In the OnFin broker, traders can choose from multiple account types (ECN, Fix, Mini, and Copy), with commissions as low as $4 per lot (ECN account) or no commission (Fix, Mini, Copy accounts).

Using the MetaTrader 4 (MT4) and MT5 platforms, OnFin ensures compatibility across desktop, Android, and iOS devices.

The broker supports various deposit methods, including SEPA, MasterCard, VISA, Crypto, SticPay, QiWi, and Yoomoney, with zero deposit and withdrawal fees.

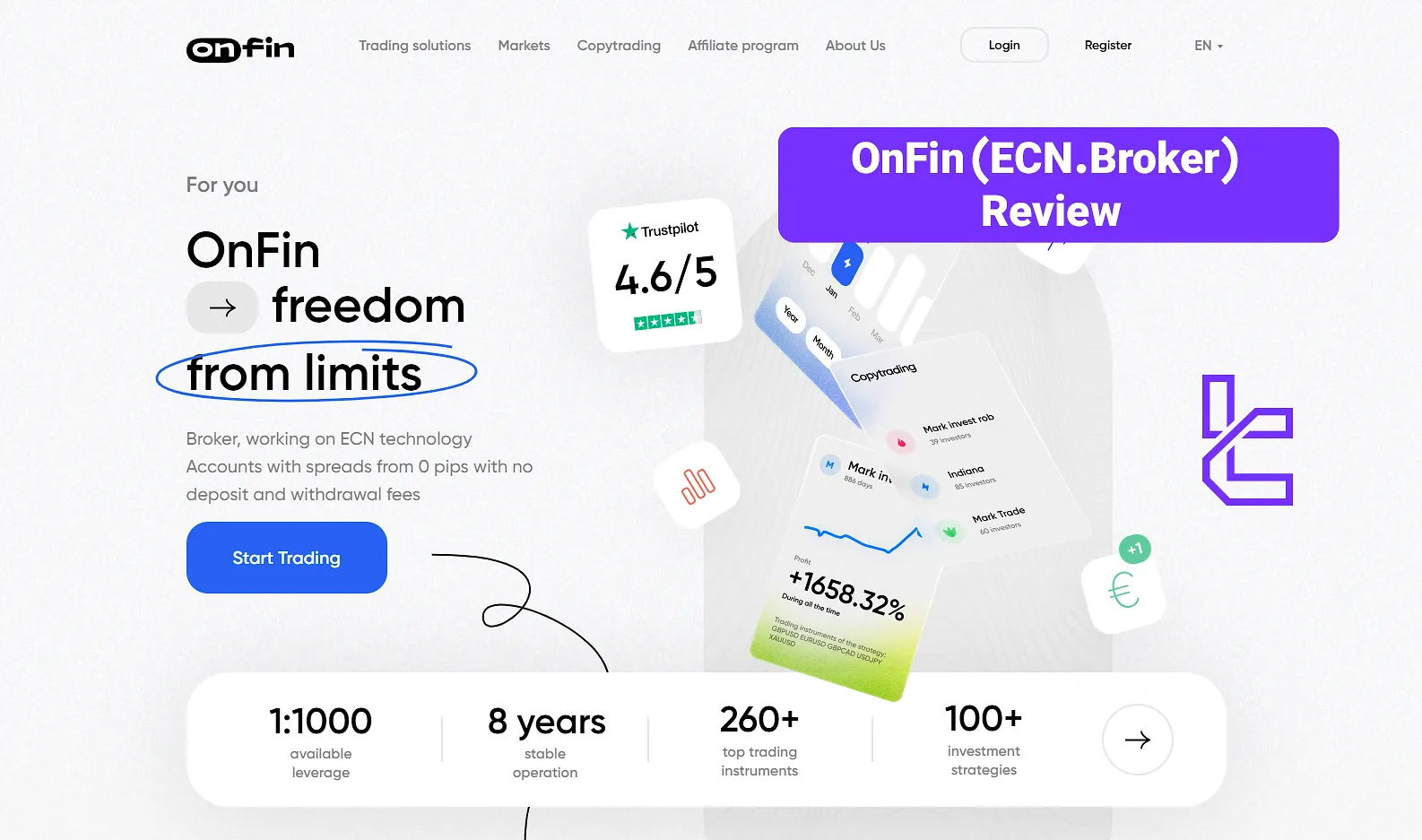

OnFin (Company Information and Regulation)

OnFin Ltd was founded in 2015 on the Island of Mohéli, the Comoros Union. The company is licensed by the MWALI International Services Authority (MISA) with license number “BFX2024038”. Key features of OnFin (formerly known as ECN.Broker):

- 260+ trading instruments

- Up to 1:1000 leverage

- 100+ copy trading strategies

- Utilizes technology of secure connections (SSL)

- Partnership with AMTS Solutions

OnFin Table of Specifications

Through a partnership with AMTS Solutions, the Forex broker has gained access to top liquidity providers, such as Bank of America, UBS Group AG, Barclays, and JPMorgan Chase. Thus, it offers tight spreads from 0.0 pips and fast execution speed. Here are some specific details about OnFin.

Broker | OnFin |

Account Types | ECN, FIX, MINI, COPY |

Regulating Authorities | MISA |

Based Currencies | USD |

Minimum Deposit | $1 |

Deposit Methods | AwPay, SEPA, MasterCard, VISA, Crypto, SticPay, QiWi, Yoomoney |

Withdrawal Methods | AwPay, MasterCard, VISA, Mir, Crypto, SticPay, Perfect Money |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Investment Strategies |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Metals, Indices, Commodities, Shares, Crypto |

Spread | Fixed and Floating |

Commission | $4 on ECN account |

Orders Execution | Market, Instant |

Margin Call / Stop Out | Variable based on the account type |

Trading Features | Copy Trading |

Affiliate Program | Yes |

Bonus & Promotions | IB, Multilevel, Representative |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Phone, Email |

Customer Support Hours | 24/5 |

OnFin Account Types

The broker caters to a diverse range of traders by offering three main account types, each designed to meet specific trading needs and preferences. OnFin also provides a dedicated copy trading account, which we will discuss later in this article.

Features | ECN | Fix | Mini |

Base Currency | USD | USD | USD |

Min Deposit | $50 | $50 | $1 |

Order Execution | Market | Instant | Market |

Margin Call | 100% | 50% | 50% |

Stop Out | 40% | 20% | 20% |

Min Order Size | 0.01 lots | 0.01 lots | 0.01 lots |

Max Leverage | 1:1000 | 1:1000 | 1:1000 |

Swap Free | Available | Available | Available |

OnFin Broker Pros & Cons

To help you make an informed decision, let's examine the advantages and disadvantages of trading with OnFin.

Pros | Cons |

ECN technology for superior execution | Offshore regulation |

Competitive spreads starting from 0.0 points | No support for TradingView platform |

High leverage up to 1:1000 | Lack of educational resources |

No deposit or withdrawal fees | - |

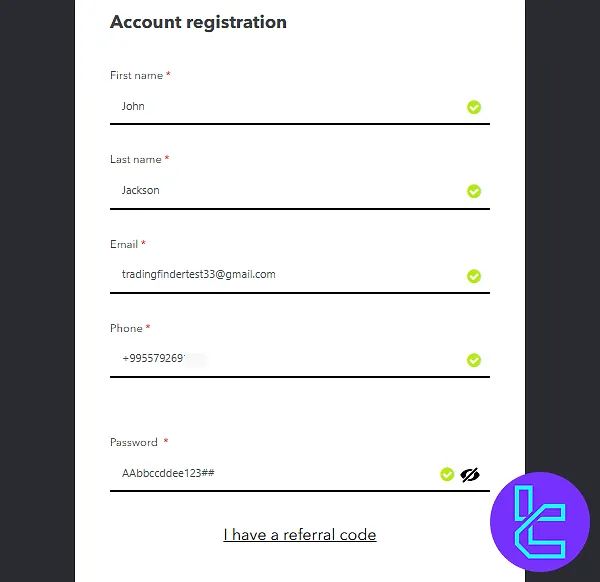

OnFin Account Opening and KYC Verification

The OnFin registration process takes under 4 minutes. The process gives you access to 260+ trading instruments with up to 1:1000 leverage, and includes secure email verification as part of its KYC onboarding.

#1 Start Your Application

Visit the OnFin website and click “Open an Account”. Fill in the application form with the following details:

- First name

- Last name

- Email address

- Mobile number

Create a strong password using uppercase/lowercase letters, digits, and symbols. Add a referral code if available and accept the terms.

#2 Confirm Your Email

A 6-digit verification code will be sent to your inbox. Copy and paste this code into the designated field to verify your email address and activate your OnFin dashboard.

#3 Complete the KYC Procedure

To access the full features of the broker, you must proceed with the OnFin verification process by providing supporting documents, including:

- Proof of ID: Passport or Driving license

- Proof of Address: Bank statement or Utility bill

- Proof of Payment: A screenshot of your e-wallet

OnFin Apps and Trading Platforms

OnFin supports both MetaTrader 4 and MetaTrader 5 platforms, catering to a wide spectrum of trader profiles. MT4, known for its simplicity and robust functionality, suits beginners, while MetaTrader 5 provides advanced tools for seasoned professionals.

Both platforms are available on desktop and mobile (Windows, iOS, Android). Here are the download links:

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can access for free.

OnFin Trading Costs

Access to tier-1 liquidity providers enables OnFin to offer some of the best trading conditions, including tight spreads and low commissions.

The ECN account boasts raw spreads from 0.0 pips plus a $4 commission per lot. Fix and Mini accounts come with fixed spreads and no commission. Fix accounts offer spreads from 3.0 pips with no additional charges.

Account Type | Spreads (Points) | Commission (Per lot) |

ECN | Floating from 0.0 | $4 |

Fix | Fixed from 3.0 | $0 |

Mini | Floating from 1.2 | $0 |

Copy | Floating from 2.4 | $0 |

OnFin Broker Payment Methods

OnFin supports multiple funding options, including bank transfers, Visa/Mastercard, and crypto/e-wallets such as Bitcoin and USDT (ERC20/TRC20).

Withdrawals vary by method: card withdrawals may cost $5–$20, while local methods like AwPay and Cambodia transfer have lower thresholds. Most transactions are processed within 1–5 business days.

Method | Min Deposit | Deposit Fee | Min Withdrawal | Withdrawal Fee |

SEPA | €500 | 0% | $15 | 0% |

MasterCard | $1 - $50 | 0% | $5 - $20 | 0% |

VISA | $1 - $50 | 0% | $5 - $20 | 0% |

Crypto | $1 - $10 | 0% | $1 - $10 | 0% |

SticPay | $1 | 0% | $1 | 0% |

QiWi | ₽100 | 0% | Not Available | 0% |

Perfect Money | Not Available | Not Available | $10 | 0% |

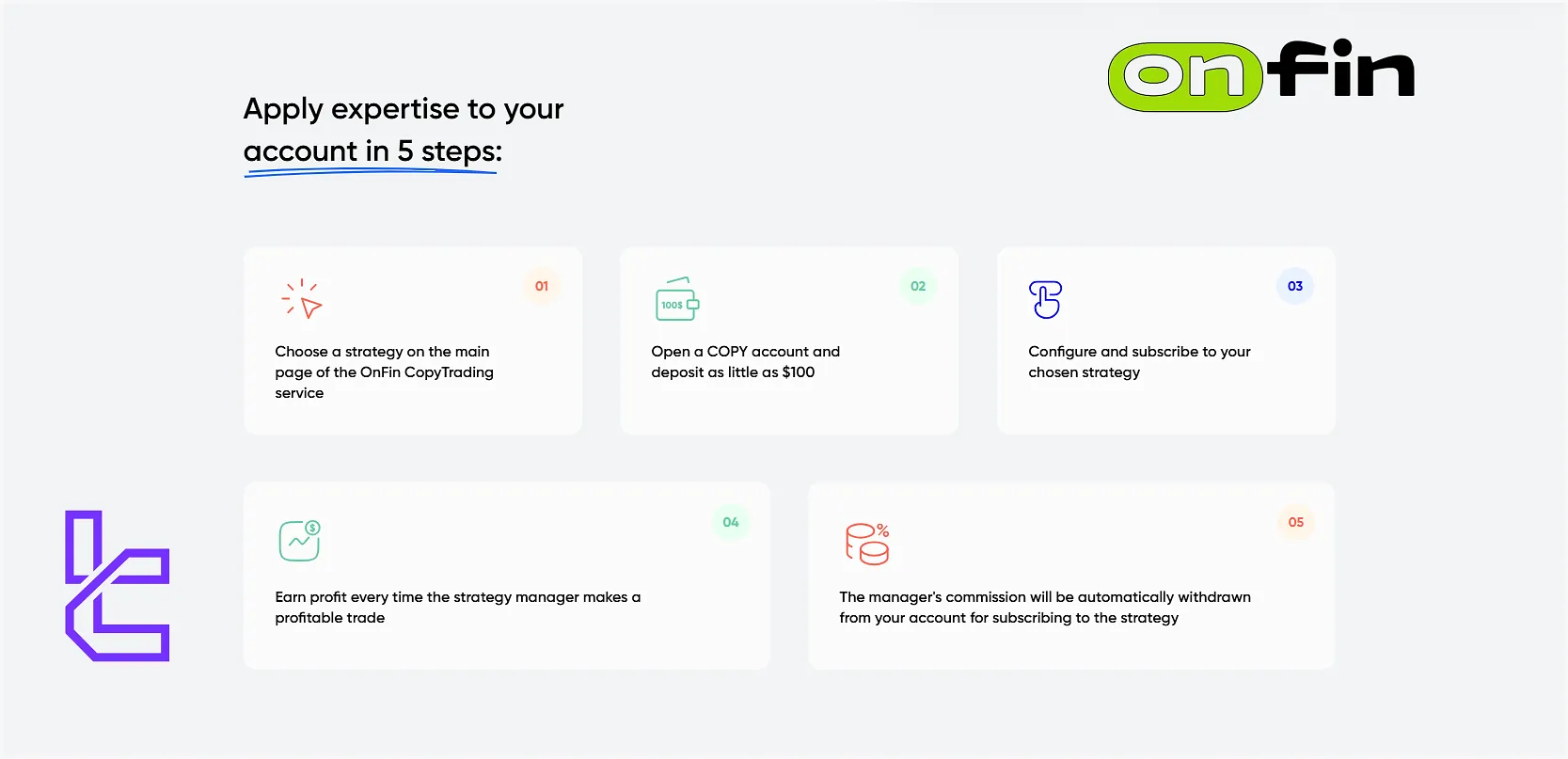

OnFin Broker Copy Trading

The company offers an exclusive copy trading account, known as Copy, which allows investors to automatically replicate the trades of successful strategy providers. Key features of OnFin Copy account:

Base Currency | USD |

Min Deposit | $100 |

Order Execution | Market |

Margin Call | 50% |

Stop Out | 20% |

Min Order Size | 0.01 lots |

Max Leverage | 1:1000 |

Swap Free | Available |

Tariffs on the Copy account come in three models:

- Percent of profit

- Fixed amount per trade

- Sum for a certain period

You can select your preferred model and maximize your profit potential.

OnFin Trading Assets

The broker provides access to a wide range of trading instruments (260+), from the Forex market to Russian Shares and Cryptocurrencies.

- Forex: Over 50 major, minor, and exotic currency pairs

- Metals: Five of the most popular precious metals, including Gold, Silver, Aluminum, Palladium, and Platinum

- Indices: Major global stock indices, such as ASX200, DAX40, DowJones30, Nikkei 225, and Nasdaq100

- Commodities: Energies like BRENT, WTI, NGAS

- Shares: 130 US, 1 UK, 7 DE, 7 Asia, and 25 RU shares

- Crypto: 21 of the most popular cryptocurrencies, including BTC, LTC, ETH, NEO, BCH, XRP, and TRX

The broker does not support trading in bonds, ETFs, options, futures, or mutual funds, potentially limiting diversification for some investors.

OnFin Bonus and Promotion

Passive income is one of the most attractive topics in this OnFin review. The broker offers an attractive partnership program for those looking to earn additional income by referring new clients or representing the broker.

- Introducing Broker (IB): Earn up to $20 commissions per lot on referred clients' trading activity;

- Multilevel Partnership: An 8-level reward program that offers up to $15 commissions per lot;

- Representative Program: Become an official OnFin representative in your region with exclusive benefits and higher commission rates.

OnFin Broker Customer Support

ECN.Broker prides itself on providing 24/5 (Monday to Friday) customer support through phone, email, and live chat. Here’s a list of OnFin contacts in various regions.

Region | Phone | |

Georgia | +995 706 770001 | support@onfin.io |

Russia | +7 (800) 551-38-35 | russia@onfin.io |

Europe | +35722009460 | europe@onfin.io |

Philippines | +63180013200005 | philippines@onfin.io |

Hong Kong | +852800931465 | hongkong@onfin.io |

Africa | - | africa@onfin.io |

Kenya | +254207640470 | kenya@onfin.io |

OnFin Prohibited Countries

Like many international brokers, OnFin is subject to regulatory restrictions prohibiting it from offering services in certain countries. While the full list of prohibited countries may change over time, some notable exclusions include:

- United States of America

- North Korea

OnFin User Satisfaction

We must explore user ratings and trust scores in this OnFin review. User satisfaction is a crucial factor when choosing a broker. The company has a profile on TrustPilot with 44 reviews, scoring an excellent rate of 4.7 out of 5.

OnFin Broker Educational Content

Despite all of its attractive features and conditions, the broker lacks educational materials. OnFin doesn’t offer webinars, eBooks, podcasts, tutorial videos, or any kind of resources aimed at educating traders.

You can use TradingFinder's Forex education and Crypto tutorials for additional learning materials.

OnFin Compared to Other Brokers

The table below compares OnFin's services and features with popular forex brokers:

Parameter | OnFin Broker | XM Broker | FxPro Broker | FXGlory Broker |

Regulation | MISA | ASIC, FSC, DFSA, CySEC | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0.0 | $0 (except on Shares account) | From $0 | $0 |

Minimum Deposit | $1 | $5 | $100 | $1 |

Maximum Leverage | 1:1000 | 1:1000 | 1:500 | 1:3000 |

Trading Platforms | MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | ECN, FIX, MINI, COPY | Micro, Standard, Ultra Low, Shares | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 260+ | 1400+ | 2100+ | 45 |

Trade Execution | Market, Instant | Market, Instant | Market, Pending | Market, Instant |

Conclusion and Final Words

The OnFin broker utilizes partnerships with top liquidity providers such as Bank of America, UBS Group AG, Barclays, and JPMorgan Chase through AMTS Solutions, offering fast execution speeds and competitive trading conditions.

Copy trading is a notable feature, providing access to 100+ strategies and tariff models such as percent of profit, fixed amount per trade, and sum for a certain period.

With zero deposits and withdrawal fees and a TrustPilot score of 4.7/5, OnFin is well-regarded for its user satisfaction.

Prohibited countries include the United States and North Korea, reflecting regulatory compliance.