OANDA US offers trading services for over 68 major, minor, and exotic currency pairs and 8 cryptocurrencies in MetaTrader 4, TradingView, and the OANDA platform.

OANDA US Standard and Elite accounts have 2.0 pips average spreads with trading commissions from $0.01.

OANDA US Company and Regulatory Information

OANDA US was founded in 1996 in New York. Over the years, this award-winning global company has expanded its reach, opening offices in key financial hubs likeLondon, Singapore, and Australia.

OANDA's commitment to transparency and client protection is evident in its robust regulatory framework. The group of companies are overseen by several prestigious financial authorities worldwide, including:

- National Futures Association (NFA)

- Commodity Futures Trading Commission (CFTC)

- Financial Conduct Authority (FCA)

- Malta Financial Services Authority (MFSA)

- Monetary Authority of Singapore (MAS)

- Australian Securities and Investments Commission (ASIC)

- Financial Futures Association of Japan (FFAJ)

- British Virgin Islands Financial Services Commission (BVIFSC)

However, this review will be focused on the American branch, which operates under the supervision of the NFA and CFTC.

OANDA provides access to a diverse selection of markets, including forex, commodities, stock CFDs, metals, indices, ETFs, bonds, and cryptocurrencies.

In the United States, cryptocurrency trading is offered in partnership with Paxos Trust, enabling clients to purchase actual digital assets rather than CFDs.

| Entity Parameters/Branches | OANDA Corporation |

Regulation | NFA, CFTC |

Regulation Tier | 1 |

Country | United States |

Investor Protection Fund/Compensation Scheme | No |

Segregated Funds | Yes |

Negative Balance Protection | No |

Maximum Leverage | 1:50 |

Client Eligibility | US |

OANDA US Broker Summary of Specifications

To fully understand OANDA US Forex broker's position among other platforms, let’s review its key specifications:

Broker | OANDA US |

Account Types | Standard, Elite Trader |

Regulating Authorities | CFTC, NFA |

Based Currencies | USD |

Minimum Deposit | $0 |

Deposit Methods | Credit/Debit Cards, ACH Bank Transfers, Wire Transfers, Bpay |

Withdrawal Methods | Credit/Debit Cards, bank transfer |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:50 |

Investment Options | No |

Trading Platforms & Apps | OANDA web, OANDA app, TradingView, MT4 |

Markets | Forex, cryptocurrencies |

Spread | Floating average around 2.0 pips |

Commission | Starts from $0.01 |

Orders Execution | Market |

Margin Call/Stop Out | 50%/50% |

Trading Features | Forex calculator |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, phone, SMS |

Customer Support Hours | Monday to Friday, 6 am to 8 pm |

Restricted Countries | North Korea, Lebanon, Iran, Syria |

OANDA US Account Types Review

OANDA US offers two primary account types to cater to different trading needs and volumes:

- Standard: Designed for everyday traders, this account has no minimum deposit requirement. It uses a spread-only pricing model and provides access to all core features;

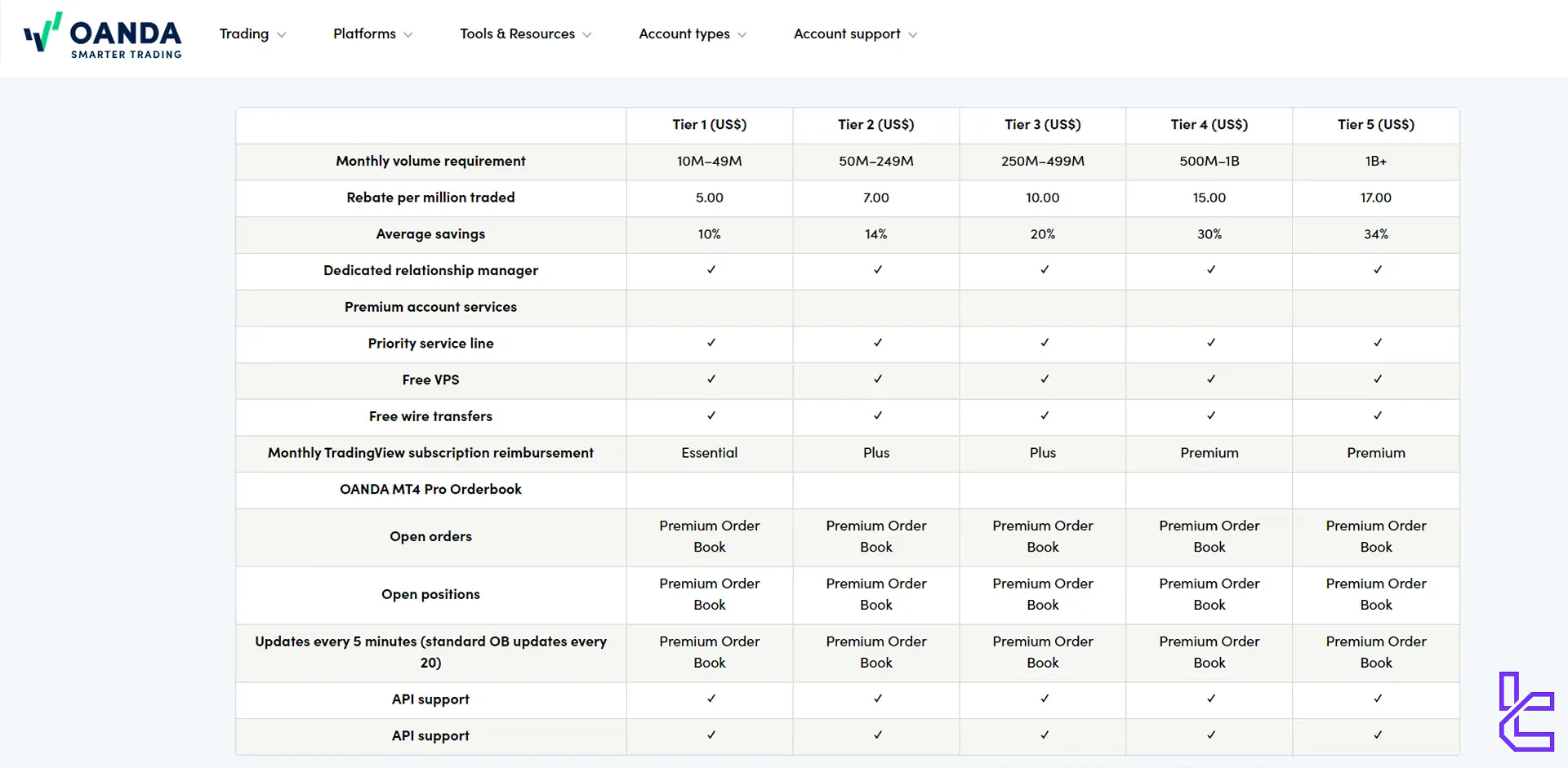

- Elite Trader: Geared toward high-volume professionals, this account requires a minimum deposit of $10,000 and a monthly trading volume of $10 million.

Eligible traders for Elite accounts enjoy benefits such as tighter spreads, volume-based cash rebates, and a dedicated relationship manager.

This flexible structure ensures that both casual and institutional traders find an account model aligned with their needs.

OANDA US Elite is perfect for high-volume traders

OANDA US Elite is perfect for high-volume traders

OANDA Account Type Comparison

Features | Standard | Elite |

Trading platform | OANDA web, OANDA app, TradingView, MT4 | OANDA web, OANDA app, TradingView, MT4 |

Average spread | 2.0 pips | 2.0 pips |

Commission | No | Yes |

Tradable instruments | FX, cryptocurrencies | FX, cryptocurrencies |

Minimum trading volume | No | From $10M per month |

OANDA US Benefits and Drawbacks

Let's take a balanced look at the pros and cons of trading with OANDA US:

Advantages | Disadvantages |

Strong Regulation | Limited tradable instruments |

User-Friendly Mobile App | Higher than average spreads |

Inactivity fee | - |

Support isn’t available 24/7 | - |

OANDA US Sign Up & Verification Process Guide

Joining OANDA US is designed to be quick and regulatory-compliant, providing traders access to forex and CFD markets under strict US financial oversight.

The process involves identity verification, tax compliance, and employment disclosure to meet regulatory standards.

#1 Access the OANDA US Website

Go to the official OANDA US site and click on the “Start Trading” button to begin.

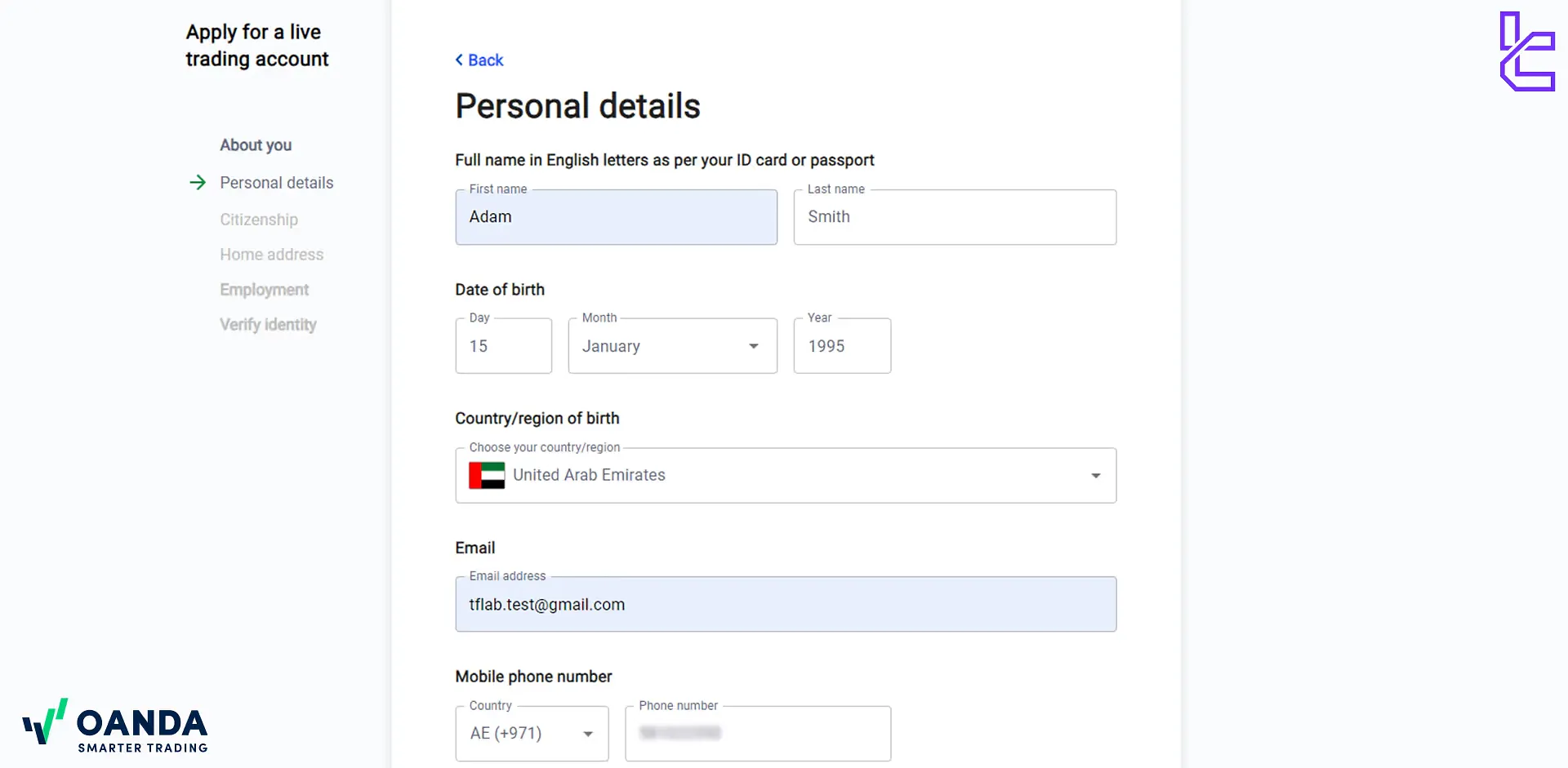

#2 Provide Personal Information

Fill out the registration form with the following information:

- Full name

- Date of birth

- Country of birth

- Email address

- Phone number

- Account password

Enter your personal details to register in OANDA US broker

Enter your personal details to register in OANDA US broker

#3 Verify Citizenship & Tax Information

Select your citizenship status, input your Social Security Number (SSN) or Tax ID, and complete required tax declarations for compliance with U.S. law.

#4 Enter Residential Details

Type in your residential details:

- Street address

- City

- State

- ZIP code

#5 Disclose Employment Details

Provide your employment status, occupation, and possibly employer information as required by OANDA’s regulatory obligations.

#6 Upload Verification Documents

Submit supporting documents to finalize your account setup and start trading.

- Proof of Identity: Passport or Driver’s license

- Proof of Address: Utility bill or Bank statement

OANDA US Available Trading Platforms

OANDA US provides a suite of powerful trading platforms to suit different trading styles and preferences.

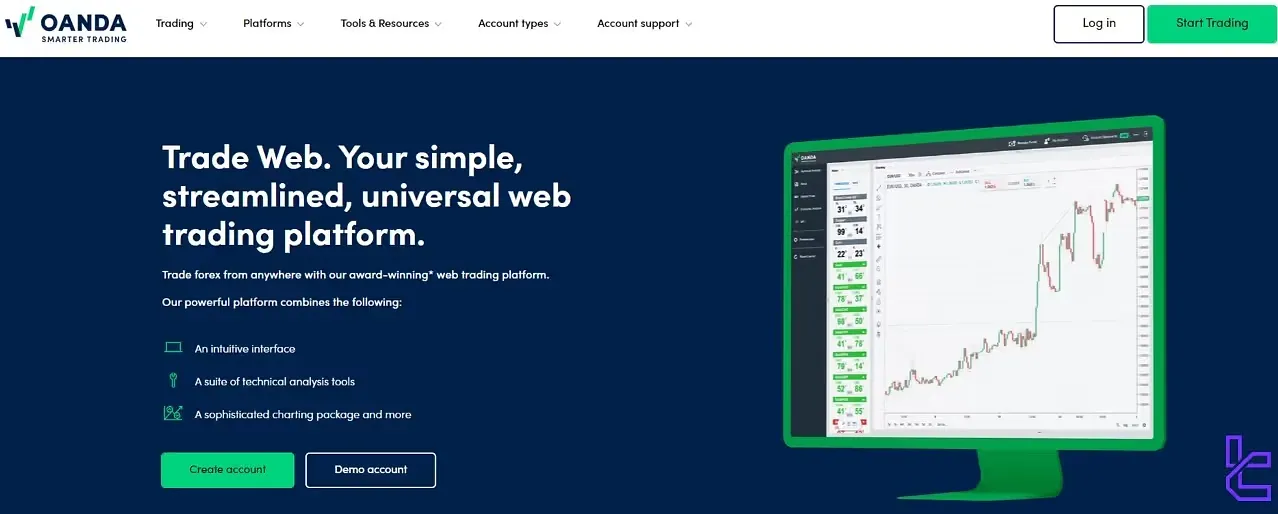

OANDA Trade Web Platform

OANDA's primary trading platform is OANDA Web, which offers an all-in-one package for traders. Key features of this platform include:

- Fully customizable web-based trading platform

- Advanced charting and technical analysis tools

- Real-time market data for news trading

OANDA Mobile

OANDA mobile is designed for traders who prefer trading on the go. Main features of OANDA mobile:

- Available for iOS and Android devices

- Seamless trading wherever you go

- Access to full account functionality

Links:

MetaTrader 4 (MT4)

MetaTrader 4 is the most well-known trading platform used by traders worldwide. Key features of this trading platform:

- Popular third-party platform

- Advanced trading tools

- Customizableindicators and expert advisors

Links:

TradingView

TradingView is a modern trading platform with a variety of different features, including:

- Integrated third-party platform

- Powerful charting capabilities

- Social trading features

Additional tools include VPS hosting for automation, REST and FIX API access for custom algorithmic trading, and integration with third-party tools such as Autochartist.

TradingFinder has developed various MT4 indicators and TradingView indicators that you can use for free.

OANDA US Broker Trading Costs (Spreads and Commissions)

OANDA US offers flexible pricing options to cater to different trading styles:

OANDA Spread-Only Pricing

- Pay only the bid-ask spread

- No additional commissions

- Suitable for traders who prefer simplicity

OANDA Commission Plus Core Spread

- Lower spreads

- Fixed commission of $5 per $100,000 traded per side (equivalent to $10 per round trip)

- Ideal for high-volume traders

- Minimum deposit requirement of $10,000

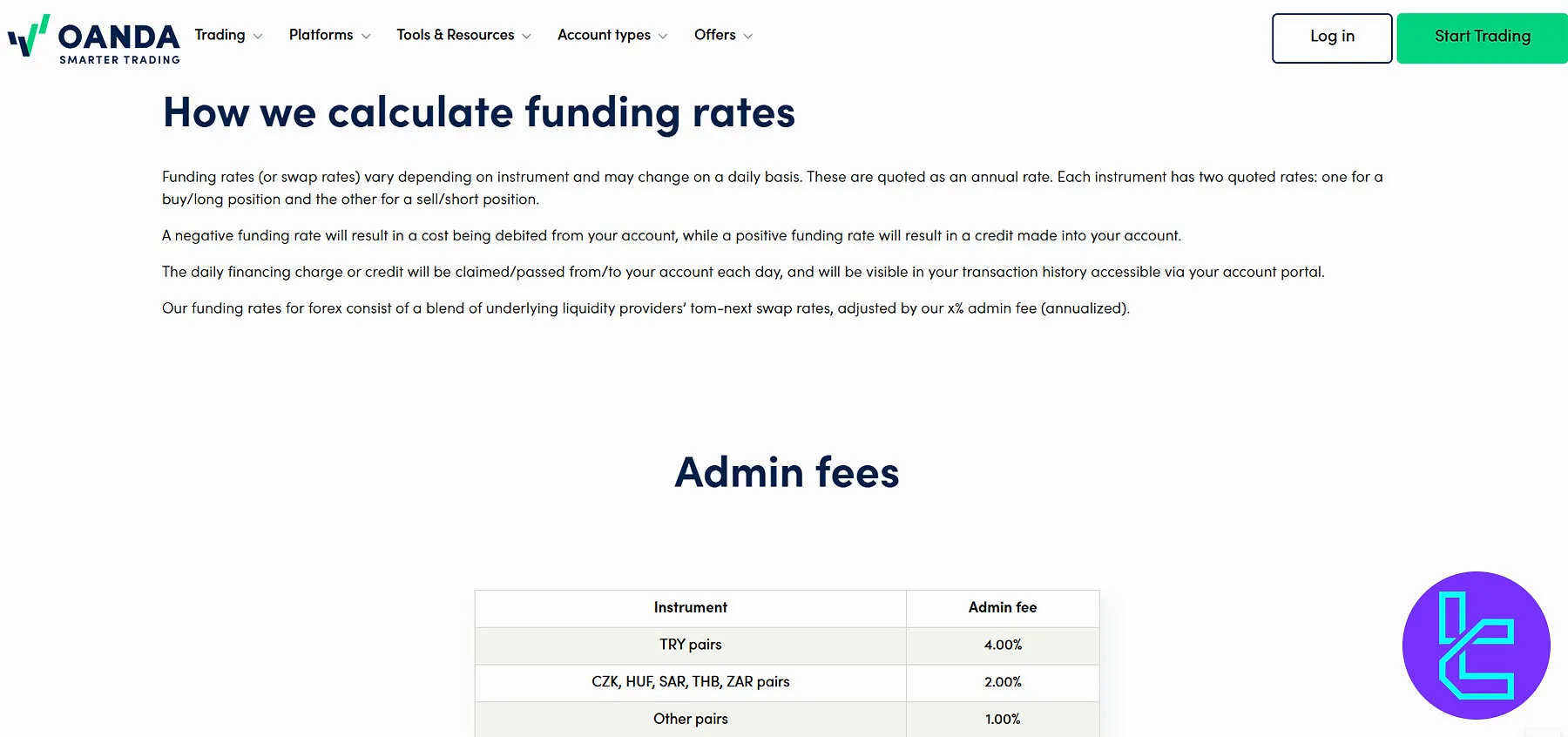

OANDA US Swap Fees

OANDA applies a daily financing adjustment to overnight positions held past 5 p.m. ET. This may result in a cost or credit based on trade direction, currency pair, and prevailing funding rates, including admin fees.

Rates are dynamic and reflect liquidity provider inputs and settlement timing.

- Rates differ for long vs. short positions

- Triple charge on Wednesdays for weekend rollover

- Admin fee: 1–4% based on currency

- Formula:

OANDA US Non-Trading Costs

Compared to other brokers, OANDA has higher fees, which could significantly impact traders’ profitability.

The broker also charges a monthly $14 dormant fee after 12 months of inactivity, which is a major downside for semi-active traders.

OANDA US Broker Deposits & Withdrawals

OANDA US provides several convenient options for deposits and withdrawals:

- Credit/Debit Cards

- ACH Bank Transfers

- Wire Transfers

- Bpay

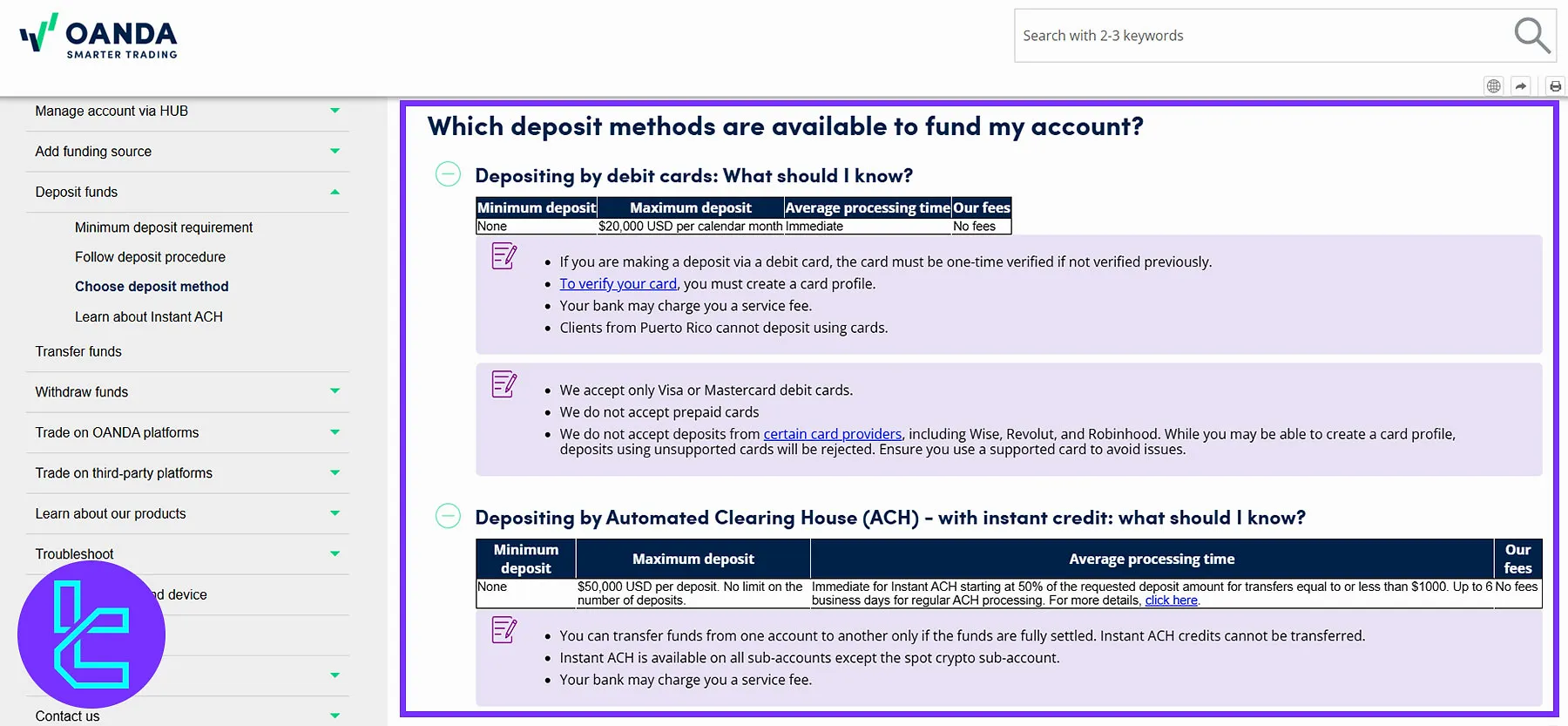

OANDA US Deposit Options

OANDA offers several deposit methods, including debit card, ACH, and wire transfer, each with specific processing times and conditions.

While OANDA charges no deposit fees, banks may apply service charges. Some restrictions apply depending on region, card type, and account type.

Deposit Methods | Min Deposit | Max Deposit | Processing Time | OANDA Fees |

Debit Card | None | $20,000 USD per calendar month | Immediate | None |

ACH (Instant/Cleared) | None | $50,000 USD per deposit (unlimited deposits) | Immediate (50% credit ≤ $1000), up to 6 business days for full clearance | None |

Wire Transfer | None | None | 1–3 business days (domestic), up to 5 days (international) | None |

Crypto Wallets | Not supported | Not supported | – | – |

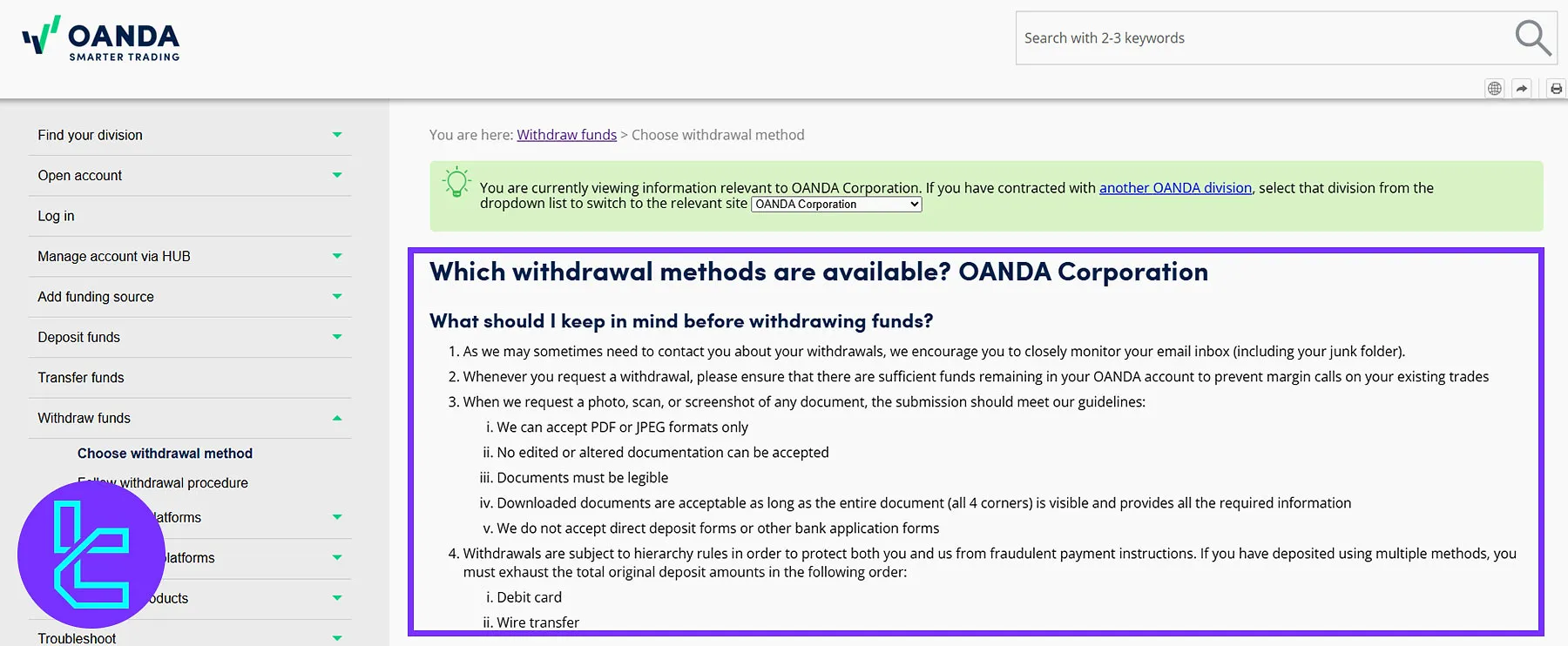

OANDA US Withdrawal Methods

OANDA supports withdrawals via debit card and wire transfer, with strict identity and source verification to ensure compliance and security.

Withdrawals follow a hierarchical rule, prioritizing the original deposit method. Processing times vary, and while OANDA charges no fees, your bank may apply service charges.

Withdrawal Methods | Processing Time | Withdrawal Fee |

Debit Card | 1–3 business days | 0% |

Wire Transfer | 1–5 business days | 0% |

To withdraw funds from OANDA US, follow these steps:

- Choose the account you want to withdraw from;

- Click on "Withdrawal" and choose your preferred withdrawal method;

- Enter the necessary information and thewithdrawal amount;

- The amount will be deducted from your account balance.

Copy Trading & Investment Options Offered on OANDA US

OANDA doesn't offer a dedicated copy trading feature, which could be a drawback, especially for beginner traders who want to use the knowledge and skills of experienced traders. If you insist on using copy trading, we suggest checking out AvaTrade and Pepperstone offerings.

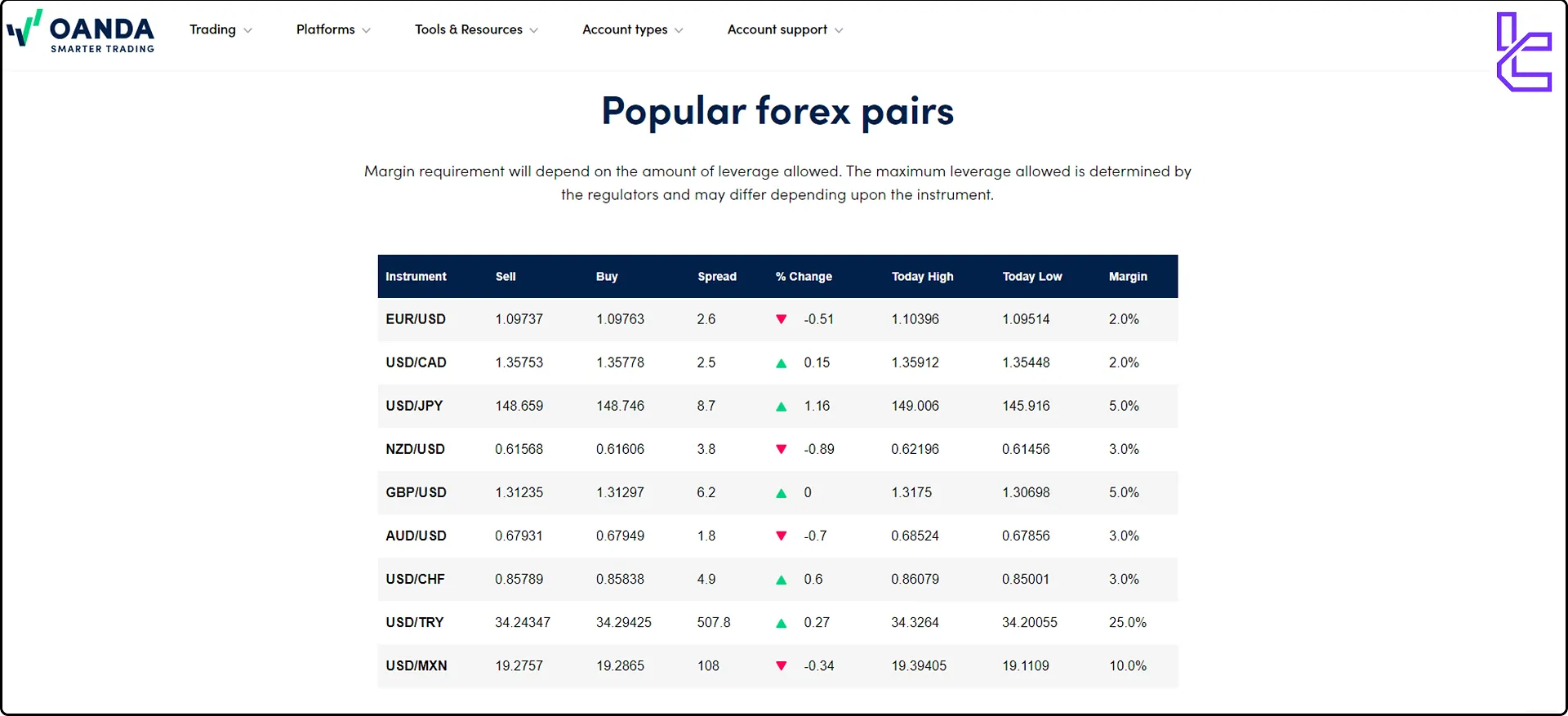

OANDA US Tradable Markets Overview

For U.S. clients, OANDA offers a limited but focused set of tradeable assets across two asset classes, including Forex and Cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 68 | 50 - 70 currency pairs | Major pairs 1:50 Other pairs 1:20 |

Cryptocurrencies | Spot | 8 digital assets (e.g., Bitcoin, Ethereum, etc.) | 20 - 30 instruments | 1:1 |

Through a partnership with Paxos, OANDA US offers access to Bitcoin, Bitcoin Cash, Ethereum, PAX Gold, Litecoin, Aave, Chainlink, Uniwap, and Solana, all against the US dollar.

Unlike international accounts, U.S. traders cannot access commodities, indices, ETFs, stock CFDs, or bond products due to regulatory restrictions.

Despite the limited range, OANDA maintains strong execution speeds and reliable pricing, making it a suitable option for forex market and crypto traders focused on the U.S. market.

OANDA US Broker Bonuses

Unfortunately, OANDA US doesn’t offer bonuses. The welcome and referral bonus is only available for traders outside the CFTC regulations.

Traders outside this zone can receive a $888 welcome bonus by depositing at least $10,000 and meeting the trading requirement for 30 days.

OANDA also has a referral program that allows traders to gain commissions for bringing new traders to the platform.

For active clients, OANDA’s Elite Trader program offers volume-based rebates ranging from $5 to $17 per million traded.

You can use TradingFinder's Forex Rebate Calculator to get an estimate of your cashback earnings.

OANDA US Awards

Over the past several years, the broker has received consistent recognition across multiple independent industry award programs, highlighting strengths in trust, platform quality, research capabilities, and user experience. OANDA US Awards:

- Best Forex Broker in the Americas 2024: TradingView Broker Awards

- Broker of the Year 2023: TradingView Awards

- Best Platform Features: Investment Trends US Leverage Trading Report (2023)

- Best Low Cost Broker 2023: ADVFN International Financial Awards

- Most Popular Broker: TradingView Awards (2020–2022)

- Best Client Satisfaction 2021: Mobile Platform/App – Investment Trends US Leverage Trading Report (Margin Forex)

OANDA US Support Channels

OANDA US provides comprehensive customer support through various channels:

- Email: frontdesk@oanda.com

- Phone: +1 212 858 7690 (Sunday 4 p.m. ET to Friday 6 p.m. ET)

- SMS/Text: +12128587690 (US number)

OANDA's multi-channel support ensures that traders can get assistance through their preferred method of communication.

While response quality is high, the absence of 24/7 coverage may be a downside for international traders or those trading on weekends.

OANDA US Broker Restricted Countries

While OANDA operates in8 regulated markets globally, including the US, there are still regions and countries in which this broker doesn’t provide services, including:

- Iran

- Syria

- North Korea

- Lebanon

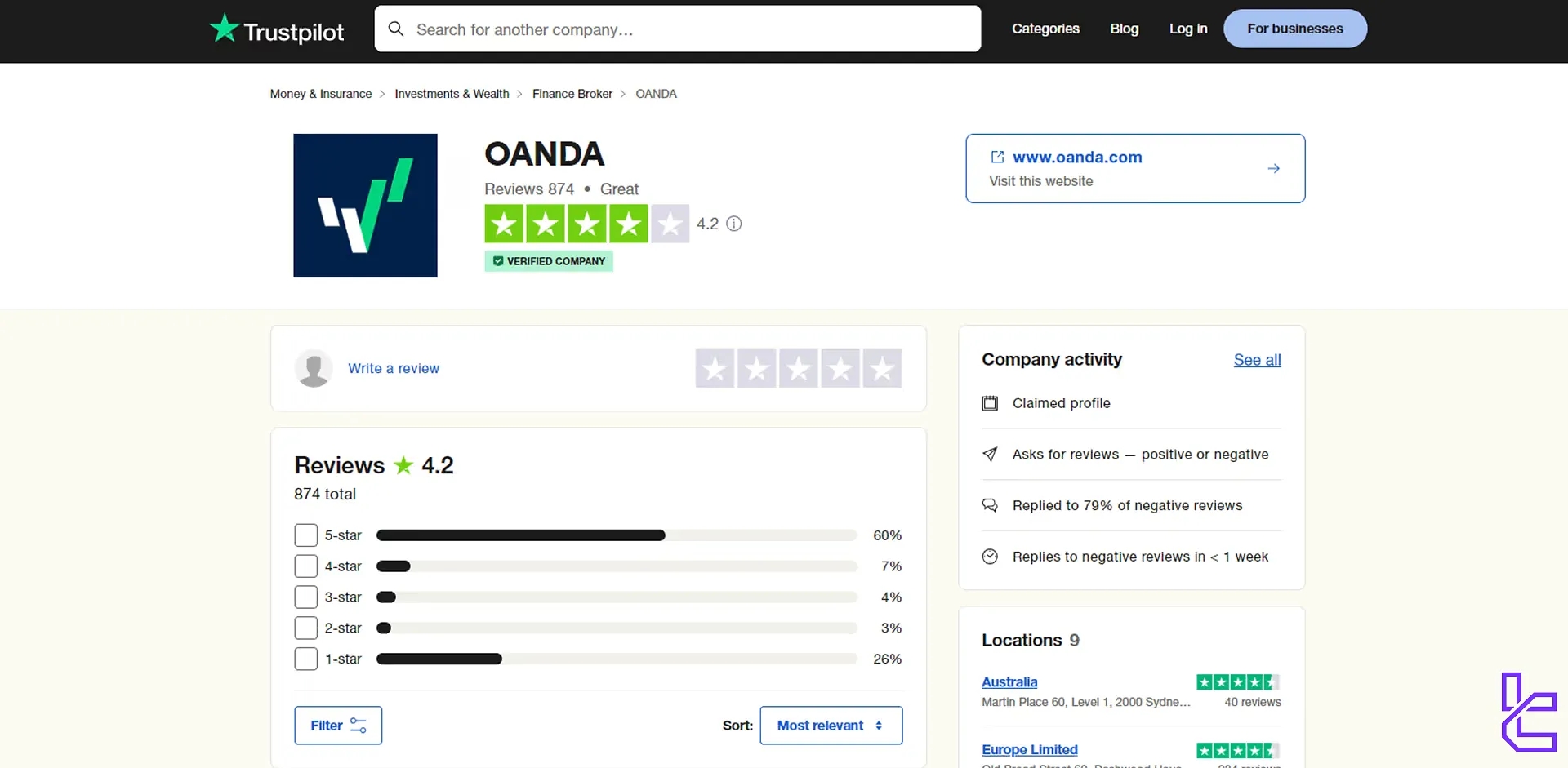

OANDA US Ratings and Trust Scores

The OANDA Trustpilot profile paints the company as a highly trusted forex and CFD broker with a 4.2/5 score based on 874 reviews. This shows that OANDA has created a secure trading environment for traders worldwide.

OANDA US Education Resources

OANDA has launched a comprehensive education portal called "OANDA Learn" to support traders at all levels:

- Wide Range of Resources: Videos, eBooks, webinars, and events

- Topics Covered: Leveraged trading, fundamental and technical analysis, indicators and oscillators, risk management strategies

With over 25 years of industry experience, OANDA's commitment to education is evident in this new portal, which aims to provide traders with the necessary tools and knowledge to develop informed trading strategies.

You can access TradingFinder's Forex education section for additional free resources.

OANDA US Comparison Table

Let's compare OANDA's standing in the trading world with that of top brokers.

Parameter | OANDA US Broker | XM Broker | LiteForex Broker | FXGlory Broker |

Regulation | CFTC, FCA, ASIC, BVI FSC, CIRO, MAS, NFA, FFAJ | ASIC, FSC, DFSA, CySEC | CySEC | No |

Minimum Spread | Average 2.0 pips | From 0.6 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0.01 | $0 (except on Shares account) | From $0.0 | $0 |

Minimum Deposit | $0 | $5 | $50 | $1 |

Maximum Leverage | 1:50 | 1:1000 | 1:30 | 1:3000 |

Trading Platforms | OANDA web, OANDA app, TradingView, MT4 | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Elite Trader | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | 76 | 1400+ | N/A | 45 |

Trade Execution | Market | Market, Instant | Market | Market, Instant |

TF Expert Suggestion

OANDA US’ high regulatory oversight by CFTC and NFA authorities means that the broker has provided a secure trading platform.

However, the brokers’ $14 inactivity fee, low leverage options (1:50 maximum), and higher than industry average spreads (2.0 pips on average) indicate that OANDA US might not offer the best trading conditions for everyone.