PU Prime provides Forex and CFD trading services for 800 instruments across 6 asset classes. This broker has 4 primary account types, including Standard, Prime, ECN, and Cent, with floating spreads from 0.0 pips and a minimum deposit of $20.

PU Prime offers 5 deposit and withdrawal methods with 0$ commissions.

PU Prime Company Information & Regulation

PU Prime is a well-established CFD broker that has been operating since 2016 and has gained recognition in the financial industry for its comprehensive trading solutions.

The company is based in Seychelles and operates under multiple regulatory licenses, ensuring a secure trading environment for its global clients. Here are the key points regarding PU Prime's company information and regulations:

- Licensed and regulated by the Australian Securities and Investments Commission under the license no. 410681

- Additional oversight from the Financial Services Authority of Seychelles (NO. SD050) and the Financial Services Commission of Mauritius

- Licensed by the FSCA authority in South Africa (No. 52218)

- Client funds are held in segregated bank accounts for enhanced security

- Offers negative balance protection to safeguard traders from excessive losses

- Strict data protection measures to ensure client information security

The table below provides a summary of the broker's company information:

| Entity Parameters/Branches | PU Prime Limited | PU Prime Trading Pty Ltd | PU Prime Ltd | PU Prime (PTY) Ltd |

Regulation | FSA | ASIC | FSC | FSCA |

Regulation Tier | 3 | 1 | 3 | 2 |

Country | Seychelles | Australia | Mauritius | South Africa |

Investor Protection Fund/Compensation Scheme | No | No | Up to €20,000 under The Financial Commission | No |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:1000 | 1:30 | 1:1000 | 1:1000 |

Client Eligibility | Global | Australian Users | Global | Global |

PU Prime Broker Summary of Specifications

PU Prime offers a comprehensive suite of trading services and features designed to meet the needs of diverse traders. Here's a summary of the Forex broker's key specifics:

Broker | PU Prime |

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | SVG FSC, Mwali FSC, FSCA, ASIC |

Based Currencies | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY |

Minimum Deposit | $20 |

Deposit Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Withdrawal Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy trading, social trading |

Trading Platforms & Apps | MT4, MT5, PU Prime app |

Markets | Forex, indices, commodities, shares, bonds, metals, ETFs |

Spread | Floating from 0.0 pips |

Commission | From $1 per side/lot |

Orders Execution | ECN/STP, market execution |

Margin Call/Stop Out | 50%/ 20% |

Trading Features | Demo account, Islamic account |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, rebate bonus, refer a friend program |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, phone, live chat |

Customer Support Hours | 24/7 |

Restricted countries | USA, UAE, Egypt, North Korea, Australia, and more |

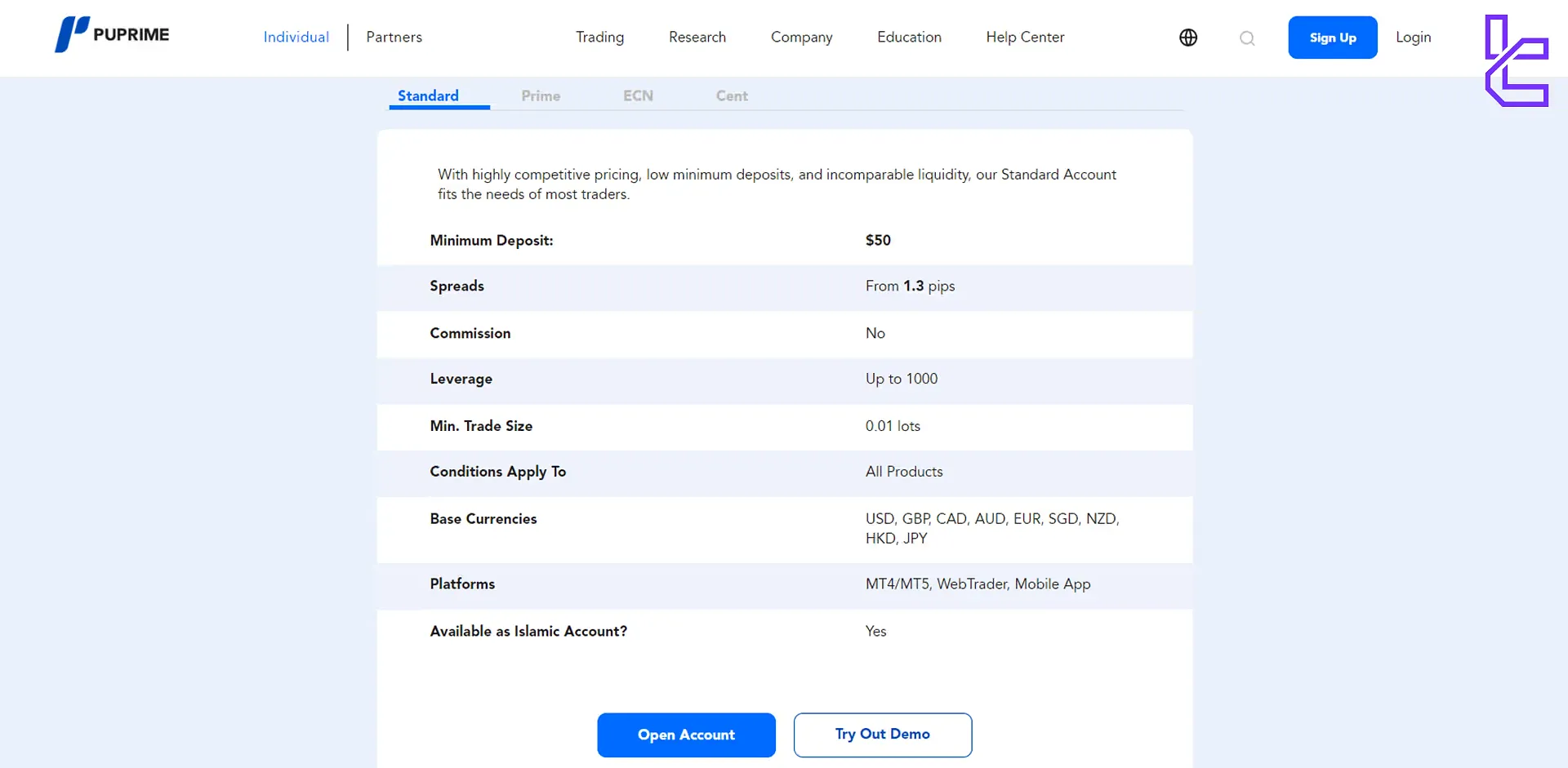

PU Prime Account Types

PU Prime offers a range of account types to suit different trading styles and experience levels. Each account type comes with its own set of features and trading conditions.

Account Type | Standard | Prime | ECN | Cent |

Spread | Floating from 1.3 pips | Floating from 0.0 pips | Floating from 0.0 pips | Floating from 1.3 pips |

Commission | No | $3.5 per side/lot | $1 per side/lot | No |

Minimum deposit | $50 | $1000 | $10,000 | $20 |

Maximum leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

Platforms | MT4/MT5, WebTrader, Mobile App | MT4/MT5, WebTrader, Mobile App | MT4/MT5, WebTrader, Mobile App | MT4/MT5, WebTrader, Mobile App |

The variety of account options ensures that traders can choose the one that best aligns with their trading volume, preferred instruments, and risk appetite.

PU Prime Standard account is suitable for intermediate-level traders

PU Prime Standard account is suitable for intermediate-level traders

Advantages and Disadvantages of PU Prime

Like any broker, PU Prime has its strengths and weaknesses. Here's a balanced look at the advantages and disadvantages of trading with PU Prime:

Advantages | Disadvantages |

Wide range of tradable assets | Mixed reviews on credible websites |

Variety of account types | Not available to US residents |

Up to 1:1000 | - |

Advanced trading platforms | - |

Various bonuses | - |

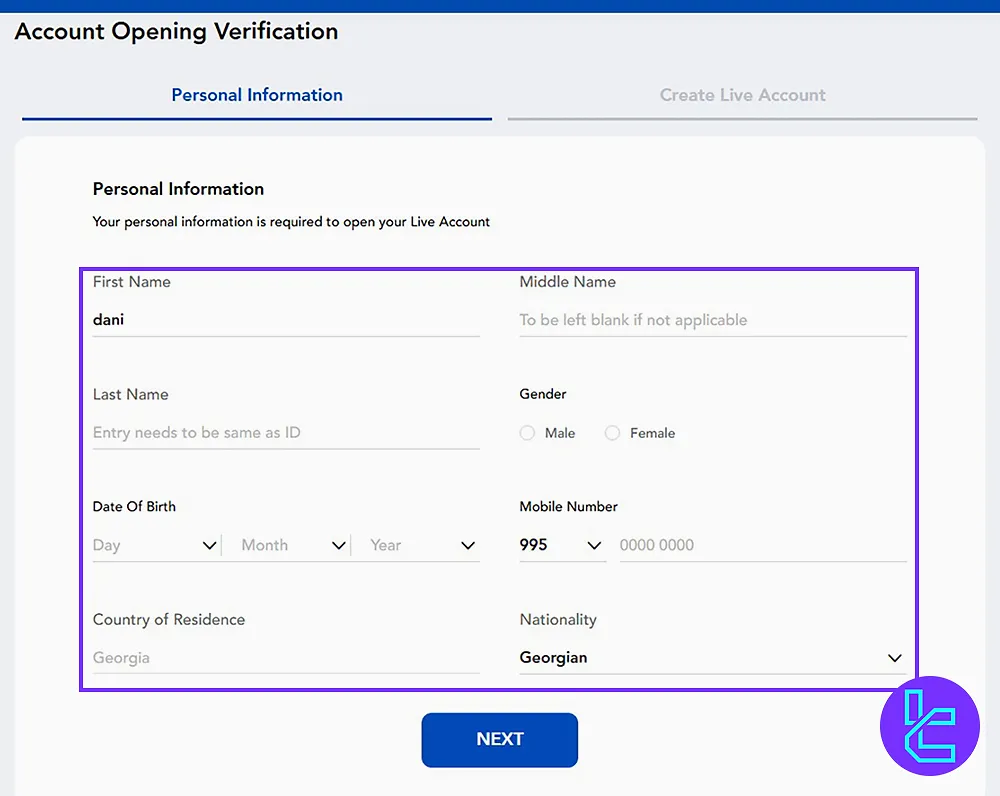

PU Prime Broker Registration & Verification Guide

PuPrime offers fast and secure account setup for global traders, excluding U.S. citizens. The registration flow enables users to open a Standard account in under 5 minutes, with the flexibility to choose preferred platforms (like MT4 or MT5) and base currencies. Step-by-step PU Prime registration guide:

#1 Start Registration

Visit the official Pu Prime website and click on “Sign Up”. You’ll be redirected to the account creation page.

#2 Provide Basic Information

Fill out the application form with the following details:

- Country

- Full name

- Password

Confirm you’re not a U.S. citizenand click“Create Account”.

#3 Complete Profile Details

Provide the following information and then proceed by clicking“Next”:

- Full name

- Date of birth

- Gender

- Mobile number

- Nationality

#4 Set Trading Preferences

Adjust your account settings by choosing the following parameters:

- Trading platform (e.g., MetaTrader 4)

- Account type

- Base currency

Agree to the terms and conditions, then click “Confirm” to finish the setup and access the PU Prime dashboard.

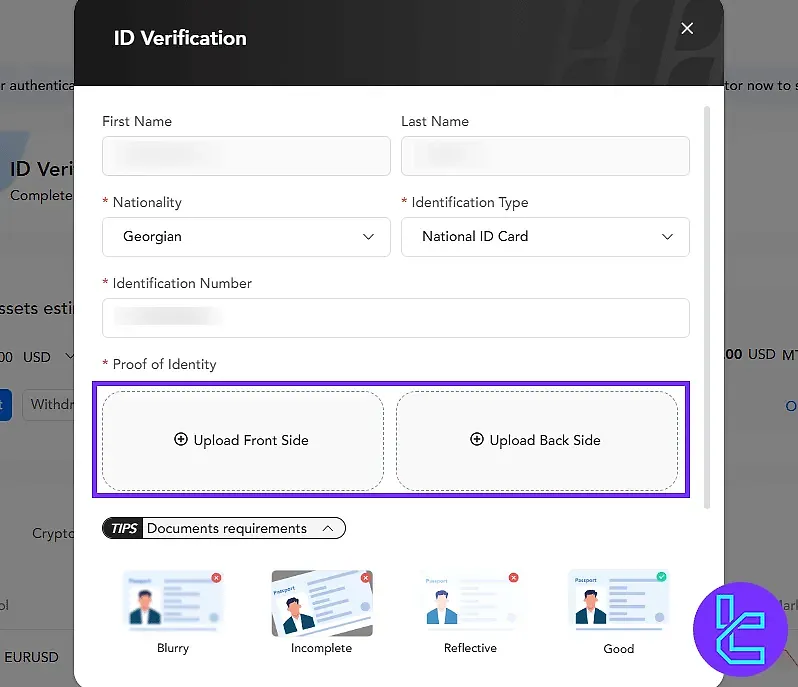

#5 Verify Your Account

To begin trading, proceed with full identity verification through the PuPrime verification process.

The procedure is mandatory for all users and requires you to provide the following documents:

- Proof of Identity: Passport, Driver’s license, or Government-issued ID

- Proof of Residence: Utility bill or Bank statement

Pu Prime Trading Platforms

PU Prime offers a selection of popular and user-friendly trading platforms, from MetaTrader 5 to a proprietary mobile app, to cater to different trader preferences:

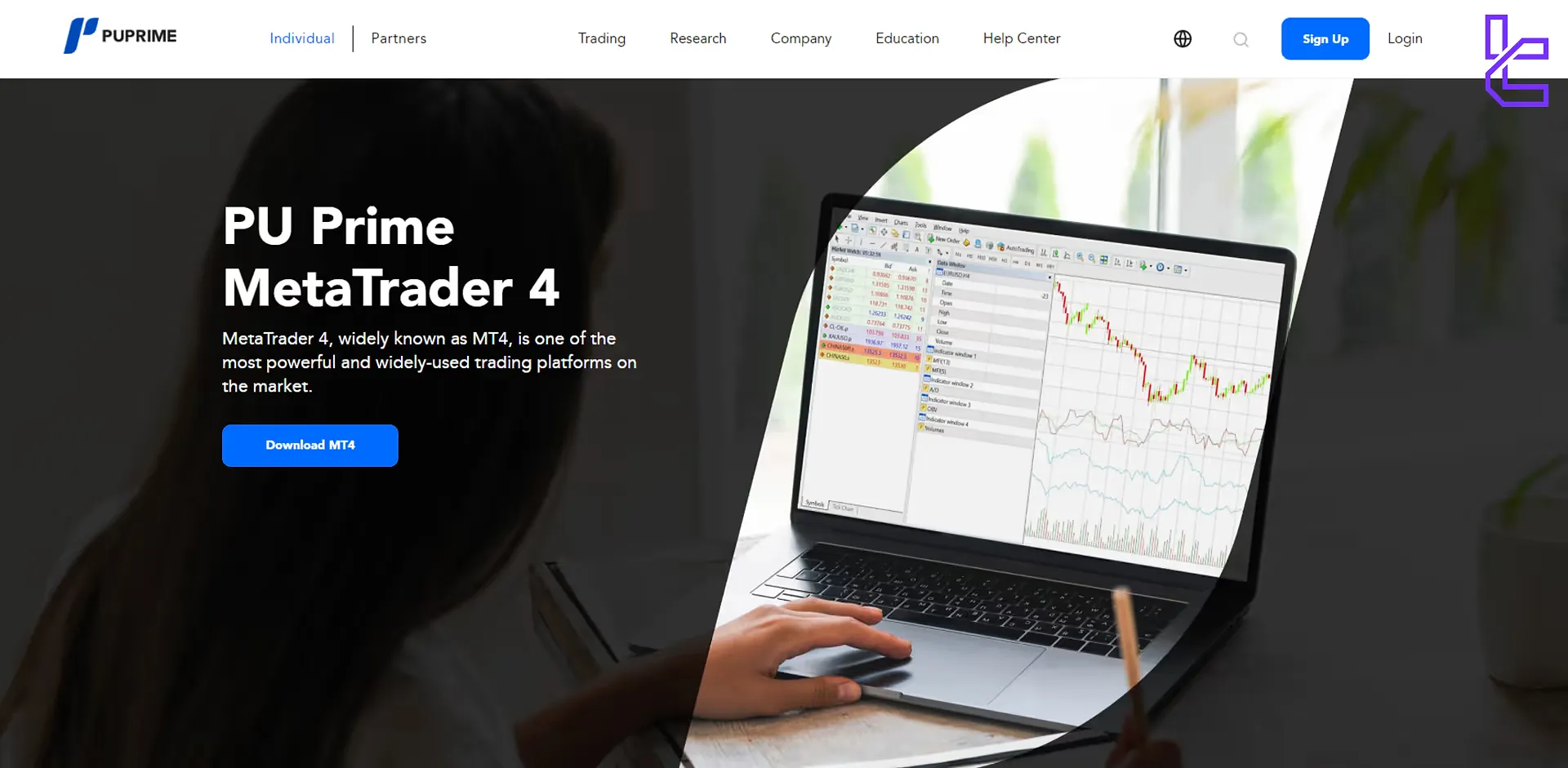

PU Prime MetaTrader 4 (MT4)

The industry-standard platform known for its robust charting tools, automated trading capabilities, and extensive indicator library.

Links:

- MT4 Android

- MT4 iOS

- Windows

- Mac

PU Prime MetaTrader 5 (MT5)

An advanced version of MetaTrader 4, offering additional timeframes, an economic calendar, and a wider range of tradable assets.

Links:

- MT5 Android

- MT5 iOS

- Windows

- Mac

PU Prime WebTrader

A browser-based platform that allows for quick access to markets without the need for software downloads.

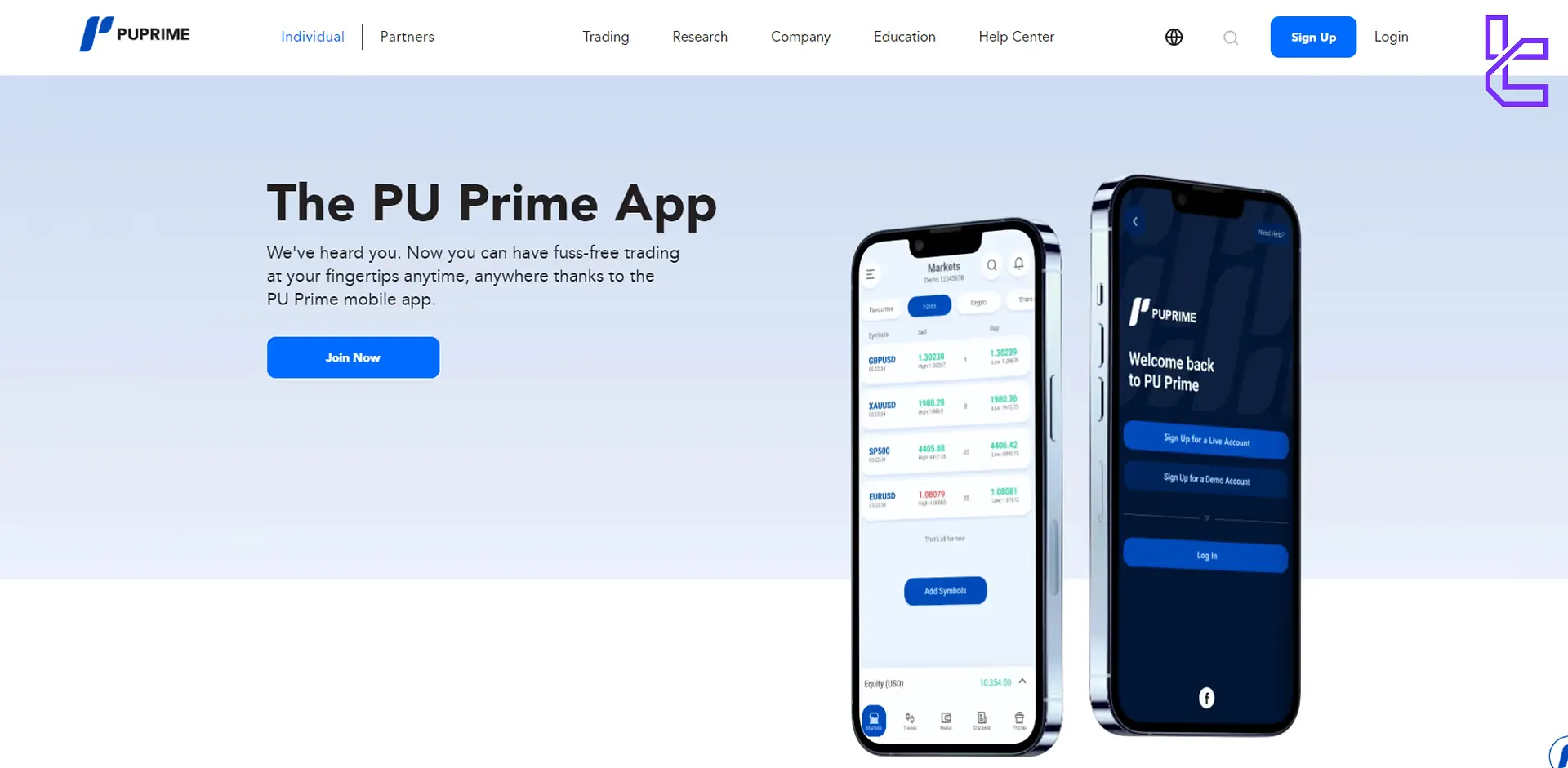

PU Prime Mobile App

A proprietary mobile trading solution that includes unique features like copy trading and social trading functionalities.

Links:

PU Prime broker offers trading services on its official mobile app

PU Prime broker offers trading services on its official mobile app

The availability of multiple platforms ensures that traders can choose the one that best fits their trading strategies and device preferences, whether they prefer desktop, web-based, or mobile trading.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

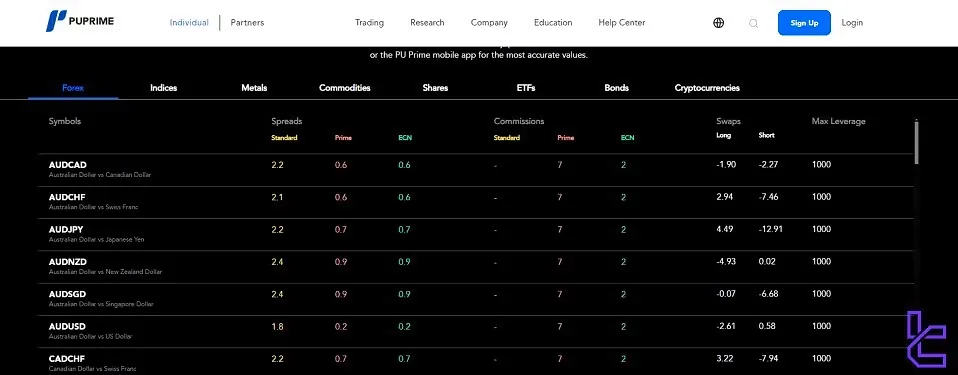

PU Prime Broker Spreads and Commissions

PU Prime offers a competitive pricing structure compared to other Forex brokers across its various account types. Here's an overview of the spreads and commissions:

Account Type | Spread | Commission |

Standard Account | Floating from 1.3 pips | No |

Prime Account | Floating from 0.0 pips | $3.5 per side/lot |

ECN Account | Floating from 0.0 pips | $1 per side/lot |

Cent Account | Floating from 1.3 pips | No |

It's important to note that spreads can vary depending on market conditions and the specific instrument being traded. PU Prime provides a transparent fee structure, with all costs clearly displayed on their website and within the trading platforms.

PU Prime Forex spreads and commissions

PU Prime Forex spreads and commissions

While the spreads are generally competitive, traders should consider the overall cost of trading, including potential withdrawal fees andovernight swap rates, when evaluating the total expense of maintaining an account with PU Prime.

PU Prime Swap Fees

Swap rates (or rollover fees) are overnight charges applied to open positions, based on factors like position size, interest rates, and trade direction. They apply to most instruments, except futures, and vary by product and trading day.

- Charged on all instruments except futures, following GMT+2/GMT+3 24:00 hrs server time

- Triple swap: Wednesday for Forex, Gold, Silver; Friday for Oil, Indices, Commodities, Shares, ETFs

- Swap-Free trading: Islamic accounts with an administration fee instead

PU Prime Non-Trading Costs

The broker offers fee-free deposits and withdrawals, with exceptions for certain bank transfers. While there’s no inactivity fee, prolonged account dormancy can lead to archival.

- International wire transfers may incur extra charges;

- First monthly international bank withdrawal reimbursed; additional withdrawals cost 20 account currency (JPY & HKD equal USD);

- No inactivity fee, but accounts idle 90+ days may be archived.

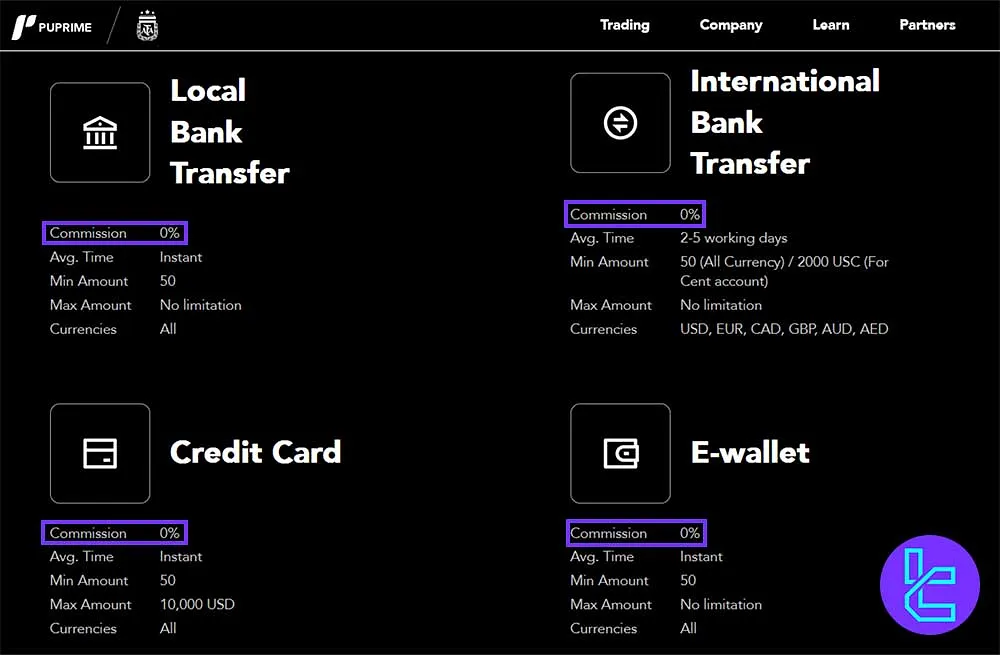

PU Prime Deposit & Withdrawal

PU Prime offers a range of deposit and withdrawal options to accommodate traders from different regions. Here's an overview of PU Prime deposit and withdrawal options:

- Credit Cards

- E-wallets

- Cryptocurrencies

- Local Bank Transfer

- International Bank Transfer

- AliPay

- Union Pay

PU Prime Deposits

The broker offers various deposit methods, ranging from international wire transfers and credit cards to instant bank transfers across multiple countries.

With a low minimum deposit of $50 and mostly fee-free funding, it provides traders with fast and diverse funding options.

Method | Currencies | Commission | Min Amount | Max Amount | Avg. Time |

Credit Cards | All | 0% | $50 | $10,000 | Instant |

E-wallets | All | 0% | $50 | No limits | Instant |

Cryptocurrencies | All | 0% | $50 | No limits | Instant |

Local Bank Transfer | All | 0% | $50 | No limits | Instant |

International Bank Transfer | USD, EUR, CAD, GBP, AUD, AED | 0% | $50 | No limits | 2-5 working days |

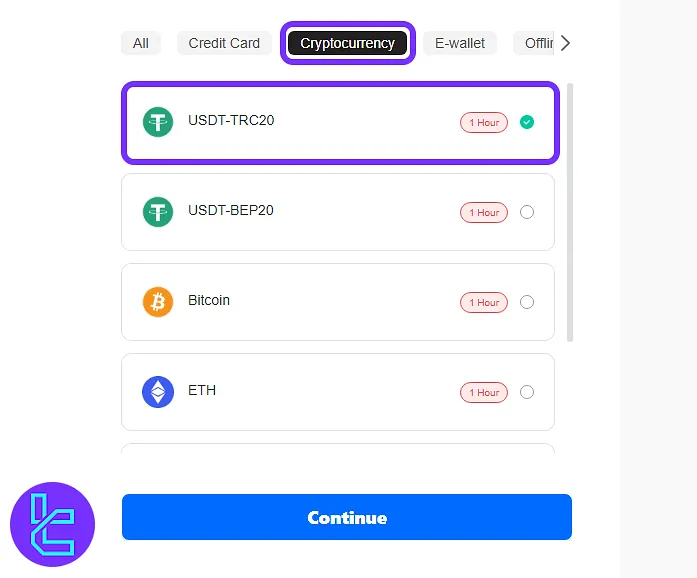

PU Prime TRC20 Deposits

Funding your account with USDT via TRC20 is a fast, secure, and low-cost method, typically processed instantly. Key Points about PU Prime TRC20 deposits:

- 3-step process: Access “Funds”, choose USDT-TRC20, confirm payment & check status;

- Wallet address/QR code provided for transfer via crypto wallet;

- Only the blockchain network fee applies (PU Prime charges no extra fees);

- Transactions trackable in Transaction History; processed approximately in 1 hour.

PU Prime Withdrawals

The platform supports all of the mentioned methods for withdrawals, excluding Alipay, with processing times from instant to 5 business days.

Most withdrawals are fee-free, though international bank transfers may incur a $20 charge after the first monthly transaction.

Withdrawal Methods | Processing Time |

International Bank Wire | 2-5 business days |

Credit/Debit Card | 2-3 business days, depending on the merchant |

E-wallets | Immediate |

China Union Pay Transfer | 1-3 business days |

Canada Local Bank Deposit | 2-5 business days |

Indonesia Instant Bank Transfer | 1-2 business days |

Malaysia Instant Bank Transfer | 1-2 business days |

South Korea Local Bank Transfer | Within 24 hours |

Vietnam Instant Bank Transfer | 1-2 business days |

Philippines Instant Bank Transfer | 1-2 business days |

Thailand Instant Bank Transfer | 1-2 business days |

South Africa Bank Transfer | 1-2 business days |

Nigeria Bank Transfer | 1-2 business days |

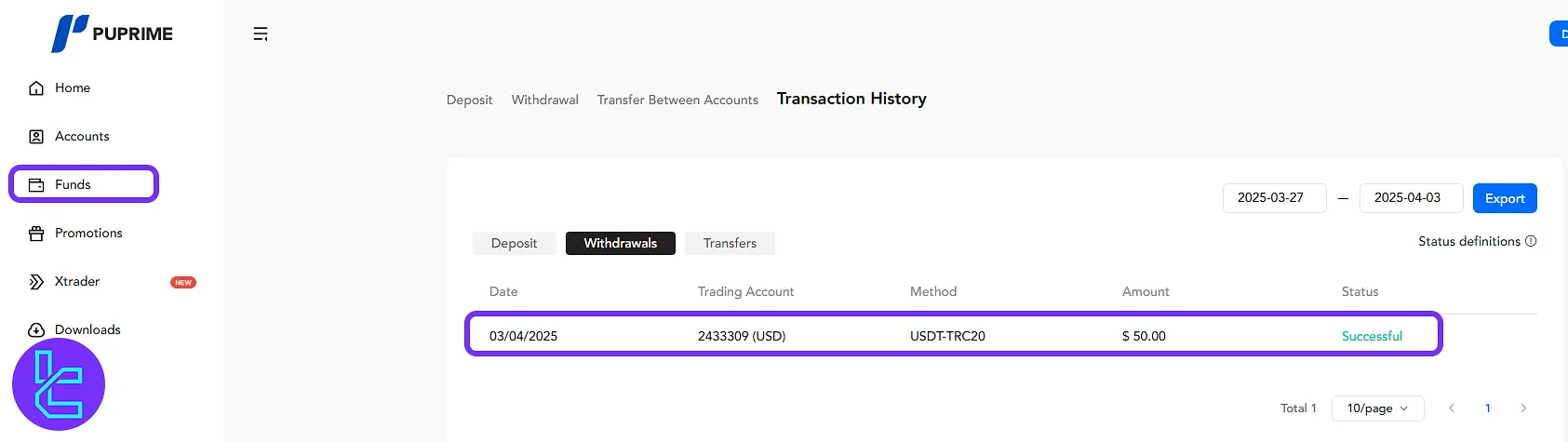

PU Prime TRC20 Withdrawals

Cashing out USDT via the TRC20 network is a quick, secure process, usually completed in under 5 minutes with no broker fees and a $40 minimum withdrawal. Key points about PU Prime TRC20 withdrawals:

- 3-step process: Access “Funds”, select USDT-TRC20, confirm via email code;

- Enter payout amount (min $40) or click “Max” for full balance;

- Provide wallet address and optional notes before confirming;

- Track status in Transaction History; only blockchain network fees apply.

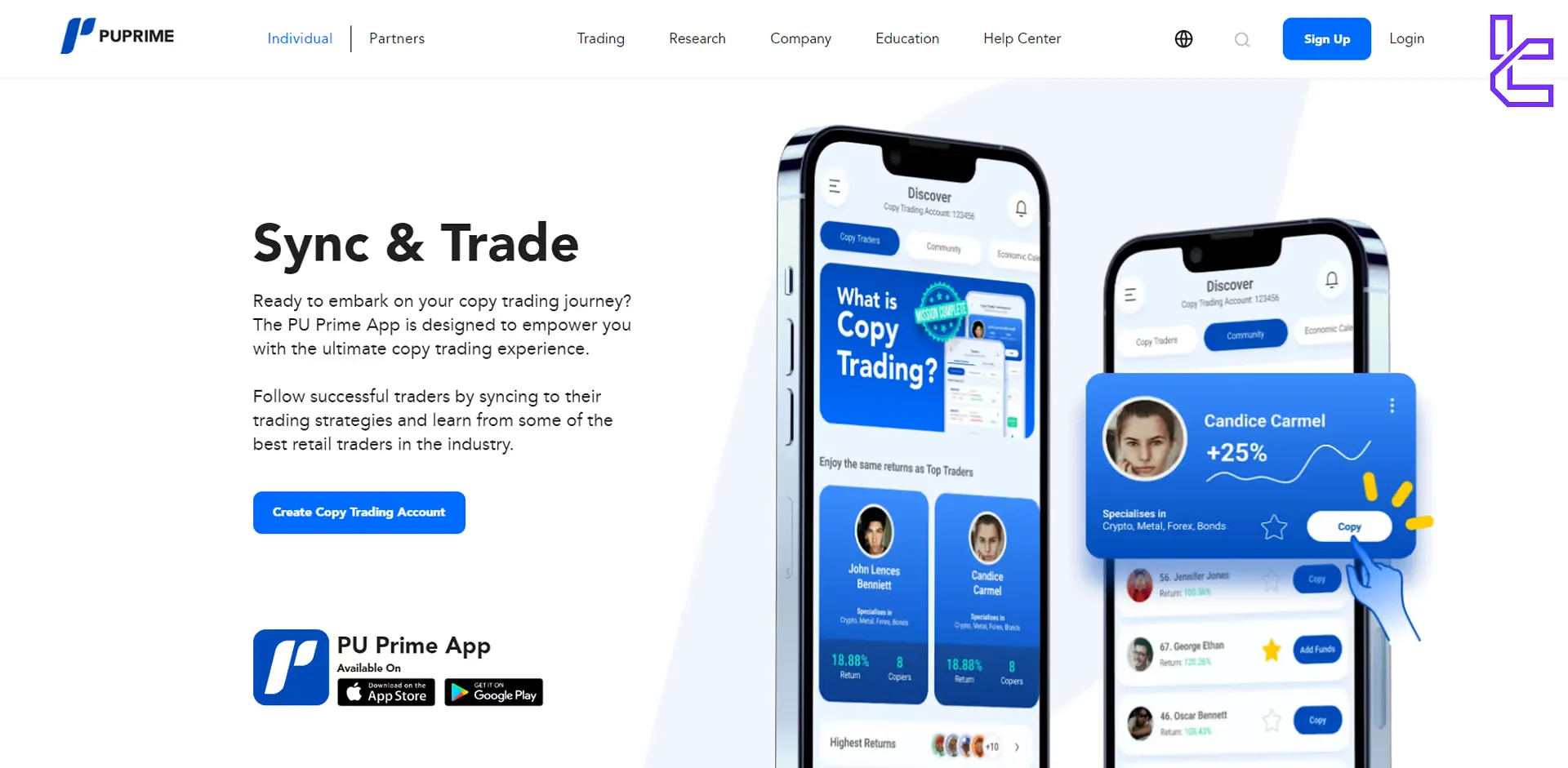

PU Prime Broker Copy Trading & Investment Options

PU Prime offers a unique copy trading feature through its proprietary mobile app, which allows both novice and experienced traders to diversify their strategies. PU Prime copy trading features:

- Available exclusively on the PU Prime app

- Experienced traders can become signal providers

- Novice traders can copy the signal and become a Copier

- Easy selection of Signal Providers based on performance metrics

- Flexible allocation of funds to multiple providers

- Real-time tracking of copied trades

The copy trading feature allows less experienced traders to benefit from the expertise of successful traders while also providing an additional revenue stream for skilled traders who become Signal Providers.

PU Prime also provides social trading features where beginner traders can follow professionals and copy their trades. This platform also allows flexible copying parameters to manage your risk effectively.

PU Prime Tradable Markets & Symbols Overview

PU Prime provides access to a diverse selection of more than 800 tradable instruments across multiple asset classes, from the Forex market to shares and cryptocurrencies like Bitcoin.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 54 | 50 - 70 currency pairs | 1:1000 |

Indices | CFDs | Over 30 | 10 - 20 instruments | 1:500 |

Stocks | CFDs | 550+ | 800 - 1200 | 1:20 |

ETFs | CFDs | 150+ | 20 - 30 | 1:33 |

Bonds | CFDs | 7 sovereign bonds from UK, US, and Europe | N/A | 1:100 |

Commodities | CFDs, Futures | 22 instruments like gold, silver, and crude oil | 15 - 30 instruments | 1:500 |

Cryptocurrencies | CFDs, ETFs | 59 instruments | 20 - 30 instruments | N/A |

The broker also provides access to the Futures market and bonds. This extensive coverage supports a wide range of trading strategies for retail and professional traders alike.

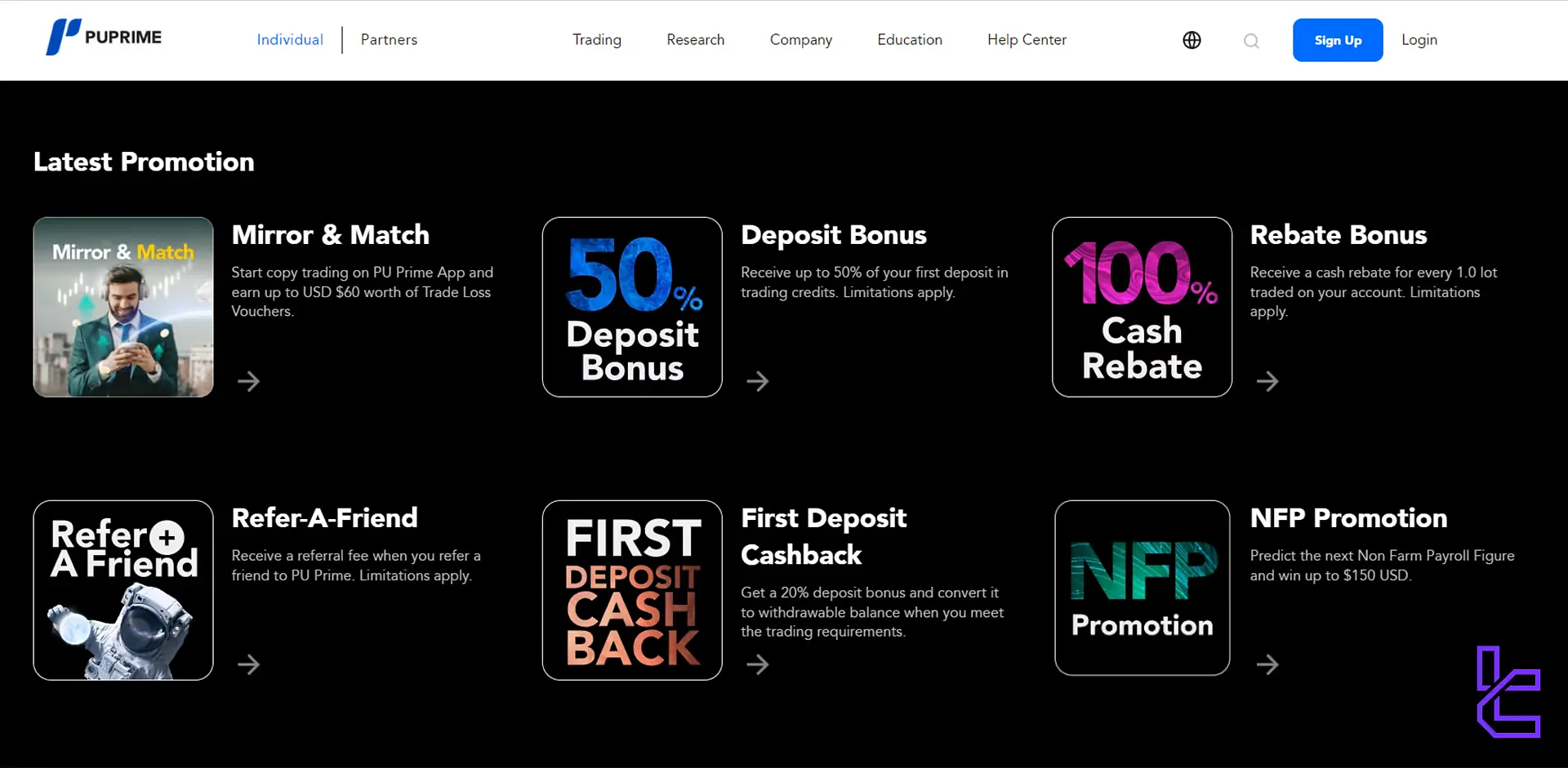

PU Prime Broker Bonuses and Promotions

PU Prime offers several attractive bonuses and promotions to both new and existing clients:

- Copy trading bonus: Start copy trading in PU Prime and earn up to $60 of trade loss vouchers;

- Welcome Bonus: Get 50% deposit bonus up to $500 on the first deposit, and 20% up to $9,500 on the second deposit;

- Rebate bonus: Get 100% cashback based on your trading volume;

- Refer-a-Friend Program: Earn rewards for introducing new clients to PU Prime;

- First deposit cashback: Get 20% deposit bonus and convert it to a withdrawable balance;

- NFP promotion: Predict the next non-farm payroll data and win up to USD $150.

You can use TradingFinder's Forex Rebate Calculator to get an estimate of your earnings from the cashback plan.

Here's how you can recieve PU Prime depsoit bonus:

- Head to the client portal and click on the "promotions" tab;

- Make your deposit;

- Get rewarded 50% of your deposit on the first $1000 deposit and 20% on subsequent deposits.

It's important to note that all bonuses and promotions come with specific terms and conditions, including minimum deposit requirements, trading volume conditions, and time limits.

Traders should carefully review these terms before participating in any promotional offers.

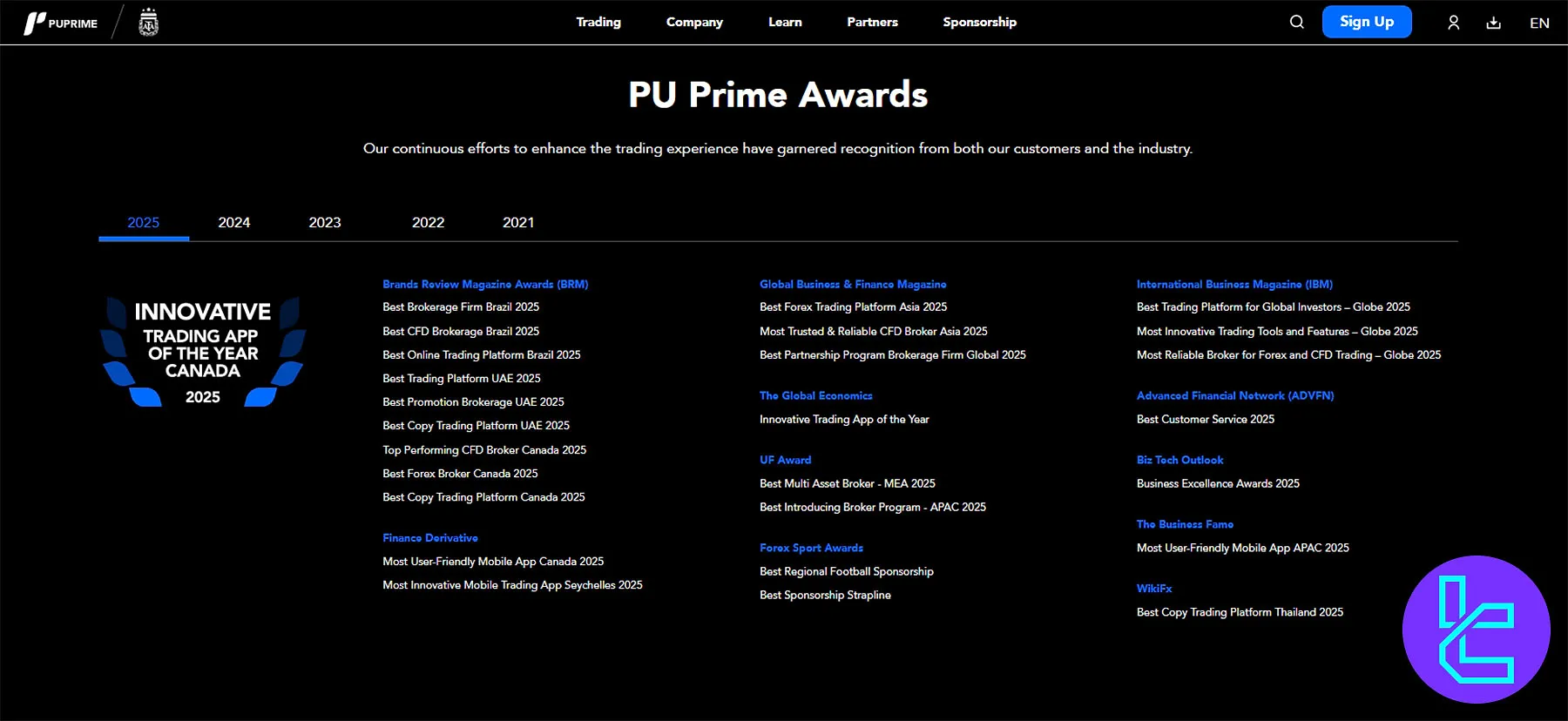

PU Prime Awards

The broker has earned global recognition for excellence in trading services, innovative platforms, and customer experience, receiving prestigious awards across multiple regions from 2021 to 2025.

- 2025: Honors from Brands Review Magazine, Finance Derivative, Global Business & Finance Magazine, The Global Economics, UF Award, and more, including Best Brokerage Firm Brazil and Most User-Friendly Mobile App Canada

- 2024: Awards for Market Liquidity Mastery, Best Brokerage Firm Brazil, Most Innovative Brokerage Firm UAE, and Best Trade Execution

- 2023: Recognized for Best Trading Account for Beginners, Outstanding Broker, Most Innovative Forex Trading Strategies, and Best Copy Trading Community Builder

- 2022: Fastest Growing Online Broker, Best Copy Trading Platform, and Most Innovative Mobile Trading App Europe

- 2021: Named World’s Fastest Growing Online Broker and Most Innovative Forex Broker MENA

PU Prime Broker Support

PU Prime prides itself on providing comprehensive customer support to assist traders with any queries or issues they may encounter:

- Ticket: leave feedback or questions for PU Prime support team

- Live chat: available on the main page of the website

- Email: info@puprime.com

- Phone support: +248 4373 105

The quality of customer support can significantly impact a trader's experience with a broker. PU Prime's commitment to 24/7 multilingual support demonstrates their focus on client satisfaction.

PU Prime Restricted Countries

While PU Prime aims to serve global clients, there are certain restrictions on who can open an account due to regulatory requirements and company policies. The main restricted countries include:

- Kenya

- Egypt

- UAE

- Singapore

- North Korea

- Australia

- Afghanistan

- Pakistan

- Indonesia

- Belarus

- Bermuda

- USA

It's important to note that the list of restricted countries can change based on evolving regulatory landscapes and company policies. Potential clients should always check the most up-to-date information on the PU Prime website or contact customer support to confirm their eligibility to open an account.

PU Prime Broker Trust Scores & Reviews

Trust scores and user reviews provide valuable insights into a broker's reputation and reliability. Here's an overview of PU Prime's score in review websites:

Source | Score |

Trustpilot | 3.2 |

ForexPeaceArmy | 1.85 |

4.8 |

While PU Prime has received recognition in the form of industry awards, the mixed user reviews and offshore regulatory status suggest that traders should exercise caution and conduct thorough due diligence before opening an account.

PU Prime Broker Education

PU Prime offers a comprehensive suite of educational resources to help traders improve their skills and market knowledge:

- PU Prime Academy: A structured learning program covering basics to advanced trading concepts

- Webinars: Regular live sessions on various trading topics hosted by industry experts

- Video Tutorials: Step-by-step guides on platform usage and trading strategies

- E-books: Downloadable resources on risk management, technical analysis, and more

- Trading Quizzes: Interactive tests to reinforce learning and assess knowledge

The educational content caters to traders of all levels, from beginners to advanced practitioners. While the resources are comprehensive, their effectiveness ultimately depends on the individual trader's engagement and application of the knowledge gained.

Traders are encouraged to make full use of these resources to enhance their trading skills and market understanding.

Check TradingFinder's Forex education and crypto tutorials for additional resources.

PU Prime Comparison Table

Let's check PU Prime's standing in the forex trading world in comparison with other brokers.

Parameter | PU Prime Broker | HFM Broker | FxPro Broker | FXGlory Broker |

Regulation | SVG FSC, Mwali FSC, FSCA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | From 0.0 pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | From $1.0 | From Zero | From $0 | $0 |

Minimum Deposit | $20 | From $0 | $100 | $1 |

Maximum Leverage | 1:1000 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | MT4, MT5, PU Prime app | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Prime, ECN, Cent | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 800+ | 1,000+ | 2100+ | 45 |

| Trade Execution | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Trading Finder expert suggestion

PU Prime bonuses, including copy trading bonus, welcome bonus, rebate bonus, first deposit cashback, NFP Promotion, and refer-a-friend program, made this broker an attractive choice for over $500,000 traders.

Additionally, the brokerage has received a license from the ASIC, a top-tier financial authority, making it more reliable than brokers regulated by mid-tier figures.