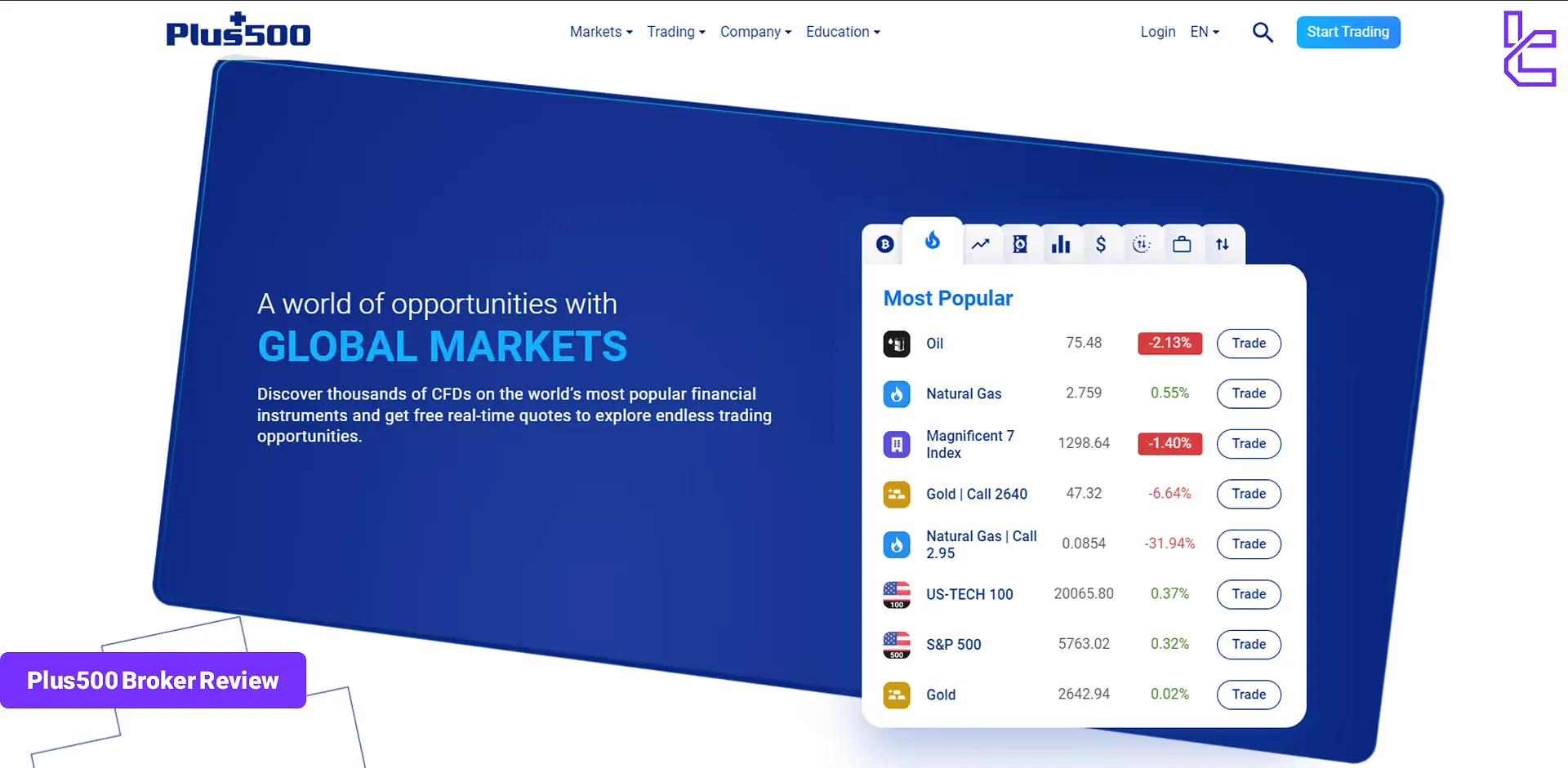

Plus500 (an Israel-founded CFD broker) is regulated by CySEC, DFSA, EFSA, ASIC, FSCA, and other financial authorities. This broker provides Retail and Professional accounts with a minimum deposit of $100 and a maximum leverage of 1:300 (professional account).

Traders can trade over 2800 instruments on Plus500 WebTrader and mobile trading app.

Plus500 Company Information & Regulatory Status

Plus500 has established itself as a reputable player in the Forex broker space, backed by robust regulatory oversight. Here's a breakdown of the company's key information:

- Founding year: 2008

- Headquarters: London, UK

- Public Listing: London Stock Exchange (FTSE 250 index)

- Primary Offerings: CFDs (Contracts for Difference) and share dealing

The company is publicly listed on the London Stock Exchange (LSE: PLUS) and operates in over 50 countries through 10 licensed subsidiaries.

Its regulatory coverage includes oversight from top-tier authorities such as the UK FCA, Cyprus CySEC, and Australia ASIC, offering clients peace of mind regarding compliance and transparency.

- Financial Conduct Authority (FCA) in the UK (No. 509909)

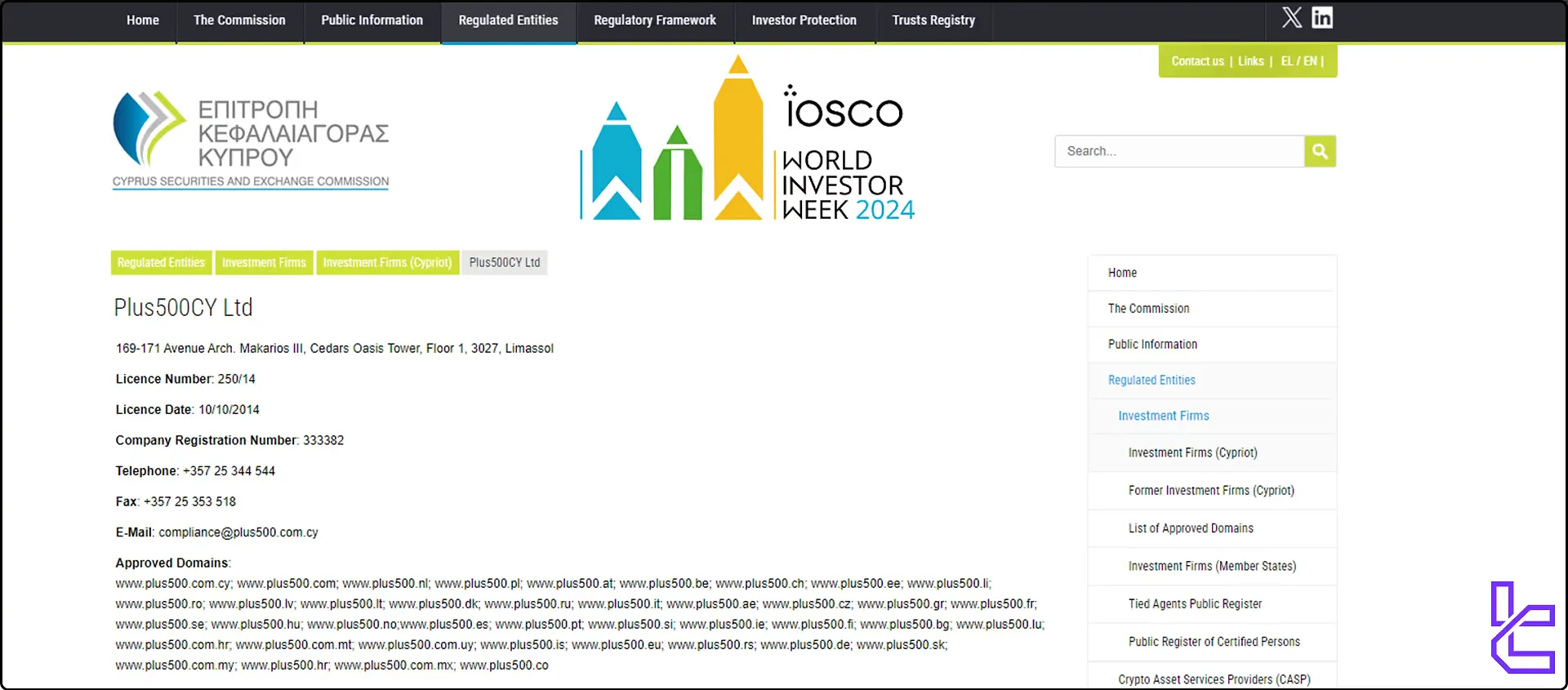

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus (no. 250/14)

- Australian Securities and Investments Commission (ASIC) in Australia

- Financial Markets Authority (FMA) in New Zealand

- Financial Sector Conduct Authority (FSCA) in South Africa

- Monetary Authority of Singapore (MAS) in Singapore (Licence No CMS100648)

- Israel Securities Authority (ISA) in Israel

- Dubai Financial Services Authority (DFSA) in the UAE

- Estonian Financial Services Authority (EFSA)

Plus500 is regulated by CySEC based on the document above

Plus500 is regulated by CySEC based on the document above

Plus500 appeals primarily to self-directed traders who value streamlined technology and a frictionless interface. With fast onboarding, responsive customer support, and minimal administrative fees, the broker is especially well-suited for casual and swing traders.

While it may not offer the tightest spreads, its combination of transparency, ease-of-use, and regulatory backing makes it a standout in the retail CFD space.

| Entity Parameters/Branches | Plus500CY Ltd | Plus500uk Ltd | Plus500EE AS | Plus500AU Pty Ltd | Plus500AU Pty Ltd | Plus500AU Pty Ltd | Plus500AE Ltd | Plus500SG Pte Ltd | Plus500SEY Ltd |

Regulation | CySEC | FCA | EFSA | ASIC | FMA | FSCA | DFSA | MAS | FSA |

Regulation Tier | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 3 |

Country | Cyprus | United Kingdom | Estonia | Australia | New Zealand | South Africa | United Arab Emirates | Singapore | Seychelles |

Investor Protection Fund/Compensation Scheme | Up to €20,000 under ICF | Up to £85,000 under FSCS | Up to €20,000 | No | No | No | No | No | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 | 1:20 | 1:300 |

Client Eligibility | Europe | UK | Estonia | Australia | New Zealand | South Africa | UAE | Singapore | Global |

Plus500 Broker Specifications Summary

Let's take a closer look at what sets Plus500 apart in the crowded world of online brokers:

Broker | Plus500 |

Account Types | Retail, Professional |

Regulating Authorities | FCA, ASIC, CySEC, MAS, EFSA, DFSA, AFSC, FMA |

Based Currencies | USD, GBP, SGD, EUR, CHF, CAD, TRY, SEK, CZK, NOK, ZAR, JPY, AUD, HUF |

Minimum Deposit | $100 |

Deposit Methods | Visa/MasterCard, PayPal, Bank Wire, GooglePay, ApplePay, Skrill |

Withdrawal Methods | Visa/MasterCard, PayPal, Bank Wire, GooglePay, ApplePay, Skrill |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:300 |

Investment Options | No |

Trading Platforms & Apps | Own platform |

Markets | Forex, indices, commodities, options, crypto, ETFs, stocks |

Spread | Floating from 0.5 pips |

Commission | No commission |

Orders Execution | Market |

Margin Call/Stop Out | N/A |

Trading Features | Demo account, Economic calendar |

Affiliate Program | Yes |

Bonus & Promotions | First deposit bonus |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/7 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, and more |

Plus500 Account Types Overview

Plus500 keeps its account structure simple by offering a single standard live account for most retail clients, with a low minimum deposit requirement of $100. Plus500 Live account features:

- Access to live markets

- Maximum leverage: Up to 1:30

- Suitable for traders of all levels

- Risk management tools

- Minimum deposit: $100

Traders who meet certain criteria can apply for a professional account, which offers higher leverage. Plus500 Professional account features:

- Minimum investment portfolio: €500,000

- Maximum leverage: Up to 1:300

- Suitable for professional traders

Plus500 also offers a demo account. This account type is particularly valuable for newcomers, allowing them to familiarize themselves with the platform and test trading strategies without financial risk. It's also useful for experienced traders looking to try new trading strategies.

Plus500 Benefits and Drawbacks

Every trading platform has its strengths and weaknesses. Here's an honest look at Plus500's pros and cons:

Advantages | Disadvantages |

Top-tier regulatory oversight | Lack of MT4/MT5 integration |

Wide range of tradable assets | No social/copy trading features |

Mobile trading app with full functionality | - |

Trading Academy to nurture trading talents | - |

Plus500 Account Opening & Verification Process

Plus500 offers a fast and user-friendly onboarding experience that enables traders to explore forex, stocks, indices, and crypto CFDs across more than 2,800 instruments.

The Plus500 registration process is designed to meet security standards while giving users instant access to the Plus500 trading platform.

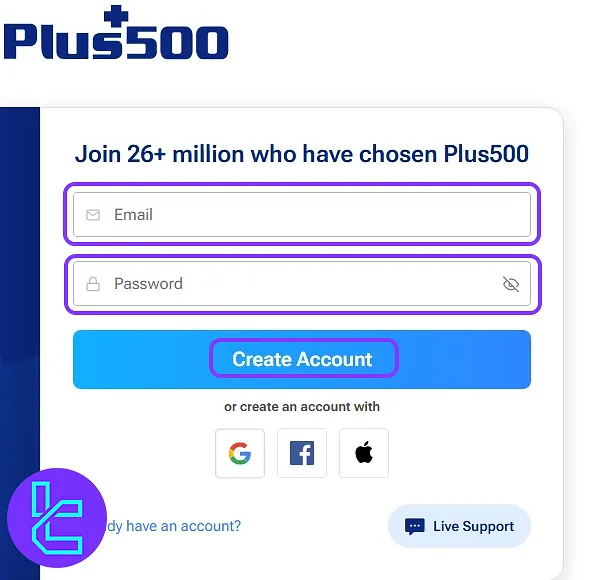

#1 Navigate to the Official Platform

Visit the Plus500 official website and click “Start Trading” to begin the sign-up flow.

#2 Set Up Your Account Credentials

Enter your email address and create a strong password (minimum 12 characters including upper/lowercase letters, numbers, and symbols). Then click “Create Account”.

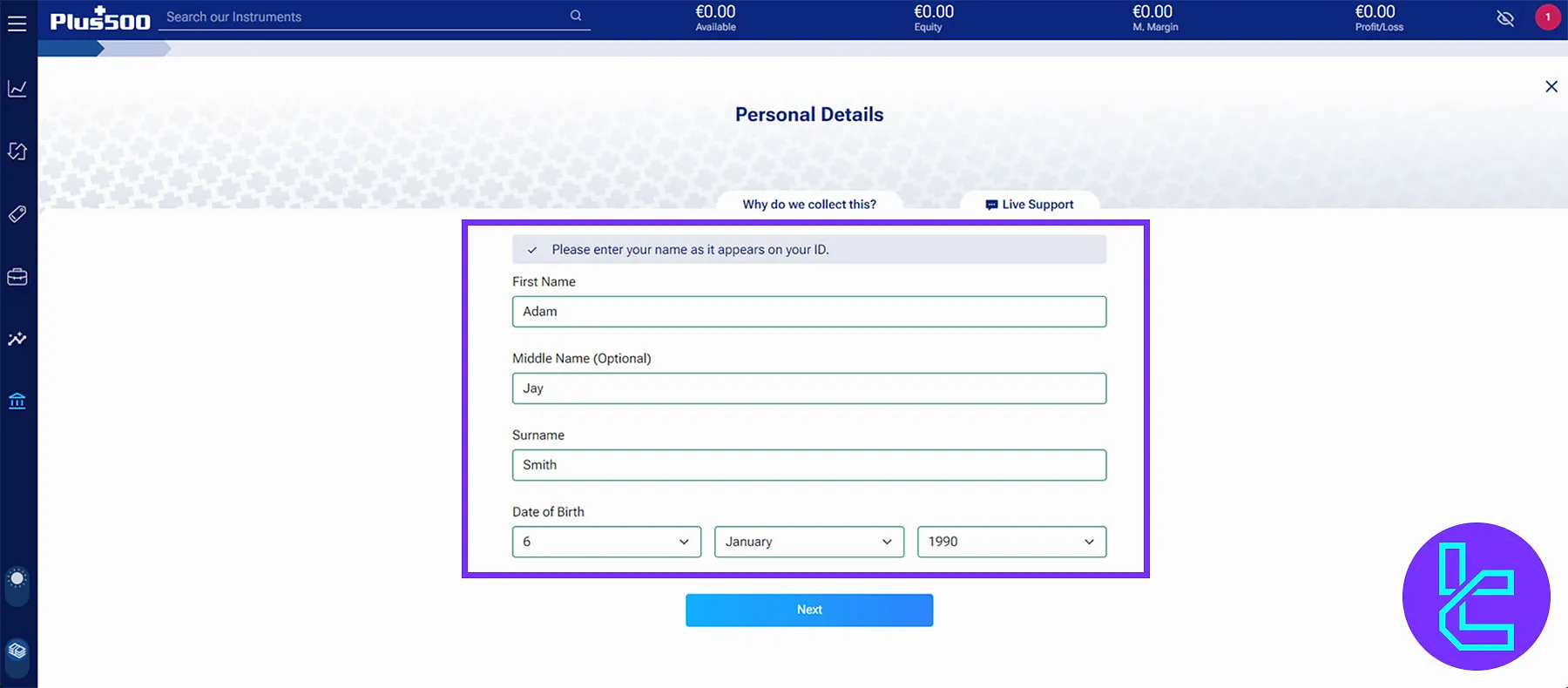

#3 Verify Your Account

To trade with real funds, you’ll need to complete identity verification and make a minimum deposit, as part of the platform’s regulatory compliance.

Go to account settings and click on “Verify Me” to initiate the KYC procedure. Enter your personal information, including;

- First Name

- Surname

- Date of birth

- Residential address

Complete the verification process by uploading supporting documents, including:

- Proof of ID: Passport, Driver's license, or National ID card

- Proof of Address: Utility bill or Bank statement

Plus500 Trading Platforms and Apps

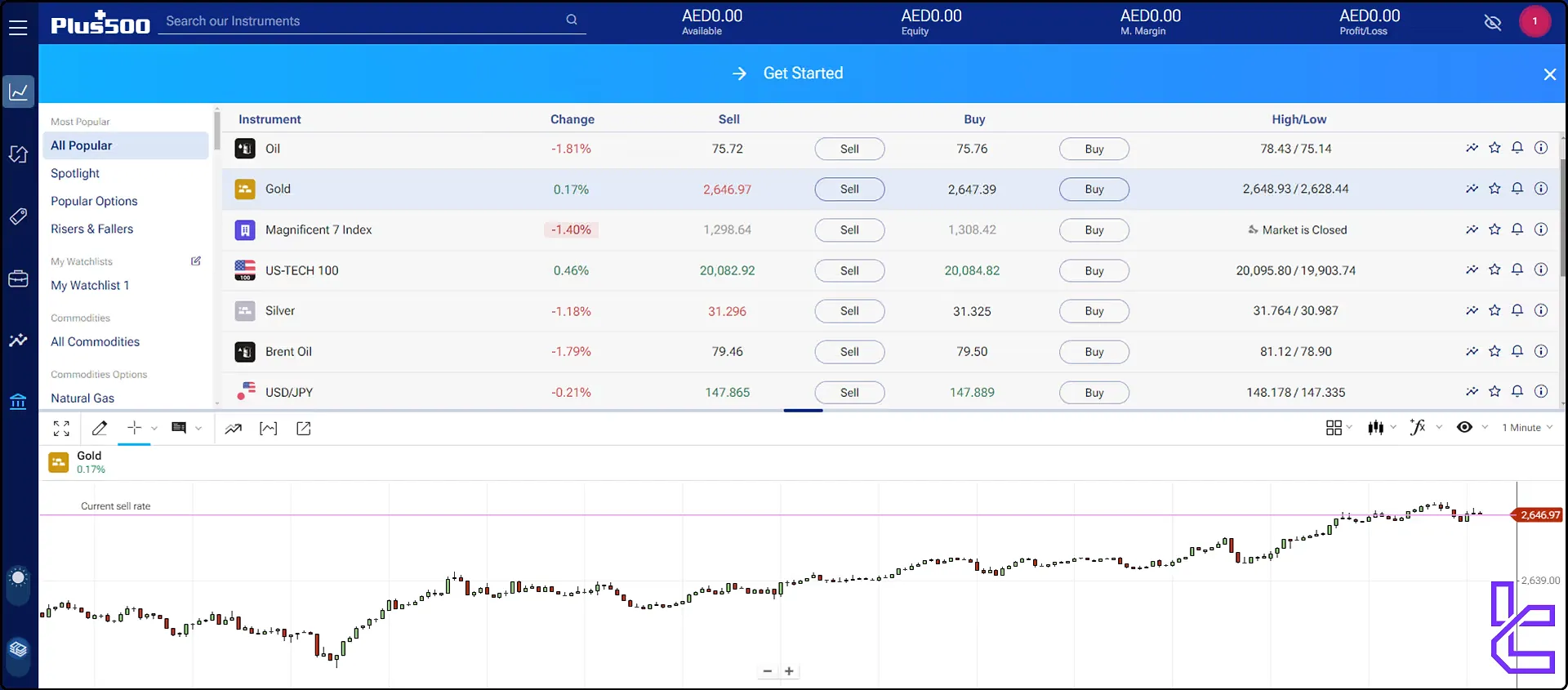

Plus500 provides a clean and intuitive proprietary WebTrader platform available on browsers, Windows, iOS, and Android.

Traders can access a wide range of tools, including 100+ indicators, customizable alerts, and order types such as market, limit, and trailing stops.

Plus500 WebTrader

- Browser-based, no download required

- Intuitive interface with customizable charts

- Real-time quotes and price alerts

- Risk management tools (stop loss, trailing stop, and guaranteed stop)

Plus500 Mobile App

- Available for iOS and Android devices

- Full functionality mirroring the web platform

- Push notifications for market events and price alerts

Links:

While the platforms lack some advanced features found in MetaTrader 4 and MT5, they offer a clean, straightforward trading experience that's particularly appealing to novice and intermediate traders.

Plus500 Trading Costs (Spreads and Commissions)

Plus500 operates on a spread-only model for most instruments, meaning there are no separate commissions charged on trades. Here's what you need to know:

- Spreads are variable and can widen during periods of high volatility;

- Forex market spreads start from 0.5 pips on major pairs;

- No commissions are charged on most trades (except for share CFDs in some regions);

The table below provides spread charges for some of the most popular trading instruments during peak trading hours:

Instrument | Spreads |

EURUSD | 1.4 Pips |

GBPJPY | 3.9 – 4.1 pips |

WTI Oil | $0.04 |

Gold | $0.61 - $0.78 |

Bitcoin | $237.5 - $253.42 |

DAX 40 | 1.9 – 2.3 pips |

Apple | $1.78 |

It's important to note that while Plus500's spreads are competitive, they may not always be the tightest in the market. Traders should always consider the total cost of trading, including potential overnight fees, when comparing brokers.

Traders don’t need to pay fees for deposits, real-time Forex quotes, and dynamic charts on Plus500

Traders don’t need to pay fees for deposits, real-time Forex quotes, and dynamic charts on Plus500

Plus500 Swap Fees

Plus500 applies overnight funding when positions remain open past a specific cut-off time.

The charge or credit depends on trade size, market rates, and instrument type, with details available in-platform for each asset.

- General Formula: Trade Size × Position Opening Rate × Point Value × Daily Overnight Funding%

- Share CFDs Formula: Trade Size × Daily Close Rate × Point Value × Daily Overnight Funding%

- Daily Close Rate: Average [(Buy + Sell) ÷ 2] from last quote 30 minutes before funding time

- Check Details: Available via the “Details” link beside each instrument in Plus500’s platform

- Example: EUR/USD long positions incur a $10.80 swap fee

Plus500 Non-Trading Costs

The broker charges an inactivity fee when a live trading account remains unused for three months, helping cover service maintenance costs. The fee applies monthly until account activity resumes.

- Inactivity Amount: Up to USD 10 per month (or currency equivalent)

- Trigger: No login for at least 3 months

- Deduction: $10 or the account balance (if lower than $10)

- Applicability: Only on Real accounts with sufficient funds

- Avoidance: Logging in periodically prevents the inactivity fee

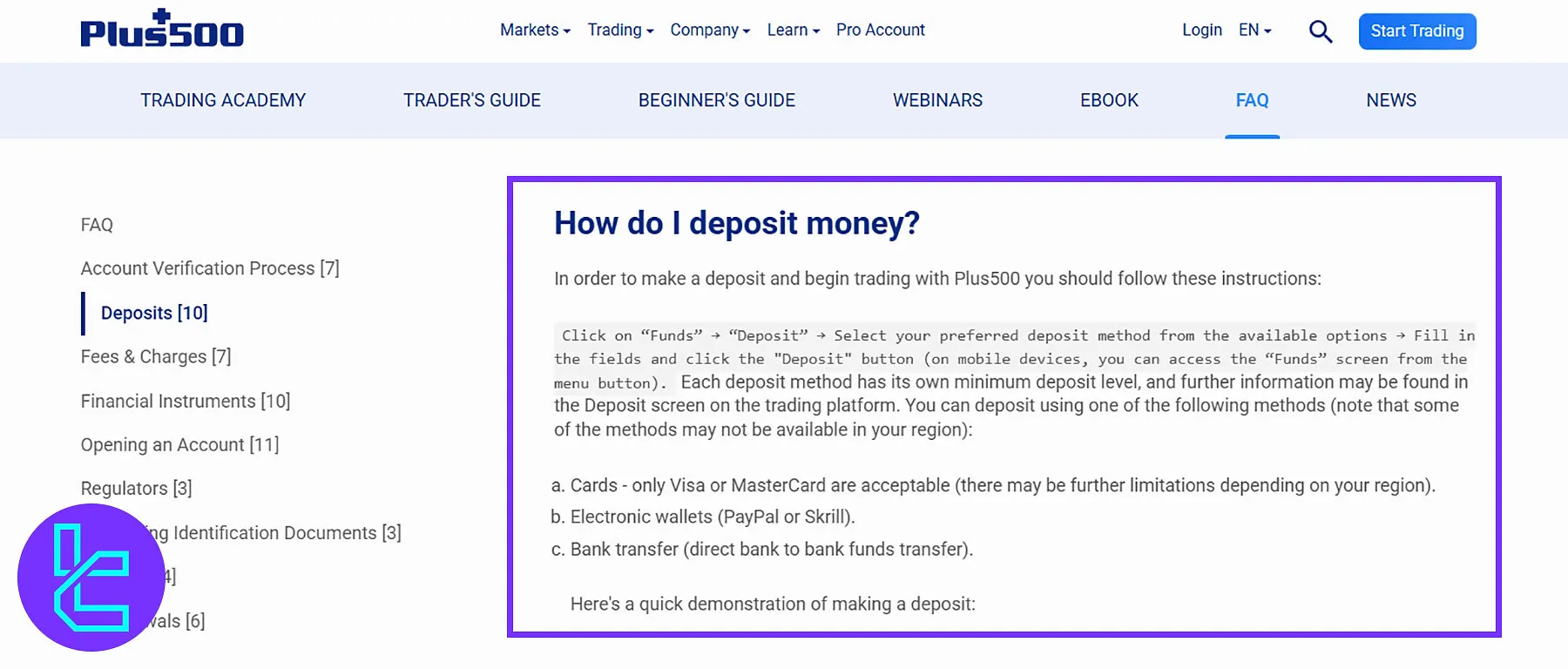

Plus500 Deposit & Withdrawal Methods

Depositing and withdrawing funds at Plus500 is fast, flexible, and free of broker-side charges. Supported methods include:

- Credit/Debit Cards (Visa, Mastercard)

- Bank Wire Transfer

- PayPal

- Skrill

- Local payment methods (varies by region)

- Google and Apple Pay

Plus500 Deposits

The broker supports Bank transfers, cards, and e-wallet payments with various processing times:

| Deposit Methods | Processing Time | Min Deposit | Deposit Fees |

VISA / MasterCard | Instant | $100 | 0% |

Bank Transfers | Instant | $100 | 0% |

Skrill / PayPal | Instant | $100 | 0% |

Note that the availability of payment methods differs based on your region.

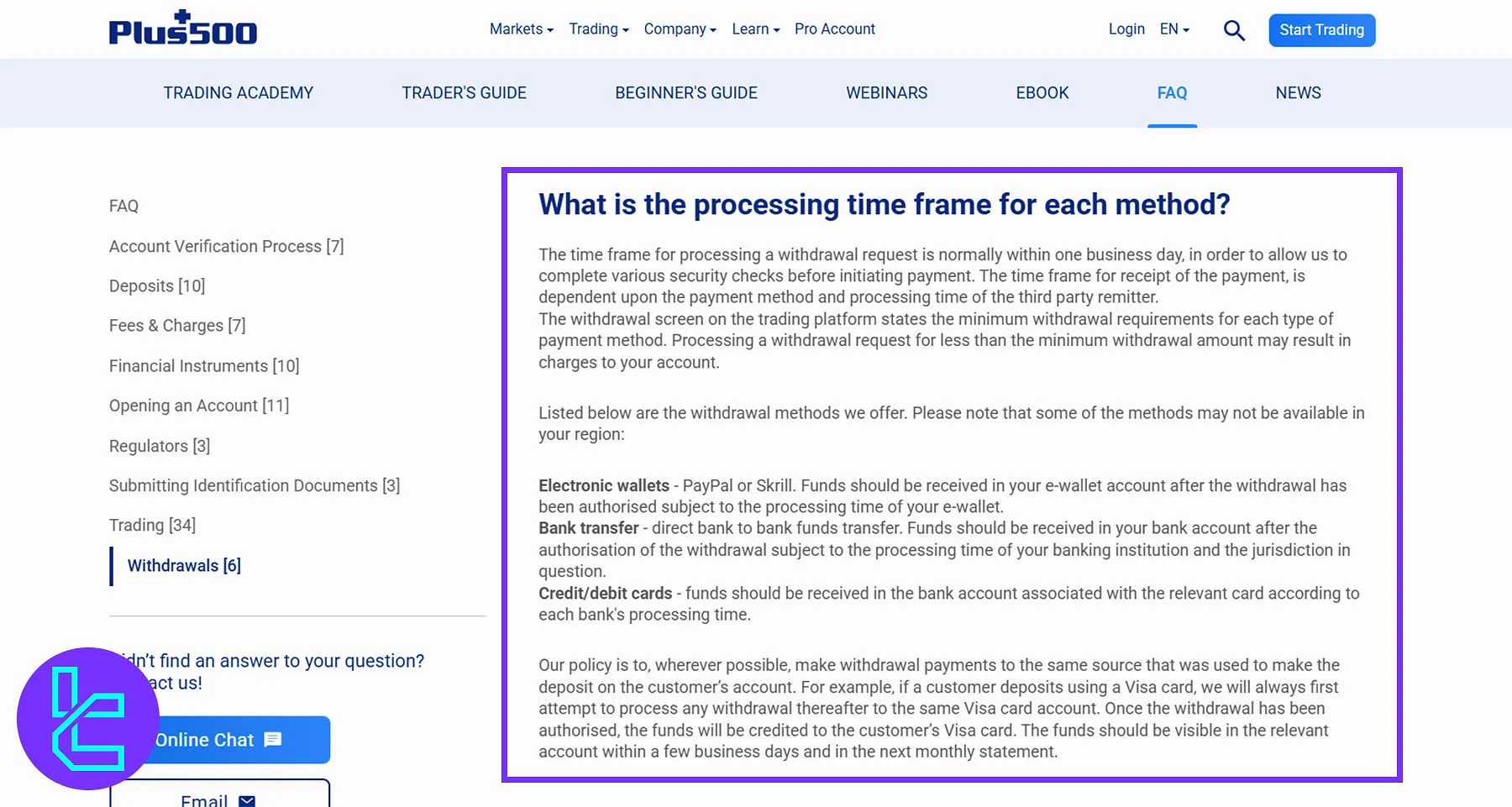

Plus500 Withdrawals

Withdrawals are typically processed within 1-3 business days. While Plus500 doesn’t charge funding fees, a currency conversion fee of up to 0.7% applies for trades executed in currencies different from the account base.

| Withdrawal Methods | Processing Time | Min Withdrawal | Withdrawal Fees |

VISA / MasterCard | 1-3 business days | $100 | 0% |

Bank Transfers | 1-3 business days | $100 | 0% |

Skrill / PayPal | 1-3 business days | $50 | 0% |

Plus500's diverse payment options and fee-free structure make funding and withdrawing from your account a hassle-free experience.

Copy Trading Services & Investment Options Offered on Plus500 Broker

It's important to note that Plus500 does not currently offer copy trading or social trading features. The platform focuses on self-directed trading, providing tools and resources for individual decision-making rather than following other traders' strategies.

While this may be a drawback for those interested in copy trading, it aligns with Plus500's focus on providing a straightforward, individual trading experience.

Plus500 Tradable Instruments Overview

Plus500 gives traders access to over 2,800 CFDs across major asset classes, including the Forex market, Options, and Cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 70 | 50 - 70 currency pairs | 1:30 |

Indices | CFDs | Over 25 | 10 - 20 instruments | 1:20 |

Stocks | CFDs | 1,800+ | 800 - 1200 | 1:5 |

ETFs | CFDs | 90+ | 20 - 30 | 1:5 |

Options | CFDs | 350+ instruments | N/A | 1:5 |

Commodities | CFDs | 29 instruments, including metals, energies, and agricultural products | 15 - 30 instruments | Gold 1:20 Other Commodities 1:10 |

Cryptocurrencies | CFDs | 23+ digital assets like Bitcoin, Ethereum, and Binance coin, and two indices (Crypto 10 and Nasdaq Crypto) | 20 - 30 instruments | 1:2 |

In addition, the broker offers separate platforms for share trading (Plus500 Invest) and U.S.-based futures markets trading (Plus500Futures), expanding access for multi-asset investors.

This wide selection allows traders to diversify their portfolios and take advantage of opportunities across different markets.

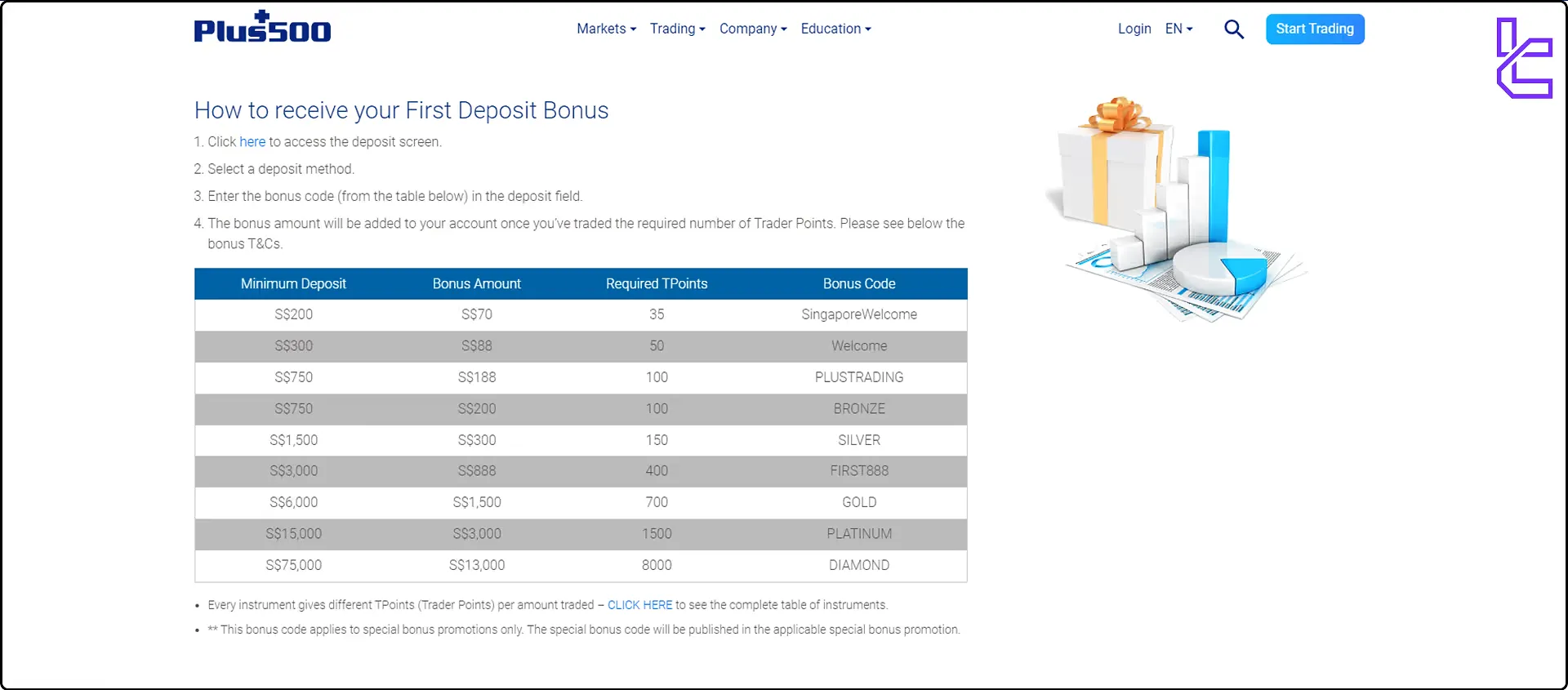

Plus500 Promotions and Bonuses

Plus500 occasionally offers promotional bonuses, but these are subject to change and may vary by region due to regulatory constraints. As of 2023, the following promotions may be available:

- First Deposit Bonus: New clients can receive a bonus on their initial deposit;

- Referral Program: Earn rewards for referring new traders to the platform.

Plus500 Awards

Plus500 has earned multiple prestigious awards for its trading platform, reliability, and user experience, reflecting its strong global reputation in the CFD and forex trading industry.

- Best Online Trading Services (2023): ADVFN

- Safest Global Broker (2023): International Investor Magazine

- Most Trusted Global FX Broker (2022): International Investor Magazine

- Best CFD Broker (2021): Rankia

- Best FX Broker (2021): Le Fonti Award

Plus500 Broker Support Channels

Customer support at Plus500 is available 24/7 through live chat, WhatsApp, and emailchannels. While phone support is not offered, the response times via chat and email are typically prompt, often under five minutes.

All support interactions are conducted through a ticket-based system, which is suitable for most inquiries but may not satisfy traders who prefer real-time verbal interaction.

- 24/7 Live Chat: Available directly on the website and trading platform

- Email Support: support@plus500.com

- FAQ Section: Comprehensive answers to common questions

While Plus500's support is generally responsive, some users have reported longer wait times during peak trading hours.

Plus500 Restricted Countries

Due to regulatory constraints, Plus500 is not available in all countries. Notable restrictions include:

- Iran

- North Korea

- Sudan

- Syria

Traders should always check the most up-to-date information on Plus500's website regarding country restrictions, as these can change based on evolving regulatory landscapes.

Plus500 Trust Score on Review Websites

Trust is paramount in the world of online trading. The Plus500 Trustpilot profile has generally positive reviews with a 4.1/5 score based on over 13,000 reviews. This shows the popularity of this broker among the trading community.

Plus500 Broker Education Materials

Plus500 supports its clients with a comprehensive Trading Academy, offering tutorials, market explainers, and videos tailored to CFD education. The platform includes an economic calendar and proprietary tools like +Insights, which reflect aggregated client sentiment.

- Basic trading guides

- Market news updates

- Video tutorials

- Ebooks

- Webinars

While research depth is adequate for beginner-to-intermediate users, the absence of professional-grade tools like Reuters feeds limits its appeal for advanced traders.

Check TradingFinder's Forex education and Crypto tutorial sections for additional resources.

Plus500 vs Other Brokers

The table below compares Plus500 features and services with other popular brokers:

Parameter | Plus500 Broker | XM Broker | LiteForex Broker | Exness Broker |

Regulation | FCA, ASIC, CySEC, MAS, EFSA, DFSA, AFSC, FMA | ASIC, FSC, DFSA, CySEC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 0.5 pips | From 0.6 Pips | 0.0 Pips | 0.0 Pips |

Commission | $0 | None Except On Shares Account No Withdrawal & Deposit Commissions | From Zero | From $0.2 to USD 3.5 |

Minimum Deposit | $100 | $5 | $50 | $10 |

Maximum Leverage | 1:30 | 1:1000 | 1:30 | Unlimited |

Trading Platforms | Proprietary Platform | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Retail, Professional | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | No | Yes | No | Yes |

Number of Tradable Assets | 2,800+ | 1400+ | N/A | 200+ |

| Trade Execution | Market | Market, Instant | Market | Market, Instant |

TF Expert Suggestion

Plus500 high Trustpilot rating of 4.1/5 from over 13,000 user reviews and its availability in over 50 countries suggest that this broker has successfully attracted Forex and CFD traders worldwide.

Despite that, many traders mention the lack of investment options, such as copy trading, and the unavailability of MT4 and MT5 trading platforms as the main downsides of trading with this broker.