the “Confirm Email Address” button in the message to activate your trading account.

#4 Complete the KYC

Provide proof of identity (passport or driver’s license) and proof of address (utility bill or bank statement).

LiteFinance Broker Trading Platforms

The company offers a comprehensive suite of trading platforms, from MetaTrader 4 to a proprietary mobile app, to cater to various trader preferences and needs.

MetaTrader 4 (MT4)

- Desktop

- MT4 Android

- MT4 iOS

MetaTrader 5 (MT5)

- Desktop

- MT5 Android

- MT5 iOS

cTrader

- Desktop

- cTrader Android

- cTrader iOS

Proprietary Mobile App

The broker offers a full suite of features, including mobile apps such as LiteFinance Partner, Forex Analysis, Forex Signals, Trading Strategies, Currency Rates, and an Economic Calendar.

LiteFinance Fees and Commissions

The company utilizes the ECN technology and provides some of the tightest market spreads. LiteFinance offers competitive fee structures across its various account types.

Account Type | Commission (per lot) | Spreads |

CLASSIC | None ($0.0) | Floating from 1.8 points |

ECN | FX Major $5 FX Crosses $5 FX Minor $6 Metals $5 Oil $0.5 Share CFDs 0.1% of asset’s market price Stock Indices $3.5 per contract | Floating from 0.0 points |

The company charges an inactivity fee of $10 for dormant accounts (no trades in 3 months) and archives it in 40 calendar days after the balance reaches zero.

Furthermore, standard overnight charges apply to open positions. Triple swaps may be charged on Wednesdays and Thursdays, depending on the trading instrument.

Also, if the base currency of your account differs from the asset being traded, conversion costs may apply.

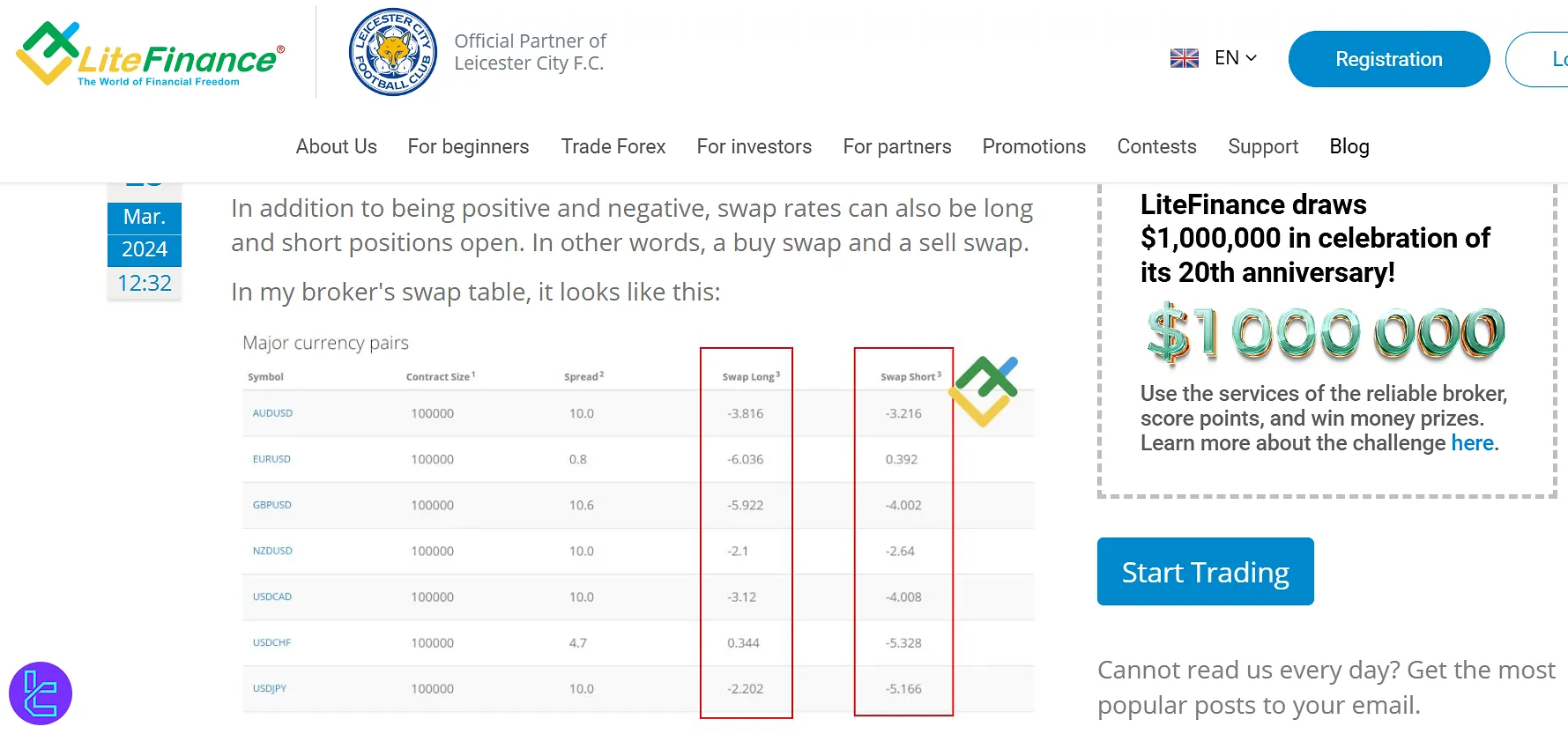

Swap Fee

In Forex trading, swap fees for EUR/USD vary between short and long positions and depend on lot size, currency rates, markup, and the current quote.

- Short position formula: (Lot × (quote rate – base rate – markup) / 100) × quote ÷ 365

Example: 1 lot at 1.19626 with 0.20% markup ≈ 0.163 EUR, while a broker calculator may show 0.376 USD due to actual markup. - Long position formula: (Lot × (base rate – quote rate – markup) / 100) × quote ÷ 365

Example: Same inputs ≈ –1.474 EUR, vs. broker’s –6.036 USD, showing greater markup impact.

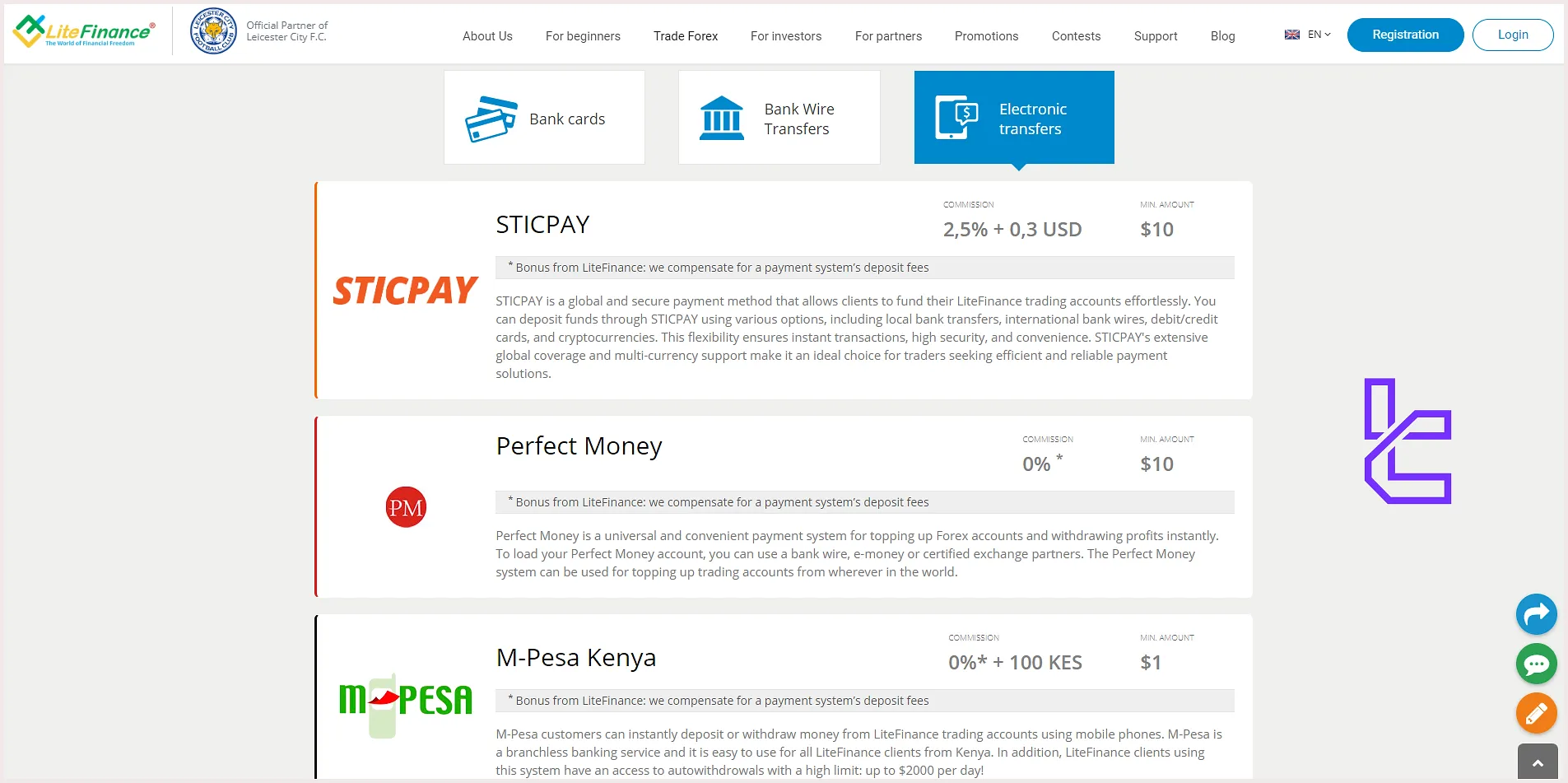

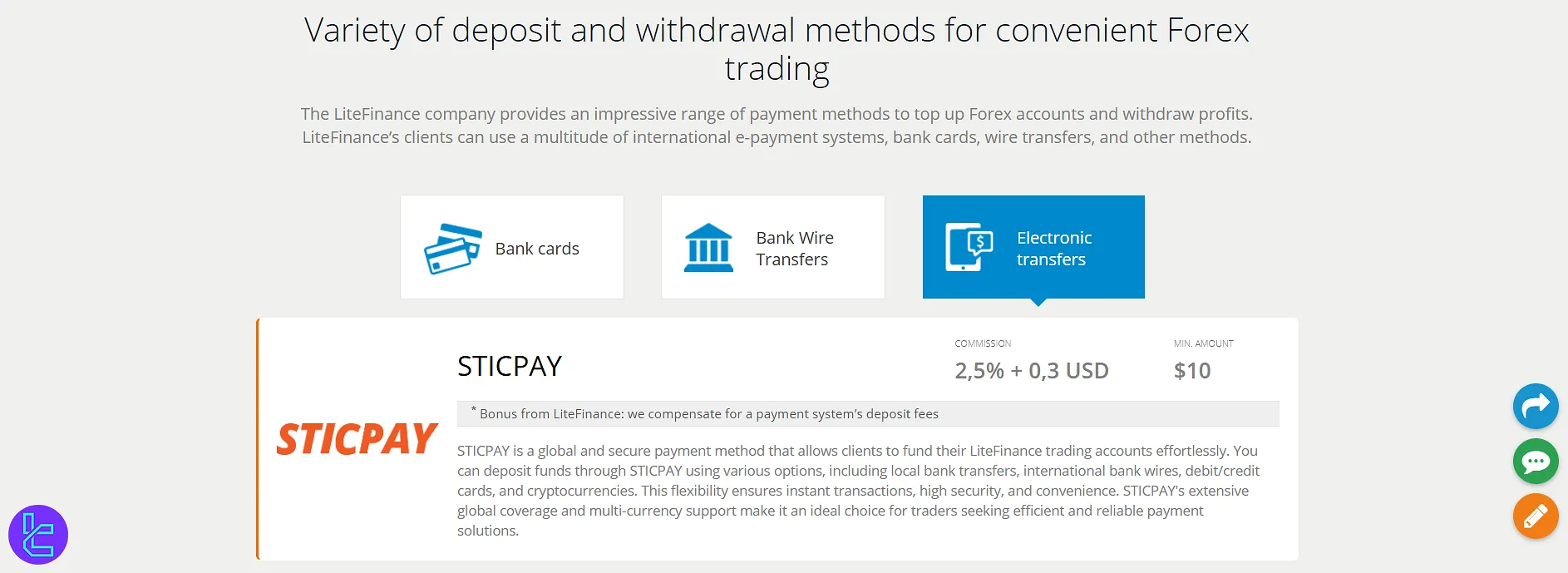

LiteFinance Deposit/Withdrawal Options

The broker provides a wide array of deposit and withdrawal methods to ensure convenient fund management for traders. The table below discusses LiteFinance's payment options:

Method | Min Amount | Commission |

VISA/MasterCard | $10 | 0% |

Bank Wire | $100 | 0% |

STICPAY | $10 | 2.5% + $0.3 |

Perfect Money | $10 | 0% |

Volet | $10 | 0% |

Africa Mobile Money | $10 | 4.5% |

The company compensates traders for the deposit fee they have to pay to 3rd party payment systems, except for the Africa Mobile Money method.

LiteFinance also offers an auto withdrawal feature that allows you to withdraw up to $5,000 per day through various payment systems, including Credit cards, bank transfers, Neteller, Skrill, UnionPay, and Crypto (BTC, ETH, and more).

LiteFinance offers a wide variety of account funding options designed to accommodate traders in different regions. With 21 available deposit methods, you can choose from bank cards, bank transfers, e-wallet services, and cryptocurrencies to top up your trading balance.

Deposit Fees

- 0% commission applies to most methods, including Visa/MasterCard, Skrill, Perfect Money, Neteller, and cryptocurrencies;

- Exceptions include SticPay (2.5% + $0.30), M-Pesa Kenya (0% + 100 KES), M-Pesa Tanzania (0% + 2000 TZS), and Africa Mobile Money (4.5%).

LiteFinance’s diverse funding methods allow traders to start with as little as $1 using select local options, while cryptocurrency deposits offer fast, secure, and borderless transactions.

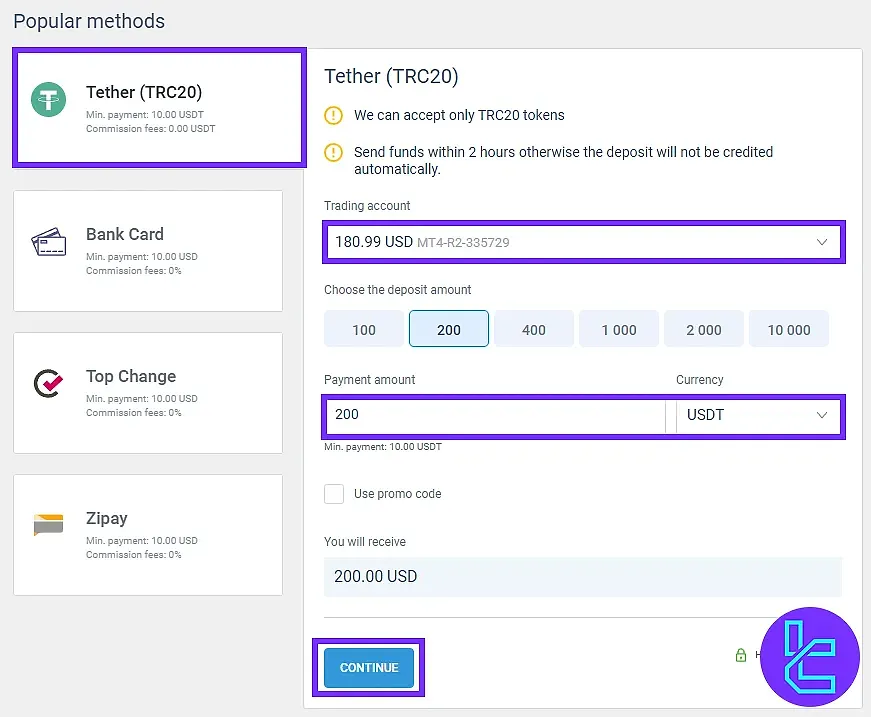

LiteFinance TRC-20 Deposit

LiteFinance supports USDT (TRC-20) deposits with no commission and a $10 minimum.

The process, completed in about 5 minutes, follows three steps. First, log into your account and access the Finance section. Select Tether (TRC-20), choose your trading account, enter the amount, and apply any promo code.

Next, receive the wallet address or QR code, then transfer funds from your personal wallet and confirm.

Transactions are processed instantly via the TRC-20 network, making it a low-cost, efficient funding method. For other deposit or withdrawal options, see the LiteFinance Tutorials page.

LiteFinance Withdrawal Methods

LiteFinance supports a comprehensive range of withdrawal options, enabling traders to access funds quickly and securely after completing account verification. The broker processes all approved withdrawal requests within 24 hours.

Categories of Withdrawal Options:

Category | Methods & Examples | Processing Time After Approval |

Bank Cards | Visa, MasterCard (via CardPay) | Within 24 Hours |

Bank Transfers | Local Withdrawal, SWIFT Transfer | Local: ≤ 24 Hours; SWIFT: Varies by Intermediary Banks |

Electronic Transfers | Skrill, SticPay, Perfect Money, M-Pesa Kenya, M-Pesa Tanzania, Africa Mobile Money, Volet, WebMoney, Neteller | Same Day for Most Methods |

Cryptocurrencies | BTC, USDT, ETH, XRP, ZEC, Monero, LTC, BCH | Usually Within 24 Hours |

Withdrawal Fees

- 0% commission applies to the majority of methods, including Visa/MasterCard, Skrill, Perfect Money, Neteller, and most cryptocurrencies;

- Exceptions include SticPay (2.5% + $0.30), M-Pesa Kenya (0% + 100 KES), M-Pesa Tanzania (0% + 2000 TZS), and Africa Mobile Money (4.5%).

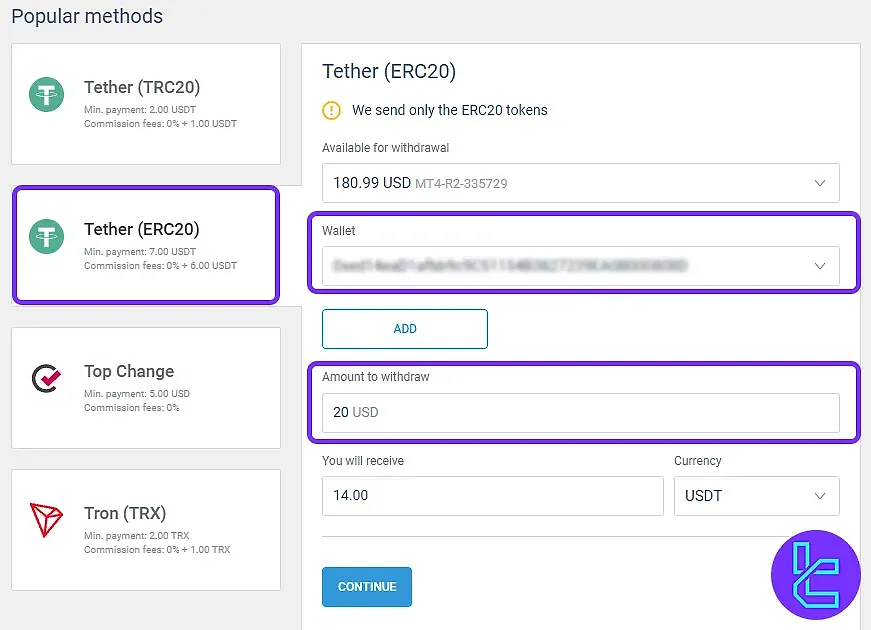

LiteFinance ERC-20 Withdrawal

LiteFinance offers quick USDT (ERC-20)withdrawals with a $20 minimum and a fixed $6 fee. The process typically takes around 10 minutes, depending on Ethereum network congestion.

To cash out, log into your account, open the Finance section, select Withdrawal, choose USDT ERC-20, enter your wallet address and amount, confirm the fee deduction, then verify via security code.

Once processed, funds are transferred directly to your wallet. While ERC-20 is fast, blockchain fees make it more expensive than alternatives like TRC-20 USDT, which LiteFinance supports for lower-cost transfers.

Does LiteFinance Have Copy Trading or any Growth Plans?

Investment plan is one of the most attractive topics in this LiteFinance review. This kind of service has become very popular among brokerages. The broker offers a robust Forex social trading platform, allowing clients to benefit from the experience of successful traders. Key features of the LiteFinance Copy Trading:

- Automated system for duplicating trades

- Social trading platform to communicate with other investors and strategy providers

- Top Traders with profitability up to %37,000

Trading Instruments and Assets

LiteFinance provides its tradable instruments in a total of 4 asset categories:

Category | Types of Instuments | Number of Symbols | Competitor Average |

Forex | Major, Minor, and Exotic Currency Pairs | ~55 Pairs | Varies; Some Brokers offer More |

Stocks | CFDs on US and European Stocks | Not Specified | Many Competitors offer a Wider Range |

Commodities | Precious, Metals, Energies, and Soft Commodities | 12+ | Similar to Market Average |

Indices | Global Indices like DAX30, FTSE100, CAC40, etc | 15+ | Similar to Market Average |

LiteFinance Bonus and Promotions

The broker offers several attractive bonuses and promotions to enhance the trading experience, including:

- Trade Smart Challenge: 50% credit on client investments for smart trading available only on ECN accounts

- Return of Commission with Zero Fees: Reimbursement of payment system commissions on deposits

- Affiliate Programs: 70% commission of the broker’s profit on your referred clients

- Contests: Seasonal tournaments for traders and partners

LiteFinance Awards

LiteFinance has accumulated a diverse range of industry recognitions over recent years. In 2023, the broker was honored by Global Brands Magazine with two regional titles: "Best ECN Broker, Asia" and "Best Forex Brokerage Company, MENA".

Previous accolades from the same organization include "Most Innovative ECN Broker, MENA" and "Most Innovative Regional FX Broker, Asia".

At the Forex Expo Dubai 2023, LiteFinance was awarded "Best Trading Account for Beginners" , reflecting recognition within the Middle East trading community.

Additional distinctions listed on the company’s website reference achievements such as "Best Client Service in Latin America", along with awards acknowledging advancements in trading technology, market conditions, and its copy trading platform.

It is possible to view and review all of this broker’s awards on the LiteFinance awards page.

LiteFinance Broker Customer Support

Customer support is the heart of any online business, especially trading services providers, since they’re associated with the clients’ money. LiteFinance prioritizes 24/5 support by offering comprehensive contact channels, including:

clients@litefinance.com | |

Live Chat | Available on the official website |

Skype | |

Telegram | https://t.me/LiteFinanceSupport |

Restricted Countries on LiteFinance

LiteFinance Global LLC is registered in St. Vincent & the Grenadines as a Limited Liability Company with registration number 931 LLC 2021 and has certain restrictions on the countries it can serve:

- United States

- European Economic Area (EEA)

- Israel

- Russia

- Japan

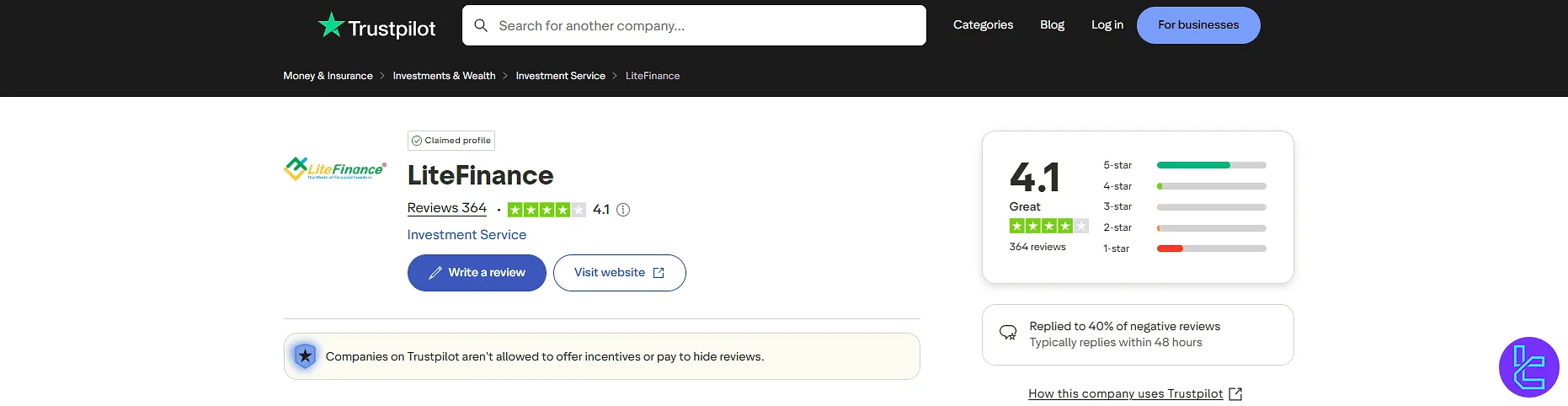

Trust Scores

When providing a complete LiteFinance review, it's crucial to consider user reviews and trust scores from various platforms.

4.4 out of 5.0 based on 275 ratings | |

Forex Peace Army | 2.3 out of 5.0 based on 223 reviews |

Reviews.io | 3.5 out of 5.0 based on 28 comments |

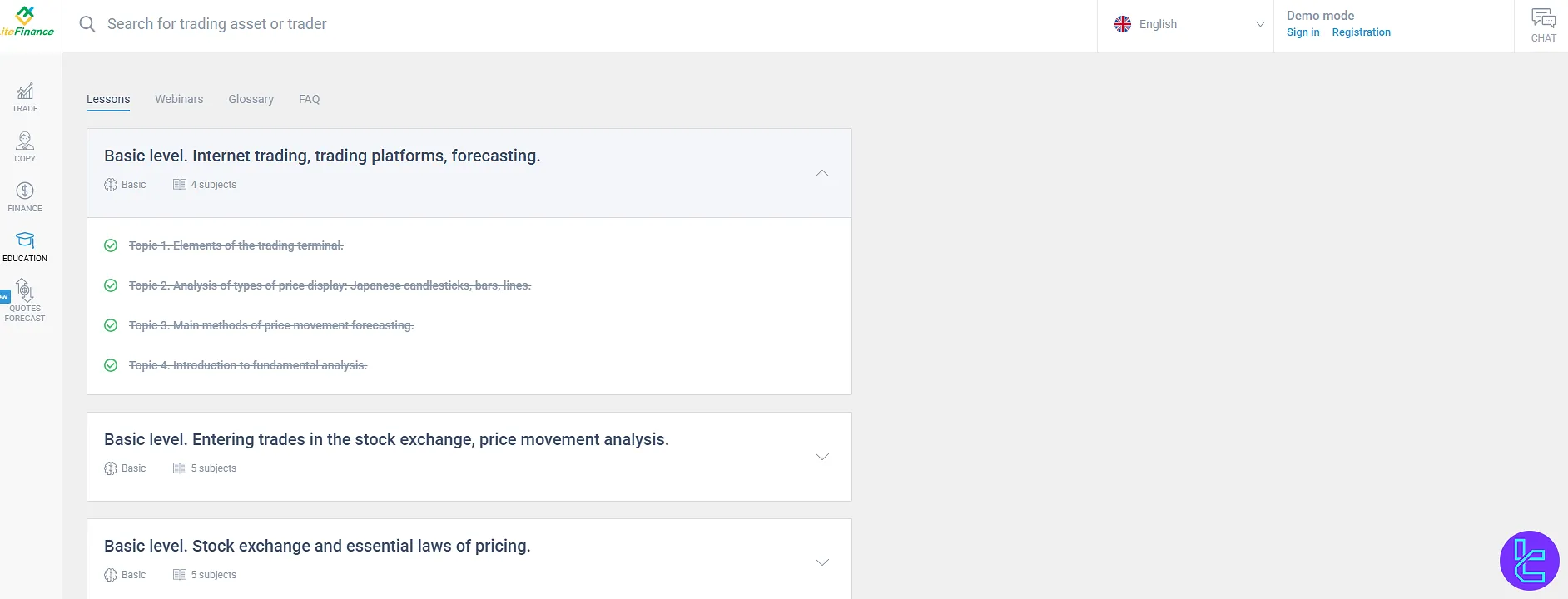

Educational Resources on LiteFinance's Website

Per our investigations on the broker's website, this company offers a decent level of educational content to its clients, consisting of:

- Webinars

- Glossary

- Trader's tools, such as an economic calendar, analytics, calculators, etc.

These resources are mainly free and accessible for anyone, regardless of being registered with the broker. For a wider range of Forex education resources, you can visit the related page on this website.

Comparison with Top Brokers

The table below is a fair comparison between LiteFinance and its peers:

Parameter | Lirunex Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | FSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | CLASSIC from 1.8 points ECN from 0.0 points | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | Classic $0.0 ECN from $0.25 per lot | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | $50 | $10 | From $0 | $100 |

Maximum Leverage | 1:1000 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MT4, MT5, cTrader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | CLASSIC, ECN | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 200+ | 1,000+ | 2100+ |

| Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and Final Words

LiteFinance has claimed a profile on the Trustpilot website, receiving over 270 reviews with an average score of 4.4/5. The company has replied to +85% of the negative reviews. On the other hand, ForexPeaceArmy has received over 220 user reviews for the broker, leading to a 2.3/5 average rating.