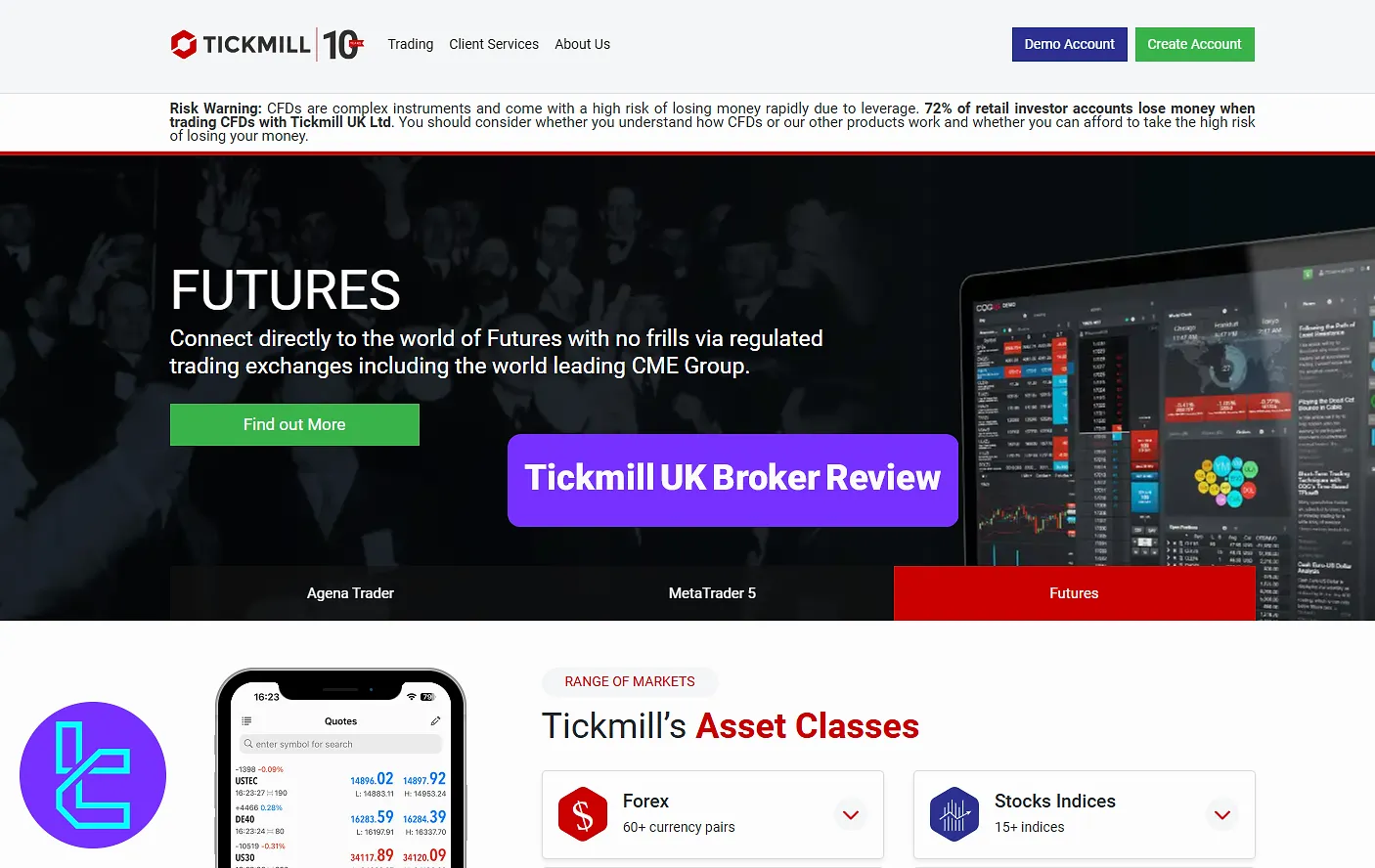

Tickmill UK offers access to CFDs, Futures, and Options trading with leverage up to 1:30. The minimum deposit for CFD accounts is $100 and for Futures is $1,000.

Tickmill UK broker provides free access to various trading tools, including the Signal Centre, Acuity Trading Tool, and Figaro Market Data.

Tickmill UK; Company Information and Regulation

Tickmill UK Ltd is a member of Tickmill Group, authorized and regulated by multiple authorities, including:

- The Financial Conduct Authority (FCA) of the United Kingdom

- The Dubai Financial Services Authority (DFSA)

The group is one of the most renowned online Forex Broker service providers across 180+ countries with the following key features:

- 20ms average execution time

- 87M+ executed trades

- 129B+ average monthly trading volume

| Entity Parameters/Branches | Tickmill UK Ltd |

Regulation | FCA, DFSA |

Regulation Tier | 1, 2 |

Country | United Kingdom, UAE |

Investor Protection Fund/Compensation Scheme | Up to GBP 85,000 under FSCS |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:30 |

Client Eligibility | UK clients |

Tickmill UK Broker Key Specifications

The company is licensed under key directives like MiFID II and is a member of Financial Service Compensation Scheme (FSCS) with an £85,000 insurance coverage per client. Key features of Tickmill UK:

Broker | Tickmill UK |

Account Types | Classic, Raw, Futures |

Regulating Authorities | FCA, DFSA |

Based Currencies | USD, EUR, GBP, PLN, CHF |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfer, Visa, Mastercard, Skrill, Neteller, Przelewy 24, Sofort, PayPal |

Withdrawal Methods | Bank Transfer, Visa, Mastercard, Skrill, Neteller, Przelewy 24, Sofort, PayPal |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, Tickmill mobile app, CQG, Agena Trader |

Markets | Forex, Stock Indices, Commodities, Bonds, Stocks, Futures, Options |

Spread | From 0.0 pips |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | VPS, API Trading, Futures, Options, Acuity Trading Tool |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Tel |

Customer Support Hours | Mon – Fri from 7:00 to 16:00 UK |

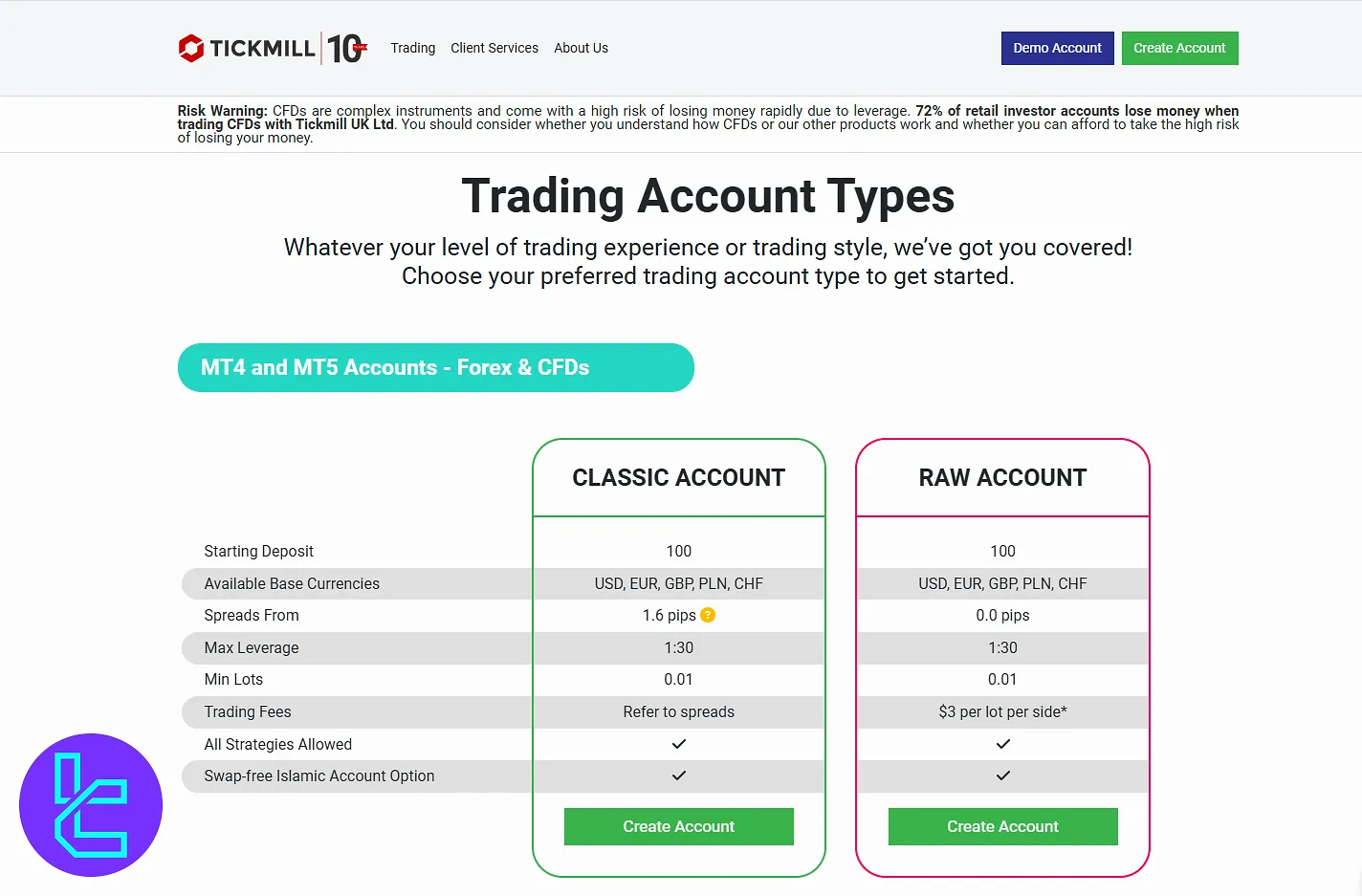

Account Types

The broker provides 3 main account types, two for CFDs trading and one for Futures markets and Options.

Tickmill UK Classic and Raw Accounts

Features | Classic | Raw |

Min Deposit | 100 | 100 |

Base Currencies | USD, EUR, GBP, PLN, CHF | USD, EUR, GBP, PLN, CHF |

Spreads from | 1.6 pips | 0.0 pips |

Commissions | $0 | $3 per lot per side |

Max Leverage | 1:30 | 1:30 |

Min Order Size | 0.01 lots | 0.01 lots |

Swap-Free Option | Yes | Yes |

Tickmill UK Futures Account

Min Deposit | $1,000 |

Commissions From | $0.85 |

Min Ticket Fee | $0.0 |

Exchanges | CME, NYMEX, COMEX, CBOT, EUREX |

Trading Market Hours | Variable based on the exchange |

Order Types | MARKET, LIMIT, STOPS, ICEBERG, BRACKET, OCO, SYNTHETICS |

Min Trade Size | 1 Contract |

Tickmill UK Islamic Account

The broker provides swap-free Islamic options, available on both Classic and Raw accounts. The base currencies are USD, EUR, GBP, and PLN.

While the Islamic account has no swap or rollover fees, it incurs a handling fee, variable based on the trading instrument:

Instruments | Handling Fee ($ per lot) | Charge Free Days |

EURSGD | 10 | 3 |

GBPCHF | 5 | 6 |

EURJPY | 10 | 6 |

USDJPY | 10 | 6 |

BRENT | 0.03 | 3 |

Stocks & ETFs | 0.01 | 3 |

DE40 | 3 | 6 |

EURBOBL | 0.02 | 6 |

To activate your Islamic account, you must first sign up for a regular one and then request swap-free options with the support team.

Tickmill UK Pros and Cons

We must mention in this Tickmill UK review that the broker has a flexible approach in regard to trading strategies and allows for EAs, hedging, and scalping. However, like any other broker, it sure has some flaws, too.

Pros | Cons |

Tight spreads (as low as 0.0 pips on Raw account) | No bonus offerings |

Regulated by top-tier authorities (FCA, DFSA) | Geo-restrictions |

MetaTrader 4 and 5 platforms with numerous add-ons | No copy trading services |

Fast execution speeds (average 0.20 seconds) | - |

Registration and KYC Verification

Opening an account at Tickmill UK requires completing a KYC-compliant process designed to meet FCA standards while offering users flexibility across the Tickmill Group’s legal entities.

#1 Visit the Tickmill Website

Go to the official Tickmill UK site and click “Create Account” to begin.

#2 Choose the Appropriate Account Type

Select between an Individual or Corporate account, depending on your trading profile.

#3 Complete the Registration Form

Enter personal details, including your country of residence. Based on your jurisdiction, you may be redirected to register under a different Tickmill Group entity.

#4 Provide Contact Details

Submit a valid email address and phone number, then confirm your email via the verification link sent to your inbox.

#5 Upload KYC Documents

To complete identity verification, upload supporting documents, including:

- Proof of ID: Passport, Driver’s license, or national ID

- Proof of Address: Utility bill or Bank statement

Tickmill UK Broker Platforms

While the broker offers MetaTrader 4, MetaTrader 5, and a proprietary mobile app for Forex and CFDs trading, applications for Futures and Options are CQG and Agena Trader.

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

- WebTrader

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

- WebTrader

Tickmill Mobile App

CQG

- CQG Android

- CQG iOS

- Desktop

Agena Trader

The platform is only available for desktop devices.

TradingFinder has developed a wide range of MT4 indicators and MT5 indicators that you can use for free.

Fees and Commissions Explained

The transparent fee structure is one of the strength points of this Tickmill UK review. The broker’s fees vary based on theaccount type and instrument.

Account Type | Commissions | Spreads From |

Classic | None | 1.6 pips |

Raw | $3 per lot per side | 0.0 pips |

Futures | From $0.85 | N/A |

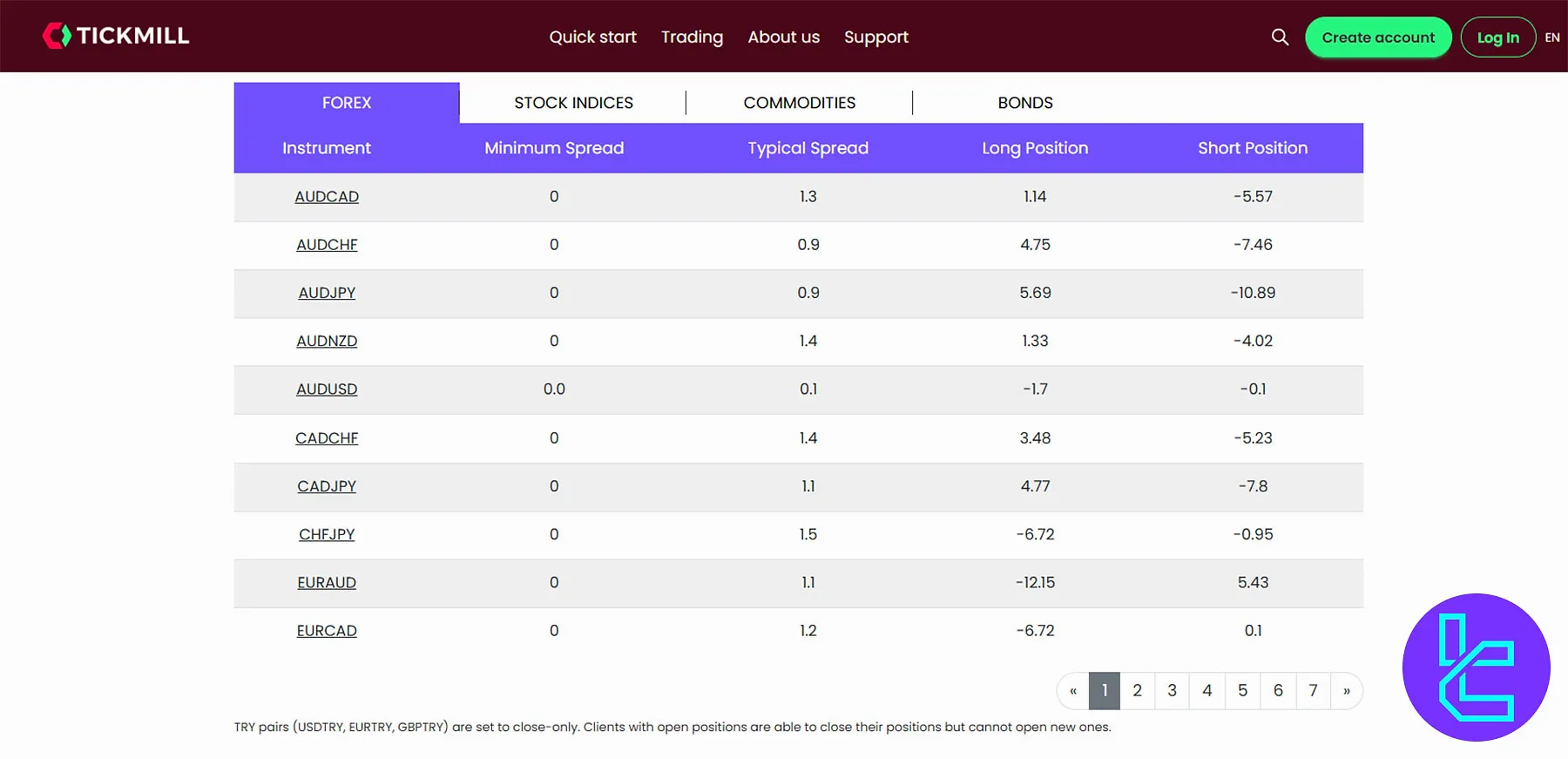

Here's a list of typical Tickmill UK spreads on some of the most popular instruments:

Instruments | Min Spread (pips) | Typical Spread (pips) |

EURCAD | 0 | 1.2 |

EURGBP | 0 | 0.4 |

EURUSD | 0 | 0.1 |

DXY | 0.05 | 0.05 |

BRENT | 0.04 | 0.04 |

XTIUSD | 0.04 | 0.04 |

#EURBUND | 0.026 | 0.026 |

Tickmill UK Options & Futures Commissions

The broker offers competitive pricing on Futures and Options markets as follows:

- Futures Standard Contract: $1.30

- Futures Micro Contract: $0.85

- Options Micro Contract: $1.30

Tickmill UK Swap Fees

Tickmill UK provides competitive overnight swap rates across all markets, including Forex, Stock Indices, Commodities, and Bonds. These rates apply to both long and short positions and vary by instrument. Sample Forex swap rates:

Instruments | Long Position Swap Rate | Short Position Swap Rate |

AUDJPY | +5.69 | -10.89 |

AUDUSD | -1.7 | -0.1 |

CHFJPY | -6.72 | -0.95 |

EURAUD | -12.15 | +5.43 |

CADJPY | +4.77 | -7.8 |

Swap charges are calculated daily per standard lot.

Tickmill UK Non-Trading Fees

While Tickmill UK has no maintenance costs, it charges inactivity fees on accounts that are dormant for over 365 days. The inactivity cost is £10 (or equivalent) per quarter.

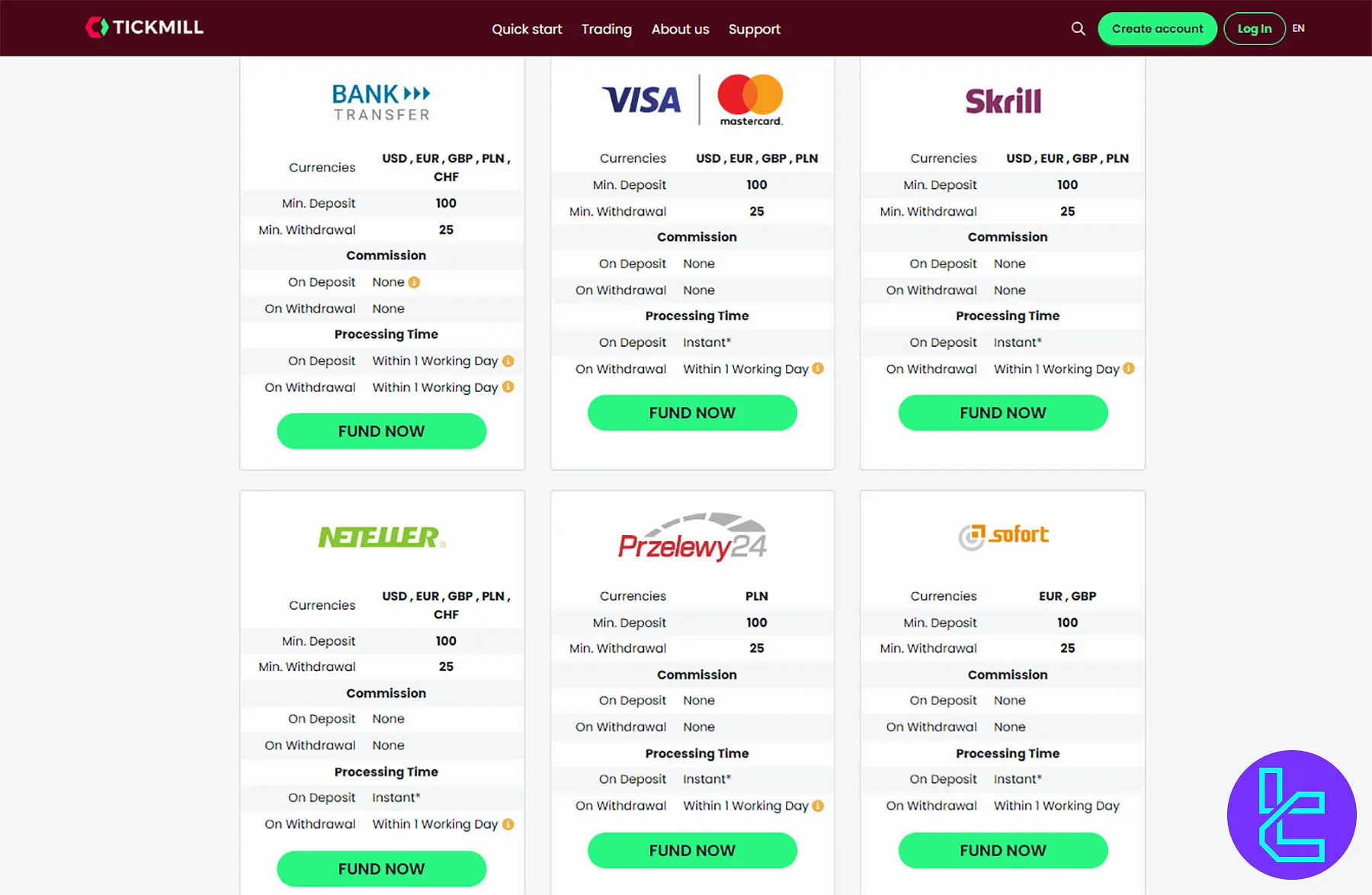

Tickmill UK Funding and Withdrawal

The broker provides multiple payment options, from Credit / Debit Cards to eWallets, including:

- Bank Transfer

- Credit/Debit Cards: Visa and Mastercard

- E-wallets: Skrill and Neteller

- Online Payment Systems: Przelewy24, Sofort, and PayPal

Tickmill UK Deposits

Deposit Method | Currencies | Min Deposit | Processing Time |

Bank Transfer | USD, EUR, GBP, PLN, CHF | 100 | Within 1 Working Day |

VISA / Master Card | USD, EUR, GBP, PLN | 100 | Instant |

Skrill | USD, EUR, GBP, PLN | 100 | Instant |

Neteller | USD, EUR, GBP, PLN, CHF | 100 | Instant |

Przelewy24 | PLN | 100 | Instant |

Sofort | EUR, GBP | 100 | Instant |

Rapid Transfer | USD, EUR, GBP, PLN | 100 | Instant |

PayPal | USD, EUR, GBP, PLN, CHF | 100 | Instant |

Tickmill UK Withdrawals

Withdrawal Method | Currencies | Min Withdrawal | Processing Time |

Bank Transfer | USD, EUR, GBP, PLN, CHF | 25 | Within 1 Working Day |

VISA / Master Card | USD, EUR, GBP, PLN | 25 | Within 1 Working Day |

Skrill | USD, EUR, GBP, PLN | 25 | Within 1 Working Day |

Neteller | USD, EUR, GBP, PLN, CHF | 25 | Within 1 Working Day |

Przelewy24 | PLN | 25 | Within 1 Working Day |

Sofort | EUR, GBP | 25 | Within 1 Working Day |

Rapid Transfer | USD, EUR, GBP, PLN | 25 | Within 1 Working Day |

PayPal | USD, EUR, GBP, PLN, CHF | 25 | Within 1 Working Day |

Tickmill UK Broker Copy Trading

The company doesn't offer a proprietary copy trading solution. However, it has a comprehensive API service providing access to 3rd party trading solutions and EAs.

Tickmill UK also offers free access to multiple tools to level up your trading, including:

- Acuity Trading Tool

- Signal Centre

- Advanced Trading Toolkit (e.g., Figaro Market Data, and Sentiment Trader)

Trading Assets

Tickmill UK provides access to CFDs and 100+ Options / Futures markets across various markets, from the Forex market to Bonds.

The broker also provides Cryptocurrency trading for professional clients who have a financial portfolio of over €500,000.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs, Futures, Options | Over 60 | 50 - 70 currency pairs | 1:30 |

Stock Indices | CFDs, Futures, Options | Over 20 | 10 - 20 instruments | 1:20 |

Stocks & ETFs | CFDs, Futures, Options | Over 500 | 800 - 1200 | 1:10 |

Bonds | CFDs, Futures, Options | 4 instruments | N/A | 1:5 |

Commodities | CFDs, Futures, Options | 19 instruments | 15 - 30 instruments | 1:20 |

Cryptocurrencies | CFDs, Futures, Options | 16 digital assets | 20 - 30 instruments | Not Specified |

Note: In addition to the asset class, the maximum leverage also varies based on the instrument.

Promotions and Bonuses

The lack of traditional promotions like deposit bonuses and welcome gifts is one of the biggest letdowns in this Tickmill UK review.

However, the broker offers a comprehensive affiliate program with the following key features:

- Unlimited commissions

- Performance tracking using the CellXpert platform

- Dedicated personal manager

- Monthly payouts

Note that other branches of Tickmill Group with less stringent regulations may offer more promotional programs.

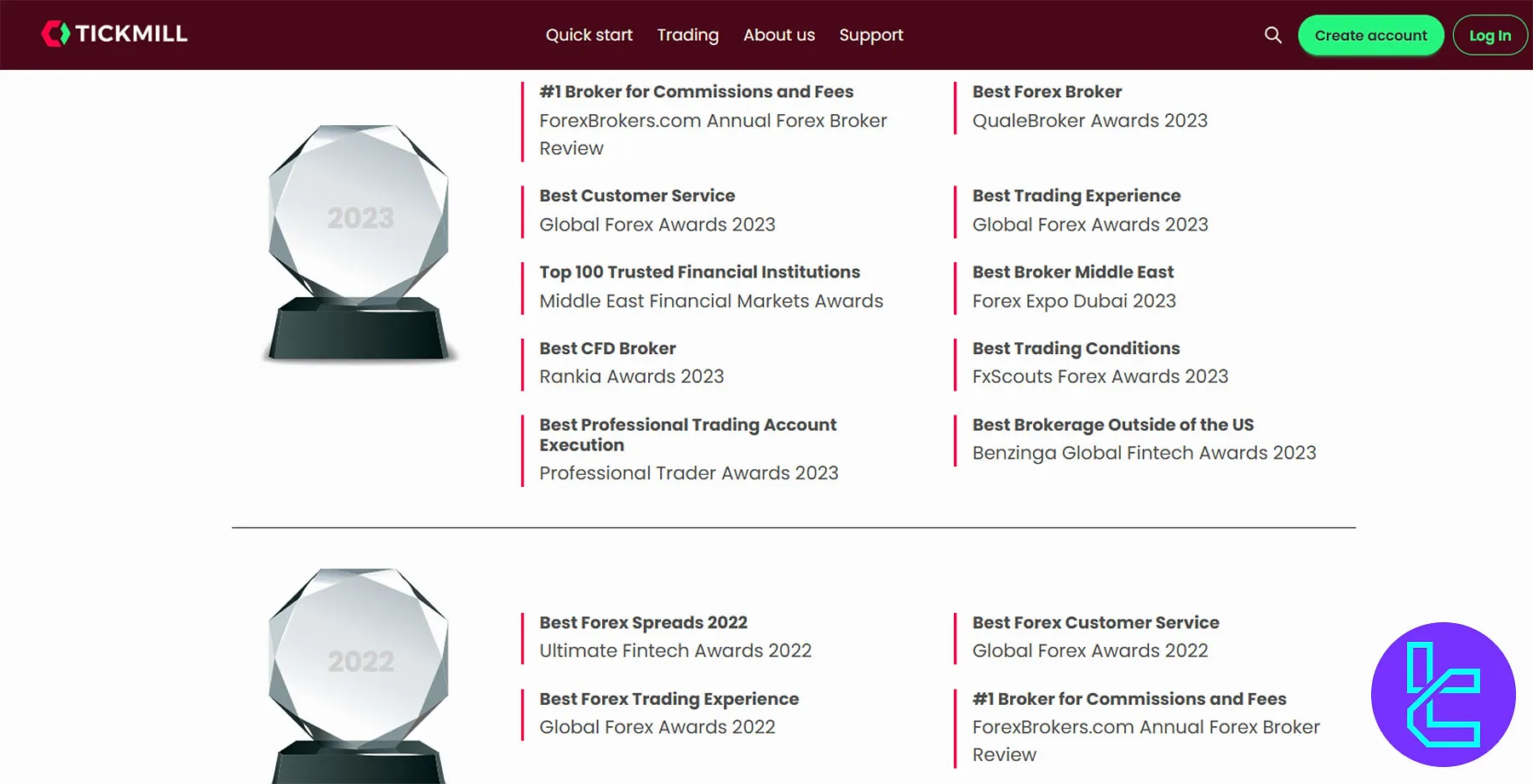

Tickmill UK Awards

Through multiple regulated entities worldwide, Tickmill has consistently earned industry acclaim for delivering competitive pricing, trusted platforms, and superior trading experiences across major financial markets. Tickmill UK awards:

- 2025: Best Global Multi-Asset Broker (Finance Derivative), Excellence in Client Onboarding (World Business Outlook)

- 2024: Best Zero Commission Broker (International Investor), Most Transparent Execution (Finance Magnates)

- 2023: Best CFD Trading Environment (Global Business Review), Fastest Trade Execution (Trader’s Circle Awards)

- 2022: Best User Experience in Forex (Global Forex Awards), Best Institutional Trading Support (Wealth & Finance International)

- 2021: Top Broker for Professional Clients (Investors Chronicle), Best Trading Tools (Global Banking & Finance Review)

- 2020–2018: Awards in Mobile Trading, Risk Management Innovation, and Algorithmic Trading Access

Tickmill’s accolades reflect its commitment to advanced technology, cost-efficiency, and trader-centric services across all experience levels.

Tickmill UK Broker Customer Support

The company provides 24/5 multilingual support through the online chat feature. It also offers a hotline; however, the working hours are Monday to Friday from 7:00 to 16:00 UK time.

support@tickmill.co.uk | |

Tel | +44 789 703 6806 |

Live Chat | Available on the broker’s official website |

Ticket | Through the “Contact Us” page |

Many users have praised Tickmill for its high-quality customer support, prompt responses, and friendly demeanor.

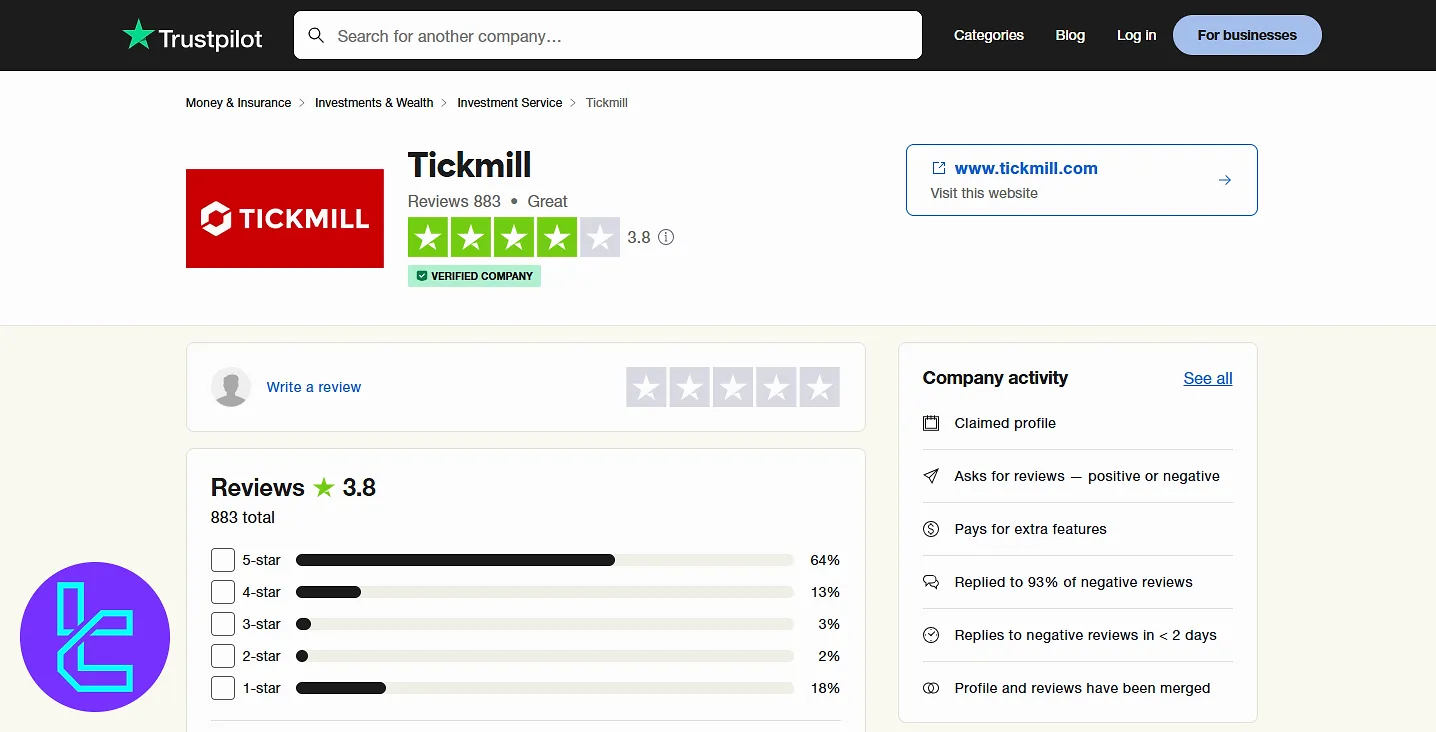

Tickmill UK Trust Score

The wide range of payment methods, deposit fees coverage, and the smooth trading experience have caused many positive Tickmill UK reviews.

Note that the UK branch has not been featured separately on review websites, however, its mother company have profiles on websites like:

3.8 out of 5 based on 883 reviews | |

Forex Peace Army | 3.316 out of 5 based on 243 ratings |

Users have praised Tickmill for smooth withdrawals, good customer support, fast execution, and transparent pricing.

Negative reviews highlight unstable spreads, a high withdrawal threshold, and unresolved refund issues.

Educational Resources

The broker offers a vast amount of educational materials, from e Books to Webinars and Infographics, covering various topics, including:

- Glossary

- Futures basics

- Economic events

- Platforms tutorials

You can also check TradingFinder's Forex education section for additional resources.

Tickmill UK vs Other Brokers

Let's compare Tickmill UK's offerings with those of other popular brokers:

Parameter | Tickmill UK Broker | Moneta Markets Broker | OctaFX Broker | FP Markets |

Regulation | FCA, DFSA | FSCA, FSRA | FSCA, MISA | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Spread | From 0.0 Pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | From $0.0 | From $0.0 | From $0 | $3 |

Minimum Deposit | $100 | $50 | $25 | $50 |

Maximum Leverage | 1:30 | 1:1000 | 1:1000 | 1:500 |

Trading Platforms | MT4, MT5, Tickmill mobile app, CQG, Agena Trader | MT4, MT5, Pro Trader, App Trader | MT4, MT5, OctaTrader, Octa Copy | MT4, MT5, cTrader |

Account Types | Classic, Raw, Futures | Direct, Prime, Ultra | MT4, MT5, OctaTrader | Standard, RAW |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 600+ | 1000+ | 277 | 1000+ |

Trade Execution | Market | Market | Market | Instant |

Conclusion and Final Words

Tickmill UK provides access to 5 asset classes, including Forex and Bonds, in addition to Crypto Futures & CFDs for professional clients.

It offers spreads from 0.0 pips through MT4/5, CGQ, and Agena Trader platforms.