The PU Prime verification process is a mandatory 4-step procedure to activate deposits and withdrawals. The entire process takes about 5 to 10 minutes.

After completing the PU Prime KYC, you can choose between ECN, Cent, Standard, and Prime accounts with variable spreads starting from 0.0 pips and a minimum deposit of $5.

How to Complete the PU Prime Authentication Process

After PU Prime registration, follow these steps to complete your account authentication in PU Prime broker. PU Prime KYC:

- Access the KYC section;

- Submit identity confirmation documents;

- Upload address authentication documents;

- Monitor account approval status.

The following details and information are required during the account verification process in PU Prime.

Verification Requirement | PU Prime Broker |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | Yes |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

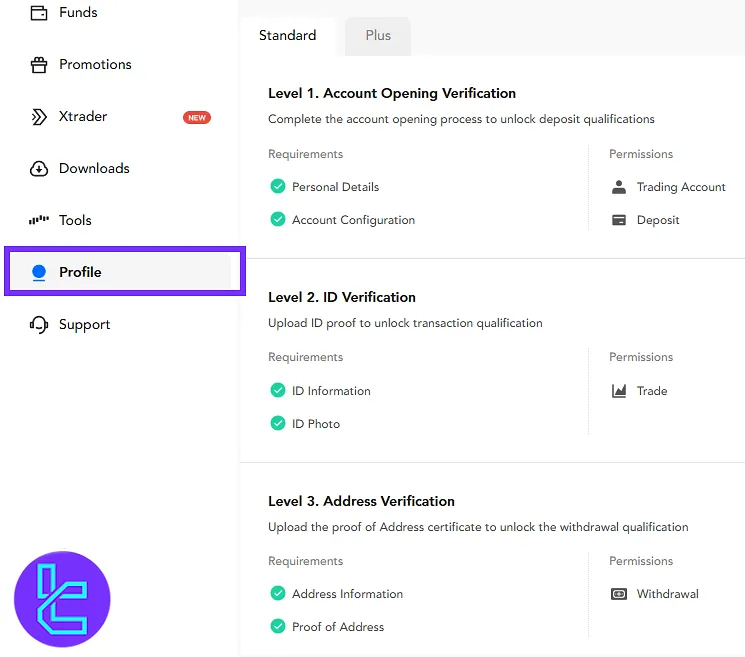

#1 Accessing the KYC Section

Log in to your PU Prime account, go to the "Verification" tab, and start the process.

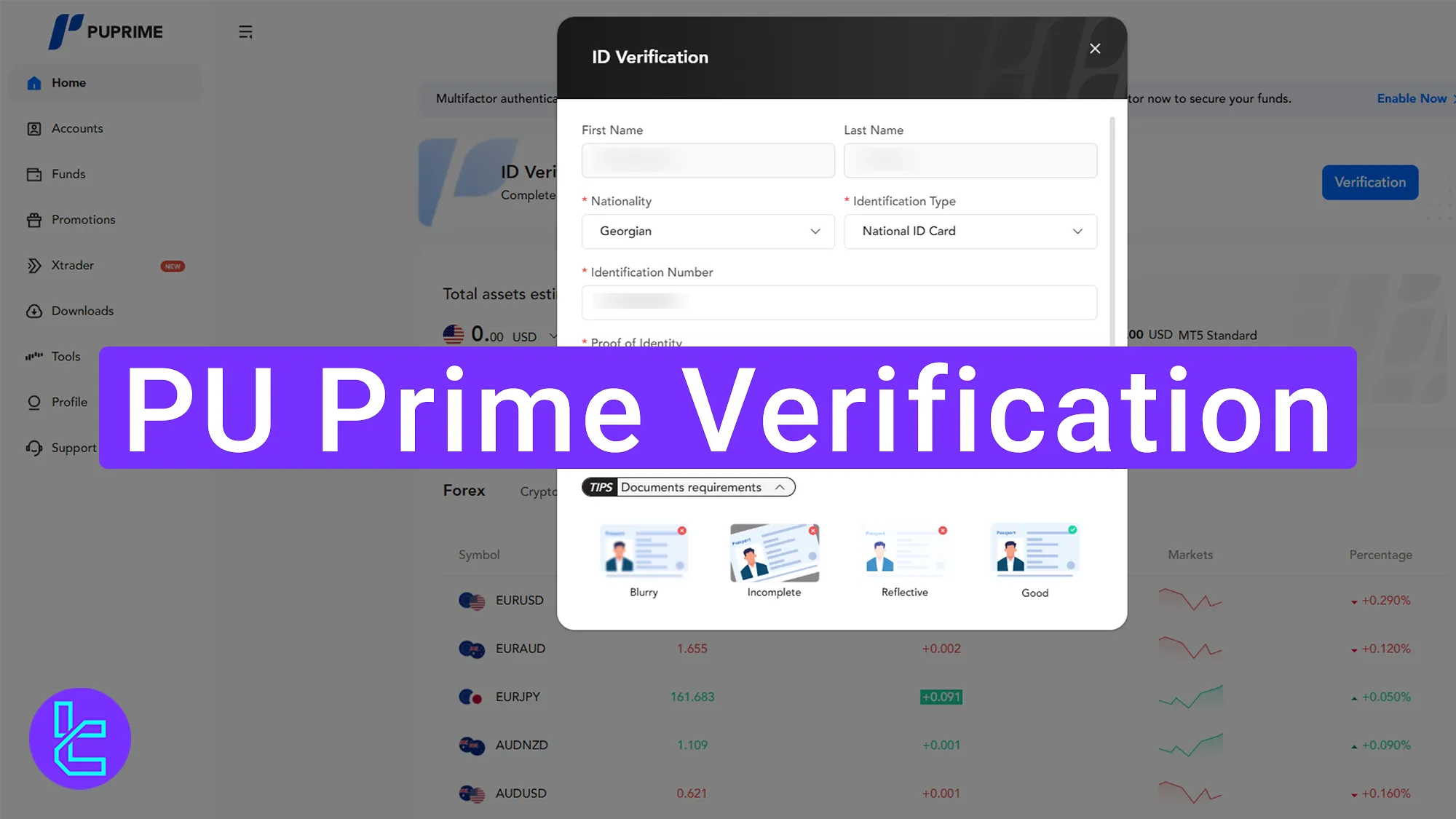

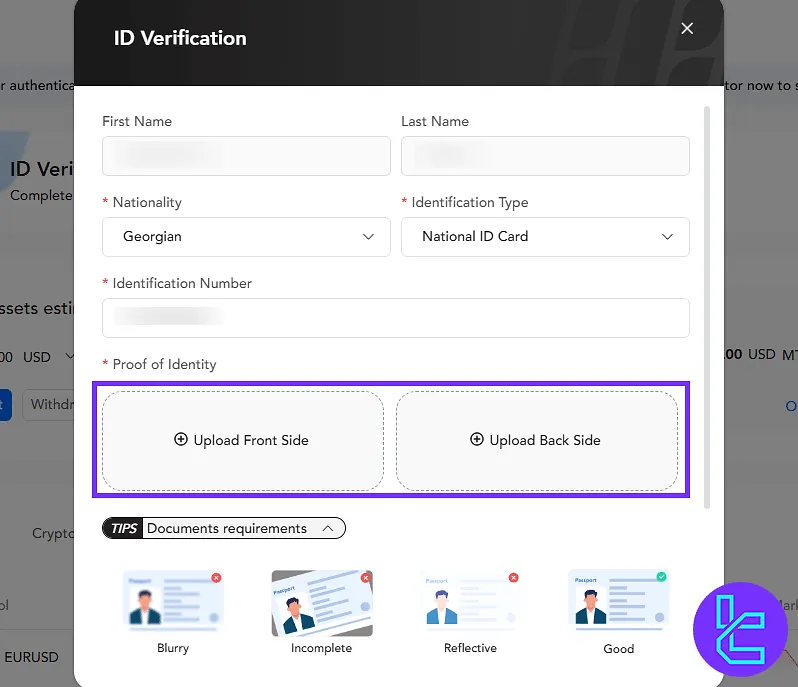

#2 Submitting Proof of Identity Documents (POI)

To complete this step, follow this process:

- Enter your full name and nationality;

- Select the type of ID you want to upload (National ID, passport, driver’s license);

- Input your ID card number;

- Upload clear photos of both the front and back of your document.

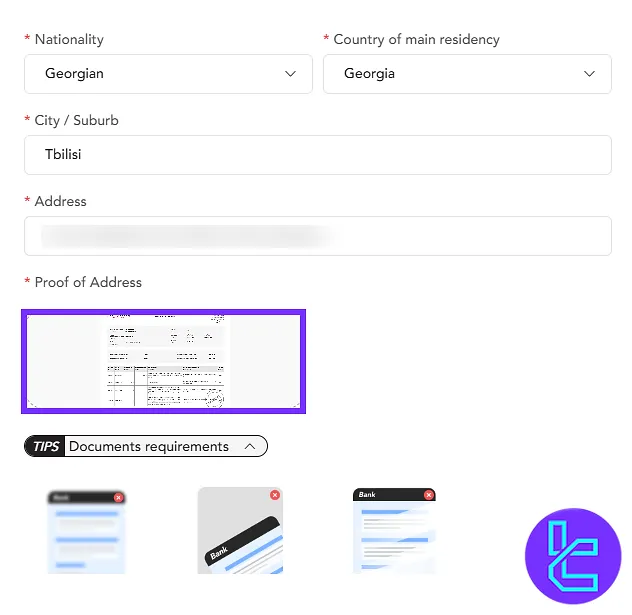

#3 Uploading Proof of Address Document (POA)

After providing POI documents, click on "Verify Now" to proceed and follow these steps:

- Enter your country of residence;

- Input your city, address, and postal code;

- Upload a valid bank statement or utility bill as proof of address.

#4 Monitoring the Athentication Status

Navigate to the "Profile" section to review the status. Once approved, your account will be verified and ready for transactions.

PU Prime KYC vs Other Brokers

The table below shows how the KYC process on PU Prime differs from other Forex brokers.

Verification Requirement | PU Prime Broker | |||

Full Name | No | No | Yes | Yes |

Country of Residence | No | No | No | Yes |

Date of Birth Entry | No | No | Yes | No |

Phone Number Entry | No | No | No | No |

Residential Address Details | Yes | No | Yes | No |

Phone Number Verification | No | No | Yes | No |

Document Issuing Country | Yes | Yes | Yes | Yes |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | Yes | Yes | Yes |

Utility Bill (for POA) | Yes | Yes | No | Yes |

Bank Statement (for POA) | Yes | Yes | No | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | No | No |

Financial Status Questionnaire | No | No | Yes | No |

Trading Knowledge Questionnaire | No | No | Yes | No |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

The PU Prime verification documents are typically reviewed and approved within 24 hours. For identification traders can upload documents, such as an ID card or passport, and a utility bill or bank statement for proof of address.

Now that your account is verified, you can explore PU Prime Deposit and Withdrawal methods and manage your finances with ease. Complete information about these methods is available on the PU Prime tutorial page.