LiteFinance provides access to a leverage of up to 1:1000 and an ECN account with zero-spread trading; However, fees apply; for example, FX major pairs come with $5 per lot commissions. On the other hand, trading pairs with the Classic account have spreads starting from 1.8 points, without any fees.

LiteFinance: An Introduction to the Company and Its Regulatory Status

LiteFinance has been providing access to various markets, such as Currency pairs, Stocks, and Metals, since July 2005. The company's longevity in this competitive sector speaks volumes about its reliability and adaptability. Key Points About The Brokerage:

- Regulated by the Mauritius Financial Services Commission (FSC)

- Offices in 15 countries, including St. Vincent & the Grenadines

- The first broker with $1 Cent accounts

- Over 3.01M clients worldwide

- Average daily trading volume of $24B

- 24/5 customer support in 15 languages

LiteFinance Broker Specifications

The company has established itself as a stable and innovative broker in the Forex trading industry. Here's a table summarizing the key specifications of LiteFinance.

Broker | LiteFinance |

Account Types | CLASSIC, ECN |

Regulating Authorities | FSC |

Based Currencies | USD, EUR |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, STICPAY, Perfect Money, Africa Mobile Money, Volet |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5, cTrader, Mobile App |

Markets | Currency, Commodities, Indices, Stocks |

Spread | CLASSIC from 1.8 points ECN from 0.0 points |

Commission | Classic $0.0 ECN from $0.25 per lot |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Mobile Trading, Copy Trading, Tournaments |

Affiliate Program | Yes |

Bonus & Promotions | Trade Smart Challenge, ZERO Fees |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Telegram, Skype |

Customer Support Hours | 24/5 |

LiteFinance Account Types

The broker offers two primary account types to cater to trading styles and preferences: ECN and CLASSIC.

Features | CLASSIC | ECN |

Min Deposit | $50 | $50 |

Base Currency | USD, EUR | USD, EUR |

Spreads | From 0.0 points | From 1.8 points |

Commission | None | From $0.25 per lot |

Max Leverage | 1:1000 | 1:1000 |

Copy Trading | Available | Available |

Min Order Size | 0.01 lots | 0.01 lots |

Margin Call | 100 | 100 |

Stop Out | 20 | 20 |

Swap-free and demo accounts are also available. Each ECN and Classic account has a swap-free version with similar specifications.

LiteFinance Broker Pros & Cons

When considering LiteFinance as your brokerage, it's essential to weigh its strengths and weaknesses:

Pros | Cons |

Wide Range Of Trading Instruments | Limited account types |

Competitive Spreads And Fast Execution | Lack of 24/7 support |

Extensive Platform Options | - |

Copy Trading Feature | - |

LiteFinance Registration and KYC Verification

We must discuss the LiteFinance verification in this section of the review. The broker maintains a robust anti-money laundering (AML) and know-your-customer (KYC) policy to ensure compliance with international standards and protect its platform's integrity. Steps to open an account on LiteFinance:

- Visit the broker’s official website at “https://www.litefinance.org/”;

- Click “Registration”;

- Provide personal information like country of residence, birth date, and email;

- Verify your email via the activation link sent to your inbox;

- Provide proof of identity (passport or driver’s license) and proof of address (utility bill or bank statement).

For a more detailed and comprehensive guide, visit the LiteFinance Registration page on this website.

LiteFinance Broker Trading Platforms

The company offers a comprehensive suite of trading platforms, from MT4 to a proprietary mobile app, to cater to various trader preferences and needs.

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

cTrader

Proprietary Mobile App

The broker offers a full suite of features as mobile apps, including LiteFinance Partner, Forex Analysis, Forex Signals, Trading Strategies, Currency Rates, and Economic Calendar.

LiteFinance Fees and Commissions

The company utilizes the ECN technology and provides some of the tightest spreads in the market. LiteFinance offers competitive fee structures across its various account types.

Account Type | Commission (per lot) | Spreads |

CLASSIC | None ($0.0) | Floating from 1.8 points |

ECN | FX Major $5 FX Crosses $5 FX Minor $6 Metals $5 Oil $0.5 Share CFDs 0.1% of asset’s market price Stock Indices $3.5 per contract | Floating from 0.0 points |

The company charges an inactivity fee of $10 for dormant accounts (no trades in 3 months) and archives it in 40 calendar days after the balance reaches zero.

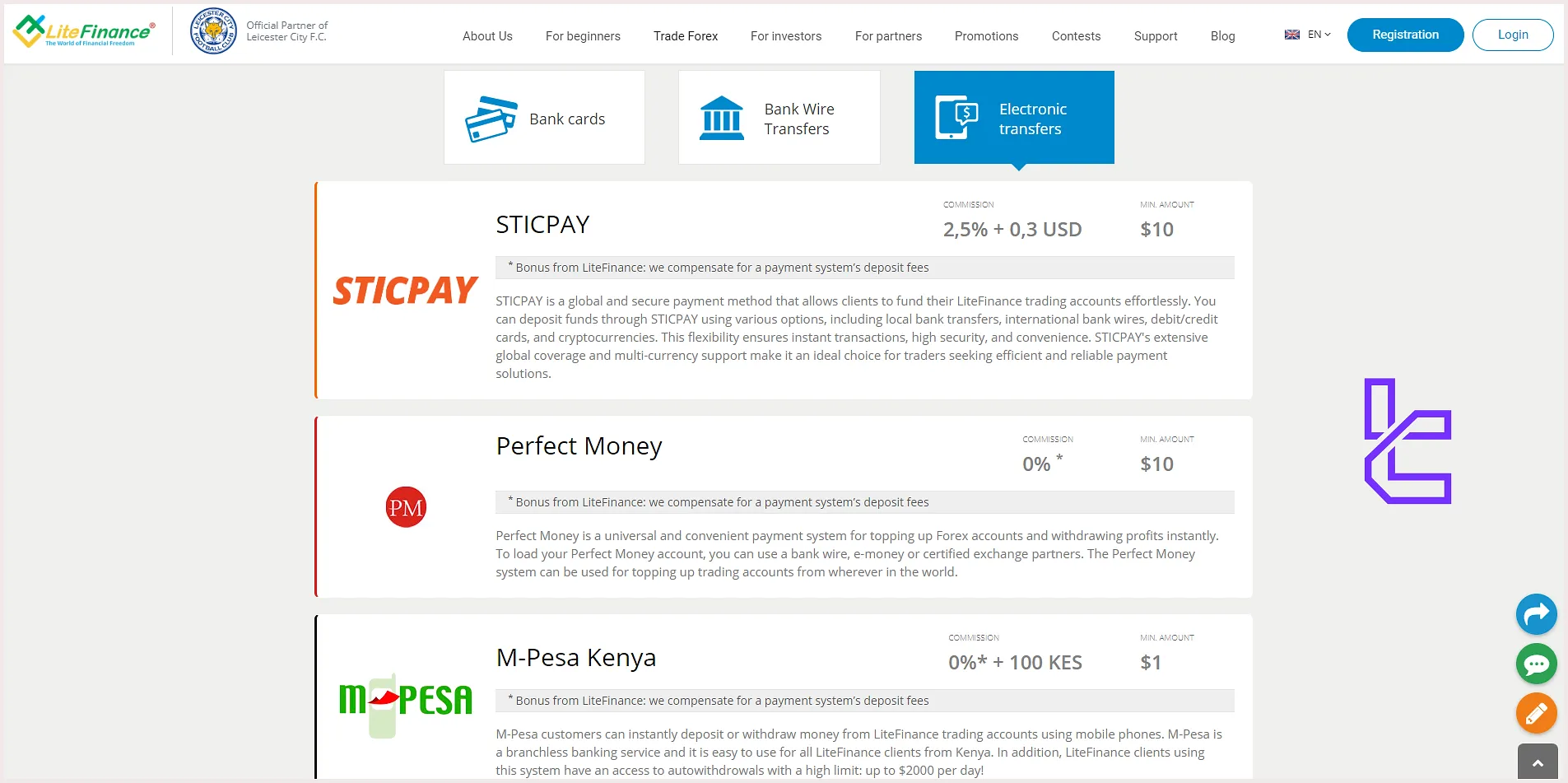

LiteFinance Deposit/Withdrawal Options

The broker provides a wide array of deposit and withdrawal methods to ensure convenient fund management for traders. The table below discusses LiteFinance's payment options:

Method | Min Amount | Commission |

VISA/MasterCard | $10 | 0% |

Bank Wire | $100 | 0% |

STICPAY | $10 | 2.5% + $0.3 |

Perfect Money | $10 | 0% |

Volet | $10 | 0% |

Africa Mobile Money | $10 | 4.5% |

The company compensates traders for the deposit fee they have to pay to 3rd party payment systems, except for the Africa Mobile Money method.

LiteFinance also offers an auto withdrawal feature that allows you to withdraw up to $5,000 per day through various payment systems, including Credit cards, bank transfers, Neteller, Skrill, UnionPay, and Crypto (BTC, ETH, and more).

Does LiteFinance Have Copy Trading or any Growth Plans?

Investment plan is one of the most attractive topics in this LiteFinance review. This kind of service has become very popular among brokerages. The broker offers a robust Forex social trading platform, allowing clients to benefit from the experience of successful traders. Key features of the LiteFinance Copy Trading:

- Automated system for duplicating trades

- Social trading platform to communicate with other investors and strategy providers

- Top Traders with profitability up to %37,000

Trading Instruments and Assets

LiteFinance provides its tradable instruments in a total of 4 asset categories:

- Forex: Popular and minor currency pairs

- Stocks: CFDs on shares of American and European companies

- Commodities: Energies and metals

- Indices: Global stock index symbols

LiteFinance Bonus and Promotions

The broker offers several attractive bonuses and promotions to enhance the trading experience, including:

- Trade Smart Challenge: 50% credit on client investments for smart trading available only on ECN accounts

- Return of Commission with Zero Fees: Reimbursement of payment system commissions on deposits

- Affiliate Programs: 70% commission of the broker’s profit on your referred clients

- Contests: Seasonal tournaments for traders and partners

LiteFinance Broker Customer Support

Customer support is the heart of any online business, especially trading services providers, since they’re associated with the clients’ money. LiteFinance prioritizes 24/5 support by offering comprehensive contact channels, including:

clients@litefinance.com | |

Live Chat | Available on the official website |

Skype | |

Telegram | https://t.me/LiteFinanceSupport |

Restricted Countries on LiteFinance

LiteFinance Global LLC is registered in St. Vincent & the Grenadines as a Limited Liability Company with registration number 931 LLC 2021 and has certain restrictions on the countries it can serve:

- United States

- European Economic Area (EEA)

- Israel

- Russia

- Japan

Trust Scores

When providing a complete LiteFinance review, it's crucial to consider user reviews and trust scores from various platforms.

4.4 out of 5.0 based on 275 ratings | |

Forex Peace Army | 2.3 out of 5.0 based on 223 reviews |

Reviews.io | 3.5 out of 5.0 based on 28 comments |

Educational Resources on LiteFinance's Website

Per our investigations on the broker's website, this company offers a decent level of educational content to its clients, consisting of:

- Webinars

- Glossary

- Trader's tools, such as an economic calendar, analytics, calculators, etc.

These resources are mainly free and accessible for anyone, regardless of being registered with the broker. For a wider range of Forex education resources, you can visit the related page on this website.

Conclusion and Final Words

LiteFinance has claimed a profile on the Trustpilot website, receiving over 270 reviews with an average score of 4.4/5. The company has replied to +85% of the negative reviews. On the other hand, ForexPeaceArmy has received over 220 user reviews for the broker, leading to a 2.3/5 average rating.