Swissquote offers access to more than 3 million products, including Forex, and Stocks from across NYSE, NASDAQ, AMEX, and SIX exchanges. The minimum deposit is $1,000, and spreads are from 0.0 pips.

Swissquote Introduction; Is The Broker Regulated?

Swissquote's journey began in 1990 when Marc Bürki and Paolo Buzzi founded Marvel Communication SA. The company took a significant leap forward in 1996 by launching the Swissquote financial platform, offering free access to prices for all securities traded on the Swiss stock exchange.

In 2000, Swissquote went public and obtained a banking license. It also gained access to the Swiss Stock Exchange, NYSE, NASDAQ, and AMEX in the same year. Headquartered in Gland, Switzerland, the company has 9 more offices in Zurich, London, Cyprus, Dubai, Singapore, etc. Key features of Swissquote:

- Regulated by FINMA, DFSA, CySEC, CSSF, FCA, SFC, MFSA, MAS, and FSCA

- Exclusive Crypto exchange named SQX with over 30 cryptocurrencies

- More than 3 million trading products (exclusive to Switzerland brand)

- Multilingual customer support

- Leverage options up to 1:100

- Zero-commission trading

- Minimum deposit of $1,000

- Sponsor of “ZSC Lions” and “Genève‑Servette” hockey clubs

- MetaTrader support

As of 2023, the company employs over 1,100 people and is listed on the SIX Swiss Exchange under the ticker symbol "SQN". The Forex broker has 500,000+ clients with more than CHF 56B in assets.

Being a regulated bank, it offers client deposit protection of up to CHF 100,000 under Swiss law.

This robust regulatory framework and institutional-grade oversight make Swissquote one of the most secure trading environments available.

Swissquote's core business areas encompass online trading and investment services for private and institutional clients, as well as traditional banking products like savings accounts and mortgages.

Swissquote Table of Specifications

To give you a clear picture of Swissquote's trading conditions and charges, let's break down the key specifications.

Broker | Swissquote |

Account Types | Standard, Premium, Prime, Professional |

Regulating Authorities | FINMA, DFSA, CySEC, CSSF, FCA, SFC, MFSA, MAS, FSCA |

Based Currencies | EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, CZK |

Minimum Deposit | $1,000 |

Deposit Methods | Credit/Debit Cards, Bank Wire |

Withdrawal Methods | Credit/Debit Cards |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:100 |

Investment Options | Robo-Advisory, Themes Trading, Yield Boosters |

Trading Platforms & Apps | MT5, MT4, CFXD |

Markets | Forex, Stocks, Indices, Commodities, Bonds, Metals |

Spread | Variable based on the instrument |

Commission | $0.0 (except for Stocks) |

Orders Execution | Market, Instant |

Margin Call / Stop Out | 100% / 30% |

Trading Features | Blog, Podcasts, Webinars, EAs, Fix API |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Chat Bot, Phone |

Customer Support Hours | 24/7 |

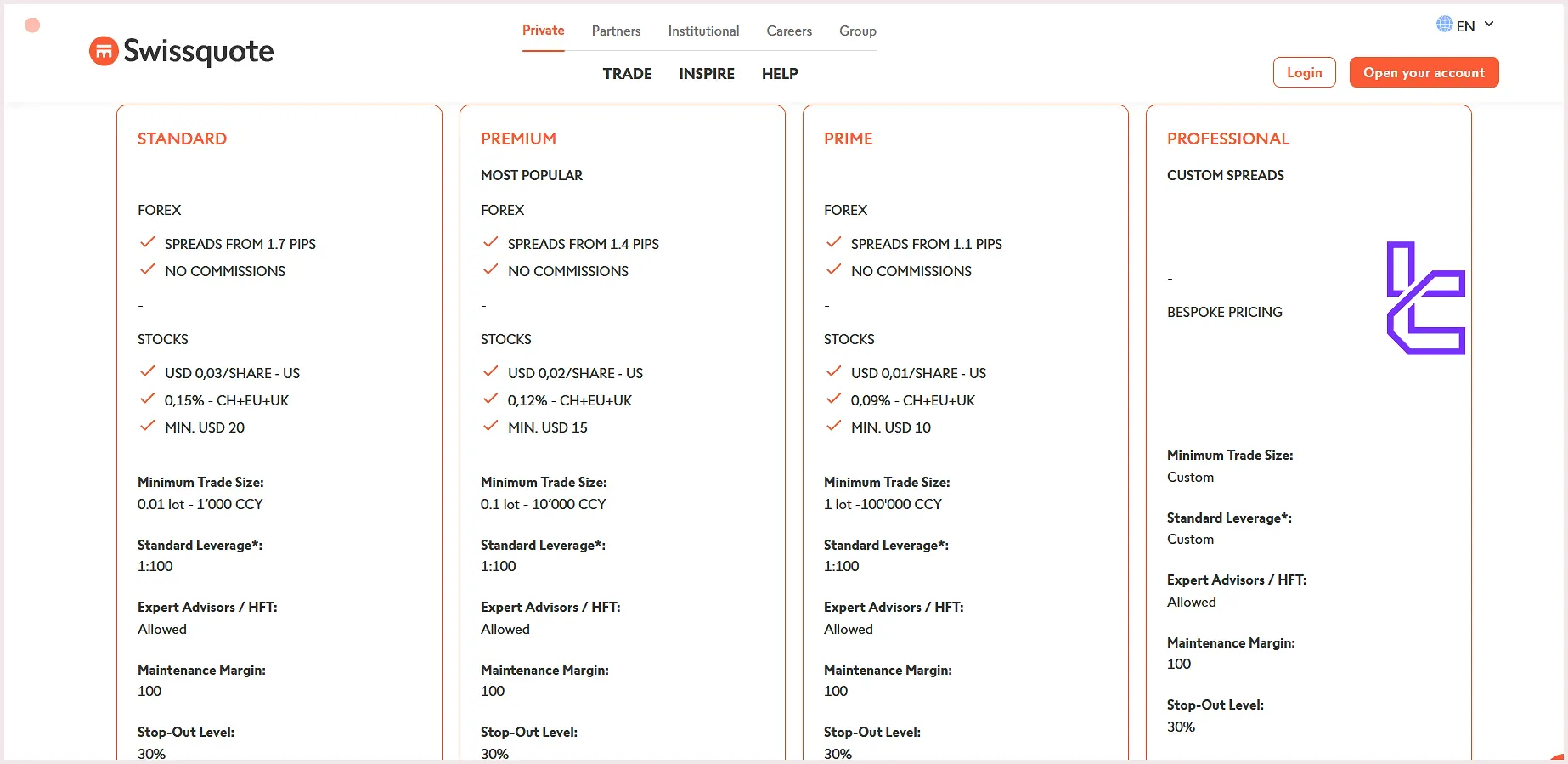

Swissquote Account Offerings

The bank provides a range of account types to suit different trading styles and investment goals:

Features | Standard | Premium | Prime | Professional |

Min Trade Size | 0.01 lot | 0.1 lot | 1 lot | Custom |

Leverage | 1:100 | 1:100 | 1:100 | Custom |

Margin Call | 100% | 100% | 100% | 100% |

Stop Out Level | 30% | 30% | 30% | 30% |

Base Currency | EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, CZK | |||

Min Deposit | $1,000 | $10,000 | $50,000 | Volume Based |

Note that account types and features may differ based on your residential region. Make sure to check the broker’s official website designated to your region for the latest updates.

Key features across all Swissquote accounts:

- Access to MT4, MT5, and Advanced Trader platforms

- Negative balance protection

- Islamic (swap-free) account options are available upon request

These account options cater to both retail and professional traders with different capital and strategy needs.

Why Swissquote? (Advantages & Disadvantages)

While the broker offers multiple trading platforms, over 400 financial instruments in its international branch, and fast order executions, it has several flaws. Let’s have a balance look at the Swissquote’s upsides and downsides.

Pros | Cons |

Vast Product Range | High Minimum Deposit |

Regulated by multi top-tier entities | Complex Product Offering |

Multilingual Support | Higher Fees than other brokers |

Robust MT4 and MT5 trading platforms | Limited leverage options |

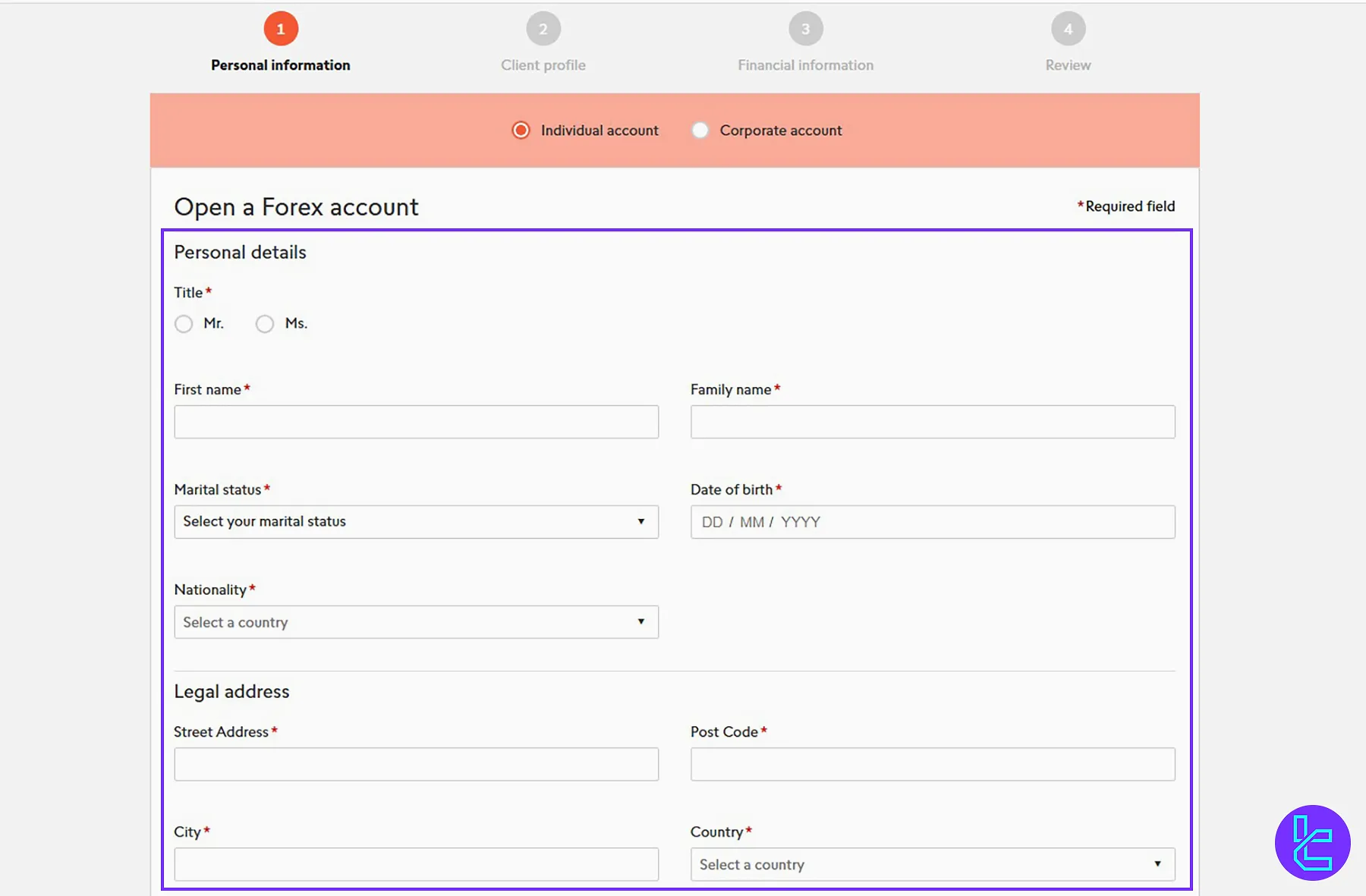

Account Opening and KYC on Swissquote Broker

Swissquote lets traders from across the globe create an account in under 10 minutes. The process involves entering verified contact details, selecting your preferred platform (MT4, MT5, or CFXD), disclosing financial information, and submitting identification. Steps to Swissquote Registration:

#1 Visit the Swissquote Website

Navigate to the official Swissquote site via the “Go to Website” button on this page, click “Open your account”, and opt for a Real Account to begin.

#2 Input Personal Information

Provide your personal details, including:

- Full name

- Marital status

- Birthdate

- Nationality

- Address

- Phone number

#3 Complete the Client Profile

Fill out the "Client Profile" with the following details:

- Employment status

- Political status

- Tax residency

At the end, you must declare if you're a US person or a non-US person.

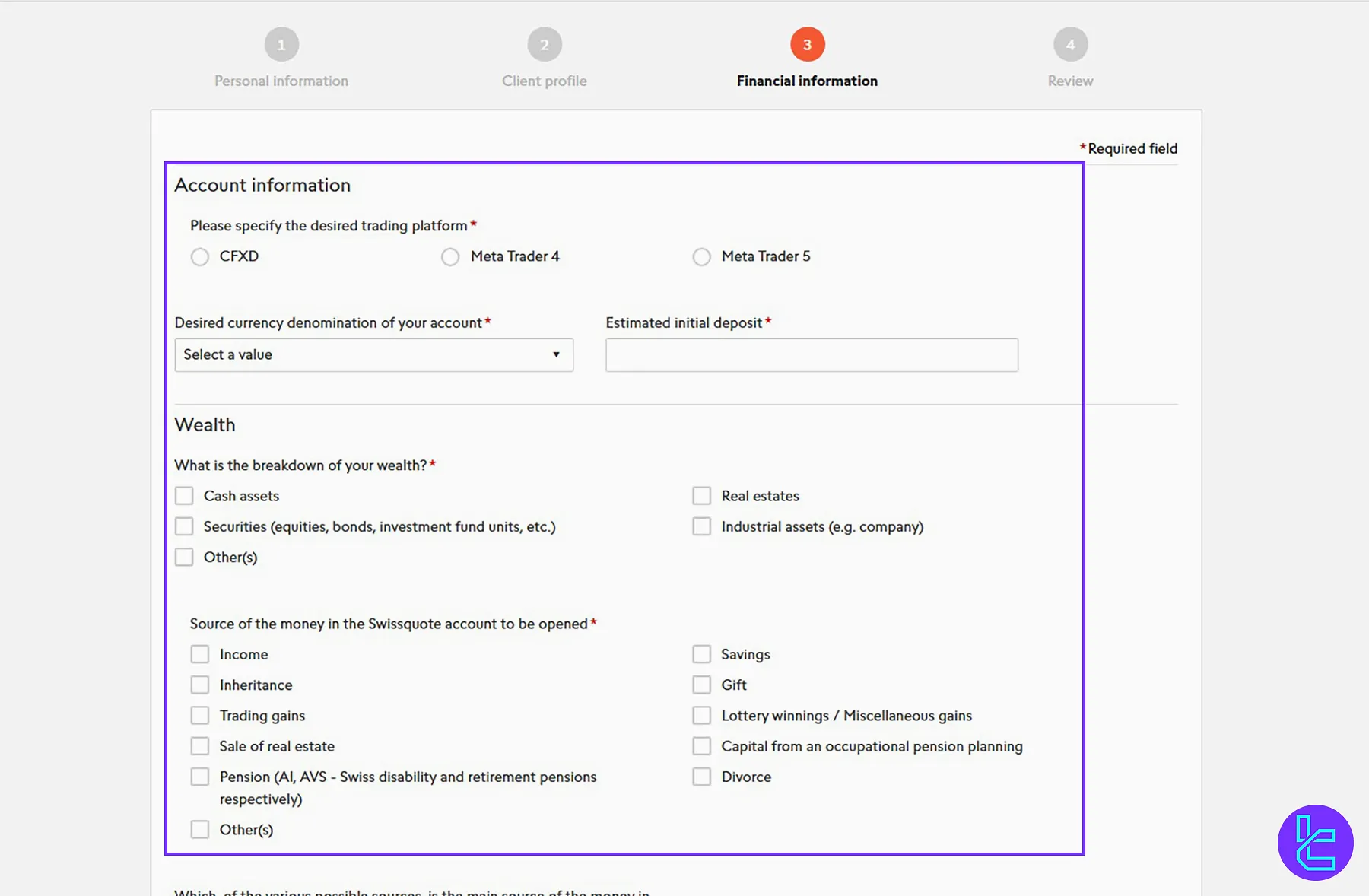

#4 Enter Financial & Trading Preferences

Next, you must complete your financial profile with the following information:

- Preferred trading platform

- Account base currency

- Estimated initial deposit

- Source of income

#5 Review and Submit

Confirm all details, submit the form, and receive your login credentials via email, including MetaTrader access.

You can now fund and verify your account to begin full-access trading with Swissquote.

#6 Swissquote Verification

Access the broker's client portal, navigate through the KYC menu, and upload supporting documents, including:

- Proof of Identity: Passport or ID card

- Proof of Address: Utility bill or Bank statement (not older than 6 months)

Swissquote Trading Platforms

The broker offers three award-winning trading platforms to cater to different trading styles and preferences. MT4, MT5, and Custom-built CFXD are Swissquote's platform offerings. Key features include:

- MT4 / MT5: Access to Expert Advisors (EAs), custom indicators, and advanced order types. Ideal for algorithmic and discretionary trading alike;

- CFXD: Swissquote’s in-house platform with over 50 built-in indicators, drag-and-drop charting, multi-screen layout, and integrated news feeds.

All platforms support instant and market execution with minimal latency, offering stability for both manual and automated strategies.

These trading platforms are available on the following operating systems.

- MT4

- Desktop

- Web

- Swissquote MT4 Android

- Swissquote MT4 iOS

- MT5

- Desktop

- Web

- Swissquote MT5 Android

- Swissquote MT5 iOS

- CFXD

TradingFinder has developed a list of MT4 and MT5 indicators that you can use for free.

Swissquote Fee Structure

We must discuss the fee structure in this Swissquote review. The broker prides itself on offering competitive and transparent fees across its range of services. However, the rates may be higher than average on some instruments.

Instruments | Spreads | Commissions |

Forex | From 1.1 pips | $0.0 |

Indices | From 0.6 pips | $0.0 |

Commodities | From 0.0135 pips | $0.0 |

Bonds | From 0.05 pips | $0.0 |

Stocks | From 0.0 pips | US from $0.01 per share Other countries from 0.09% |

There are also additional fees that you should consider. Inactivity fee after 6 months amounts to 10 units of your base currency.

Swissquote Broker Payment Methods

The company offers two main payment methods to make deposit/withdrawal transactions. While there are no fees associated with bank wire deposits, withdrawals may incur fees.

Methods | Deposit Fees | Withdrawal Fees | Processing Time |

Wire Transfer | None | Based on the currency | Up to 1 working day |

Visa / MasterCard | 0% for none-SEPA residents 1.9% for SEPA residents | Not available | Instant |

This setup ensures straightforward and relatively low-cost fund movement for both domestic and international clients.

Swissquote Copy Trading and Growth Plans

While Swissquote doesn't offer a traditional copy trading service, it provides several innovative solutions for passive investing and growth.

- Robo-Advisory: Automated investment management based on your risk profile and goals

- Themes Trading: Curated baskets of stocks based on specific themes or trends

- Yield Boosters: Structured products designed to enhance portfolio yield

Swissquote Financial Instruments and Markets

At this stage of the Swissquote review, we explore available markets and financial instruments. The broker offers Forex (currency pairs), Precious Metals, and CFDs on Stocks, Indices, Commodities, and Bonds.

The company also provides contracts on other markets, such as Crypto, ETFs, Options, and Futures, in some of its regional branches. Key features of Swissquote trading markets:

- Forex: Over 80 major, minor, and exotic currency pairs with a minimum spread of 1.2 pips and leverage up to 1:100

- Precious Metals: The four most popular symbols including Gold (XAU), Silver (XAG), Platinum (XPT), and Palladium (XPD), with a minimum spread of 0.01 pips and leverage up to 1:50

- CFDs: Spot, Forward, and synthetic contracts on Stocks, Indices, Commodities, and Bonds with leverage up to 1:50

This asset variety supports both speculative trading and long-term portfolio building in a single, regulated environment.

Swissquote Bonus and Promotional Programs

The broker offers several attractive referral and promotional programs in addition to bonus plans. However, most of the bonuses are seasonal and available only in regional branches. Key features of the Swissquote referral program:

Amount in CHF | Standard | Premium | Prime | VIP |

Minimum deposit Referred Client | 5,000 | 10,000 | 50,000 | 100,000 |

Bonus Referrer | 100 | 200 | 400 | 800 |

Bonus Referred Client | 50 | 100 | 200 | 400 |

Customer Support on Swissquote Broker

The company provides multilingual customer support through various channels, but mainly through phone centers. Swissquote customer care:

Support Center | +41 44 825 88 88 | 8:00 - 22:00 CET Monday to Friday |

Forex | +41 44 825 87 77 | 8:00 - 18:00 CET Monday to Friday |

Forex Dealing Desk | +41 22 999 94 76 | From 23:00 Sunday to 23:00 Friday CET |

Ticket | Through the official website | 24/7 |

Chat Bot | Available on the website | 24/7 |

Swissquote's multilingual support team is known for their professionalism and expertise, ensuring clients receive timely and accurate assistance.

Swissquote Restricted Countries

While Swissquote is a global broker, it doesn’t have the required licenses to operate in certain regions. Therefore, clients from these countries must check their local laws and see if they can use the company’s services. Swissquote Geo-Restrictions:

- United States

- Canada

- Turkey

- Japan

- Russia

- France

- Italy

- Germany

Swissquote on Review Websites (Trust Score)

User satisfaction may be the most important aspect of the Swissquote review. The broker has established a strong reputation in the online trading industry with 135,000+ monthly Google searches and experience of over 20 years in the markets.

3.8 out of 5 based on 2,835 reviews | |

Forex Peace Army | 2.5 out of 5 based on 15 reviews |

Swissquote Educational Content

The broker offers a comprehensive educational center named “INSPIRE” to support traders at all levels. Here are the key parts of the Swissquote educational center.

- Morning News: Market strategy by the company’s analysts

- Swissquote Medium: Various subjects like investment, derivatives, forex, crypto, platforms, and many more

- YouTube Channel: Daily content on market conditions

- Podcast: Daily updates with senior market analyst, Ipek Ozkardeskaya

- Webinars: Knowledge and insights from the best in the field

These resources empower clients with actionable insights and platform proficiency, especially valuable for newer traders.

You can also check TradingFinder's Forex education section for additional materials.

Swissquote vs Top Forex Brokers

Let's see Swissquote's standing in the trading world compared to other industry players.

Parameter | Swissquote Broker | |||

Regulation | FINMA, DFSA, CySEC, CSSF, FCA, SFC, MFSA, MAS, FSCA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | None | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0..0 pips | From 0.0 pips | 0.1 Pips | From 0.6 Pips |

Commission | $0 | From $0.2 | None | From Zero |

Minimum Deposit | $1,000 | $10 | $10 | $5 |

Maximum Leverage | 1:100 | Unlimited | 1:3000 | 1:1000 |

Trading Platforms | MT5, MT4, CFXD | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Standard, Premium, Prime, Professional | Standard, Standard Cent, pro, Raw Spread, Zero | Standard, Premium, VIP, CIP | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 3M+ | 200+ | 50+ | 1,400+ |

| Trade Execution | Market, Instant | Market, Instant | Market, Instant | Market, Instant |

Conclusion and Final Words

Swissquote is a brokerage company sponsoring the ZSC Lions and Genève‑Servette hockey clubs. The broker offers multiple investment plans, including Themes Trading and Yield Boosters, and a dedicated crypto exchange named SQX.