SimpleFX is a Forex and Cryptocurrency trading platform that has won 4 prestigious awards from Cryptocurrency World and Crypto Expo. This broker offers a Standard trading account with a minimum spread of 0.9 pips for over 60 Forex pairs.

SimpleFX supports over 37 deposit methods, including deposits made with its own cryptocurrency, “SFX.”

SimpleFX Company Information and Regulatory Status

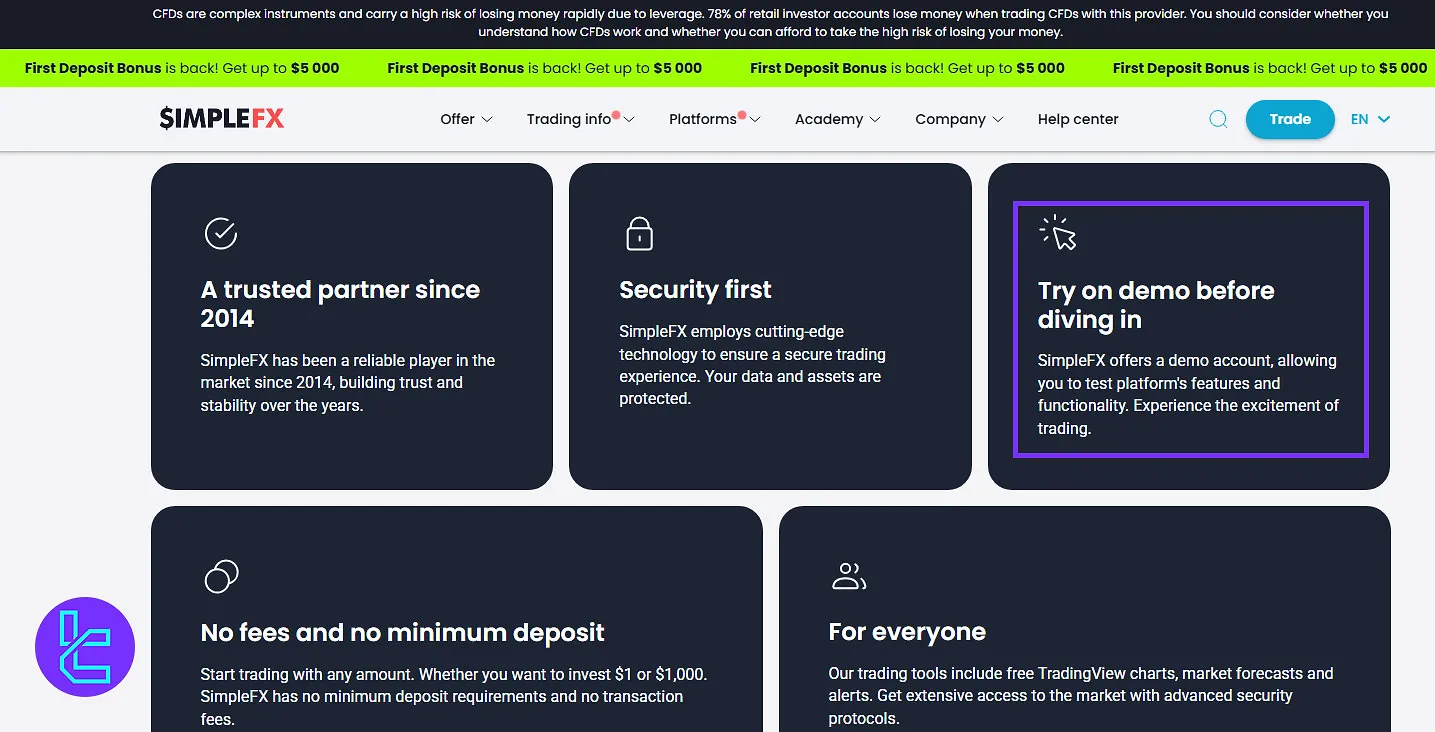

SimpleFX is a global trading provider that has been making waves in the financial markets since its inception. Founded in 2014, the company has quickly established itself as a go-to platform for traders seeking a seamless trading experience.

Here's what you need to know about SimpleFX's company structure and regulatory status:

Parameter | 8TECH LTD | 8TECH ZA (PTY) LTD | 8TECH SVG LTD |

Regulation | Authorized and supervised by the Financial Services Commission (FSC), License No. GB23201604 | Authorized by the Financial Sector Conduct Authority (FSCA), License No. 53073 (Crypto Assets Service Provider & FSP) | No regulation |

Regulation Tier | Tier 5 | Tier 2 | None |

Country | Mauritius | South Africa | Saint Vincent and the Grenadines |

Investor Protection Fund / Compensation Scheme | N/A | N/A | N/A |

Segregated Funds | Yes | Yes | N/A |

Negative Balance Protection | Yes | Yes | N/A |

Maximum Leverage | N/A | N/A | 1:1000 |

Client Eligibility | Global clients (excluding U.S., EU, EEA, UK) | Crypto-based clients (excluding U.S., EU, EEA, UK) | Global clients (excluding U.S., EU, EEA, UK) |

SimpleFX has been operating forover a decade as a registered broker, though it does not currently hold licenses from tier-1 regulatory bodies such as the FCA, CySEC, or ASIC.

However, the broker emphasizes transparency in its operations and states that client funds are held in segregated accounts to reduce counterparty risk.

SimpleFX Broker Summary of Specifics

To give you a quick overview of what SimpleFX offers, here's a concise table summarizing the Forex broker's key features:

Broker | SimpleFX |

Account Types | Standard, Demo |

Regulating Authorities | FSC, FSCA |

Based Currencies | $USD |

Minimum Deposit | $0 |

Deposit Methods | Visa/MasterCard, Bank wired, crypto |

Withdrawal Methods | Visa/MasterCard, Bank wired, crypto |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | Staking |

Trading Platforms & Apps | WebTrader, Desktop app, mobile app |

Markets | Forex, indices, commodities, equities, cryptocurrencies, metals |

Spread | Floating from 0.9 pips |

Commission | No commission |

Orders Execution | Market |

Margin Call/Stop Out | 20%/20% |

Trading Features | Demo account, economic calendar, crypto staking |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cashback bonus |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, USA, Canada and more |

SimpleFX Account Types Overview

SimpleFX simplifies its offering by providing a single live account type that gives traders access to the full suite of available assets and trading tools.

Additionally, a risk-free demo account is available for beginners to practice strategies before transitioning to real capital.

SimpleFX Standard Account

SimpleFX’s Standard account is suitable for traders who are ready to trade in the real market and employ various strategies to generate profits.

Account details:

- Minimum deposit: $0

- Maximum leverage: Up to 1:1000

- Spreads: From 0.9 pips

- Commission: No

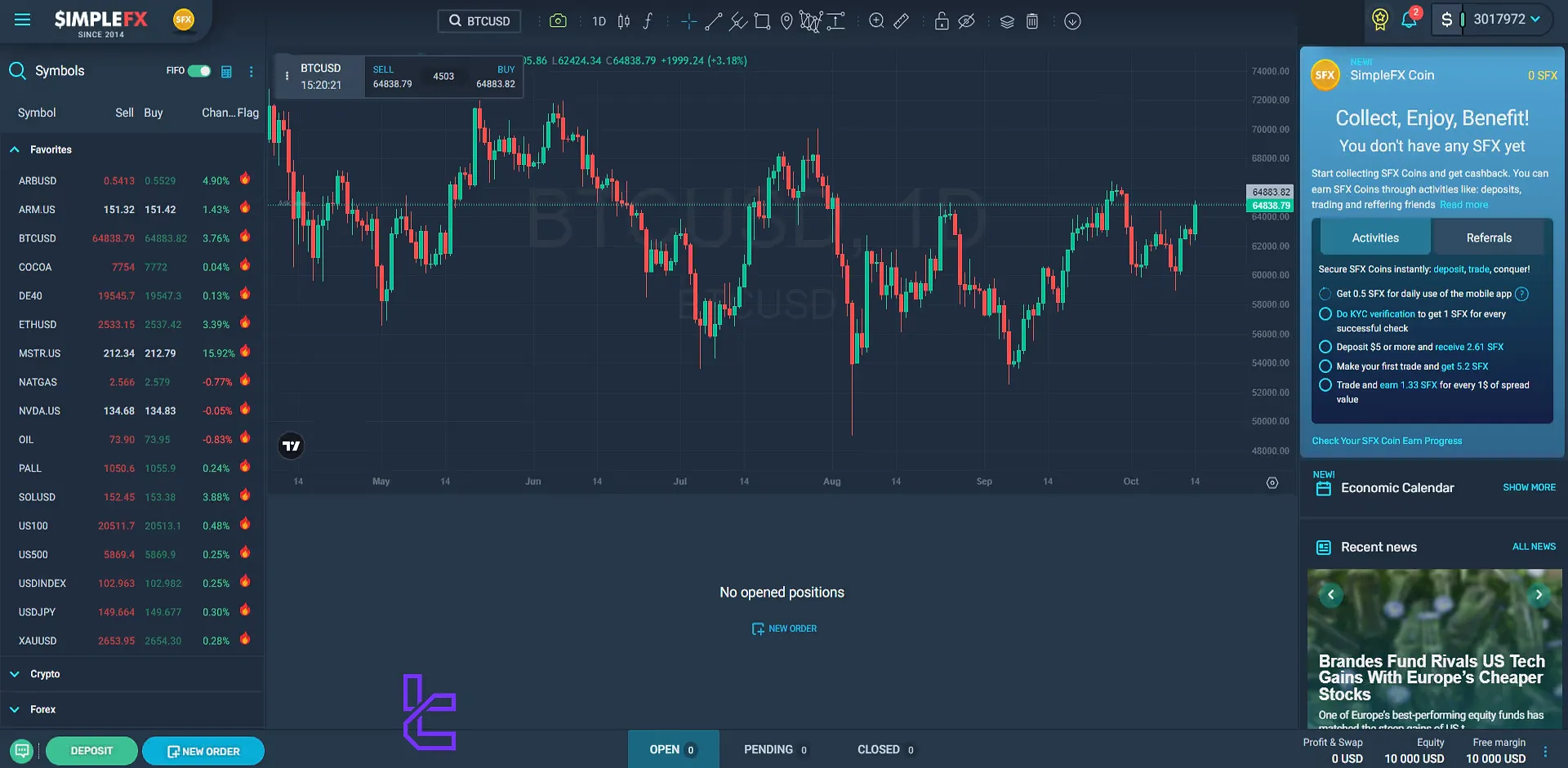

SimpleFX Demo Account

For anyone who is trying to learn trading or test various strategies, the demo account of SimpleFX is the perfect option.

Account details:

- 10,000 Virtual USD

- All features of the standard account

- Risk-free practice environment

- Ideal for testing strategies and getting familiar with the platform

The SimpleFX demo account is an excellent tool for both beginners and experienced traders to test their trading skills and strategies without risking real capital.

It's a perfect way to familiarize yourself with the platform's features and fine-tune your trading strategies before transitioning to live trading.

Advantages and Disadvantages SimpleFX Broker

To help you make an informed decision, let's weigh the pros and cons of trading with SimpleFX as a Forex broker:

Advantages | Disadvantages |

No minimum deposit | Higher spreads compared to some competitors |

High leverage options (up to 1:1000) | Not regulated by major financial authorities |

Wide range of tradable assets and instruments | - |

Various payment methods, including cryptocurrencies | - |

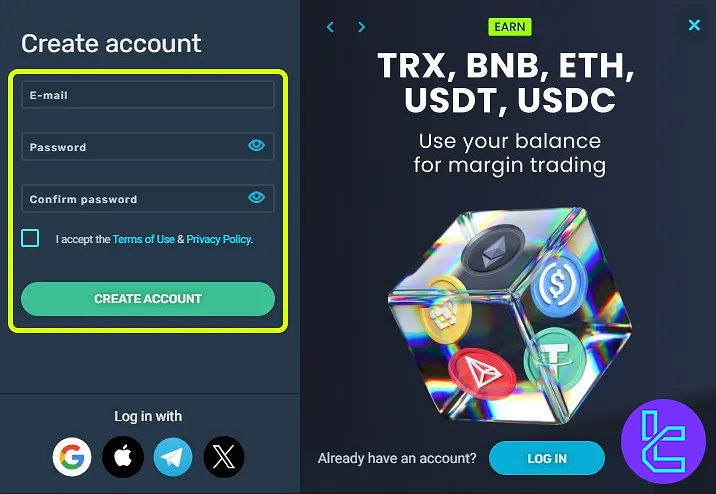

Account Opening & Verification in the SimpleFX Broker

SimpleFX registration is free and requires only an email address and password, taking less than 4 minutes to complete. It's perfect for beginners looking for a fast entry into online trading.

#1 Access the SimpleFX Platform

Go to the official website and click the “Trade” tab to begin the onboarding process.

#2 Register Your Account

Select “Create Account”, input your email address, and set a secure password with mixed characters. Agree to the platform’s terms to proceed.

#3 Confirm Email Address

Check your inbox for the SimpleFX verification email. Click “Verify Now” to activate your account and access the live platform.

Once registered, users can explore the platform and proceed with full SimpleFX verification to access unrestricted features.

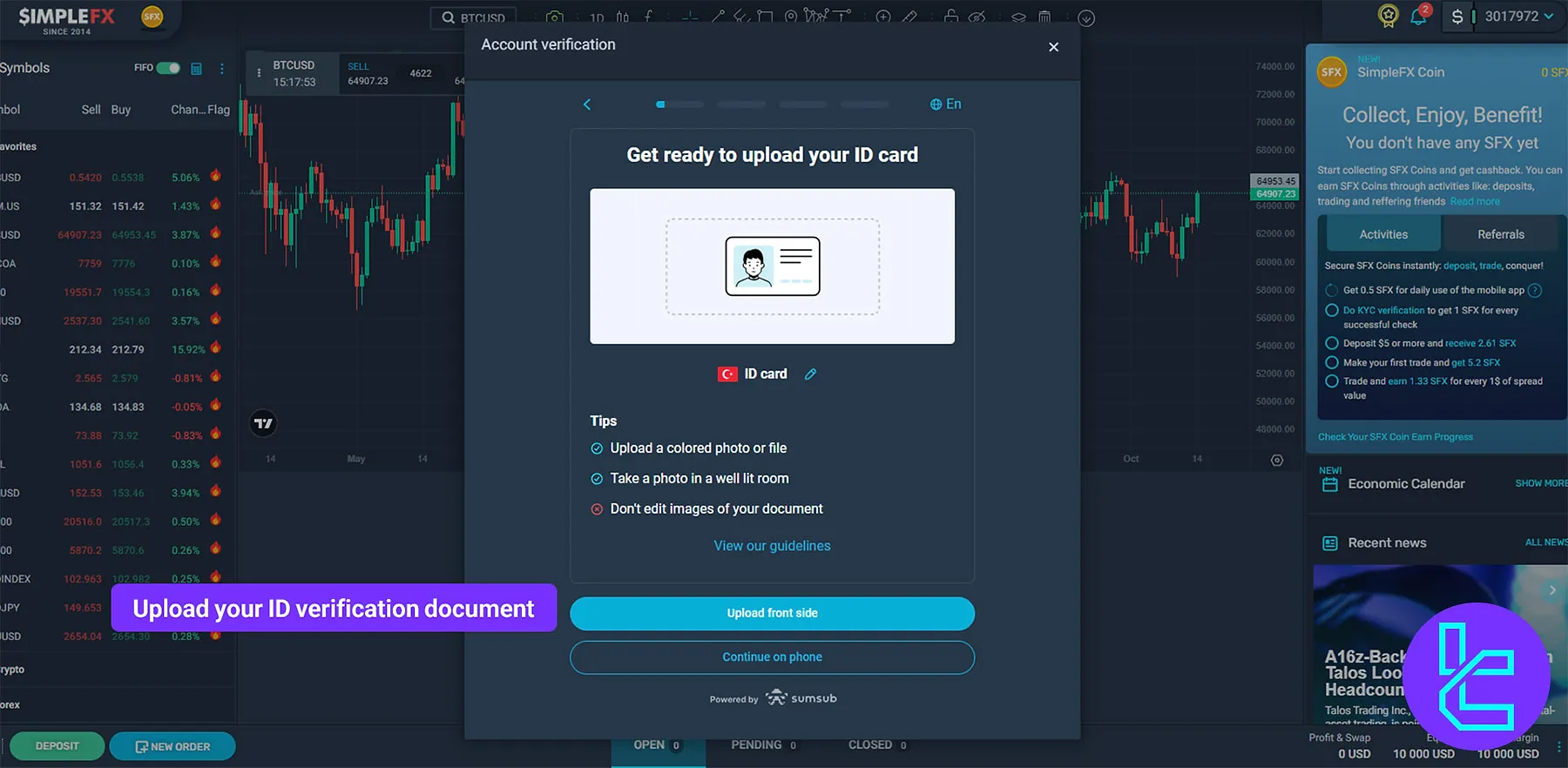

#4 SimpleFX Verification

Head to the SimpleFX client portal and click on the "Start Verification". Choose your ID verification document and upload pictures of its front and back:

- Passport

- National ID

- Driver’s license

Now you must pass the liveness check by capturing and uploading a selfie. Then provide proof of address verification documents, such as:

- Utility bill

- Bank statement

Answer the SimpleFX financial knowledge questionnaire.

SimpleFX Trading Platforms for Desktop and Mobile

SimpleFX offers a variety of trading platforms to suit different trader preferences:

WebTrader

SimpleFX offers a fully-featured web trading platform for desktop and mobile users. Key features of this trading platform:

- Browser-based platform

- User-friendly interface

- Economic Calendar

- Advanced charting and analytics tools

- Real-time market data

- Compatible with all devices

SimpleFX Mobile App

For traders who prefer to trade on a dedicated mobile app, SimpleFX offer a trading platform designed for iOS and Android user. Main features of

- Full trading functionality

- Push notifications for market alerts

- Biometric login for added security

- Seamless sync with the web platform

Links:

SimpleFX Desktop app

SimpleFX also offers a Desktop app for having the best trading experience. Key features of SimpleFX Desktop app:

- Low latency and fast order execution

- High security

- Supports a wide range of assets

Each platform is designed to provide a seamless trading experience, with real-time data synchronization across devices.

Spreads and Commissions in SimpleFX Broker

Although SimpleFX aims to keep trading costs competitive, its spreads are generally higher than other brokers. Minimum spreads start from 0.9 pips and could go as high as 1.5 pips on major Forex trading pairs:

Key points about SimpleFX's pricing:

- No commission fee structure

- No inactivity fee

- No withdrawal fee

SimpleFX operates on a commission-free pricing model for most instruments, with trading costs embedded within variable spreads. These spreads fluctuate based on market liquidity and volatility.

Traders should consider the overall cost of trading, including potential slippage and swap fees, when evaluating the broker's cost-effectiveness.

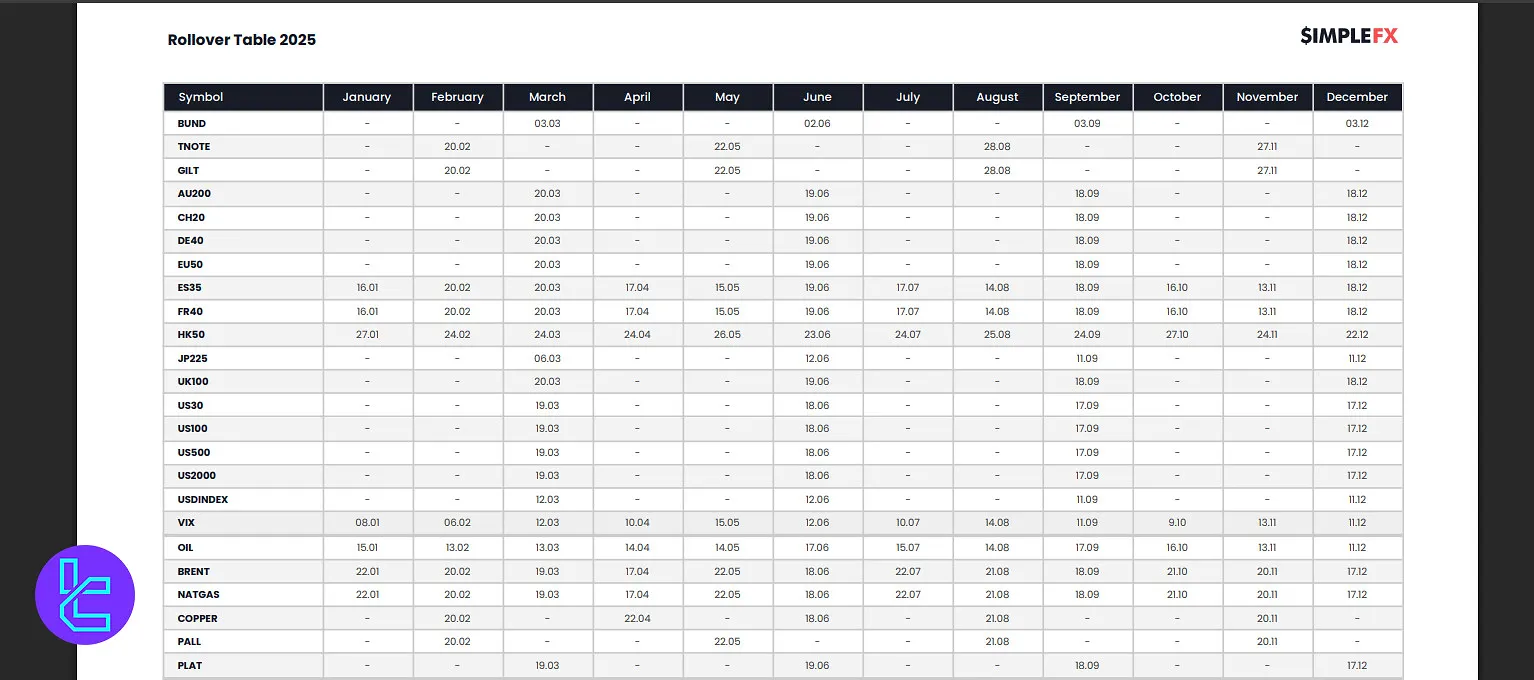

SimpleFX Swap Fees

All SWAP points applicable to each instrument can be found in the SimpleFX Terms and Conditions page and within the “Symbol Information” tab of the trading platform.

Calculation Formula:

- Order Size: measured in lots

- Swap Rate: specified in the broker’s Terms and Conditions

- Quote Currency: the second currency in a trading pair (e.g., EURUSD → USD)

This mechanism ensures accurate reflection of overnight interest adjustments across all active trading positions on the SimpleFX platform.

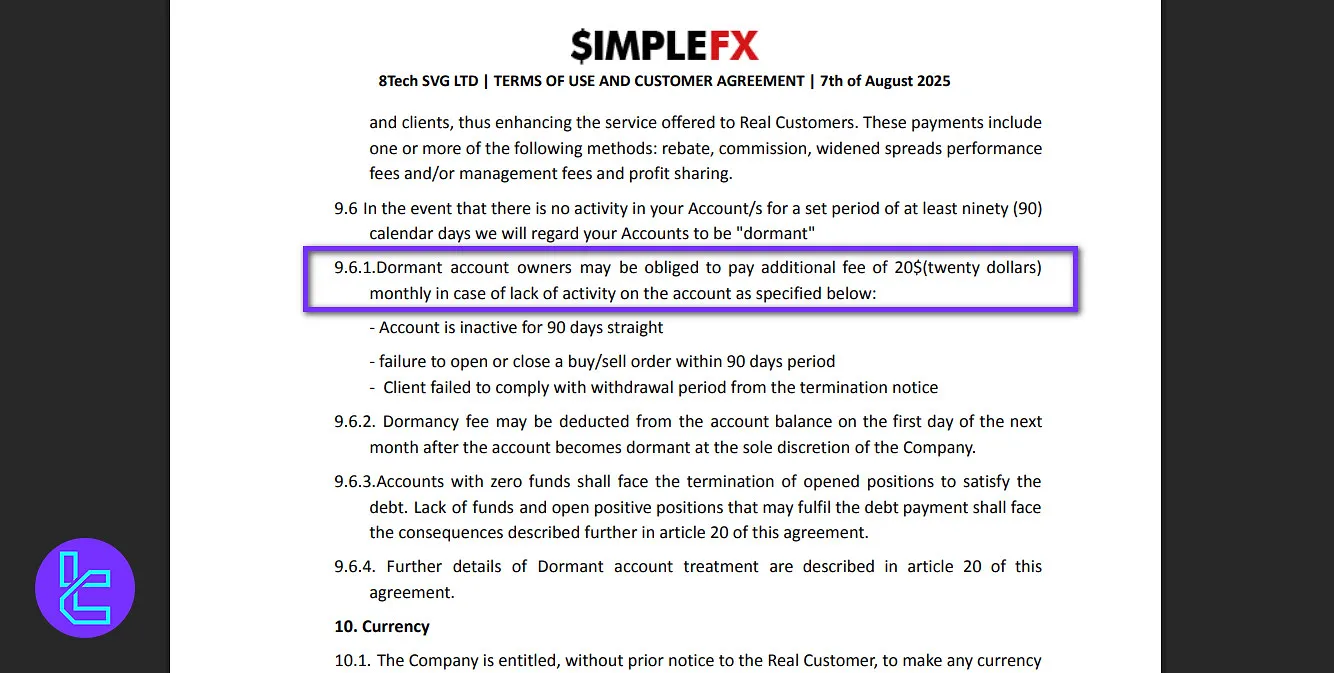

SimpleFX Non-Trading Fees

A SimpleFX trading account may be labeled dormant if no trading or transactional activity occurs for 90 consecutive days.

Once this status applies, a monthly maintenance charge of $20 can be deducted beginning on the first day of the following month, at the company’s discretion.

An account is considered inactive under any of the following conditions:

- No buy or sell positions opened or closed for 90 days;

- No withdrawals following a termination notice within the stated period.

For accounts that remain inactive and request withdrawals, an additional 3% fee (minimum $25) may apply, particularly when funds are withdrawn through the payment system used for the largest deposit.

All deposits made to SimpleFX accounts are free of charge, ensuring traders only incur costs related to inactivity or non-trading operations.

SimpleFX Broker Deposit and Withdrawal Overview

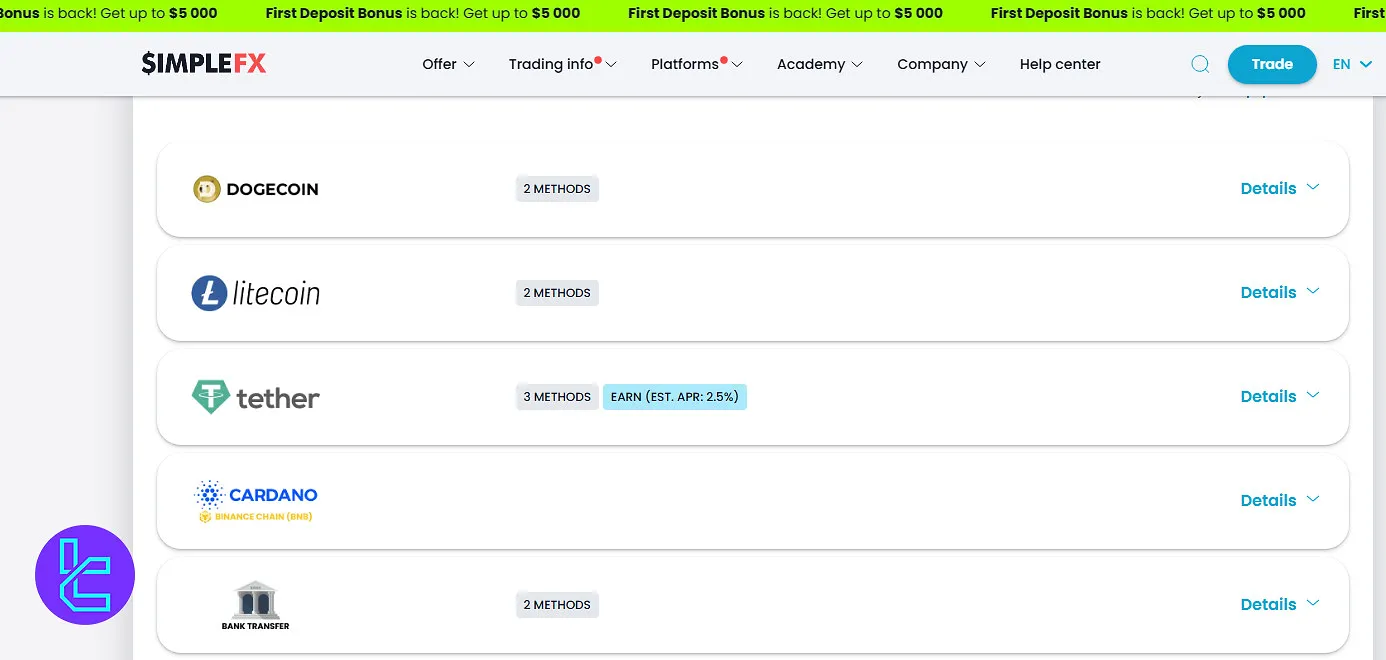

SimpleFX provides a variety of options for funding your account and withdrawing your profits, including:

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin, etc.)

- Bank Transfer

- FasaPay

- Credit/Debit Cards (Visa, Mastercard)

- USDT

Key points:

- Minimum deposit is $0

- No deposit fees charged by SimpleFX (third-party fees may apply)

- Minimum withdrawal and fees vary depending on the method chosen

Cryptocurrency is one of SimpleFX deposit and withdrawal options. It's particularly noteworthy, offering fast and cost-effective options for payments.

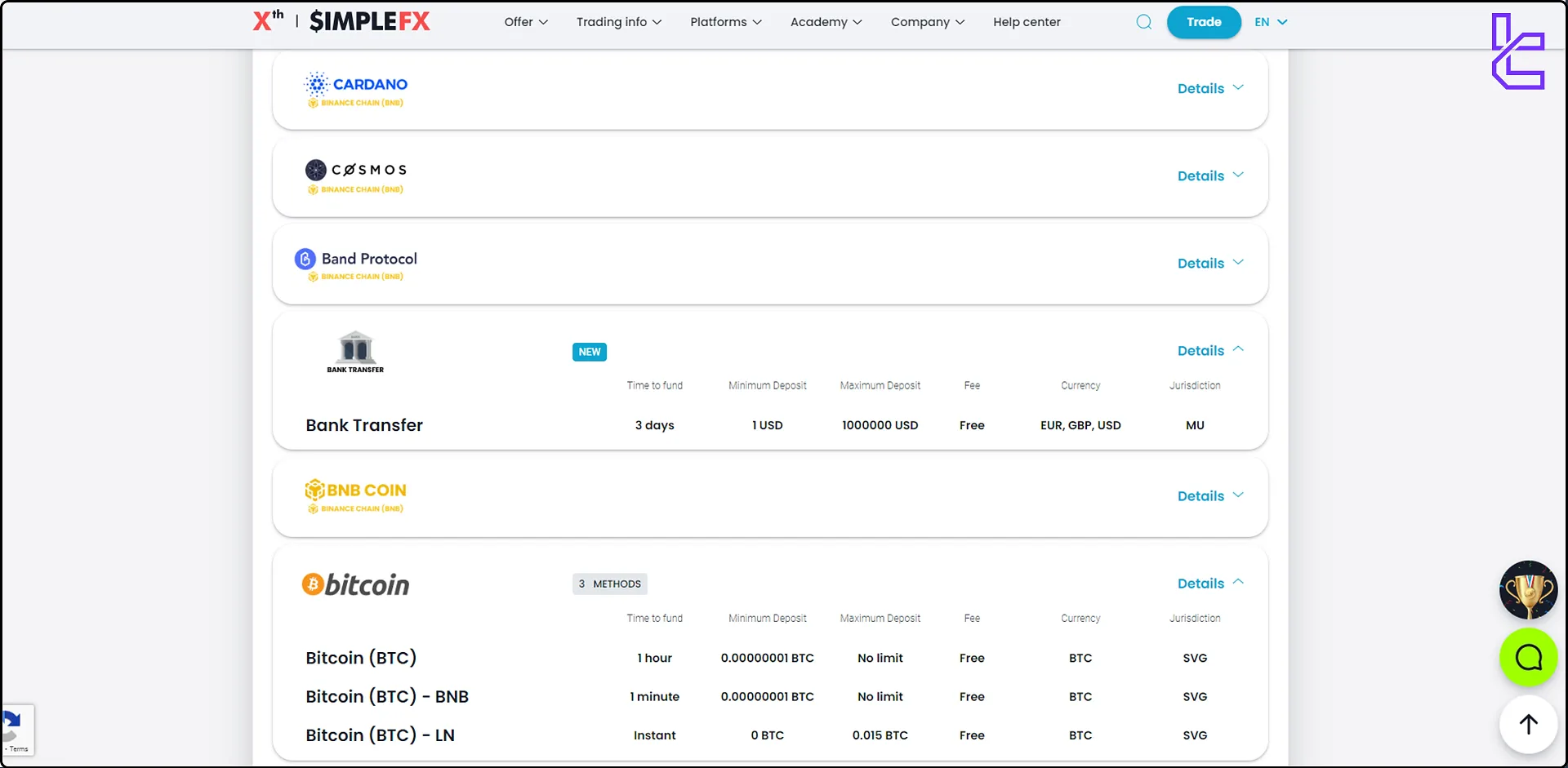

SimpleFX Deposit

SimpleFX supports a wide range of crypto-based and fiat deposit methods, offering instant to multi-day processing times with zero deposit fees.

Most cryptocurrency transactions are handled under the Saint Vincent and the Grenadines (SVG) jurisdiction, while bank transfers operate through Mauritius (MU).

All deposits on SimpleFX are free of charge, with no upper limits, and minimum requirements depend on the selected payment channel. Below is a structured overview of available deposit methods and their conditions:

Deposit Method | Networks / Types | Processing Time | Minimum Deposit | Maximum Deposit | Currency |

Dogecoin (DOGE) | DOGE / BEP20 (BSC) | 1 minute – 1 hour | 0.01 DOGE | No limit | DOGE |

Litecoin (LTC) | LTC / BEP20 (BSC) | 1 minute – 1 hour | 0.01 LTC | No limit | LTC |

Tether (USDT) | BEP20 (BSC), ERC20 (ETH), TRC20 (TRX) | 1 – 15 minutes | 0.01 USDT | No limit | USDT |

Cardano (ADA) | Native Network | 1 minute | – | No limit | ADA |

Bank Transfer | Standard / SEPA | 24 hours – 3 days | 10 USD / 10 EUR | No limit | EUR, USD |

Binance Coin (BNB) | Native Network (Earn APR ~0.5%) | 1 minute | – | No limit | BNB |

Bitcoin (BTC) | BTC / BEP20 (BSC) / Lightning Network | Instant – 1 hour | – | 0.015 BTC | BTC |

Bitcoin Cash (BCH) | BCH / BEP20 (BSC) | 1 minute – 1 hour | – | No limit | BCH |

Chainlink (LINK) | ERC20 (ETH) / BEP20 (BSC) | 1 – 15 minutes | – | No limit | LINK |

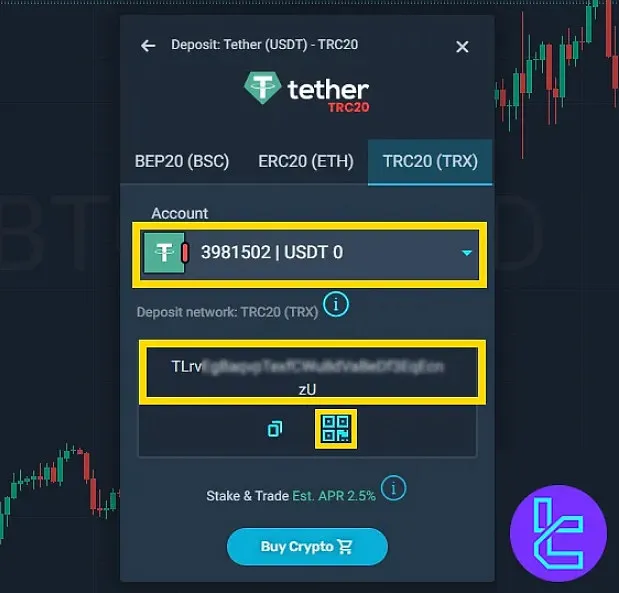

SimpleFX TRC20 Deposit

Funding a SimpleFX account via TRC20 (Tron network) is a fast, secure, and cost-effective method, typically completed in under 5 minutes. Users must have a TRC-20 compatible wallet. Each transaction incurs a $7 network fee.

Three-step process:

- Access Deposit Section: Log in to the SimpleFX dashboard, click “Deposit”, and select TRC20 (TRX) as the funding method;

- Provide Payment Details: Choose the target trading account, copy the wallet address or scan the provided QR code, then enter the transfer amount in your wallet;

- Confirm Transaction: Monitor the deposit status via “Deposit and Withdrawal” on the SimpleFX dashboard after blockchain validation.

SimpleFX TRC20 deposit ensures near-instant crediting of funds once the Tron network confirms the transaction.

SimpleFX Withdrawal

SimpleFX enables withdrawals through both cryptocurrency and bank transfer channels, processed typically within 24 hours, except for international wire transfers which may take up to three business days.

All withdrawals are managed under Saint Vincent and the Grenadines (SVG) for digital assets and Mauritius (MU) for fiat transactions.

Each method has specific minimum thresholds, fees, and network options. Below is a consolidated table summarizing available withdrawal methods and conditions:

Withdrawal Method | Networks / Types | Processing Time | Minimum Withdrawal | Maximum Withdrawal | Fee | Currency |

Dogecoin (DOGE) | DOGE / BEP20 (BSC) | 24 hours | 20–40 DOGE | No limit | 2 DOGE | DOGE |

Litecoin (LTC) | LTC / BEP20 (BSC) | 24 hours | 0.005–0.01 LTC | No limit | 0.001 LTC | LTC |

Tether (USDT) | BEP20 (BSC), ERC20 (ETH), TRC20 (TRX) | 24 hours | 5 USDT | No limit | 0.2–0.9 USDT | USDT |

Cardano (ADA) | Native Network | 24 hours | 2 ADA | No limit | 0.5 ADA | ADA |

Bank Transfer | Standard / SEPA | 24 hours – 3 days | 10–100 USD / EUR | No limit | 2–10 USD / EUR | EUR, USD |

Binance Coin (BNB) | Native Network (Earn APR ~0.5%) | 24 hours | 0.001 BNB | No limit | 0.0002 BNB | BNB |

Bitcoin (BTC) | BTC / BEP20 (BSC) / Lightning Network (LN ⚡) | 24 hours | 0.00005–0.0001 BTC | Up to 0.015 BTC (LN) | Free – 0.00001 BTC | BTC |

Bitcoin Cash (BCH) | BCH / BEP20 (BSC) | 24 hours | 0.001 BCH | No limit | 0.0003 BCH | BCH |

Chainlink (LINK) | ERC20 (ETH) / BEP20 (BSC) | 24 hours | 0.1–1 LINK | No limit | 0.02–0.4 LINK | LINK |

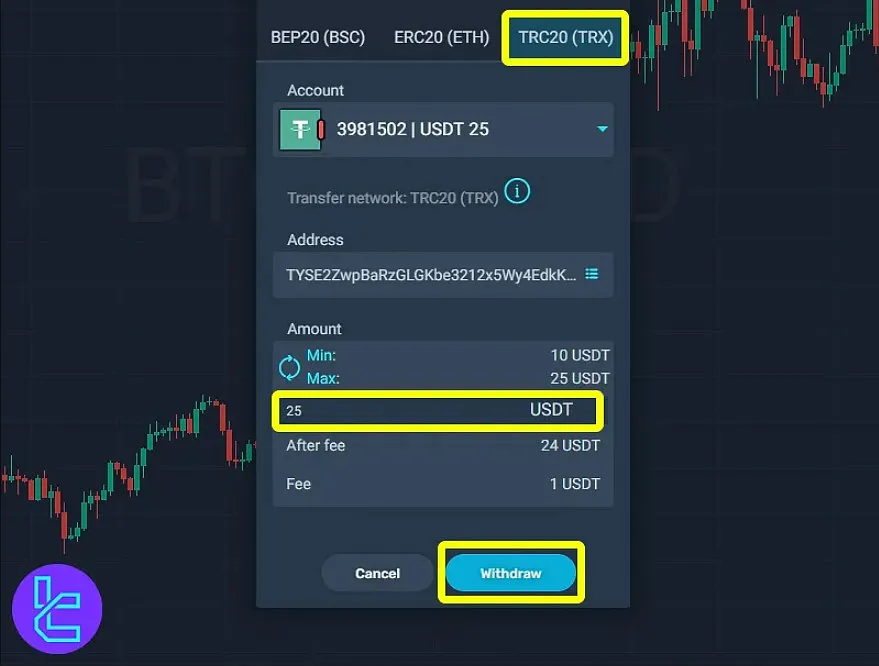

SimpleFX TRC20 Withdrawal

Withdrawing funds via TRC20 (Tron network) on SimpleFX is fast, secure, and low-cost, typically taking 10–15 minutes with a $1 transaction fee.

Step-by-step process:

- Access Withdrawal Section: Log in to the SimpleFX dashboard, navigate to “Accounts and Deposits”, and select “Withdrawal”;

- Select Payout Method & Confirm Wallet: Choose TRC20 as the withdrawal method and enter a valid wallet address. Confirm the address through the verification email sent by SimpleFX;

- Enter Amount & Confirm Transaction: Specify the withdrawal amount (minimum $10), submit the request, and verify the transaction via the email confirmation link;

- Check Transaction Status: Review your transaction history in the dashboard to confirm successful processing.

SimpleFX TRC20 Withdrawal ensures quick access to funds while maintaining network-level security through TRC20 confirmations.

Copy Trading and Investment Options Offered by SimpleFX Broker

SimpleFX does not offer a dedicated copy trading or social trading feature. This means that traders on the platform cannot automatically copy the trades of other successful investors.

However, SimpleFX does provide an Earn feature for staking cryptocurrencies and receiving rewards which we will review the in the following sections.

While the lack of copy trading might be a drawback for some, SimpleFX focuses on providing a robust platform for self-directed trading. Traders looking for copy trading features may need to consider other brokers that specialize in this area.

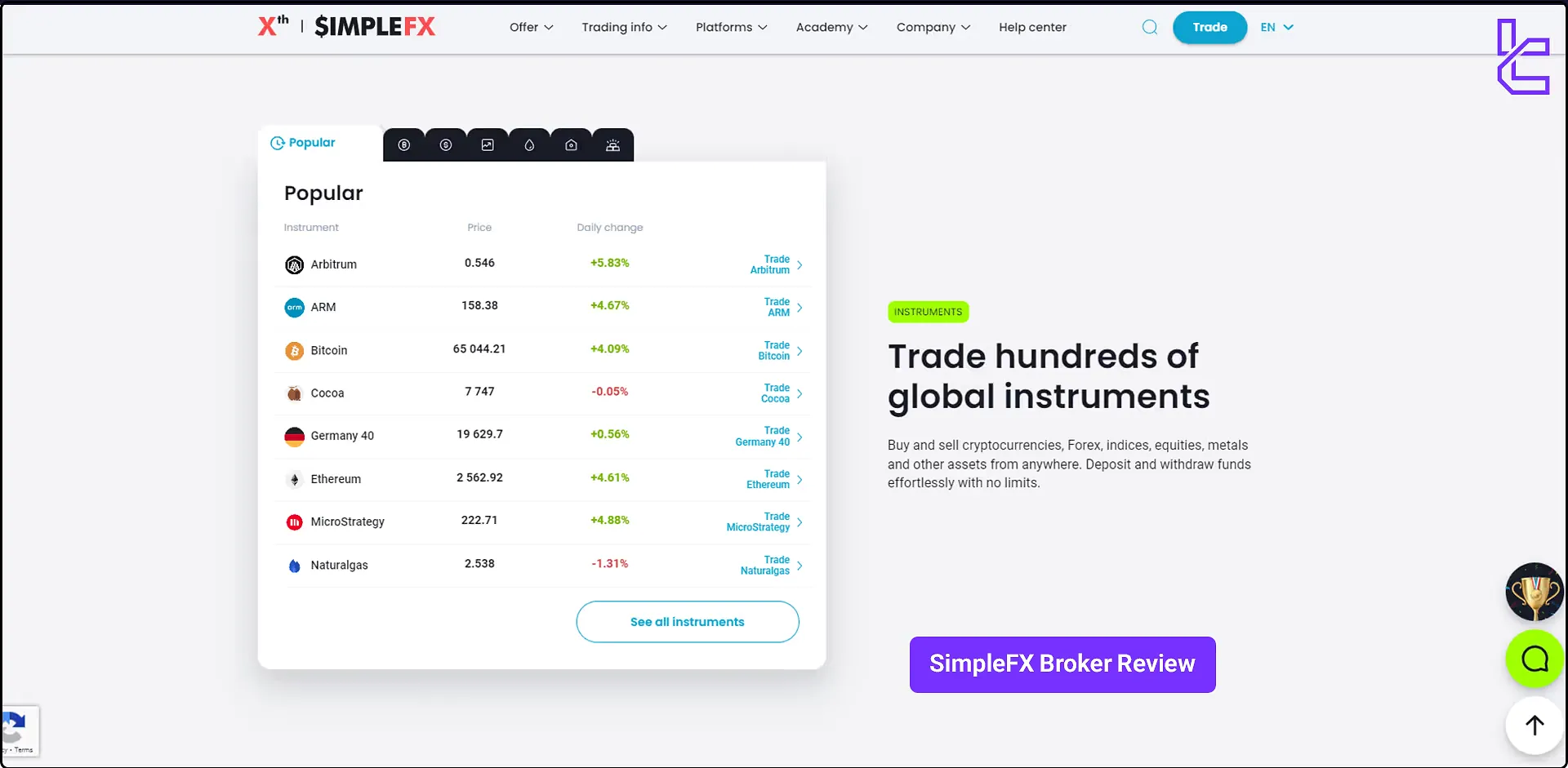

Tradable Markets and Assets in the SimpleFX Broker

SimpleFX gives traders access to over 450 tradable instruments across six asset classes, including:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, minor, and exotic currency pairs | 55 currency pairs | 50–70 currency pairs | 1:1000 |

Cryptocurrencies | Popular digital assets (e.g., BTC, ETH, LTC) | 42 crypto assets | 15–25 crypto assets | N/A |

Indices | Equity indices (e.g., S&P 500, DAX 40) | 18 indices | 10–20 indices | N/A |

Commodities | Oil, natural gas | 11 instruments | 10–20 instruments | N/A |

Metals | Gold and silver | 8 instruments | 2–5 instruments | N/A |

Equities | Global stock CFDs (e.g., Tesla, Amazon, Apple) | 900+ stocks | 800–1200 stocks | N/A |

This wide variety of instruments allows traders to buy and sell the asset that they can analyze best.

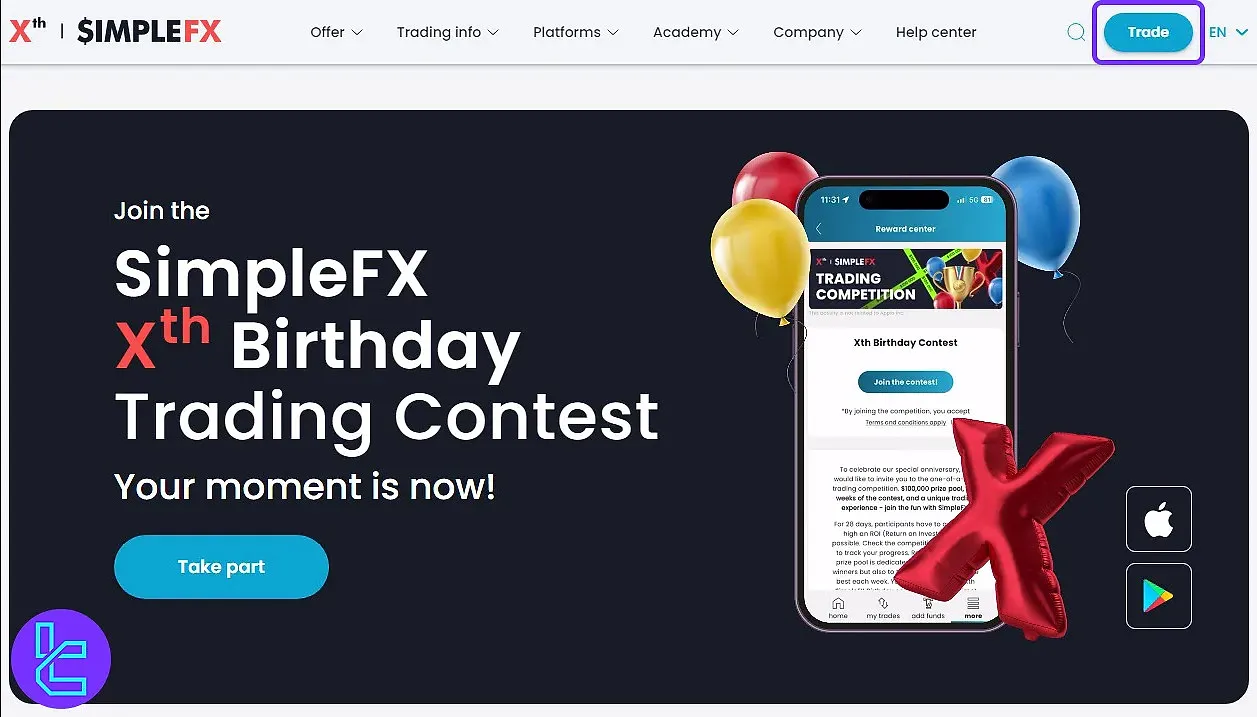

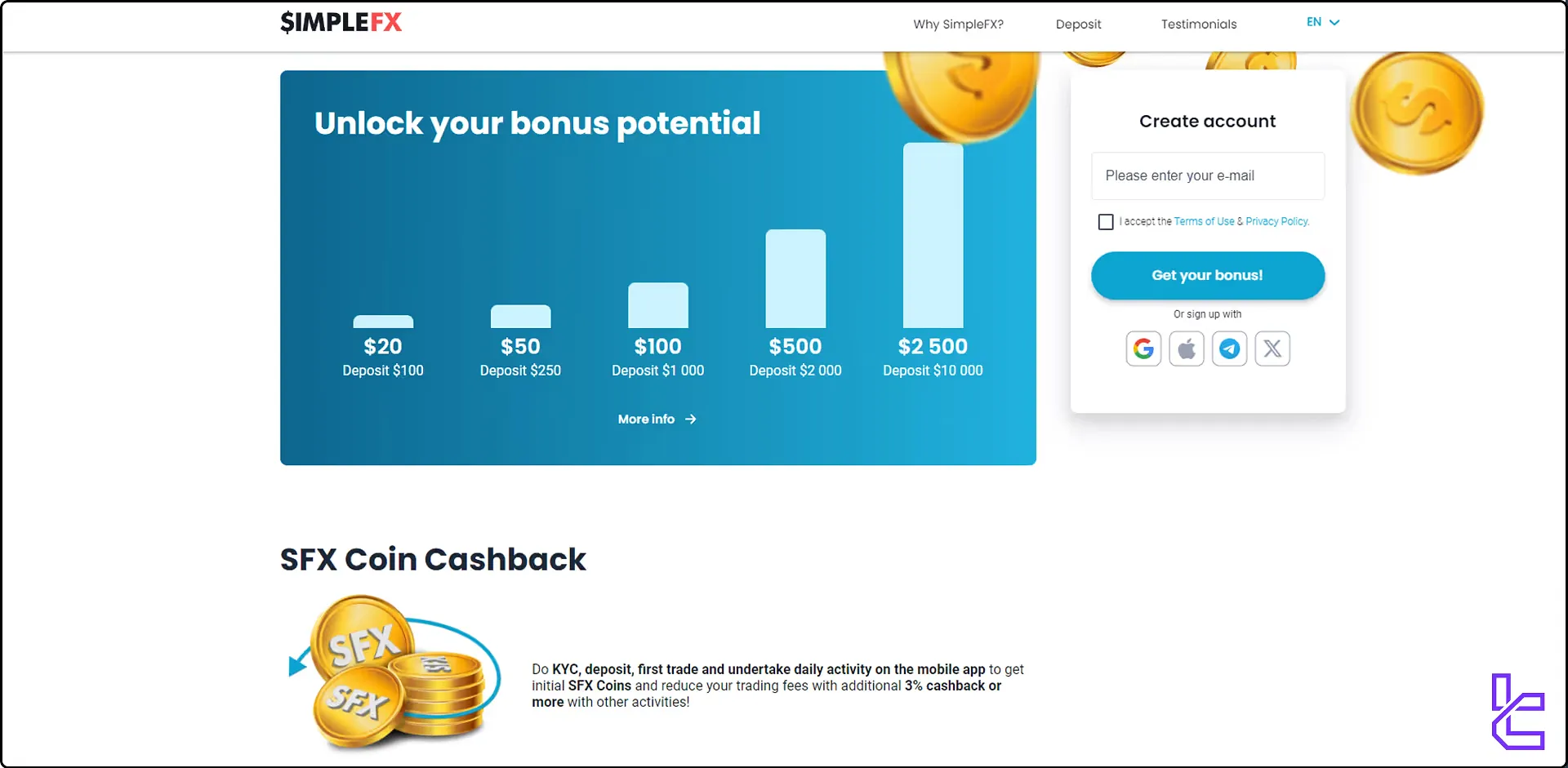

SimpleFX Broker Bonuses and Promotional plans

SimpleFX offers several attractive bonuses and promotions to incentivize new and existing traders:

$2500 deposit bonus:

- Available for new and existing clients

- Bonus amount depends on the deposit size (from $100 to $10,000)

Referral program:

- Earn up to 50% revenue share from referred traders

- Up to $800 per qualified client

Decade celebration trading contest:

- Compete with other traders to have chance of receiving up to $100,000 prize

- Trader ranks are based on ROIs

- SFX coin weekly prizes for top 15 traders

SFX cashback:

- Complete KYC, make a deposit and do daily activities on SimpleFX mobile app

- Get rewarded with SFX coins and 3% cashback on your trader

While these bonuses can provide additional trading capital, it's important to approach them cautiously and not let them influence your trading decisions unduly.

The availability and conditions of these promotions may vary by region and time, often tied to specific events or campaigns.

SimpleFX Awards

SimpleFX’s focus on continuous innovation, intuitive design, and trader-oriented features has positioned it among the more respected names in online trading.

Over the years, this approach has earned SimpleFX several notable distinctions, including Best Trading Platform awards in 2017, 2018, and 2022.

The SimpleFX awards highlight consistent performance and excellence in user experience within the financial technology sector.

SimpleFX Broker Support Methods

SimpleFX provides customer service through live chat and email, operating 24 hours a day, five days a week. An integrated help center addresses frequently asked questions and basic troubleshooting.

- Live Chat: Available 24/5 on the website

- Email Support: support@SimpleFX.com

- FAQ Section: Comprehensive guide covering common questions

SimpleFX Broker Restricted Countries and Regions

SimpleFX maintains a list of restricted countries due to regulatory and legal considerations. The following countries are banned from using SimpleFX broker:

- United States

- Syria

- Japan

- Myanmar

- Pakistan

- Canada

- Puerto Rico

- Virgin Islands

Residents of these countries are not permitted to open trading accounts with SimpleFX. It's important to note that this list may change, and traders should always check the most up-to-date information on the SimpleFX website or contact customer support for clarification.

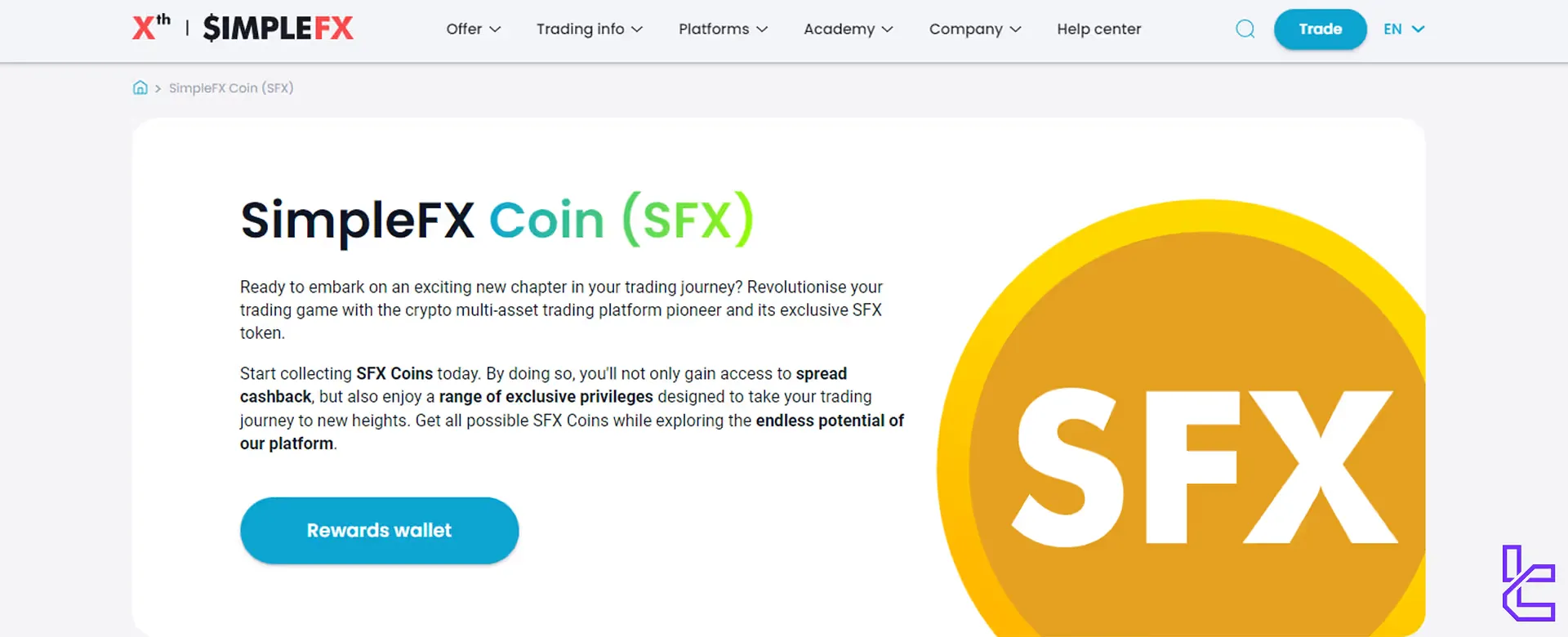

What is SimpleFX SFX Token?

SimpleFX introduced SFX, a native coin designed to enhance the trading experience on its platform. With SFX, users can access exclusive benefits like cashback rewards and reduced trading fees.

The coin is seamlessly integrated into the platform, providing a streamlined way for traders to optimize their accounts.

Cointelegraph also featured SimpleFX in a blog post, highlighting the broker’s innovative approach and the role of SFX in transforming the trading landscape.

The article praised SimpleFX’s efforts to integratecryptocurrency solutions into traditional trading, offering a modern, user-focused experience.

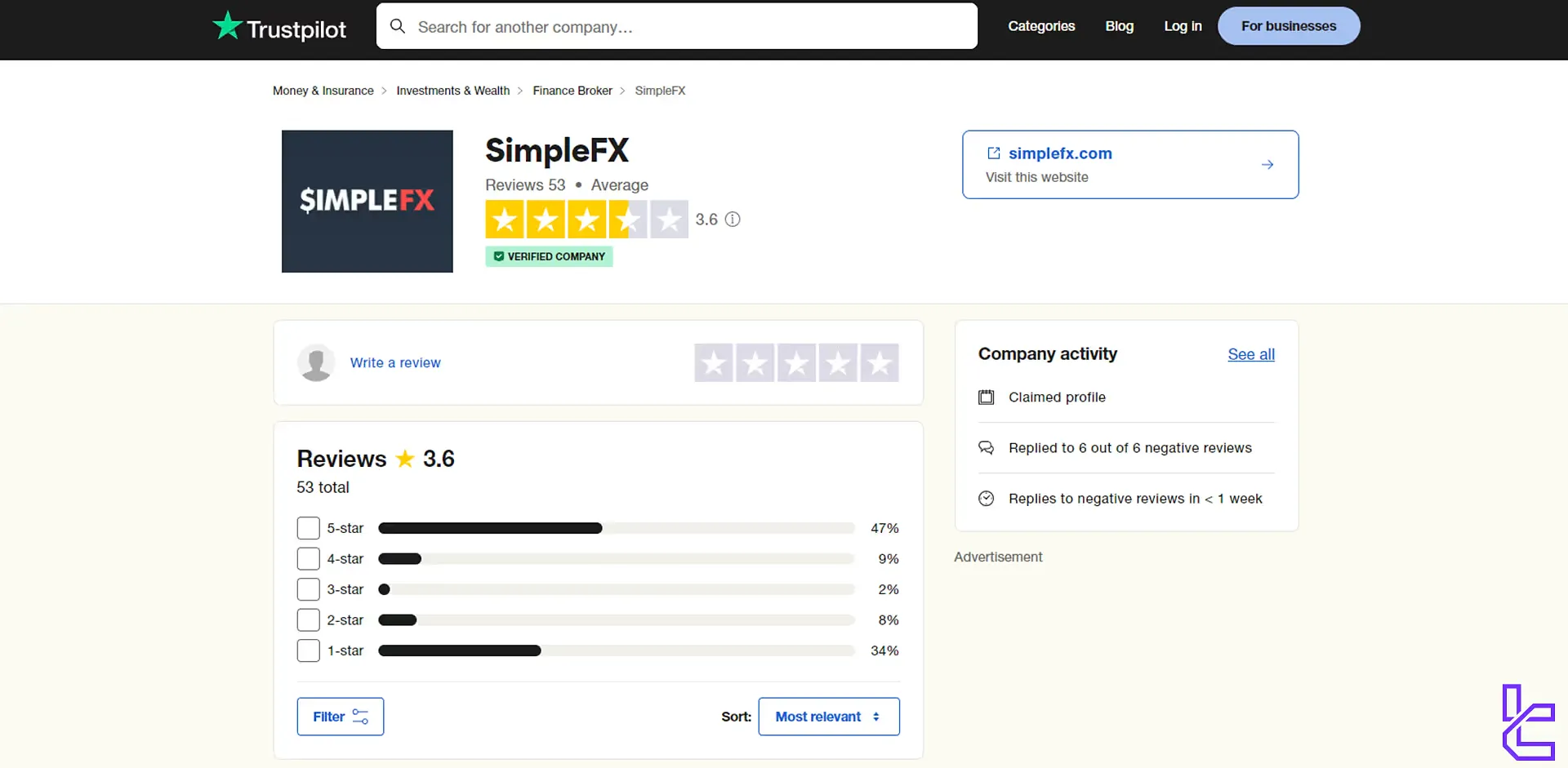

SimpleFX Broker Trust Scores on Review Websites

There are mixed reviews on the SimpleFX Trustpilot profile. Here's a summary of the trust scores and reviews:

- Overall Trustpilot Score: 3.6 out of 5

- Number of Reviews: Over 50

It's important to note that online reviews may not always represent the typical user experience. Potential traders should consider these reviews alongside their own research and risk tolerance.

SimpleFX Education Materials

SimpleFX offers several educational resources under its academy tab to help traders improve their skills and knowledge:

- SimpleFX Education: Most Up-to-date news regarding currency pairs, stocks, crypto, and more

- Trading Glossary: Comprehensive list of trading terms and Easy-to-understand capital markets definitions

- SimpleFX Blog: Daily market analysis combined with trading tips and tricks

While SimpleFX's educational offerings are not as extensive as some larger brokers, they provide a solid foundation for beginners and some valuable insights for more experienced traders.

Check TradingFinder's Forex education and Crypto tutorials for additional resources.

SimpleFX vs Other Brokers

The table below compares SimpleFX features with some of the most popular Forex brokers.

Parameter | SimpleFX Broker | |||

Regulation | FSC, FSCA | FSA, CySEC, ASIC | CySEC | None |

Minimum Spread | From 0.9 pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $0 | Average $1.5 | From Zero | $0 |

Minimum Deposit | $0 | $200 | $50 | $10 |

Maximum Leverage | 1:1000 | 1:500 | 1:30 | 1:3000 |

Trading Platforms | WebTrader, Desktop app, mobile app | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MT4, MT5 |

Account Types | Standard, Demo | Standard, Raw Spread, Islamic | Classic, ECN, Demo | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | No | Yes |

Number of Tradable Assets | 450+ | 2,250+ | N/A | 50+ |

| Trade Execution | Market | Market | Market | Market, Instant |

TF Expert Suggestion

SimpleFX’s no minimum deposit, high leverage (up to 1000), and cryptocurrency staking option make the broker’s services suitable for beginners and professionals.

However, traders need to consider higher-than-industry average spreads (starting from 0.9 pips) and the lack of regulation by a recognized financial authority, including the CFTC, FCA, SEC, or CySEC.