tastyfx provides access to a leverage of up to 1:50 with spreads starting from 0.8 pips onEUR/USD and USD/CAD pairs. The support department in this company is available 24 hours a day, from 3 AM Saturday to 5 PM Friday, EST.

The broker operates under Tier-1 CFTC and NFA oversight, ensuring strict compliance and transparency. With a minimum deposit of $250, zero commission trading, and spreads that average 0.8 to 1.2 pips.

tastyfx review: everything about the broker, good or bad

tastyfx review: everything about the broker, good or bad

tastyfx Company Information & Regulation

This broker is one of the oldest companies in the Forex industry, being founded in 1974. Here's what you need to know about the company's background and regulatory status:

- Rebranded version of IG Broker

- Registered as a Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC)

- Member of the National Futures Association (NFA ID: 509630)

- Headquartered at 1330 West Fulton, Chicago, IL 60607

- Recipient of 5 industry awards, including ForexBrokers.com's #1 Overall Broker in 2024

With its regulatory base rooted in the U.S., tastyfx delivers a robust and compliant trading environment. The firm has earned multiple accolades over the years, including being named the #1 Overall Broker in 2024.

These Tier-1 authorities ensure that tastyfx adheres to rigorous standards in capital reserves, risk management, and operational integrity.

All client funds are fully segregated and held in secure accounts at major U.S. financial institutions, offering an added layer of protection against broker default.

In the table below you can see the regulatory details of the broker:

Parameter / Branch | tastyfx, LLC |

Regulation | Registered with the Commodity Futures Trading Commission (CFTC) as a Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) |

Regulation Tier | Tier‑1 |

Country | United States (Illinois / Chicago) |

Investor Protection Fund / Compensation Scheme | N/A |

Segregated Funds | N/A |

Negative Balance Protection | N/A |

Maximum Leverage | 1:50 |

Client Eligibility | U.S. resident retail clients (broker focuses on U.S. market) |

tastyfx Summary of Key Specifics

To give you a quick overview of what the forex broker brings to the table, here's a summary of its general features:

Broker | tastyfx |

Account Types | Standard, Professional, Demo |

Regulating Authority | CFTC |

Based Currencies | USD |

Minimum Deposit | $250 |

Deposit Methods | Credit/Debit Card, Wire Transfer, ACH Transfer |

Withdrawal Methods | Credit/Debit Card, Wire Transfer, ACH Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:50 |

Investment Options | MT4 Signals, Automated Trading |

Trading Platforms & Apps | tastyfx Platform, TradingView, MetaTrader 4, ProRealTime |

Markets | Forex |

Spread | From 0.8 Pips |

Commission | None |

Orders Execution | N/A |

Margin Call / Stop Out | N/A |

Trading Features | Analytical Tools, VPS, Premium Services |

Affiliate Program | No |

Bonus & Promotions | Cashback, Funding Bonus |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Email, Phone Call |

Customer Support Hours | 24 hours a day, from 3 AM Saturday to 5 PM Friday, EST |

Account Types Overview and Comparison

tastyfx offers a streamlined account structure with only one choice. The specifications are as follows:

- Minimum Deposit: $250

- Maximum Leverage: 1:50

Also, there is a demo account with $10,000 of virtual funds for practicing and testing strategies.

Notable Benefits and Drawbacks

Like any other Forex broker, tastyfx services come with flaws. Let's go through the pros and cons of trading with the discussed brokerage:

Benefits | Drawbacks |

Long Track Record in The Industry | No Instruments Other Than Forex Pairs |

Various Trading Platforms | No Variety in Account Types |

No Commissions | - |

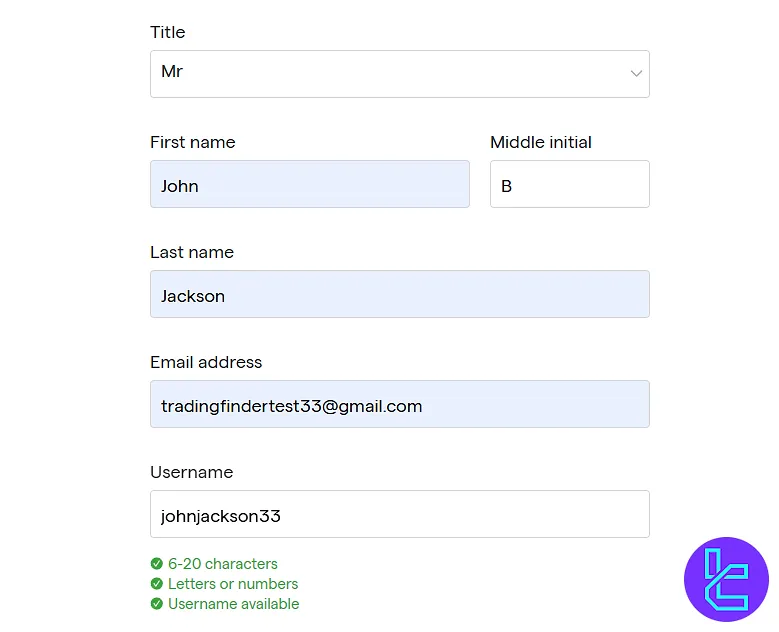

How to Sign Up and Verify Your Identity

The tastyfx registration is a streamlined3-step process to help traders quickly access their live account dashboard. No email or phone verification is required, and users can complete the setup in under 10 minutes.

During registration, applicants provide personal details, citizenship information, and a full financial profile, including employment status and trading experience, ensuring compliance with regulatory standards.

#1 Start Your Sign-Up on the tastyfx Website

Click “Open Live Account” on the tastyfx homepage. Choose your country of residence and fill in the following details:

- Name

- Username

- Password

Click Next to continue.

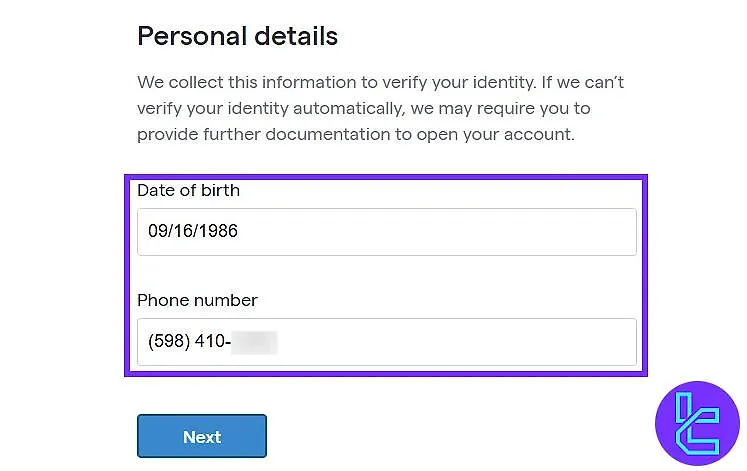

#2 Enter Identity and Citizenship Information

Provide the following information:

- Birthdate

- Mobile number.

- Citizenship

- Social Security Number

- Residential address

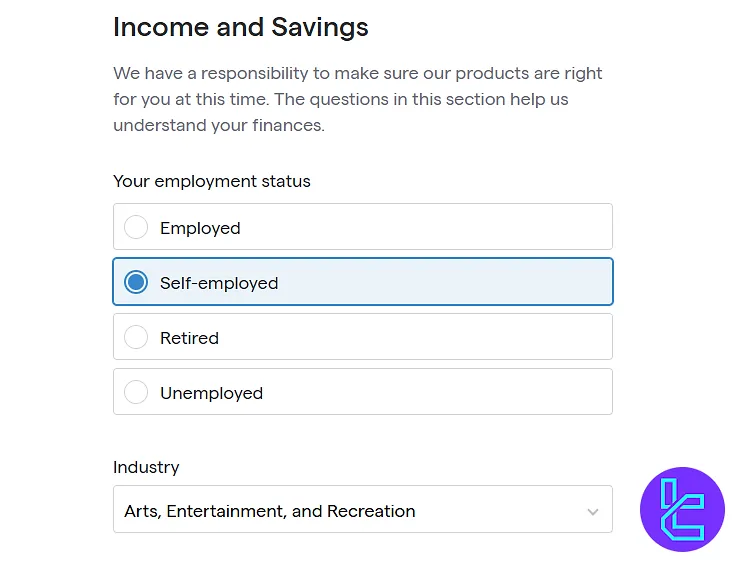

#3 Complete Your Financial Profile

Answer questions on regulatory violations, political exposure, and employment status, and specify the following:

- Job title

- Income range

- Source of funds

- Trading background

- Financial knowledge

Accept the terms and click Submit to finish.

#4 Complete the KYC Verification

To get full access to the broker's services, provide supporting documents, including:

- Proof of Identity: Passport or Driver's license

- Proof of Address: Utility bill or Bank statement

Note that this brokerage accepts clients only from the United States (except Ohio); if you are from another region, you can check out other international options.

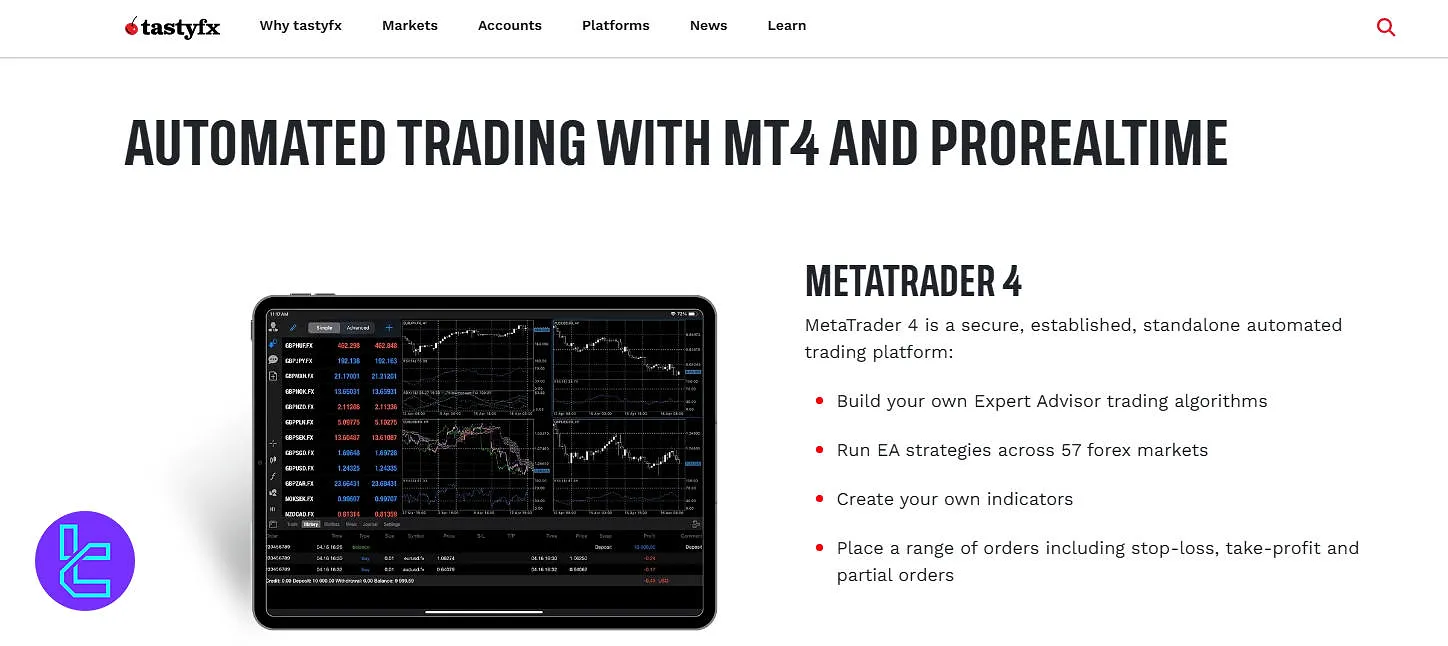

Which Trading Platforms Are Employed by tastyfx?

The broker offers a large suite of 4 trading platforms for traders with different skills and experience levels:

tastyfx Platform:

The interface is designed for ease of use, with intuitive charting tools, fast order execution, and customizable layouts.

TradingView Integration:

MetaTrader 4 (MT4):

- MT4 Android

- MT4 iOS

- Windows

- macOS

ProRealTime:

TradingFinder has developed a wide range of TradingView and MT4 indicators that you can use for free.

Commissions and Spreads in Working With tastyfx

tastyfx operates on a commission-free model, making money through the spread. The broker's spreads start from 0.8 pips on pairs like EUR/USD and USD/CAD. There are no other costs of any kind in the mentioned brokerage.

Tastyfx Swap Fees

All trades on Tastyfx are executed on margin, which means traders deposit a fraction of the total trade value while the broker effectively finances the remainder. Positions closed within the same trading day incur no additional cost.

However, holding a trading position overnight triggers a small funding fee, designed to cover the interest on the leveraged portion of the trade.

This overnight fee is calculated based on the tom-next interest rate, with an additional administrative fee of 0.5% per year.

This structure ensures transparency and aligns the cost of holding positions with prevailing market conditions, allowing traders to plan their strategies while managing financing expenses effectively.

Tastyfx Non-Trading Fees

Tastyfx maintains a transparent policy regarding non-trading fees, ensuring that traders are not burdened by unnecessary account maintenance costs.

Clients who decide to pause their trading activity can simply keep their accounts open without funding them. Importantly, no inactivity fees are charged, allowing users to resume trading at any time without the need for a new account verification process.

Deposits to Tastyfx accounts are free of charge on the broker’s side, regardless of the chosen funding method. However, clients should be aware that bank or intermediary charges may apply when sending funds, depending on the financial institution used.

When it comes to withdrawals, wire transfers incur a fixed $15 fee, while other available withdrawal options typically remain cost-free.

This structure makes Tastyfx’s non-trading fees relatively straightforward, helping traders manage operational expenses with clarity and predictability.

Deposit/Withdrawal Options

tastyfx provides 3 options for funding and withdrawing from your account:

- Credit/Debit Cards: Fast and easy, ideal for quick deposits

- Wire Transfer: Suitable for larger amounts, may take 1 business day

- ACH Transfer: Typically processed within 3 business days

There could be more choices, such as e-wallets and crypto transactions. Withdrawals are typically processed within 1–2 business days, ensuring timely access to funds.

The broker itself does not charge internal fees for deposits or withdrawals; however, external fees may apply based on the client’s bank or payment provider, particularly for international wire transfers.

Tastyfx Deposit

Tastyfx allows clients to add funds to their trading accounts using several secure and regulated payment channels. Available funding methods include debit cards, wire transfers, and bank transfers through the Automated Clearing House (ACH) system.

Before initiating a transaction, users must ensure that their payment source is verified, as Tastyfx only accepts deposits from approved accounts or cards. Once verification is complete, deposits can be made directly from the “Deposit Funds” section within the trading dashboard.

Among the available methods, ACH transfers are generally the fastest and most convenient. By linking a bank account through Plaid Services, clients benefit from instant verification and next-business-day funding, streamlining the process for frequent traders.

For those preferring wire or standard bank transfers, deposits can be initiated by contacting their bank and providing Tastyfx’s banking details, which are accessible on both the desktop and mobile platforms under the “Wire” option.

Here are the details of each deposit method available on Tastyfx:

Deposit Method | Description | Verification Required | Processing Time |

ACH Transfer | Transfer funds via Automated Clearing House network through Plaid Services | Yes | Instant verification, funds available next business day |

Wire Transfer | Bank-to-bank international or domestic transfer using Tastyfx bank details | Yes | 1–3 business days |

Debit Card | Deposit using a verified debit card linked to your account | Yes | Instant after verification |

Tastyfx Withdrawal

Tastyfx provides several secure channels for clients to withdraw funds, including debit card refunds, wire transfers, and ACH payments. Withdrawals can be initiated through the My tastyfx portal by selecting the “Withdraw Funds” option within the Live Accounts section.

Before a withdrawal request is processed, the broker may ask for proof of deposit to verify the funding source, as all payouts must generally be returned to the original payment method.

Clients are required to link their bank account in My tastyfx before requesting an ACH or wire transfer withdrawal.

For wire transfers, a $15 withdrawal fee applies. If the request is submitted before 12 PM Eastern Standard Time (EST), funds are typically received the same business day, between 2 PM and 6 PM EST. Requests made later in the day are usually processed within 24 hours.

Withdrawals made via debit card or ACH are subject to the processing time of the issuing bank, which generally takes 3–5 business days.

The total amount refunded to a debit card cannot exceed the original deposit amount made using that card. Any remaining balance beyond this limit will be returned via ACH or wire transfer to the verified bank account on file.

In the table below you can check out the details for each withdrawal method:

Withdrawal Method | Description | Fee | Processing Time |

Wire Transfer | Funds sent directly to your verified bank account. | $15 per withdrawal | Same day (if requested before 12 PM EST) or within 24 hours |

ACH Transfer | Domestic transfer via Automated Clearing House network. | Free | 3–5 business days |

Debit Card Refund | Refund to the same card used for deposits. | Free | 3–5 business days (depends on card issuer) |

Copy Trading & Investment Features on tastyfx

Based on the investigations made by our team, currently, the discussed broker provides:

- Access to third-party trading signals

- Integration with automated trading systems through MT4

These 2 are ways to earn passive income through copying price signals and strategies.

Trading Assets and Instruments

tastyfx offers a long list of over 80 currency pairs in 6 main categories, including Major, Minor, Emerging, Australasian, Scandinavian, and Exotic:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, Minor, Emerging, Australasian, Scandinavian, and Exotic pairs | 80+ Currency Pairs | 50–70 currency pairs | 1:50 |

The broker does not currently support trading in Cryptocurrencies, stocks, ETFs, or futures markets, which makes it more specialized for short-term traders focused on FX and digital assets.

tastyfx Broker Bonuses and Promotions

tastyfx offers 3 incentives to both new and existing traders:

- New Account Bonus: Up to $10,000 funding bonus for new accounts

- Cashback Rebates: Earn up to 15% monthly cashback on trading volume

- Premium Client Service: Exclusive content and dedicated account manager for high-volume traders

To qualify for these bonuses, adhere to terms and conditions specified for each promotion.

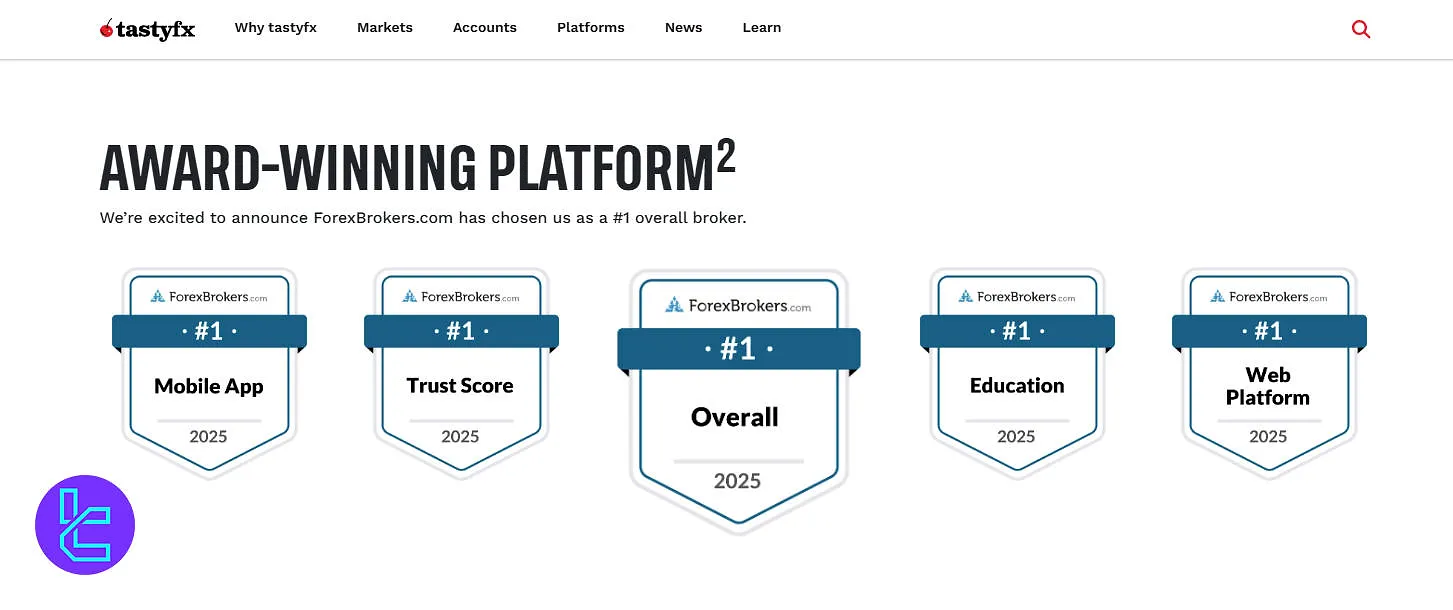

Tastyfx Awards

Tastyfx has received multiple recognitions from ForexBrokers.com in 2025, ranking #1 Overall Broker along with top scores across several key categories.

The broker was rated first for its Mobile App, Trust Score, Education, and Web Platform, reflecting its strong performance across both technology and trader support metrics.

These Tastyfx awards highlight the broker’s consistent focus on offering a reliable trading environment, user-friendly interfaces, and comprehensive educational tools; key factors that appeal to both beginner and professional traders.

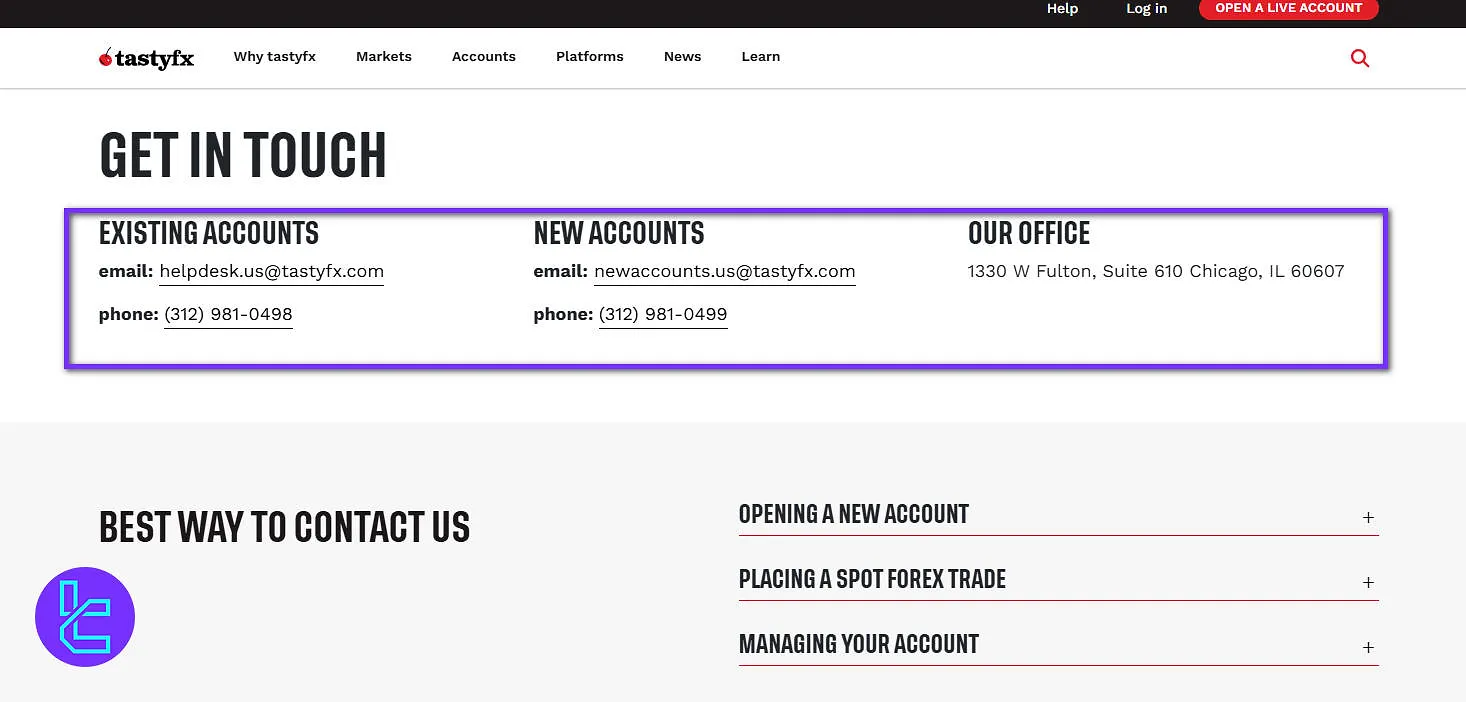

Support Department Contact Methods and Open Hours

tastyfx provides 3 support channels, available for its clients and other users:

- Email: [newaccounts.us@tastyfx.com] for new customers, [us@tastyfx.com] for existing customers

- Phone: (312) 981-0499 (new users), (312) 981-0498 (existing accounts)

- Web Chat: Available through the website

As stated by the company on its official website, the support is available 24 hours a day, from 3 AM Saturday to 5 PM Friday, EST.

Countries Forbidden by tastyfx

Actually, the broker’s website does not provide a clear list with names; however, because of international sanctions and other sorts of embargos, most companies do not offer their services to these countries:

- Iran

- Iraq

- Afghanistan

- North Korea

- Pakistan

- Syria

- Yemen

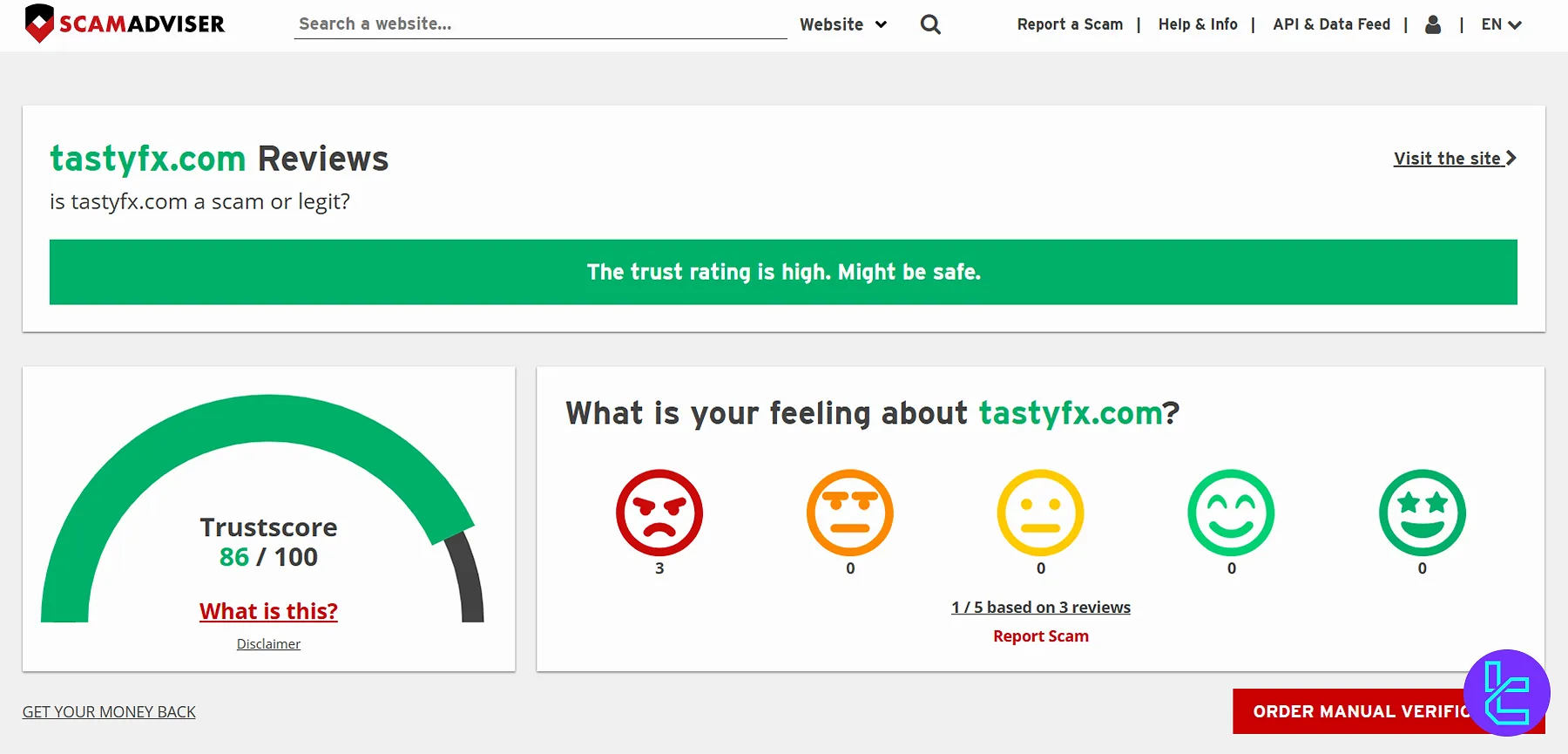

tastyfx Trust Scores and User Ratings

The broker does not have scores on many sources across the web. However, the tastyfx ScamAdviser profile has received a Trustscore of 86/100, based on these factors:

- Validity of the SSL certificate

- Long track record of the website

- DNSFilter marking the website as "safe"

Education Content

tastyfx has dedicated a page of its website for educational resources with articles on various topics related to the what, why, and how in Forex trading and the industry. Also, analytical tools are available for registered users, covering their trading history across all pairs.

You can also check TradingFinder's Forex education section for additional learning materials.

tastyfx vs Other Brokers

Let's check tastyfx's standing in the Forex trading world in comparison with popular brokerage companies:

Parameter | tastyfx Broker | IC Markets Broker | XM Broker | HFM Broker |

Regulation | CFTC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | From 0.8 Pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | $0 | From $3 | $0 (except on Shares account) | From $0 |

Minimum Deposit | $250 | $200 | $5 | From $0 |

Maximum Leverage | 1:50 | 1:500 | 1:1000 | 1:2000 |

Trading Platforms | tastyfx Platform, TradingView, MetaTrader 4, ProRealTime | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MT4, MT5, Mobile App |

Account Types | Standard, Professional, Demo | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Cent, Zero, Pro, Premium |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 80+ | 2,250+ | 1400+ | 1,000+ |

Trade Execution | N/A | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

tastyfx employs 4 trading platforms [proprietary, TradingView, MetaTrader 4, ProRealTime] with a minimum deposit requirement of $250 in its single live account.

Besides the real account, a demo environment is available with $10,000 in virtual funds.