Spread Co offers 0% financing on short index positions, Forex trading with no commissions, and fixed spreads through the SaturnTrader platform, which includes access to TradingView charts. The minimum order size for spread betting is £1.

Spread Co has been operating for over 17 years, serving clients across more than 50 countries. The broker provides access to 1,000+ trading instruments, including 20+ Forex pairs, 4 commodities such, over 100 UK and US equities and 3 major global indices.

Spread Co; Company Background and Regulatory Status

Spread Co Limited is a financial services firm authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

The company has been operating since 2006 under firm registration number 446677, providing trading services to clients globally. Key features of SpreadCo:

- 0% financing on short index positions

- Low margin requirements

- Fixed spreads

Traders can open either a Standard or Limited Risk account; the latter includes automatic guaranteed stop-loss features. Additionally, the broker provides both single-position and consolidated account formats to match varying portfolio strategies.

With its proprietary trading platform and commitment to simplified execution, Spread Co enables clients to trade forex, indices, equities, and commodities all from a single platform.

In the table below, you can see the regulatory details of the broker:

Entity Parameters/Branches | Spread Co Limited |

Regulation | Financial Conduct Authority (FCA) |

Regulation Tier | Tier 1 |

Country | United Kingdom |

Investor Protection Fund/Compensation Scheme | Financial Services Compensation Scheme (FSCS) & Financial Ombudsman Service (FOS) |

Segregated Funds | Yes, client funds are held in segregated bank accounts with Barclays Bank |

Negative Balance Protection | Yes, FCA rules require client protection |

Maximum Leverage | 1:20 |

Client Eligibility | Individuals and entities eligible under FCA regulations |

Spread Co Broker Specifications

The company offers spread betting, CFD, and Forex trading services, mostly to UK traders. Let’s take a quick look at what the Forex broker brings to the table.

Broker | Spread Co |

Account Types | CFD, Spread Betting |

Regulating Authorities | FCA |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer |

Minimum Order | 1 |

Maximum Leverage | 1:20 |

Investment Options | No |

Trading Platforms & Apps | Proprietary |

Markets | Equities, Commodities, Currencies, Indices |

Spread | Fixed |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Mobile Trading, Spread Betting |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | N/A |

PAMM Account | N/A |

Customer Support Ways | Email, Tel, Live Chat |

Customer Support Hours | Monday to Friday 8 am-5:30 pm (UK time) |

Spread Co Account Types

The broker offers two main types of trading accounts: CFD (Contract for Difference) and Spread Betting.

Both account types allow traders to speculate on price movements of various financial instruments with the following key feature:

- Tax Treatment: While CFD profits are subject to Capital Gains Tax, spread betting profits are tax-free in the UK;

- Minimum Trade Sizes: Minimum trade size of £1 per point for spread betting, while CFD minimum trade sizes vary by instrument (e.g., €1 for equity CFDs);

- Stop Out Level: It’s 50%;

- Use leverage options of up to 1:30.

These accounts are suitable for retail traders seeking a cost-efficient and transparent way to trade.

Advantages and Disadvantages

Spread Co enables traders to enjoy tax-free profits on spread betting with a minimum bet size of £1.

To provide a balanced view in this Spread Co review, we examine the pros and cons of trading with the broker.

Pros | Cons |

FCA-regulated | Limited leverage options (up to 1:30) |

0% financing on short index positions | No support for MetaTrader or TradingView |

Diverse products (spread betting, CFD, and options) | Complex fee structure |

Low margin requirements | High entry barrier |

Registration and Verification

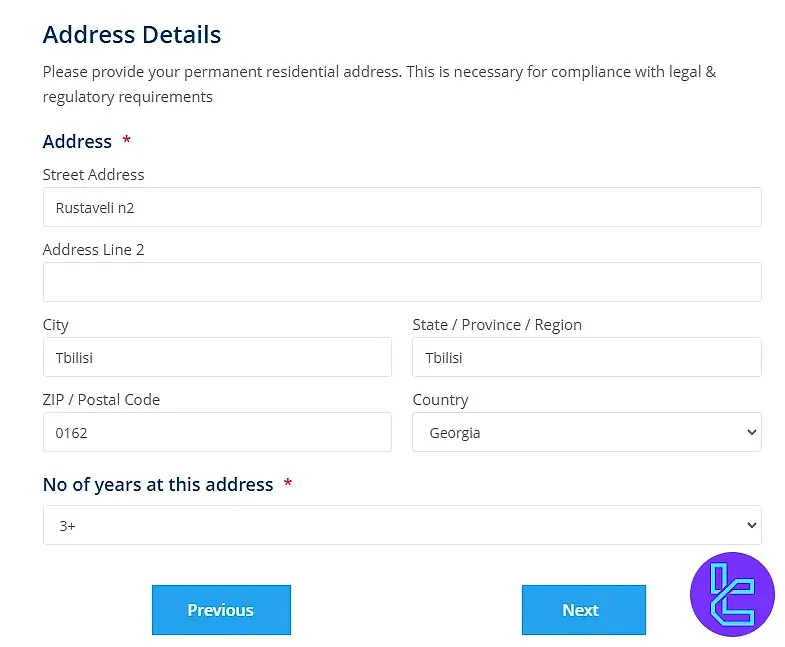

Getting started with the broker involves a structured sign-up journey, where traders provide personal details, financial suitability info, and select their account preferences.

The Spread Co registration process is quick, typically under 10 minutes, and unlocks immediate dashboard access.

#1 Visit the Platform and Start Registration

Go to the Spread Co homepage and click "Start Trading" to begin the account setup.

#2 Enter Personal and Account Details

Select your account type (CFD or Spread Betting), base currency (USD, GBP, or EUR), and fill in your personal information, including:

- Full name

- Nationality

- Contact info

- Residential address

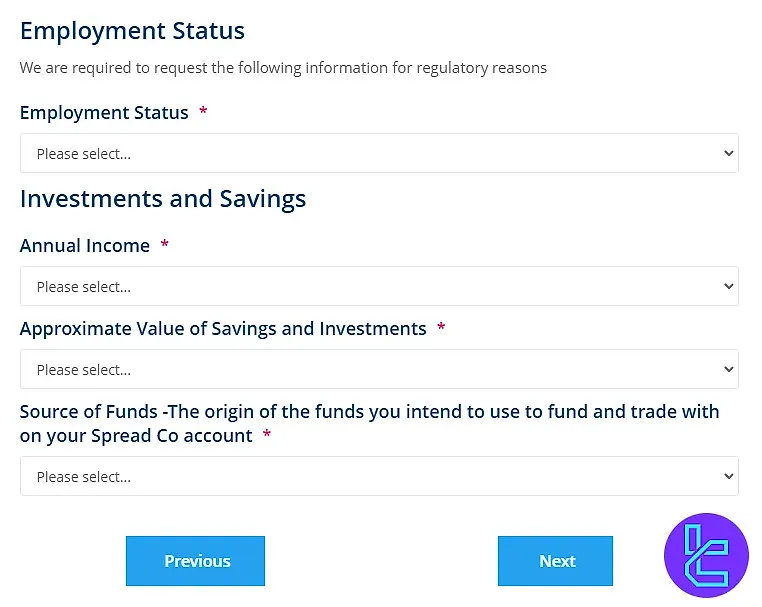

#3 Complete the Financial Questionnaire

Submit employment status, trading experience, and answer risk assessment questions. Accept the terms and click "Apply" to finalize your application.

Note: No phone or email verification is required for initial account creation, but full verification is needed for live trading.

#4 Proceed with the KYC Procedure

To fully access the platform's features, provide supporting documents, including:

- Proof of Identity: Passport, ID card, or Driving license

- Proof of Address:Utility bill, Bank statement, or tenancy agreement

Spread Co Broker Apps and Platforms

The company provides its proprietary "SaturnTrader" platform for web-based and mobile trading. Spread Co has partnered with the TradingView platform to provide market charts.

For additional analytical tools, you can check TradingFinder’s extensive list of TradingView indicators.

While the mobile software is available on Android and iOS devices, you can’t download it through Google Play Store or Apple App Store. To install the Spreadco application, you need to visit the following URL: “app.spreadco.com”.

Here are SaturnTrader's key features:

- Customizable layouts

- Real-time charting powered by TradingView

- Risk monitoring dashboards

- Automatic and guaranteed stop-loss functionality

This combination provides a tailored and streamlined experience for traders who prioritize flexibility and control.

Fees and Commissions

Spread Co offers a transparent fee structure. The broker charges no commissions onCommodity, Forex, and Index markets, with costs primarily coming from spreads and overnight financing.

While spreads are fixed, they vary based on the underlying instrument:

Market | CFD | Spread Betting |

Currencies | From 0.6p | From 0.8p |

Indices | From 0.3p | From 0.3p |

Commodities | From 0.03p | From 2.5p |

Equities | From 2.0p markup on US equities From 0.05% markup on UK equities | |

An added benefit is the broker’s 0% financing policy on short index positions, offering cost-efficient opportunities for bearish strategies.

Spread Co Swap Fees

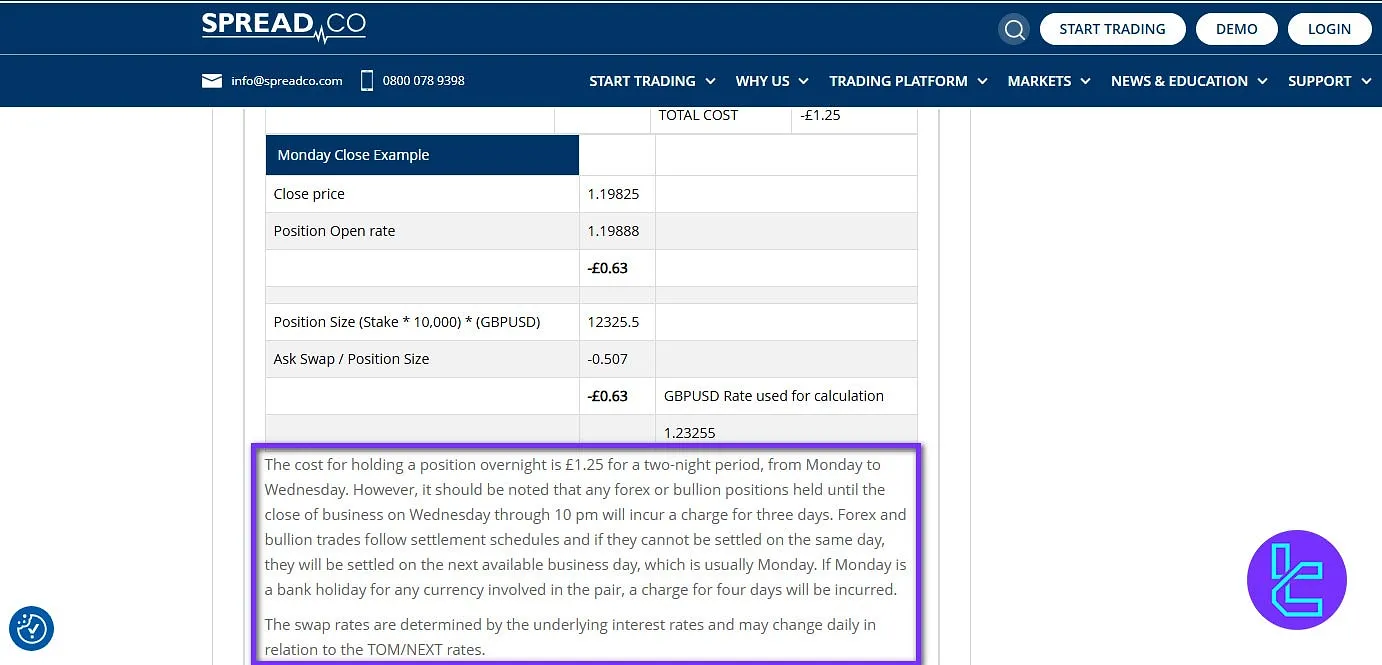

The overnight financing fee is set at £1.25 for a two-night period covering Monday to Wednesday. Traders should be aware that forex and bullion positions held past Wednesday’s close, up to 10 p.m., are subject to a three-day charge.

This adjustment aligns with standard settlement cycles, as trades that cannot be finalized on the same day are rolled over to the next business day, typically Monday.

If Monday happens to be a public holiday for any currency in the pair, the rollover extends to four days.

Swap rates are influenced by interbank interest rate differentials and are adjusted daily in accordance with TOM/NEXT market movements.

Spread Co Non-Trading Fees

Spread Co applies no account opening or inactivity charges. Deposits made via credit or debit card are free of company fees, though individual card issuers may classify the transaction as a cash advance and apply their own charges.

For bank transfers, clients should be aware that intermediary or originating banks may deduct handling fees, resulting in a slightly reduced credited amount. It’s advisable to confirm any such costs directly with your bank before transferring funds.

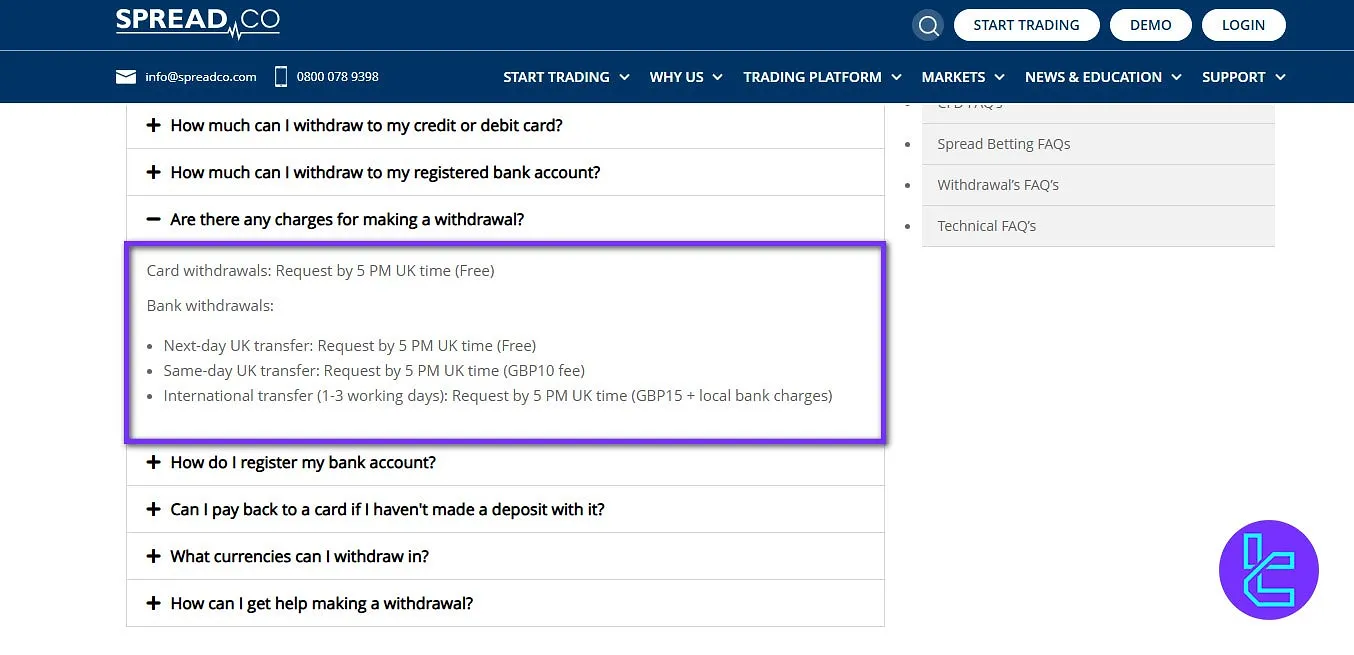

Withdrawal requests submitted before 5 PM (UK time) are processed as follows: card withdrawals are free of charge; UK bank transfers can be completed the next business day at no cost or on the same day for a £10 fee.

International bank transfers, which typically take one to three working days, incur a £15 charge plus any applicable fees imposed by the receiving bank.

Spread Co Deposit and Withdrawal

The broker, led by Ajay Pabari, has a traditional mindset towards payment methods, as it doesn’t accept e-wallets or cryptocurrencies. Spreadco only supports bank transfers and card payments.

Withdrawing to cards is only available when you request a payout to the deposit source. While credit/debit card transactions are free, bank withdrawals have a different story:

Method | Withdrawal Fee |

Same-day UK Bank Transfer | £10 |

International Bank Transfer | £15 |

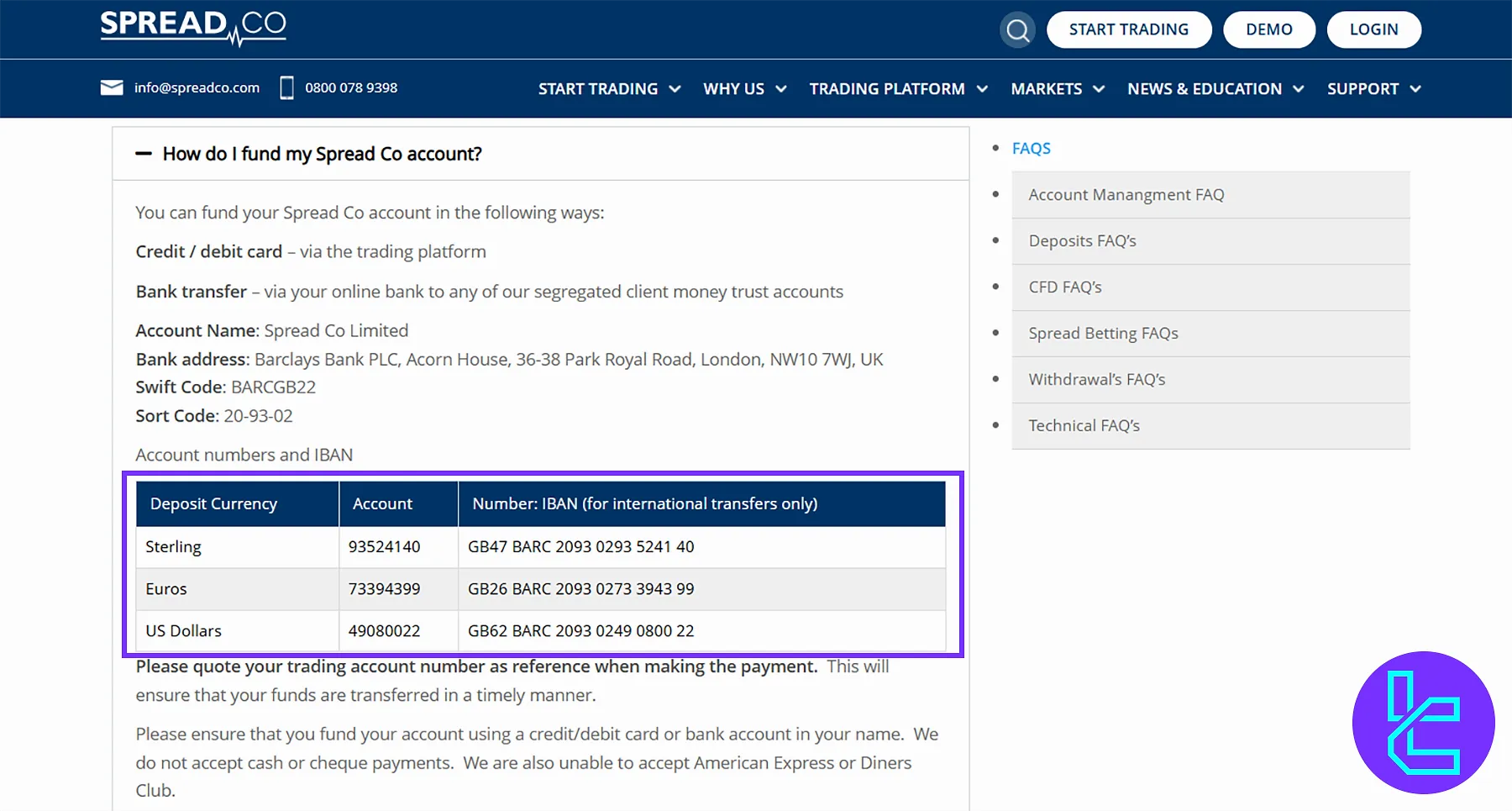

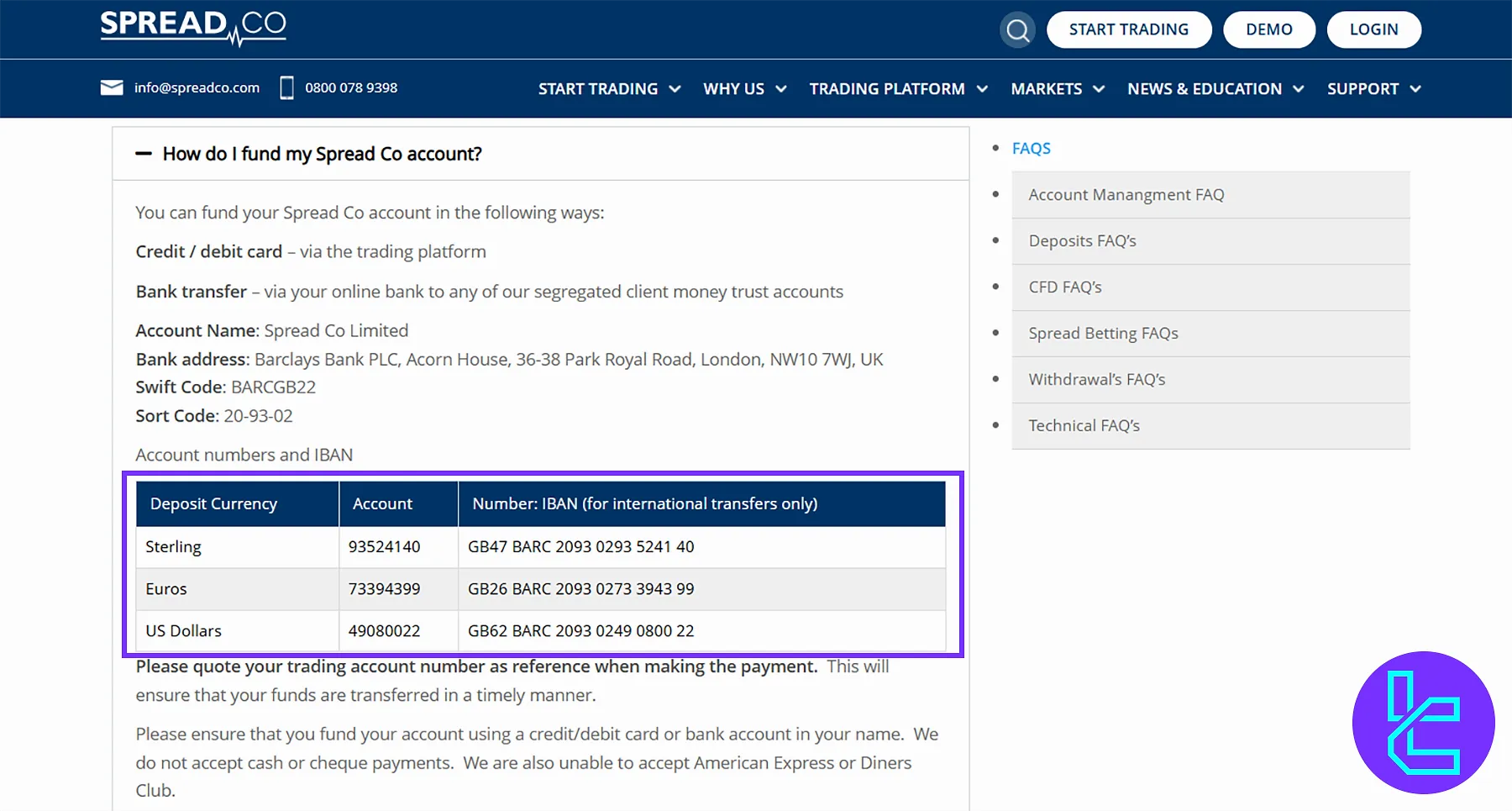

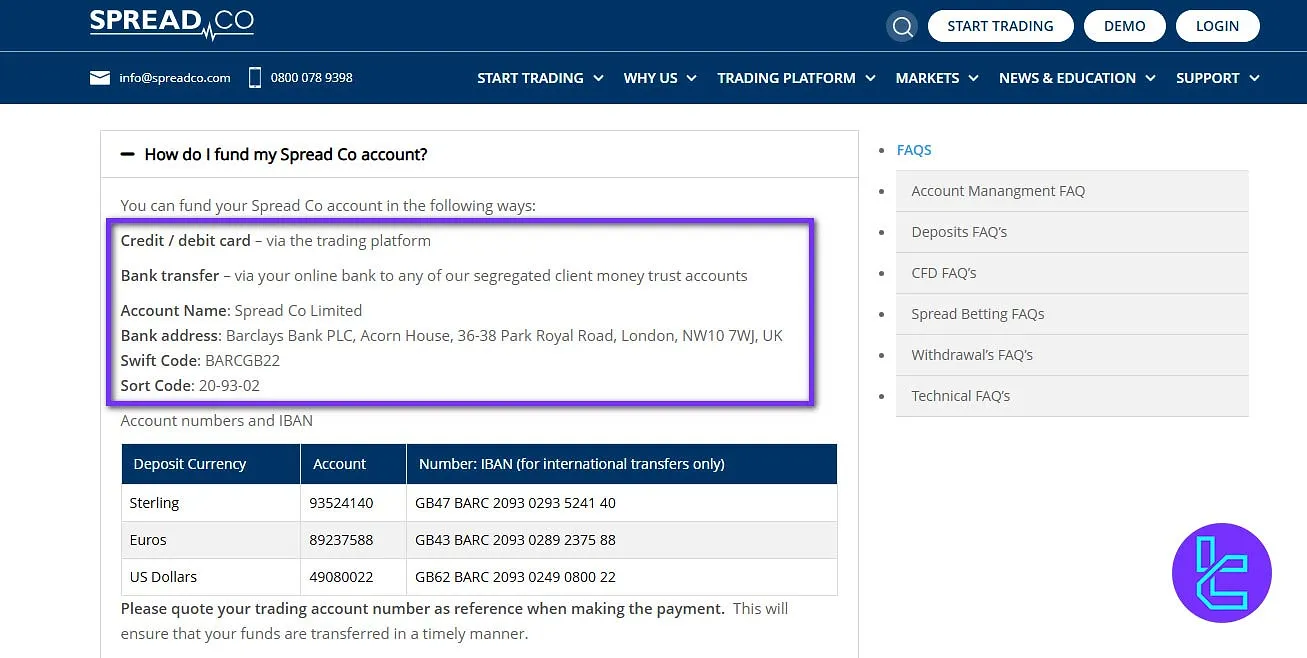

Spread Co Deposit

Clients can add funds to their Spread Co trading accounts through two main channels: credit or debit card payments and direct bank transfers. Deposits are accepted in GBP, EUR, and USD.

Card transactions are processed instantly once authorised, while bank transfers depend on standard banking clearance times. There are no upper limits on the amount you can deposit using a debit or credit card.

All client deposits are directed to segregated trust accounts held with Barclays Bank PLC, ensuring funds remain separate from company capital.

Here are the details on the deposit methods available:

Deposit Method | Access Channel | Processing Time | Accepted Currencies |

Credit / Debit Card | Through trading platform | Instant (upon authorization) | GBP, EUR, USD |

Bank Transfer | Via online banking to Spread Co client trust account | 1–3 business days (depending on bank) | GBP, EUR, USD |

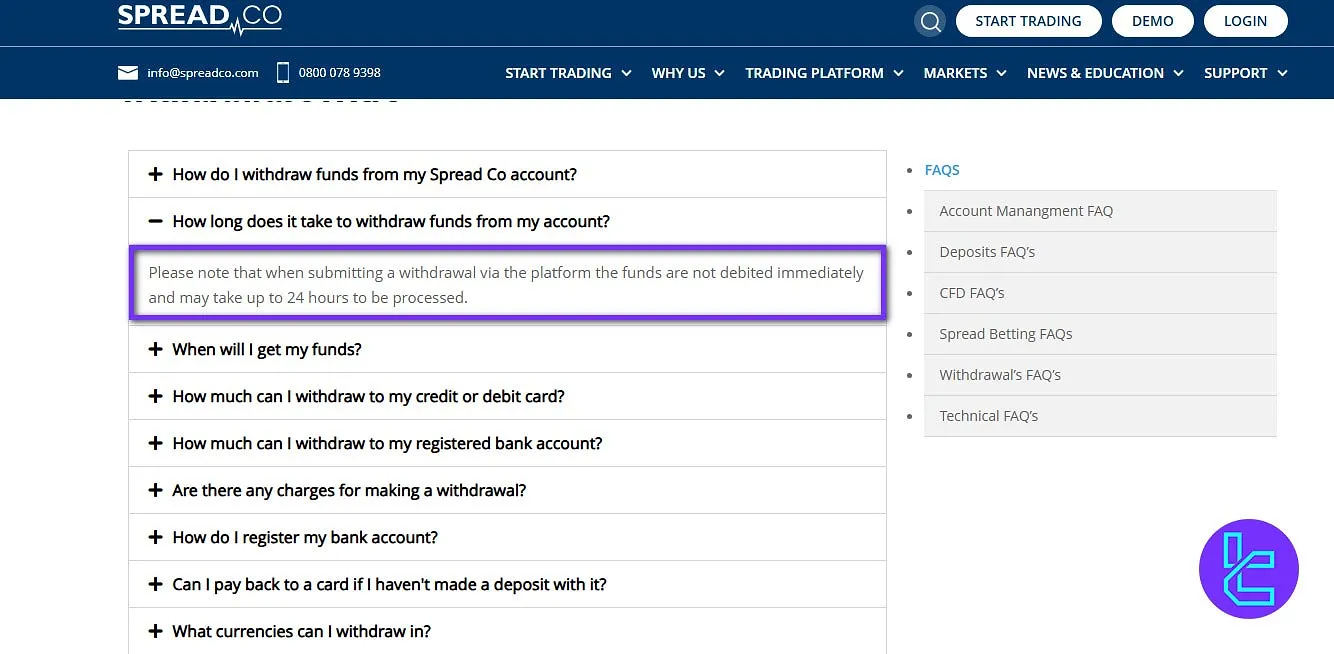

Spread Co Withdrawal

Withdrawals can be made directly through the Payments section of the trading platform by selecting Withdraw, choosing your preferred currency and amount, and confirming your payment method.

Funds can be returned to registered debit or credit cards, excluding Mastercards. For Mastercard users, withdrawals must be processed via bank transfer.

If a verified bank account is already on file, transfers will be made to that account automatically. All withdrawal requests may take up to 24 hours for internal processing before funds are released.

In the table below, you can see the details of each withdrawal method:

Withdrawal Method | Processing Time | Cut-off Time (UK) | Fee |

Credit/Debit Card | 1 hour – 5 working days | 5 PM | Free |

UK Bank Transfer (Next-day) | 1 business day | 5 PM | Free |

UK Bank Transfer (Same-day) | Same business day | 5 PM | £10 |

International Bank Transfer | 1–3 working days | 5 PM | £15 + local bank charges |

Copy Trading and Investment Plans on SpreadCo

At the time of writing this Spread Co review, the broker does not offer a dedicated copy trading or social trading feature.

The website also doesn’t disclose any information about money management or investment services.

Spread Co Markets

Spread Co provides CFDs and Spread Betting on 1,000+ trading assets across four main asset classes, from the Forex market to Equities.

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, minor, and exotic currency pairs | 38 | 50–70 currency pairs | 1:20 |

Stocks | UK and US equities and ETFs (CFDs via MT5) | Over 100 symbols | 800–1200 | Not specified |

Commodities | Gold, Silver, WTI, and BRENT (CFDs) | 4 instruments | 10–20 instruments | Not specified |

Indices | Global stock indices (FTSE100, S&P500, NDQ100) | Around 3 major indices | 10–20 indices | 1:20 |

Does Spread Co have Any Active Promotions?

The broker’s official website doesn’t indicate active promotions or affiliate programs, and SpreadCo does not offer interest rates on clients’ free margins.

While the lack of promotional and partnership programs can be a letdown for potential clients, you should consider all of the company’s offerings before deciding on your broker.

Spread Co Awards

As of now, Spread Co has not receivedany publicly verified industry awards, or at least their official website does not mention any accolades.

While the broker is fully regulated by the FCA and maintains a positive reputation among clients, there is no verifiable record of formal awards or recognitions from recognized financial industry bodies.

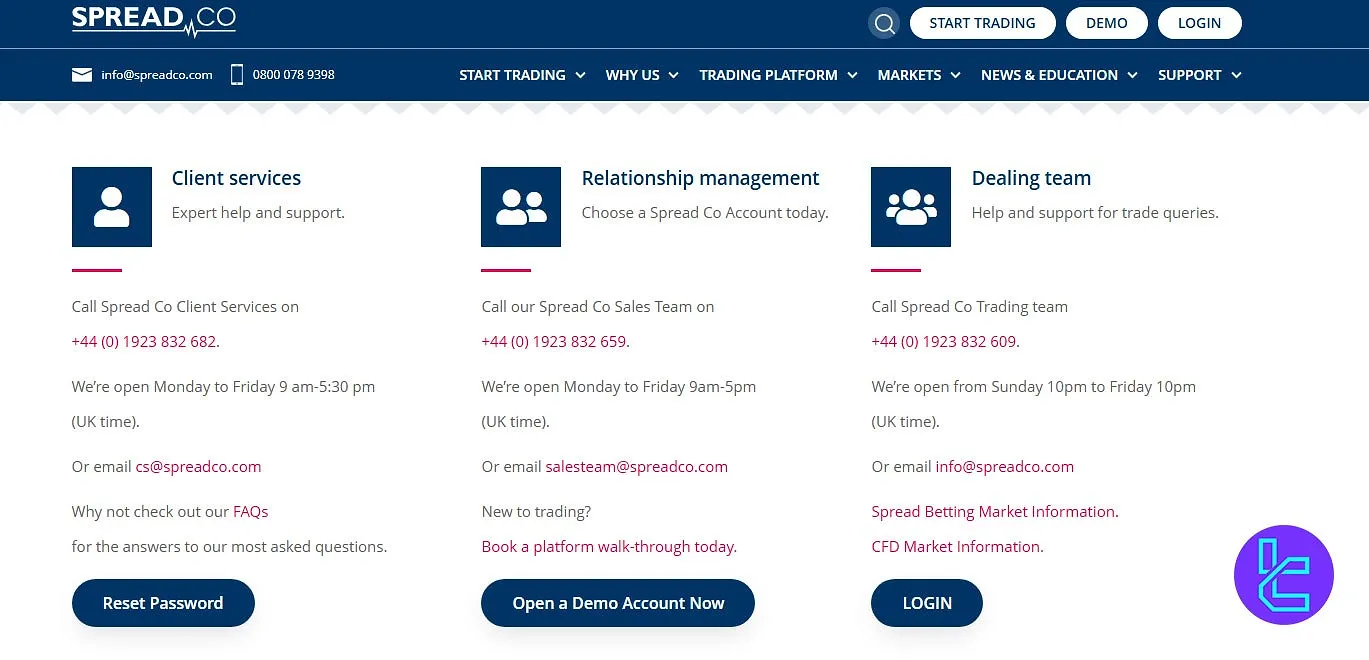

Spread Co Broker Customer Support

The company’s customer service team is available Monday to Friday, 8 am-5:30 pm (UK time), through live chat, phone calls, and email.

cs@spreadco.com | |

Tel 1 | +441923832682 |

Tel 2 | +448000789398 |

Live Chat | Available on the “Contact Us” page |

Support services are multilingual and aim to assist with platform navigation, account issues, and general trading inquiries. While support is not available on weekends, response times during working hours are generally reliable. Do note that availability may be reduced on UK public holidays.

Spread Co Geo-Restrictions

As a UK-based and FCA-regulated broker, the company primarily focuses on clients in the UK jurisdictions. However, non-EU residents too can use SpreadCo services with certain geographical restrictions in place:

- United States

- Canada

- Iran

- North Korea

- Yemen

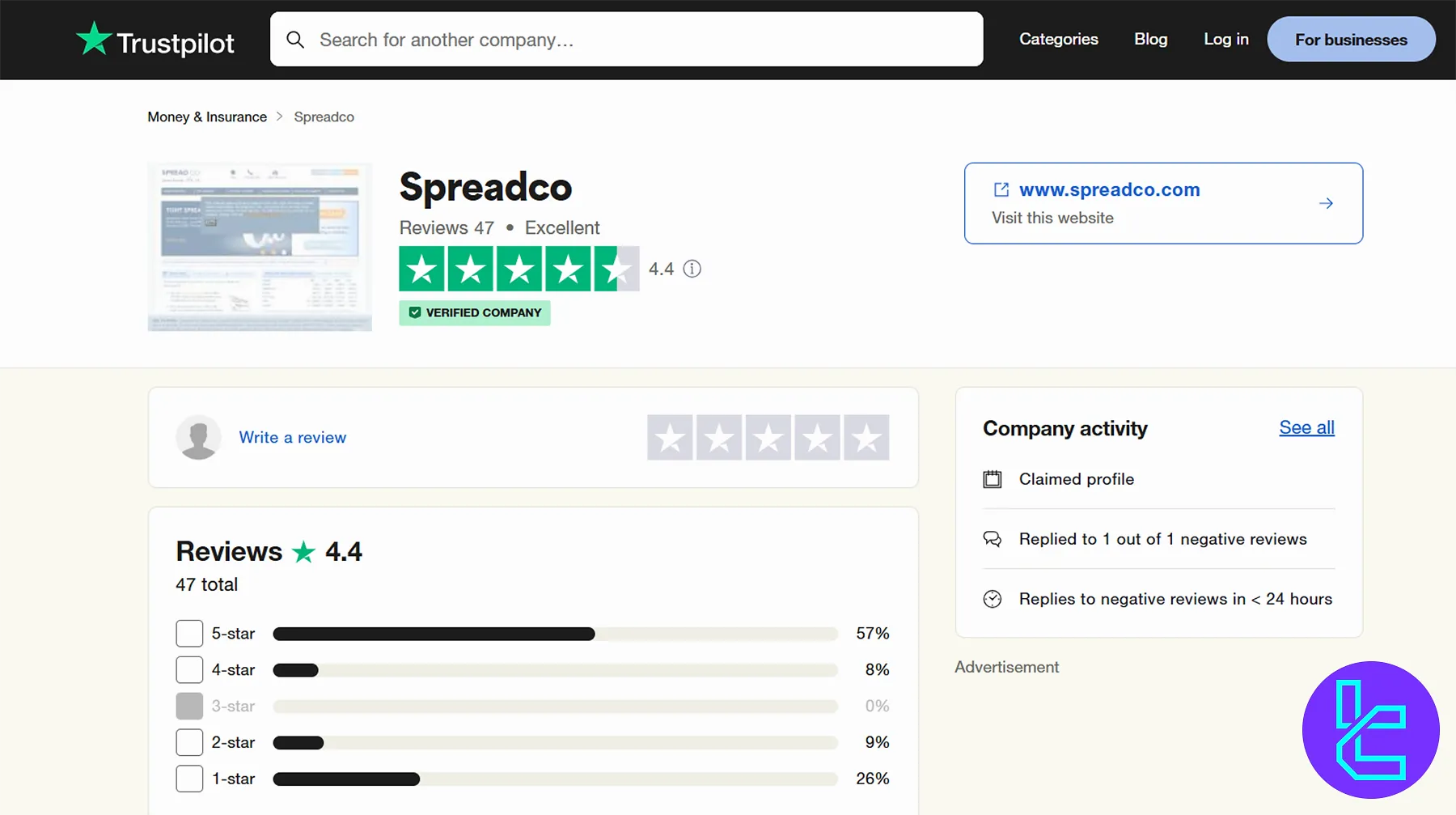

Spread Co Reviews

The company has received mostly positive reviews from customers on the TrustPilot platform. 47 users have rated the broker, resulting in a Spread Co TrustPilot score of 4.4 out of 5.

Spread Co Educational Contents

The broker provides preliminary education through its website, covering the following topics:

- Trading guides on CFD, Spread Betting, and Forex

- Introduction to technical analysis

- Trading Strategies

- Glossary

While the content is not highly advanced, it is geared toward new traders seeking to understand fundamental analysis and concepts, as well as improve their platform fluency. Spread Co emphasizes ease of use and ongoing support for all trading goals.

You can also check TradingFinder's Forex education section for additional resources.

Spread Co Comparison Table

The table below provides a comprehensive comparison between Spread Co and other forex brokers:

Parameter | Spread Co Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FCA | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.03p | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $100 | $200 | $5 | $50 |

Maximum Leverage | 1:20 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | Proprietary Platform | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | CFD, Spread Betting | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | N/A | Yes | Yes | No |

Number of Tradable Assets | 1,000+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and Final Words

Spread Co provides access to 1,000+ trading instruments with leverage options of up to 1:30. It offers low margin requirements for FX trading, starting at 3.33%.

Spread Co broker has a TrustPilot score of 4.4. While the company serves a global clientele, it doesn’t accept US clients.