OnEquity verification takes less than 5 minutes. You must enter the authentication section, upload proof of identification and address, and wait for document review.

Overview of OnEquity KYC Steps

Verifying your account in the OnEquity broker is a simple 4-step process allowing traders to access all their account features.

OnEquity verification:

- Login and access the KYC section;

- Upload your ID and provide the necessary details;

- Submit proof of address;

- Wait for approval.

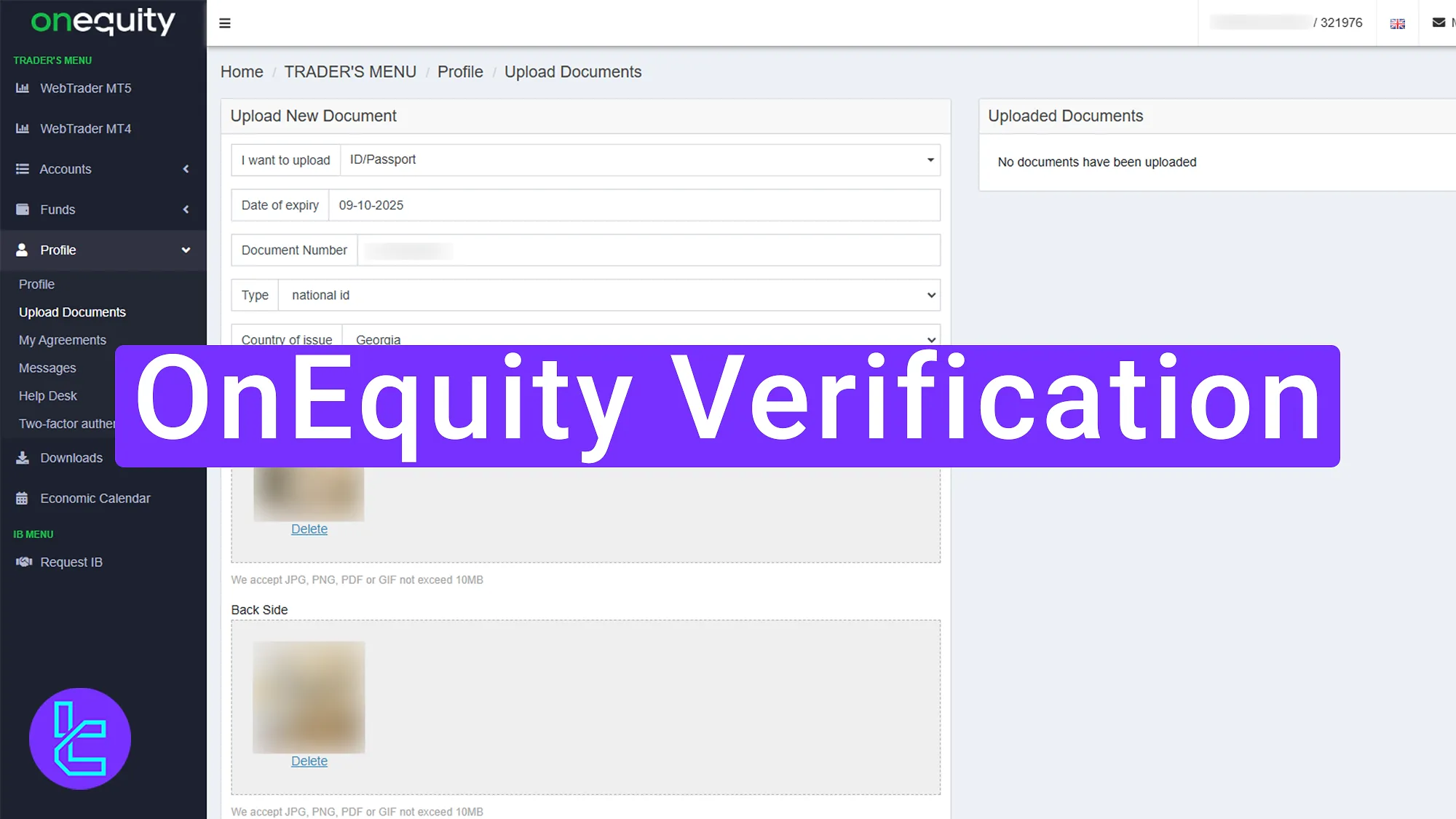

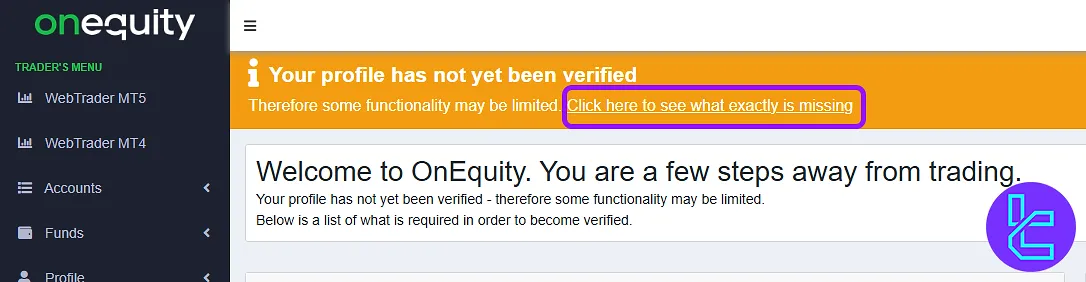

#1 Login and Access the KYC Section

To start the OnEquity user approval process:

- Log into your OnEquity dashboard;

- Choose “Click here to see what exactly is missing”.

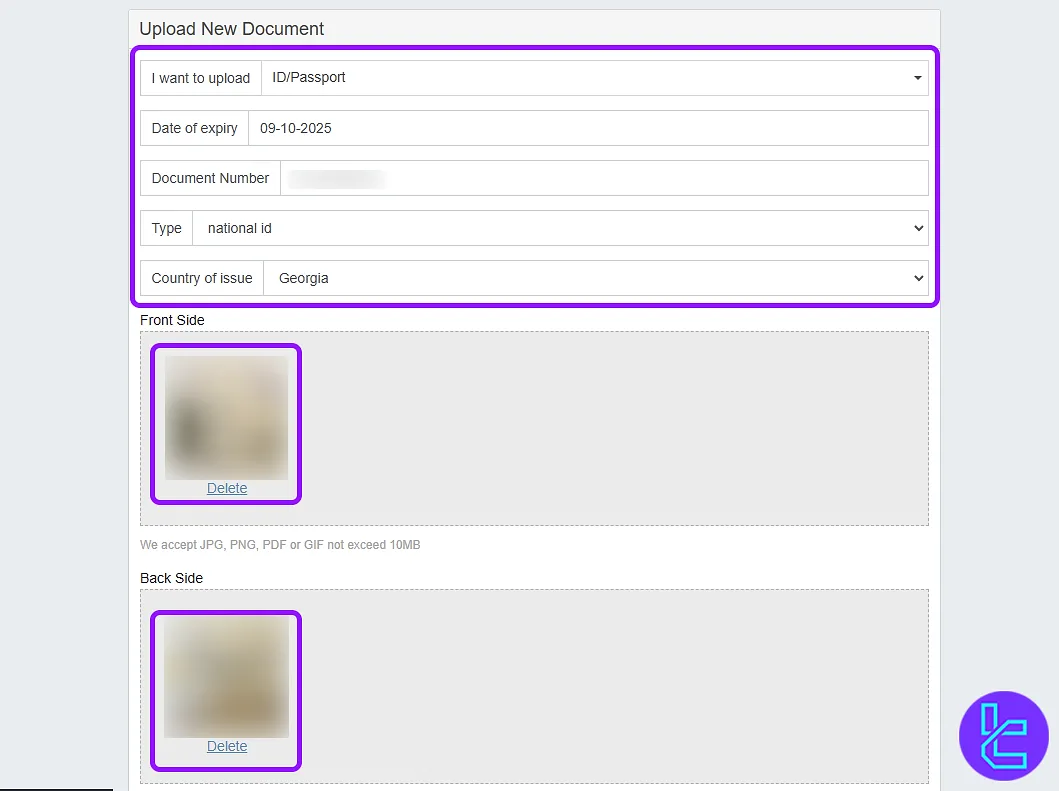

#2 Upload Your ID and Provide Required Information

Select the type of document you want to use for KYC. Accepted option include:

- Passport

- Driving License

- ID Card

Enter the ID number, expiration date, and country of issue, and upload the front and back side of your ID card.

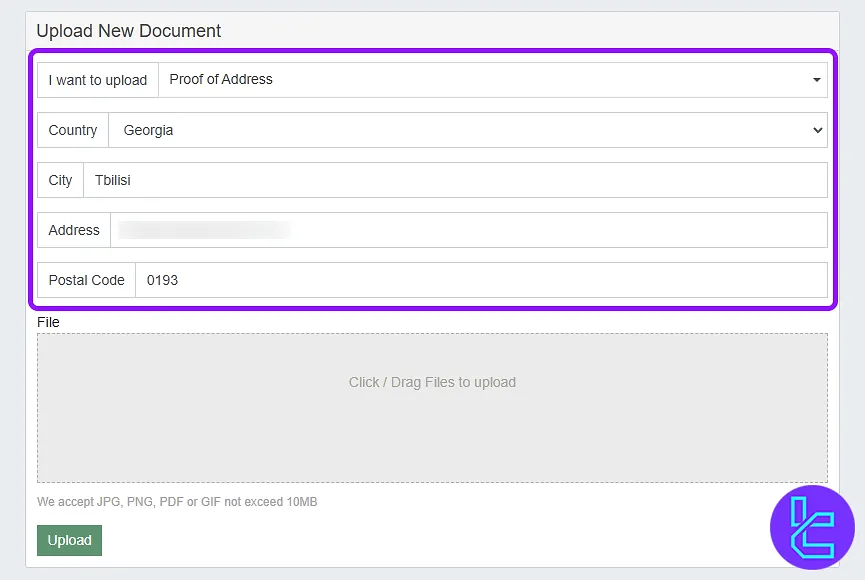

#3 Submit Proof of Address with Correct Information

Now, navigate to the proof of address document upload. Enter the following information:

- Country

- City

- Complete address

- Postal code

Upload a document that is no older than 6 months. After submitting your documents, click "Upload" and wait for review.

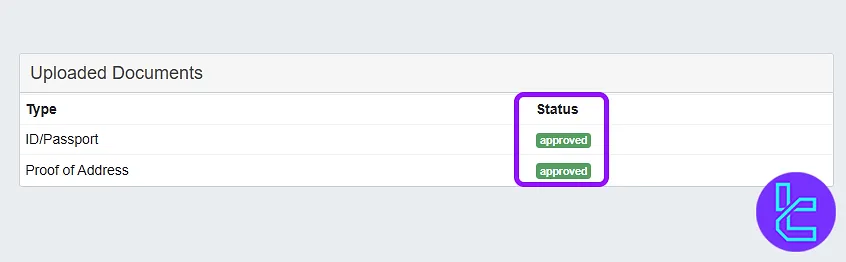

#4 Wait for User approval and Start Trading

The OnEquity KYC process usually takes less than 5 minutes. Once approved, you will receive a confirmation message.

TF Expert Suggestion

OnEquity verification document review and approval takes only 5 minutes. To complete the process, upload a passport, driving license, or ID card for proof of identity (POI) and a utility bill or bank statement for proof of address (POA).

To learn more about the fastest OnEquity deposit and withdrawal methods to fund your newly verified account, visit the OnEquity tutorial page.