Tickmill is a multi-asset brokerage with more than 785,000 registered users. It offers spreads from 0.0 pips and up to 1:300 leverage.

There are 6 base currencies [USD, EUR, GBP, ZAR, PLN, CHF] for the accounts on this broker.

Tickmill Company Information & Regulation

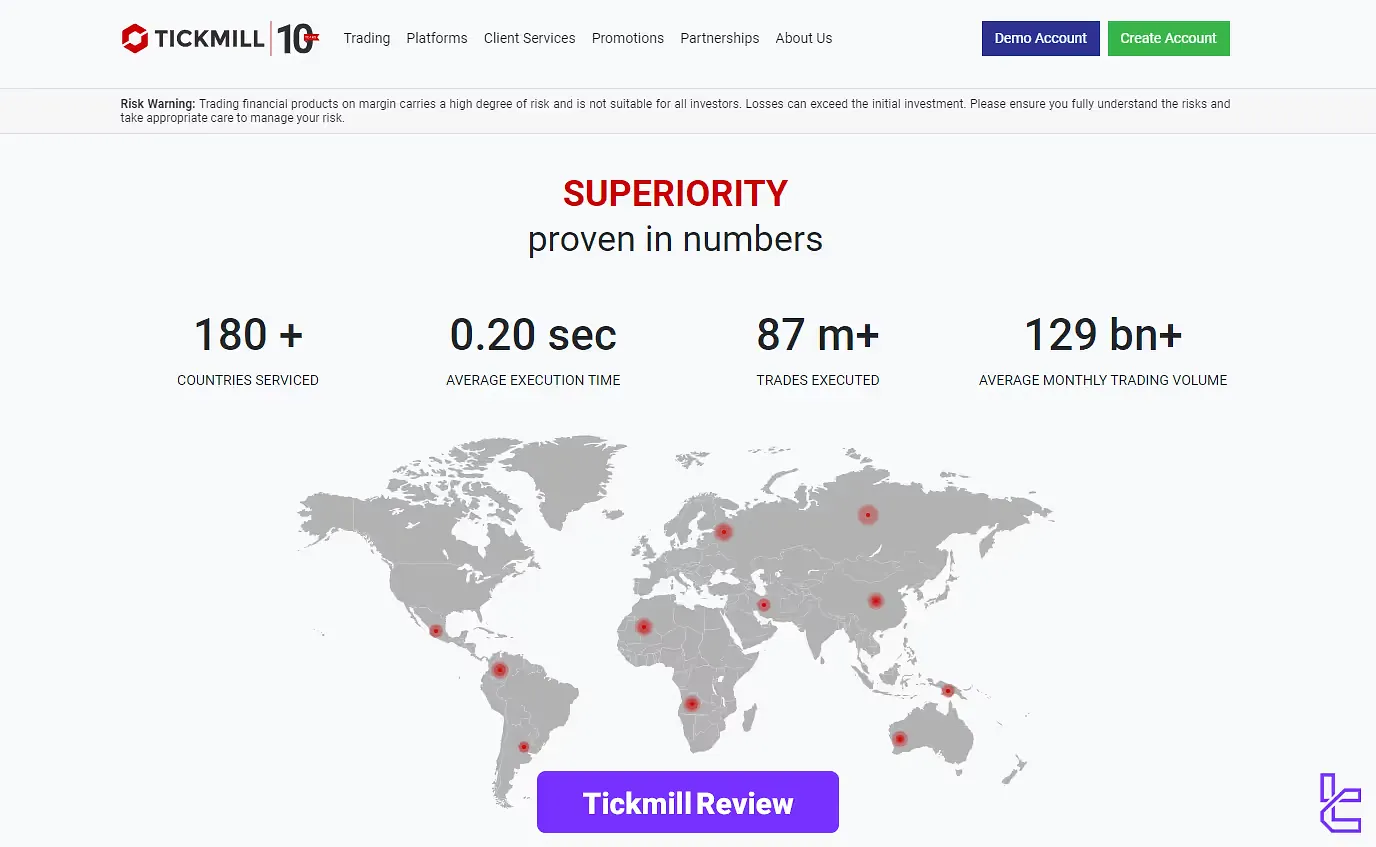

Tickmill is a global group of CFD and Forex brokers that has garnered numerous industry awards and recognitions over the years.

The company's excellence in client service, trading conditions, and technology has solidified its position as a trusted name in the trading world.

Operating in over 180 countries, Tickmill boasts an impressive average monthly trading volume exceeding $129 billion.

Regarding regulation, this broker has taken a multijurisdictional approach, being regulated by the authorities listed below:

- Financial Services Authority (FSA) in Seychelles with fund insurance via Lloyd’s, ranging from $20,000 to $1,000,000

- Financial Conduct Authority (FCA) in the United Kingdom

- Cyprus Securities and Exchange Commission (CySEC), with clients protected by the Investor Compensation Fund (ICF)

- Labuan Financial Services Authority (LFSA)

- Financial Sector Conduct Authority (FSCA) in South Africa with license number FSP 49464

Founded in 2014 and operating under a no-dealing-desk (NDD) model, Tickmill routes client orders directly to liquidity providers without internal dealing desk interference, supporting fast execution and deep liquidity.

| Entity Parameters/Branches | Tickmill Europe Ltd | Tickmill South Africa (Pty) Ltd | Tickmill Ltd | Tickmill UK Ltd |

Regulation | CySEC | FSCA | FSA | FCA, DFSA |

Regulation Tier | 1 | 2 | 3 | 1, 2 |

Country | Cyprus | South Africa | Seychelles | United Kingdom, UAE |

Investor Protection Fund/Compensation Scheme | Up to EUR 20,000 under ICF and from €20,000 to €1,000,000 under Funds Insurance with Lloyd’s | Up to $1,000,000 under Funds Insurance with Lloyd’s | Up to $1,000,000 under Funds Insurance with Lloyd’s | Up to GBP 85,000 under FSCS |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:1000 | 1:1000 | 1:30 |

Client Eligibility | European clients | Global | Global | UK clients |

While the broker operates globally, we have a separate Tickmill UK review that explores the features and services of the FCA-regulated entity. The company offers top-tier protection, including segregated accounts, negative balance protection, and coverage under the FSCS up to £85,000.

Tickmill Specifics Summary

In this section, we will have a glance at the broker's main specifics and features. Summary table at Tickmill:

Broker | Tickmill |

Account Types | Classic, Raw |

Regulating Authorities | FSA, FCA, CySEC, LFSA, FSCA |

Based Currencies | USD, EUR, GBP, ZAR, PLN, CHF |

Minimum Deposit | $100 |

Deposit Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Withdrawal Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Minimum Order | 0.01 |

Maximum Leverage | 1:1000 |

Investment Options | Social Trading |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Markets | Forex, Stock Indices, Commodities, Crypto, Stocks, Bonds |

Spread | From 0 Pip |

Commission | From $0 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/30% |

Trading Features | Negative Balance Protection, Scalping, Hedging |

Affiliate Program | Yes |

Bonus & Promotions | $30 Welcome Account, NFP Machine, Trader Of The Month Bonus |

Islamic Account | Yes |

Pamm Account | No |

Customer Support Ways | Live Chat, Email, Phone |

Customer Support Hours | 24/5 |

Trading Accounts Available on Tickmill

Different account types offer various specifications for traders. This brokerage offers two main types of trading accounts in addition to a demo account. Live accounts on Tickmill:

- Classic: For commission-free trading with access to global markets

- Raw: Offers trading with tight spreads and competitive commissions

Tickmill Account Comparison

| Account Type | Raw | Classic |

Min. Deposit | $100 | |

Base Currencies | USD, EUR, PLN, CHF, GBP | |

Max. Leverage | 1:1000 | |

Min. Lots | 0.01 | |

Strategies Allowed | All | |

Islamic Account | Yes | |

These account types differ in commission and spreads, which will be covered later in the article.

Islamic (swap-free) versions are available across all account types, making the broker suitable for Sharia-compliant traders.

Tickmill Forex Broker Advantages and Disadvantages

Examining the pros and cons of a broker helps you to get a balanced view of it. Tickmill benefits and drawbacks:

Pros | Cons |

Regulated In Multiple Top-Tier Jurisdictions | Low Variety On Account Types |

Advanced Trading Platforms For Futures And Options | Relatively Low Amount Of Forex Pairs |

| - | Educational Resources And Copy Trading Services |

| - | Popular Trading Platforms Supported |

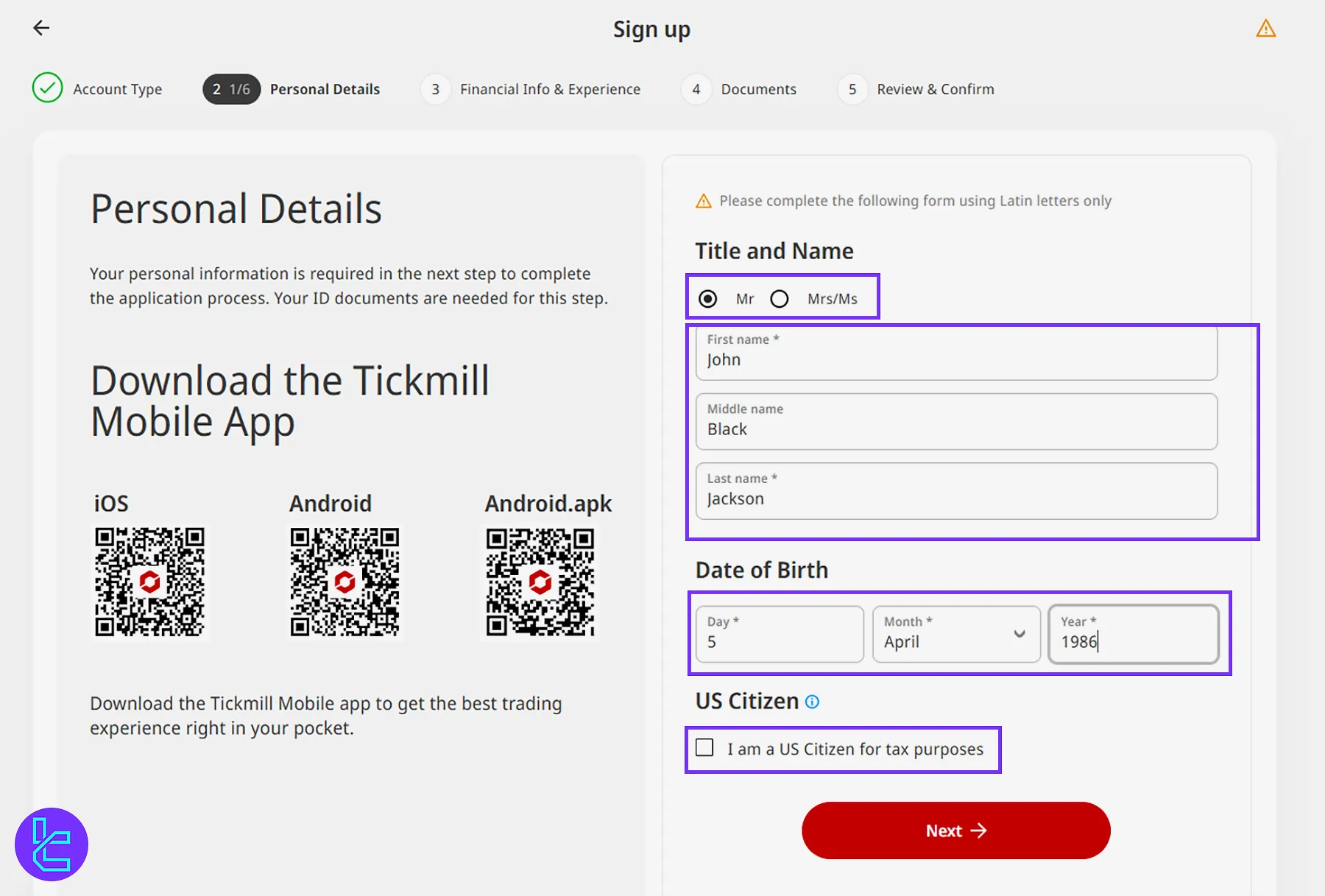

Tickmill Broker Registration & Verification Tutorial

The TickMill registration takes less than 10 minutes and involves providing your personal data, financial background, and trading profile.

Users must select an individual account, confirm their citizenship, and accept trading risks. After submission, access to the Client Area is granted, subject to verification.

#1 Open the Registration Page

Visit the official TickMill website and click on “Create Account” to launch the sign-up form.

#2 Set Account Type and Personal Info

Choose Individual as your account type and enter the following details:

- Title

- Full name

- Birth date

- Citizenship status

#3 Select Country and Trading Product

Choose your country of residence, select Forex & CFDs as your preferred product, and agree to the terms.

#4 Provide Contact Information

Submit contact details, including:

- Email address

- Mobile number

- Language preference

#5 Enter Address and Nationality

Provide your nationality, full address, and indicate if you are a politically exposed person. Referral code is optional.

#6 Secure Your Account

Set a strong password (with uppercase, lowercase, numbers, and symbols), and confirm it.

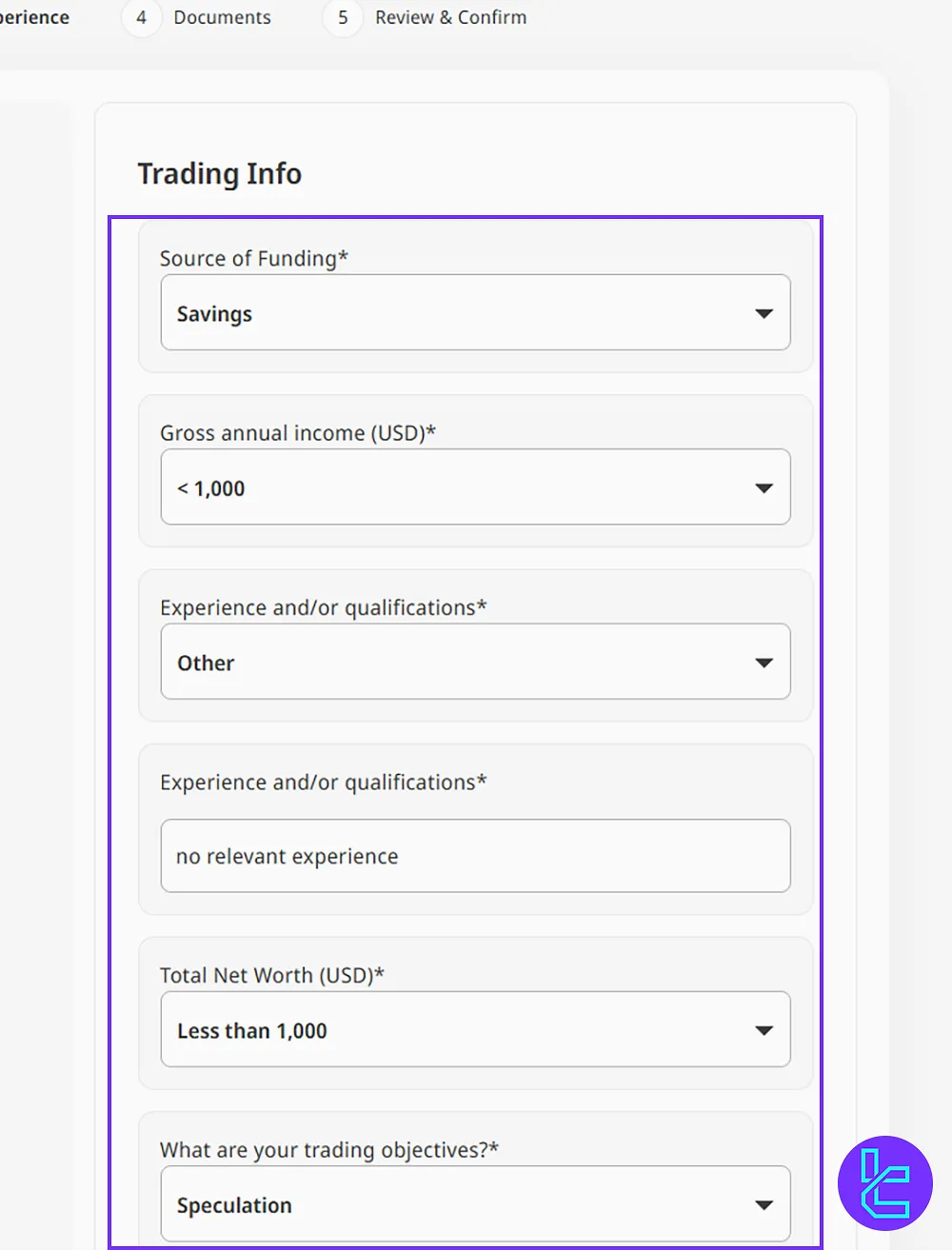

#7 Add Background Details

Specify your trading background by providing the following information:

- Education

- Employment status

- Industry

#8 Provide Financial and Trading Profile

Declare your financial information, including:

- Income source

- Gross annual income

- Net worth

- Trading objectives

#9 Indicate Trading Experience

Mention whether you have experience with Forex or CFDs, and accept the trading risks.

#10 Complete the KYC Process

Access the TickMill client dashboard and upload supporting documents, including:

- Proof of ID: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

Tickmill Platforms & Apps

Traders use different platforms with brokers. Therefore, these companies usually try to offer various platforms to attract more users. Tickmill trading platforms and apps:

MetaTrader 4

MetaTrader 4 remains one of the most popular trading platforms globally, and Tickmill's offering includes:

- Order execution with no partial fills

- EA trading through the broker's VPS services

- More than 50 indicators available in 39 languages

- Automated trading capabilities (Expert Advisors)

- Trading signals

Download links:

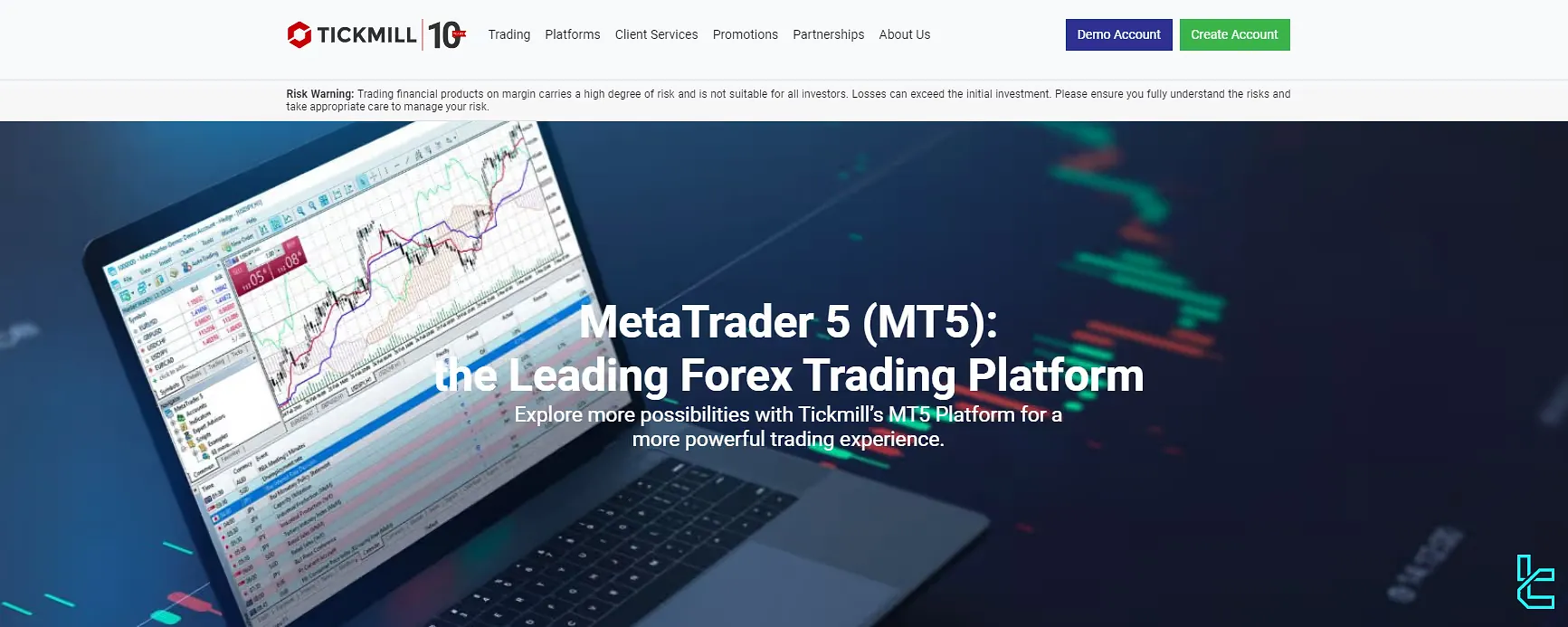

MetaTrader 5

The more advanced MetaTrader 5 platform offers enhanced features:

- Support for all order types, including 6 pending order types

- Sophisticated algorithmic applications (Expert Advisors, trading robots, copy trading)

- 38+ integrated technical indicators

- 21 timeframes

- Customizable charts

- Built-in economic calendar

Download links:

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Tickmill Mobile App

For traders on the go, the broker's proprietary mobile app provides:

- Account management features

- Deposit and withdrawal functionality

- Fast login using biometric authentication

- 0.02s executions on average

- Access to trading with all strategies

- Transaction history for account management

Download Links:

Traders also benefit from additional tools such as VPS hosting for algorithmic strategies, API integration, and FX Blue’s Advanced Trading Toolkit. This broad ecosystem accommodates both manual and algorithmic trading styles.

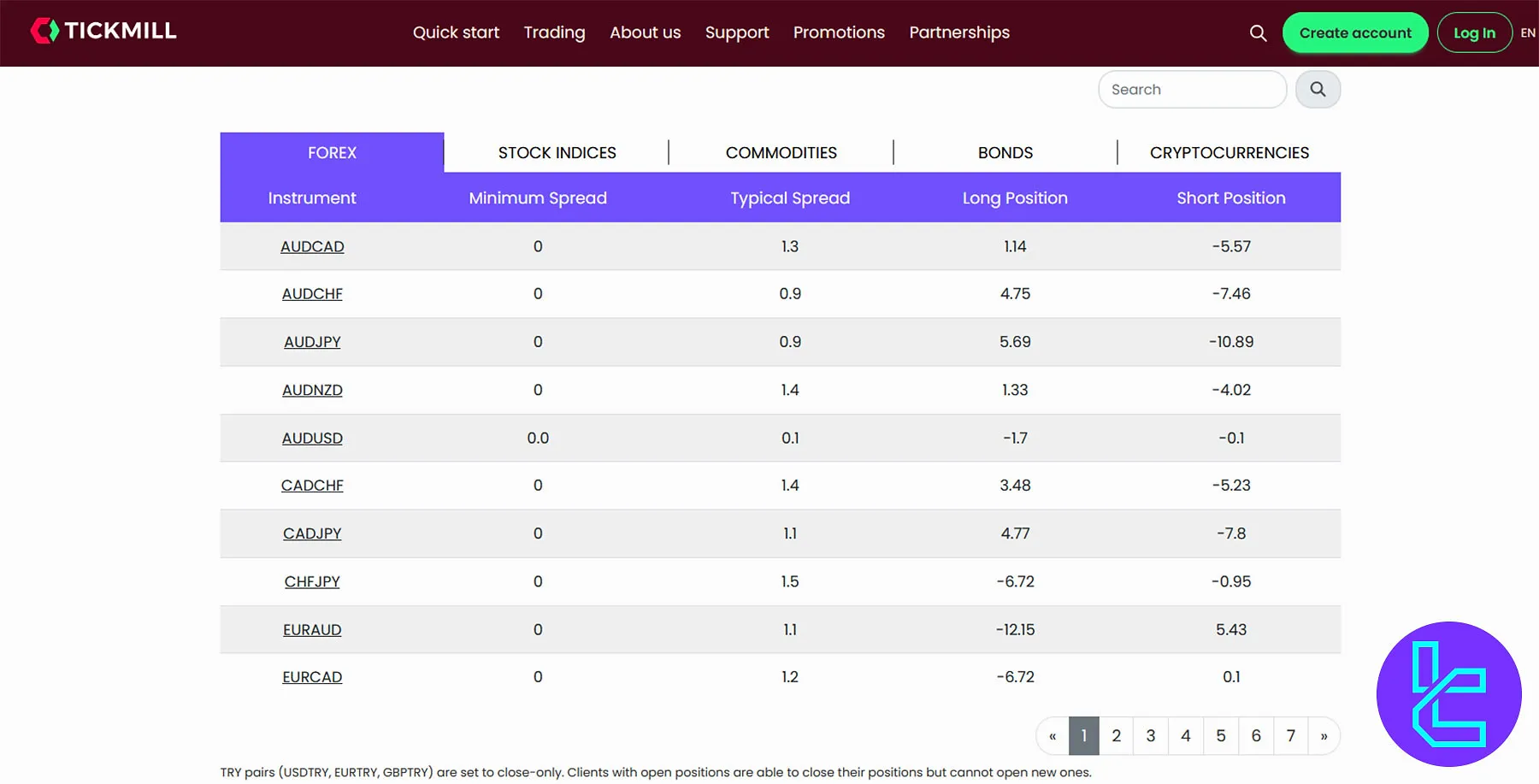

Spreads & Commissions on Different Account Types

Spreads and commissions are very effective in the cost management of your trading strategy. At the table below, we will examine the trading fees on the broker:

| Account Type | Commission | Spread |

Classic Account | None | From 1.6 Pips |

Raw Account | $3 per lot per side | From 0.0 Pips |

Tickmill Swap Rates

Swap fees represent the cost or gain associated with keeping a position open overnight, driven by the interest rate differential between traded currencies.

A Swap Long applies to long (buy) positions, while a Swap Short affects short (sell) positions. Tickmill calculates swaps per standard lot (100,000 units of the base currency). As of the latest data:

- EUR/USD: Long positions incur a $6.08 charge, while short positions receive a $2.85 credit;

- GBP/JPY: Long positions earn a $17.90 credit, whereas short positions are charged $30.77.

Compared to other brokers, Tickmill’s overnight financing rates were generally aligned with typical industry levels at the time of review. Traders should note that swap values arevariable and subject to periodic adjustments.

Tickmill Non-Trading Fees

Tickmill charges a quarterly inactivity fee for dormant accounts. This applies only if no trading, transactions, or logins occur for 12 months, and the account balance is below $50 (or equivalent). Key Points:

- Inactivity definition: No trades, logins, deposits, withdrawals, or open positions for 12+ monthswith a low balance

- Fee amount: $10 / €10 / £10 / CHF10 or PLN 40, billed every quarter

- Trigger condition: Charged after 12 consecutive months of inactivity

- No fees on deposits/withdrawals: All funding and withdrawal actions remain free of charge

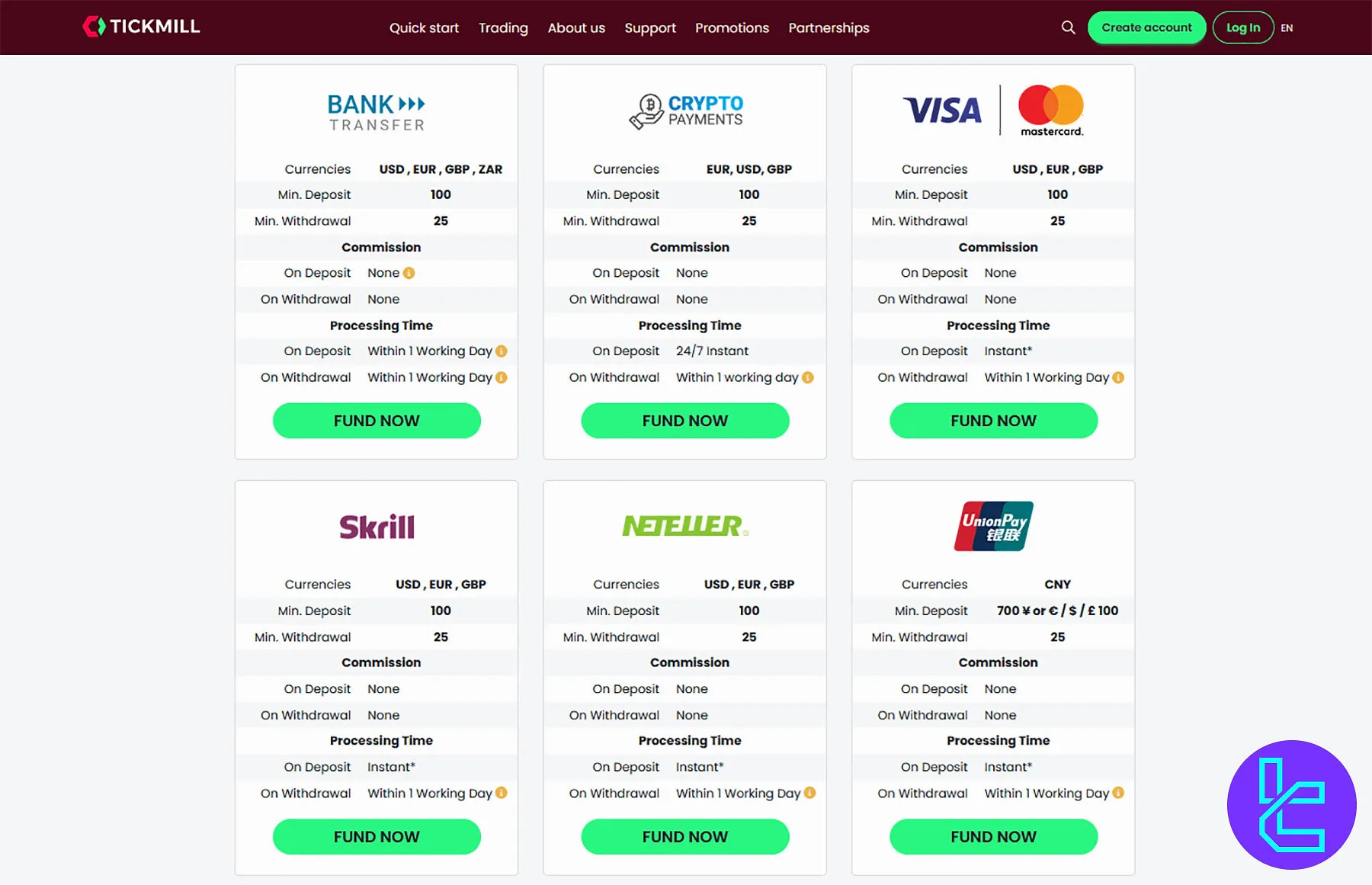

Deposit and Withdrawal Methods on Tickmill

The broker offers a range of secure and convenient payment options. List of deposit and withdrawal methods on the broker:

- Bank Transfer: Using local banks

- Cryptocurrency Payments: Popular cryptocurrencies supported

- Credit/Debit Cards: Visa, Mastercard

- Electronic Payment Systems: Skrill and Neteller

- Union Pay: For Chinese traders

Tickmill Deposits

The broker supports multiple secure and fast deposit methods, including:

Deposit Method | Currencies | Min Deposit | Processing Time |

Bank Transfer | USD, EUR, GBP, ZAR | 100 | Within 1 Working Day |

VISA / Master Card | USD, EUR, GBP | 100 | Instant |

Skrill | USD, EUR, GBP | 100 | Instant |

Neteller | USD, EUR, GBP | 100 | Instant |

UnionPay | CNY | 700 ¥ or € / $ / £ 100 | Instant |

Crypto Payments | USD, EUR, GBP | 100 | Instant |

TickMill Withdrawals

All of the methods mentioned above are also available for payout with two key differences: Minimum amount and Processing time.

Withdrawal Method | Currencies | Min Withdrawal | Processing Time |

Bank Transfer | USD, EUR, GBP, ZAR | 25 | Within 1 Working Day |

VISA / Master Card | USD, EUR, GBP | 25 | Within 1 Working Day |

Skrill | USD, EUR, GBP | 25 | Within 1 Working Day |

Neteller | USD, EUR, GBP | 25 | Within 1 Working Day |

UnionPay | CNY | 25 | Within 1 Working Day |

Crypto Payments | USD, EUR, GBP | 25 | Within 1 Working Day |

All non-bank deposit methods are processed instantly. There are no deposit fees, and for bank wire deposits exceeding $5,000, the broker may reimburse fees up to $100 upon request.

Does Tickmill Offer Copy Trade and Investment Options?

The broker offers copy trading services through its "Social Trading" section. It allows the user to become a "Strategy Provider" and let other people copy their trades or become a "follower" and copy the provided signals and strategies.

Also, a trader can be a provider and a follower at the same time by opening two different trading accounts. Regarding fees, providers can set up a maximum of 50% of the profit made for a follower as a commission.

Tickmill Social is the broker’s in-house solution for copying strategies (available only for Seychelles-registered users).

While previously supported platforms like ZuluTrade and Pelican have been discontinued, these options still allow clients to follow successful traders automatically, either as signal followers or strategy providers.

Which Markets and Instruments Can You Trade on Tickmill?

This brokerage offers a diverse range of trading instruments across six asset classes, from the Forex market to Bonds.

Here's a comprehensive list of available instruments and trading markets on Tickmill:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 60 | 50 - 70 currency pairs | 1:1000 |

Stock Indices | CFDs | Over 20 | 10 - 20 instruments | 1:100 |

Stocks & ETFs | CFDs | Over 500 | 800 - 1200 | 1:20 |

Bonds | CFDs | 4 instruments | N/A | 1:100 |

Commodities | CFDs | 19 instruments | 15 - 30 instruments | 1:1000 |

Cryptocurrencies | CFDs | 16 digital assets | 20 - 30 instruments | 1:200 |

This robust asset coverage allows traders to execute multi-asset strategies within a single broker environment, though the product breadth is slightly narrower than that of industry leaders.

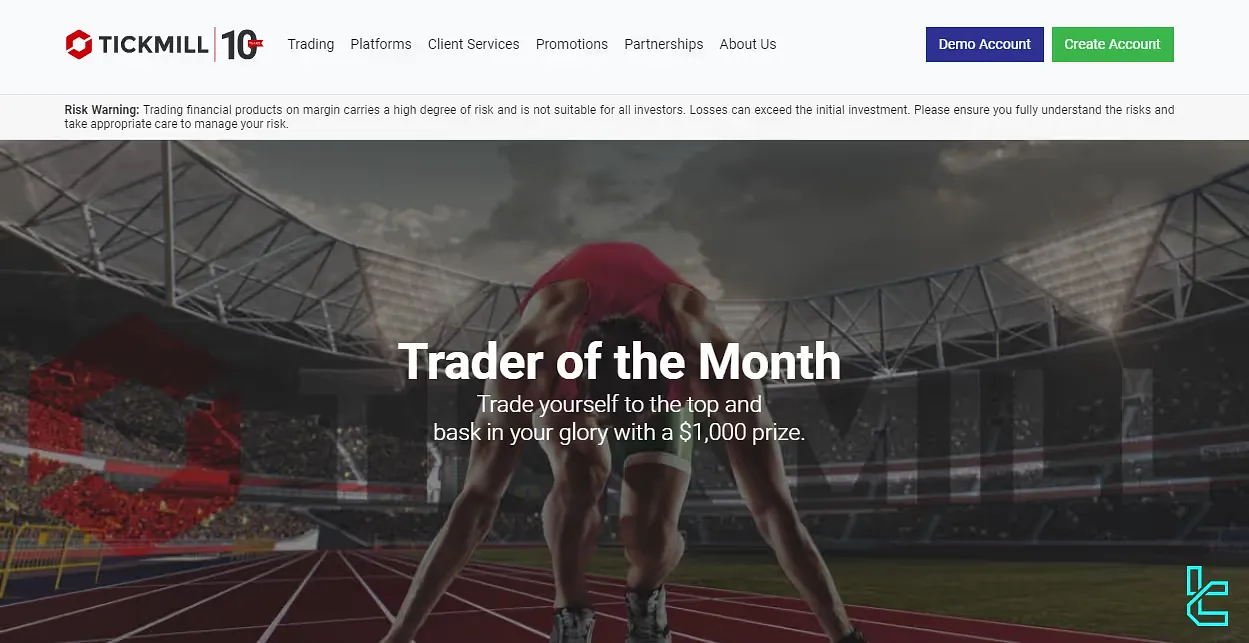

Bonuses & Promotions on Tickmill

The broker periodically offers various bonuses and promotions to attract new clients and reward existing ones. Currently, it offers these bonuses for traders:

- Trader of The Month: A $1,000 prize for the best trader chosen by the broker

- NFP Machine: $500 for the trader who guesses the correct price of a chosen instrument after the NFP release

- $30 Welcome Account: A risk-free trading account for new traders

It's important to note that bonuses and promotions are subject to change and may have specific terms and conditions.

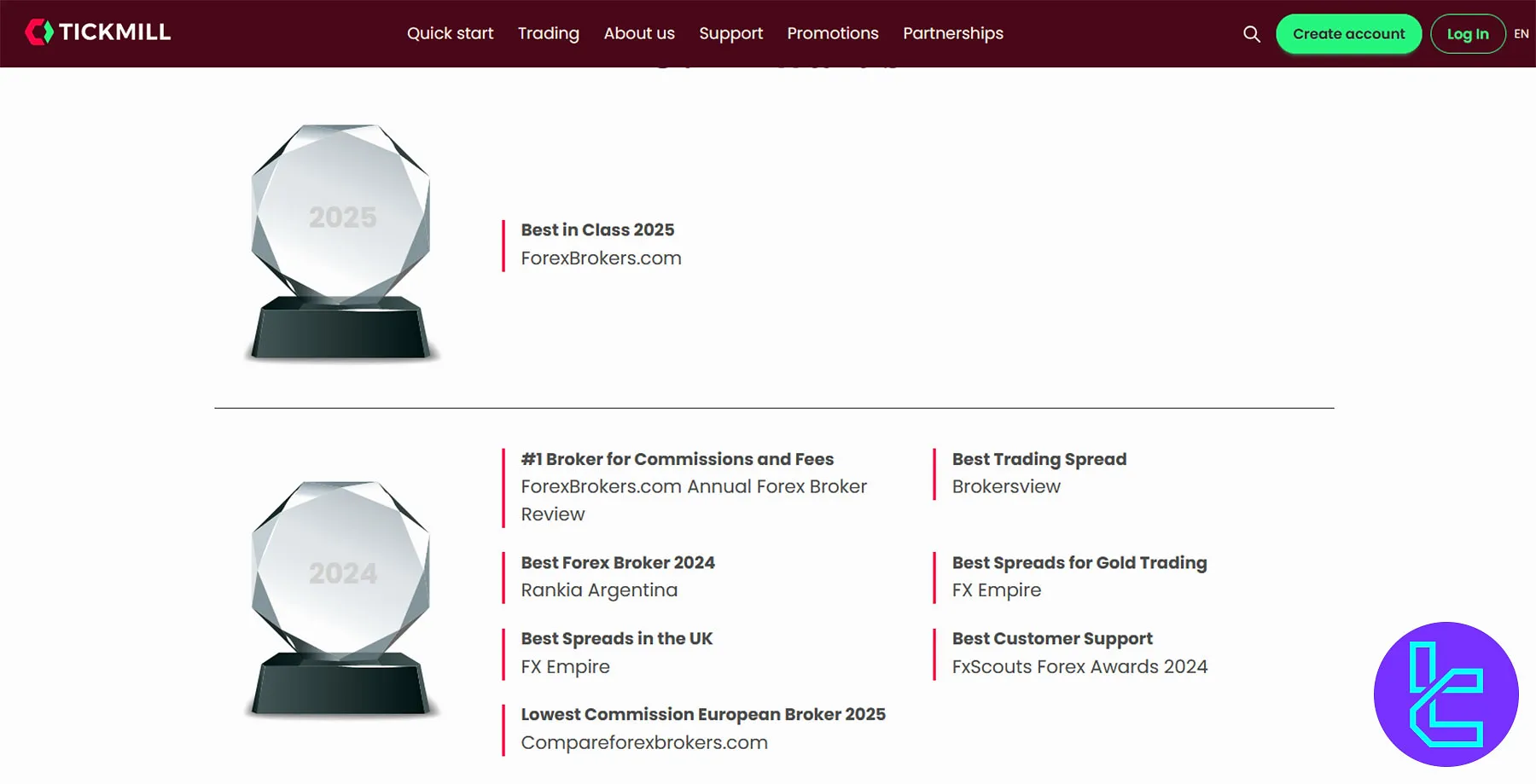

Tickmill Awards

Tickmill has built a strong international reputation, backed by multiple entities and a consistent record of award-winning performance in spreads, commissions, execution, and client service. Tickmill Awards Summary:

- 2025: Best in Class, Lowest Commission Broker

- 2024: #1 for Fees, Best Spreads, Top Broker (Rankia)

- 2023: Best Trading Conditions, Top 100 Financial Institutions, Best CFD Broker

- 2022: Best Customer Service & Trading Experience (Global Forex Awards), Best Spreads

- 2021: Best MENA Broker, Best Execution (Cairo Investment Expo), Global Client Support

- 2020–2018: Recognized for Reliability, Education, Platform Quality, Transparency

- 2017: Most Trusted Broker in Europe (Global Brands), Best Trading Conditions (UK Forex Awards)

Tickmill Broker Customer Support

The brokerage provides common methods for contacting support. It offers multilingual services for users from around the world. Tickmill support contact methods:

- Live Chat: accessible on the website

- Phone Call: different phone numbers for various regulatory authorities

- Email Address: support@tickmill.com, getting a response within 24 hours on business days

The support team is available 24/5.

Tickmill Restricted Countries List

While the broker operates globally, there are certain countries where its services may be restricted due to regulatory or legal reasons.

As of the last update, Tickmill does not provide any services to the countries listed below:

- Iraq

- North Korea

- Syria

- Myanmar

- Cuba

- Iran

- Sudan

- United States

Tickmill Trust Scores on Reliable Websites

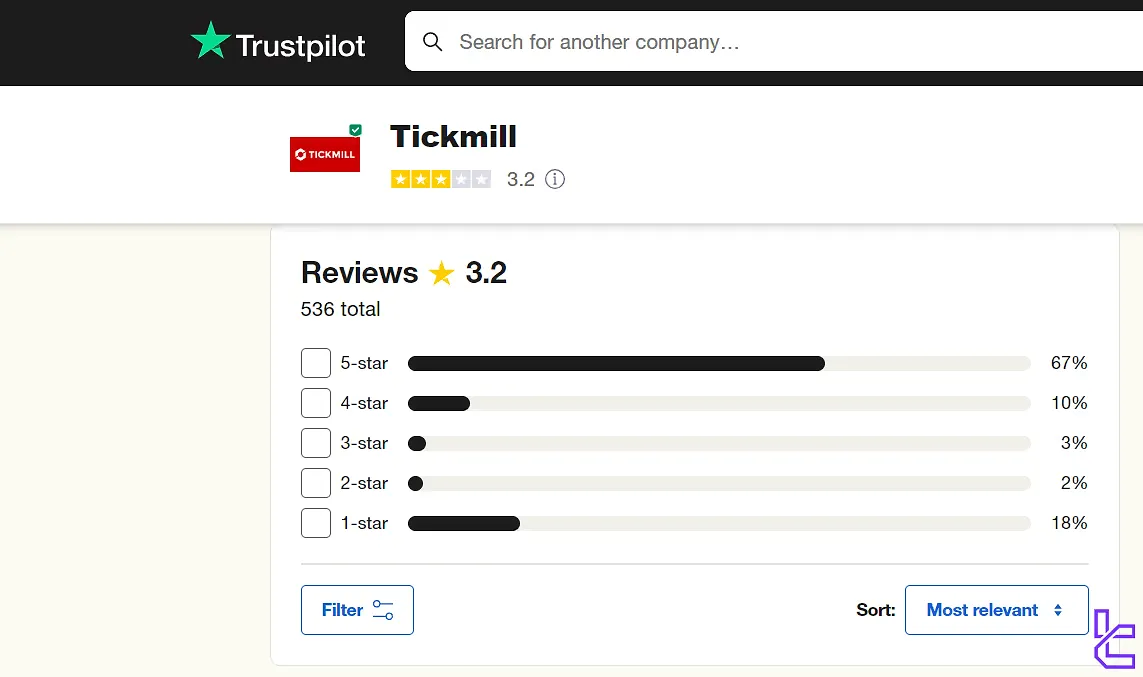

This company has garnered positive trust scores on various reliable review websites, including ForexPeaceArmy. In this section of Tickmill review, we will have an overview of these scores:

- Trustpilot: 3.2 out of 5, based on over 500 reviews

- TickMill ForexPeaceArmy: 3.34/5, with over 200 votes

Educational Content and Materials Offering

Tickmill offers a comprehensive section dedicated to educational resources to help traders of all levels improve their skills. The broker's educational content:

- Market analysis and trading psychology guides

- Basic tutorials for working with a trading terminal and indicators

- Glossary of technical terms in the industry

- Market insights, infographics, webinars, and seminars

- Research tools like market commentary, analysis videos, and an economic calendar

- Trading signals from Signal Centre and Acuity

While not as comprehensive as top-tier brokers, Tickmill’s educational portal remains effective for building trading knowledge across all levels.

You can also check TradingFinder's forex education for additional resources.

TickMill vs Other Brokers

Let's check TickMill's standing in the financial world compared to top forex brokers:

Parameter | TickMill Broker | |||

Regulation | FSA, FCA, CySEC, LFSA, FSCA | No | FSA, CySEC, ASIC | Standard, Standard Cent, pro, Raw Spread, Zero |

Minimum Spread | From 0.0 pips | 0.1 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $0.0 | $0 | Average $1.5 | From $0.2 |

Minimum Deposit | $100 | $1 | $200 | $10 |

Maximum Leverage | 1:1000 | 1:3000 | 1:500 | Unlimited |

Trading Platforms | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | MetaTrader 4, MetaTrader 5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Classic, Raw | Standard, Premium, VIP, CIP | Standard, Raw Spread, Islamic | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 600+ | 45 | 2,250+ | 230+ |

| Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion and Final Words

Tickmill, a financial brokerage with a 3.2/5 trust score on "Trustpilot" based on more than 500 reviews, has a minimum order size of 0.01 lots.

The company provides +15 global indices in addition to +500 stocks and ETFs, with an 0.2 sec average execution time.