Samtrade offers no-commission trading accounts with floating spreads from 1.7 pips. The broker requires a minimum deposit of $10, and offers leverage options of up to 1:1000. S.A.M. Trade (Asia) Pte Ltd is publicly traded on the OTC Markets in the USA with the symbol “SMFX”.

S.A.M. Trade has grown its client base to over 300,000 traders in 8 countries, offering more than 80 instruments across five asset classes. The broker executes thousands of trades daily, with average spreads starting at 1.7 pips on EUR/USD.

S.A.M. Trade is a broker with over 300,000 clients across 8 countries

S.A.M. Trade is a broker with over 300,000 clients across 8 countries

Samtrade; Company and Regulation

S.A.M. Trade (formerly known as Samtrade FX) was established in 2015 on the fundamentals of 3 pillars: Synergy, Adaptability, and Motivation.

The company previously operated with two main legal entities in Australia and Saint Vincent and the Grenadines.

However, the Australian company, which was licensed by the ASIC, was deregistered on 16th July, 2024. Therefore, Samtrade now operates only through its legal entity in Saint Vincent and the Grenadines with two main regulatory licenses, including:

- The Financial Commission (FinaCom)

- The Financial Transactions and Reports Analysis Center of Canada (FINTRAC), with registration number “M19977589”

It's important to note that Samtrade previously came under scrutiny from Singapore's authorities in 2022.

The Monetary Authority of Singapore (MAS) and the Singapore Police Force had launched an investigation into the company.

The probe related to suspicions of "irregular trading activities" on the platform, leading to three arrests.

The investigation raises questions about the Forex broker's operations and compliance with local regulations.

Here are the details about the broker’s regulation:

Entity Parameters/Branches | S.A.M. Trade (Asia) Pte Ltd |

Regulation | FINTRAC (Canada) – Money Services Business (MSB), Registration Number: M19977589 |

Regulation Tier | N/A |

Country | Incorporated in Saint Vincent and the Grenadines |

Investor Protection Fund/Compensation Scheme | N/A |

Segregated Funds | N/A |

Negative Balance Protection | N/A |

Maximum Leverage | 1:1000 |

Client Eligibility | General public, except residents of: Afghanistan, Belarus, Botswana, Brazil, Burundi, Colombia, Congo, Cuba, Egypt, Guinea, Guinea-Bissau, Iran, Iraq, Japan, Lebanon, Liberia, Libya, Mali, Nicaragua, Nigeria, North Korea, Pakistan, Somalia, South Africa, Spain, Sudan, Syria, Togo, Ukraine, USA, Venezuela, Yemen, Zimbabwe |

Samtrade FX Specific Details

S.A.M. Trade is an ECN/STP brokerage company offering Forex, CFDs, and Futures with EUR/USD spreads from 1.7 pips. Let’s take a quick look at the broker’s offerings.

Broker | S.A.M. Trade |

Account Types | Standard, VIP, Islamic, ECN |

Regulating Authorities | FinaCom, FINTRAC |

Based Currencies | Crypto, Currencies |

Minimum Deposit | $10 |

Deposit Methods | Visa/Mastercard, Bank Transfer, USDT |

Withdrawal Methods | Visa/Mastercard, Bank Transfer, USDT |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, CopySam |

Markets | Forex, Indices, Commodities, Cryptocurrencies, Futures |

Spread | Variable based on the account types |

Commission | None (except for the ECN account) |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Copy Trading, Promotions, Crypto Trading, Futures, Partnership |

Affiliate Program | Yes |

Bonus & Promotions | SamRewards, Referral, Traders’ Challenge |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Ticket, Email |

Customer Support Hours | 24/5 |

S.A.M. Trade Account Offerings

Samtrade understands that one size doesn't fit all regarding trading accounts. It offers a range of account types to cater to different trading styles and experience levels.

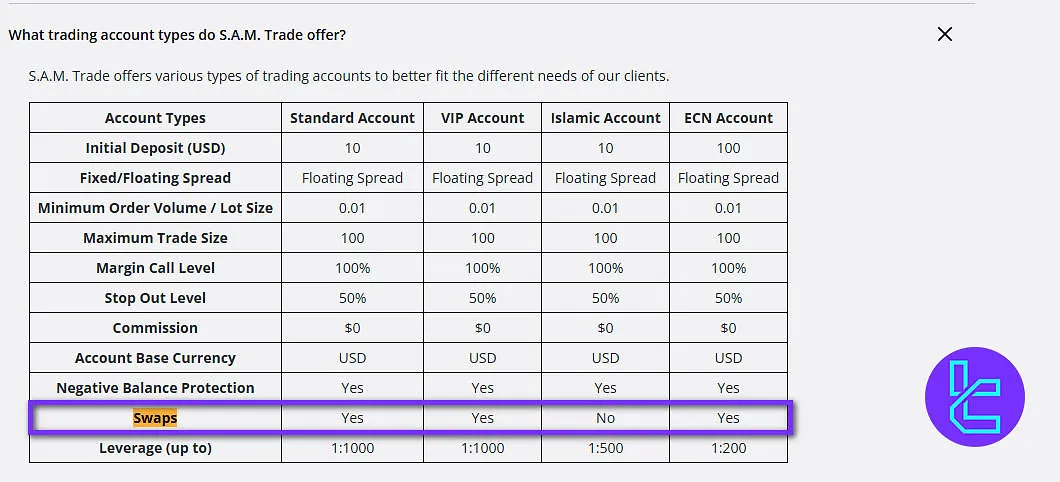

Features | Standard | VIP | ECN | Islamic |

Min Deposit | $10 | $10 | $100 | $10 |

Max Leverage | 1:1000 | 1:1000 | 1:200 | 1:500 |

Commission | None | None | $5 | None |

Spreads | Standard | Tight | Best Offerings | Standard |

Priority Support | No | Yes | Yes | No |

Leverage can reach up to 1:1000 depending on account type. All accounts are MT4-compatible and provide swap-free Islamic options.

Samtrade Pros and Cons

S.A.M. Trade is an award-winning brokerage company led by CEO Sam Goh.

However, it has some weaknesses, too. Let's weigh Samtrade's advantages against its disadvantages to have a balanced view.

Pros | Cons |

High leverage options (up to 1:1000) | Conflicting data about the broker’s regulatory status |

Proprietary copy trading platform (CopySam) | Higher spreads compared to some competitors |

Multiple account types to choose from | Problems with financial authorities in Singapore |

Crypto offerings | Limited payment options |

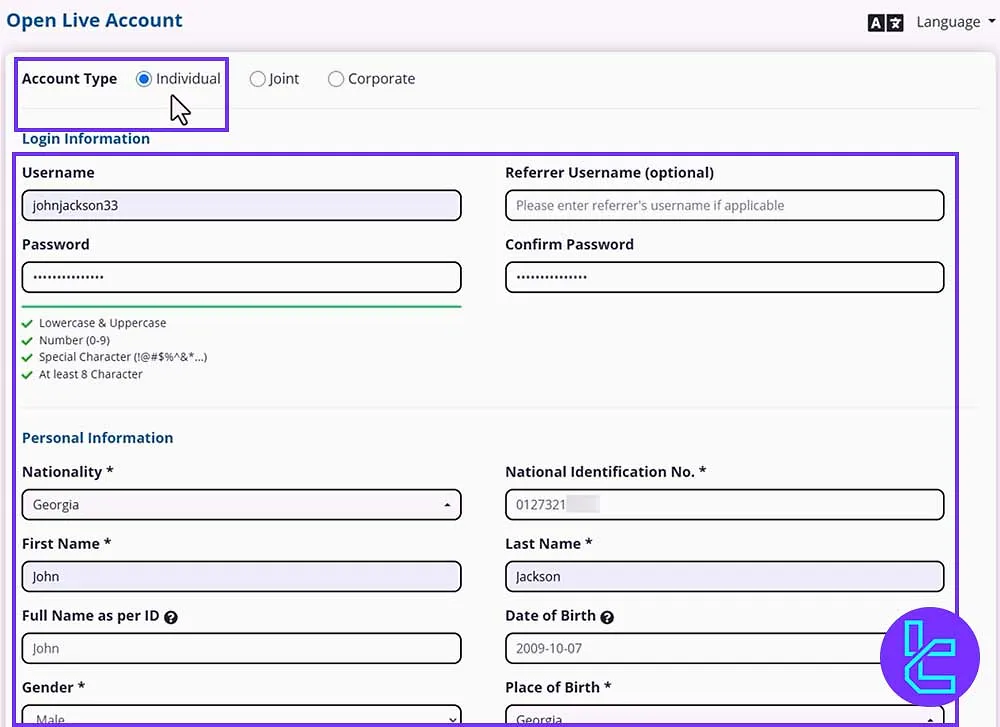

Samtrade Registration and KYC Verification

The Samtrade registration is a multi-layered process that takes about 10 minutes and includes full KYC, wealth assessment, and 2FA activation via Google Authenticator. The broker supports global clients and follows AML/CFT compliance protocols.

#1 Access the Registration Page

Go to the Samtrade homepage, click “Open Live Account”, select your jurisdiction (e.g., St. Vincent and the Grenadines), and proceed to the form.

#2 Enter Personal & Contact Details

Choose account type (Individual), then enter:

- Username, password

- Full name, nationality, ID number

- Date/place of birth, gender

- Residential address, country, postal code

- Email and mobile phone number

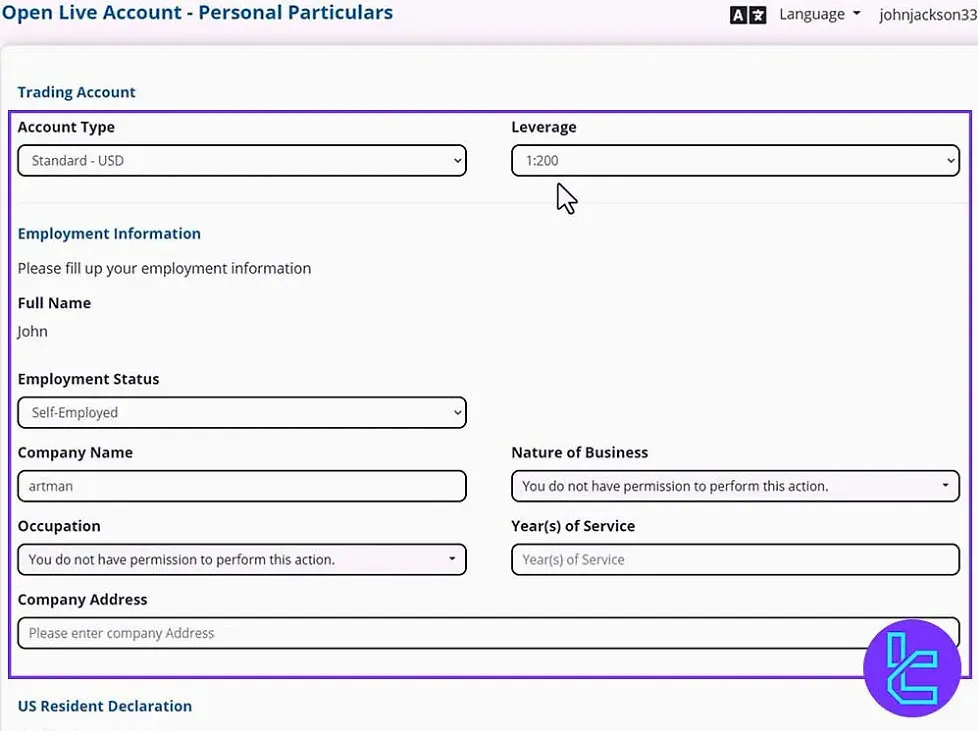

#3 Trading Setup & Employment Info

Select leverage, confirm U.S. citizenship status, and provide:

- Employment status

- Company name, address, and years of service

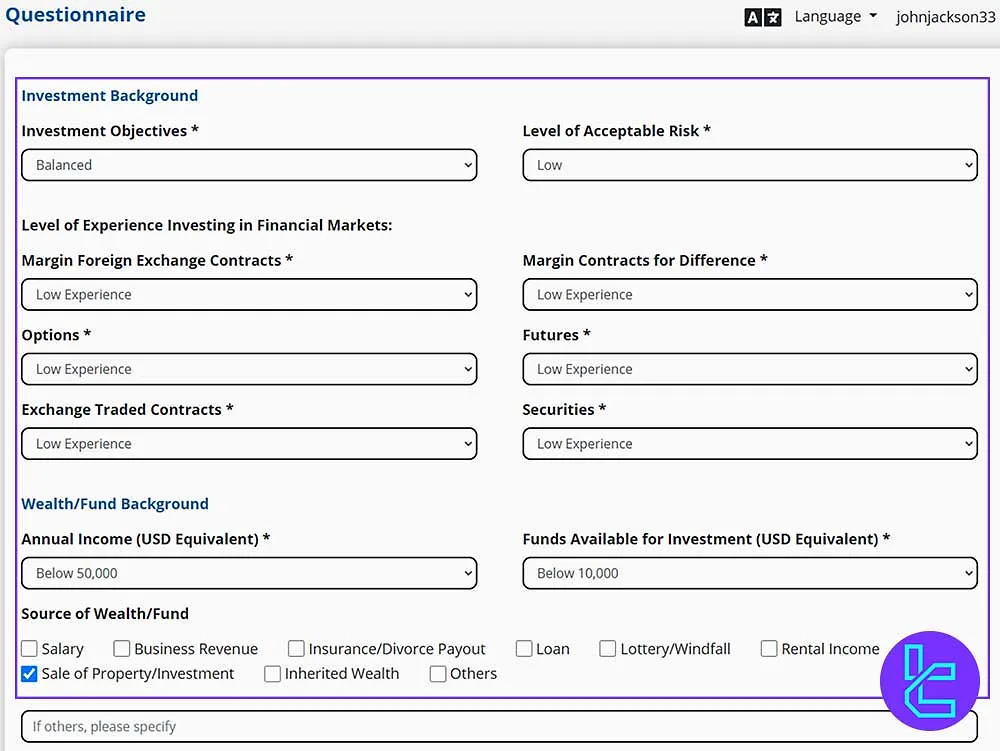

#4 Fill in the Financial Questionnaire

Disclose trading objectives and experience, and declare:

- Annual income, investment funds, and source of money

- PEP status, accredited investor declaration

#5 Complete the KYC Verification

To fully unlock the platform's features, you must upload supporting documents, including:

- Proof of ID: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

Note: You need to provide documents translated into English.

#6 Activate via Google Authenticator

Use the Google Authenticator app to scan the QR code or enter the secret key manually, then input the 6-digit code to activate your trading account securely.

Note: You must be at least 18 years old to be able to open an account.

Samtrade FX Trading Platforms

The company offers two primary trading platforms, catering to different trader preferences and styles, including the robust MetaTrader 4 and the proprietary copy trading platform CopySam.

While the CopySam application is not listed on any reputable app stores, and even the broker doesn’t provide any download links for it, here are the links to download MT4 mobile.

Clients also benefit from VPS hosting, Autochartist integration, and signal services.

TradingFinder has developed various advanced MT4 indicators that you can use for free.

Samtrade Fees and Commission

S.A.M. Trade’s main source of income is spread. Having no commissions on the Standard, Islamic, and VIP accounts, the broker charges higher spreads than average.

However, the ECN account that comes with a $5 commission, has the tightest spreads that the broker offers. Typical spreads on some of the most popular instruments:

Instrument | Spread (Pips) |

EURUSD | 1.7 – 2.0 |

EURGBP | 2.4 – 2.7 |

SPX500 | 8 |

US30 | 5 |

NAS | 500 |

XAUUSD (Gold) | 30 – 42 cents |

WTI | 5.0 cents |

DAX 30 Futures | 37 |

US Oil Futures | 4 |

S.A.M Trade Swap Fees

All trades executed on S.A.M. Trade are settled on a T+2 basis (trade date plus two business days). Positions that remain open past 5:00 PM New York time will automatically roll over to the next trading day (T+3) and may incur overnight swap fees.

Swap charges, either credits or debits, are determined by the interest rate differential between the currencies involved, reflecting the overnight rates set by the respective banks.

Traders who require a swap-free option can request an Islamic account after verification. Approval is subject to validation by S.A.M. Trade’s operations team.

It is important to note that S.A.M. Trade maintains the right to withdraw swap-free privileges from any account if misuse or abuse is detected.

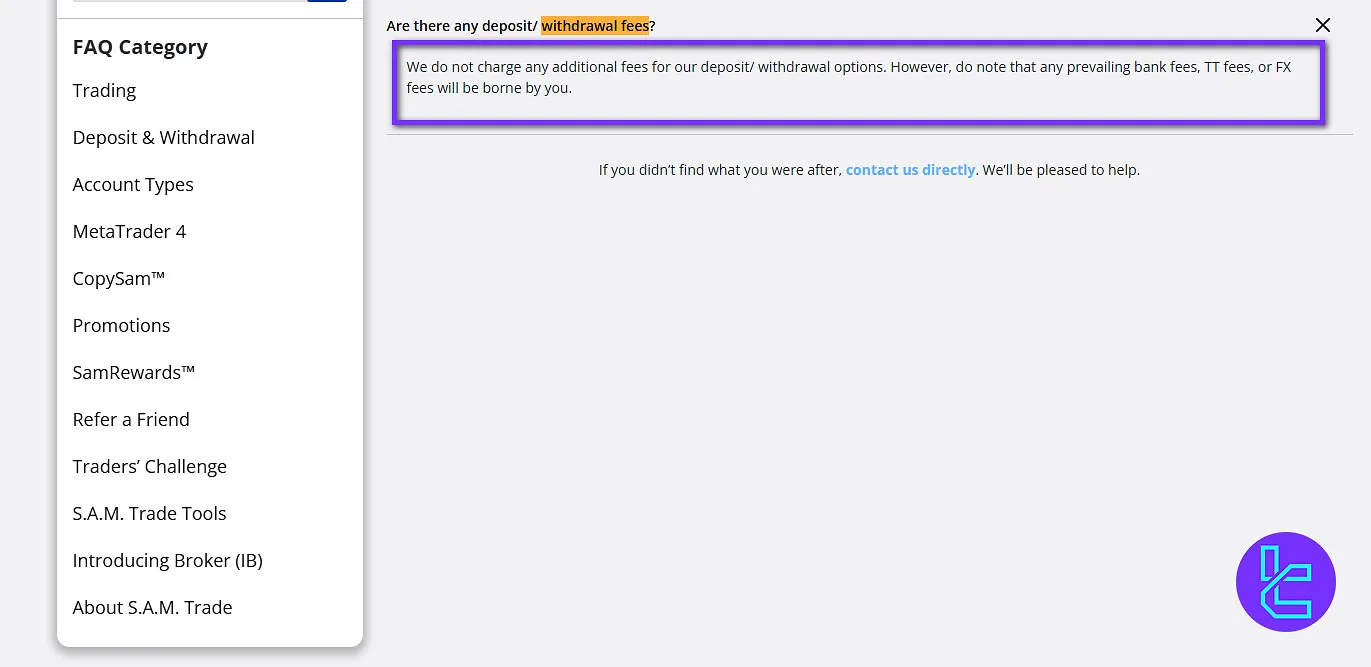

S.A.M Trade Non-Trading Fees

S.A.M. Trade does not impose extra charges for deposit or withdrawal transactions. Clients are responsible only for any fees applied by their banks, including telegraphic transfer (TT) or foreign exchange (FX) charges.

Account creation with S.A.M. Trade is entirely free. Registered users gain access to educational webinars, promotional offers, and tiered benefits such as SamRewards, enhancing the overall trading experience.

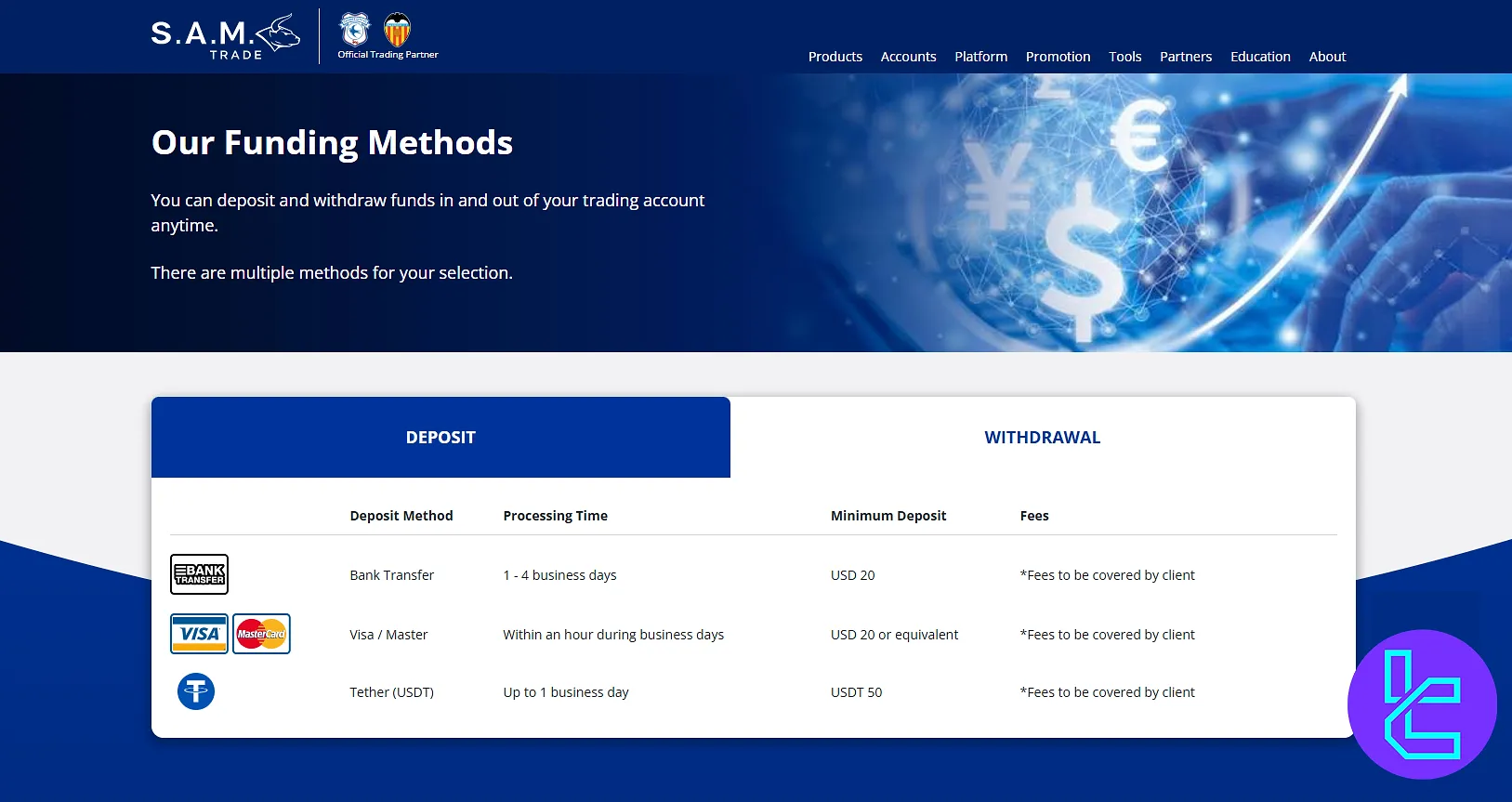

Samtrade FX Withdrawal/Deposit Methods

We must discuss payment options in this S.A.M. Trade review. The company offers only three methods for funding accounts and withdrawing money, including Bank Wire, Cryptocurrency, andcards.

Here are the deposit & withdrawal methods, their limits, and processing time:

Method | Min Deposit | Deposit Processing | Withdrawal Processing |

Bank Transfer | $20 | 1 – 4 business days | 1 – 4 business days |

Visa / MasterCard | $20 | Within an hour | 1 – 4 business days |

USDT | $50 | Up to 1 business day | Up to 1 business day |

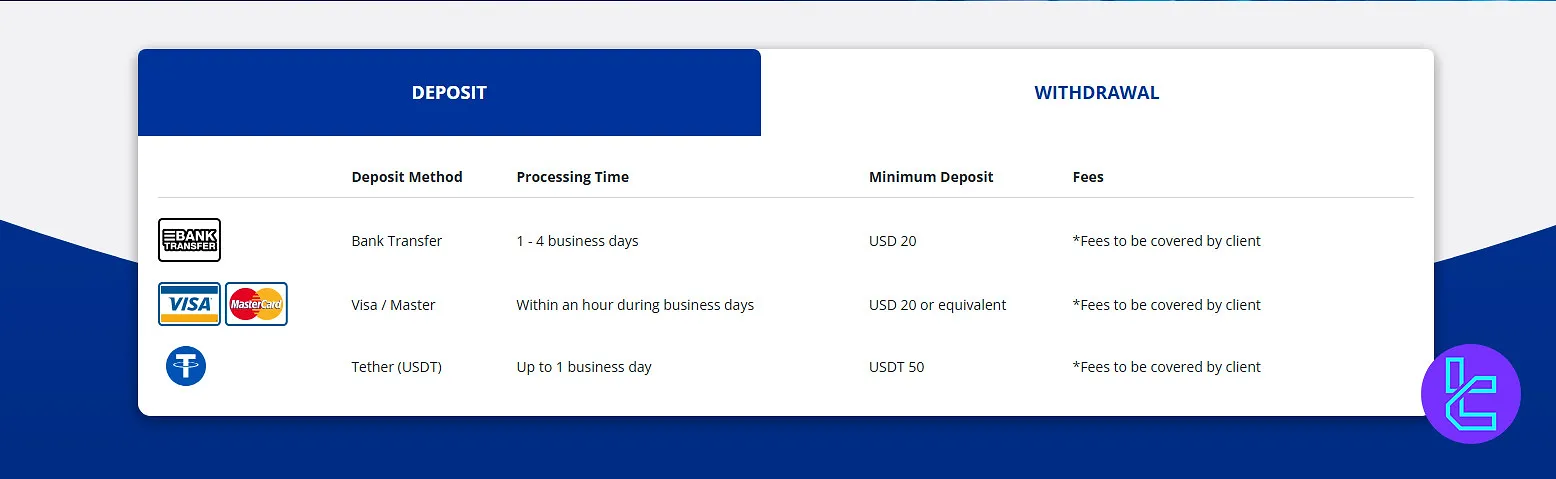

S.A.M Trade Deposit

S.A.M. Trade provides several deposit methods to accommodate different trading preferences.

Here are the deposit methods:

Deposit Method | Platform / Network | Processing Time | Minimum Deposit | Fees |

Bank Transfer | Bank Transfer | 1–4 business days | USD 20 | Client covers applicable fees |

Visa / Mastercard | Visa / MasterCard | Within 1 hour during business days | USD 20 or equivalent | Client covers applicable fees |

USDT | Tether (USDT) | Up to 1 business day | USDT 50 | Client covers applicable fees |

Processing times and minimum amounts vary depending on the chosen method. All client-side fees, including bank or card charges, are the responsibility of the account holder.

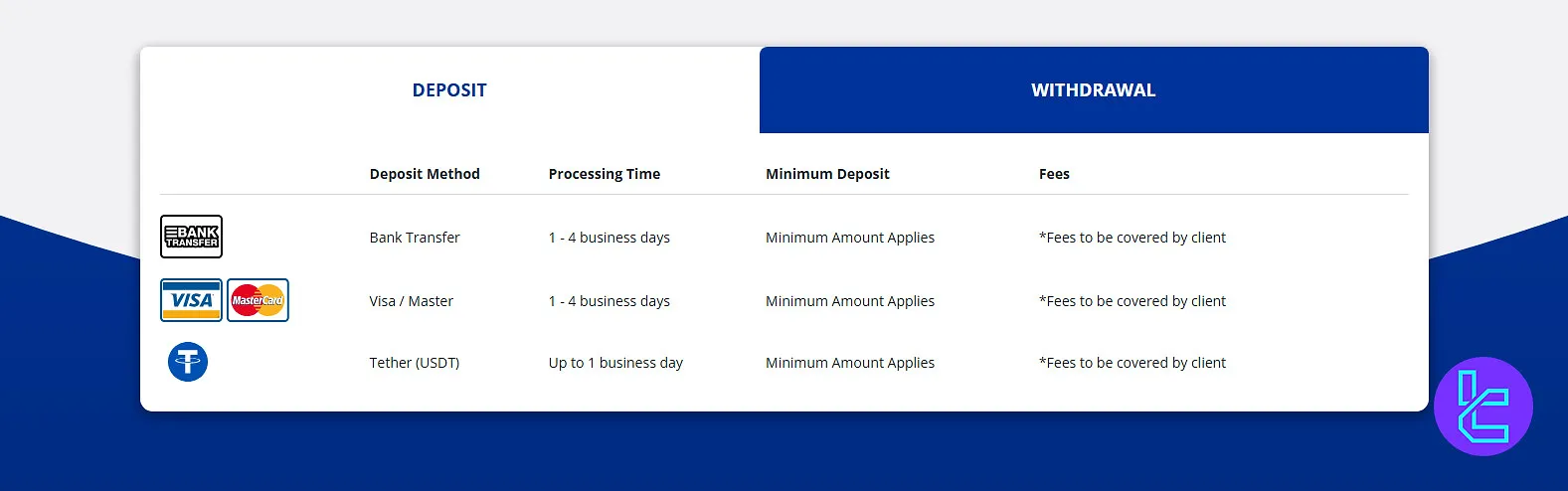

S.A.M Trade Withdrawal

S.A.M. Trade allows clients to withdraw funds using multiple methods, each with specific processing times.

Here are the withdrawal methods:

Withdrawal Method | Platform / Network | Processing Time | Minimum Amount | Fees |

Bank Transfer | Bank Transfer | 1–4 business days | Minimum amount applies | Client covers applicable fees |

Visa / Mastercard | Visa / MasterCard | 1–4 business days | Minimum amount applies | Client covers applicable fees |

USDT | Tether (USDT) | Up to 1 business day | Minimum amount applies | Client covers applicable fees |

All withdrawal-related fees, including bank or card charges, are the responsibility of the account holder. Minimum withdrawal amounts apply depending on the chosen method.

Samtrade Copy Trading Service

CopySam is Samtrade's proprietary copy trading platform, designed to allow traders to follow and automatically replicate the trades of successful investors.

The Financial Commission has approved CopySam and has issued the “Collective Investment Platform Certification” for it.Key features of CopySam:

- Easy-to-use interface for selecting traders to copy

- Real-time performance tracking of copied traders

- Minimum deposit of $100

- Option to manually close copied trades

- Detailed statistics and historical performance data

Samtrade Trading Assets

Samtrade FX offers 80+ instruments across five different asset classes, from the Forex market to digital assets and the Futures market. Here’s a list of the most popular instruments available on the platform.

Category | Type of Instruments | Number of Symbols / Examples | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | 30+ major, minor, and exotic currency pairs | 50–70 currency pairs | Up to 1:1000 |

Commodities | CFDs on commodities | Gold, Silver, WTI, Brent, Natural Gas (around 15 instruments) | 10–20 instruments | Up to 1:100 |

Indices | CFDs on global indices | 17 popular indices, including ASX200, GER30, FTSE100, NAS100 | 10–20 indices | Not specified |

Futures | Future contracts | 10 symbols: Volatility Index, India Nifty 50, KOSPI 200, Dollar Index | Varies by provider | Not specified |

Crypto | CFDs on popular cryptocurrencies | BTC, BCH, UNI, XRP, LTC, TRX, BNB | Varies by provider | Up to 1:5 |

This multi-asset range supports diversified trading strategies.

S.A.M Trade Broker Promotional Programs

Samtrade FX offers several promotional programs, from traditional deposit bonuses to an Affiliate program, to attract and retain traders.

- Bonus Accounts: Enjoy two account types with $33 or $88 extra funds;

- SamRewards: Earn SamPoints based on your trading activities and receive special gifts;

- Affiliate: Refer new friends and earn up to 100 SamPoints per referral;

- Traders’ Challenge: Participate in trading contests with a $2,000 prize in addition to 1,000 SamPoints.

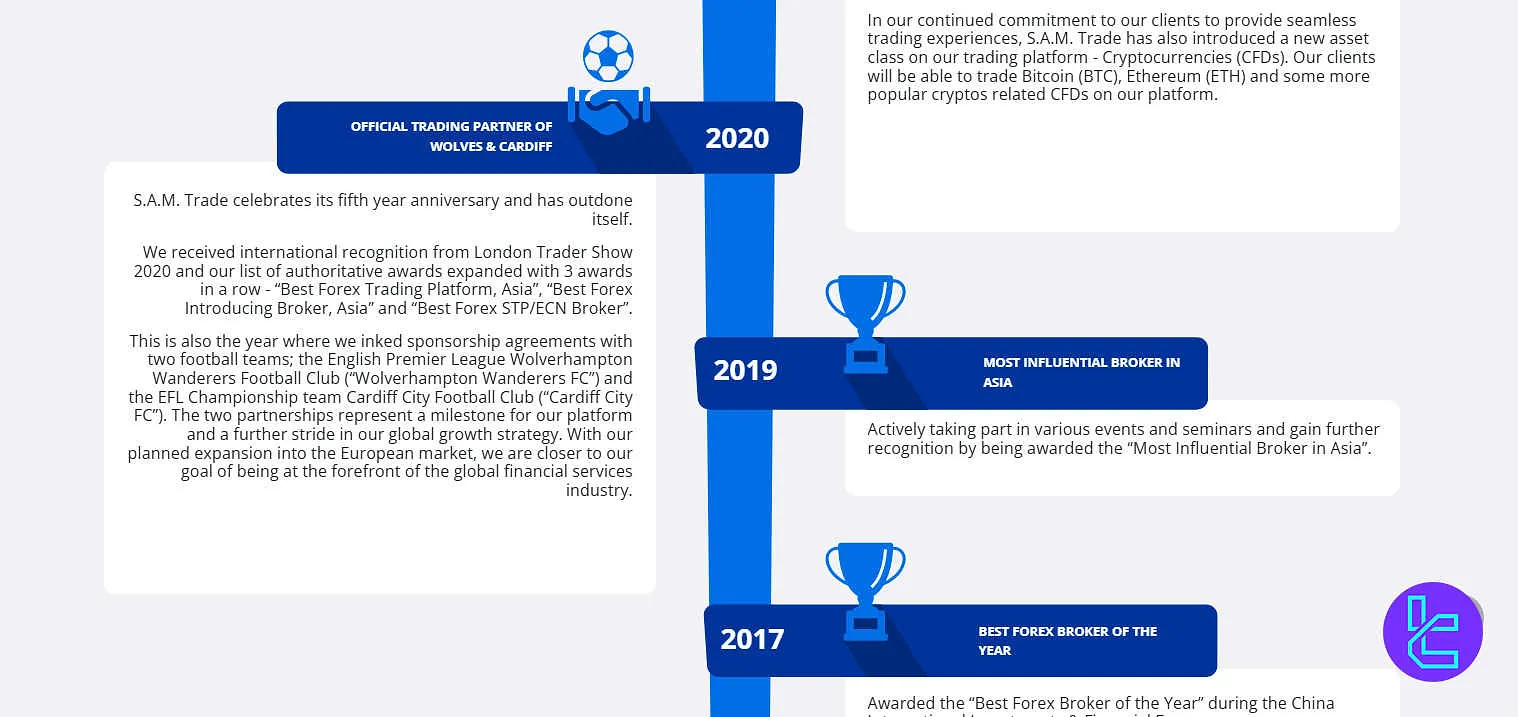

S.A.M Trade Awards

S.A.M. Trade has earned multiple awards acknowledging its technological innovations and industry presence.

Here is the list of S.A.M Trade awards:

- Global Forex Awards 2021 – Retail: Best Forex Copy Trading Platform – Asia (for CopySam platform)

- London Trader Show 2020: Best Forex Trading Platform, Asia

- London Trader Show 2020: Best Forex Introducing Broker, Asia

- London Trader Show 2020: Best Forex STP/ECN Broker

- China International Investments & Financial Expo 2017: Best Forex Broker of the Year

- China (Shenzhen) Forex Expo 2016: Best STP/ECN Broker

These S.A.M Trade awards collectively reflect the broker’s ongoing presence and recognition within the global forex brokerage landscape.

How to Reach Samtrade Support?

The broker offers 24/5 support through two main channels, including email and a dedicated ticket system.

support@samtradefx.com | |

Ticket | Through the “Contact Us” page |

Samtrade FX offers multilingual support (English, Mandarin, Malay) through live chat, email, and phone. While the broker faced scrutiny in 2022, user reviews continue to highlight its intuitive platform and responsive service.

Samtrade FX Restricted Countries

The company, while operating globally, does have restrictions on accepting clients from certain countries.

The limitation is often due to regulatory requirements or company policies. S.A.M. Trade Red Flag Countries:

- Afghanistan

- Belarus

- Botswana

- Brazil

- Burundi

- Colombia

- Congo

- Cuba

- Egypt

- Guinea

- Guinea-Bissau

- Iran

- Iraq

- Japan

- Lebanon

- Liberia

- Libyan Arab Jamahiriya

- Mali

- Nicaragua

- Nigeria

- North Korea

- Pakistan

- Somalia

- Somali Republic

- South Africa

- Spain

- Sudan

- Syrian Arab Republic

- Singapore

- Togo

- Ukraine

- United States of America

- Venezuela

- Yemen

- Zimbabwe

Samtrade Trust Score

User satisfaction is one of the most important topics in this S.A.M Trade review. The broker doesn’t have profiles on reputable websites like TrustPilot and Reviews.io.

The Samtrade Forex Peace Army profilehas a score of 2.7 out of 5 based on 3 reviews. While the score may not be indicative about the broker’s reliability, the lack of licensing from top-tier regulators and the MAS probe into the company indicate that users should exercise caution.

S.A.M. Trade Educational Content

Samtrade FX provides educational support through a blog, trading academy, video lessons, and daily market analysis. The content suits both beginner and experienced traders seeking structured learning.

- Learn to Trade articles

- Economic calendar

- Trade signals

- 8 weekly sessions in Trader’s Club with a 10,000 membership fee

S.A.M. Trade vs Other Brokers

Let's compare S.A.M. Trade services and offerings with other popular forex brokers:

Parameter | S.A.M. Trade Broker | Alpari Broker | FXGT Broker | Pepperstone Broker |

Regulation | FinaCom, FINTRAC | MISA | VFSC, CySEC, FSA, FSCA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Spread | From 1.7 Pips on EURUSD | From 0.0 Pips | From 0.0 Pips | From 0.0 pips |

Commission | From $0.0 | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $10 | $50 | $5 | $1 |

Maximum Leverage | 1:1000 | 1:3000 | 1:5000 | 1:500 |

Trading Platforms | MT4, CopySam | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader | MT4, MT5 | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Account Types | Standard, VIP, Islamic, ECN | Standard, ECN, Pro ECN, Demo | Standard+, ECN Zero, Mini Optimus, Pro | Standard, Razor |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 80+ | 120+ | N/A | 1200+ |

Trade Execution | Market | Market | Market | Instant |

Conclusion and Final Words

Samtrade provides an exclusive award-winning copy trading platform, CopySam, with a minimum deposit requirement of $100. The broker also utilizes the robust MT4 for trading services on 80+ instruments across five different asset classes.

Samtrade FX’s ASIC license was revoked and its legal entity in Australia was deregistered. It was under probe for suspicious activities by Monetary Authority of Singapore (MAS) in 2022.