MYFX Markets provides commission-free trading on four asset classes, including Forex and Crypto, through its Standard and Micro accounts. The broker supports MAM and PAMM solutions on the MT4 platform. It offers cashbacks of up to $3,000 to its clients.

MYFX Markets; Company Information and Regulation

MYFX Markets, formerly known as Morris Prime, was founded in 2012 by Wilf Bai.

The broker is regulated by two financial authorities through multiple entities, including:

- MYFX Group regulated in the Union of Comoros with license No. L15835/MYFX

- MYFX Group Limited regulated by the Financial Services Authority (FSA) of Seychelles under License Number SD202

While the lack of top-tier regulation might raise concerns for some traders, MYFX Markets strives to maintain a transparent and secure trading environment for its clients.

MYFX Markets Broker Key Specifications

The Forex broker with 12+ years of experience offers segregated accounts, fast execution, and MAM / PAMM solutions.

Broker | MYFX Markets |

Account Types | Standard, Pro, Micro |

Regulating Authorities | FSA, Union of Comoros Offshore Finance Authority |

Based Currencies | USD, JPY, AUD, GBP, EUR |

Minimum Deposit | From $0 |

Deposit Methods | Visa, MasterCard, Wire Transfer, Skrill, Neteller, Bitcoin, Ethereum |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | No |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Indices, Commodities, Cryptos |

Spread | From 0.0 pips |

Commission | From $0.0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Commission-free accounts, Crypto CFDs, Mobile trading, MAM/PAMM solutions |

Affiliate Program | Yes |

Bonus & Promotions | Cashback, Affiliate |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Call Center, Ticket, Email |

Customer Support Hours | 24/7 |

MYFX Markets Account Types

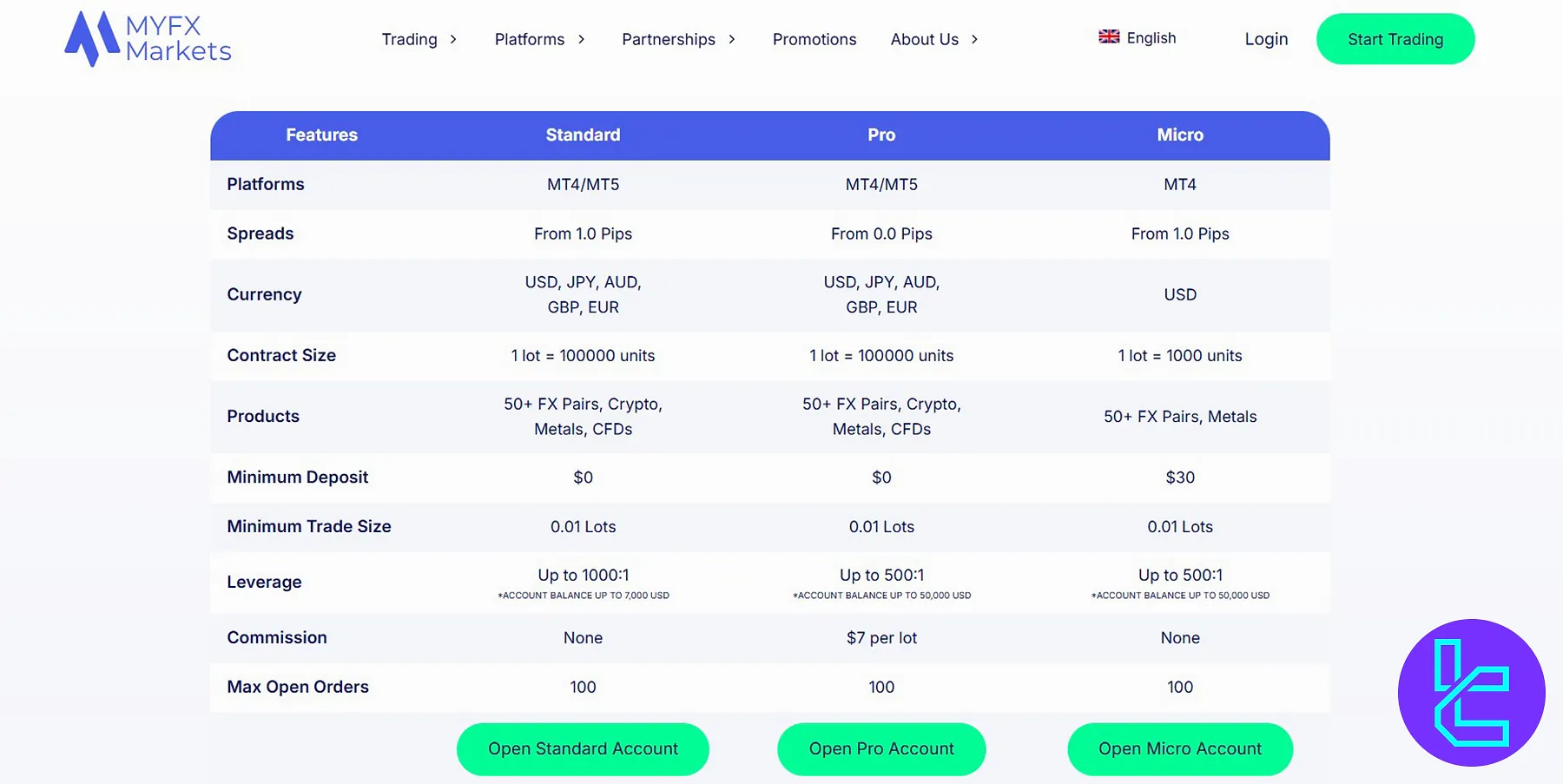

The broker offers 3 main account types, including Standard, Pro, and Micro with various leverage options, minimum deposits, and platforms.

Features | Standard | Pro | Micro |

Platforms | MT4 / MT5 | MT4 / MT5 | MT4 |

Max Open Orders | 100 | 100 | 100 |

Base Currency | USD, JPY, AUD, GBP, EUR | USD | |

Products | FX Pairs, Crypto, Metals, Index CFDs | FX Pairs, Metals | |

Min Deposit | $0 | $0 | $30 |

Max Leverage | 1:1000 | 1:500 | 1:500 |

Min Trade Size | 0.01 Lots | 0.01 Lots | 0.01 Lots |

Spreads From (Pips) | 1.0 | 0.0 | 1.0 |

Commission | $0 | $7 | $0 |

Maximum Account Balance | $7,000 | $50,000 | $50,000 |

Each account type is designed to accommodate different trading styles and experience levels, allowing traders to choose the option that best suits their needs.

MYFX Markets Islamic Account

The broker offers Islamic accounts, also known as swap-free accounts, which are designed for traders who adhere to Islamic finance principles and do not want to incur interest (swap) charges on overnight positions.

These accounts are offered in accordance with Sharia law, which prohibits the charging or paying of interest. Instead of swaps, MYFX Markets charges an administration fee on overnight positions in their Islamic accounts.

Note: To open an Islamic account, eligible customers must contact the broker’s support team.

MYFX Markets Pros & Cons

The broker offers a regulated framework to trade five asset classes with tight spreads from 0.0 pips and fast execution speed with servers located in the NY4 and TY3 data centers in New York and Tokyo.

To have a balanced view, let’s weigh the advantages of MYFX Markets against its disadvantages.

Pros | Cons |

High leverage up to 1:1000 | Limited trading instrument offerings |

Multiple account types for different traders | Limited educational resources |

User-friendly MT4 and MT5 platforms | No tier-1 regulatory licenses |

No minimum deposit requirement | High minimum amount for deposit methods ($200) |

While MYFX Markets offers attractive trading conditions and a robust platform, the lack of top-tier regulation and some negative customer experiences are factors to consider before opening an account.

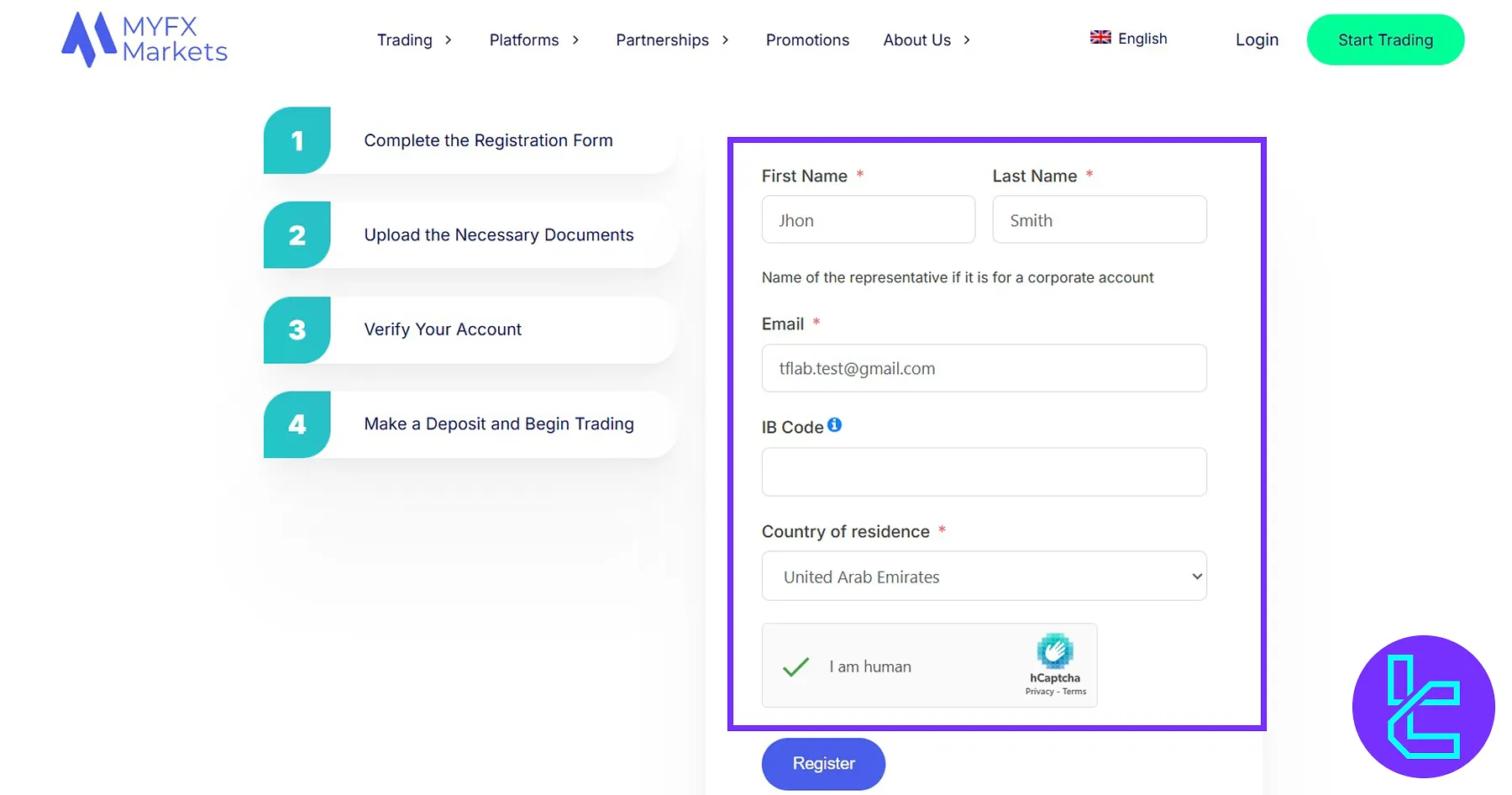

MYFX Markets Broker Sign Up and KYC

The MYFX Markets registration takes less than 3 minutes allowing traders to access various markets through 5 account types. Here’s a step-by-step guide to the sign-up process:

#1 Visit MYFX Markets Website

Navigate to the broker’s official website and click “Start Trading” to reach the application form.

#2 Fill out the Registration Form

Fill in your personal information, including:

- First name

- Last name

- Email address

- Country of residence

Note: If using the domains below, add “@myfxmarkets.com” to your safe sender list before registering:

- @hotmail.com

- @live.jp

- @outlook.com

- @iCloud.com

- @biglobe.ne.jp

#3 Verify Your Email Address

Click the verification link sent to your email or use the OTC to activate your trading account and access the client portal.

#4 Complete the KYC Process

To fully activate your account, you must go through a Know Your Customer (KYC) procedure. Navigate to the “Verification” menu in your dashboard and upload supporting documents, including:

- Proof of Identity: Passport or Driving License

- Proof of Address: Utility bill or Bank statement

Once your account is verified, you can fund it and start trading. MYFX Markets aims to process KYC documents quickly, usually within 24-48 hours.

MYFX Markets Trading Platforms

The broker provides access to industry-standard MetaTrader 4 and MetaTrader 5 platforms from MetaQuotes offering the following features:

MYFX Markets MetaTrader 4 (MT4)

- User-friendly interface

- Advanced charting tools

- Wide range of technical indicators

- Support for Expert Advisors (EAs)

- Available for desktop, web, and mobile

- MT4 Android

- MT4 iOS

MYFX Markets MetaTrader 5 (MT5)

- More advanced features than MT4

- Built-in economic calendar

- Market depth display

- Enhanced order execution

- Available for desktop, web, and mobile

- MT5 Android

- MT5 iOS

Both platforms provide traders with a comprehensive suite of tools for market analysis, trade execution, and account management. The choice between MT4 and MT5 often depends on individual trading preferences and strategies.

Note: MYFX Markets only offers Micro accounts through the MT4 platform.

TradingFinder has developed various MT4 indicators and MT5 indicators that you can use for free.

MYFX Markets Fees and Commissions

While there are no non-trading costs, including deposit / withdrawal / inactivity fees, the broker offers competitive pricing structures across its account types:

- Standard: No commission, spreads from 1.0 pips

- Pro: $7 commission per lot, spreads from 0.0 pips

- Micro: No commission, spreads from 1.0 pips

MYFX Markets strives to maintain transparency in its fee structure, allowing traders to make informed decisions based on their trading style and volume.

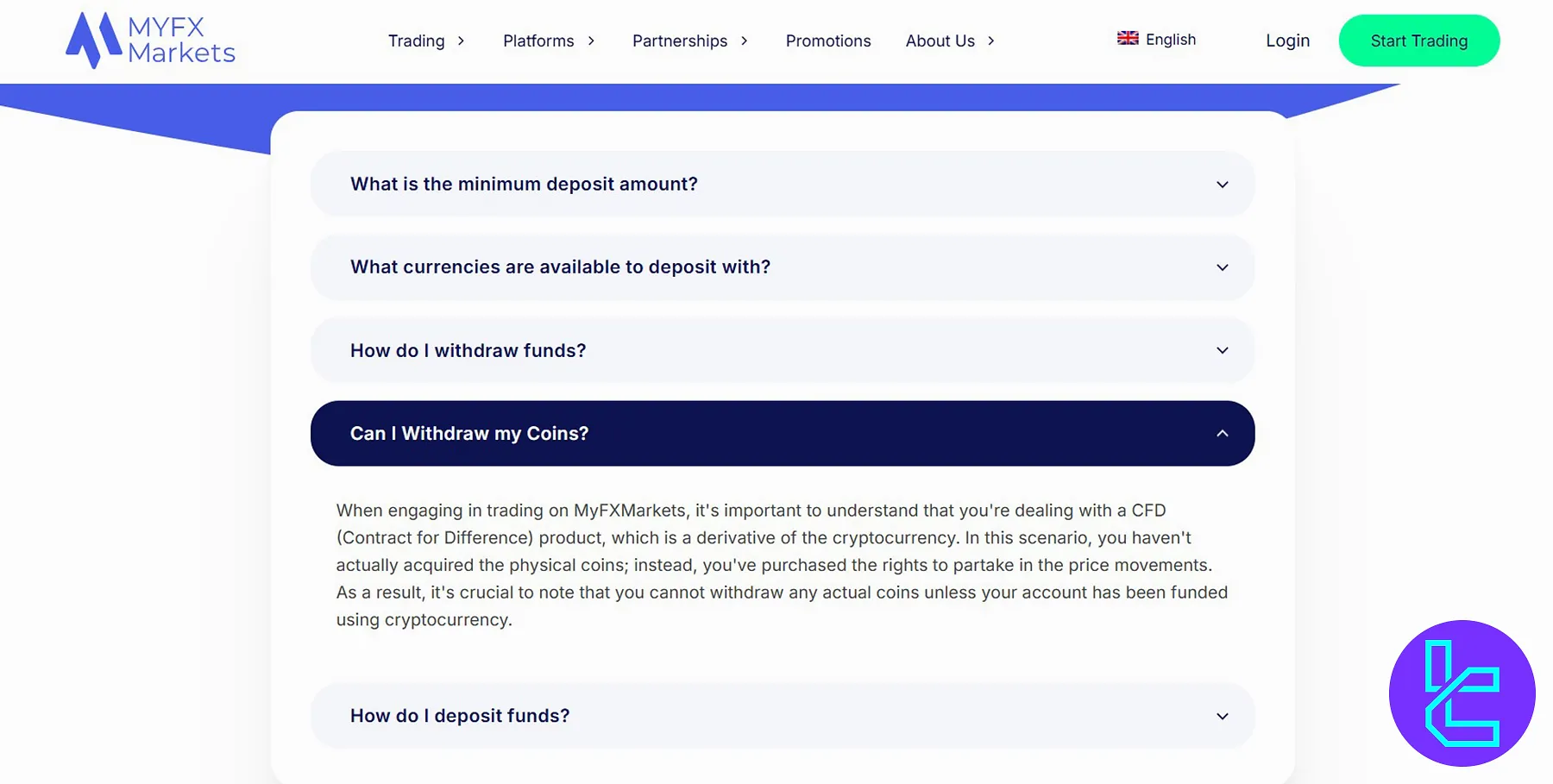

MYFX Markets Broker Payment Methods

The platform accepts deposits in various currencies, including USD, AUD, JPY, EUR, and GBP.

While there are various methods for funding an account, the only available option for withdrawals is bank transfer to an account in the client’s name. MYFX deposit methods:

- Credit/Debit Cards: Visa and MasterCard

- Bank Wire Transfer

- E-wallets: Skrill and Neteller

- Cryptocurrencies: Bitcoin and Ethereum

Note: The minimum deposit for all payment methods is $200.

By offering a range of payment options, MYFX Markets aims to provide flexibility and convenience for its global client base. However, traders should be aware of any potential fees associated with their chosen payment method and factor these into their overall trading costs.

MYFX Markets Investment and Growth Plans

While the company doesn’t offer a copy trading service or investment bundles, it features a comprehensive MAM program for money managers. Strategy providers can manage all of their slave accounts through the MT4 platform and set flexible performance fees.

MYFX Markets Tradable Assets

The broker offers access to over 50 trading instruments across four asset classes, from the Forex market to Cryptocurrencies.

- Currency Pairs: 24/5 trading of major and minor FX pairs

- Commodities: Metals (gold and silver) and energies (WTI and BRENT)

- Indices: CFDs on global indices with leverage options of up to 1:500

- Cryptocurrencies: CFDs on Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple with a maximum leverage of 1:5

MYFX Markets Broker Promotional Programs

The platform features a promotion center offering seasonal bonus programs. At the time of writing this MYFX Markets review, the only available campaign is the “Summer Cash Frenzy”, with the following specifications:

- Cashback of up to $3,000

- Available till July 4th, 2025

- Based on trading volume (excluding USD/JPY pairs and Gold)

- Only on MT5 Standard or Pro accounts

You can use the TradingFinder Forex Rebate Calculator to get an estimate on your cashback rewards.

MYFX Markets also has implemented various partnership programs, including:

- Introducing Broker (IB): Commissions based on the trading activity of referred clients

- Money Manager (MAM): Customizable performance fee-based MAM solutions integrated with the MetaTrader 4 platform

- EA Vendor Program: Up to $1,000 of Real account trading credit for Expert Advisor (EA) providers

MYFX Markets Customer Support

One of the biggest letdowns in this MYFX Markets review is the lack of an online chat feature. However, the broker provides a dedicated call center and ticket system.

- Phone Number: +6498894022

- Email Address: customer.service@myfxmarkets.com

- Ticket System: Available on the “Contact Us” page

MYFX Markets Geo-Restrictions

Regulated by the FSA of Seychelles, the broker does not provide services to residents or citizens of certain jurisdictions, including but not limited to:

- the United States

- Australia

- Canada

- Japan

- the European Union

- the Islamic Republic of Iran

- North Korea

- Belize

- Russia

In addition, residents of the following regions may face restrictions:

- Albania

- Barbados

- Burkina Faso

- Cambodia

- Cayman Islands

- Haiti

- Jamaica

- Malta

- Mauritius

- Myanmar

- Nicaragua

- Panama

- Senegal

- South Sudan

- Syria

- Yemen

- Zimbabwe

MYFX Markets Trust Scores

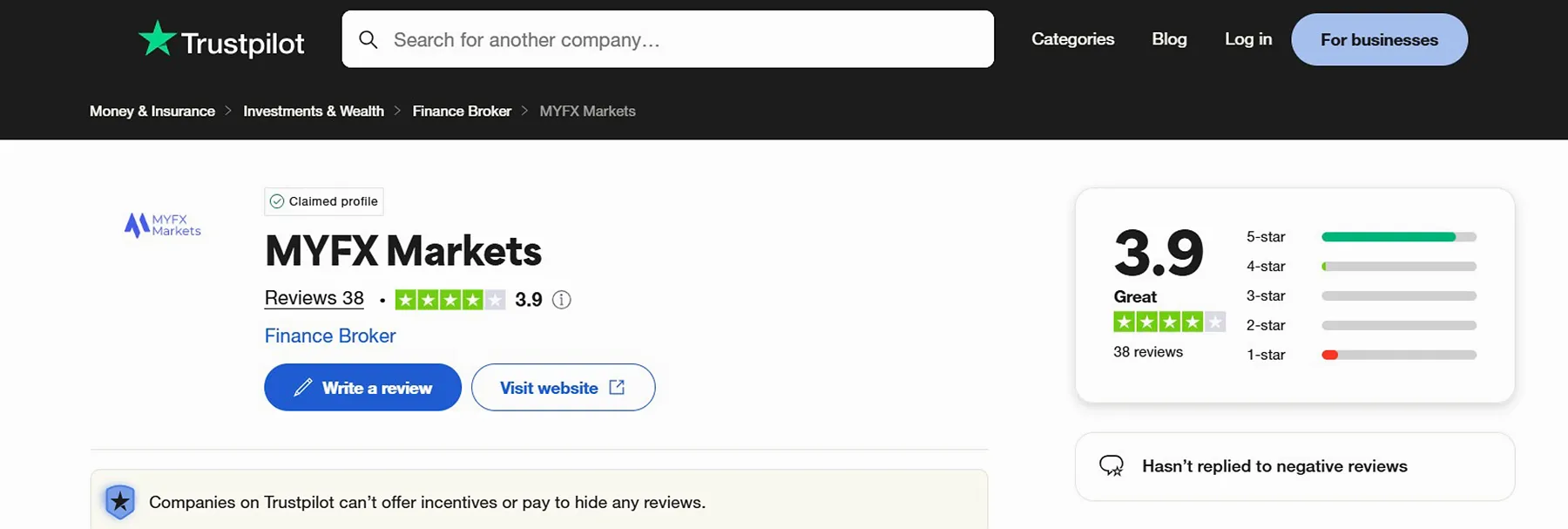

The broker has received great feedback on review websites. The MYFX Markets Trustpilot profile features 38 comments, 90% of which are positive (4-star and 5-star) and only 10% are negative (1-star). It has a great score of 3.9 out of 5.

MYFX Markets reviews mostly praise tight spreads, fast execution speed, and limited slippage. However, negative comments complain about:

- Restrictions on trading strategies like “Latency Trading”

- Limited support channels

- Slow withdrawal processing

- Closing all open positions on the account when requesting a withdrawal

MYFX Markets Broker Education

The platform offers learning materials through its blog, covering a wide range of topics, from market insights to technical analysis. However, the MYFX blog is completely in Japanese. The broker also provides access to various trading tools, such as:

- Signal Centre: Integrated with MetaTrader 4 and MT5 providing up to 50 signals per day

- Economic Calendar: Acuity economic calendar to track global macroeconomic events

However, the educational offerings are somewhat limited compared to some competitors. Traders looking for more comprehensive educational materials may need to supplement with external resources.

You can check TradingFinder’s Forex education and Crypto tutorial sections for additional free resources.

MYFX Markets Compared to Major Brokers

We will investigate how MYFX Markets fares against the top brokerages in the industry in the table below:

Parameter | MYFX Markets Broker | |||

Regulation | FSA | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Min Spread | From 0.0 pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | From $0.0 | From $3.0 | From $0.0 | From $0.2 |

Min Deposit | $0 | $200 | $100 | $10 |

Max Leverage | 1:1000 | 1:500 | 1:500 | Unlimited |

Trading Platforms | MT4, MT5 | MT4, MT5, cTrader, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Pro, Micro | Standard, Raw Spread | Standard, Pro, Raw+, Elite | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Instruments | 50+ | 2,250+ | 270+ | 230+ |

Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

MYFX Markets provides access to 50+ trading instruments with leverage options of up to 1:1000. It offers Micro accounts on the MT4 platform with a minimum deposit of $30 and spreads from 1.0 pips. The broker has a 3.9 out of 5 trust score on Trustpilot.