Phillip Securities SG offers market spreads from 0.3 pips across 10 markets, covering CFD, Futures, and option contracts. The broker provides Forex trading with no commissions through its Cash Plus account.

The company has implemented various promotions, including a welcome gift of up to 1,000 SGD, and a referral commission of $680 per client.

Phillip Securities SG (Company Introduction and Regulatory Status)

Phillip Securities is a longstanding financial services firm established in 1975 and has been operating under the Phillip Capital Group since 2002.

Phillip Securities Pte Ltd (Reg. No. 197501035Z) is a member of PhillipCapital, which has 200+ investment centers and branches in 4 continents, 15 countries (e.g., Australia, USA, China, and the UK), and over 5,000 employees. Key features of PhilipSecurities SG:

- Regulated by the Monetary Authority of Singapore (MAS)

- Investment plans and insurance

- 40,000+ products

- Over $35B in Assets Under Management (AUM)

Registered in Japan, the company is officially regulated by the Financial Services Agency (FSA) and holds a Retail Forex License (No. 127).

The Forex broker grants access to Japan’s primary trading venues, including the Tokyo Stock Exchange (TSE), the Osaka Exchange (OSE), and the Tokyo Commodity Exchange (TOCOM), thereby reinforcing its role in the domestic securities landscape.

| Entity Parameters/Branches | Phillip Securities Pte Ltd | Phillip Securities Japan, Ltd |

Regulation | MAS | FSA |

Regulation Tier | 2 | 2 |

Country | Singapore | Japan |

Investor Protection Fund/Compensation Scheme | No | Up to ¥10 million |

Segregated Funds | Yes | Yes |

Negative Balance Protection | No | No |

Maximum Leverage | 1:3.5 | 1:3.5 |

Client Eligibility | Singapore | Japan |

Phillip Securities CEO

The Phillip Securities Group operates under the guidance of experienced CEOs and Managing Directors across multiple regions:

- Singapore: Linus Lim (Director & CEO of Phillip Capital Management)

- Thailand: Cameron Payne Frazier (CEO of Phillip Securities Thailand Public Company Limited)

- Japan: Makoto Nagahori (President & CEO of Phillip Securities Japan)

- Hong Kong: Lim Wah Sai (Managing Director & Responsible Officer of the Phillip Securities Group of Companies)

- Malaysia: En. Mohd Fadzli Bin Mohd Anas (CEO & Executive Director of Phillip Mutual Berhad PMB)

Phillip Securities SG Table of Specifications

The company provides trading services through Poems Forex Broker with access to26 exchange markets worldwide. Let’s explore the key features of Phillip Securities.

Broker | Phillip Securities SG |

Account Types | Cash Plus, Cash Management |

Regulating Authorities | FCA, SEC, ASIC, MAS, FSA |

Based Currencies | SGD, USD, HKD, JPY, AUD, GBP, EUR, CAD, CNY, and MYR |

Minimum Deposit | S$1,000 |

Deposit Methods | PayNow, PayLah!, PayAnyone, Google Pay, FAST, eNETS, Electronic Payment for Shares (EPS), Internet Bill Payment, Telegraphic Transfer, CPF/SRS, GIRO |

Withdrawal Methods | Bank Transfer, PayNow, Quick Cheque, Telegraphic Transfer, POEMS Reward Redemption |

Minimum Order | None |

Maximum Leverage | ×3.5 |

Investment Options | Stocks, ETFs, Unit Trusts, Bonds, SDR, Managed Account Services, Robo Advisor, Regular Saving Plans |

Trading Platforms & Apps | MT5, Phillip Nova 2.0, CQG, Trading Technologies (TT), POEMS 2.0, POEMS Pro, POEMS Mobile 3 |

Markets | Forex, Stocks, CFDs, ETFs, Stock Indices, Options, Futures, Bonds, Investment Funds, NVDR |

Spread | From 0.6 pips |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Stock Research, Market Watch, ETF Screener, Employee Share Options Service |

Affiliate Program | Yes |

Bonus & Promotions | Referral, Trading Promotions, Reward Points |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Phone, Chatbot, Call Back |

Customer Support Hours | Mon to Fri: 8:30 am to 12:00 am Sat: 8:30 am to 1:00 pm |

Poems Broker Account Offerings

Phillip Securities supports multiple account structures tailored to diverse investor profiles, including CDP-linked accounts, Cash Management Accounts, and Margin Accounts with financing rates from 3.08% p.a.

Opening an account incurs no fees, with a minimum initial funding requirement of S$1,000.

Phillip Securities Cash Plus Account

- Lowest brokerage rates (from 0.06% in the Singapore market to $1.88 flat for US trades)

- Multi-currency facility (SGD, USD, HKD, JPY, AUD, GBP, EUR, CAD, CNY, and MYR)

- Financing quantum of investment product up to 71%

- Online currency conversion

- Leverage up to ×3.5

- Access to over 20 global markets

Phillip Securities Cash Management Account

- Designed to control all investments, including Shares, Unit Trusts, and Bonds

- Multi-currency support (USD, HKD, MYR, JPY, AUD, GBP, EUR, CNY, and CAD)

- No dividends on SGX shares

Phillip Securities SG Pros and Cons

No platform and custody fees, and 10 different account currencies are the broker's strengths.

Here's a quick overview of the upsides and downsides of using Phillip Securities' POEMS platform.

Pros | Cons |

Access to 26 global stock exchanges and 12 international markets | Higher minimum commission fees for some international markets |

Free access to market insights and analysis | Complex product offerings for beginners |

Cash Management Account for consolidated fund management | Limited account types |

No commissions on Forex | High minimum deposit ($25,000) for advisory services |

Phillip Securities SG Account Opening and Verification Process

Creating an account with POEMS (Phillip Securities) is designed for both Singaporean and international clients, with full KYC compliance.

Singapore citizens benefit from Sign Pass-based onboarding, while foreign applicants must submit supporting documents manually.

The platform supports Cash Plus and Cash Management accounts with access to trading, multi-currency features, and more.

#1 Start the Registration Process

Go to the official POEMS website and click “Open an Account”. Select your preferred account type and the facilities you want to enable.

#2 Submit Application

Fill in the online form with your personal details, including:

- Full name

- Email address

- Phone number

- Country of residence

#3 Complete KYC verification

Log in to the broker's client dashboard and navigate to the KYC menu. Note that the verification procedure differs based on the client's nationality.

While Singaporeans can use Sign Pass for automatic data integration, other nationalities must provide the following documents:

- Proof of Identity: Passport or National ID

- Proof of Address: Utility bill or Bank statement

- Signature image

- Selfie

You also must provide your Tax Identification Number (TIN) and bank details to complete the Phillip Securities verification process.

Once reviewed and approved, your POEMS account will be activated for trading.

Phillip Securities SG Trading Platforms

We must discuss the trading platforms in this Phillip Securities SG review. Poems brokeroffers a full suite of solutions, from the most advanced MetaTrader 5 to the proprietary POEMS Mobile 3.

MT5

TradingFinder has developed a wide range of advanced MT5 indicators that you can use for free.

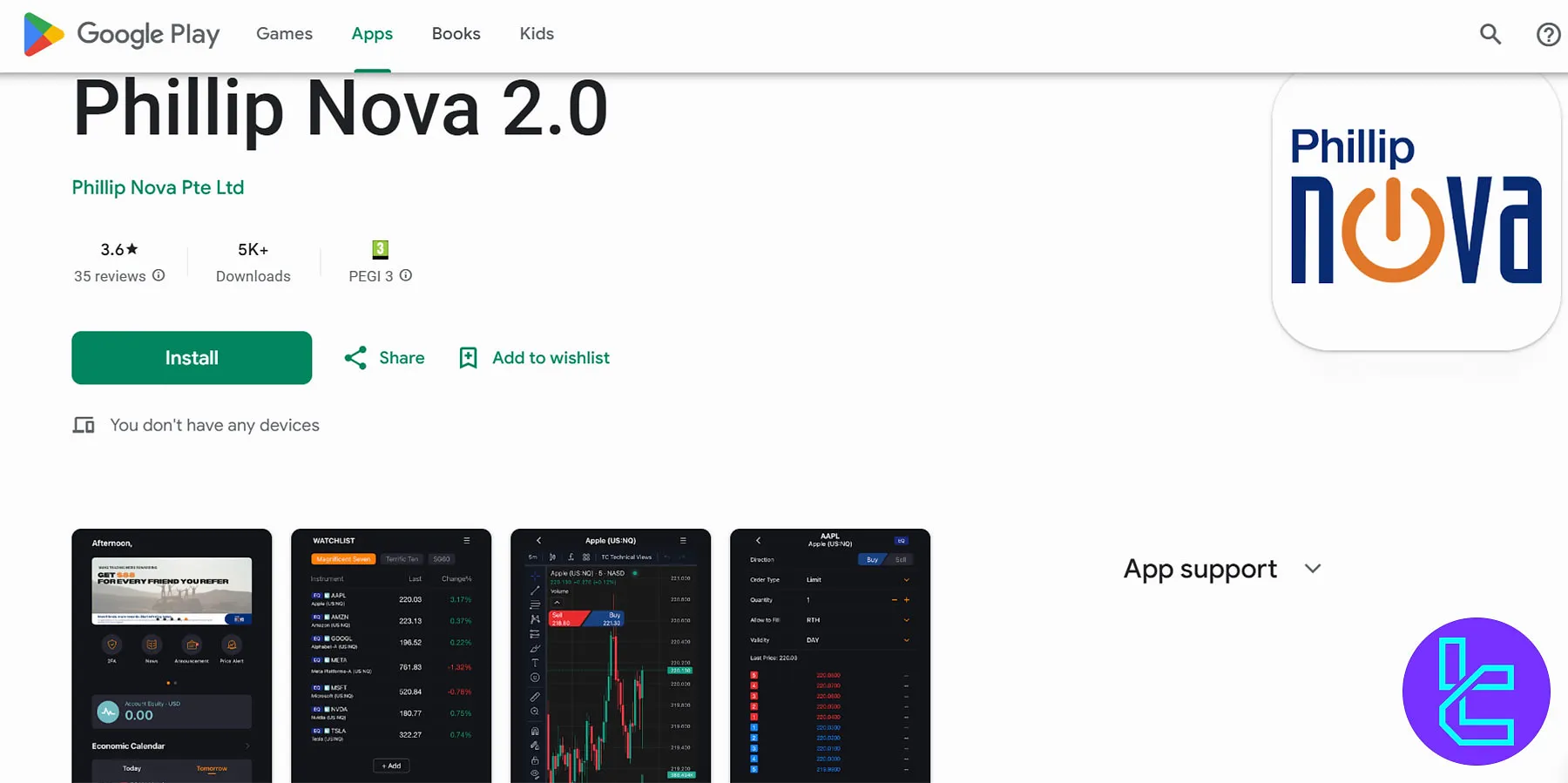

Phillip Nova 2.0

CQG

Trading Technologies (TT)

POEMS 2.0 (Stocks, Forex, Gold, Futures, etc.)

POEMS Pro

The platform is only accessible through Windows devices.

POEMS Mobile 3

Phillip Securities SG Fee Structure

Trading costs at Phillip Securities vary by asset and account type, with Singapore equities and ETFs charged at 0.12% commission (no minimum), and Hong Kong and Chinese equities starting from 0.05% and 0.08%, respectively.

Forex trading is commission-free, with spreads starting from 0.6 pips. CFD trades incur a minimum fee depending on region, for instance, US$15 for U.S. equities, HK$150 for Hong Kong, and AU$15 for Australian shares.

Phillip Securities' fee structure across various account types:

Phillip Securities Cash Plus Fees

- Singapore Stocks: 0.06% to 0.08%

- US Stocks: Flat rate of $1.88 to $3.88

- Forex: No commissions

- Market Spreads

Phillip Securities Cash Management Trading Costs

- Foreign Shares: S$2.00 per counter per month

- Cash Dividend: 1% on the net dividend as a handling fee

- Other Products: S$10

- Market Spreads

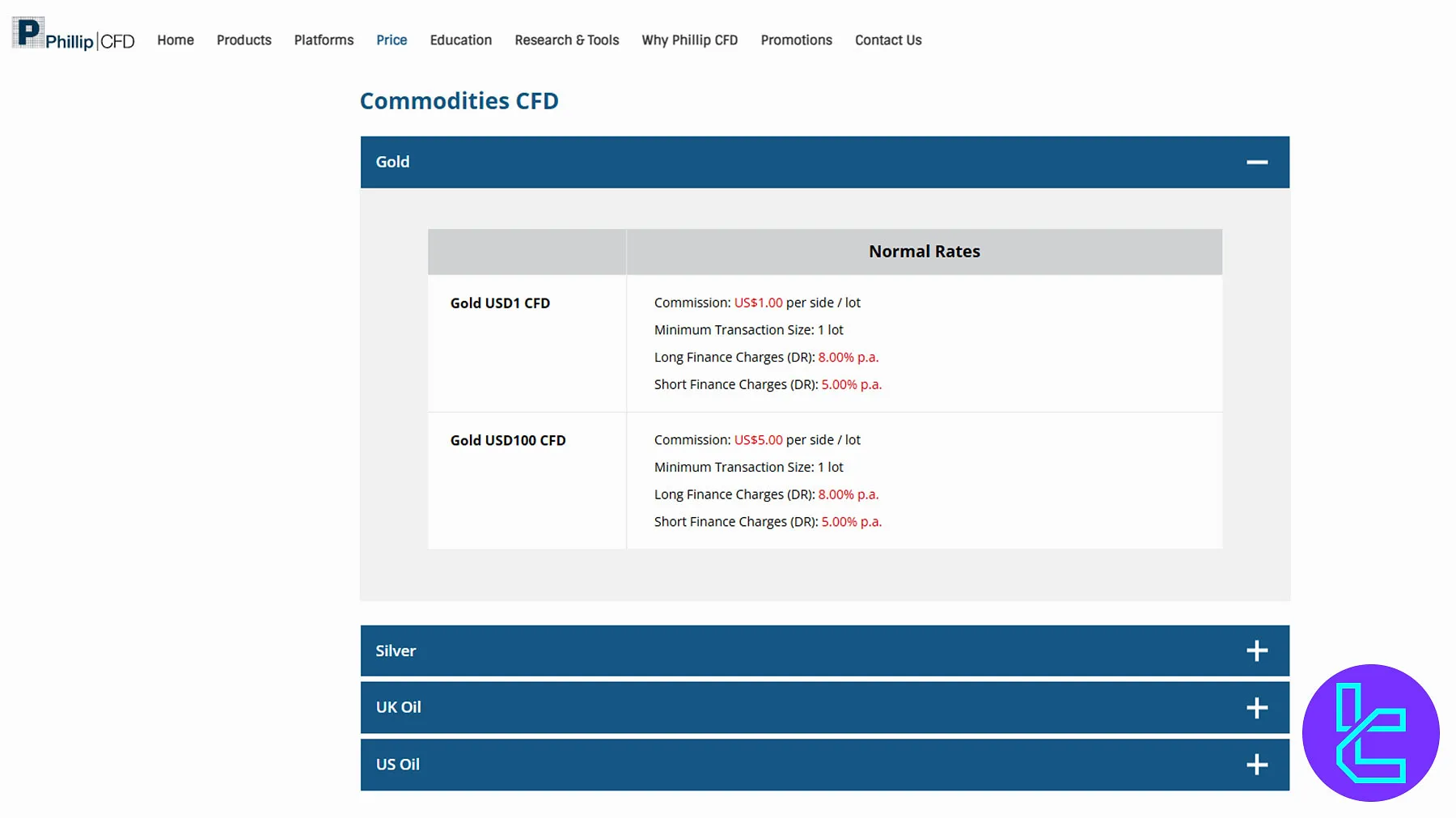

Phillip Securities Swap Fees

The broker charges rollover fees for holding positions overnight. Note that swap rates for FX pairs are not disclosed on the official website.

Here are the Phillip Securities swap fees for various trading instruments:

Instrument | Swap Long POEMS | Swap Short POEMS | Swap Long MT5 | Swap Short MT5 |

Australia Stocks | 6.5% | From 3.0% | - | - |

Hong Kong Stocks | 7.25% | From 3.0% | - | - |

Japan Stocks | 2.75% | From 2.75% | - | - |

Singapore Stocks | 6.75% | From 3.0% | 6.75% | From 3.0% |

United Kingdom Stocks | 7.5% | From 3.0% | - | - |

United States Stocks | 8.0% | From 2.0% | 8.0% | From 2.0% |

Singapore Indices | 6.75% | 4.0% | 6.75% | 4.0% |

UK Indices | 7.5% | 2.5% | 7.5% | 2.5% |

US Indices | 8.0% | 2.0% | 8.0% | 2.0% |

Metals | 8.0% | 5.0% | 8.0% | 5.0% |

Energies | 8.0% | 2.0% | 8.0% | 2.0% |

Forex | N/A | N/A | N/A | N/A |

Phillip Securities Non-Trading Costs

Poems does not charge a blanket inactivity fee for all accounts, but certain account types incur maintenance or custodian fees if there is no trading activity.

Poems Cash Account Non-Trading Fee

- Maintenance fee: S$15.00 quarterly (plus GST)

- Charged based on account balance at the end of March, June, September, and December

- Waiver: At least 1 trade per quarter

Global Stocks Account Non-Trading Fee

- Custodian fee: S$2.00 per counter per month (plus GST), capped at S$150 per quarter

- Waiver: At least 1 trade per quarter

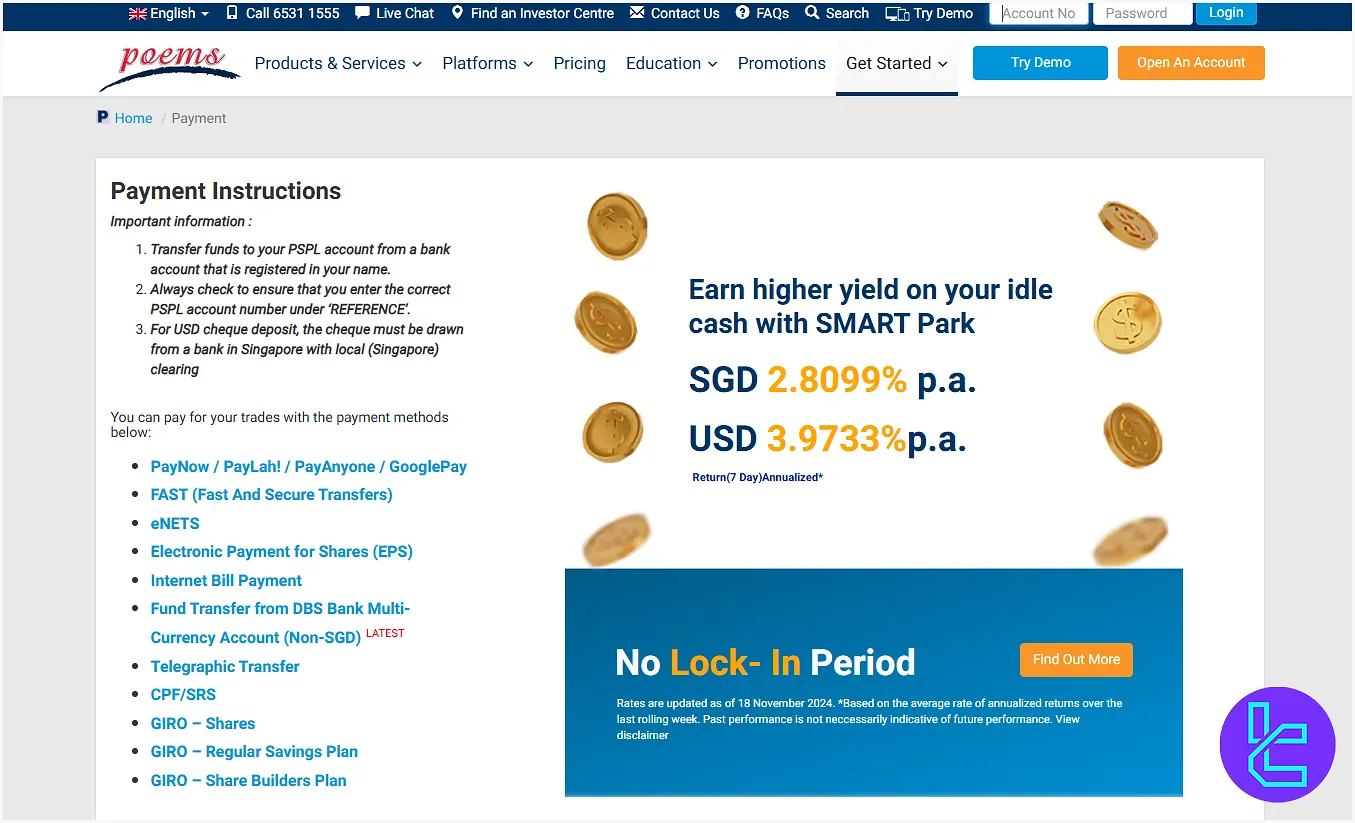

Poems Broker Payment Options

Phillip Securities offers a variety of payment methods for funding trading accounts and withdrawals.

Phillip Securities charges no fees for deposits

Phillip Securities charges no fees for deposits

Phillip Securities Deposit Methods

Clients can fund their Phillip Securities accounts through various online and offline payment methods. All transfers must originate from a bank account registered in your name, and the correct PSPL account number must be entered as the payment reference.

Deposit Method | Processing Time | Fee | Minimum Deposit | Currency |

PayNow / PayLah! | 15 mins (excl. 11:15 pm–12:15 am & 5–9 am) | $0 | Banking limit | SGD |

FAST Transfer | 15 mins (excl. 11:15 pm–12:15 am & 5–9 am) | $0 | Banking limit | SGD |

eNETS | 15 mins (excl. 11:15 pm–12:15 am & 5–9 am) | $0 | SGD 1,000 | SGD |

Electronic Payment for Shares (EPS) | Next working day if before 9 pm | $0 | No limit | SGD |

Internet Bill Payment | 2 working days | $0 | Banking limit | SGD |

DBS Multi-Currency Account Transfer (Non-SGD) | Up to 1 working day | $0 | Banking limit | USD, HKD, AUD, EUR, GBP, CNH |

Telegraphic Transfer (TT) | Up to 1 week | Bank charges; +S$10 handling (outgoing) | Banking limit | SGD, USD, HKD, JPY, MYR, AUD, GBP, EUR, CAD, CNY |

CPF/SRS | On due day | Agent bank/SRS fee | CPF/SRS investable amount | SGD |

GIRO – Shares | D+2 (deduction), D+1 (payment) | $0 | No limit | SGD |

GIRO – Regular Savings Plan (RSP) | 1–5 working days before investment day | $0 | Scheduled amount | SGD |

GIRO – Share Builders Plan (SBP) | 1–5 working days before investment day | $0 | Scheduled amount | SGD |

Phillip Securities Withdrawal Methods

- Bank Transfer

- PayNow to NRIC/FIN/UEN

- Quick Cheque

- Telegraphic Transfer

- POEMS Reward Redemption (Cash)

Phillip Securities SG Copy Trading and Investment Plans

Poems offers Managed Account Services for investors who prefer professional portfolio management. However, a dedicated copy trading feature is not offered.

- Direct ownership of stocks in the investor's name

- Flexible withdrawals with no lock-in periods or hidden fees

- 24/7 online access to portfolio holdings and monthly statements

- Customized portfolio strategies based on risk profile and objectives

- Diversified portfolios across global asset classes

- Leveraging Phillip's global research network

- Minimum investment: S$10,000

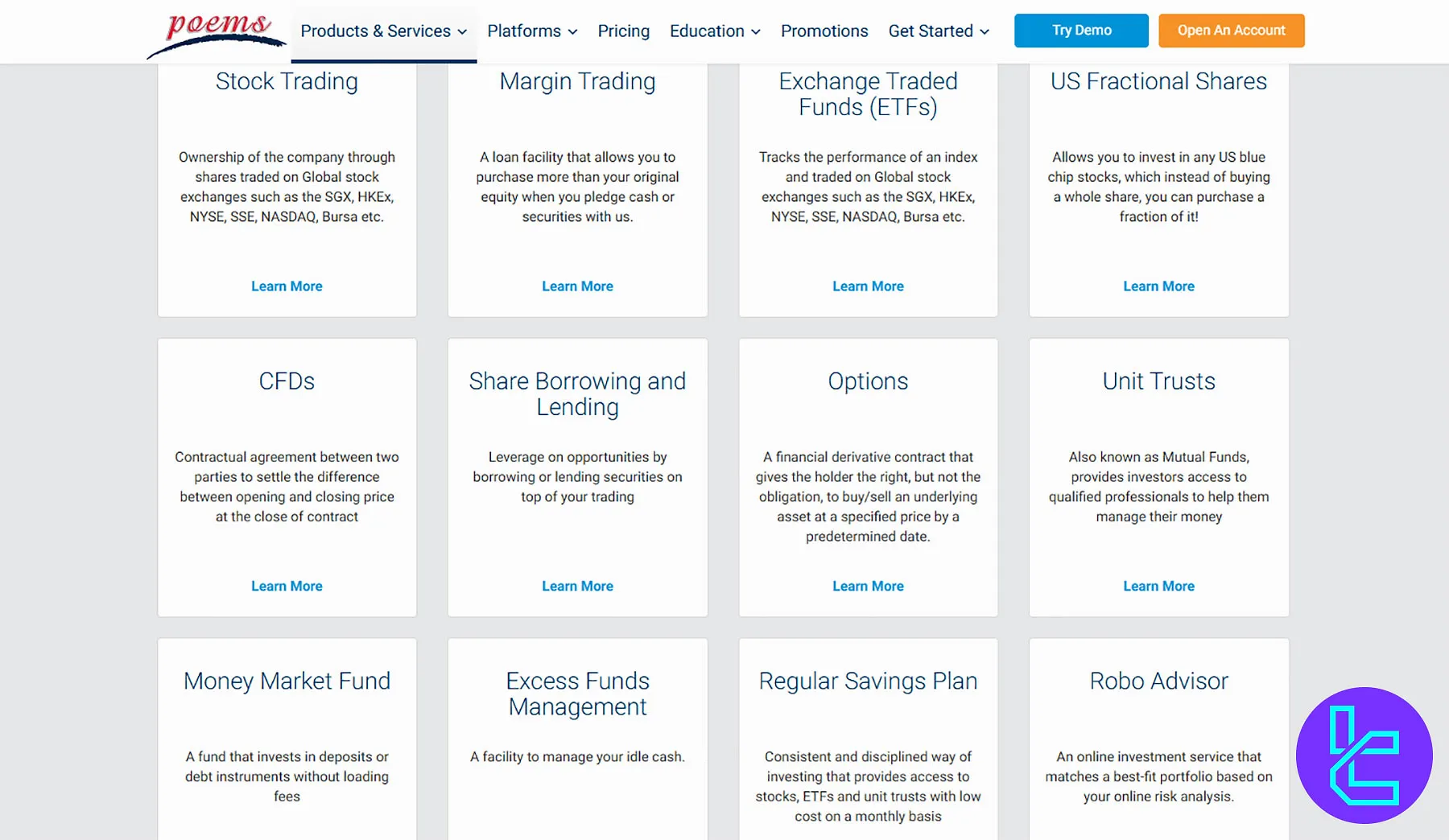

Poems Trading Assets

Phillip Securities offers a multi-asset investment environment with access to over 40,000 instruments across 26+ global exchanges.

Tradable assets include the Forex market, equities, ETFs, contracts for difference (CFDs), bonds, Futures market,derivatives like DLCs and warrants, mutual funds, unit trusts, and a wide FX selection of over 40 currency pairs.

The firm also supports advanced portfolio strategies via managed accounts, Robo-Advisory, share financing, and access to Pre-IPO investment vehicles in markets like Hong Kong.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | 40+ | 50 - 70 currency pairs | 1:3.5 |

Indices | CFDs | 5 | 10 - 20 instruments | N/A |

Stocks | CFDs | 20,000+ | 800 - 1200 | N/A |

ETFs | CFDs | 4,000+ | 20 - 30 | N/A |

Bonds | CFDs | 20,000+ | N/A | N/A |

Commodities | CFDs | 6 instruments like gold, silver, and crude oil | 15 - 30 instruments | N/A |

Futures | Futures | 100+ | 50 - 100 instruments | N/A |

Options | Options | N/A | N/A | N/A |

The wide range of tradable instruments allows for diverse trading strategies and portfolio diversification.

Phillip Securities SG Promotional Programs

The broker offers 3 main bonus plans: Reward Points, Referrals, and Trading Promotions (for new and existing accounts).

- Affiliate: Up to $680 for referring new clients

- Reward Points: 1 Poems Reward Point for everyS$1 commission on trading equities via proprietary platforms

- Trading Promotions: Deposit bonus on Smart Portfolio, welcome gift of up to S$1,000, cash credits for investing in certain products

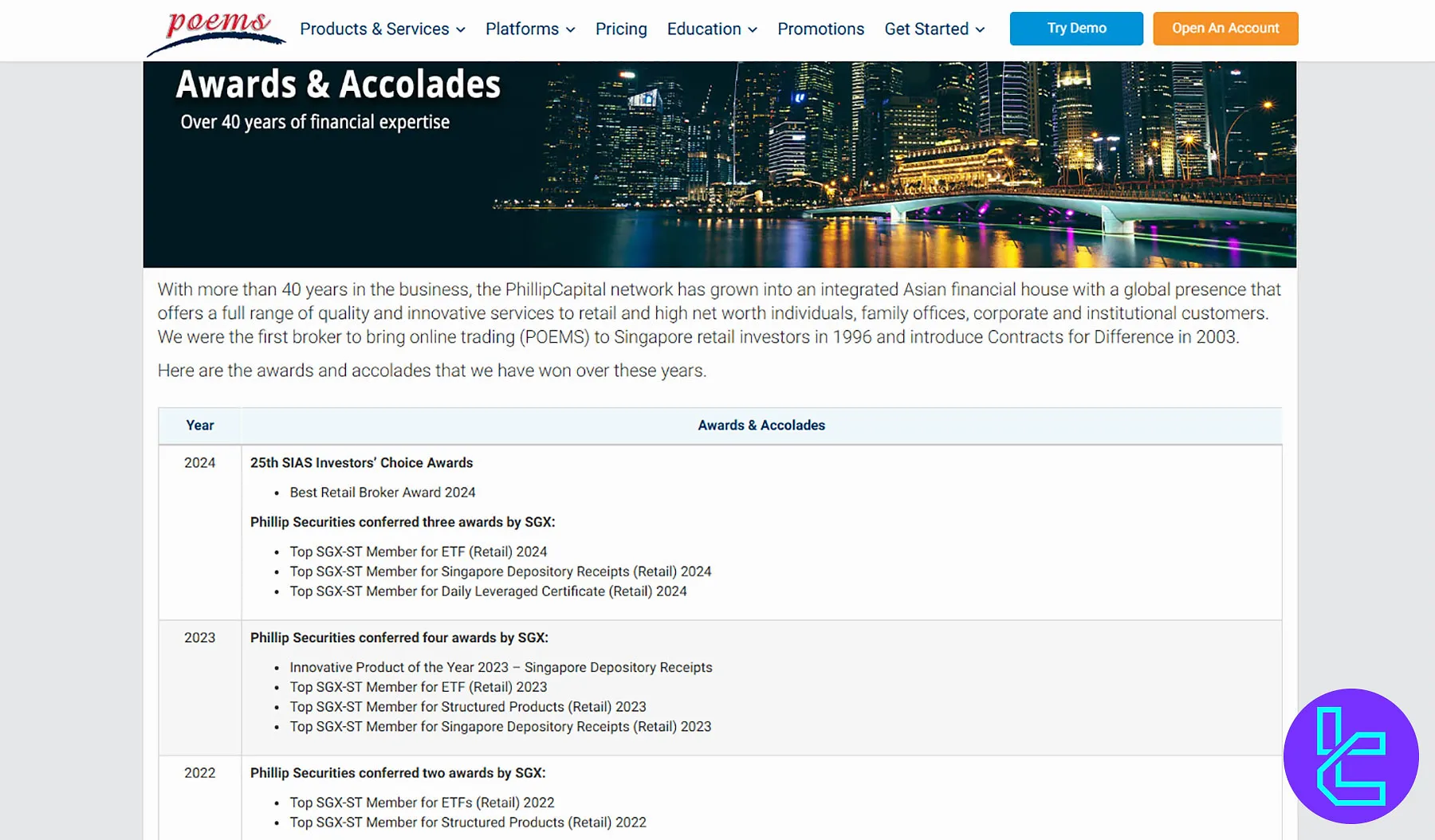

Phillip Securities Awards

With over 40 years of market leadership, PhillipCapital pioneered online trading in Singapore with POEMS (1996) and CFDs (2003), earning consistent recognition for innovation, service quality, and product excellence across regional and global financial markets. Key Phillip Securities awards:

- Multiple SIAS Best Retail Broker wins and SGX Top Member titles

- Recognized for ETF market making, innovative products, and platform reliability

- Multiple ShareInvestor Awards across brokerage, CFD, forex, and platform categories

- Repeated Investment Trends titles for the Largest CFD/Online Broker

Poems Broker Support Channels

The company provides support from Monday to Friday, 8:30 am to 12:00 pm, and on Saturdays from 8:30 am to 1:00 pm. Phillip Securities also offers a full suite of customer service hotlines and an email address.

talktophillip@phillip.com.sg | |

Phone | 6531 1555 |

Chatbot | Available on the official website |

Call Back | Through the “Contact Us” page |

Clients can also engage with investment advisors at any of the 15 Phillip Investor Centre branches located throughout Singapore. The firm offers multilingual support and access to financial specialists for portfolio management, insurance planning, and other advisory services.

Phillip Securities SG Restricted Countries

The company has imposed geographical restrictions on certain countries due to regulatory compliance and AML policies. Red flag countries on Poems broker:

- United States

- Iran

- North Korea

Poems User Satisfaction

Trust score is one of the most important topics in this Phillip Securities SG review. The company has won multiple global awards, including the “Best Retail Broker 2024”, “Innovative Product of the Year 2023 – Singapore Depository Receipts”, and many more.

While there are not many reviews about Phillip Securities SG on reputable review websites, there are several factors we can consider to check the broker’s reliability.

- Reputation: Established in 1975 and part of the larger PhillipCapital network with a global presence in 15 countries

- Regulation: Multiple licenses in various regions, including FCA, SEC, MAS, and ASIC

- Security Measures: Segregated accounts for client funds

- Awards: Recipient of over 70 industry awards

Phillip Securities SG Broker Educational Content

Phillip Securities enhances client decision-making through its research-rich POEMS 2.0 platform, which includes professional-grade tools like Advanced Charting, Trading Central integrations, Web TV, Smart News feeds, and an Economic Calendar.

Investors can explore opportunities with ETF Screeners, Smart Alerts, and Robo-Advisory features. The broker also fosters investor education through face-to-face sessions with ETF issuers and in-branch financial literacy support.

In addition to a vast range of financial products, Poems provides a full suite of trading lessons and educational materials, mostly for free.

- Investment seminars and events

- Market Journal

- Video tutorials

- Weekly Market Call updates

You can also check TradingFinder's Forex education for additional resources.

Phillip Securities Comparison Table

The table below compares Phillip Securities' services with popular competitors in the market.

Parameter | Phillip Securities Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FCA, SEC, MAS, ASIC, MAS, FSA | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.6 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | From $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | S$1,000 | $200 | $5 | $50 |

Maximum Leverage | 1:3.5 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MT5, Phillip Nova 2.0, CQG, Trading Technologies (TT), POEMS 2.0, POEMS Pro, POEMS Mobile 3 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Cash Plus, Cash Management | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | N/A | Yes | Yes | No |

Number of Tradable Assets | 40,000+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and Final Words

Phillip Securities SG provides access to 40,000+ financial products, from Forex to Stocks and Bonds, via POEM, MT5, Nova, CQG, and TT trading platforms. Poems broker also offers money management services with a minimum deposit requirement of 10,000 SGD, and it accepts Google Pay, eNETS, and PayNow payments.