Tastytrade offers various account types, including standard brokerage accounts, retirement accounts, and entity corporate accounts.

The commission structure includes $0 for stocks & ETFs and $1 per leg for options on stocks & ETFs, with other commissions such as $1.25 for futures and $2.5 for options on futures.

The platform supports diverse payment methods, including ACH, wire transfers, and ACAT transfers.

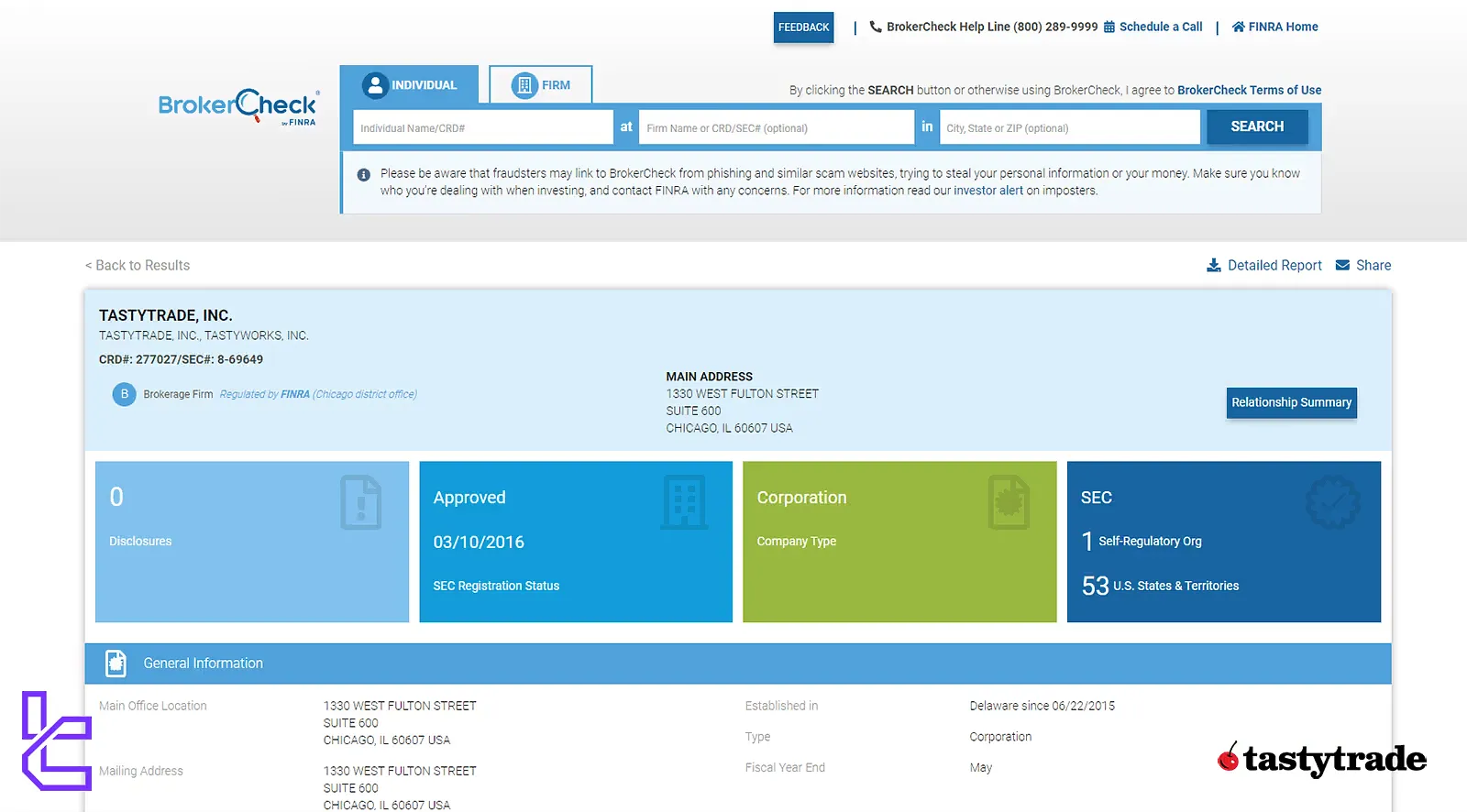

Tastytrade Company Information & Regulation Status

Tasty Trade is more than just a broker; it's a financial ecosystem designed for traders. It combines institutional-grade technology with a trader-first design philosophy.

Tastytrade, originally launched as tastyworks in 2017 and rebranded in 2023, is the brainchild of the creators behind thinkorswim one of the most acclaimed trading platforms in the U.S., later acquired for $750 million.

This pedigree is evident in the broker's approach to trading and investor education. Key points about Tastytrade's company information and regulation:

- Founded by Scott Sheridan and Tom Sosnoff in 2017

- Approved as an Introducing Broker-Dealer

- Trading in futures, options, stocks, and cryptocurrencies

- Regulated by FINRA, SEC, and National Futures Association

Client accounts are protected by SIPC insurance, which covers up to $500,000 per client (including $250,000 for cash), in the event of broker insolvency. This ensures a layer of investor protection, although it does not safeguard against market losses.

Tastytrade's commitment to transparency and innovation is reflected in its low, straightforward trading rates and intuitive, feature-rich platform.

Catering primarily to active options and futures traders, the platform has earned a reputation for delivering advanced execution tools, in-depth analytics, and an extensive educational ecosystem.

Although its DIY design may initially seem intimidating, Tastytrade offers a comprehensive suite of tools, education, and services tailored to serious retail traders.

Here is an overview of Tastytrade’s regulatory information:

Entity Parameters/Branches | Tastytrade Details |

Regulation | FINRA (Financial Industry Regulatory Authority), SEC (Securities and Exchange Commission), NFA (National Futures Association) |

Regulation Tier | N/A |

Country | United States |

Investor Protection Fund/Compensation Scheme | SIPC insurance up to $500,000 per client (including $250,000 for cash) |

Segregated Funds | Yes |

Negative Balance Protection | N/A |

Maximum Leverage | 1:2 |

Client Eligibility | Primarily retail traders, especially active options and futures traders; must comply with U.S. regulations |

Tastytrade Summary of Specifics

Here is a complete summary of what this broker is and its offerings:

Broker | Tastytrade |

Account Types | Standard, Retirement, Entity Corporate |

Regulating Authorities | FINRA, SEC, NFA |

Based Currencies | USD |

Minimum Deposit | No minimum |

Deposit Methods | ACH, Wire, Check, ACAT |

Withdrawal Methods | Bank Transfer |

Minimum Order | $1 |

Maximum Leverage | 1:2 (for Stocks) |

Investment Options | NO |

Trading Platforms & Apps | Own Platform (Desktop, Web, Mobile App) |

Markets | Stocks, Options, Futures, Options on Futures, Cryptocurrencies, ETF, Commodities, Indices |

Spread | From 0.0 |

Commission | From 0.0 |

Orders Execution | Market, Limit, Stop market, Stop limit |

Margin Call/Stop Out | N/A |

Trading Features | Follow Feed, Video Feed |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | NO |

PAMM Account | NO |

Customer Support Ways | Email, Online Chat, Phone Call |

Customer Support Hours | (7:00 AM CST - 5:00 PM CST, Monday-Thursday and 7:00 AM CST - 4:00 PM CST on Friday) |

Tastytrade's competitive edge lies in its options-centric approach, offering features tailored to active traders that are often missing from more generalist platforms.

Tastytrade Types of Accounts

Tasty Trade offers a diverse range of account types to cater to various investor needs and goals:

Category | Accounts | Description |

Standard Brokerage Accounts | Individual | Single ownership, providing options for both cash and margin trading with flexibility and access to leverage for different strategies |

TIC Joint | Joint ownership where each individual holds a defined share of the account. In case of death, the deceased’s portion is transferred to their estate | |

Joint with Rights of Survivorship | Joint ownership with equal division of assets. Upon the death of one owner, the surviving party takes full ownership of the account | |

Retirement Accounts | Traditional IRA | Contributions grow tax-deferred, and withdrawals are taxed as income. Eligibility is based on earned income |

Roth IRA | Contributions made post-tax, with the potential for tax-free withdrawals during retirement for qualifying individuals | |

SEP-IRA | Designed for small business owners and self-employed individuals, offering tax-deferred growth and allowing larger contributions than other IRAs | |

Beneficiary Traditional IRA | An account set up for a beneficiary after inheriting an IRA, with specific tax rules depending on the original IRA type | |

Beneficiary Roth IRA | ||

Entity Corporate Accounts | C Corp | Legally recognized entities authorized by a US state to operate as businesses |

S Corp | Similar to C Corps, but with no income tax at the corporate level and limited to 100 shareholders | |

LLC | Unincorporated entities offering limited liability to owners with income passed through for tax purposes | |

Partnership | Entities formed by two or more individuals, with profits and losses passed to individual partners for taxation |

Each account type offers unique benefits and is designed to accommodate different trading strategies and investment objectives.

The flexibility in account options allows traders to choose the structure that best aligns with their financial goals and tax considerations.

Tastytrade Advantages and Disadvantages

While Tasty Trade is not primarily a forex broker, its platform offers several advantages and disadvantages for traders:

Pros | Cons |

Low commissions and fees for options and futures trading | Steep learning curve for new traders |

Sophisticated trading platforms and tools for active traders | Limited investment choices beyond options, futures, stocks, and cryptocurrencies |

Extensive educational content focused on options strategies | Narrowly focused research and educational resources |

Tastytrade's platform is well-suited for experienced options and futures traders seeking low-cost, advanced trading capabilities. However, its specialized approach may not be ideal for novice investors or those looking for a more diverse range of investment products.

Tastytrade Broker Signing Up & Verification Process

The Tastytrade registration requires a structured onboarding process involving user credentials, financial background, and identity details.

Applicants must select their account type (Individual, Joint, or Corporate), submit tax and employment information, and finalize their registration with an e-signature.

The platform supports advanced security features like 2FA, ensuring compliance and account safety.

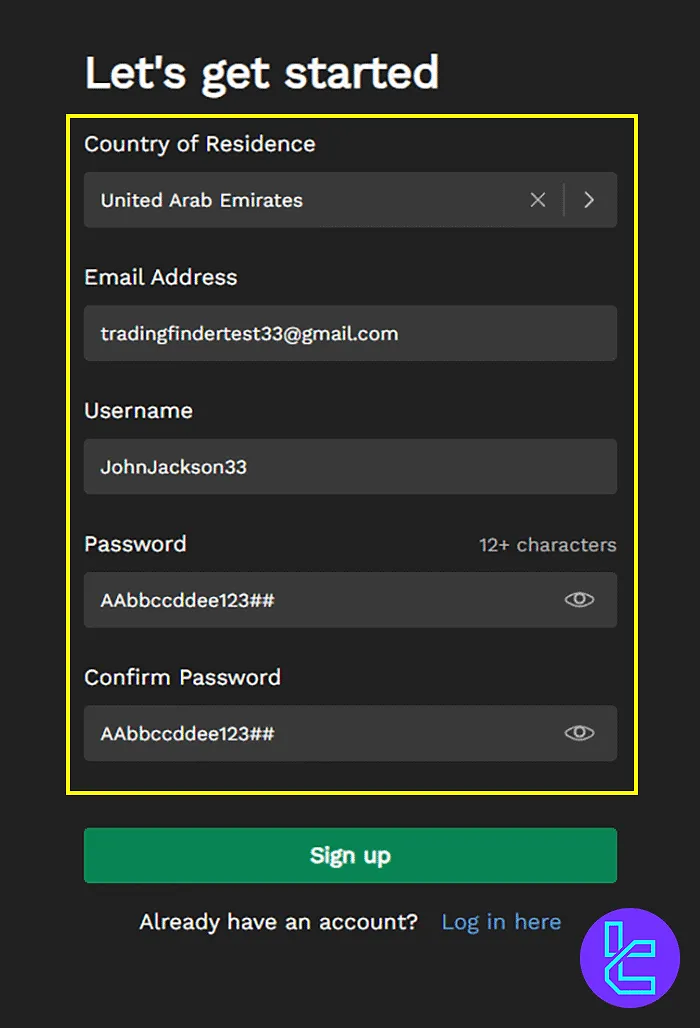

#1 Begin Registration

Head to the official Tastytrade website and click "Open an Account" to initiate the sign-up.

#2 Enter Personal Information

Submit the following information:

- Username

- Password

- Country of residence

Provide your full name, residential address, and mobile number at the next step.

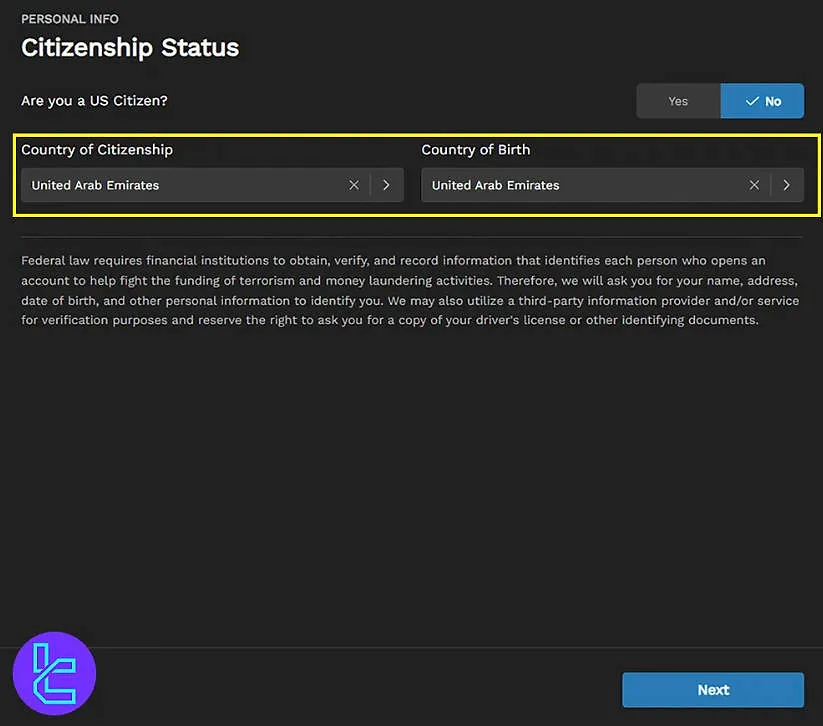

#3 Provide Regulatory Details

Confirm your citizenship, tax residency, and input the following details:

- National ID or Passport number

- Birth date

- Marital status

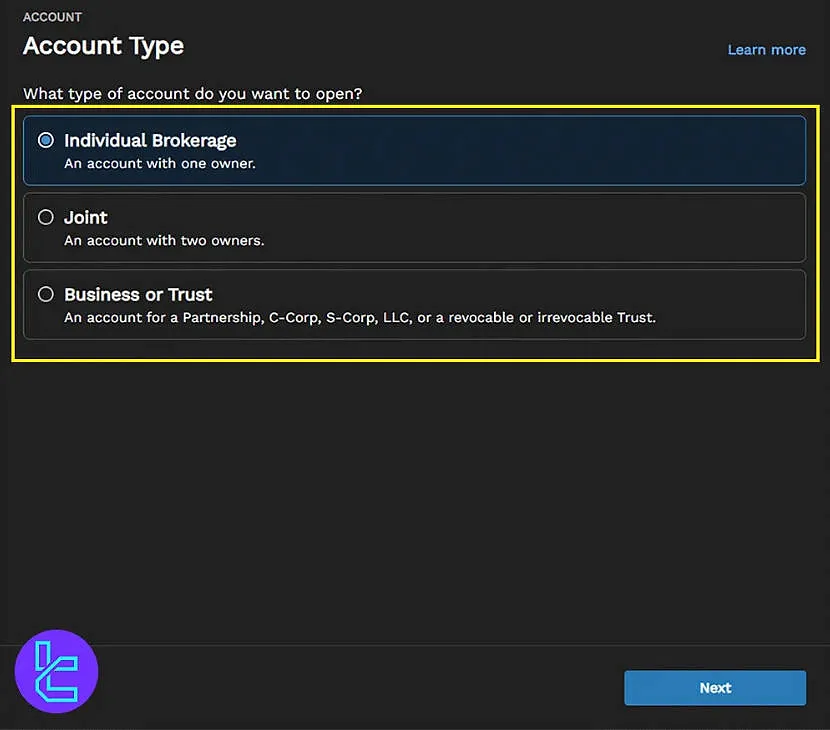

#4 Configure Account Preferences

Adjust your account settings, including:

- Account type

- Trading method (e.g., Cash or Margin)

At the end, define your trading experience, income, and financial goals.

#5 Complete Security and Verification

EnableTwo-Factor Authentication, set a security question, and optionally assign atrusted contact. Upload your ID and proof of address, review your details, accept the terms, and submit your digital signature.

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or bank statement

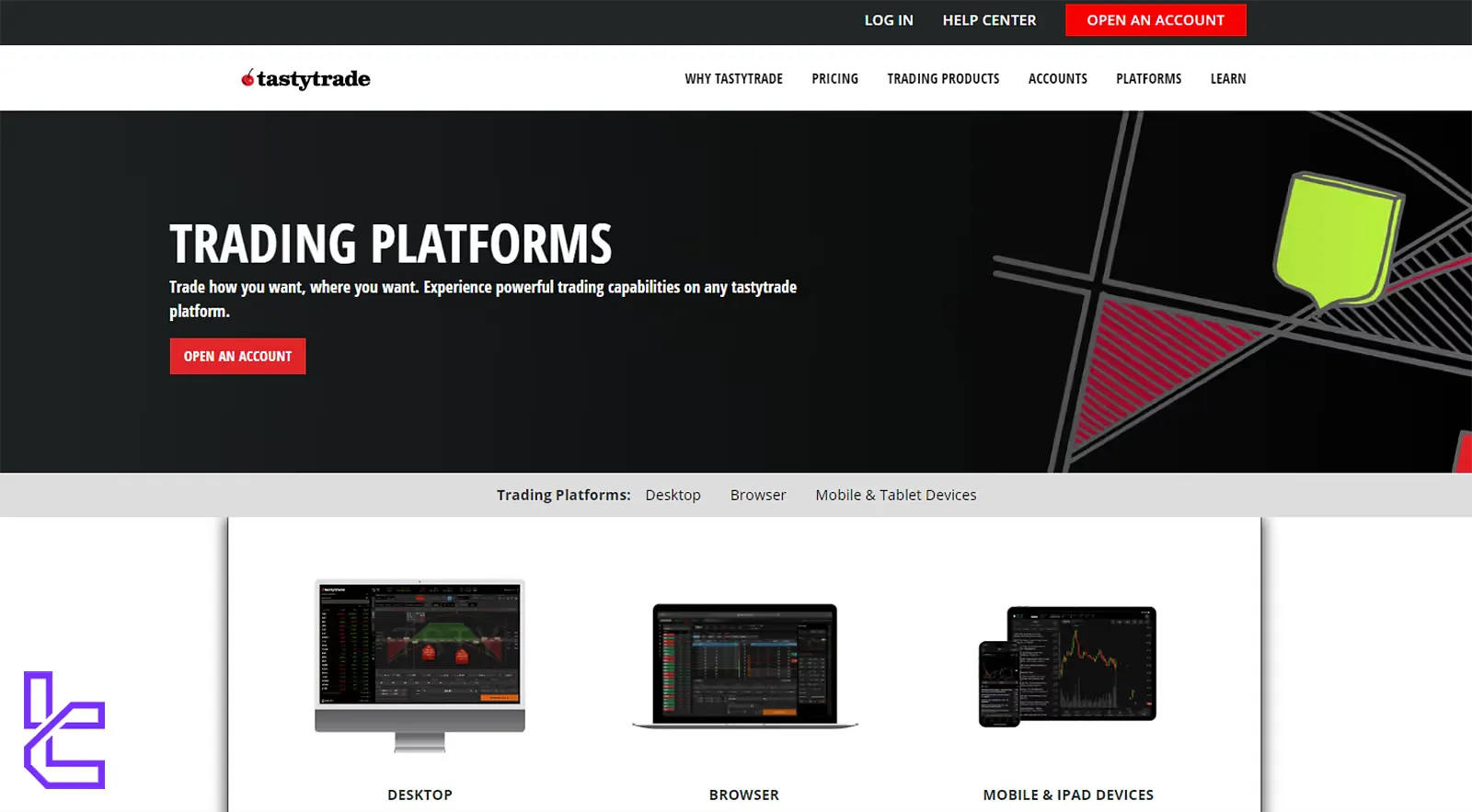

Tastytrade’s Trading Platform

Tasty trade's trading platform is a cornerstone of its offering, designed to cater to the needs of active traders. Here are the available versions:

- Desktop

- Browser-Based

- Mobile/Tablet

Desktop Platform

- Advanced Charting Tools: Analyze price movements with customizable indicators and studies, allowing for in-depth technical analysis;

- Multi-Chart Viewing: Monitor multiple stock and futures charts simultaneously in tastycharts mode, enhancing your ability to track various assets at once;

- Order Chains Feature: Evaluate the performance of equity and ETF options positions, providing a comprehensive view of your investment strategies;

- Alerts System: Configure alerts that notify you via email when specific price points or implied volatility levels are reached, ensuring you stay informed about market movements.

Browser-Based Platform

- Trade Anywhere: Engage in trading activities from any location using tastytrade's online platform;

- Account Management: Fund and oversee your tastytrade accounts and user profile seamlessly;

- Visual Trading Options: Utilize the curve trading mode for a graphical approach or the traditional table view to trade and monitor multiple stock and futures options expirations simultaneously;

- Interactive Options Trading: Click and drag options along the strike plane for a customized trading experience.

Mobile/Tablet Platform

- Account Funding and Tracking: Deposit funds into your account and monitor your transaction history;

- Performance Monitoring: Review the recent performance of equities, futures, and ETFs using curated watchlists or create personalized ones;

- Chart Analysis: Utilize tastytrade’s charting tools to evaluate price movements effectively and enhance your technical analysis;

- Order Activity Overview: Access the activity tab to track all orders, whether they are pending, completed, or canceled.

While paper trading isn’t available, a built-in options backtester lets users simulate strategies using historical data.

Tastytrade Spreads and Commissions

Tasty trade's pricing model is one of its most attractive features:

Product Type | Opening Commission (per contract/Purchase) | Closing Commission (per contract/Purchase) |

Cryptocurrency | $0 | $0 |

Stock & ETFs | $0 (unlimited shares) | $0 |

Options on Micro Futures | $1.5 | $0 |

Options on Futures | $2.5 | $0 |

Options on Stock & ETFs | $1 ($10 max per leg) | $0 |

Micro Futures | $0.85 | $0.85 |

Futures | $1.25 | $1.25 |

The broker charges margin interest of 8-11% and withdrawal fees, variable based on the method:

- ACH: Free

- Domestic wire: $25

- International wire: $45

- ACAT: $75

Tastytrade charges no annual or inactivity fees.

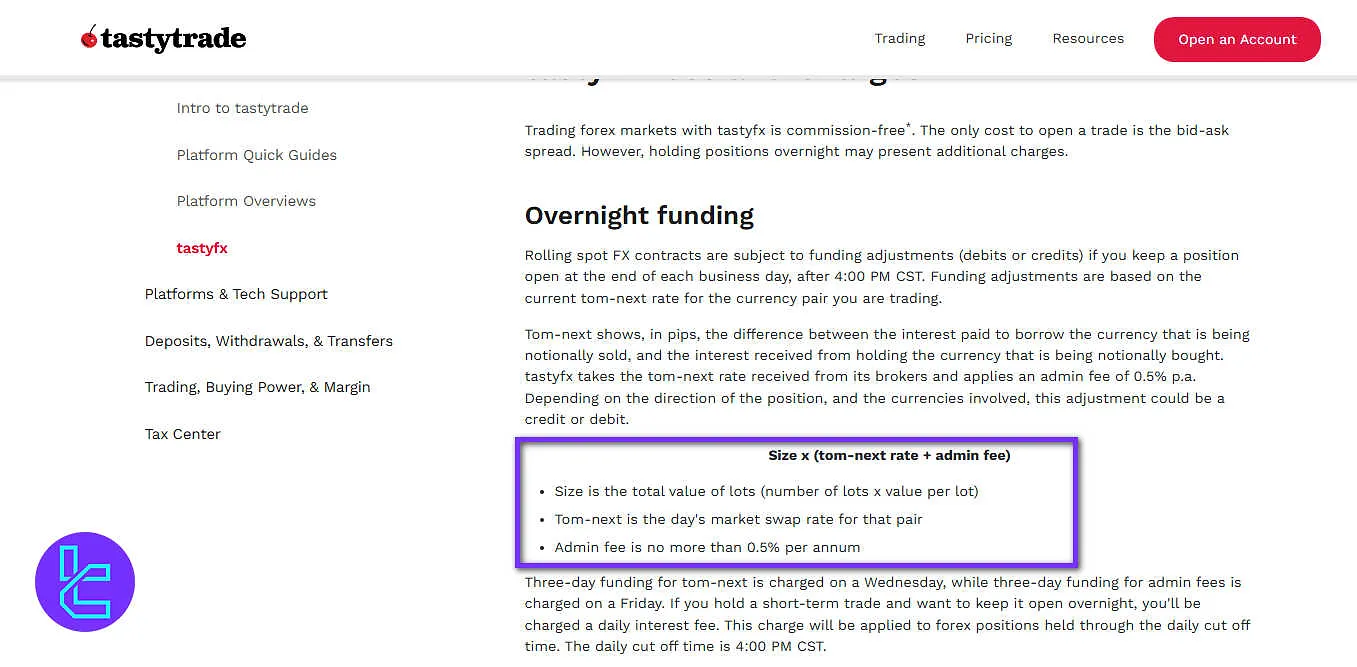

Tastytrade Swap Fees

When holding spot FX positions on Tastytrade past the daily cutoff at 4:00 PM CST, trades are subject to funding adjustments, which may result in either a debit or a credit. These adjustments are calculated using the tom-next rate for the relevant currency pair.

The tom-next rate represents the difference, expressed in pips, between the interest owed on the currency being sold and the interest earned on the currency being purchased.

TastyFX applies this market rate obtained from its brokers, along with an administrative fee of up to 0.5% per annum. Depending on the trade direction and the currencies involved, this can increase or decrease the overall trading position value.

The funding adjustment is calculated as:

Where:

- Position Size= Number of lots × value per lot

- Tom-Next Rate= Daily market swap rate for the traded currency pair

- Admin Fee= Up to 0.5% p.a.

For trades spanning multiple days, three-day funding adjustments apply on Wednesdays for the tom-next component and on Fridays for the administrative fee.

Tastytrade Non-Trading Fees

Tastytrade does not impose annual maintenance or inactivity fees on client accounts. Additionally, deposits and withdrawals are generally free of charge: wire transfers incur no incoming fees, and ACH transactions, both deposits and withdrawals, are processed without fees.

This fee structure ensures that users can manage their accounts and move funds without additional non-trading costs, maintaining transparency and predictability in account management.

Tastytrade Broker Deposit & Withdrawal [ACH, Wire, Check, and ACAT]

Tasty Trade offers several convenient funding options:

- Bank Transfer: easy transfers by linking your bank account

- Wire transfers: direct deposit to your account

- Checks: by mailing the broker

- ACAT: No incoming fee, up to $75 reimbursement

Tastytrade Deposit

Tastytrade provides multiple ways to fund your account, including ACH bank transfers, wire transfers, stablecoins, and check deposits. Each method is designed to offer convenience, transparency, and minimal fees:

Bank Transfers (ACH)

Link your bank account to gain instant buying power up to $1,000. ACH deposits and withdrawals are free, and the account can be linked directly via the Tastytrade mobile app or web platform.

Wire Transfers

U.S. wire transfers are typically credited the next business day, with no incoming fees charged by Tastytrade. For international wires, a SWIFT code is used. Ensure the account name matches your Tastytrade account, and include your account number in the memo to ensure proper credit.

Stablecoin Funding

For rapid account funding, Tastytrade accepts select stablecoins, including USDC, USDT, PYUSD, and RLUSD. Deposits can be made in amounts as small as $1 once crypto trading is enabled.

Check Deposits

Checks can be mailed to Tastytrade, with funds generally available four business days after posting. The check should be made payable to Tastytrade, with the account number in the memo line.

In the table below, you can see an overview of the deposit methods:

Funding Method | Processing Time | Fees | Notes |

ACH Bank Transfer | Instant buying power up to $1,000 | Free | Can link via mobile app or web; deposits/withdrawals are fee-free |

Wire Transfer | Next business day (U.S.) | Free | Include account number in memo; SWIFT required for international |

Stablecoin | Instant | None specified | Supports USDC, USDT, PYUSD, RLUSD; minimum $1 deposit |

Check | 4 business days | None | Payable to Tastytrade; include account number in memo line |

Tastytrade Withdrawal

Tastytrade provides clients with secure and convenient options to access their funds. Depending on preference, withdrawals can be made via ACH transfer for fast, electronic processing, or via check for a mailed payment.

ACH Withdrawals

Clients can withdraw funds via ACH transfer on weekdays before 1:00 PM Central Time (Chicago time). Requests submitted before this cutoff (excluding bank holidays) are generally processed the same day and sent overnight or on the following business day.

Check Withdrawals

U.S. clients can request withdrawals via check by navigating to “My Money”, then “Withdrawals”, and finally to “By Check”. Each check withdrawal incurs a $5 fee. Processing typically takes up to 4 business days.

Clients must include their Tastytrade account number in the memo line to ensure proper crediting. Checks are payable directly to Tastytrade and mailed to the address registered on the account.

Wire Transfers

Withdrawals via wire transfer require the recipient’s ABA routing number and bank account number. For foreign banks or banks requiring a “for further credit to” field, provide this information accurately. Account numbers must be entered without dashes or spaces to avoid errors.

Stablecoin Withdrawals

Withdrawals using stablecoins are planned but not currently available. When supported, the blockchain wallet address must match the cryptocurrency being withdrawn, as transactions sent to an incorrect address cannot be reversed.

In the table below, you can see an overview of the withdrawal methods:

Withdrawal Method | Availability | Fees | Cutoff / Processing Time |

ACH | U.S. clients | None | Weekdays before 1:00 PM CT; same-day processing when possible, sent overnight or next business day |

Check | U.S. clients | $5 per check | Processed after request; typically sent next business day |

Wire Transfer | Domestic & international | Varies by bank | Typically 1–2 business days, depending on the bank |

Stablecoin | Coming soon | None specified | TBD |

Copy Trading & Investment Option Offerings

While Tasty Trade does not offer a dedicated copy trading feature, the broker provides robust tools and resources for developing and implementing trading strategies.

Traders can leverage Tastytrade's educational content and platform features to create their trading approaches or follow strategies discussed by experts on the platform.

Tastytrade Tradable Markets & Symbols Overview

The broker offers a wide range of tradable markets:

Category | Type of Instruments | Number of Symbols / Offerings | Competitor Average | Maximum Leverage |

Stocks | Shares | Thousands of U.S. and global stocks | 800–1200 global stocks | 1:2 |

Options | Equity & Index Options | Broad range on listed stocks and indices | Varies widely | N/A |

Futures & Micro Futures | Standard & Micro Futures Contracts | Includes major commodity, index, and financial futures | Varies by exchange | N/A |

Options on Futures | Derivatives on Futures | Available on select futures contracts | Limited | N/A |

Cryptocurrencies | Major crypto assets | Selected popular coins and tokens | Varies widely | N/A |

ETFs | Exchange-Traded Funds | Broad selection of U.S. and global ETFs | 500–1000+ | N/A |

Commodities | Commodity Derivatives & Contracts | Includes energy, metals, and agricultural products | 10–20 instruments | N/A |

Indices | Index Derivatives | Major global indices | 10–20 indices | N/A |

U.S. Treasurys | Treasury Futures & ETFs | Selected U.S. government debt instruments | Limited | N/A |

This diverse offering allows traders to implement various strategies across different asset classes, all from a single platform.

Forex, mutual funds, and IPOs are not offered, reflecting the platform’s options-first philosophy. While the selection may not suit passive investors, it caters perfectly to derivatives traders.

Tastytrade Bonuses and Promotions

Tasty Trade offers several attractive promotions:

Category | Details |

Promotion | Tiered Account Opening Promotion |

Eligibility | New customers only (determined by Tax ID) |

Must be US Resident (at least 18 years old) | |

Eligible Account Types | Individual (cash or margin) |

Joint (cash or margin) | |

S-Corp, LLC, C-Corp (cash or margin), Partnerships | |

Trust Accounts | |

Non-Eligible Account Types | International customers |

IRAs (not eligible due to tax reasons) | |

Promotional Period | April 1, 2024, to December 31, 2024 |

Referral Code | MYNEWBONUS |

Withdrawal Hold | 12-month hold on the initial funding amount to retain the cash bonus |

Here are the deposit funds and the bonus cash amount you get in return:

- $2,000 - $4,999: $50

- $5,000 - $24,999: $100

- $25,000 - $99,999: $500

- $100,000 - $249,999: $2,000

- $250,000 - $499,999: $3,000

- $500,000 - $999,999: $4,000

- $1,000,000+: $5,000

Note: A 12-month holding period applies to bonus-eligible funds.

These promotions demonstrate Tastytrade's commitment to providing value to its trading community and incentivizing active participation on the platform.

TastyTrade Awards

Tastytrade has received multiple industry accolades for its trading platforms, innovation, and services, reflecting its strength in derivatives and active trading markets.

Key Awards (2024–2025):

- Best for Low-Cost Micro Futures – Benzinga, October 2025

- Best Online Brokers for Options Trading – Bankrate, March 2025

- Best Overall Options Trading Platform – Investopedia, October 2025

- Best Broker in North America – TradingView, 2024

- Best Options Trading Platform – BrokerChooser.com, 2025

- #1 Options Trading – Stockbrokers.com, 2025

- #1 Options Trading Platform – Stockbrokers.com, 2025

- #1 Futures Trading – Stockbrokers.com, 2025

- #1 Futures Trading Platform – Stockbrokers.com, 2025

- Best Broker for Dedicated Options Traders – The Motley Fool, 2025

- #1 Innovation – Stockbrokers.com, 2025

- Best Midsize Companies to Work for in Chicago – BuiltIn Chicago, 2025

- Best Brokers for Buying Fractional Shares – Bankrate, December 2024

These Tastytrade awards highlight the broker’s emphasis on options and futures trading, innovation, and employee-friendly operations, reinforcing its reputation among professional and active traders.

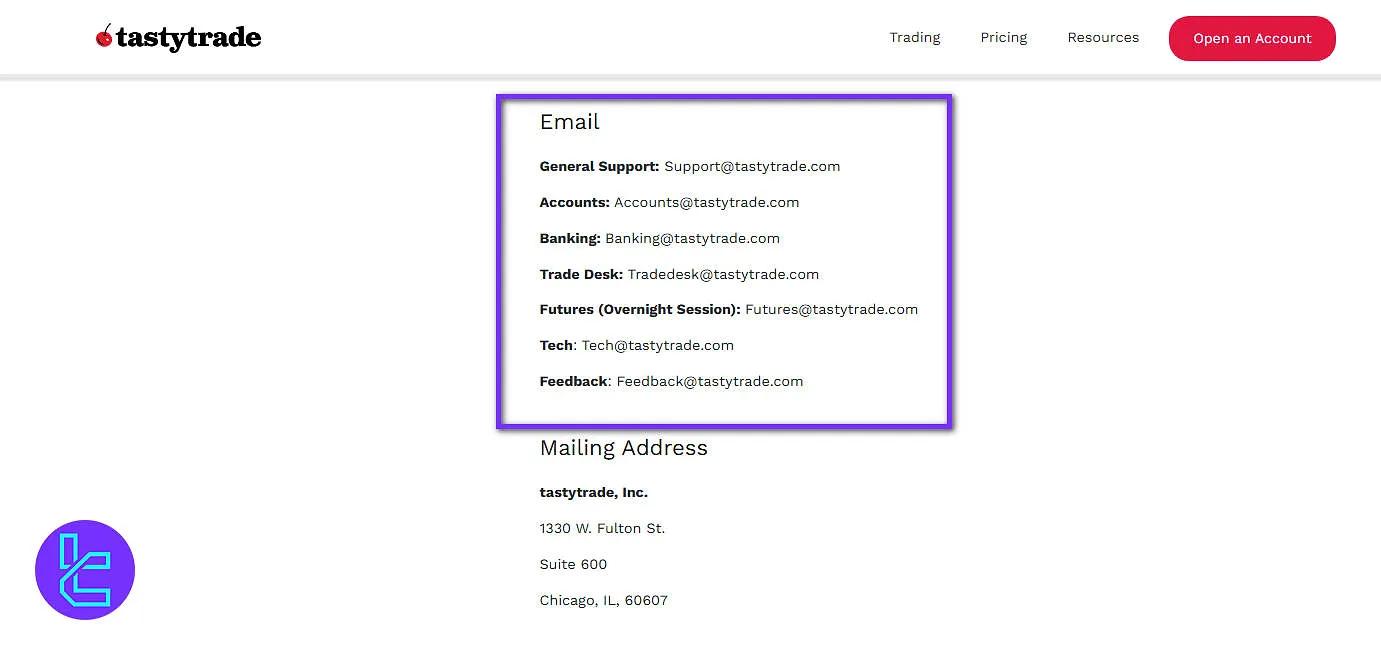

Tastytrade Broker Support

The broker prides itself on comprehensive customer support:

- Phone support: 888-247-1963

- Email assistance: Support@tastytrade.com

- Live chat

The support team can help with various inquiries, from account-related questions to trading strategy guidance. This commitment to customer service contributes to Tastytrade's high user satisfaction ratings.

Tastytrade Broker List of Restricted Countries

Due to regulatory constraints or other factors, Tasty Trade's services are not available in certain countries:

- Afghanistan

- Albania

- Algeria

- Angola

- Anjouan

- Barbados

- Belarus

- Bosnia & Herzegovina

- Botswana

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cayman Islands

- Central African Republic

- Chad

- Comoros

- Côte d'Ivoire (Ivory Coast)

- Cuba

- Democratic Republic of the Congo

- Equatorial Guinea

- Eritrea

- Ethiopia

- Ghana

- Gibraltar

- Guinea

- Guyana

- Haiti

- Iran

- Iraq

- Jordan

- Kenya

- Lao PDR

- Latvia

- Lebanon

- Liberia

- Libya

- Mali

- Malta

- Mauritius

- Mauritania

- Mexico

- Morocco

- Montserrat

- Mozambique

- Myanmar

- Namibia

- Nicaragua

- Niger

- Nigeria

- North Korea

- Pakistan

- Palestinian Territory

- Panama

- Philippines

- Russia

- Sao Tome & Principe

- Senegal

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sri Lanka

- Sudan

- Syria

- Tajikistan

- Tanzania

- Turkey

- Turkmenistan

- Uganda

- Ukraine

- UK

- Vanuatu

- Venezuela

- Western Sahara

- Yemen

- Zaire

- Zimbabwe

Tastytrade Broker Trust Scores & Reviews

Tasty Trade has garnered impressive trust scores and reviews:

- Tastytrade Trustpilot score: 4.3 out of 5 (Over 475 reviews);

- Praised for easy-to-use platform and excellent customer support;

- Highly rated for educational resources and advanced trading features.

While most reviews are positive, some users have reported issues with certain trading scenarios and occasional platform glitches.

Education on Tastytrade Broker

Tastytrade's Learn Center is a comprehensive educational resource:

Category | Topics |

Accounts | Account Types Cash vs. Margin Accounts |

Stocks | Types of Securities Stock Market Index How to Buy & Sell Stocks Fundamental Analysis |

Futures | Futures Characteristics Equity & Volatility Futures Commodity Futures Futures Trading 101 Futures Trading Strategies |

The Greeks | Options Greeks Delta Gamma Theta Vega Analyzing Greeks |

Options | Long Call Long Put Short Call Short Put Long Call Vertical Spread Short Call Vertical Spread Long Put Vertical Spread Short Put Vertical Spread Long Call Calendar Spread Short Call Calendar Spread Long Put Calendar Spread Short Put Calendar Spread Long Call Diagonal Spread Short Call Diagonal Spread Iron Condor Covered Call Covered Put |

These resources cater to traders of all experience levels, helping them develop and refine their trading skills using the Tastytrade approach.

Tastytrade’s standout educational hub, tastylive, provides a 24/7 stream of expert-led shows, webinars, and trade idea feeds. The platform includes deep-dive blogs, visual guides, and backtesting tools for options.

While third-party research is limited to Refinitiv data and basic financials, the tastylive content offers practical insights aligned with active trading, useful for fundamental analysis.

You can also check TradingFinder's Forex education section to access additional learning materials.

Tastytrade Comparison Table

Here's a comprehensive comparison between Tastytrade's services and those of other platforms:

Parameter | Tastytrade Broker | LiteForex Broker | Exness Broker | FXGlory Broker |

Regulation | FINRA, SEC, NFA | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | No |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0 | From $0.0 | From $0.2 to USD 3.5 | $0 |

Minimum Deposit | $0 | $50 | $10 | $1 |

Maximum Leverage | 1:2 | 1:30 | Unlimited | 1:3000 |

Trading Platforms | Proprietary platform | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Retirement, Entity Corporate | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Premium, VIP, CIP |

Islamic Account | No | No | Yes | Yes |

Number of Tradable Assets | N/A | N/A | 200+ | 45 |

Trade Execution | Market, Instant | Market | Market, Instant | Market, Instant |

Conclusion and final words

In conclusion, Tastytrade is a broker tailored to active options and futures traders. The platform is available on desktop, web, and mobile apps, providing a seamless trading experience across devices.

It offers advanced charting tools, video feeds, and an affiliate program. The Trustpilot rating of 4.3 out of 5 with over 475 reviews highlights its positive reception among users.