LYNX caters to active traders with its proprietary platforms LYNX+, Mobile Trading App, and Trader Workstation (TWS) and supports trading ETFs, options, futures, and CFDs.

This platform is particularly suited for experienced traders, offering commission rates starting from 3 EUR for shares and zero commissions for Forex symbols.

Company Information & Regulation

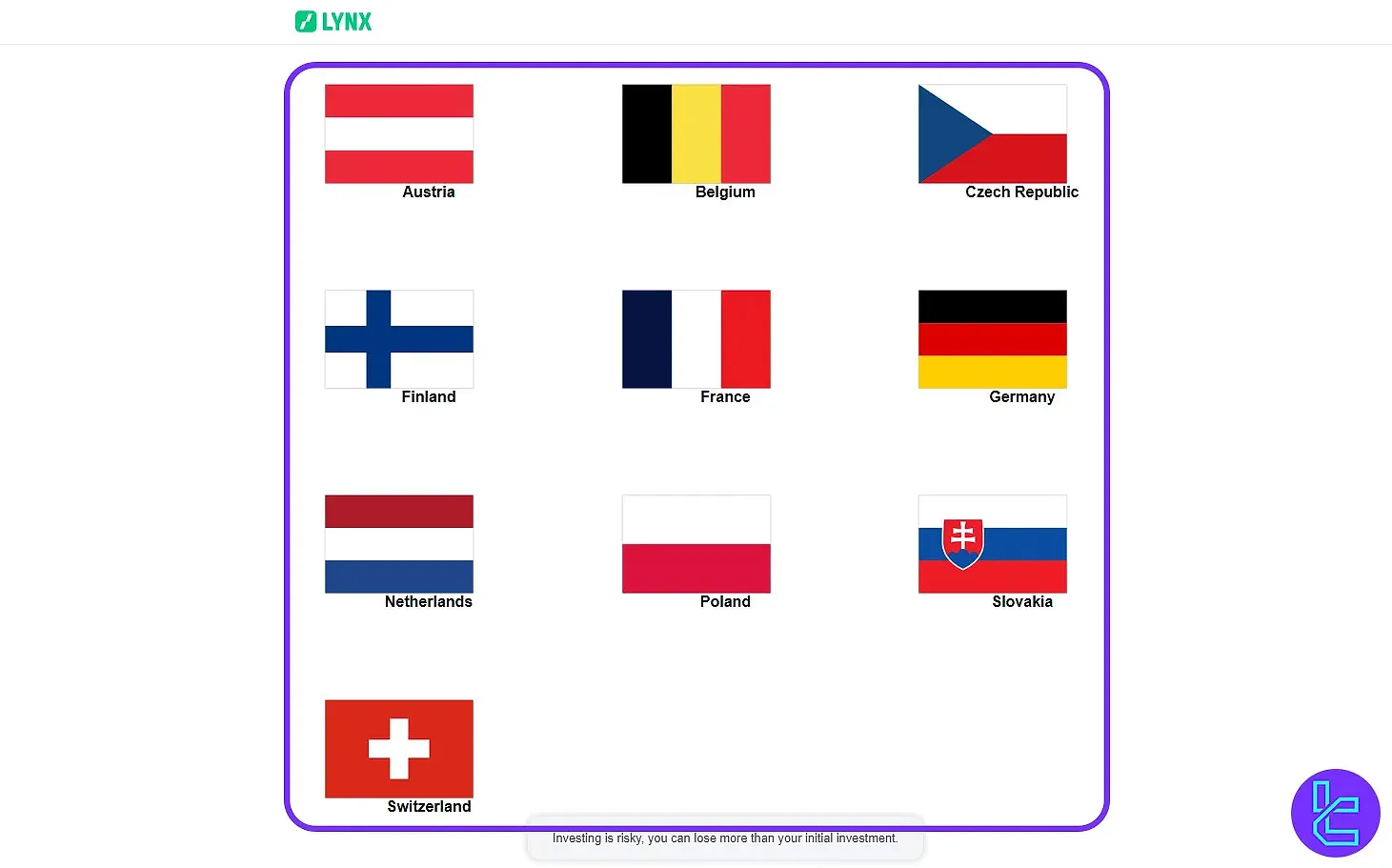

LYNX broker is a well-established online brokerage that provides investors with access to a wide array of financial instruments across 150 markets in over 30 countries. According to the data provided by Crunchbase, here are some key points about the company:

- Headquarters: Utrecht, Utrecht, The Netherlands

- Number of Employees: 101-250

- Founded Date: 2006

One of LYNX's standout features is its strong regulatory framework. Each branch of the broker is regulated by the related authorities. A high-tier authority among them is the Federal Financial Supervisory Authority (BaFin) in Germany.

Here are the most important details about LYNX:

Entity Parameters / Branches | Netherlands (LYNX B.V.) | Germany Branch | Czech Branch | Belgium Branch | Poland (virtual) | Slovakia (virtual) | France (served via BE) |

Regulation | AFM & DNB | AFM / BaFin | CNB | FSMA | AFM | AFM | AFM |

Regulation Tier | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

Country | Netherlands | Germany | Czech Republic | Belgium | Poland | Slovakia | France |

Investor Protection Fund / Compensation Scheme | Dutch BCS €20k | Dutch BCS / IBIE ICS €20k | IBIE ICS €20k | Dutch BCS / IBIE ICS €20k | IBIE ICS €20k | IBIE ICS €20k | IBIE ICS / Dutch BCS €20k |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 |

Client Eligibility | EEA countries | Germany (DE) | CZ, PL, SK (etc.) | BE (FR/NL) & FR clients | PL (passported clients) | SK (passported clients) | FR clients (served via BE) |

Table of Specifics and Features

To provide a clear overview of LYNX's offerings, let's examine some key specifics of this Forex broker:

Broker | LYNX |

Account Types | Individual, Joint, Corporate |

Regulating Authorities | BaFin and Other Authorities For Branches |

Based Currencies | USD, EUR, KRW, AUD, CNY, GBP, etc. |

Minimum Deposit | 3,000 EUR |

Deposit Methods | Interactive Brokers |

Withdrawal Methods | Interactive Brokers |

Minimum Order | Not Specified |

Maximum Leverage | 1:30 |

Investment Options | None |

Trading Platforms & Apps | LYNX+, Mobile Trading App, Trader Workstation |

Markets | Forex, Shares, Options, Futures, ETFs, Commodities, CFDs |

Spread | Not Specified |

Commission | From 3 EUR For Shares From Zero For Forex Symbols |

Orders Execution | Not Specified |

Margin Call/Stop Out | Not Specified |

Trading Features | Different Trading Terms for Each Region |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | None |

PAMM Account | None |

Customer Support Ways | Live Chat, Email, Phone Call |

Customer Support Hours | 24/7 |

Account Types Overview

LYNX broker offers traders a variety of account types. However, there's not much information available on their specifics in detail. Accounts in LYNX:

- Individual Investment: Registered under one person's name, full control and responsibility over the account

- Joint Investment: Shared by two people, both registered as account holders, allows joint trading and investment

- Corporate Investment: For companies, partnerships, and other legal entities, enables trading and investment activities for businesses

Also, a demo account is available. The demo is particularly useful for new traders, allowing them to familiarize themselves with the platform and test strategies without risking real capital.

At the moment, the brokerage does not offer any Islamic account options.

Benefits and Drawbacks

To help you make an informed decision, let's examine the pros and cons of using LYNX as your forex broker:

Benefits | Drawbacks |

Wide Selection Of Investment Products | Geared Towards Active Traders |

Fractional Share Trading Available | Complex Platform For Novice Investors |

Regulated by a High-Tier Authority | A Very High Minimum Deposit of 3,000 EUR |

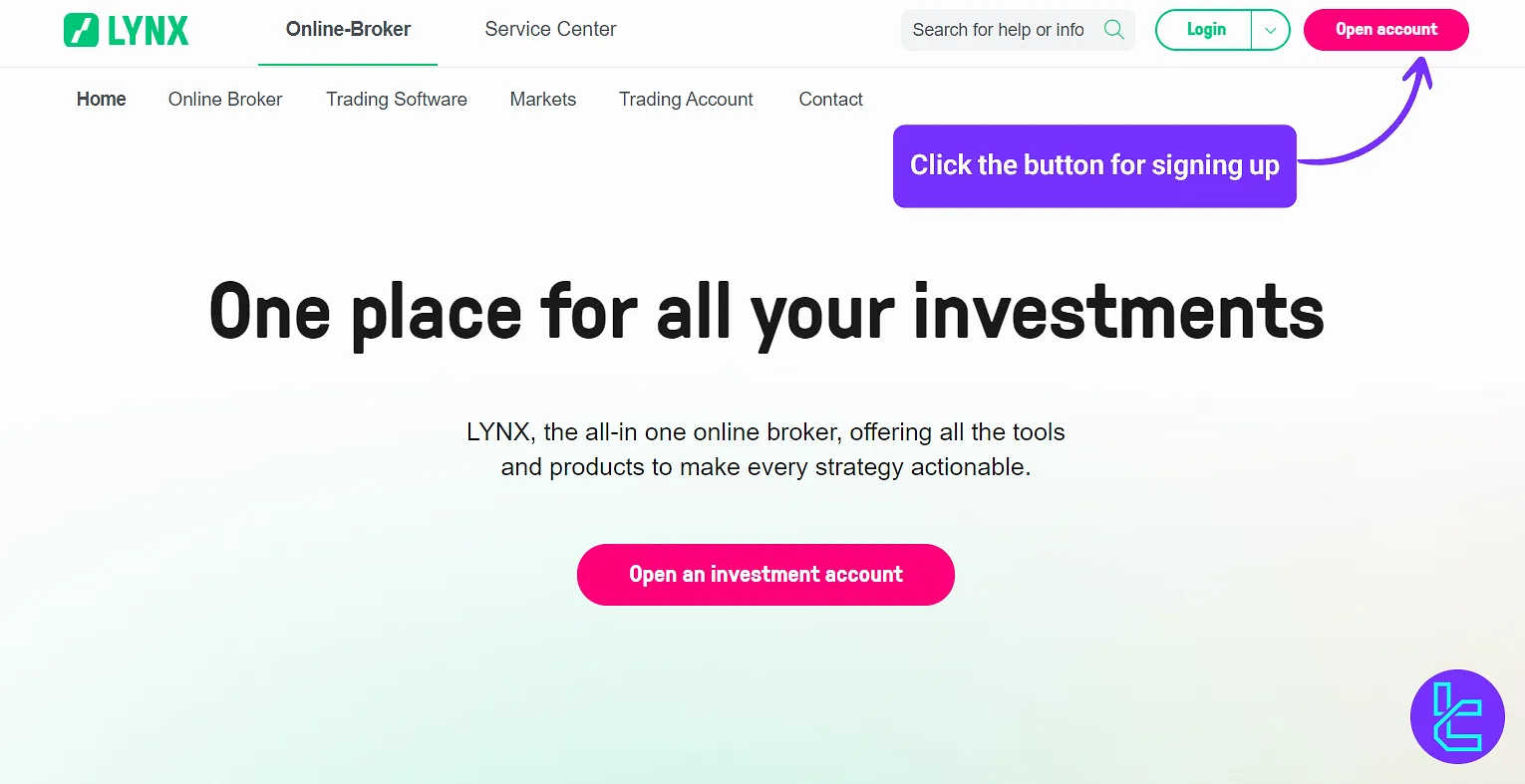

How to Register and Verify on LYNX Broker

Creating an account with the broker is quick and fully digital, designed to meet international regulatory standards and ensure secure access to global markets. LYNX broker registration includes identity checks, residency validation, and financial background checks.

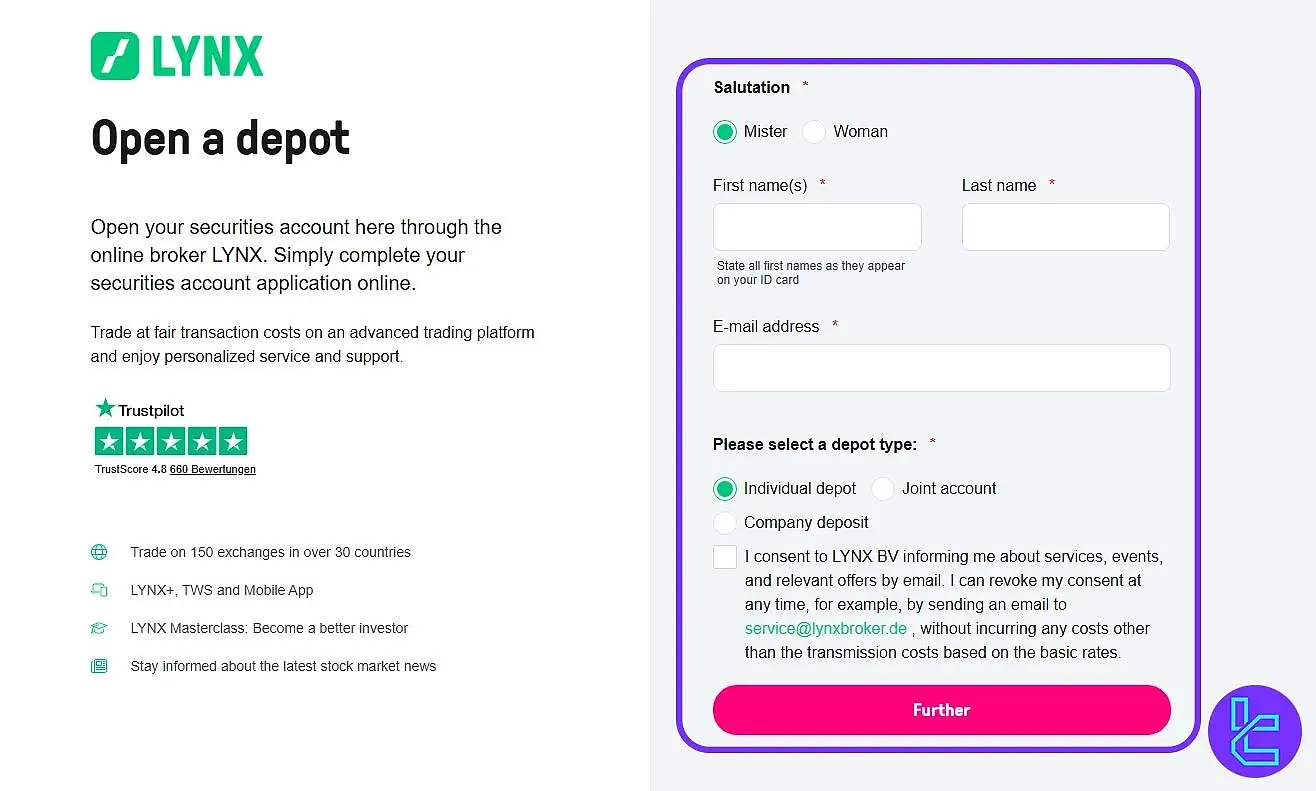

#1 Start Your Application

Visit the official LYNX website and select "Open Account".

Afterwards, click on "Create New Account".

#2 Choose Your Country

From the dropdown list, select your country to apply the proper regional settings and regulatory conditions for your LYNX account.

#3 Submit Personal Details

In this section, you need to follow these three steps:

- Enter your basic information, including gender, first and last name, and a valid email address;

- Next, choose the type of account you wish to open individual, joint, or corporate;

- Before moving forward, tick the checkbox confirming that you agree to LYNX’s terms and policies.

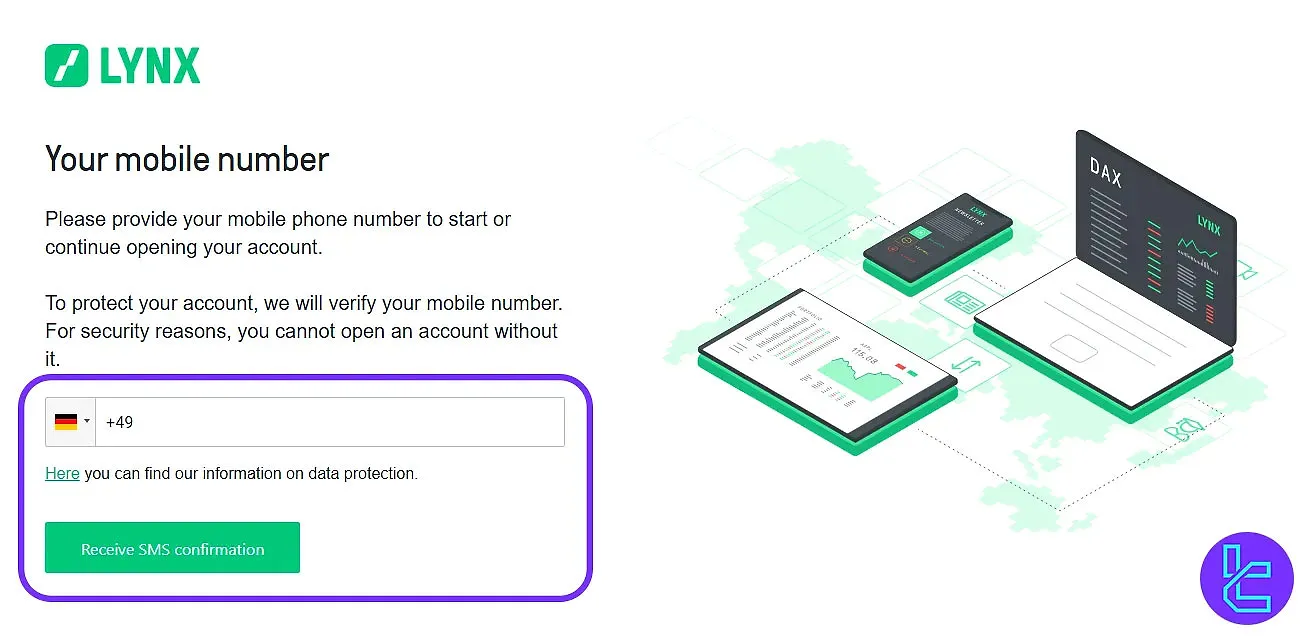

#4 Add Your Mobile Number

Provide your mobile phone number to receive a verification code via SMS.

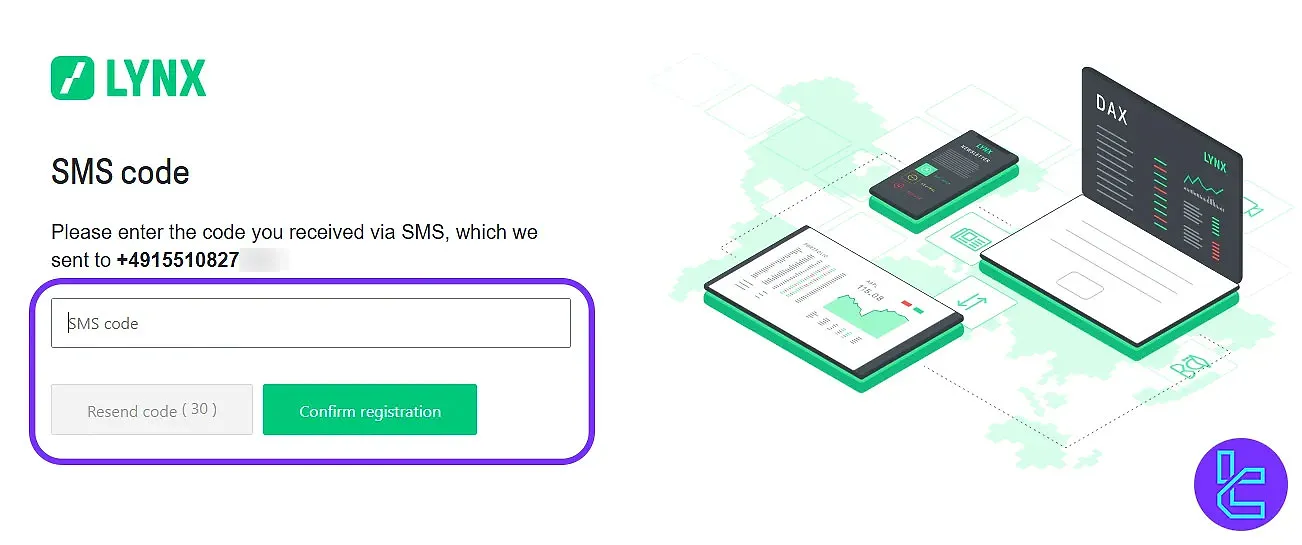

#5 Confirm Account Registration

After receiving the SMS code, type it into the designated field and press “Confirm Registration” to finalize your LYNX account setup.

#6 Identity Verification

Fill in your personal and residential information, including your legal address and nationality. Upload verification documents:

- Government-issued ID (passport or national ID)

- Proof of address (utility bill or bank statement)

#7 Complete KYC & Submit

Once documents are uploaded, your account enters the compliance review phase. Upon approval, trading access will be granted.

Trading Platforms and Software

Many forex brokers typically utilize third-party platforms for trading. Some of them develop their own proprietary platforms, too. LYNX provides 3 proprietary platforms:

- LYNX+: A platform with a comprehensive suite of features in a convenient interface, accessible on web.

- Mobile Trading App: Trading anytime, anywhere, with all available features, tools, etc. from your phone

- Trader Workstation (TWS): A more advanced platform with many features, recommended for more experienced investors

There's not much information available on the website about each platform. Nevertheless, you can download the mobile app via these links:

Spreads and Commissions

LYNX's website does not offer much information about trading spreads. Regarding commissions:

- From 3 EUR for shares

- From zero for Forex symbols

These numbers are the same for all accounts. Check the official website for additional data. For withdrawals and other operations with the broker, no exact data is provided.

Swap (Overnight Financing) Fees at LYNX

LYNX calculates swap or overnight financing based on the “IBKR benchmark interest rate” for each currency, combined with specific markups or markdowns stated in its official pricing schedule.

This approach ensures that financing costs reflect real interbank conditions rather than fixed retail rates, providing transparency and alignment with professional market standards.

Below are the main parameters defining how swap fees are calculated:

- Long CFD positions: Charged at IBKR benchmark rate + 2% markup per annum, calculated daily on open positions;

- Short CFD positions: Credited or charged at IBKR benchmark rate − 2% markdown, depending on whether the rate remains positive;

- Margin debit interest: For leveraged positions, the same IBKR rate + 2% markup applies as the overnight financing cost;

- Securities borrowing (short selling): Subject to IBKR borrow rate + a fixed or variable borrow markup depending on stock liquidity;

- Reference benchmark rates (BM rates): Updated regularly and available in the LYNX client portal.

Non-Trading Fees at LYNX

LYNX charges several non-transaction costs beyond simple trade commissions, including fees tied to inactivity, account maintenance, and withdrawal rules.

These costs are clearly outlined in their official “List of Prices and Services” and associated disclosures.

To make your total cost picture clear, keep in mind that the following extra fees may apply:

- Monthly Minimum Activity / Platform Fee: If your commission in a calendar month is less than EUR 5 (or equivalent) and your account’s net liquidation value is under EUR 100,000, LYNX charges a top-up fee (difference to reach EUR 5);

- Withdrawal fees (after first free withdrawal): Only the first withdrawal per calendar month is free; subsequent withdrawals incur fees depending on the currency and region;

- Telephone / Voice Order Fee: Placing or modifying an order by phone, via the broker’s desk, may incur a fixed premium (e.g. ~EUR 30) per transaction when done outside standard trading interfaces;

- Exposure / Risk Fee: For accounts with substantial margin or risk exposure, a daily “Exposure Fee” may be assessed if certain stress tests deem the account’s risk profile high.

How To Make Deposits and Withdrawals

At LYNX, the only supported method for both depositing and withdrawing funds is Bank transfer.

All transactions are processed directly to a bank account in your name. Keep in mind that withdrawal fees may apply for additional requests beyond the first free withdrawal each calendar month, and processing times typically take 1–3 business days.

Deposit Methods at LYNX

To fund your LYNX trading account, LYNX supports bank transfers only, with the requirement to submit a deposit notification before transferring.

Deposits must come from a bank account in your name and currency conversion may apply if you deposit in a currency different from your account base.

For clarity, the following table summarizes what LYNX officially discloses about deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer (e.g. SEPA or international) | Various (EUR, USD, etc.) | Explicitly not stated | No fee charged by LYNX | Typically 1–3 business days after deposit notification is matched to the transfer |

Withdrawal Methods at LYNX

When you request a withdrawal from your LYNX trading account, funds are always sent to a bank account in your name via the banking transfer methods supported in your country.

LYNX enforces one free withdrawal per calendar month, with potential fees applied to subsequent requests.

To give you full clarity on the structure, here’s a table of withdrawal details as officially disclosed:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank transfer (SEPA / wire) | EUR, USD, etc. | No public minimum | First withdrawal per month: free Additional withdrawals: local tariff (e.g. EUR 1-8 for EUR, USD 10 for USD) | 1-3 business days typically |

Does LYNX Offer Copy Trading or Any Investment Options For Its Clients?

Unfortunately, LYNX does not currently offer copy trading or other methods for social trading and earning passive income.

It’s mainly because this broker is focused on offering services to active traders and experienced investors. Therefore, consider other options if you are interested in earning via those methods.

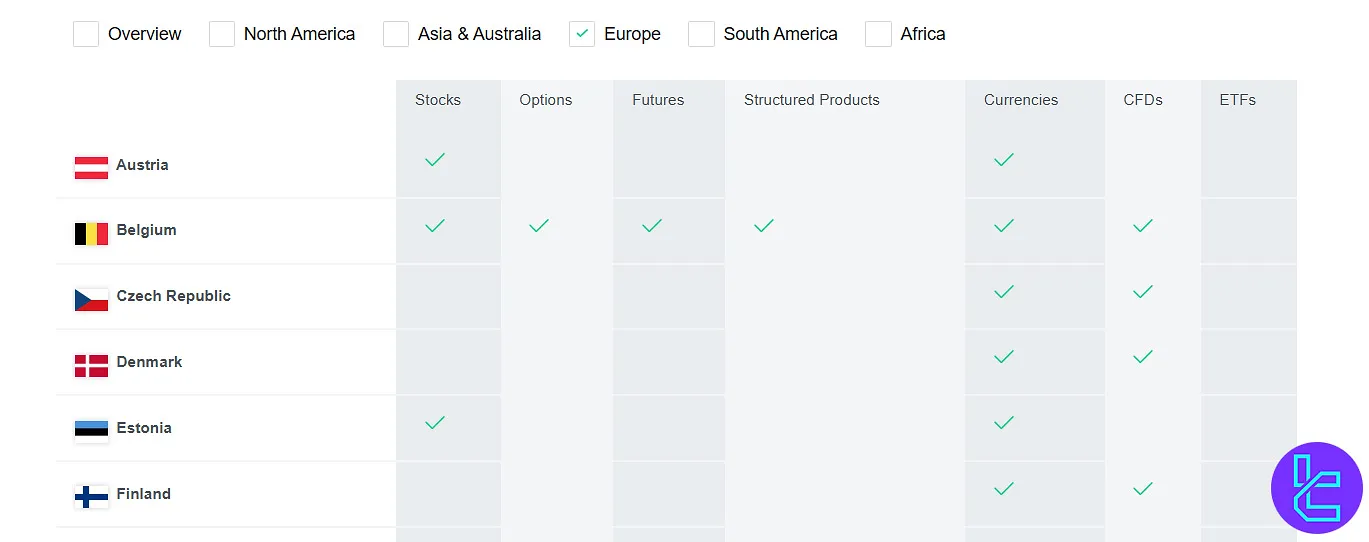

Tradable Markets & Symbols

LYNX offers an impressive range of tradable markets and symbols, including the Forex market, Options contracts, and the Futures market, which are broader than many competitors, and it's one of the broker's strengths:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Equities | Stocks | 7000+ | 2,000–10,000 | N/A |

Options | Stock Options, Index Options | 3000+ | 5,000–15,000 | N/A |

Futures | Commodities, Indices, Currencies | N/A | 2,000–10,000 | N/A |

ETFs | Exchange-Traded Funds | N/A | 1,500–2,000 | N/A |

Contracts for Difference | N/A | 5,000–10,000 | N/A | |

Forex | Currency Pairs | 100+ | 50–100 | N/A |

Structured Products | Warrants, Certificates | N/A | 100–500 | N/A |

Overall, the brokerage provides access to over 150 exchanges from around the world.

Bonuses: Does LYNX Offer Any Promotions?

We investigated the broker and its website for any bonus programs and promotions, and found nothing. Currently, there are no bonuses available for clients. Check the website and official sources to find out about any updates regarding this.

LYNX Awards

LYNX has garnered recognition for its excellence in online brokerage services, earning over 24 international awards. These accolades reflect the company's commitment to providing optimal conditions for investors.

Here are some of the notable awards LYNX has received:

- Best Online Broker

- Best Futures Broker

- Lowest Cost Broker

By the way, there are no information available on whom gave them these awards.

LYNX Broker Support Contact Methods and Working Hours

Support department in a company becomes very important when you face a challenge. LYNX provides multiple channels for customer support:

- Phone: via +31 (0)20 6251524

- Email: info@lynxbroker.com

- Live Chat: Available on the official website

- TeamViewer: Direct support through connecting to the user's computer

Per our investigations, it seems that the live chat does not support English, which is disappointing, but it's available 24/7. However, phone support schedule is different, working Monday to Friday from 8:00 to 22:00.

Some positive reviews and comments about the customer service department exist across the web.

Restricted Countries

While LYNX broker offers its services in many countries, there are some restrictions. Unfortunately, a comprehensive list of restricted countries is not provided in the given information. However, it mainly consists of these countries:

- Iran

- Afghanistan

- Lebanon

- Cuba

- North Korea

- Iraq

LYNX Broker Trust Rating

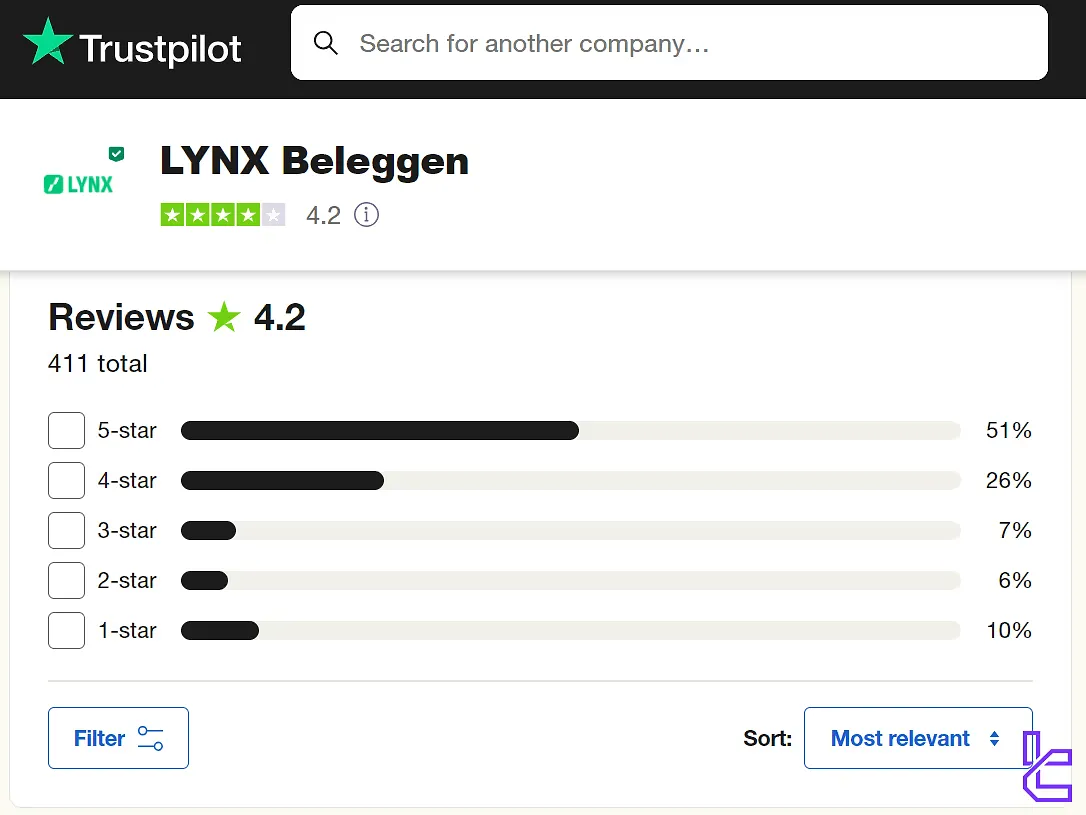

The LYNX Trustpilot profile has seen positive reviews from its users. Let's examine these reviews in more detail:

- Overall Rating: 4.2/5 stars

- Total Reviews: +400

- 5-Star Ratings: +50%

LYNX has responded to 4 out of 4 negative reviews, demonstrating their commitment to customer satisfaction and addressing concerns. However, there are no trust scores on other resources and websites. This is considered a weakness.

Education Content on LYNX

This broker does not hold a high place among its competitors when it comes to education resources. LYNX provides these contents to traders for education purposes:

- Introduction on the platform

- Trading Tips

- YouTube Channel (No English Videos Available)

Check TradingFinder's Forex education section to access free learning materials.

LYNX in Comparison to Other Brokers

The table in this section demonstrates a comparison between LYNX and some of the other Forex brokerages:

Parameter | LYNX Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | BaFin and Other Authorities For Branches | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | Not Specified | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From 3 EUR For Shares From Zero For Forex Symbols | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | 3,000 EUR | $10 | From $0 | $100 |

Maximum Leverage | 1:1 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | LYNX+, Mobile Trading App, Trader Workstation | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Individual, Joint, Corporate | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | None | Yes | Yes | Yes |

Number of Tradable Assets | 150+ | 200+ | 1,000+ | 2100+ |

| Trade Execution | Not Specified | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and final words

LYNX is a broker with a 4.2/5 Trustpilot rating based on over 400 reviews, indicating customer service satisfaction.

While offering fractional share trading and 24/7 live chat support, the broker lacks bonuses and copy trading. Drawbacks like a 3,000 EUR minimum deposit may limit its appeal to new or passive traders.