Pepperstone processes an average of $9.2B of trades by over 400,000 clients every day. This brokerage works with 10 base currencies [AUD, USD, GBP, JPY, EUR, CAD, CHF, NZD, SGD, HKD] and offers a leverage of up to 1:500. The allowed order size in the broker is in the range of 0.01-100 lots.

Pepperstone Forex Broker (Company Information & Regulation)

Pepperstone is a reputable forex broker that has been operational since 2010. Founded in Melbourne, Australia, the company has rapidly expanded its global presence, now operating from several offices in different regions of the world. This international footprint allows the broker to cater to a diverse clientele across various markets.

One of Pepperstone's strongest selling points is its robust regulatory framework. The broker is overseen by several top-tier financial authorities, including:

- Australian Securities and Investments Commission (ASIC)

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Dubai Financial Services Authority (DFSA)

- Capital Markets Authority (CMA) in Kenya

- Federal Financial Supervisory Authority (BaFin) in Germany

The broker ensures client fund safety through segregated bank accounts and does not use client funds for hedging. These layers of oversight and protection make Pepperstone a trusted choice across multiple regions.

Here's a summary of the company's entities with specifics in a table:

Entity Parameters/Branches | Pepperstone Limited | Pepperstone EU Limited | Pepperstone GmbH | Pepperstone Group Limited | Pepperstone Financial Services (DIFC) Limited | Pepperstone Markets Kenya Limited | Pepperstone Markets Limited |

Regulation | Financial Conduct Authority (FCA) | Cyprus Securities and Exchange Commission (CySEC) | Federal Financial Supervisory Authority (BaFin) | Australian Securities and Investments Commission (ASIC) | Dubai Financial Services Authority (DFSA) | Capital Markets Authority of Kenya (CMA) | Securities Commission of The Bahamas (SCB) |

Regulation Tier | 1 | 1 | 1 | 1 | 2 | 2 | 3 |

Country | UK | EU | Germany | Australia | United Arab Emirates | Kenya | Bahamas/Global |

Investor Protection Fund / Compensation Scheme | FSCS Up to £85,000 | ICF Up to €20,000 | EdW Up to €20,000 | No | No | No | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 | 1:500 | 1:200 |

Client Eligibility | Only the United Kingdom | Only EU/EEA Residents | Only Germany | Only Australia | Only the United Arab Emirates | Only Kenya | Global |

Summary of Specifications & Key Features

Brokers have some common parameters, which have different specifics. In the table below, we will have a look at these features:

Broker | Pepperstone |

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Based Currencies | AUD, USD, GBP, JPY, EUR, CAD, CHF, NZD, SGD, and HKD |

Minimum Deposit | $1 |

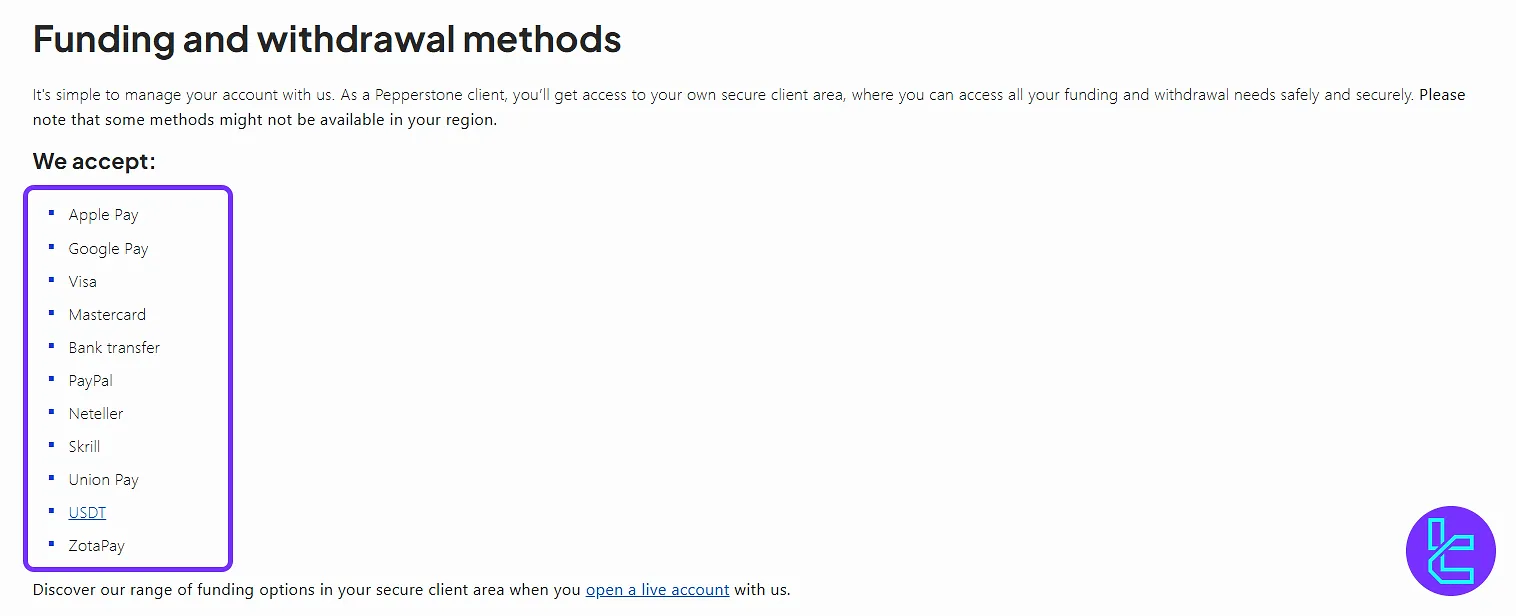

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Minimum Order | 0.01 lot |

Maximum Leverage | Up to 1:500 |

Investment Options | Copy Trading |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Markets | Forex, Commodities, Crypto, Shares, Indices, ETFs |

Spread | From 0.0 pips |

Commission | From $0 |

Orders Execution | Instant |

Margin Call/Stop Out | 90%/20% |

Trading Features | Using EAs Hedging allowed |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, phone call, live chat |

Customer Support Hours | 24/7 |

Pepperstone Account Types

Pepperstone provides a comprehensive range of account types designed to meet the needs of various traders:

- Standard: A commission-free option with costs built into slightly wider spreads, ideal for beginners or those who prefer simple pricing

- Razor: Suitable for experienced and high-frequency traders, offering ultra-low spreads with a commission of $3.5 per side

- Islamic: Available for eligible clients from select countries, requiring a minimum deposit of $200 AUD

- Spread Betting: Available for UK and Ireland-based traders, offering tax-free trading under certain conditions

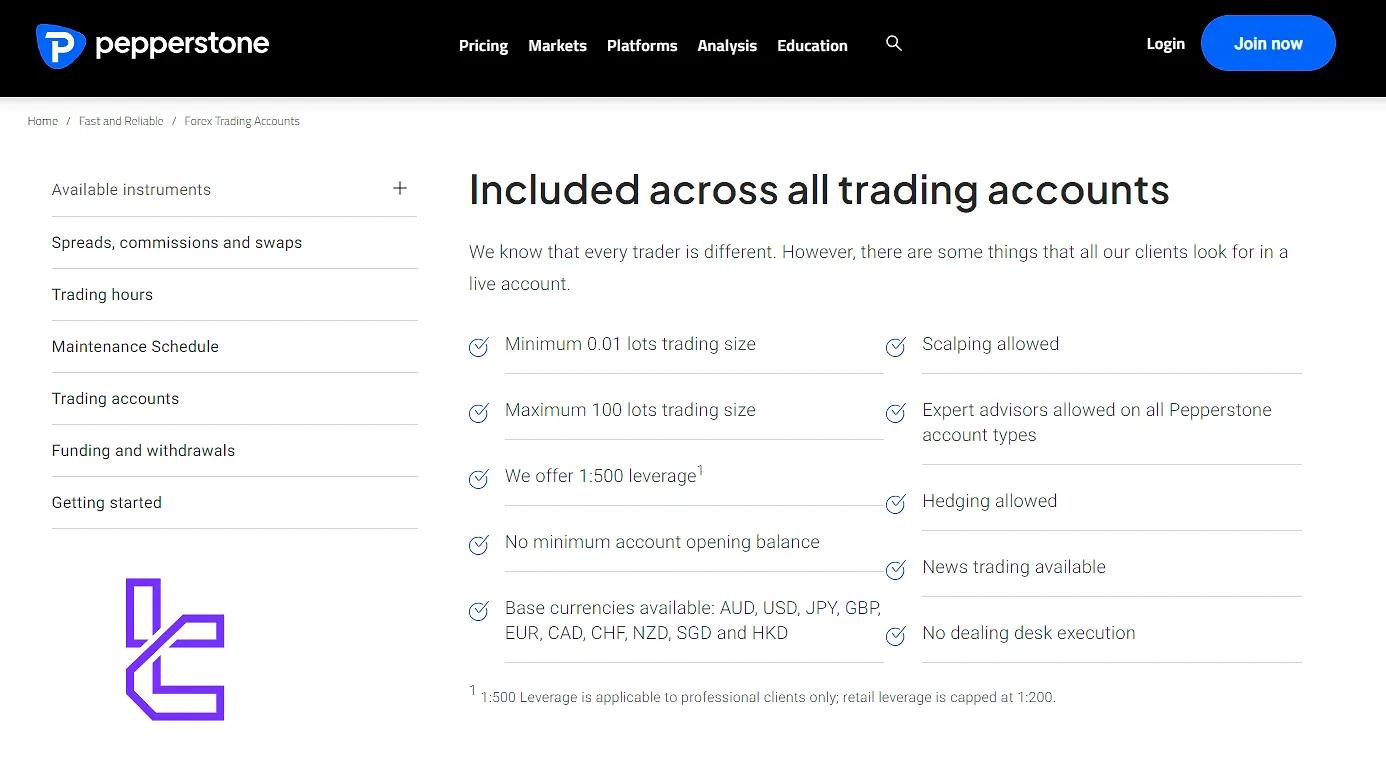

Let's take a closer look at the broker's 2 main trading accounts: Standard and Razor. There is some common ground between these accounts:

- Minimum Order Size: 0.01 lot

- Maximum Order Size: 100 lots

- Leverage: up to 1:500

- Minimum balance for an account: none

- Scalping: Allowed

- Expert Advisors: Allowed

- Hedging: Allowed

- News Trading: Permitted

- Base Currencies: AUD, USD, GBP, JPY, EUR, CAD, CHF, NZD, SGD, and HKD

- Stop Out Level for Retail Clients: 50%

- Stop Out Level for Professional Clients: 20%

Pepperstone has no fixed minimum deposit requirement, allowing traders to start with any amount they’re comfortable with. However, certain payment methods may enforce a technical minimum, usually around $10.

Pepperstone Islamic Account

Pepperstone offers Islamic accounts for clients in eligible regions. These swap-free accounts comply with Sharia principles by removing overnight interest charges. They are available on both Standard and Razor account types upon verified request.

Pros and Cons

Pepperstone is a well-performing broker in some aspects, but it has its own drawbacks, too. At the table below, we will take a look at the advantages & disadvantages of trading with it:

Pros | Cons |

Regulated by ASIC, CySEC, and other top-tier regulators | Limited access to demo account |

Extensive selection of tradable instruments across multiple asset classes | Limited leverage options |

Deep liquidity | No PAMM accounts |

Various options for trading platforms | Limited promotional offerings |

Account Registration and Verification: Step-by-Step Guide

Whether you're opening a live or demo account, Pepperstone registration involves providing essential personal and financial information while configuring your trading preferences — all within 10–15 minutes.

#1 Start Registration

Go to the official Pepperstone website and click "Join Now". You can register using Email, Apple ID, Google, or Facebook.

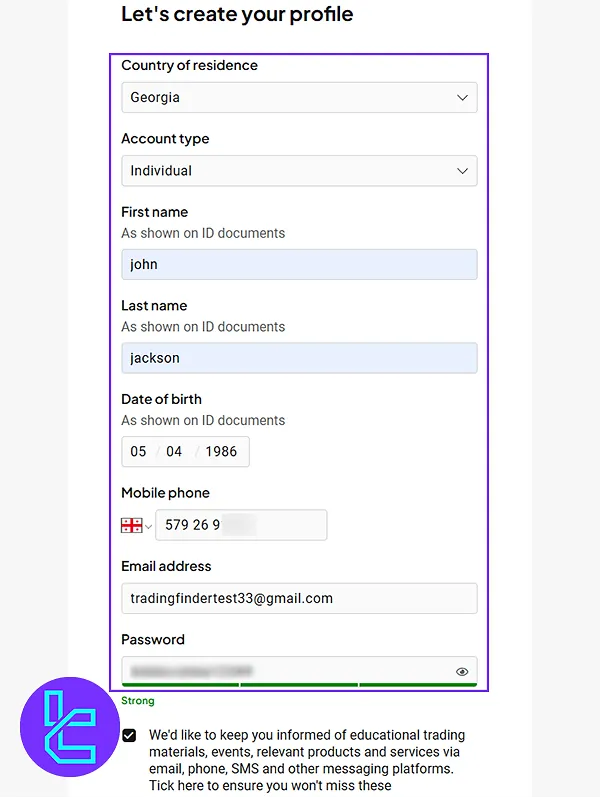

#2 Personal Information

Input the following details to complete the sign-up application:

- Country of residence

- Account type

- Full name

- Date of birth

- Phone number

- Email address

- Account password

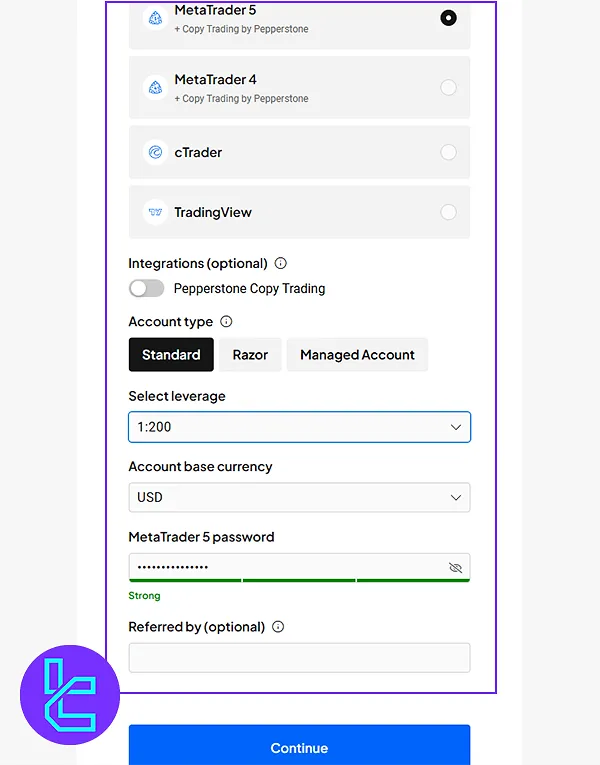

#3 Choose Account Settings

Select between a Live or Demo account, and then adjust the following parameters:

- Trading platform

- Leverage

- Account base currency

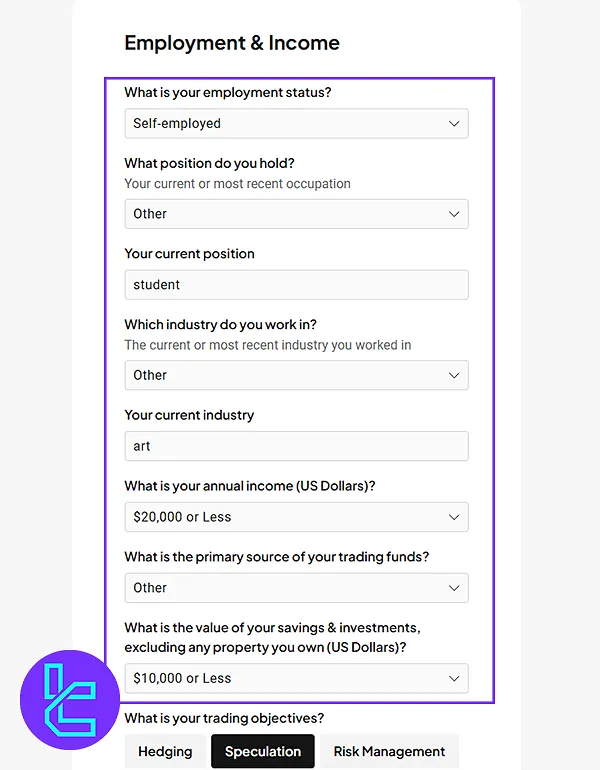

#4 Financial Profile & Experience

Submit your financial information and trading specs, including:

- Employment status

- Income range

- Trading experience

- Risk appetite

- Trading goals

After completing the form, you'll be required to complete the suitability questionnaire.

#5 Email Verification

Confirm your email to activate the account. Once verified, you’ll gain access to the Pepperstone trading dashboard.

Pepperstone Trading Platforms + Download

Pepperstone offers one of the broadest selections of trading platforms in the industry:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- TradingView

- Pepperstone’s proprietary web and mobile platforms

All platforms are accessible via desktop, browser, and mobile devices, ensuring flexibility across all devices and operating systems.

MetaTrader 4 (MT4)

MetaTrader 4 is the most popular trading application available. It offers these features:

- Complete customization

- 28 indicators and EAs available with the broker's Smart Trader Tools

- Access to 85 pre-installed indicators on the desktop app

- Automated trading for markets

- Enables clients to create EAs with MetaQuotes Language 4

- Backtesting feature

- Autochartist for identifying market movements

Links:

MetaTrader 5 (MT5)

As shown by its title, it is the next generation of MT4 with some advantages and additional features. MetaTrader 5 Key Specifics:

- Easier user interface

- Position hedging

- MQL5 programming language

- Access to 21 timeframes

Links:

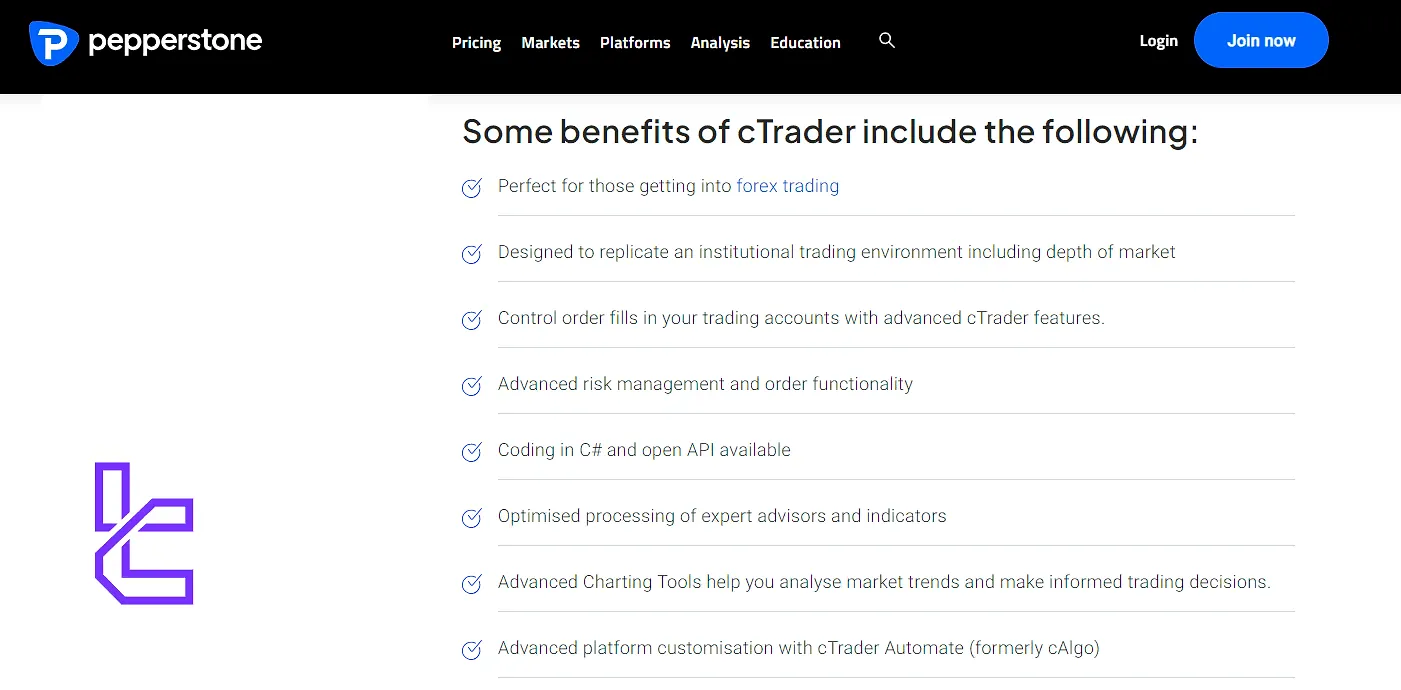

cTrader

It's a newer platform that is suitable for those new to forex trading. cTrader Top Features:

- Simulates an institutional trading environment

- Advanced risk management

- Ability to code in C# and open API

- High-level customization with cTrader Automate

Links:

TradingView

A popular platform for using charting tools and technical analysis, it provides a vast social network for traders. Important Features & Stats:

- Over 30 million traders

- Top-level charting technology

- Access to a wide range of indicators

- Economic calendar and news features available

Links:

Pepperstone Mobile App

It's the proprietary platform of the broker, available through the web and mobile. Some of its features include:

- Quick Switch for swapping between charts

- A convenient way of searching and finding instruments

- Public watchlists available

- Multiple options offered for charting and analysis

Links:

Pepperstone Spreads and Commissions on Trading

Pepperstone offers competitive trading spreads and commissions, which are variable based on the account type:

- Standard Account: EUR/USD averages around 1.0–1.2 pips (spread only);

- Razor Account: Spreads can drop to 0.0 pips on major pairs like EUR/USD, with a commission charged separately (favored by active traders and scalpers).

| Account Type | Spread | Commission (Forex Only) |

Standard Account | Variable (relatively higher than Razor) | $0 |

Razor Account | Raw (from 0 pips) | $3.5 per lot per side |

Swap Fees

Swap rates represent the interest adjustment applied when positions are held overnight, either as a debit or a credit, depending on funding costs.

The calculation method varies by asset class, with rates updated daily to reflect market conditions.

Forex

Tom-next rates are sourced from tier-one global investment banks and adjusted daily. Commodity metals follow the same method.

Indices

Long positions incur ARR/IBOR; short positions receive it.

Commodities

Shares

Cryptocurrencies

Rates shown on the platform are indicative and may change with volatility.

Non-Trading Fees

According to Pepperstone's official statement on its website, "no account keeping or inactivity fees" or any other kinds of non-trading commissions are charged by the brokerage.

Pepperstone Deposit & Withdrawal Options

The broker offers a good range of deposit and withdrawal methods. We will investigate in detail in the following sections.

Deposit Methods

Look at the table below for a summary of the necessary information about the payment solutions available:

Options | Minimum Amount | Fees |

Apple Pay | 5 USD | None |

Google Pay | 5 USD | None |

Visa | 5 USD | None |

Mastercard | 5 USD | None |

Bank Transfer | 100 USD | None |

PayPal | 5 USD | None |

Neteller | 5 USD | None |

Skrill | 5 USD | None |

Union Pay | 5 USD | None |

USDT | 5 USD | None |

ZotaPay | 5 USD | None |

Withdrawal Options

The broker employs the same platforms and systems for withdrawals:

Option | Minimum Amount | Processing Time |

Apple Pay | 30 USD | Instant–1 Business Day |

Google Pay | 30 USD | Instant–1 Business Day |

Visa | 20 USD | 1–3 Business Days |

Mastercard | 20 USD | 1–3 Business Days |

Bank Transfer | 80 USD | 1–3 Business Days |

PayPal | 20 USD | Instant–1 Business Day |

Neteller | 20 USD | Instant–1 Business Day |

Skrill | 20 USD | Instant–1 Business Day |

Union Pay | 30 USD | 1–3 Business Days |

USDT | 20 USD | Instant–1 Business Day |

ZotaPay | 20 USD | Instant–1 Business Day |

Copy Trading & Investment Options Offered on Pepperstone

This company does not provide many options for passive earnings, but it offers a copy trading tool through MT4/5 accounts by a service called "Signal Start". You can set up your account either as a "Signal Follower" or "Signal provider" on the service. The broker also enables copy trading through these platforms:

- Duplitrade

- MetaTrader Signals

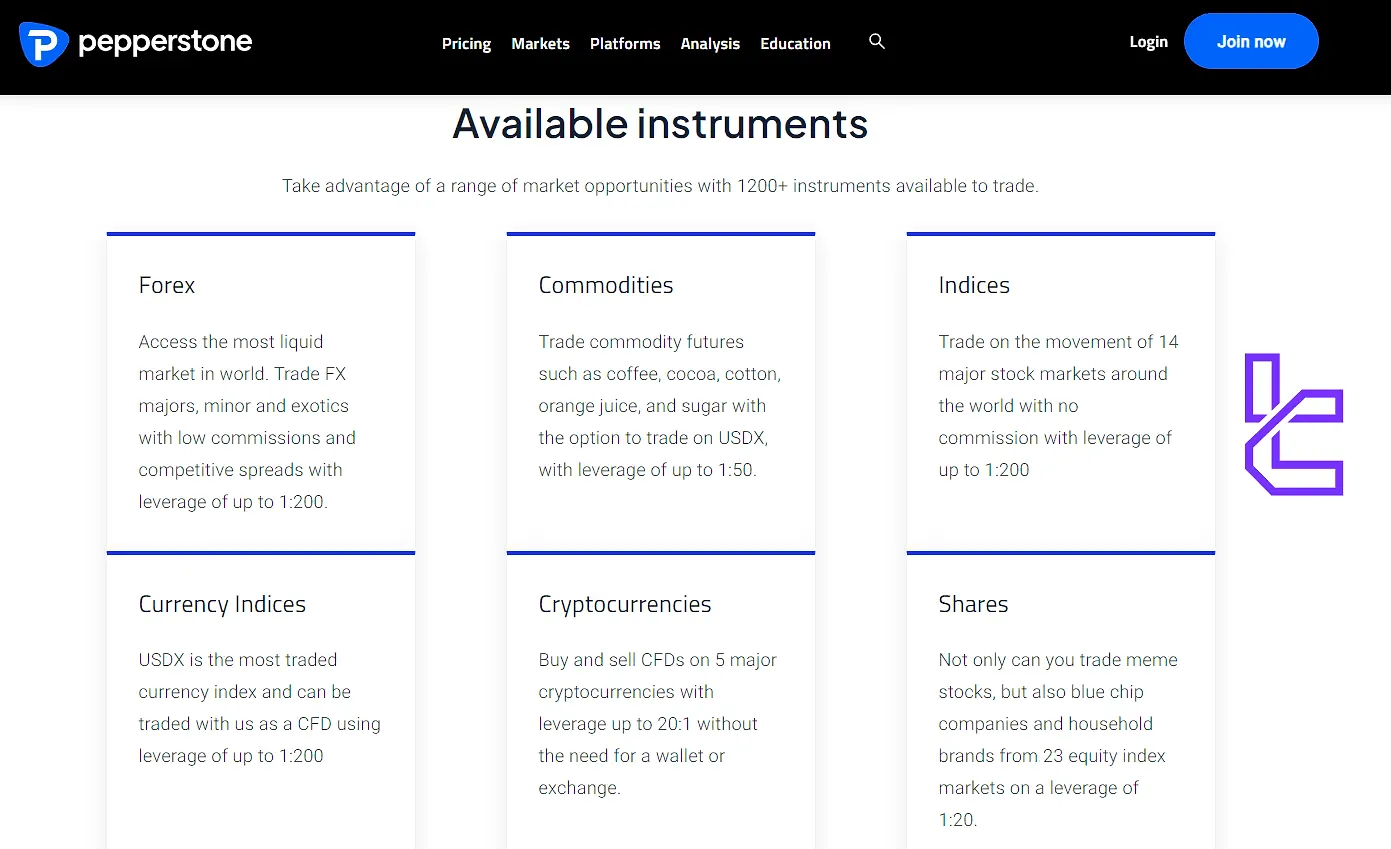

Pepperstone Tradable Markets & Symbols Overview

This is one of the sections in which this broker shines. Pepperstone provides access to a wide range of CFDs across 6 asset classes.

You can trade over 1,200 instruments from Forex to ETFson the Pepperstone broker. Tradable Symbols:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Majors, Minors, Crosses, Exotics, and NDF | 55 Currency Pairs | 50–70 Currency Pairs | 1:500 | |

Commodities | CFDs on Metals and Energies | Around 15 Instruments | 10–20 Instruments | 1:500 |

Indices | CFDs on Indices from North America, Europe, and Asia/Africa | Around 14 Indices | 10–20 Indices | 1:400 |

CFDs on Digital Assets, including BTC, ETH, and LTC | Around 10–15 Cryptocurrencies | 5–20 Cryptocurrencies | 1:100 | |

Shares | CFDs on Shares from Europe, the US, the UK, and Other Markets | Over 1000 Global Stocks | 800–1200 Stocks | 1:20 |

ETFs | CFDs on ETFs Covering Banks & Financials, Bonds, Energy, and Industrials | Around 30–50 ETFs | 20–60 ETFs | N/A |

This broad range enables traders to diversify across asset classes without opening multiple accounts.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Between 74-89 % of retail investor accounts lose money when trading CFDs.

Does Pepperstone Offer Any Bonuses and Promotions?

This company, like many regulated forex brokers, has limited offerings when it comes to traditional bonuses and promotions. This is largely due to regulatory restrictions in many jurisdictions that aim to protect traders from misleading marketing practices. Therefore, it currently does not provide any bonuses for clients. Always check the current offers on Pepperstone's official website or contact their customer support for the most up-to-date information.

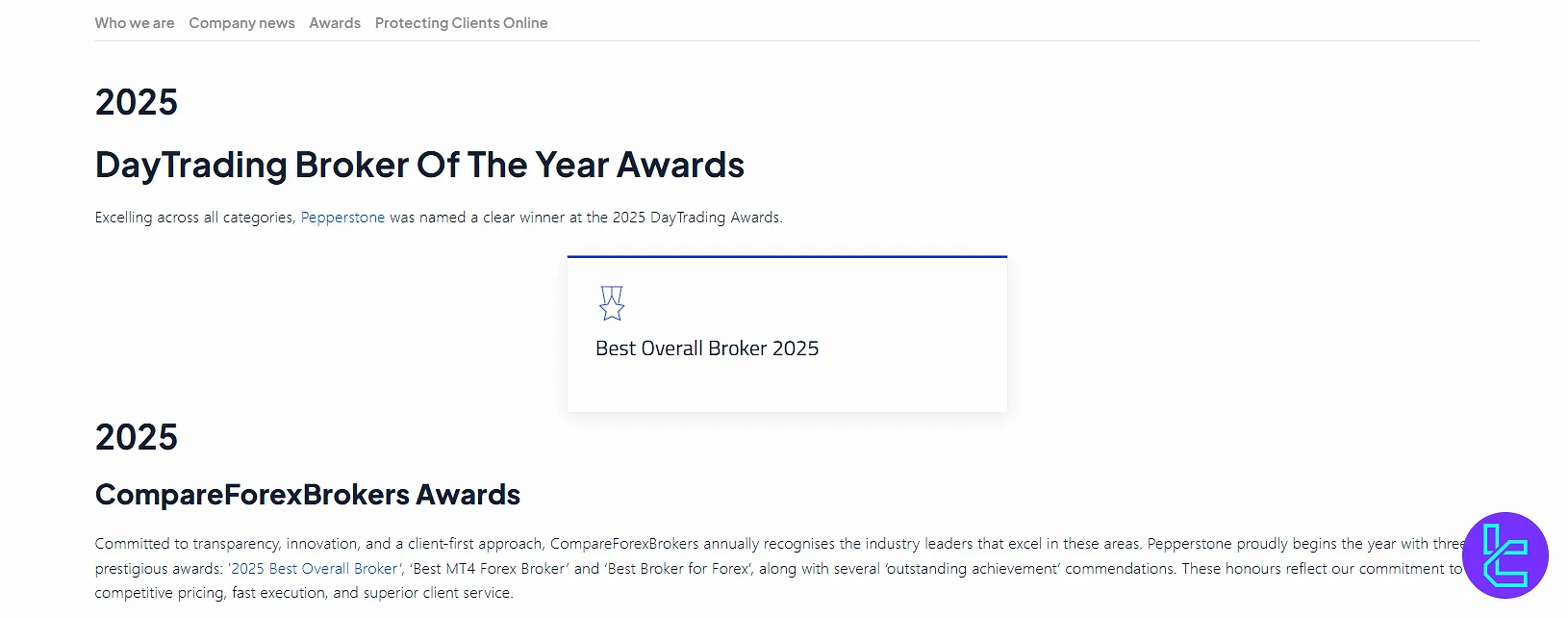

Pepperstone Broker Awards

Pepperstone is a globally recognized forex and CFD broker, consistently acknowledged by independent industry bodies for its trading environment, platform range, and service quality.

Awards from organizations such as TradingView, CompareForexBrokers, and Good Money Guide highlight its strengths in areas including MT4/MT5 integration, competitive spreads, and execution efficiency.

Key recognitions of the Pepperstone awards include:

- TradingView Broker of the Year: Awarded for advanced technology, user engagement, and global adoption

- Best Overall Broker 2025: Named by CompareForexBrokers for low-cost trading, rapid order execution, and platform diversity

- Best MT4 Broker: Recognized for a comprehensive MT4 setup with robust tools and features.

- Best MetaQuotes Broker: Cited for strong support of both MT4 and MT5 platforms

- Best Forex Broker: Awarded for competitive pricing and high-speed execution in currency markets

- Best in Client Satisfaction: Acknowledged by Investment Trends for value for money, customer service, and trade execution speed

Pepperstone Support: Does It Offer 24/7 Services?

Support options usually include "live chat" on official websites. On this broker, it's available, too. Other Customer Service Contact Options:

- Phone Call: +1786 628 1209

- Email: support@pepperstone.com

As per the official website, the support team offers 24/7 services to the clients.

Pepperstone List of Restricted Countries

Financial companies do not offer services to some countries because of certain rules, sanctions, etc. Pepperstone has also restricted many countries, including but not limited to:

- Iran

- Iraq

- Canada

- United States

- Japan

- South Africa

- Argentina

- North Korea

Trust Scores & Reviews

Users and experts submit scores and reviews of brokers on certain websites. Pepperstone Trust Scores on Reputable Sites:

- Pepperstone Trustpilot: 4.4 out of 5, based on over 3,000 reviews

- ForexPeaceArmy: 3.4 out of 5, based on more than 380 reviews

- Pepperstone REVIEWS.io: 3.8 out of 5 with over 100 scores

As mentioned above, this company has achieved a high overall score from different users and reviewers.

Tutorials & Education Materials Available on Pepperstone

The education section on this broker provides a good level of content for users with various trading skills. Key Specifics:

- Technical and fundamental analysis guide

- Tutorials on trading different asset classes

- Educational videos

- Webinars

- Information on how forex trading works

Pepperstone vs Other Brokers

Let's have a comparison between Pepperstone services and popular Forex brokers:

Parameter | Pepperstone Broker | |||

Regulation | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FSC, Misa, FinaCom |

Minimum Spread | From 0.0 pips | From 0.0 pips | N/A | From 0.0 Pips |

Commission | From $0 | Classic $0 Edge $3.5 | N/A | $0 |

Minimum Deposit | $1 | $100 | $100 | $100 |

Maximum Leverage | 1:500 | 1:1000 | 1:400 | 1:3000 |

Trading Platforms | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrade 4, MetaTrade 5, Mobile App |

Account Types | Standard, Razor | EDGE, CLASSIC | Retail, Professional, Islamic, Demo | Standard, ECN, Fixed, Crypto |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1,200+ | 12,000+ | 1,250+ | 700+ |

| Trade Execution | Instant | Market | Instant | Market, Instant |

Conclusion and Final Words

Pepperstone is regulated by six financial authorities [ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC] as a Forex brokerage. Headquartered in Melbourne, Australia, this company provides 24/7 support services through 3 channels [email, live chat, phone call].