Tacirler Yatırım is a prominent Forex broker that has been offering various financial services since its inception in 1991. This broker has 5,490 million TL in assets and 2,425 million TL in equity. Tacirler Yatırım has 26 offices in Turkey and is regulated by SPK.

With over 30 years of experience and multiple trading platforms, including MT4 and the Tacirler Yatırım app, the company provides access to more than 50 Forex pairs, Turkish equities, commodities, and global indices, catering to a wide range of investor needs.

Tacirler Yatırım Company Information & Regulation

Tacirler Yatırım Menkul Değerler Anonim Şirketi, commonly known as Tacirler Yatırım, is a well-established forex brokerage firm in Turkey. Since its inception in 1991, the company has built a strong reputation in the Turkish financial markets over the years. Here are some key points about the company:

- Regulation: Tacirler Yatırım is regulated by the Capital Markets Board of Turkey (SPK), ensuring adherence to financial standards and investor protection measures;

- Services: The company offers a wide range of investment services, including stock trading, derivatives (VIOP), Forex, asset management, and corporate finance.

- Experience: With over 30 years of experience in the Turkish financial market, Tacirler Yatırım has developed a deep understanding of local market dynamics.

Here are the regulatory details of Tacirler yatirim:

Entity Parameters / Branches | Tacirler Yatırım Menkul Değerler A.Ş |

Regulation | Capital Markets Board of Turkey (SPK) |

Regulation Tier | Tier 2 |

Country | Turkey |

Investor Protection Fund / Compensation Scheme | Members of the Investor Protection Fund (Takasbank Investor Compensation Fund) under Turkish law |

Segregated Funds | Yes |

Negative Balance Protection | N/A |

Maximum Leverage | 1:10 |

Client Eligibility | Individual and corporate clients authorized under Turkish capital market regulations |

Tacirler Yatırım Summary of Specifications

Here’s a general overview of Tacirler Yatırım broker:

Broker | Tacirler Yatırım |

Account Types | Real, demo |

Regulating Authorities | SPK |

Based Currencies | TRY |

Minimum Deposit | 50,000 TRY |

Deposit Methods | Bank transfer |

Withdrawal Methods | Bank transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:10 |

Investment Options | Auto trading, portfolio management |

Trading Platforms & Apps | MT4, Tacirler Yatırım app |

Markets | Forex, indices, commodities, stocks, metals futures |

Spread | Floating from 0.5 pips |

Commission | No commission |

Orders Execution | Market |

Margin Call/Stop Out | 50%/20% |

Trading Features | Demo account, economic calendar |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, USA, North Korea, Canada, and more |

Tacirler Yatırım Broker Account Types Overview

Tacirler Yatırım offers two primary account types to cater to different investor needs:

- Real Accounts: These are live trading accounts where investors can trade with real funds in various financial markets;

- Demo Accounts: Thedemo account is available free of charge and provides an opportunity to test trading conditions using the MetaTrader 4 platform. To activate it, users must register on the official FXTCR website.

The minimum deposit required for live trading is 50,000 TRY, with the Turkish Lira (TRY) being the only supported account currency.

The account offers a maximum leverage of 1:10. Notably, the broker does not support cent or PAMM account investment solutions, and trading terms remain the same for all users, regardless of deposit size.

Key features of Tacirler Yatırım accounts:

- Maximum leverage of 1:10, providing a balanced approach to risk management

- Access to multiple asset classes, including Forex, stocks, and commodities

- Real-time market data and advanced charting tools

- Risk management features to help control potential losses

Tacirler Yatırım Broker Benefits and Drawbacks

When considering Tacirler Yatırım as your broker, it's essential to weigh both the pros and cons:

Advantages | Disadvantages |

Regulated by SPK, ensuring reliability | Limited information available for international clients |

Diverse range of investment products | High minimum deposit of 50,000 TRY may deter smaller investors |

Over 30 years of experience in the industry | Only offers bank transfers for deposits and withdrawals |

| - | Lack of transparent data regarding trading fees |

How to Sign up and Verify in Tacirler Yatırım Broker?

Opening a trading account with Tacirler Yatırım requires just a few steps and grants access to products like FX and futures market.

The process is designed for fast onboarding and includes secure data collection such as personal identification, contact information, and preferred trading instruments.

Registration is available in both Turkish and English interfaces. Tacirler Yatırım registration:

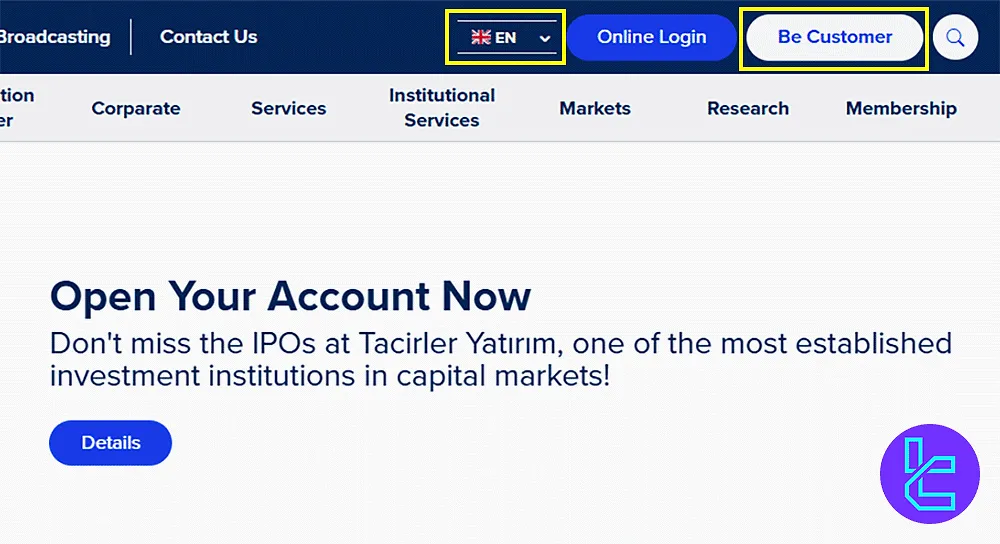

#1 Visit the Official Registration Portal

Go to the Tacirler Yatırım homepage, switch to the English version (if needed), and select “Be Customer” to launch the signup form.

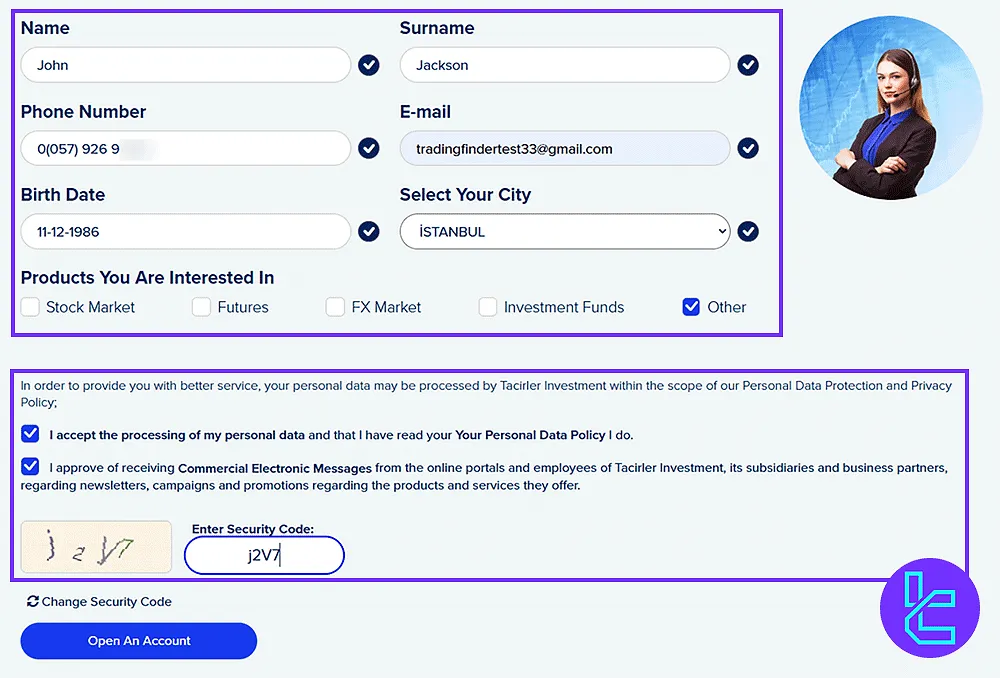

#2 Complete and Submit the Form

Enter your full name, mobile phone number, email address, birthdate, and city of residence. Choose your trading product, confirm the terms, pass the CAPTCHA, and hit “Open An Account.” A representative will follow up by phone or email to finalize the account setup.

Tacirler Yatırım Broker Trading Platforms Overview

Tacirler Yatırım offers two trading platforms for Forex and stock traders.

MetaTrader 4

MetaTrader 4 is renowned for its user-friendly interface and powerful features:

- Advanced Charting: Access to a wide range of technical indicators and drawing tools

- Automated Trading: Ability to use Expert Advisors (EAs) for algorithmic trading

- Custom Indicators: Option to create or import custom indicators

- Mobile Trading: MT4 mobile app for trading on-the-go

- Market Analysis: Built-in market analysis, technical analysis and news feed

- Multiple Order Types: Support for various order types, including stop-loss and take-profit orders

Download links:

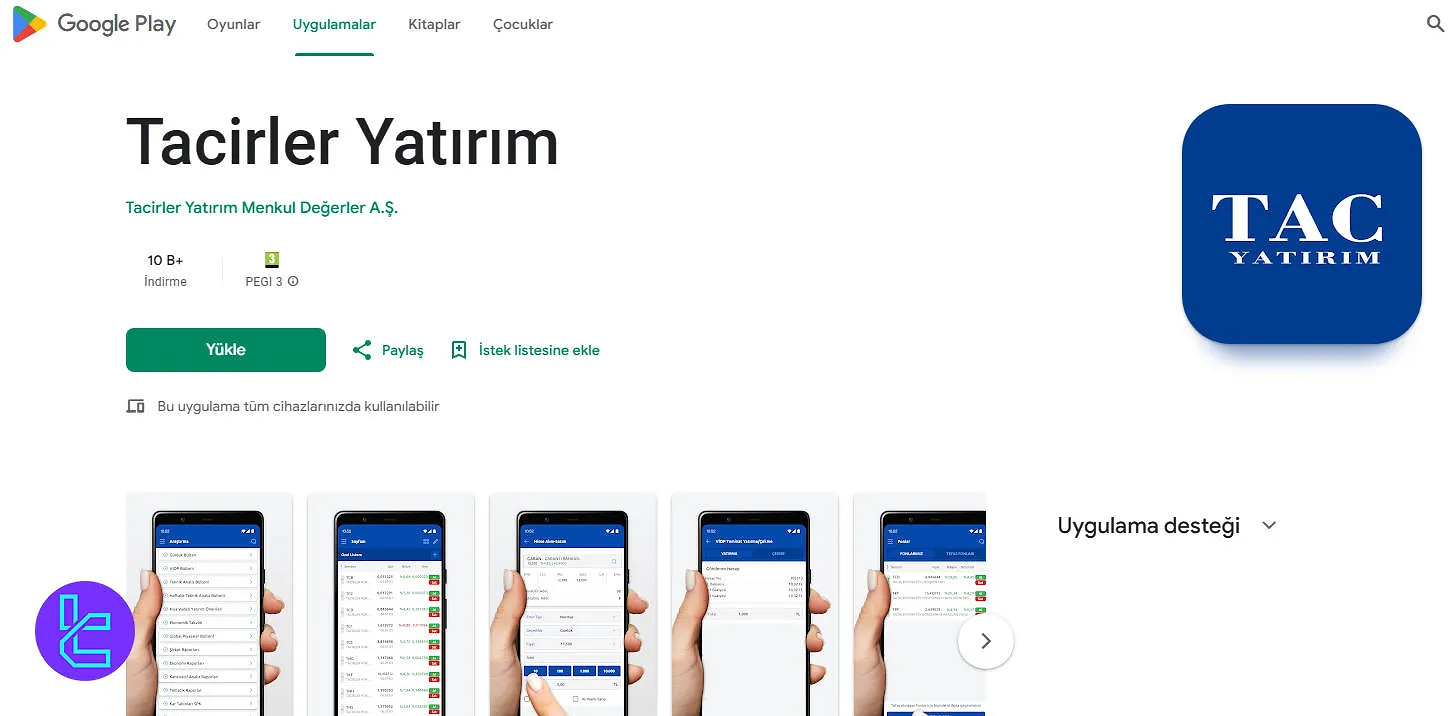

Mobile App

For traders who prefer to have access to Tacirler Yatırım services wherever and whenever they want, it offers a mobile app with various features:

- Fast order execution

- Quick access to bulletins and analyses

- Price alerts

- Various tradable instruments, including Borsa Istanbul Indices, currency pairs, commodities, leading US, Europe, Japan, Germany, France, and England indices

Download links:

Tacirler Yatırım Fees (Spreads and Commissions)

Unfortunately, Tacirler Yatırım isn’t transparent regarding the trading fees on its platforms. However, our evaluations revealed that the broker spread varies between 0.5 and 1.0 pips on major Forex pairs. For example, check the pairs below:

- EUR/USD: from 0.5 to 0.9 pips

- GBP/USD: from 0.5 to 1.1 pips

It’s worth mentioning that Tacirler Yatırım broker has a commission-free cost structure. Other fees in Tacirler Yatırım broker:

- No inactivity fee

- No deposit fee

- No withdrawal fee

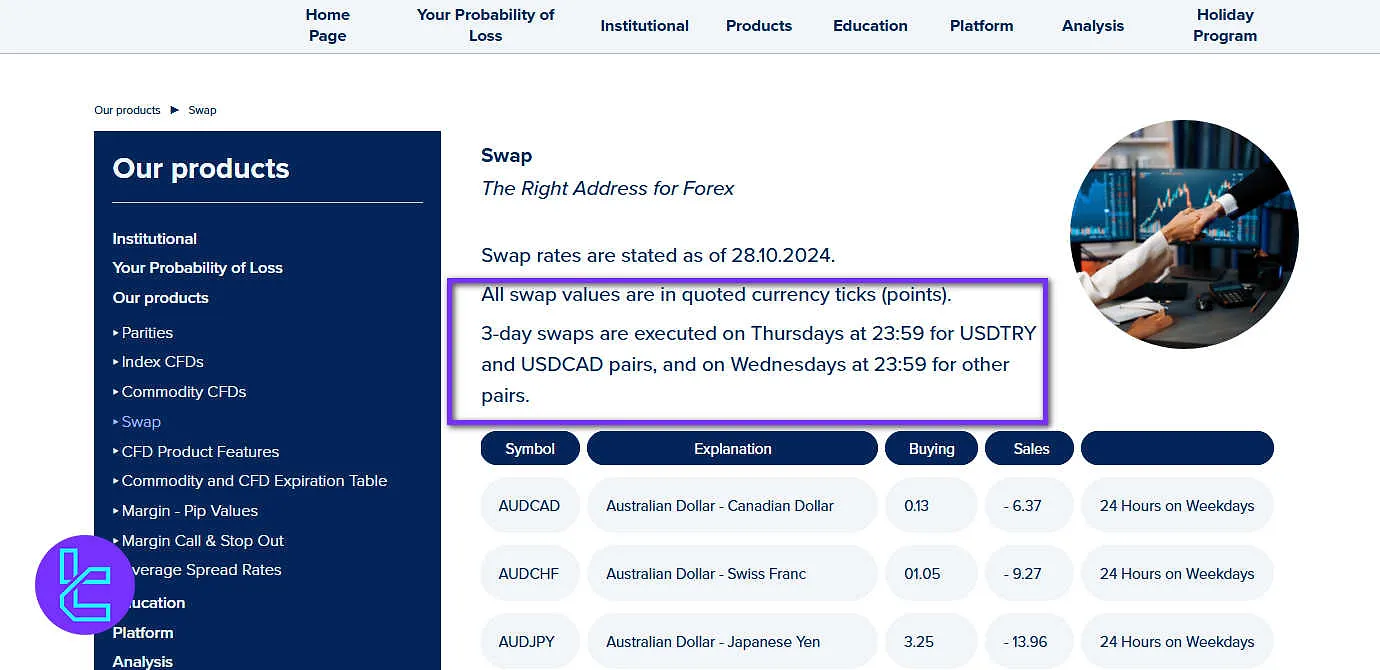

Tacirler Yatırım Swap Fees

Tacirler Yatırım provides transparent swap rates for its forex and precious metals instruments. The broker executes 3-day swaps on Thursdays at 23:59 for the USDTRY and USDCAD pairs, while for other currency pairs, they are applied on Wednesdays at 23:59.

Swap rates vary significantly depending on the instrument and the trading position type (buying or selling). For example, major currency pairs such as EURUSD carry swaps of -11.79 (buy) and 1.72 (sell), while USDJPY has 5.23 (buy) and -23.55 (sell).

Exotic pairs and metals such as XAUUSD (gold vs. USD) and USDMXN (US dollar vs. Mexican peso) have notably higher swaps due to market volatility and liquidity factors.

All swaps for forex pairs are applied 24 hours on weekdays, whereas precious metals like gold and silver have swaps calculated during specific periods (e.g., 02:00–00:59 server time for XAUUSD and XAGUSD).

Other commodities, such as palladium and platinum, have swaps applied 01:00–23:59 on trading days, with early Friday closings considered.

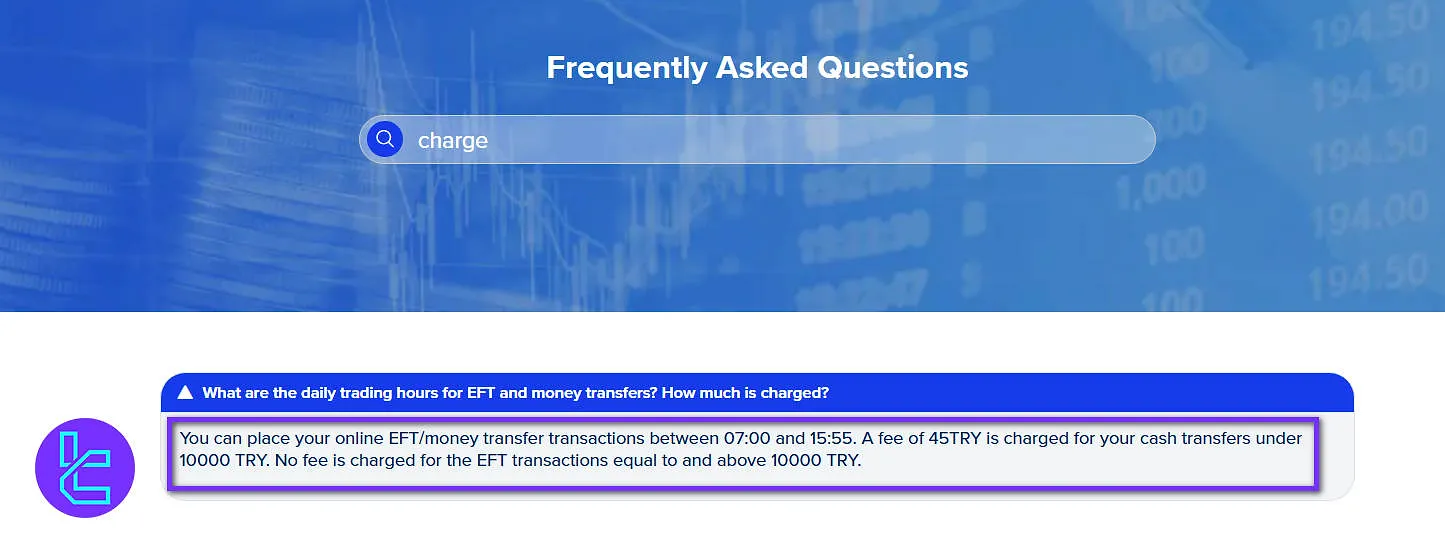

TY Non-Trading Fees

Tacirler Yatırım applies a fee of 45 TRY for cash transfers below 10,000 TRY, while electronic funds transfers (EFT) equal to or exceeding 10,000 TRY are processed without any charge.

The broker does not disclose any information regarding inactivity fees for dormant accounts, and no official statement is available on this topic.

Broker Deposit & Withdrawal Methods in Tacirler Yatırım

Tacirler Yatırım has specific requirements for deposits:

- Minimum Deposit: 50,000 TRY (Turkish Lira)

- Deposit Method: Bank transfer only

While this high minimum deposit may be a barrier for some traders, it also indicates that Tacirler Yatırım caters to more serious investors.

The reliance on bank transfers is a major drawback that could discourage many traders from joining the platform. For withdrawal, traders should know that:

- The only withdrawal method is bank transfers

- Traders can withdrawUSD or TRY

- Withdrawal processing hours are 9:00 to 16:00

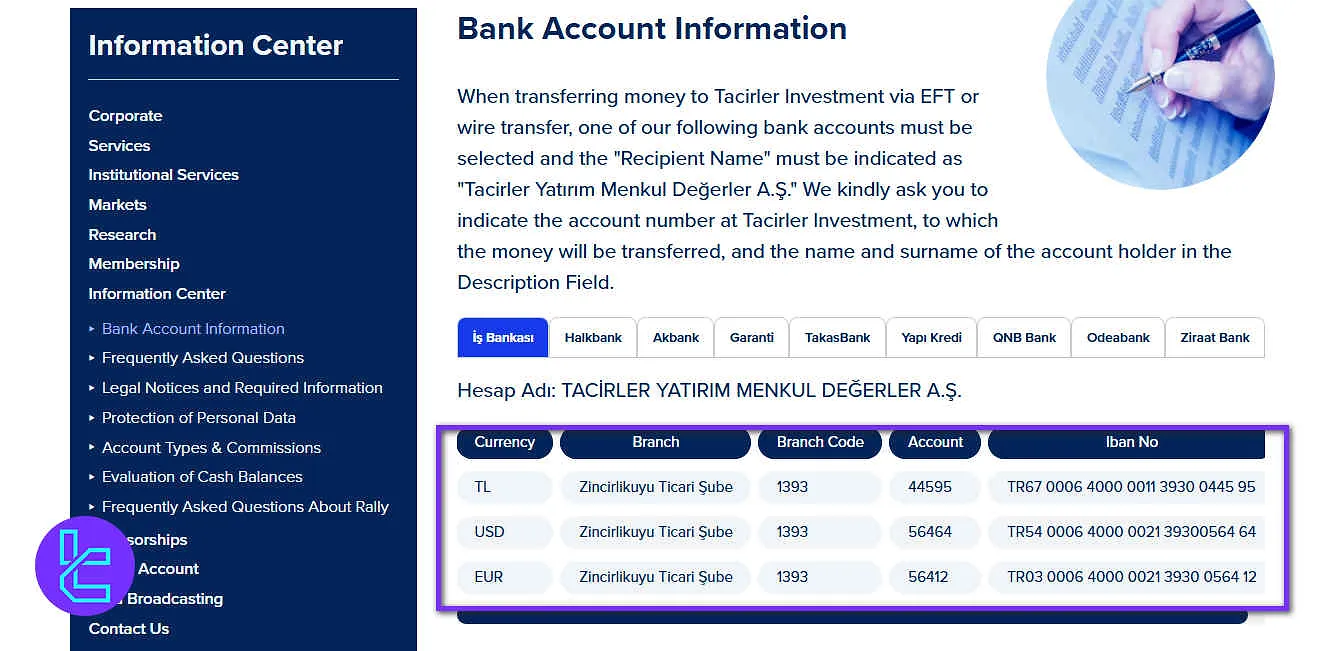

Tacirler Yatırım Deposit

Clients can fund their accounts at Tacirler Yatırım via EFT or wire transfer using one of the broker’s designated bank accounts.

When making a transfer, the recipient name must be entered as “Tacirler Yatırım Menkul Değerler A.Ş.”, and the account number along with the account holder’s full name should be included in the description field to ensure correct processing.

Here are the details:

Deposit Method | Currencies Supported | Notes / Requirements |

Bank Transfer (EFT) | TL, USD, EUR | Use designated Tacirler accounts; include recipient name, account number, and full name in description |

Transfer speed may vary depending on the bank’s systems and the broker’s trading processes.

Tacirler Yatırım Withdrawal

Tacirler Yatırım provides basic information indicating that clients can withdraw funds from their accounts using bank transfer.

However, the broker does not share detailed information regarding withdrawal methods, processing times, fees, or related procedures on its official website.

Copy Trading & Investment Options Offered on Tacirler Yatırım

Tacirler Yatırım broker offers several investment options to cater to different investor needs:

- Individual Portfolio Management: Tailored investment strategies based on individual client goals and risk tolerance with a 20% performance fee;

- Investment Consultant: Professional advice and guidance on investment decisions;

- Auto trading: Automatic order execution based on predefined parameters on stocks and VIOP.

These services provide flexibility for investors with varying levels of market knowledge and time commitment.

Tacirler Yatırım Markets & Instruments Overview

Tacirler Yatırım provides access to a diverse range of financial markets:

Category | Type of Instruments | Number of Symbols / Instruments | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts (via FXTCR brand) | 50 major, minor, and exotic currency pairs | 50–70 currency pairs | Up to 1:10 |

Stocks | Individual company stocks | Focus on Turkish equities | 800–1200 | N/A |

Commodities | CFDs on commodities | Gold, silver, oil | 10–20 instruments | N/A |

Indices | CFDs on global indices | S&P 500, FTSE 100, others | 10–20 indices | N/A |

Metal Futures | Futures contracts on metals | Gold, silver, other metals | No available information | N/A |

With access to numerous asset classes, investors can diversify their holdings and leverage opportunities in multiple markets.

Tacirler Yatırım Broker Bonuses

Unfortunately, Tacirler Yatırım doesn’t offer any bonuses or affiliate programs at the moment. This can be a drawback for traders looking to increase their trading capital.

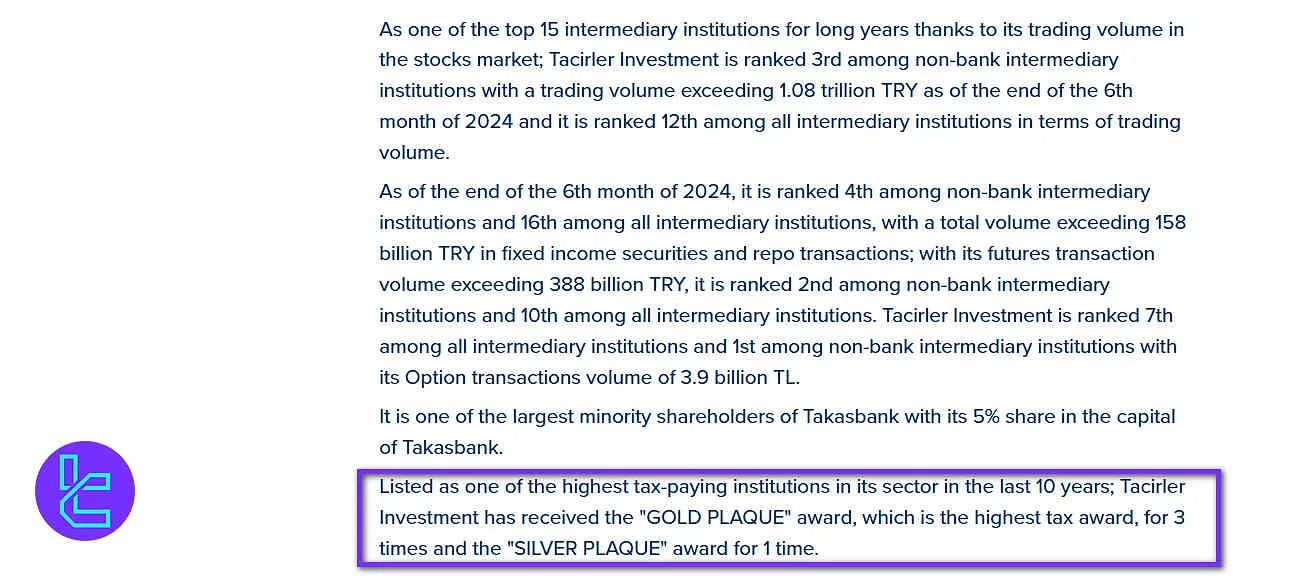

Tacirler Yatırım Awards

Tacirler Yatırım Menkul Değerler A.Ş. has been recognized for its contributions within the Turkish financial sector, receiving Gold Plaque awards three times and a Silver Plaque award once for being among the highest tax‑paying institutions in its category.

Beyond these Tacirler Yatırım awards, the broker does not provide further information regarding industry‑specific awards or rankings on its official website.

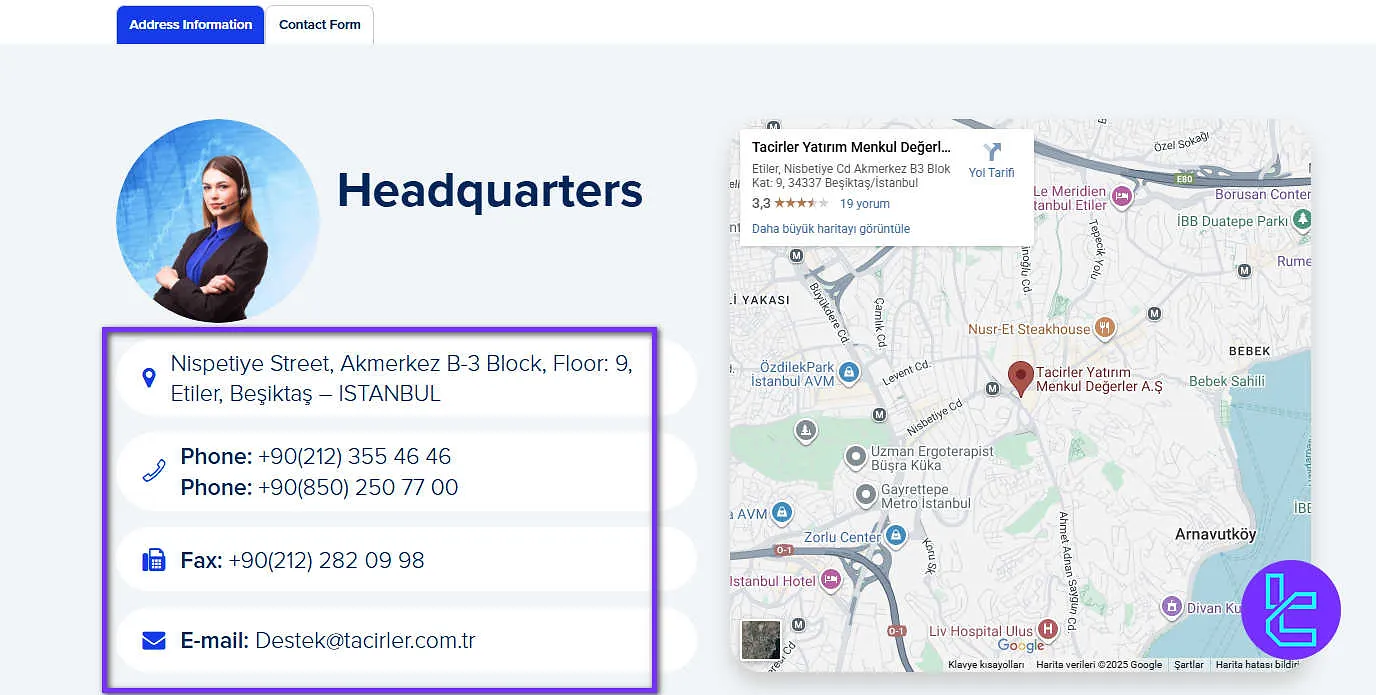

Tacirler Yatırım Broker Support Methods and Hours

Tacirler Yatırım provides customer support through:

- Email: destek@Tacirler.tr

- Phone: +902123554646

- Visit their physical office

The support team is active 24/5 but only offers help in Turkish.

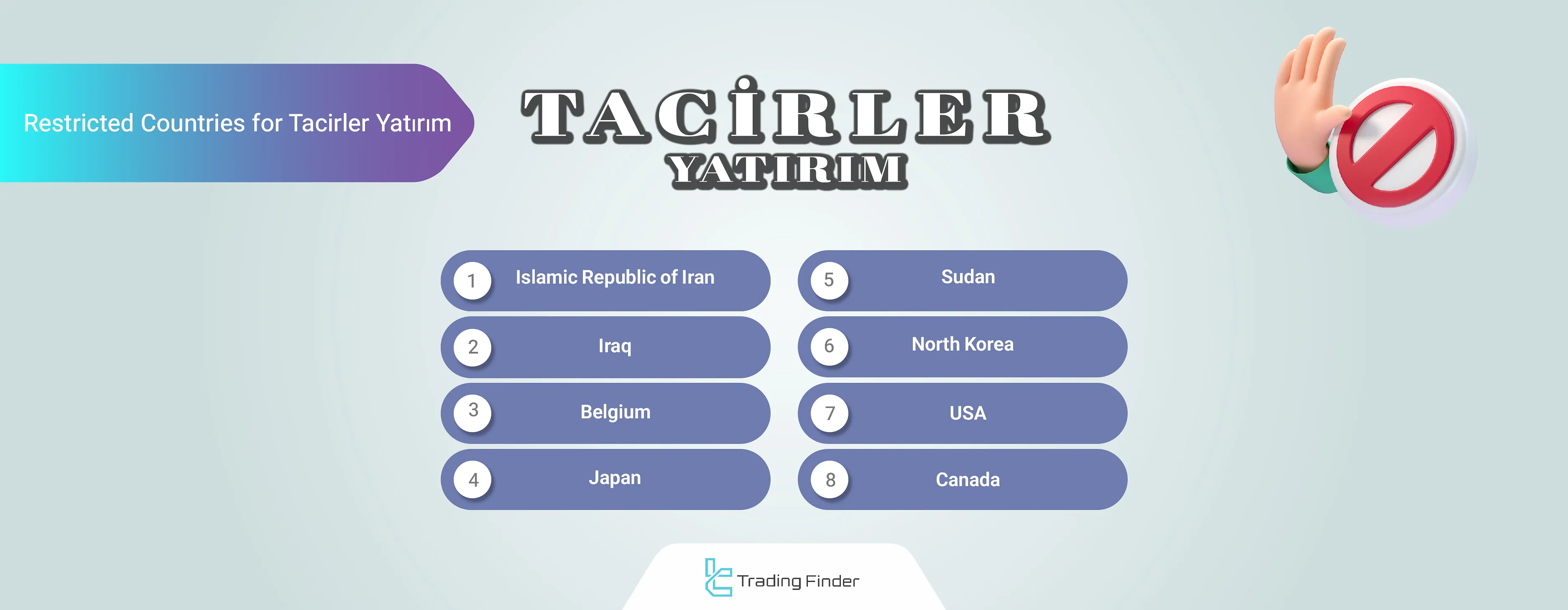

Tacirler Yatırım Broker Restricted Countries

Here’s a list of countries Tacirler Yatırım doesn’t provide services in:

- United States

- Canada

- Japan

- North Korea

- Iran

- Iraq

- Belgium

- Sudan

Tacirler Yatırım User Reviews and Trust Scores

We couldn’t locate user reviews for Tacirler Yatırım on major review platforms like Trustpilot, Reviews.io, or ForexPeaceArmy. This lack of feedback can be a disadvantage for new traders seeking insights into the broker’s strengths and weaknesses before committing.

To get a clearer picture of the service quality, we recommend engaging with other traders on Tacirler Yatırım’s social media channels, such as Instagram and Twitter, where you can find firsthand experiences and updates from the community.

Tacirler Yatırım Educational Resources

Tacirler Yatırım appears to offer educational resources to its clients, including:

- Economic reports

- Market news

- Daily bulletins

- Global market reports

- Company and sector analysis

These educational materials can be valuable for traders looking to improve their market knowledge and make informed investment decisions.

Tacirler Yatırım Comparison with Other Brokers

Is Tacirler Yatırım a good choice in comparison with other brokers? Find the answer in table below:

Parameters | Tacirler Yatırım Broker | |||

Regulation | SPK | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | ASIC, VFSC, FSC, FMA |

Minimum Spread | Floating from 0.5 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | No commission | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | 50,000 TRY | $200 | $5 | $100 |

Maximum Leverage | 1:10 | 1:500 | 1:1000 | 1:1000 |

Trading Platforms | MT4, Tacirler Yatırım app | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MT4, MT5, IRESS, TMGM Mobile App |

Account Types | Real, demo | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | EDGE, CLASSIC |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | Not Specified | 2,250+ | 1400+ | 12000+ |

Trade Execution | Market | Market | Market, Instant | Market, Instant |

TF Expert Suggestion

Tacirler Yatırım presents itself as a well-established Turkish broker offering services to individual and institutional investors under regulatory oversight of the SPK financial authority.

Its offering of the popular MT4 platform, diverse range of tradable assets (Forex, indices, commodities, metals, futures, stocks), and focus on the Turkish stock and bonds market make it an interesting option for investors interested in financial markets in this country.

However, the high minimum deposit ($1500), lack of transparent data on platform fees, and limited information for international clients may be drawbacks for potential users.