Trading services [Market Depth, US and HK Stock Live Prices, SMS Alerts, Forced Order Key], six markets, and rebates are why Maybank Kim Eng has obtained 15+ global industry awards.

This forex broker provides an Islamic account for Muslim traders and 1:25 maximum leverage.

Maybank Kim Eng Company & Regulation Overview

Maybank Kim Eng, a subsidiary of the “Maybank Group”, has a rich history dating back to 1972.

This forex broker has established itself as a Singaporean investment bank and broker firm in Southeast Asia [ASEAN region], with a presence in key financial hubs across the region.

Key points of Maybank Kim Eng's background and regulatory status:

- Founded by “Gloria Lee” and a Part of the Maybank Group, which has operations in 11 countries, including Malaysia, Singapore, Thailand, and the Philippines

- Regulated by the Monetary Authority of Singapore (MAS) in Singapore

- Holder of Capital Markets Services Licence in Singapore

- Regulated by the Financial Conduct Authority (FCA) in the United Kingdom

- Wide range of financial services, including dealing in capital markets products, securities, and forex trading

Top-tier licenses ensure client fund safety through negative balance protection and strict KYC protocols.

Table below give you more details about Maybank Kim Eng’s branches:

Entity Parameters / Branches → | Maybank Investment Bank Berhad | Maybank Securities Pte Ltd | Maybank IBG Securities (HK) Ltd | Maybank Securities (Thailand) PCL | PT Maybank Sekuritas Indonesia | Maybank ATR Kim Eng Securities Inc. | Kim Eng Securities India Pvt Ltd | Maybank Securities Ltd (Vietnam) | Maybank Kim Eng Securities (UK) Ltd | Maybank Kim Eng Securities USA Inc. |

Regulation | SCM | MAS | SFC | SEC Thailand | OJK / IDX | SEC PH / PSE | SEBI / NSE | SSC Vietnam | FCA (UK) | SEC / FINRA |

Regulation Tier | 2 | 1 | 1 | 2 | 1 | 2 | 2 | 1 | 1 | 1 |

Country of Operation | Malaysia | Singapore | Hong Kong | Thailand | Indonesia | Philippines | India | Vietnam | United Kingdom | United States |

Investor Protection (amount) | N/A | N/A | HK$500 000 | N/A | IDR 200 m | N/A | ₹350 k (NSE IPF) | N/A | £85 000 (FSCS) | US$500 000 (SIPC) |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Prot. | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | N/A | 1:10 | N/A | N/A | N/A | N/A | N/A | 1:2 | N/A | N/A |

Client Eligibility | Malaysia + foreign | SG + regional | HK + regional | Thailand residents | Indonesia residents | PH residents | India residents | Vietnam residents | UK clients | US residents |

Specifications Table

To provide a clearer picture of Maybank Kim Eng's offerings, here's a table summarizing some key specifications:

Broker | Maybank Kim Eng |

Account Types | Real, Demo |

Regulating Authorities | FCA Britain, MAS Singapore |

Based Currencies | USD, SGP |

Minimum Deposit | $0 |

Deposit Methods | Credit/Debit Cards, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:25 |

Investment Options | None |

Trading Platforms & Apps | MayBank Trade, MayBank Mobile |

Markets | Stocks, Forex, CFD, ETF, Bonds, Real Estate |

Spread | Starts From 0.5 |

Commission | $0 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/30% |

Trading Features | Rebate, Islamic Account, 1:25 Maximum Leverage, Demo Account, 500+ Tradable Instruments |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | Yes |

Pamm Account | No |

Customer Support Ways | Ticket, Indoor Meeting, Phone Call, Email |

Customer Support Hours | 9 AM to 6PM |

Maybank Kim Eng Broker Accounts

Maybank Kim Eng offers two primary account types: the “Real” account for live-market trading with real capital, and the “Demo” account for practice using virtual funds.

The Real account grants full access to their platform and research tools, whereas the Demo account allows users to test strategies risk-free.

Maybank Real Trading Account

The Maybank Real Trading Account is designed for active traders seeking direct access to global financial markets under regulated conditions. It provides flexible funding, advanced research tools, and competitive trading conditions suitable for both beginners and experienced investors.

- Access to live markets

- No minimum deposit requirements

- Full access to Maybank Kim Eng's suite of trading tools and research

- 1:25 Maximum leverage for all trades

- Spreads from 0.5 pips

Maybank offers live accounts in various types, including:

- Trade Cash: Standard trading account for direct access to assets

- Trade Pre-Funded: Ideal for users who wish to allocate funds in advance

- Margin Financing: Suited for leveraged strategies

- CFD Account: Designed for CFD traders

- FOREX Account: Specialized for currency trading

Maybank Kim Eng imposes no minimum deposit requirement for opening a trading account. However, traders should maintain enough equity to execute a minimum position size.

Maybank Demo Trading Account

The Maybank Demo Trading Account lets users explore real market conditions using simulated funds before committing actual capital.

- Allow practice trading with virtual funds

- No risk involved, ideal for beginners or testing strategies

- Valid for a limited time period (30 days)

Maybank Kim Eng offers Islamic account in its real account; Therefore, no money is collected from Muslim traders.

What Are Maybank Kim Eng Broker Pros and Cons?

Like any financial service provider, Maybank Kim Eng has its strengths and weaknesses.

Maybank Kim Eng Forex Pros and Cons:

Advantages | Disadvantages |

Long-standing presence in Southeast Asian markets | Limited global presence compared to some international brokers |

Regulated by reputable authorities (MAS, FCA) | Higher trading costs compared to some discount brokers |

Wide range of financial products available | Mixed user reviews, with some reports of customer service issues |

Proprietary trading platforms tailored for Asian markets | Demo account limited to 30 days |

Comprehensive research and educational resources | No copy trading or social trading features |

Maybank Kim Eng Registration and Verification

Registering with Maybank Kim Eng is similar to other Forex brokers and is not particularly complicated; to do this, follow the steps below:

#1 Maybank official website

Visit the broker's official website and click "Open an Account" on the home page.

#2 Phone verification

Write your phone number to receive a verification code. Enter the OTC and agree to the terms and policy.

#3 Maybank online application form

Fill out the online application form with personal details, including:

- Full name

- Date of birth

- Country of residence

#4 Maybank Kim Eng verification

Prepare necessary documents for KYC verification, including:

- Proof of ID: ID card or Passport

- Proof of Address: Utility bill or Bank statement

Maybank Kim Eng will review your application and documents (this process typically takes 3-7 working days). Once verified, you'll receive confirmation of your account activation.

Login credentials will be provided via email.Fund your account using available payment methods and start trading.

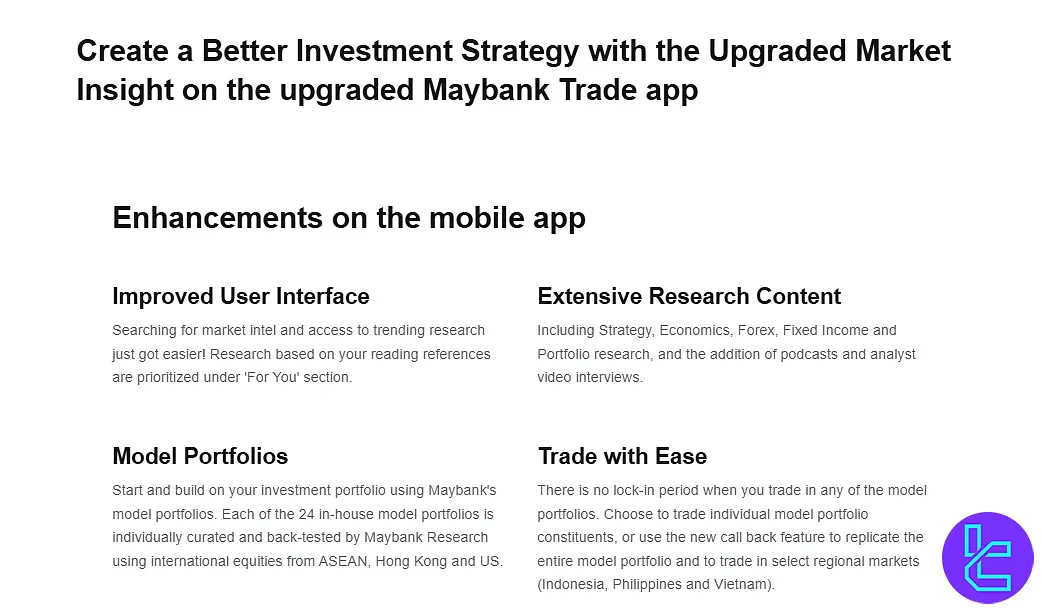

What Platforms Are Available in Maybank Kim Eng?

Although Maybank Kim Eng does not offer MetaTrader 4 or MetaTrader 5 to its traders, they have two main proprietary trading platforms:

Maybank Trade

Maybank Trade is a versatile web-based platform that allows traders to access real-time market data, analysis tools, and manage their portfolios from any browser.

These features enable efficient trading and portfolio management, as highlighted in the key capabilities below:

- Web-based platform accessible from any browser

- Real-time market data and analysis tools

- Access to multiple markets, including SGX, Bursa Malaysia, SET, HKEX, NYSE, and NASDAQ

- Features include watchlists, order management, and portfolio tracking

Maybank Mobile

Maybank Mobile provides convenient trading on iOS and Android devices with full access to essential features.

These capabilities are summarized in the key mobile features below:

- Available for iOS and Android devices

- Offers similar features to the web platform

- Real-time market data and trading capabilities

- Fingerprint login for enhanced security

- Push notifications for market updates and order status

No matter what platform you choose, both platforms have a user-friendly interface and advanced charting tools.

Spreads and Commissions

Maybank Kim Eng follows a spread-only pricing model for forex trades, meaning there are no added commissions. Spreads start from 0.5 pips.

Spreads at Maybank Kim Eng are competitive under normal conditions, with typical ranges for major pairs such as:

- EUR/USD spreads: 0.5 to 0.8 pips

- GBP/USD spreads: 0.5 to 0.7 pips

Spreads may temporarily widen during news events orlow liquidity periods.

While there are no fees for deposits, withdrawals may incur fees between 0% to 5%, depending on the payment method.

Swap Fee at Maybank Kim Eng

Holding leveraged positions overnight at Maybank Kim Eng incurs swap charges automatically debited from your CFD account.

These costs depend on whether the position is long or short and differ by country and asset type. All swaps are applied daily and reflect the actual overnight financing applied by the broker.

Here are key points to keep in mind regarding swaps:

- Singapore: Long positions incur +3.5%, short positions incur -3.5% daily;

- Malaysia: Swap charges for long are +3.5%, short positions -8.5%;

- Indonesia: Overnight swap: long +5%, short -8%, applied automatically;

- Hong Kong: Long and short swaps charged +3.5% for long and -3.5% for short positions;

- USA & UK: Overnight swaps are applied daily, with Long positions +3.5% and Short positions -3.5%;

- Islamic Accounts: Maybank Kim Eng offers swap free Islamic trading accounts for eligible clients.

Non-Trading Fees at Maybank Kim Eng

Maybank Kim Eng maintains a structure for its non-trading fees, ensuring investors are fully aware of all costs beyond the usual trading commissions. These fees generally apply to account setup, fund withdrawals, nominee services, and securities handling.

Unlike many regional brokers, Maybank Kim Eng avoids hidden maintenance or inactivity charges, making it relatively transparent for both casual and professional investors.

Below are the most important non-trading fees officially listed by the broker:

- CDS Nominee Account Opening Fee: RM 10.00 (subject to SST) for non-margin accounts in Malaysia;

- Share Withdrawal Transfer Fee: RM 10.00 per transfer, applicable to both CDS and nominee accounts;

- Securities Lending & Borrowing Fee (Singapore): SGD 20 + GST administrative fee, plus SGD 20 per day default charge if shares are not returned;

- Withdrawal Fee: Between 0 % and 5 %, depending on the withdrawal method;

- Inactivity or Maintenance Fee: None charged for dormant accounts in the Singapore market.

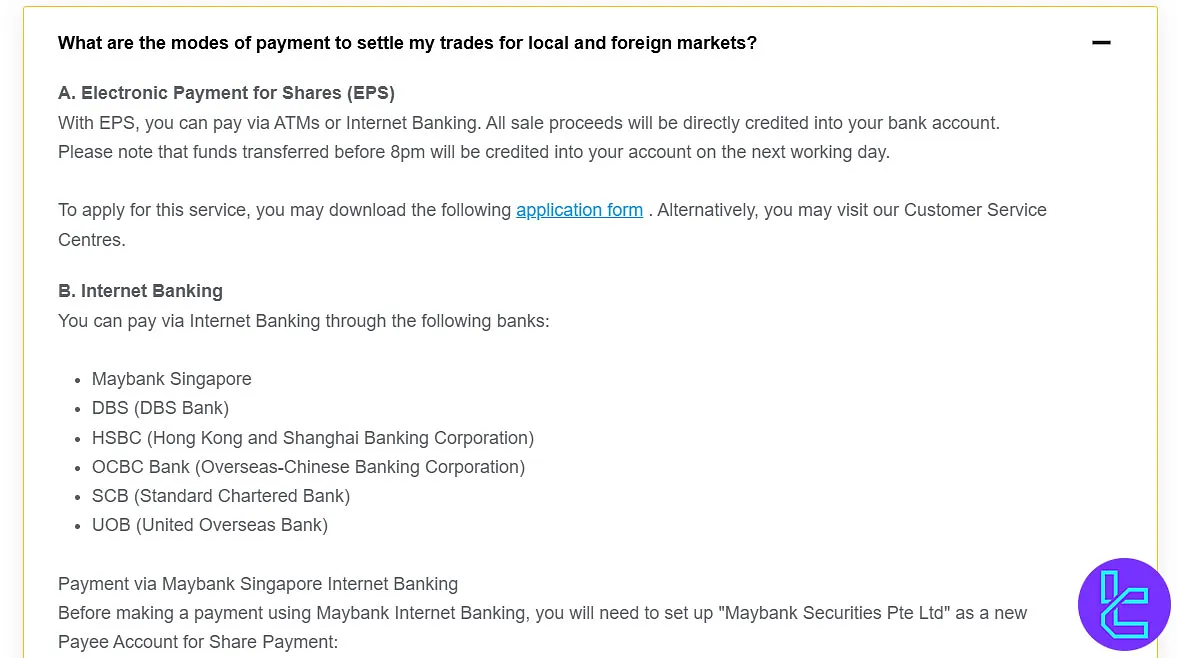

Deposit & Withdrawal Methods

Maybank Kim Eng offers 3 payment methods for depositing funds into your trading account and withdrawing your earnings.

- Bank Transfer: Direct transfer from your bank account, may take 1-3 business days to process

- Credit/Debit Cards: Instant deposits, Visa and Mastercard typically accepted

- ATM Deposits: Available for KBANK ATM card holders in Thailand

Deposit Methods at Maybank Kim Eng

Maybank Kim Eng provides multiple secure funding options for local and international clients. Investors can choose between modern digital solutions like PayNow and FAST, or traditional methods such as Telegraphic Transfer and GIRO.

Each method varies in supported currencies, processing time, and applicable charges, giving traders flexibility in managing settlement and account funding.

Below is a concise summary of the officially listed deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Electronic Payment for Shares (EPS) | SGD | Not specified | None | Next working day (if before 8 pm) |

Internet Banking | SGD | Not specified | None | Next working day (if before 8 pm) |

FAST Transfer | SGD | Not specified | None | Next working day (if before 8 pm) |

Pay Now | SGD | Not specified | None | Next working day (if before 8 pm) |

GIRO | SGD | Not specified | None | Auto-debit/credit on settlement date |

Multi-Currency e-Pay | SGD / HKD / USD | Not specified | No hidden fees | Same-day settlement |

Telegraphic Transfer (TT) | SGD / USD / HKD / AUD / MYR / GBP / CNH | Varies by bank | Bank TT fee applies | 1–3 business days |

Maybank ATMs / CDM | SGD | Not specified | None | Same-day crediting |

Internal Fund Transfer | Multi-Currency | Not specified | None | Same day (upon request) |

Withdrawal Methods at Maybank Kim Eng

Information regarding withdrawal methods from trading accounts at Maybank Kim Eng is limited on the official website. The broker does not provide a detailed public list of available withdrawal channels, minimum amounts, or processing times.

According to the Singapore branch, clients are instructed to contact their Trading Representative for assistance with any withdrawals.

Does Maybank Kim Eng Offer Copy Trading or Any Other Investment Plans?

As of the latest information available, Maybank Kim Eng does not offer copy trading or specific investment plans like some other brokers do.

Maybank Kim Eng Broker Tradable Assets

This broker offers 6 markets and 500+ assets to trade; Maybank Kim Eng Tradable Instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Stocks | Shares listed on global exchanges | N/A | 2000–6000 | N/A |

Spot currency‑pairs and FX derivatives | N/A | 60–100 | N/A | |

Exchange – Traded Funds (ETFs) | Listed funds on exchanges, traded like stocks | N/A | 200–1000 | N/A |

Bonds & Fixed Income | Corporate & sovereign bonds, possibly margin‑enabled | N/A | 200–500 | N/A |

CFDs on shares, indices, commodities, forex | N/A | 1000–5000 | N/A | |

Warrants | Leverage instruments giving rights (not obligations) to buy/sell underlying assets | N/A | 150–450 | N/A |

Real Estate Investment Trusts (REITs) | Listed real estate units that trade like shares | N/A | 50–200 | N/A |

Securities Lending | Borrowing/lending of securities for short‑selling or other strategies | N/A | N/A | N/A |

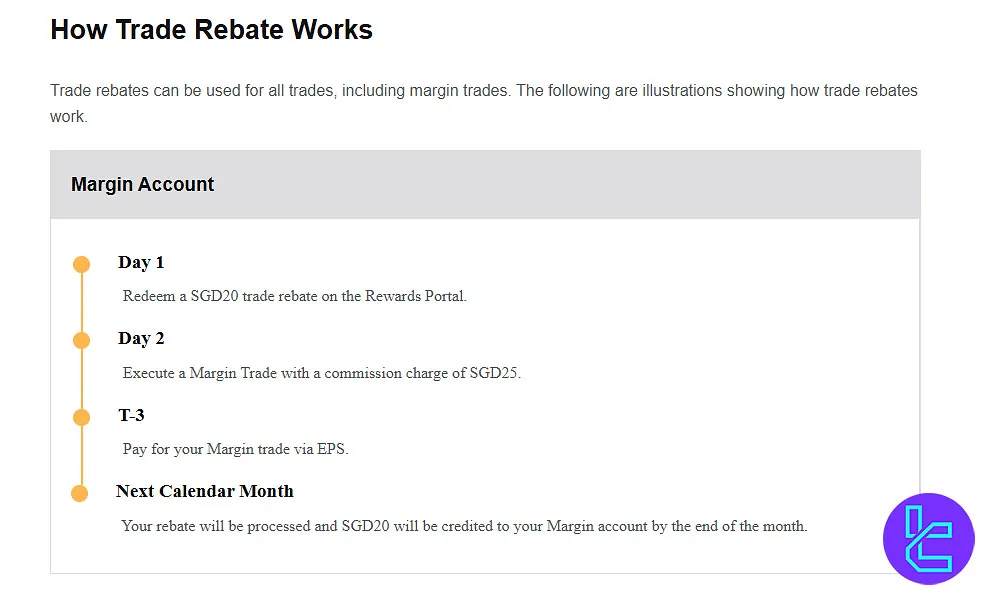

Does Maybank Kim Eng Offer Bonuses?

As of the latest information available, the only promotion offered by Maybank Kim Eng is its rebate plan.

The rebate plan in this broker is available for all users, but if you don’t know what it is, read the TradingFinder Rebate article.

Maybank Kim Eng Awards

The Maybank Kim Eng awards underscore the broker’s sustained excellence across retail, institutional, and regional markets, reflecting their leadership, innovative solutions, and unwavering commitment to delivering high-quality financial services.

These accolades highlight their reputation as a trusted and top-performing financial institution across Asia.

A closer look at these recognitions demonstrates their industry impact:

- Best Broker in Southeast Asia (Marquee Award), 2013–2022

- Best Retail Broker, 2022, 2023

- Best Boutique Prime Broker, 2015, 2017, 2023

- Best Retail Broker, 2022

- Syndicated Loan House of the Year, 2022

Support Channels

The Singaporean broker provides several support channels to assist clients with their queries and concerns. Maybank Kim Eng Support:

- Ticket System: Available through the client portal, suitable for non-urgent queries

- Indoor Meetings: Available at Maybank Kim Eng offices (Monday to Friday/9AM till 6PM)

- Phone Support: Direct line for immediate assistance, Hours may vary by region

- Email Support: General inquiries can be sent to a designated email address

Restricted Countries; What Countries Are Banned to Use Maybank Kim Eng Broker?

Although Maybank Kim Eng Forex focuses on ASEAN countries, it also serves multiple countries outside of this region, including the United States. Countries that can use this broker's services include:

- Malaysia

- Singapore

- Hong Kong

- Thailand

- Indonesia

- Philippines

- India

- Vietnam

- Saudi Arabia

- Great Britain

- United States of America

Therefore, other countries around the globe are not able to use this broker’s services.

Trust Score

Maybank Kim Eng holds a Trustpilot rating of 3.2, indicating its overall performance as evaluated by the platform. However, this score was derived from only a single review, so it may not be fully representative or reliable.

Educational Resources

Maybank Kim Eng demonstrates a strong commitment to trader education through various resources:

- Market Insight: Regular market analysis and research reports with expert commentary on economic events and trends

- Podcast: Audio content covering various financial topics plus interviews with industry experts and market analysts

- Invest Academy: Webinars, tutorials, and articles on trading strategies and market analysis

Maybank Kim Eng vs Top Forex Brokers

Let's take a quick look at Maybank's offerings and see where it stands in comparison with other players in the market.

Parameter | Maybank Kim Eng Broker | |||

Regulation | MAS, FCA | None | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.5 Pips | 0.1 Pips | From 0.0 pips | From 0.0 pips |

Commission | $0 | $0 | Average $1.5 | From $0 |

Minimum Deposit | $0 | $10 | $200 | $100 |

Maximum Leverage | 1:25 | 1:3000 | 1:500 | 1:500 |

Trading Platforms | MayBank Trade, MayBank Mobile | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Real, Demo | Standard, Premium, VIP, CIP | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 50+ | 2,100+ | 2,100+ |

| Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion and Final Words

No minimum deposit, 500+ tradable instruments, FCA and MAS regulation are some of the features of Maybank Kim Eng.

Although Maybank Kim Eng has 11 offices in various countries, this broker does not offer any bonuses and does not support copy trading.